The ASEAN Fructo-Oligosaccharides market is set to grow from an estimated USD 276.7 million in 2025 to USD 529.2 million by 2035, with a compound annual growth rate (CAGR) of 7.2% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated Industry Size (2025) | USD 276.7 million |

| Projected Value (2035) | USD 529.2 million |

| Value-based CAGR (2025 to 2035) | 7.2% |

The ASEAN region is experiencing an unpredicted rise in the demand for fructo-oligosaccharides (FOS), a type of prebiotic fiber known for its health benefits. FOS is derived from natural sources, chiefly chicory root, and is now increasingly included in a variety of food and beverage products, for its gut health-promoting, digestion-enhancing, and general overall-wellness-supporting abilities.

The increased understanding of health and nutrition that consumers have now is the factor which impacts the functionality of ingredients such as FOS most. As the lifestyles become more diabetes-preventing orientated, a slow yet noticeable change occurs toward the food products that come with extra health benefits, mainly in the beverages and foods section. FOS is known for its action of modulating the gut microbiota and the consequent improvements in the immunity system and the reduced risk of chronic diseases.

On the other hand, the clean label trend is also wielding considerable influence on the market as people prefer natural and less processed ingredients. FOS, which is sourced from plants such as chicory and others, goes hand in hand with this trend and this is the reason why it is a preferred option for producers who want to meet customers' breakthrough demands for safety, transparency, and nutrition in their products.

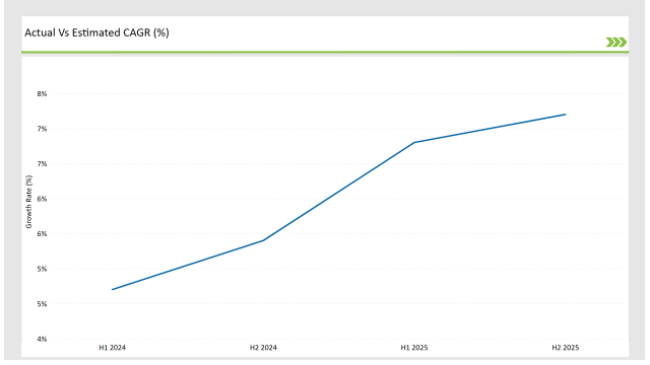

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Fructo-Oligosaccharides market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Fructo-Oligosaccharides market, the sector is predicted to grow at a CAGR of 4.7% during the first half of 2024, increasing to 5.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 6.8% in H1 but is expected to rise to 7.2% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Beneo launched a new line of chicory root-derived fructo-oligosaccharides aimed at the functional food market, enhancing gut health benefits and targeting health-conscious consumers. |

| 2024 | Tate & Lyle expanded its product portfolio with a new FOS ingredient specifically designed for plant-based dairy alternatives, improving texture and nutritional value. |

| 2024 | DuPont introduced a novel fermentation process for producing fructo-oligosaccharides, increasing yield and reducing production costs, thereby enhancing market competitiveness. |

| 2024 | Nutraceutical International Corporation developed a new range of dietary supplements featuring fructo-oligosaccharides, focusing on digestive health and immune support, catering to the growing demand for gut health products. |

Growth of the Dietary Supplements Market

The booming dietary supplements market is attributed to the rising consumer interest in health and fitness. In this regard, fructo-oligosaccharides gain popularity as they have prebiotic properties that support gut function and overall wellness. The more people together with dietary supplements to help with the health issue, directly impacts the market growth, that is, to FOS-based products.

The increasing manifestation of health problems due to lifestyle, mainly obesity and digestive issues, has driven customers into preventive methods with the help of dietary supplements. Recognized for its function of enhancing gut health, FOS also stimulates the proliferation of good bacteria, which is why it is a functional ingredient in probiotic and prebiotic supplements.

This surge is also corroborated by the broader request that our products get, such as probiotics and prebiotics, whose target customers are those who are now aware of the relationship between gut health and whole health.

Integration of FOS in Plant-Based and Vegan Products

Fructo-Oligosaccharides market is undergoing a shift due to technological developments such new technologies have a dominant part in expanding and the market introduction of alternative proteins in animal feed. Biotechnology, fermentation and precision agriculture have a great influence on the production of high-quality proteins, which can be given to livestock to meet their nutritional needs.

For example, the evolution of fermentation technology allows us to produce microbial proteins which can be made from renewable resources, are very high in protein and thus very cheap. These proteins could act as sustainable alternatives to foods made from animals, which contain essential nutrients for growth and health.

The Council also recommends the use of precision agriculture to further increase the production efficiency of protein crops. With the availability of data analytics, farmers can achieve optimal results in the planting, irrigation, and harvesting of crops, thus leading to more yields and better protein content. This not only raises the financial status of farmers but also leads to the sustainability of the agricultural system in total.

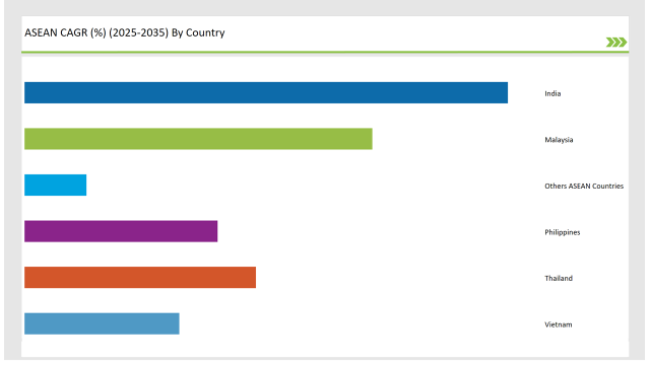

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The market of India Fructo-Oligosaccharides is on a rollercoaster growth ride as a result of many forces. The large livestock population, in tandem with the increase in meat and dairy consumption, is the main factor for the demand of high-quality animal feed. With the continued expansion of the Indian economy, a number of consumers are turning to protein-rich diets that in turn leads to the increase in the demand for poultry, dairy, and aquacultural products.

The Indian government is also introducing schemes for the improvement of the livestock sector's productivity and sustainability. Initiatives that aim to improve the skills of those involved in animal husbandry and promote the use of alternative protein sources are now fashionable. The first one is the promotion of plant-based proteins, such as soybean and pulses, which are not just fantastic sources of protein but also have a positive effect on local agriculture.

The ASEAN Fructo-Oligosaccharides market has Thailand as its main actor due to its advanced agricultural sector that can provide alternative protein sources. The increasing demand for quality animal feed in connection with livestock that is in a boom, especially poultry and aquaculture, is the main reason to turn to alternative proteins.

Thai government is eagerly implementing congratulated programs to build sustainability and the productivity chain of the livestock section. Initiatives that are focused on the more efficient utilization of feed and the less harmful effect of animal agriculture are in the course of action. In this context, the recommended use of alternative proteins, like plant-based and insect-based proteins, has been given especial consideration because of their ecological balance.

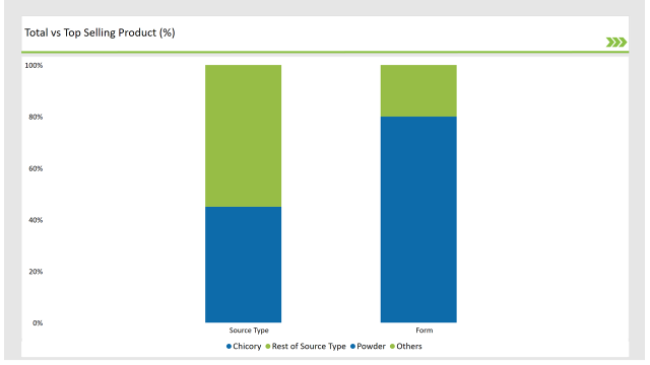

Fructo-oligosaccharides (FOS) are derived mainly from chicory root, which is the major player in this market. The chicory root-derived FOS is being popular because it has high fiber content and prebiotic properties that promote gut health and help in the enhancement of digestive function.

Chicory root-derived FOS is illustriously applied in various food and beverage products such as dairy products, baked goods, and snacks. The ingredient is acknowledged for its capacity to improve the texture and mouthfeel of food while providing a natural source of sweetness with no additional calories. Thus, this is a very alluring product for producers who are engaged in making healthier goods that are in alignment with the demands of the market for low-calorie and functional food.

Powdered fructo-oligosaccharides are a trendy type of FOS that are extensively used in a number of food application processes because of their coverall properties and being easy to mix. Flexibility is added to powdered FOS formulations and it can be used in different laboratories as a result of the ease of handling and dispensing it for dietary supplements, functional foods, and beverages.

The segment of powdered FOS is being developed due to the raising interest in dietary supplements that are gut-friendly. The general public is learning more and more about the benefits of gut health, which is why prebiotic supplements containing powdered FOS are becoming more favored. These supplements are presented as products with positive effects on the increase of good gut bacteria, the improvement of digestion, and the promotion of general health.

Powdered fructo-oligosaccharides are also entering into multiple food items, beside the dietary supplements, like these protein bars, meal replacements, and functional beverages. The ability of powdered FOS to make a soft texture and have a mild sweet flavor without adding any calories makes it a valuable player for the manufacturers who are trying to modify their products' nutritional status.

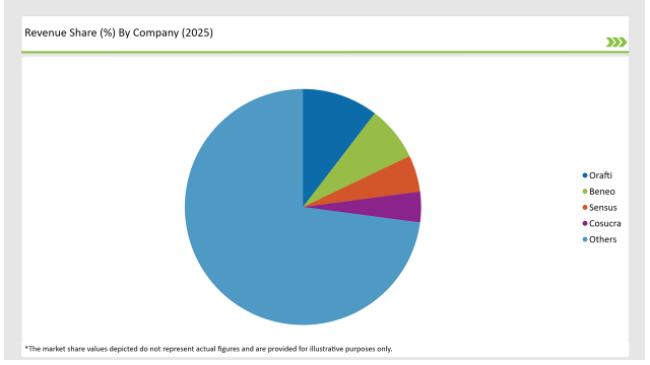

2025 Market Share of ASEAN Fructo-Oligosaccharides Manufacturers

Note: The above chart is indicative

The fructo-oligosaccharides (FOS) market displays a highly competitive atmosphere which has numerous key players who are trying to grab some of the market share. The prominent names in this field are Beneo, Tate & Lyle, DuPont, Cargill, and Nutraceutical International Corporation, apart, of course, from the other companies.

These players are adopting a range of techniques which center on multiple ways of achieving the goal of enhancing their market presence namely product innovation, strategic partnerships, and expansion into new markets.

This Segment further Categorise into Chicory, Sucrose, Inulin, Jerusalem artichoke.

This Segment further Categorise intoPowder, and Liquid.

Food & Beverages, Infant Formula, Dietary Supplements, Animal Feed, and Pharmaceuticals.

Short-chain FOS, Medium-chain FOS, and Long-chain FOS.

Fermentation, and Enzymatic Synthesis.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Fructo-Oligosaccharides market is projected to grow at a CAGR of 7.2% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 529.2 million.

India are key Country with high consumption rates in the ASEAN Fructo-Oligosaccharides market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Automotive Aftermarket Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN and Gulf Countries MAP & VSP Packaging Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Flexible Plastic Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Human Milk Oligosaccharides Market Report – Size, Demand & Growth 2025–2035

ASEAN Probiotic Ingredients Market Outlook – Growth, Size & Forecast 2025–2035

ASEAN Food Additives Market Insights – Growth, Demand & Forecast 2025–2035

ASEAN Chitin Market Analysis – Trends, Demand & Forecast 2025–2035

ASEAN Bakery Mixes Market Outlook – Size, Share & Forecast 2025–2035

ASEAN Non-Alcoholic Malt Beverages Market Trends – Demand & Forecast 2025–2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Yeast Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Green and Bio-based Polyol Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

ASEAN Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Barite Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA