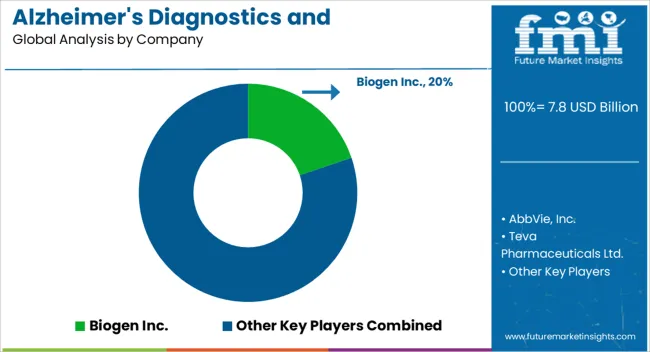

The Alzheimer's Diagnostics and Therapeutics Market is estimated to be valued at USD 7.8 billion in 2025 and is projected to reach USD 17.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Alzheimer's Diagnostics and Therapeutics Market Estimated Value in (2025 E) | USD 7.8 billion |

| Alzheimer's Diagnostics and Therapeutics Market Forecast Value in (2035 F) | USD 17.4 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The Alzheimer’s diagnostics and therapeutics market is experiencing steady expansion fueled by the rising global prevalence of neurodegenerative disorders and increasing healthcare expenditure toward early detection and treatment solutions. Advances in biomarker research, neuroimaging technologies, and precision medicine have enhanced diagnostic accuracy, enabling earlier intervention strategies.

Therapeutic innovation is being shaped by ongoing clinical trials focused on disease modifying drugs, monoclonal antibodies, and combination therapies aimed at slowing progression. Governments and healthcare organizations are investing heavily in awareness programs and clinical infrastructure to manage the socio economic burden of Alzheimer’s disease.

As aging populations grow worldwide, the demand for accessible diagnostics and effective therapeutics is expected to strengthen. The outlook remains positive as stakeholders focus on innovation, patient centric care, and integrated delivery of both diagnostic and treatment pathways.

The therapeutics segment is projected to hold 54.70% of total revenue by 2025 within the product category, positioning it as the leading segment. Growth has been driven by the increasing availability of symptomatic treatments, ongoing development of disease modifying drugs, and patient reliance on pharmaceutical intervention for disease management.

Investment in advanced biologics and pipeline therapies has further reinforced the strength of this segment.

Therapeutics continue to dominate as they address the urgent need for slowing progression and improving quality of life, thereby establishing their leadership within the product landscape.

The institutional sales segment is expected to account for 46.30% of overall revenue by 2025 under the distribution channel category, making it the most prominent channel. This position is supported by the large scale procurement of diagnostic devices and therapeutics by hospitals, specialty clinics, and long term care facilities.

Institutional sales have been strengthened by structured reimbursement frameworks and bulk purchasing agreements that ensure consistent supply and affordability.

The central role of healthcare institutions in Alzheimer’s management, combined with their ability to provide integrated diagnostic and therapeutic services, has reinforced institutional sales as the dominant distribution channel.

The market value for Alzheimer’s diagnostics and therapeutics was 43.1% of the overall USD 7.8 Billion of the global dementia treatment market in 2025.

The growing burden of Alzheimer's disease increased the sales of Alzheimer's diagnostics and therapeutics in the market. As the population ages and the number of people with Alzheimer's disease increases, there will likely be greater demand for diagnostic tests and treatments that can help manage the disease.

Alzheimer's disease is a progressive disease, which means that it worsens over time. Early and accurate diagnosis is critical to assisting patients and cares with treatment planning and options. A safe and reliable test that is able to precisely detect patients with amyloid plaques in Alzheimer's patients is still lacking. Recently the FDA has approved the first IVD (in vitro diagnostic test) for the early diagnosis of amyloid plaques linked with Alzheimer's disease is being marketed. The Lumipulse G-Amyloid Ratio test is designed for use in adult patients who are 55 years of age or older with cognitive impairment and are being assessed for Alzheimer's disease and other roots of cognitive decline.

Thus, advances in technology and research may lead to the development of new and more effective diagnostic tools and therapies, which could further increase the sales of these products and is expected to boost demand for the global Alzheimer’s diagnostics and therapeutics market is projected to expand at a CAGR of 8.4% during the forecast period (2025 to 2035).

The market has significant growth opportunities due to the increasing prevalence of Alzheimer's disease (AD) worldwide.

There is a growing interest in developing biomarker-based diagnostics for Alzheimer's disease. Biomarkers can help to identify individuals at risk of developing AD, track disease progression, and assess treatment response. There is a need for reliable and accurate biomarkers that can be used in clinical practice. There is a significant need for Alzheimer's diagnostics and therapeutics in emerging markets, such as Asia and Latin America, where the prevalence of the disease is increasing rapidly. Companies that can successfully penetrate these markets could see significant growth opportunities.

The market presents significant opportunities for companies that can develop innovative and effective solutions for the diagnosis and treatment of this devastating disease in both developed and developing regions will raise the market to new heights during the forecast period from 2025 to 2035.

The high cost of Alzheimer's disease diagnosis is one of the significant factors that will likely stymie the growth of the Alzheimer's disease diagnostic market. Given the resources deployed to prevent, diagnose, treat, and manage dementia, the economic costs of AD are significant for the health system. The societal costs of dementia extend beyond these direct costs, as the disease has an economic and quality-of-life impact on individuals, families, and careers.

According to some studies, the direct and indirect costs of Alzheimer's disease-related healthcare are very high. Alzheimer's disease necessitates post-mortem assessment of brain tissue via positron emission tomography (PET) and cerebrospinal fluid (CSF) biomarkers, as well as several innovative clinical criteria that can aid diagnosis in patients. The cost of a true dementia diagnosis is calculated by dividing the total cost of all investigations by the number of final dementia diagnoses. The unit costs for the various components of the diagnostic process are used to assess all costs.

Aligned with the global aging population, the global prevalence of Alzheimer's disease is expected to rise exponentially in the coming decades. As a result, the costs of AD have come under increased scrutiny, and projections have been made which are restraining the growth of the Alzheimer's diagnostics and therapeutics market during the forecast period from 2025 to 2035 in the world.

With a market share of 89.7% in 2025, theUSA continue to dominate the North American region. This large market share is expected to continue throughout the forecast period.

The United States has one of the maximum prevalence rates of Alzheimer's disease in the world.

Additionally, the combination of an aging population, high prevalence of Alzheimer's disease, high healthcare spending, and strong research infrastructure make the United States an attractive market for Alzheimer's diagnostics and therapeutics.

This will result in the propulsion of demand for Alzheimer’s diagnostics and therapeutics in the country during the forecast period of 2025 to 2035.

The United Kingdom dominates the European region with a total market share of about 39.6% in 2025 and is expected to continue to experience the same growth throughout the forecast period.

The United Kingdom has an aging population, which increases the demand for Alzheimer's diagnostics and therapeutics. As people live longer, the prevalence of Alzheimer's disease increases, and the United Kingdom is expected to see a significant rise in the number of people living with the disease in the coming years.

The United Kingdom government has shown a commitment to funding research into Alzheimer's disease, with investments in both public and private sector research. This support helps to attract investment from pharmaceutical companies, which are crucial for bringing new diagnostics and therapeutics to market and will foster profitable growth of the market over the course of the forecast period.

Japan in the East Asia region holds a market share of 60.4% in 2025 and will expand with growing numbers in the future.

Japan has a robust research infrastructure, with many leading research institutions dedicated to studying Alzheimer's disease. The country is home to a few of the world's top pharmaceutical companies, and the Japanese government has made significant investments in research and development in this area.

The aging population, strong research infrastructure, innovative technologies, and supportive government policies all suggest that Japan will continue to be an important market for Alzheimer's diagnostics and therapeutics.

Diagnostics is expected to present high growth at a CAGR of 7.5% throughout the forecast period, with a market share of 54.1% in the global market in 2025. Recent technological advancements in diagnostic testing have led to the development of more accurate and reliable tests for Alzheimer's disease. These advances have helped to increase the adoption of diagnostic testing and drive market growth.

As the demand for reliable and accurate diagnostic tests continues to grow, the market for Alzheimer's diagnostics is expected to expand significantly in the coming years.

Institutional sales hold the market share value of 57.9% during the year 2025. Institutional sales by distribution channels allow hospitals and clinics to purchase the necessary equipment and drugs needed to treat patients with Alzheimer's disease and also enable manufacturers to expand their market reach. By partnering with hospitals and clinics, manufacturers can reach a larger patient population and increase sales of their products.

Thus, institutional sales are expected to benefit the most from the sales of Alzheimer's diagnostics and therapeutics globally in the next decade.

Manufacturers invest heavily in research and development to discover new diagnostic tools and treatments for Alzheimer's disease. Some manufacturers may diversify their product offerings to include a range of diagnostic and therapeutic options for Alzheimer's disease.

Acquisitions, collaboration, and clinical trials significantly accelerate the manufacturer’s ability to capture a significant share of the market. A few of the recent instances include

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2012 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, United Kingdom, Germany, Italy, Russia, Spain, France, BENELUX, Nordic Countries, India, Thailand, Indonesia, Malaysia, Vietnam, Philippines, Japan, China, South Korea, Australia, New Zealand, Türkiye, GCC Countries, Israel, North Africa, and South Africa |

| Key Market Segments Covered | Product, Distribution Channel, and Region |

| Key Companies Profiled | Biogen Inc.; AbbVie, Inc.; Teva Pharmaceuticals Ltd.; Eisai Co.; Ltd.; Janssen Pharmaceuticals Inc.; Novartis AG; Zydus Lifesciences Ltd.; Sun Pharmaceutical Industries Ltd.; Dr. Reddy's Laboratories Ltd.; Aurobindo Pharma Ltd.; AMillioneal Pharmaceuticals Inc.; Macleods Pharmaceuticals Ltd.; Viatris Inc.; Lupin Ltd.; Cipla Ltd.; Torrent pharmaceuticals Ltd.; Unichem Laboratories Ltd.; Lannett Inc. |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Pricing | Available upon Request |

The global alzheimer's diagnostics and therapeutics market is estimated to be valued at USD 7.8 billion in 2025.

The market size for the alzheimer's diagnostics and therapeutics market is projected to reach USD 17.4 billion by 2035.

The alzheimer's diagnostics and therapeutics market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in alzheimer's diagnostics and therapeutics market are therapeutics, _cholinesterase inhibitors, _nmda receptor antagonists, _manufactured combination, diagnostics, _lumbar diagnostics test, _ct scan, _mri, _eeg and _pet scan.

In terms of distribution channel, institutional sales segment to command 46.3% share in the alzheimer's diagnostics and therapeutics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Leaders & Share in Alzheimer’s Therapeutics

Blood-based Biomarker For Alzheimer's Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

HIV Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Rabies Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Tissue Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Sepsis Diagnostics Market Growth - Trends & Forecast 2025 to 2035

Poultry Diagnostics Market - Demand, Growth & Forecast 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

In-vitro Diagnostics Kit Market Size and Share Forecast Outlook 2025 to 2035

In Vitro Diagnostics Market Insights - Trends & Forecast 2025 to 2035

Clinical Diagnostics Market Insights – Size, Share & Forecast 2025 to 2035

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

In-Vitro Diagnostics Packaging Market

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Molecular Diagnostics In Pharmacogenomics Market Size and Share Forecast Outlook 2025 to 2035

Psychosis Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Pneumonia Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA