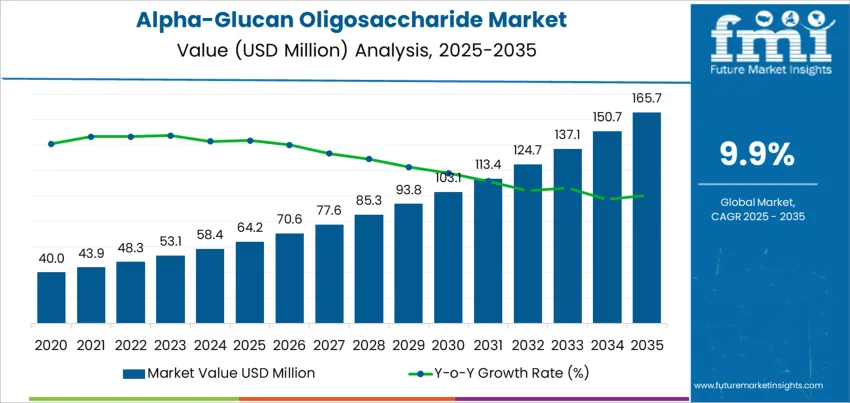

The global demand for alpha-glucan oligosaccharide is expected to grow from USD 64.2 million in 2025 to USD 165.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 9.9%. Alpha-glucan oligosaccharide, a prebiotic fiber, is increasingly used in food and beverage products to support gut health, improve digestion, and enhance immune function. The growing consumer interest in digestive health and wellness is expected to drive market expansion, as well as the increasing adoption of alpha-glucan oligosaccharides in functional foods, dietary supplements, and nutraceuticals. This ingredient is gaining popularity for its natural origin and effectiveness in supporting a healthy gut microbiome.

The market will experience steady growth, starting at USD 64.2 million in 2025 and rising to USD 70.6 million in 2026, USD 77.6 million in 2027, and USD 85.3 million in 2028. By 2029, demand for alpha-glucan oligosaccharides will rise to USD 93.8 million, continuing its upward trajectory through the 2030s. By 2035, the demand for alpha-glucan oligosaccharide is projected to reach USD 165.7 million, driven by the increasing use of functional ingredients in food and beverages and the growing consumer preference for natural, health-promoting ingredients.

The half-decade weighted growth analysis of the alpha-glucan oligosaccharide market reveals a gradual but steady increase in demand over the first five years of the forecast period (2025 to 2029). From USD 64.2 million in 2025, the market will rise to USD 93.8 million in 2029, representing an increase of USD 29.6 million. This growth is expected to be driven by increased awareness of the health benefits of prebiotics, the expansion of functional food categories, and the broader adoption of prebiotic ingredients to support digestive and immune health.

As the market matures in the second half of the forecast period (2029 to 2035), the growth rate is expected to stabilize slightly, but still continue steadily. The market will increase from USD 93.8 million in 2029 to USD 165.7 million by 2035, marking an increase of USD 71.9 million. This phase will be characterized by the ongoing expansion of product offerings that incorporate alpha-glucan oligosaccharide, as well as innovations in food formulations and the growing integration of health-focused ingredients in everyday consumer products. The half-decade weighted growth analysis shows the ongoing momentum and increasing consumer demand for natural and effective solutions for gut health and overall wellness.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 64.2 million |

| Industry Forecast Value (2035) | USD 165.7 million |

| Industry Forecast CAGR (2025 to 2035) | 9.9% |

Demand for alpha-glucan oligosaccharide (AGO) is rising worldwide as interest in gut health, immune support, and overall wellness grows. AGO belongs to the broader category of prebiotic oligosaccharides that resist digestion in the upper gastrointestinal tract and reach the colon, where they serve as food for beneficial gut bacteria. This prebiotic action helps improve digestive health, supports gut microbiome balance, and may contribute to better immune function and metabolic health. As more consumers shift toward preventive health and functional nutrition - whether through fortified foods, dietary supplements, or functional beverages - alpha-glucan oligosaccharides are increasingly used as a natural, gut-health promoting ingredient.

On top of nutritional uses, alpha-glucan oligosaccharide finds growing acceptance in personal-care and cosmetic applications. In skincare, AGO is used as a microbiome-friendly prebiotic ingredient that helps rebalance the skin’s microbial flora, strengthen the skin barrier, and improve skin hydration and comfort. As “clean-label,” microbiome-conscious, and gentle-formulation trends continue to grow globally, cosmetic and personal-care brands incorporate AGO into lotions, cleansers, creams and other topical products. Meanwhile ongoing advances in bioprocessing and ingredient-extraction technologies are improving the purity, consistency and scalability of AGO production. As functional-food, supplement, and clean-beauty markets continue expanding, demand for alpha-glucan oligosaccharide is expected to grow steadily in the coming years.

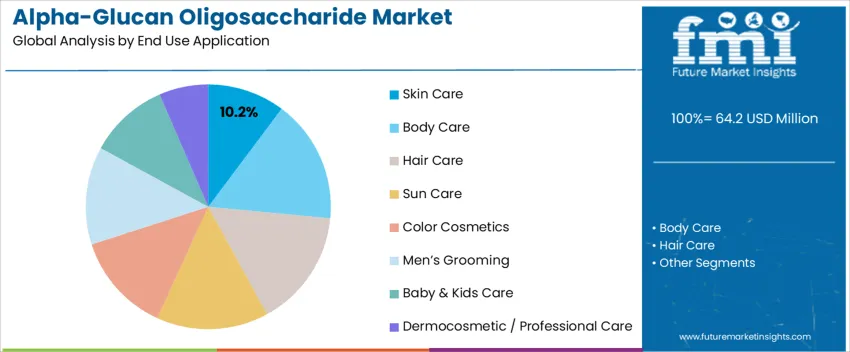

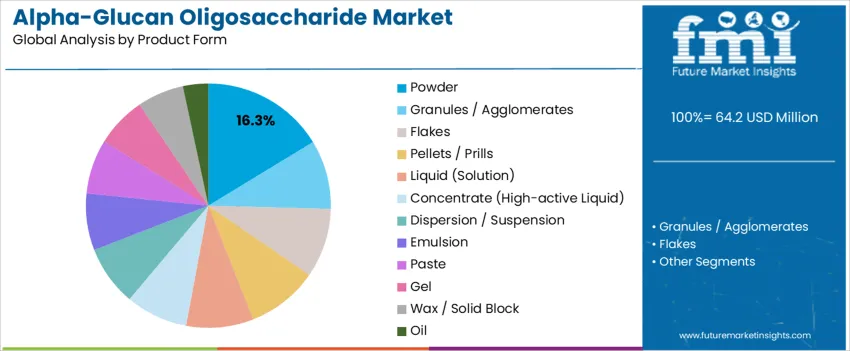

The global demand for alpha-glucan oligosaccharide is primarily driven by application and product form. The leading end-use application is skin care, which accounts for 10.2% of the market share, while powder holds the largest share in the product form segment, capturing 16.3%. Alpha-glucan oligosaccharides, known for their prebiotic and skin-protecting properties, are increasingly used in personal care formulations aimed at enhancing skin health and promoting hydration. As the demand for natural, effective skincare solutions grows, the market for alpha-glucan oligosaccharide continues to expand.

Skin care leads the end-use application demand for alpha-glucan oligosaccharide, capturing 10.2% of the market share. This ingredient is highly valued in skincare products for its ability to strengthen the skin’s natural barrier, hydrate the skin, and support the skin's microbiome. It is commonly used in moisturizers, serums, and masks to improve skin texture, reduce inflammation, and provide overall skin nourishment.

The growing consumer preference for prebiotics in skin care products, which help maintain a healthy skin microbiome, is a key factor driving the demand for alpha-glucan oligosaccharide. As consumers become more aware of the importance of microbiome health for maintaining radiant and resilient skin, the use of alpha-glucan oligosaccharide in skin care formulations is expected to increase. Its multifunctional benefits, including skin hydration, soothing properties, and support for the skin's natural defenses, make it an ideal ingredient in a variety of skincare products.

Powder is the leading product form for alpha-glucan oligosaccharide globally, holding 16.3% of the market share. The powdered form is preferred due to its stability, ease of incorporation into formulations, and longer shelf life compared to other forms like liquid or gel. It allows for more controlled concentrations and is highly versatile in various cosmetic and skincare formulations.

The demand for powdered alpha-glucan oligosaccharide is driven by its ability to deliver concentrated benefits while maintaining its effectiveness over time. Powders are also easier to handle during manufacturing and distribution, which makes them more cost-effective for producers. As the trend for personalized skincare and clean beauty grows, powdered alpha-glucan oligosaccharide remains a popular choice for manufacturers looking to create high-performance, effective, and customizable beauty products.

Demand for alpha-glucan oligosaccharide is increasing globally as consumers and manufacturers prioritize gut health, dietary fiber intake, and functional foods. Alpha-glucan oligosaccharides are soluble prebiotic fibers derived from plant sources, and they are widely used in food, beverage products, dietary supplements, and nutraceuticals. As health-conscious consumers seek digestive wellness and clean-label products, the market for alpha-glucan oligosaccharides is growing. This growth is also being driven by interest in plant-based, bio-derived ingredients and by a rising awareness of the importance of gut health in overall well-being.

The primary driver for alpha-glucan oligosaccharide demand is the growing awareness of digestive health and the need for prebiotics to promote healthy gut bacteria. As more consumers seek to improve their digestive health, alpha-glucan oligosaccharides are increasingly incorporated into functional foods, beverages, and dietary supplements. Another key driver is the rise of plant-based diets and clean-label preferences. Alpha-glucan oligosaccharides, being plant-derived and vegan-friendly, fit perfectly into these trends. In addition, scientific research supporting the health benefits of prebiotics, such as supporting gut health, immunity, and skin health, is encouraging greater adoption of alpha-glucan oligosaccharides in various consumer products.

Despite its many benefits, several challenges limit the widespread adoption of alpha-glucan oligosaccharide. One challenge is the relatively low awareness of prebiotics, particularly in emerging markets where gut health education and consumer interest in functional foods are still developing. Another barrier is the production cost, as high-quality alpha-glucan oligosaccharide extraction and purification methods are relatively expensive. This makes it difficult for manufacturers to use alpha-glucan oligosaccharides in price-sensitive, mass-market products. Additionally, competition from other prebiotic fibers and oligosaccharides, such as inulin and fructo-oligosaccharides, may reduce market share for alpha-glucan oligosaccharides. Regulatory restrictions and the need for clinical validation of health claims can also impede market growth.

One key trend driving demand is the convergence of wellness, nutrition, and personal care. Alpha-glucan oligosaccharides are being increasingly used not just in functional foods and supplements but also in skincare and scalp-care formulations. These formulations support microbiome balance and skin hydration. Additionally, the growing demand for clean-label, plant-based, and microbiome-friendly ingredients is encouraging more companies to use alpha-glucan oligosaccharides in their products. Another trend is ongoing advancements in production technologies, such as enzymatic synthesis and improved purification methods, which are making alpha-glucan oligosaccharides more accessible and cost-effective. Finally, as research into the gut microbiome and its link to overall health continues, interest in alpha-glucan oligosaccharides as a prebiotic ingredient is expected to grow, particularly in both the food and personal care sectors.

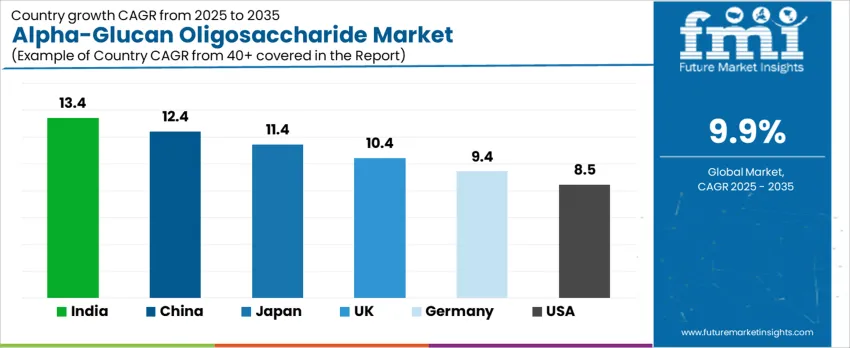

The demand for alpha-glucan oligosaccharide is projected to grow across key global markets, with India leading the way at a CAGR of 13.4%. China follows closely with a growth rate of 12.4%, while Japan is expected to grow at 11.4%. The UK, Germany, and the USA show steady growth with CAGRs of 10.4%, 9.4%, and 8.5%, respectively. The increasing awareness of the benefits of prebiotics, particularly in digestive health and immune support, is driving this market's growth. Alpha-glucan oligosaccharide, known for its digestive and gut-health-promoting properties, is becoming increasingly popular in food and dietary supplements across these regions.

| Country | CAGR (%) |

|---|---|

| India | 13.4 |

| China | 12.4 |

| Japan | 11.4 |

| UK | 10.4 |

| Germany | 9.4 |

| USA | 8.5 |

India is expected to see a robust growth in demand for alpha-glucan oligosaccharide, with a projected CAGR of 13.4%. As India’s middle class grows, so does consumer interest in health and wellness, particularly in digestive health and immunity. Alpha-glucan oligosaccharide, known for its prebiotic properties, helps support gut health and immune function, making it an increasingly popular ingredient in food products, beverages, and dietary supplements. The rise of e-commerce platforms and greater access to international wellness brands have made alpha-glucan oligosaccharide-based products more accessible to a wider audience. Additionally, with rising health consciousness and increasing awareness about the benefits of prebiotics, demand for functional foods is growing rapidly. India’s shift towards healthy eating habits, supported by a strong focus on wellness and preventive healthcare, is likely to drive the growth of the alpha-glucan oligosaccharide market in the coming years.

China’s demand for alpha-glucan oligosaccharide is expected to grow at a CAGR of 12.4%. The country’s growing interest in digestive health and functional foods is fueling the market for prebiotics, with alpha-glucan oligosaccharide being an attractive option. Consumers in China are becoming more aware of the health benefits of prebiotics, such as improved gut health and enhanced immunity, which are driving demand for alpha-glucan oligosaccharide-based products. Additionally, China’s expanding health food market, combined with the rising popularity of dietary supplements and functional beverages, supports this growth. The increasing demand for natural and plant-based ingredients, along with government initiatives to promote healthier lifestyles, provides further opportunities for the growth of alpha-glucan oligosaccharide in China. As more consumers look for effective ways to improve digestive function and immunity, alpha-glucan oligosaccharide is expected to remain a popular ingredient in China’s health and wellness market.

In Japan, the projected CAGR for alpha-glucan oligosaccharide is 11.4%. Japan has a long-standing tradition of using functional ingredients in food and beverages, and prebiotics like alpha-glucan oligosaccharide are becoming increasingly popular for their digestive and immune-supporting properties. With a growing awareness of the importance of gut health and the benefits of maintaining a balanced microbiome, Japanese consumers are increasingly turning to prebiotic-rich foods and supplements. Additionally, Japan’s aging population is driving the demand for products that support digestive health, immune function, and overall well-being. The popularity of health-conscious food trends, such as probiotics and prebiotics, further supports the adoption of alpha-glucan oligosaccharide. As Japan continues to prioritize functional food innovation, demand for alpha-glucan oligosaccharide is expected to continue growing steadily

In the UK, the demand for alpha-glucan oligosaccharide is projected to grow at a CAGR of 10.4%. The increasing focus on digestive health, coupled with rising consumer demand for natural, plant-based ingredients, is driving the adoption of alpha-glucan oligosaccharide in the UK market. With growing concerns over digestive issues, immunity, and gut health, more consumers are seeking prebiotic ingredients that offer functional benefits. Alpha-glucan oligosaccharide is highly valued for its ability to support gut health, promote a balanced microbiome, and improve overall well-being. Additionally, the UK’s clean eating movement and the rising popularity of functional foods and dietary supplements further boost the demand for this prebiotic ingredient. As awareness of gut health and the importance of prebiotics continues to grow, alpha-glucan oligosaccharide is expected to gain more traction in the UK’s health and wellness industry.

In Germany, the projected CAGR for alpha-glucan oligosaccharide is 9.4%. Germany’s strong focus on health-conscious eating and functional foods positions alpha-glucan oligosaccharide as a popular ingredient for improving digestive health and boosting immunity. As consumers in Germany become more aware of the health benefits of prebiotics, the demand for alpha-glucan oligosaccharide is rising. Germany’s well-established market for dietary supplements, coupled with its growing interest in plant-based ingredients, further supports the adoption of this prebiotic ingredient. Additionally, the increasing emphasis on preventative healthcare and the shift toward more sustainable food options make alpha-glucan oligosaccharide an attractive choice for both consumers and manufacturers. As Germany continues to prioritize functional and health-focused food ingredients, the market for alpha-glucan oligosaccharide is expected to expand steadily.

In the USA, the demand for alpha-glucan oligosaccharide is expected to grow at a CAGR of 8.5%. The U.S. market is characterized by increasing consumer interest in digestive health, immunity-boosting products, and functional foods. Alpha-glucan oligosaccharide, with its prebiotic properties, is gaining popularity as a key ingredient in dietary supplements and food products that promote gut health and overall wellness. The rise in consumer awareness of the importance of maintaining a healthy gut microbiome is driving demand for prebiotic ingredients like alpha-glucan oligosaccharide. The U.S. market’s shift toward plant-based, natural ingredients and clean label products further supports this growth. As consumers look for effective solutions to improve digestion and boost immunity, alpha-glucan oligosaccharide is expected to remain a popular ingredient in the American health and wellness sector.

Demand for alpha-glucan oligosaccharide (AGOS) is growing globally. This ingredient is valued for its prebiotic functions when used in skincare formulations. It supports a healthy skin microbiome by nourishing beneficial microorganisms, helps strengthen the skin barrier, improves skin hydration, and soothes irritation and sensitivity. The rising consumer preference for clean-label, microbiome-friendly, and natural cosmetic ingredients fuels demand for AGOS. As awareness of skin health increases, especially in regions such as North America, Europe, and Asia Pacific, manufacturers of skincare and personal care products are increasingly turning to prebiotic saccharides like AGOS. Growth in the broader prebiotics market supports the expansion of AGOS demand in both personal care and potentially ingestible health products.

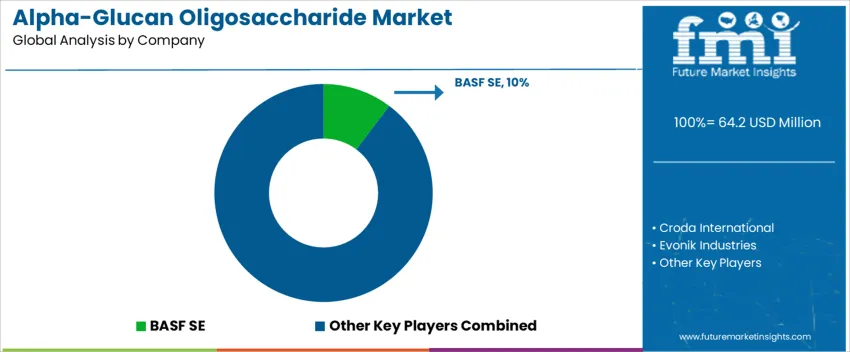

On the supply side, several large ingredient-specialist firms compete to meet this rising demand. According to your list, leading suppliers include BASF SE, along with Croda International, Evonik Industries, Symrise (including IFF/Givaudan actives), Dow Inc., Ashland, Clariant, and Seppic. These companies provide AGOS in standardized, formulation-ready forms for use in skincare, hair care, intimate hygiene, and related products. Competition among suppliers is driven by factors such as purity and consistency of the oligosaccharide, quality of fermentation or enzymatic production, ability to scale production to meet global demand, and compliance with international cosmetic safety and regulatory standards. Firms also differentiate by offering broad ingredient portfolios-some offer multiple prebiotic or bioactive ingredients to enable multifunctional formulations combining microbiome support, barrier care, hydration, and antioxidant properties. Suppliers with robust supply chains, quality control, and sustainable sourcing practices are well positioned to capture growth in the expanding AGOS market.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | North America, Europe, Asia Pacific, The Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| End Use Application | Skin Care, Body Care, Hair Care, Sun Care, Color Cosmetics, Men’s Grooming, Baby & Kids Care, Dermocosmetic / Professional Care |

| Product Form | Powder, Granules / Agglomerates, Flakes, Pellets / Prills, Liquid (Solution), Concentrate (High-active Liquid), Dispersion / Suspension, Emulsion, Paste, Gel, Wax / Solid Block, Oil |

| Key Companies Profiled | BASF SE, Croda International, Evonik Industries, Symrise (incl. IFF/Givaudan actives), Dow / Dow Inc., Ashland, Clariant, Seppic |

| Additional Attributes | Dollar sales by end-use application and product form show strong demand for inulin, particularly in skin care and body care products. Powder and liquid forms dominate, with concentrate and emulsion forms also growing in demand. Major companies like BASF, Evonik, and Ashland are key players, providing a wide range of inulin-based products for the cosmetic and dermocosmetic industries. The market is expected to grow with increasing demand for natural ingredients and innovative skincare solutions. |

The global alpha-glucan oligosaccharide market is estimated to be valued at USD 64.2 million in 2025.

The market size for the alpha-glucan oligosaccharide market is projected to reach USD 165.7 million by 2035.

The alpha-glucan oligosaccharide market is expected to grow at a 9.9% CAGR between 2025 and 2035.

The key product types in alpha-glucan oligosaccharide market are skin care, body care, hair care, sun care, color cosmetics, men’s grooming, baby & kids care and dermocosmetic / professional care.

In terms of product form , powder segment to command 16.3% share in the alpha-glucan oligosaccharide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Xylooligosaccharide Market Size and Share Forecast Outlook 2025 to 2035

Fructo-Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Key Players & Market Share in the Fructo-Oligosaccharides Industry

Marine Oligosaccharides Market Analysis – Size, Share & Forecast 2024-2034

Galacto-Oligosaccharide (GOS) Market Size, Growth, and Forecast for 2025 to 2035

Chitosan Oligosaccharides and Glucosamine Market Analysis by Product Type, Source, Application, and Form Through 2035

Isomalto-oligosaccharide Market Analysis by Form, Source, End-use Application and Region through 2035

Chitosan Oligosaccharides Market Growth - Source & Grade Trends

UK Fructo-Oligosaccharides Market Outlook – Share, Growth & Forecast 2025–2035

Human Milk Oligosaccharides Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Fructo-Oligosaccharides Market Insights – Size, Demand & Industry Growth 2025–2035

Key Companies & Market Share in the Human Milk Oligosaccharides Sector

ASEAN Fructo-Oligosaccharides Market Trends – Demand, Innovations & Forecast 2025–2035

Europe Fructo-Oligosaccharides Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Human Milk Oligosaccharides Market Trends – Size, Demand & Forecast 2025-2035

USA Human Milk Oligosaccharides Market Insights – Growth & Demand 2025-2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

Australia Fructo-Oligosaccharides Market Insights – Trends, Demand & Growth 2025-2035

Europe Human Milk Oligosaccharides Market Growth – Trends, Demand & Innovations 2025-2035

Short-chain Fructooligosaccharides Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA