FMI Analysts project the USA market for Fructo-Oligosaccharides to reach USD 683.6 million in 2025, potentially expanding to USD 1,324.0 million by 2035 at a CAGR of 6.8%, with growth predominantly driven by rising demand for prebiotic and dietary fiber-rich products, clean-label trends, and advancements in enzymatic synthesis processes.

| Attributes | Values |

|---|---|

| Estimated Industry Size in 2025 | USD 683.6 Million |

| Projected Industry Value in 2035 | USD 1,324.0 Million |

| Value-based CAGR from 2025 to 2035 | 6.8% |

Consumer awareness concerning the health aspects of prebiotic fibers is driving the USA Fructo-Oligosaccharides market. FOS have been gaining popularity as related to gut health improvements, enhanced absorption of calcium, and the reduction in sugar concentration in food formulations.

Of the trends noticed by the chicory-based FOS finds its way to application in 'clean label' products, which are popular among health-conscious consumers. In addition, recent breakthroughs in enzymatic synthesis are changing production by increasing yields and making possible cost-effective operations.

The market concentration is moderate with Ingredion Inc., Cargill Inc., and BENEO-Orafti SA. They are investing in R&D to develop new products such as high-purity short-chain FOS for dietary supplements. At the same time, new entrants like Nexira are using their agility to cater to niche markets like organic dietary supplements.

Therefore, the dynamic rivalry will ensure innovations at the leading positions while expanding into markets in such diversified industries, such as food and beverages, pharmaceuticals, or animal feed.

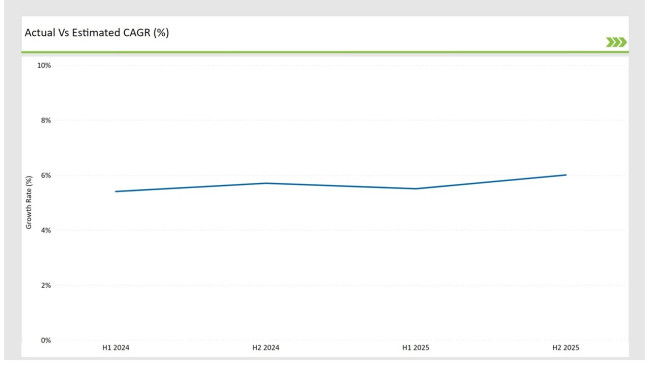

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Fructo-Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | Growth Rate (%) |

|---|---|

| H1 | 5.4% (2024 to 2034) |

| H2 | 5.5% (2024 to 2034) |

| H1 | 5.7% (2024 to 2034) |

| H2 | 6.0% (2024 to 2034) |

For the USA market, the Fructo-Oligosaccharides sector is predicted to grow at a CAGR of 5.4% during the first half of 2024, with an increase to 5.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 5.5% in H1 and rise further to 6.0% in H2.

These figures underscore the steady rise in demand for FOS as consumers continue prioritizing gut health and functional foods. Advancements in extraction techniques and increasing collaboration between ingredient manufacturers and food processors are driving this growth. This semi-annual analysis highlights key growth periods for stakeholders to refine their strategies.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Cargill introduced a new FOS-based prebiotic powder designed for functional beverages and snacks. |

| Sep-2024 | BENEO- Orafti SA partnered with a leading infant formula brand to supply short-chain FOS for digestive health. |

| Jun-2024 | Ingredion Inc. launched an enzymatically synthesized liquid FOS solution for clean-label bakery products. |

| Apr-2024 | Nexira expanded its production facility to meet growing demand for organic FOS in dietary supplements. |

| Jan-2024 | Tate & Lyle announced an investment in advanced fermentation technologies to enhance FOS production efficiency. |

Growing Demand for Prebiotic-Driven Gut Health Solutions

The growing awareness of gut health as a key component of general wellness is fueling the uptake of Fructo-Oligosaccharides. FOS is a prebiotic that encourages the proliferation of beneficial gut flora, thus improving digestion and immunity. This is further driven by the increasing functional foods and beverages that are enhanced with FOS to satisfy health-conscious consumers.

Companies like BENEO-Orafti SA are at the forefront of this change by incorporating short-chain FOS into high-demand categories such as infant formula and dietary supplements. This demand is especially strong among younger demographics and individuals seeking digestive health solutions.

Expansion of Enzymatic Synthesis for Sustainable Production

The scientific method of enzymatic synthesis has taken over as the most sustainable and efficient method to produce high purity Fructo-Oligosaccharides. Unlike conventional fermentation methods, such enzymatic methodologies give FOS manufacturers easier control over their product and fewer impurities.

It is also more environmentally friendly, in line with the call of the industry toward sustainable practices. Ingredion Inc. and Tate & Lyle are some of the key players who are spearheading the enzymatic synthesis techniques that are designed to produce specific FOS for low-calorie sweeteners, functional food additives, and more. As these innovations take off, enzymatic synthesis is poised to redefine the production landscape for FOS.

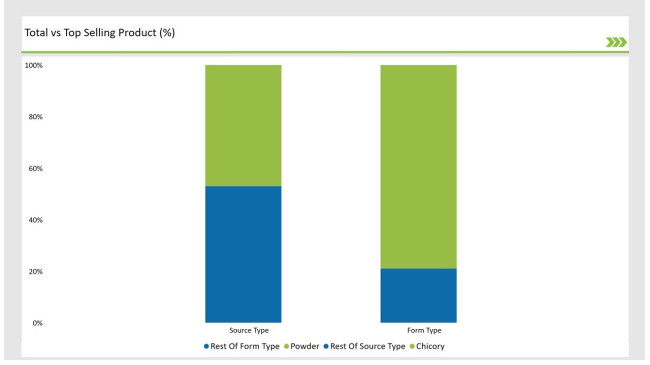

| Source Type | Market Share (2025) |

|---|---|

| Chicory | 47% |

| Remaining segments | 53% |

Chicory is the primary source of FOS in the USA-also highly efficient in extraction as well as offering prebiotic benefits that are in line with the clean-label movement. Sucrose-based FOS is gaining considerable natural low-calorie sweetness status, particularly within premium beverage formulations. In the meanwhile, inulin and Jerusalem artichoke are emerging as niche sources, valued for their unique health benefits as well as compatibility with organic certifications further diversifying the raw material base in the market.

| Form Type | Market Share (2025) |

|---|---|

| Powder | 79% |

| Remaining segments | 21% |

The majority continues to be a powdered FOS, stable under various applications-from bakery goods to dietary supplement products. For infant formula applications and ready-to-drink beverage applications, though, liquid forms are more gaining popularity, allowing for easy usage and excellent solution properties. Evenly distributed among both forms suggests the increased flexibility of FOS's applications as adapted to new demand from the dynamic consumer preferences.

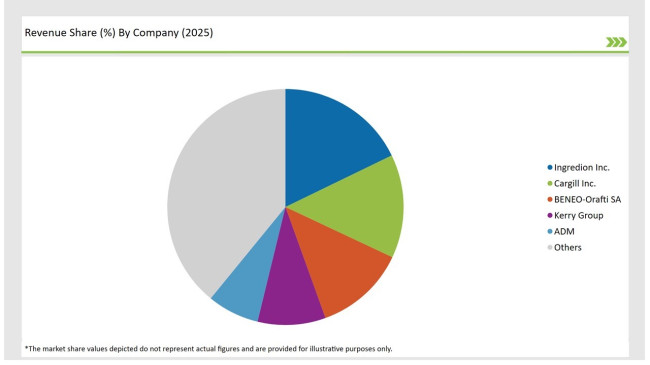

The USA Fructo-Oligosaccharides market presents a moderately concentrated landscape, and the Tier-1 companies Ingredion Inc., Cargill Inc., and BENEO-Orafti SA combined hold up to 44% of market share. These are major players as they have access to robust supply chains, latest R&D skills, and partnerships which help these firms maintain their supremacy in the markets. Ingredion's investment in enzymatic synthesis innovations, while BENEO-Orafti holds expertise with chicory-based FOS.

| Company Name | Market Share (%) |

|---|---|

| Ingredion Inc. | 17.8% |

| Cargill Inc. | 14.2% |

| BENEO-Orafti SA | 12.5% |

| Kerry Group | 9.3% |

| ADM | 7.1% |

| Others | 39.1% |

Organic and region-specific products from Nexira and Sensus America Inc. capture niche markets of Tier-2 companies. In contrast, the emerging Tier-3 players such as Friesl and Campina Ingredients experiment with enzymatic synthesis to produce premium FOS for functional foods. The competitive landscape is innovation- and differentiation-based, making it dynamic and ever-changing.

Chicory, Sucrose, Inulin, Jerusalem Artichoke.

Powder, Liquid.

Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, Pharmaceuticals.

Short-chain FOS, Medium-chain FOS, Long-chain FOS.

Fermentation, Enzymatic Synthesis.

By 2025, the USA Fructo-Oligosaccharides market is expected to grow at a CAGR of 6.8%.

By 2035, the sales value of the USA Fructo-Oligosaccharides industry is expected to reach USD 1,324.0 million.

Key factors include rising demand for prebiotic products, advancements in enzymatic synthesis, and increasing applications in dietary supplements and infant formula.

Regions such as the West Coast and Northeast, known for their health-conscious populations, dominate consumption.

Prominent players include Ingredion Inc., Cargill Inc., BENEO-Orafti SA, Kerry Group, and ADM.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA