The Europe Fructo-Oligosaccharides (FOS) market is set to grow from an estimated USD 948.8 million in 2025 to USD 1,704.0 million by 2035, with a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Estimated Industry Size (2025) | USD 948.8 million |

| Projected Value (2035) | USD 1,704.0 million |

| Value-based CAGR (2025 to 2035) | 6.0% |

The FOS Europe market passed through a critical level of evolution, and thus, there will be a steady growth rate in the region from the year 2020 to the year 2024. As a prebiotic fibre with excellent potentiality to improve gut health by promoting the proliferation of beneficial bacteria within the alimentary canal tract.

These oligosaccharides are derived naturally from fruits, vegetables, and grains. Such is their preference for the food and beverage industry, as consumers have increasingly begun to focus on health and wellness. The awareness that gut health is directly related to overall well-being is one of the major factors driving demand for FOS across Europe.

The European market structure mainly consists of different sub-segments, which are categorized based on the purities of the FOS present, different forms, such as powdered, syrup form, liquid, and granular structure, and applications in Food and Beverages, pharmaceutical sectors, animal nutrition, and cosmetics sectors.

Companies are now repositioning to reap the increase in demand through greater innovation of their products as well as through their development distribution network. Strong emphasis on the area of research and development places such giants, as DuPont, Friesl and Campina, and Sensus, head above most through striving for better purification levels to make available diversified uses of the high-purity FOS product.

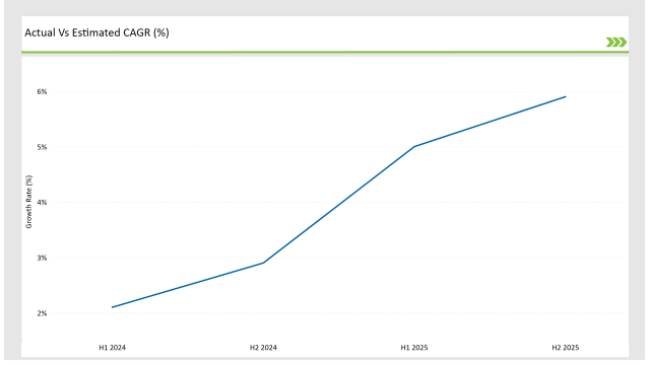

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the European Fructo-Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 2.1% (2024 to 2034) |

| H2 2024 | 2.9% (2024 to 2034) |

| H1 2025 | 5.0% (2025 to 2035) |

| H2 2025 | 5.9% (2025 to 2035) |

H1 signifies period from January to June, H2 Signifies period from July to December

For the European Fructo-Oligosaccharides market, the sector is predicted to grow at a CAGR of 2.1% during the first half of 2024, with an increase to 2.9% in the second half of the same year. In 2025, the growth rate is anticipated to slightly decrease to 5.0% in H1 but is expected to rise to 5.9% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| April-2024 | Product Launches: A new high-purity fructo-oligosaccharides product was launched by DuPont for the food and beverage industry, offering a more efficient prebiotic solution aimed at enhancing digestive health. |

| March-2024 | Strategic Partnership: Sensus partnered with a leading animal feed producer to develop a specialized fructo-oligosaccharide s blend for improving gut health in livestock, targeting growth in the pet food and animal feed sectors. |

| February-2024 | Innovation in FOS Formulations: Friesl and Campina unveiled a novel syrup formulation of fructo-oligosaccharides to increase ease of incorporation in liquid-based nutritional supplements and functional beverages. |

Higher utilization of FOS in functional beverages and dairy products

The demand for health-conscious consumers in Europe has led to an increase in the use of fructo-oligosaccharides (FOS) in functional beverages and dairy products. Manufacturers in the beverage and dairy sectors are now adding FOS to enhance the prebiotic content of their products as consumers become more conscious of the importance of digestive health. This development does not only restrict traditional dairy products such as yogurt but expands to newer formats of beverages such as functional waters and plant-based drinks.

In Europe, the functional beverage market is growing dramatically, and FOS is playing a significant role in enhancing gut health and hence overall well-being. Also, besides that, FOS offers the benefit of being used as a sugar substitute in dairy products, thereby helping manufacturers comply with consumer demand for sugar or even less-content dairy products and healthier ones.

DuPont and Friesl and Campina head this trend, and, consequently, produce suitable formulations of FOS that withstand even quite aggressive process conditions of respective beverages and dairy products.

Increasing demand for FOS in animal feed and pet food

Another innovative point driving the European market for fructo-oligosaccharides is the increasing usage of FOS in animal feed and pet food. The increased awareness about gut health is no longer a phenomenon only in human nutrition but is also of extreme importance to the animal feed industry.

FOS has been widely known to encourage the growth of beneficial gut bacteria in animals, hence improving digestive health, immune function, and general well-being. The pet food segment is leading the trend since consumers are now willing to pay more for premium products that help their pets to be healthier.

The major players, therefore, began teaming up with animal feed producers and working with them to add FOS to the specialized formulations created for livestock and pets. Innovations of FOS-based animal feed products that will promote gut health and improve digestion are expected to rise significantly.

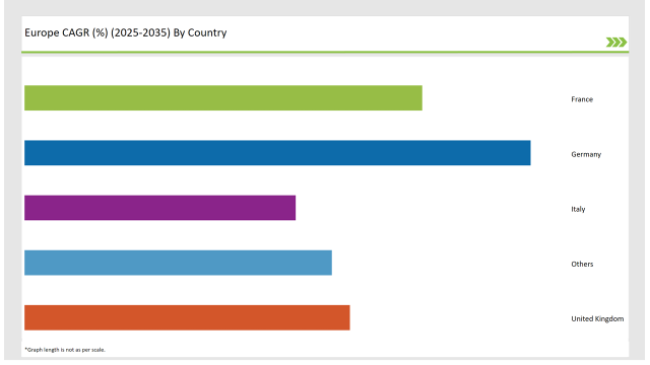

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

| Countries | Market Share (%) |

|---|---|

| Germany | 28% |

| France | 22% |

| United Kingdom | 18% |

| Italy | 15% |

| Others | 17% |

One of the fastest-emerging markets within Europe, FOS is fuelled by a huge demand for functional foods and functional beverages in the country. Most French citizens consider their health the highest priority for living; hence, the demand for various ingredients that foster digestive health increases every day, and thus, demand for FOSs, as examples of prebiotics, particularly applied in food and beverage as a functional formulation of dairy and snacks, increase usage.

High-purity FOS from the companies involved in France is used in products offering digestive advantages along with satiating the rapidly growing consumers' needs for the maintenance of healthful gut flora. Besides food and beverages, other application areas where FOS is increasingly being used include pet humanization trending higher in France, increasing its usage in pet foods.

Another major player in the country of Germany, the leading nation for the pharmaceutical and nutraceutical markets, has entered the European FOS market. Given the importance of Germany as a manufacturer of dietary supplements and nutraceutical products within Europe, FOS are highly in demand by these companies as ingredients for gut health and wellness formulations.

A strong nutraceutical market in the country has ensured quick acceptance of FOS for its use in improving digestive functions and enhancing immunity. The increasing elderly population of Germany, coupled with better awareness about maintaining a healthy gut through prebiotics, also fuels demand for FOS-based supplements.

Increasingly, German manufacturers are placing FOS in capsules, powders, and liquid supplements, which consumers would find convenient in improving their digestive health. The increasing investment of companies in research and development for FOS-based nutraceuticals targeted towards specific health issues is one trend that shows a progression in the market.

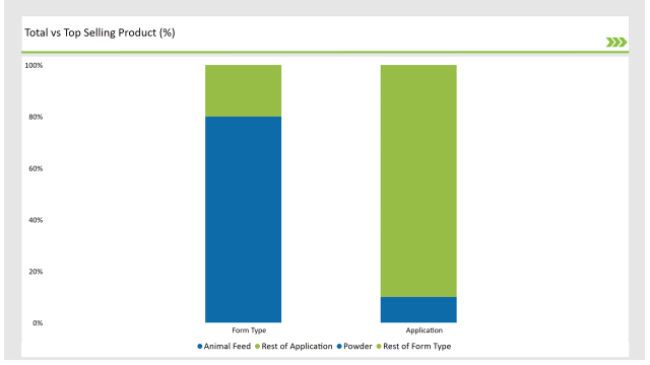

% share of Individual Categories Application and Form Type in 2025

| Main Segment | Market Share (%) |

|---|---|

| Application (Animal Feed) | 10% |

| Remaining segments | 90% |

Animal feed and pet food also register high market growth in the use of fructo-oligosaccharides as pet owners are getting fussier about the ingredients that their pets consume, for example, functional benefits such as enhanced digestive health and stronger immunity.

FOS is becoming a significant prebiotic for use in animal feed and pet food because it promotes the action of beneficial gut bacteria and helps maintain normal gut health. This has been due to the pet humanization trend, which has made pets a family member. Such a culture requires premium health-oriented pet food.

Also, the interest in sustainable and natural ingredients for pet food drives the demand for plant-based prebiotics like FOS. As such, companies operating within the animal feed and pet food sector are introducing FOS in their formulations to address these market trends. Companies like Sensus are at the forefront of that kind of change by tailoring FOS products to meet special needs in the animal feed market, which again contributes to an expanding market.

| Main Segment | Market Share (%) |

|---|---|

| Form Type (Powder) | 80% |

| Remaining segments | 20% |

One main reason for high shares in this segment is that it is flexible and convenient for both the manufacturer and the consumer. Powdered FOS can readily be incorporated into a wide spectrum of food and beverage products.

The most demanded and inquired into functional ingredients now have been that of supporting good gut health and the powdered type of FOS is one. High solubility and excellent stability are attractive properties, enhancing the nutritional content of a formula without any deleterious alterations in taste and texture. The clean-label products have further pushed the popularity of powdered FOS, as consumers are increasingly seeking natural and recognizable ingredients in their food.

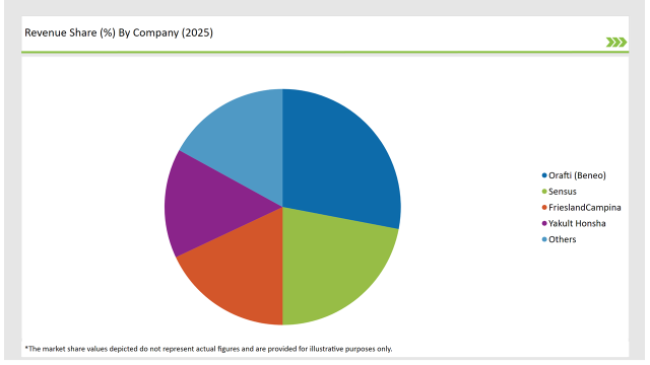

2025 Market share of Europe Fructo-Oligosaccharides manufacturers

| Manufacturer | Market Share (%) |

|---|---|

| Orafti (Beneo) | 28% |

| Sensus | 22% |

| Friesl and Campina | 18% |

| Yakult Honsha | 15% |

| Ingredion | 5% |

| Others | 12% |

Note: The above chart is indicative in nature

Fructo-oligosaccharides, short for FOS, form one of the prime categories of applications in the market for Europe, where there will be Tier 1, Tier 2, and Tier 3 companies that play important parts in this segment. The research and development competencies are relatively strong and at the distribution channel level across Tier 1.

These companies are on the cutting edge in the production of FOS products, especially in the food and beverages sector, in terms of supplying high-purity FOS in different applications. Their well-established global presence and capability to respond to the rising demand for functional ingredients have established them as leaders within the industry.

Tier 2 companies like Sensus and Ingredion focus more on regional markets and niche applications. Companies are offering niche FOS products tailored to specific industrial groups, like animal feed and pet food, and closely work with smaller players to address particular customer needs. They're now moving up the scale by increasing their product portfolios to keep pace with the escalating demand for prebiotic ingredients in functional foods and supplements.

Tier 3 companies are relatively small in size but make their contribution to the market by catering to localized needs and providing customized FOS formulations. They would tend to specialize in a specific product category and geographic region, thus becoming major contributors in niche markets.

As per Source Type, the industry has been categorized into Chicory, Sucrose, Inulin, and Jerusalem Artichoke.

As per Form Type, the industry has been categorized into Powder, and Liquid.

As per Application, the industry has been categorized into Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, and Pharmaceuticals.

As per End-Product, the industry has been categorized into Short-chain FOS, Medium-chain FOS, and Long-chain FOS.

As per Processing Method, the industry has been categorized intoFermentation, and Enzymatic Synthesis.

Industry analysis has been carried out in key countries of Germany, UK, France, Italy, Spain, Belgium, Netherlands, Nordic, Hungary, Poland, Czech Republic and Rest of Europe.

The Europe Fructo-Oligosaccharides market is projected to grow at a CAGR of 6.0% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 1,704.0 million.

Key factors driving the fructo-oligosaccharides market in Europe include the rising consumer demand for functional foods that promote digestive health and overall well-being, alongside increasing awareness of the benefits of prebiotics. Additionally, the growing trend towards clean-label products and natural ingredients is fueling the adoption of FOS in various food and beverage applications.

Germany, France, and UK are the key countries with high consumption rates in the European Fructo-Oligosaccharides market.

Leading manufacturers include Orafti (Beneo), Sensus, Friesland Campina, Yakult Honsha, and Ingredion known for their innovative and sustainable production techniques and a variety of product lines.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe & USA Consumer Electronics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Europe Plant-Based Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Europe Temperature Controlled Packaging Solutions Market Size and Share Forecast Outlook 2025 to 2035

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Europe Pet Food Market Analysis by Nature, Product Type, Source, Pet Type, Packaging, Distribution Channel, and Country - Growth, Trends, and Forecast through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA