The UK fructo-oligosaccharides (FOS) market is projected to reach USD 243.9 million by 2025, with an upward growth trajectory leading to USD 429.8 million by 2035. This expansion reflects a compound annual growth rate (CAGR) of 5.8% over the forecast period. Increasing consumer awareness of prebiotic health benefits, the growing demand for functional foods, and innovations in fermentation and enzymatic synthesis processes are driving industry growth.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 243.9 Million |

| Projected Industry Size in 2035 | USD 429.8 Million |

| Value-based CAGR from 2025 to 2035 | 5.8% |

The market for fructo-oligosaccharides of the UK is on the rise owing to the growth in the consumption of natural prebiotics in food and beverages, infant formula, and dietary supplements. The emerging functional health foods is driven by health concerns regarding immunity and gasterointestinal issues. Some notable trends in the market are the high market share of chicory-based FOS, adoption of short-chain FOS for prebiotic use, and the shift from enzyme synthesis to fermentation culture processes. Innovation in ingredient and clean-label product fueled expansion by Tate & Lyle, Kerry Group, and Beneo-Orafti, as well as increased production during the food industry’s shift towards greater health consciousness.

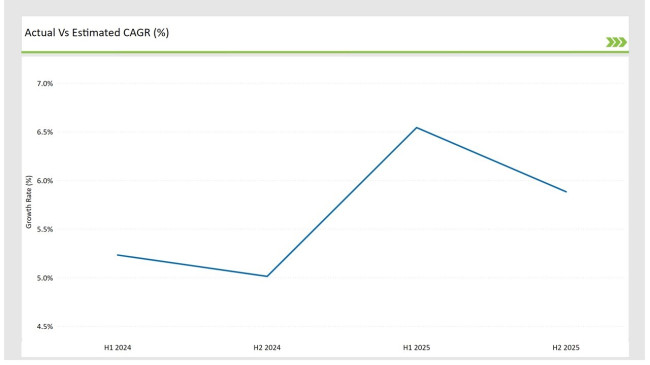

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Fructo-Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | Growth Rate (%) |

|---|---|

| H1 | 5.2% (2024 to 2034) |

| H1 | 6.5% (2024 to 2034) |

| H2 | 5.0% (2025 to 2035) |

| H2 | 5.9% (2025 to 2035) |

For the UK market, the Fructo-Oligosaccharides sector is projected to grow at a CAGR of 5.2% during the first half of 2024, with an increase to 5.0% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 6.5% in H1 and reach 5.9% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Tate & Lyle launched a new range of short-chain fructo-oligosaccharides with enhanced stability. The products demonstrate improved shelf life in various food applications including dairy and bakery. |

| Oct-2024 | British Sugar's subsidiary AB Ingredients opened a new FOS production facility in Norfolk. The facility uses sugar beet as raw material to produce various grades of fructo-oligosaccharides. |

| Aug-2024 | Prenexus Health UK acquired prebiotic manufacturer Bio Sweet for £15M. The acquisition includes proprietary technology for producing highly pure fructo -oligosaccharides. |

| May-2024 | Kerry Group expanded their Hull facility to include FOS production capabilities. The expansion aims to meet growing demand for natural sweeteners and prebiotic ingredients in the UK market. |

| Mar-2024 | Nutri biotic Solutions launched a new range of liquid FOS syrups for beverage applications. The products offer improved solubility and stability compared to powder alternatives. |

Chicory-Derived Fructo-Oligosaccharides Leading the Prebiotic Market

In the UK, Chicory FOS maintains a high value of cultivation because of its remarkable value of prebiotics and simplicity of harvesting it. Leading companies like BENEO-Orafti SA and Cosucra Groupe are actively developing sustainable methods for growing and extracting chicory to, fulfill the growing demands from the functional food and dietary supplement markets. The growing market for digestive health and immune strengthening ingredients means that the market for chicory FOS is growing at a faster pace than sucrose and inulin FOS.

Fermentation-Based Processing Gaining Preference Over Enzymatic Synthesis

FOS is being increasingly produced through the processes of fermentation. One major reason for this increasing popularity in the UK is the efficacy. It is also cost-effective and scalable. Noteworthy producers such as Tate and Lyle, Tereos are scaling up to employing fermentation extraction methods as it provides greater levels of purity, consistent quality, and lower production waste.

This trend is further pushed by the clean-label movement and the trend toward more non-GMO ingredients, making fermentation the go-to process for high-quality prebiotics in food, beverages, and infant nutrition.

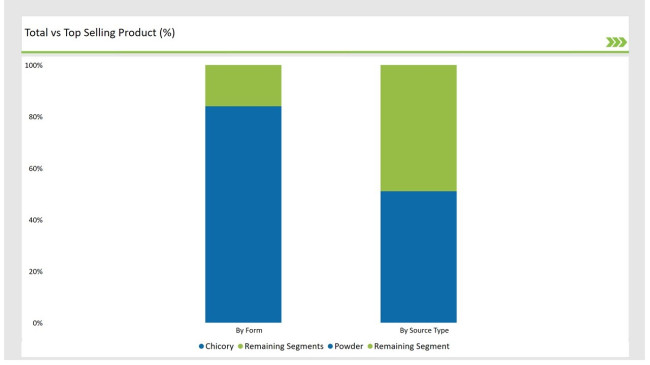

| Source Type | Market Share |

|---|---|

| Chicory | 51.2% |

| Remaining Segments | 48.8% |

The UK market is mostly dominated by chicory FOS because it is high in fiber and has potent prebiotic properties. Consumers who prefer natural solutions for better digestive health often prefer chicory-based functional foods and supplements. Other sources such as sucrose and Jerusalem artichoke are still considered niche options, and due to limited scalability and commercial viability, they cannot compete with the established supply chain of chicory.

| Form Type | Market Share |

|---|---|

| Powder | 83.5% |

| Remaining Segments | 16.5% |

Powdered FOS remains the leader in the UK market due to its long shelf life and ease in food formulation as well as its ubiquity in infant formula and dietary supplements. However, there is increasing demand for liquid FOS, particularly in the beverages and ready-to-drink nutrition segments because of solubility and better absorption. This market segment is expected to grow steadily for the next few years thanks to innovations in liquid FOS processing.

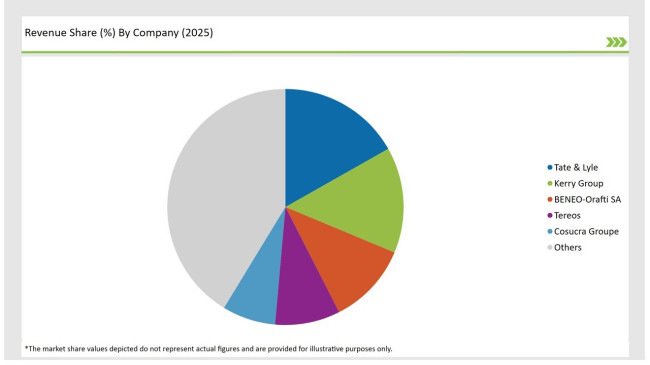

The FOS market in the UK is dominated by multinational companies, and as such is highly concentrated. Due to the existing robust supply chain for raw materials, advanced production technology, and distribution networks, Tate & Lyle, Kerry Group, and BENEO-Orafti SA have a stronghold on the industry.

FOS focused on chicory developed a fermentation process, which is what regional companies like Cosucra Groupe and Tereos have banked on. The industry is characterised by a few players due to the huge capital needed to set up FOS production facilities and the constant need to develop new prebiotic formulations.

| Company | Market Share (%) |

|---|---|

| Tate & Lyle | 16.8% |

| Kerry Group | 14.5% |

| BENEO- Orafti SA | 11.2% |

| Tereos | 8.9% |

| Cosucra Groupe | 7.3% |

| Other Players | 41.3% |

The leading firms in the UK FOS market have production facilities concentrated in England and Scotland, strategically located near food processing hubs. While Tata & Lyle and BENEO-Orafti SA have focused on chicory and inulin FOS, Kerry Group and Tereos focus on fermentation based processes for clean label products.

European farms provide raw materials for Friesl and Campina Ingredients and Nestlé UK, ensuring constant supply. In addition, the UK is experiencing increased partnerships with biotech firms in an attempt to improve prebiotic efficiency and broaden the use of supplements.

Chicory, Sucrose, Inulin, Jerusalem Artichoke

Powder, Liquid

Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, Pharmaceuticals

Short-chain FOS, Medium-chain FOS, Long-chain FOS

Fermentation, Enzymatic Synthesis

By 2025, the UK fructo-oligosaccharides market is expected to grow at a CAGR of 5.8%, driven by increasing demand for natural prebiotic ingredients and clean-label functional foods.

By 2035, the UK FOS industry is projected to reach USD 429.8 million, supported by rising consumer awareness about gut health and advancements in prebiotic formulations.

The industry is expanding due to growing demand for digestive health supplements, increasing adoption of plant-based prebiotics, technological improvements in FOS processing, and wider application in infant nutrition.

The South East and London lead in FOS consumption, particularly in functional food and dietary supplement markets, while Scotland’s dairy industry is emerging as a significant buyer of FOS-based formulations.

Major companies in the UK fructo-oligosaccharides market include Tate & Lyle, Kerry Group, BENEO-Orafti SA, Tereos, and Cosucra Groupe, with Friesland Campina Ingredients and Nestlé UK also playing a key role in product innovation and distribution.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA