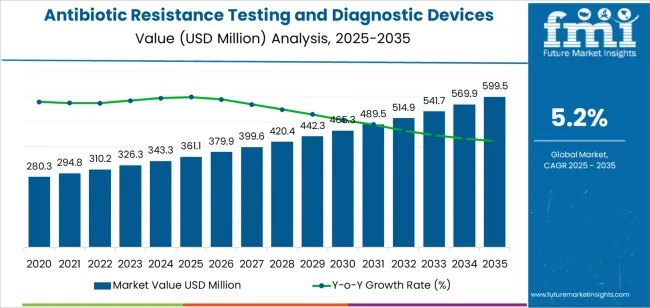

The global antibiotic resistance testing and diagnostic devices market is projected to reach USD 599.5 million by 2035, recording an absolute increase of USD 238.4 million over the forecast period. The market is valued at USD 361.1 million in 2025 and is set to rise at a CAGR of 5.2% during the assessment period. The overall market size is expected to grow by nearly 1.7 times during the same period, supported by increasing prevalence of antimicrobial resistance globally, driving demand for rapid detection technologies and increasing investments in healthcare infrastructure and laboratory automation systems worldwide. High equipment costs and limited availability of trained personnel in developing regions may pose challenges to market expansion.

The expansion trajectory reflects fundamental shifts in global healthcare priorities, where antimicrobial resistance has emerged as a critical public health threat requiring immediate diagnostic intervention. Healthcare systems face mounting pressure to implement comprehensive surveillance programs that can identify resistant pathogens before they spread through clinical and community settings. Advanced diagnostic devices deliver actionable susceptibility data within hours rather than days, enabling clinicians to initiate targeted antimicrobial therapy that improves patient outcomes while reducing unnecessary broad-spectrum antibiotic exposure. This capability addresses both immediate clinical needs and broader public health objectives related to antimicrobial stewardship and resistance containment.

Regional market dynamics show pronounced variation, with developed markets emphasizing laboratory automation and workflow efficiency while emerging economies prioritize basic diagnostic infrastructure development and capacity building. Hospitals and reference laboratories represent the primary demand centers, where automated susceptibility testing platforms integrate with existing microbiology workflows to standardize resistance detection and reporting protocols. The technology landscape encompasses traditional antimicrobial susceptibility testing systems alongside newer molecular diagnostic platforms that detect genetic resistance markers, creating diverse product offerings tailored to specific clinical settings and resource availability levels.

Investment patterns indicate sustained commitment from both public health agencies and private healthcare systems toward diagnostic infrastructure that supports antimicrobial resistance monitoring and treatment optimization. Government initiatives worldwide promote surveillance networks that rely on standardized diagnostic capabilities, creating policy-driven demand for validated testing platforms. Clinical laboratories pursue automation solutions that reduce manual labor requirements while improving result consistency, driving adoption of sophisticated diagnostic systems despite higher capital costs. The convergence of regulatory pressure, clinical necessity, and technological advancement establishes favorable conditions for market expansion through 2035, though implementation challenges related to cost barriers and technical complexity will require ongoing attention from manufacturers and healthcare policymakers to ensure equitable access across diverse healthcare environments and economic contexts.

Between 2025 and 2030, the antibiotic resistance testing and diagnostic devices market is projected to expand from USD 361.1 million to USD 468.4 million, resulting in a value increase of USD 107.3 million, which represents 45% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for rapid diagnostic solutions in hospitals and laboratories, product innovation in molecular detection technologies and automated AST systems, as well as expanding integration with electronic health records and antibiotic stewardship programs. Companies are establishing competitive positions through investment in advanced molecular diagnostic platforms, laboratory automation solutions, and strategic market expansion across hospital, third-party testing, and other healthcare applications.

From 2030 to 2035, the market is forecast to grow from USD 468.4 million to USD 599.5 million, adding another USD 131.1 million, which constitutes 55% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized diagnostic systems, including advanced nucleic acid detection platforms and integrated mass spectrometry solutions tailored for specific pathogen identification requirements, strategic collaborations between diagnostic device manufacturers and healthcare institutions, and an enhanced focus on diagnostic accuracy and antimicrobial stewardship compliance. The growing emphasis on infection control optimization and precision medicine will drive demand for advanced, high-performance antibiotic resistance testing solutions across diverse healthcare applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 361.1 million |

| Market Forecast Value (2035) | USD 599.5 million |

| Forecast CAGR (2025-2035) | 5.2% |

The antibiotic resistance testing and diagnostic devices market grows by enabling healthcare providers to achieve rapid pathogen identification and antimicrobial susceptibility testing while addressing the global threat of drug-resistant infections. Healthcare facilities face mounting pressure to implement effective antibiotic stewardship programs and optimize treatment protocols, with advanced diagnostic devices typically providing results within 2-6 hours compared to 24-72 hours for conventional culture methods, making rapid resistance testing essential for patient outcomes and infection control. The antimicrobial resistance crisis creates demand for automated solutions that can detect resistance patterns accurately, guide targeted therapy decisions, and reduce inappropriate antibiotic usage across hospital and laboratory settings.

Government initiatives promoting antimicrobial stewardship and infection surveillance programs drive adoption in hospital, third-party testing, and other healthcare applications, where rapid diagnostic capabilities have a direct impact on treatment efficacy and patient safety. The global focus on combating antimicrobial resistance and improving diagnostic infrastructure accelerates device demand as healthcare systems seek alternatives to conventional culture-based methods that delay treatment decisions. High capital investment requirements and technical complexity may limit adoption rates among smaller healthcare facilities and regions with constrained healthcare budgets.

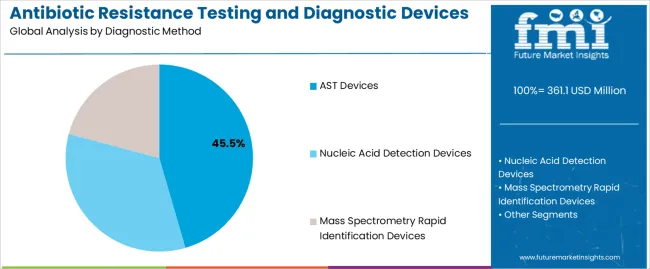

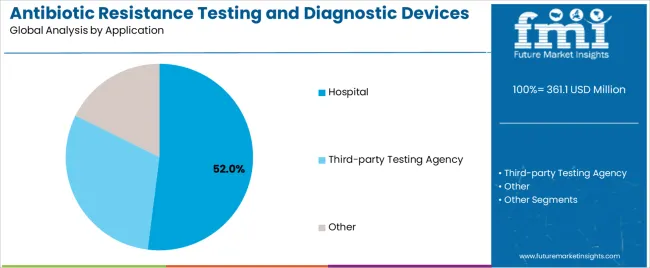

The market is segmented by diagnostic method, application, and region. By diagnostic method, the market is divided into AST devices, nucleic acid detection devices, and mass spectrometry rapid identification devices. Based on application, the market is categorized into hospital, third-party testing agency, and other. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

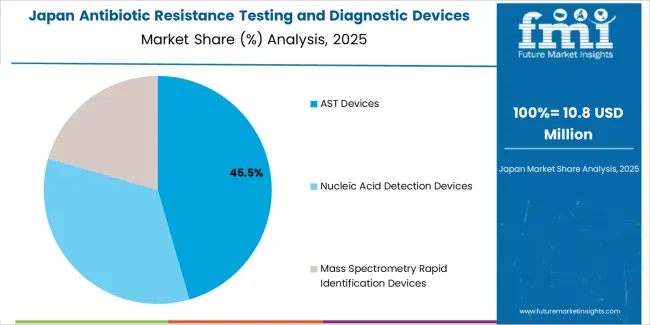

The AST devices segment represents the dominant force in the antibiotic resistance testing and diagnostic devices market, capturing approximately 45.5% of total market share in 2025. This category delivers comprehensive antimicrobial susceptibility profiling with enhanced automation and standardization capabilities. The AST devices segment's market leadership stems from its widespread clinical adoption, established regulatory pathways, and compatibility with existing laboratory workflows that prioritize reliable susceptibility data for treatment decision-making.

The nucleic acid detection devices segment maintains a substantial 36% market share, serving healthcare providers who require rapid genetic resistance marker identification through molecular diagnostic technologies. The mass spectrometry rapid identification devices segment accounts for 18.5% market share, featuring advanced protein profiling capabilities that enable species-level identification within minutes.

Key advantages driving the AST devices segment include:

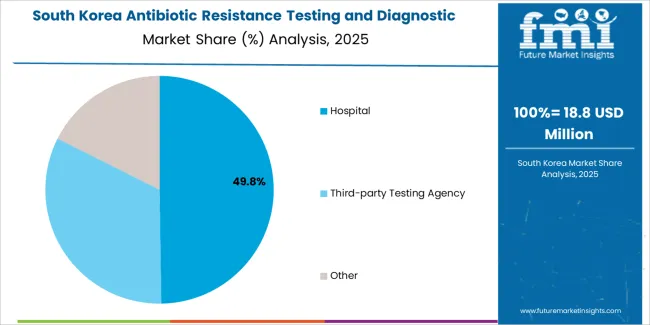

Hospital applications dominate the antibiotic resistance testing and diagnostic devices market with approximately 52% market share in 2025, reflecting the critical need for rapid diagnostic capabilities in acute care settings where timely treatment decisions directly impact patient outcomes. The hospital segment's market leadership is reinforced by widespread adoption across emergency departments, intensive care units, and microbiology laboratories, which require immediate access to susceptibility data for sepsis management and infection control programs.

The third-party testing agency segment represents 28% market share through specialized reference laboratory services that provide comprehensive antimicrobial resistance testing for multiple healthcare facilities. The other application segment accounts for 20% market share, encompassing pharmaceutical research, veterinary diagnostics, and public health surveillance programs.

Key market dynamics supporting application preferences include:

The market is driven by three concrete demand factors tied to clinical necessity and healthcare policy. First, the antimicrobial resistance crisis creates increasing requirements for rapid diagnostic capabilities, with drug-resistant infections causing approximately 700,000 deaths annually worldwide according to global health organizations, requiring reliable susceptibility testing infrastructure for infection control and treatment optimization. Second, healthcare quality improvement initiatives drive facilities toward automated diagnostic platforms, with advanced systems reducing time-to-result by 50-70% compared to conventional methods while improving diagnostic accuracy and laboratory workflow efficiency. Third, government policy support through infection surveillance programs, diagnostic reimbursement frameworks, and antimicrobial stewardship regulations accelerates adoption across Europe, North America, and Asia-Pacific regions where resistance monitoring receives priority funding.

Market restraints include high capital equipment costs affecting technology adoption and replacement cycles, particularly for molecular diagnostic platforms where system investments can exceed USD 100,000 per installation, posing financial barriers for smaller healthcare facilities and resource-constrained markets operating on limited diagnostic budgets. Technical complexity regarding molecular assay validation and quality control procedures creates additional challenges, as implementing laboratories require specialized training programs and ongoing proficiency testing to maintain regulatory compliance and ensure accurate resistance detection across diverse pathogen panels during routine clinical operations.

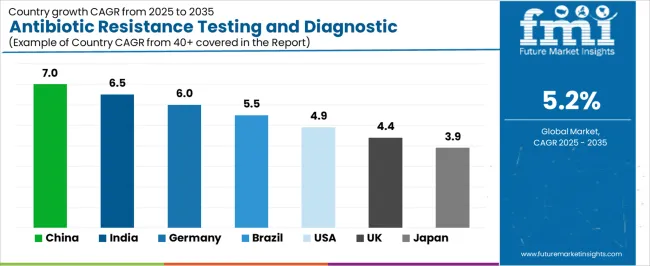

Key trends indicate accelerated adoption in Asia-Pacific markets, particularly China and India, where government programs incentivize diagnostic infrastructure development through public health investments and hospital modernization initiatives addressing antimicrobial resistance surveillance gaps. Technology advancement trends toward integrated diagnostic platforms with artificial intelligence-powered interpretation algorithms, multiplexed molecular detection panels for simultaneous resistance gene identification, and point-of-care systems that enable decentralized testing are enabling next-generation product development. The market could face disruption if alternative diagnostic approaches, such as rapid phenotypic screening technologies or machine learning-based predictive resistance modeling systems, produce comparable accuracy while reducing equipment complexity and operational costs below current molecular diagnostic platforms.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7% |

| India | 6.5% |

| Germany | 6% |

| Brazil | 5.5% |

| United States | 4.9% |

| United Kingdom | 4.4% |

| Japan | 3.9% |

The antibiotic resistance testing and diagnostic devices market is gaining momentum worldwide, with China taking the lead thanks to aggressive hospital modernization programs and national antimicrobial resistance surveillance initiatives. Close behind, India benefits from expanding healthcare infrastructure and government infection control programs, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where comprehensive laboratory automation and strict infection prevention standards strengthen its role in European healthcare systems.

Brazil demonstrates robust growth through hospital network expansion and public health diagnostic investments, signaling continued development in Latin American medical infrastructure. Meanwhile, the United States maintains steady progress through healthcare quality improvement initiatives and antimicrobial stewardship requirements, while the United Kingdom and Japan continue to record consistent advancement driven by established diagnostic frameworks and clinical excellence programs. Together, China and India anchor the global expansion story, while established markets build stability and technological sophistication into the market's growth path.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

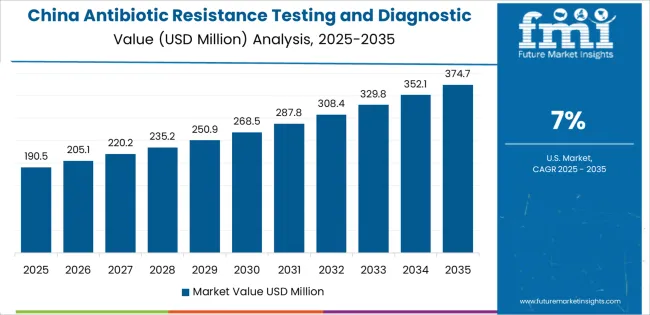

China demonstrates the strongest growth potential in the antibiotic resistance testing and diagnostic devices Market with a CAGR of 7% through 2035. The country's leadership position stems from comprehensive hospital modernization programs, intensive diagnostic infrastructure development initiatives, and aggressive antimicrobial resistance surveillance targets driving adoption of automated susceptibility testing systems. Growth is concentrated in major metropolitan healthcare networks, including Beijing, Shanghai, Guangzhou, and Shenzhen, where tertiary hospitals and clinical laboratories are implementing advanced diagnostic platforms for infection control and treatment optimization.

Distribution channels through hospital procurement systems, government healthcare agencies, and diagnostic equipment suppliers expand deployment across public hospitals and specialized infectious disease centers. The country's Healthy China 2030 initiative provides policy support for diagnostic technology advancement, including investment in laboratory automation and antimicrobial stewardship programs.

Key market factors:

In major metropolitan regions, secondary cities, and government hospital networks, the adoption of antibiotic resistance testing systems is accelerating across tertiary care hospitals, reference laboratories, and infectious disease centers, driven by antimicrobial resistance awareness campaigns and government healthcare modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 6.5% through 2035, linked to comprehensive healthcare infrastructure expansion and increasing focus on infection control enhancement solutions.

Indian healthcare facilities are implementing automated susceptibility testing platforms and molecular diagnostic technologies to improve treatment outcomes while addressing rising antimicrobial resistance rates in hospital-acquired infections and community settings. The country's National Program on Antimicrobial Resistance creates sustained demand for diagnostic capabilities, while increasing emphasis on quality healthcare drives adoption of standardized testing methods that enhance clinical decision-making.

Germany's advanced healthcare sector demonstrates sophisticated implementation of antibiotic resistance testing systems, with documented integration showing 85-90% automation rates in major hospital laboratory networks through comprehensive diagnostic platforms. The country's healthcare infrastructure in major urban centers, including Berlin, Munich, Hamburg, and Frankfurt, showcases integration of molecular diagnostic technologies with existing microbiology laboratory systems, leveraging expertise in clinical diagnostics and quality assurance protocols.

German healthcare facilities emphasize regulatory compliance and evidence-based medicine, creating demand for validated diagnostic platforms that support antimicrobial stewardship requirements and infection prevention standards. The market maintains strong growth through focus on laboratory efficiency and clinical excellence, with a CAGR of 6% through 2035.

Key development areas:

The Brazilian market demonstrates growing implementation of antibiotic resistance testing technologies based on hospital network expansion and public health diagnostic infrastructure development for enhanced infection surveillance. The country shows solid potential with a CAGR of 5.5% through 2035, driven by healthcare system modernization and increasing awareness of antimicrobial resistance challenges across major healthcare regions, including São Paulo, Rio de Janeiro, Brasília, and Belo Horizonte.

Brazilian healthcare facilities are adopting automated diagnostic platforms for compliance with infection control protocols, particularly in public hospital networks requiring standardized testing capabilities and in private healthcare systems implementing quality improvement programs. Technology deployment channels through hospital procurement consortia, diagnostic distributors, and reference laboratory networks expand coverage across diverse healthcare settings.

Leading market segments:

The USA market leads in advanced diagnostic technology innovation based on integration with electronic health records and sophisticated antimicrobial stewardship platforms for enhanced clinical outcomes. The country shows solid potential with a CAGR of 4.9% through 2035, driven by healthcare quality initiatives and increasing regulatory focus on antimicrobial resistance surveillance across major healthcare networks, including academic medical centers, integrated health systems, and reference laboratories.

American healthcare facilities are adopting FDA-cleared diagnostic devices for compliance with antimicrobial stewardship requirements, particularly in acute care hospitals requiring rapid susceptibility data and in specialized laboratories implementing comprehensive resistance monitoring programs. Technology deployment channels through group purchasing organizations, laboratory service providers, and direct hospital relationships expand coverage across diverse clinical settings.

Leading market segments:

The United Kingdom's antibiotic resistance testing market demonstrates mature implementation focused on National Health Service integration and comprehensive antimicrobial stewardship frameworks, with documented deployment across 90% of NHS hospital trusts through centralized laboratory services. The country maintains steady growth momentum with a CAGR of 4.4% through 2035, driven by government infection prevention priorities and healthcare system emphasis on diagnostic quality assurance aligned with public health surveillance objectives. Major healthcare regions, including London, Manchester, Birmingham, and Edinburgh, showcase advanced deployment of automated susceptibility testing platforms and molecular diagnostic technologies that integrate with existing pathology laboratory networks and national antimicrobial resistance monitoring programs.

Key market characteristics:

Japan's antibiotic resistance testing market demonstrates sophisticated implementation focused on advanced hospital laboratory automation and precision infection control systems, with documented integration achieving 80-85% automation rates in major medical centers through comprehensive diagnostic platforms. The country maintains steady growth momentum with a CAGR of 3.9% through 2035, driven by healthcare system emphasis on diagnostic accuracy and clinical protocols aligned with strict infection prevention standards in hospital settings. Major healthcare regions, including Tokyo, Osaka, Nagoya, and Fukuoka, showcase advanced deployment of mass spectrometry identification systems and automated susceptibility testing platforms that integrate seamlessly with existing hospital laboratory infrastructure and electronic medical record systems.

Key market characteristics:

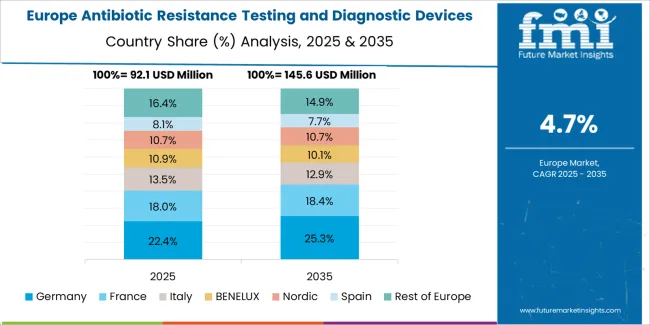

The antibiotic resistance testing and diagnostic devices market in Europe is projected to grow from USD 125.7 million in 2025 to USD 227.1 million by 2035, registering a CAGR of 6.1% over the forecast period. Germany is expected to maintain its leadership position with a 28% market share in 2025, declining slightly to 27.2% by 2035, supported by its advanced laboratory infrastructure and major healthcare centers, including Berlin, Munich, and Hamburg hospital networks.

The United Kingdom follows with a 19.1% share in 2025, projected to reach 19.5% by 2035, driven by comprehensive NHS antimicrobial stewardship programs and centralized pathology laboratory modernization initiatives. France holds a 10.2% share in 2025, expected to rise to 10.5% by 2035 through hospital network diagnostic infrastructure expansion. Italy commands a 9.4% share, while Spain accounts for 8.3% in 2025. The Netherlands maintains 6.1% in 2025, reaching 6.3% by 2035 on academic medical center adoption. The Rest of Europe region is anticipated to hold 19% in 2025, expanding to 19.2% by 2035, attributed to increasing diagnostic device adoption in Nordic countries and emerging Central and Eastern European healthcare modernization programs.

The Japanese antibiotic resistance testing and diagnostic devices market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of automated AST systems and molecular diagnostic platforms with existing hospital laboratory infrastructure across university medical centers, national hospitals, and specialized infectious disease facilities. Japan's emphasis on healthcare quality and infection prevention drives demand for validated diagnostic technologies that support antimicrobial stewardship commitments and clinical guideline adherence in acute care settings.

The market benefits from strong partnerships between international diagnostic device manufacturers and domestic healthcare technology distributors, creating comprehensive service ecosystems that prioritize regulatory compliance and technical support programs. Healthcare centers in Tokyo, Osaka, Nagoya, and other major metropolitan areas showcase advanced laboratory implementations where diagnostic systems achieve 96% accuracy through comprehensive quality control management and precision testing protocols.

The South Korean antibiotic resistance testing market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive regulatory approval support and technical services capabilities for hospital laboratory and reference testing applications. The market demonstrates increasing emphasis on healthcare quality improvement and infection surveillance initiatives, as Korean healthcare facilities increasingly demand validated diagnostic platforms that integrate with domestic electronic medical record systems and sophisticated laboratory information management systems deployed across major hospital networks.

Regional diagnostic device distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and clinical validation programs for hospital laboratory operations. The competitive landscape shows increasing collaboration between multinational diagnostic companies and Korean healthcare technology specialists, creating integrated service models that combine international quality standards with local clinical practice requirements and precision healthcare systems.

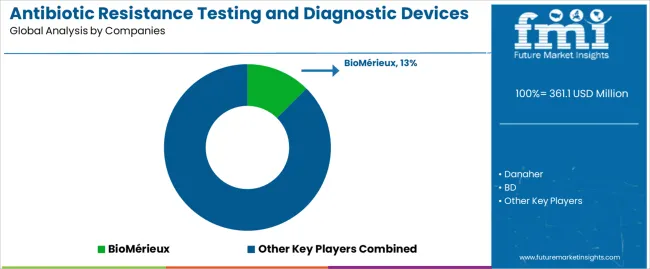

The antibiotic resistance testing and diagnostic devices market features approximately 20-25 meaningful players with moderate concentration, where the top three companies control roughly 35-40% of global market share through established hospital relationships and comprehensive diagnostic portfolios. Competition centers on diagnostic accuracy, regulatory compliance, and integration capabilities with laboratory information systems rather than price competition alone. BioMérieux leads with approximately 12.5% market share through its comprehensive automated susceptibility testing and identification platform portfolio.

Market leaders include BioMérieux, Danaher, and BD, which maintain competitive advantages through global distribution infrastructure, extensive clinical validation data, and deep expertise in regulatory requirements across multiple jurisdictions, creating trust and reliability advantages with hospital laboratory operations. These companies leverage research and development capabilities in molecular diagnostic innovation and ongoing technical support relationships to defend market positions while expanding into point-of-care and decentralized testing applications.

Challengers encompass Thermo Fisher Scientific and Deere, which compete through specialized diagnostic platforms and strong regional presence in key healthcare markets. Technology specialists, including Meihua, Xinke, and Roche, focus on specific detection methodologies or application segments, offering differentiated capabilities in molecular diagnostics, automation technologies, and customization services.

Regional players and emerging diagnostic technology providers create competitive pressure through specialized platform advantages and rapid response capabilities, particularly in high-growth markets including China and India, where local regulatory expertise provides advantages in product registration timelines and hospital procurement relationships. Market dynamics favor companies that combine regulatory compliance excellence with comprehensive clinical evidence offerings that address the complete diagnostic workflow from sample processing through result interpretation and antimicrobial stewardship reporting.

| Item | Value |

|---|---|

| Quantitative Units | USD 361.1 million |

| Diagnostic Method | AST Devices, Nucleic Acid Detection Devices, Mass Spectrometry Rapid Identification Devices |

| Application | Hospital, Third-party Testing Agency, Other |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | BioMérieux, Danaher, BD, Thermo Fisher Scientific, Deere, Meihua, Xinke, Roche |

| Additional Attributes | Dollar sales by diagnostic method and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with diagnostic device manufacturers and distribution networks, laboratory infrastructure requirements and specifications, integration with antimicrobial stewardship programs and infection surveillance initiatives, innovations in molecular diagnostic technology and automation systems, and development of specialized platforms with enhanced diagnostic accuracy and workflow efficiency capabilities. |

The global antibiotic resistance testing and diagnostic devices market is estimated to be valued at USD 361.1 million in 2025.

The market size for the antibiotic resistance testing and diagnostic devices market is projected to reach USD 599.5 million by 2035.

The antibiotic resistance testing and diagnostic devices market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in antibiotic resistance testing and diagnostic devices market are ast devices, nucleic acid detection devices and mass spectrometry rapid identification devices.

In terms of application, hospital segment to command 52.0% share in the antibiotic resistance testing and diagnostic devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antibiotics Active Pharmaceutical Ingredient (API) Market - Growth & Forecast 2025 to 2035

Global Antibiotic-Resistant Infections Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global Antibiotic Drug Market Analysis – Size, Share & Forecast 2023-2033

Antibiotic Susceptibility Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Antibiotic Resistance Diagnosis Devices Market Size and Share Forecast Outlook 2025 to 2035

Animal Antibiotics and Antimicrobials Market Size and Share Forecast Outlook 2025 to 2035

Topical Antibiotic Pharmaceuticals Market Size and Share Forecast Outlook 2025 to 2035

Peptide Antibiotics Market

Veterinary Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Antibiotics Market - Size, Share, and Forecast Outlook 2025 to 2035

Intracameral Antibiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Animal Antimicrobials and Antibiotics Market Size and Share Forecast Outlook 2025 to 2035

Resistance Bands Market Outlook – Size, Share & Forecast 2025 to 2035

Ground Resistance Testers Market Growth - Trends & Forecast 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Chemical Resistance Film Market Trends & Forecast 2024-2034

Electric Resistance Welded (ERW) Pipes and Tubes Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Low Rolling Resistance Tire Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA