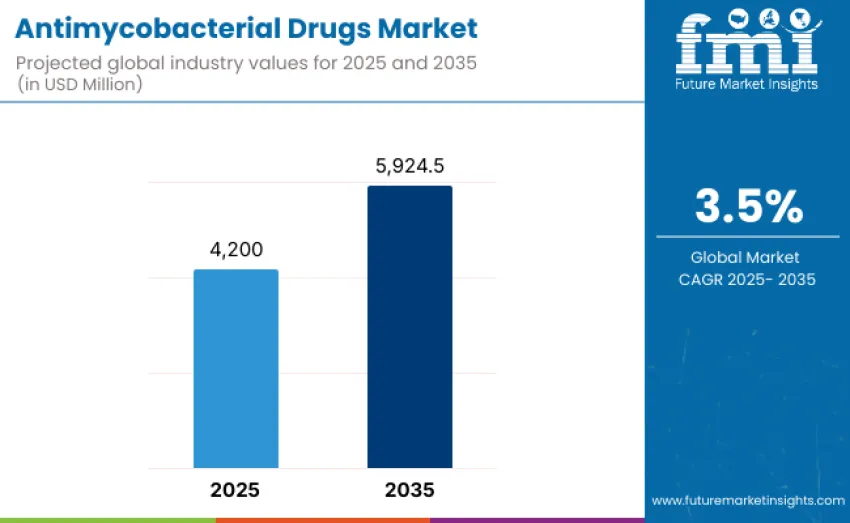

The antimycobacterial drugs market is projected to reach USD 5,924.5 million by 2035, recording an absolute increase of USD 1,724.5 million over the forecast period. This market is valued at USD 4,200 million in 2025 and is set to rise at a CAGR of 3.5% during the forecast period 2025-2035.

Overall market size is expected to grow by nearly 1.5 times during this timeframe, driven by rising prevalence of tuberculosis and other mycobacterial infections worldwide, increasing government and NGO initiatives for TB control, and expanding access to healthcare infrastructure in developing regions. Growing awareness about early diagnosis and treatment adherence, coupled with advances in drug development targeting drug-resistant mycobacterial strains, fuels demand for effective antimycobacterial therapies.

Antimycobacterial Drugs Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4,200 million |

| Market Forecast Value (2035) | USD 5,924.5 million |

| Forecast CAGR (2025 to 2035) | 3.5% |

Growth reflects fundamental shifts in tuberculosis management and infectious disease treatment protocols, where novel antimycobacterial drugs provide improved efficacy, reduced adverse effects, and shorter treatment regimens compared to conventional therapies. Healthcare providers face mounting pressure to address multidrug-resistant (MDR) and extensively drug-resistant (XDR) TB cases efficiently, with newer drugs offering improvement in treatment outcomes over legacy therapies, making these innovations critical for modern TB control strategies. Increasing patient expectations for safe and effective treatment options drive demand for next generation antimycobacterial therapies with enhanced pharmacokinetic profiles and lower toxicity.

Government initiatives, public health programs, and global funding efforts accelerate growth. National TB control programs, World Health Organization campaigns, and philanthropic partnerships drive awareness, treatment accessibility, and adoption of advanced therapies. Expansion of healthcare infrastructure and training of healthcare professionals enhances uptake of antimycobacterial drugs in clinical practice. Increasing private sector engagement in drug research and global collaboration on TB eradication strategies foster sustained demand for innovative treatment options worldwide.

Between 2025 and 2030, the antimycobacterial drugs market is projected to expand from USD 4,200 million to USD 4,988.3 million, resulting in a value increase of USD 788.3 million, which represents 45.7% of total forecast growth for the decade. This phase will be shaped by rising prevalence of tuberculosis and other mycobacterial infections, increasing adoption of new drug regimens for multidrug-resistant and extensively drug-resistant TB, and ongoing investment in healthcare infrastructure and public health initiatives.

From 2030 to 2035, growth continues from USD 4,988.3 million to USD 5,924.5 million, adding another USD 936.2 million, which constitutes 54.3% of overall ten-year expansion. This period is expected to be characterized by introduction of next-generation antimycobacterial therapies, including long-acting injectable formulations, oral drugs with improved efficacy against latent infections, and therapies targeting resistant mycobacterial strains.

The antimycobacterial drugs market grows as healthcare providers and public health systems increasingly adopt advanced therapies that improve treatment efficacy and patient outcomes for tuberculosis and other mycobacterial infections. Rising prevalence of multidrug-resistant and extensively drug-resistant TB, coupled with pressure to achieve higher treatment success rates, drives demand for next-generation drugs that shorten therapy duration, reduce side effects, and improve patient adherence. These therapies are essential for national TB control programs, hospital treatment protocols, and community healthcare initiatives targeting high-burden regions.

Government programs, global health initiatives, and NGO-led campaigns accelerate adoption by funding access to novel antimycobacterial drugs and supporting healthcare infrastructure improvements. Expanding diagnostic capabilities, such as rapid molecular testing, enable precision-targeted therapy, reinforcing demand. High treatment costs, complex administration schedules, and limited availability in low-resource settings may constrain growth, particularly in rural and underserved regions.

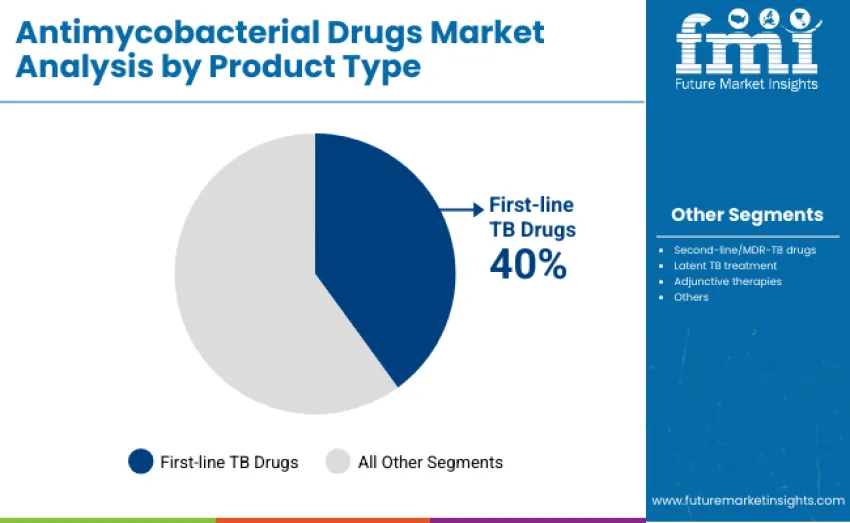

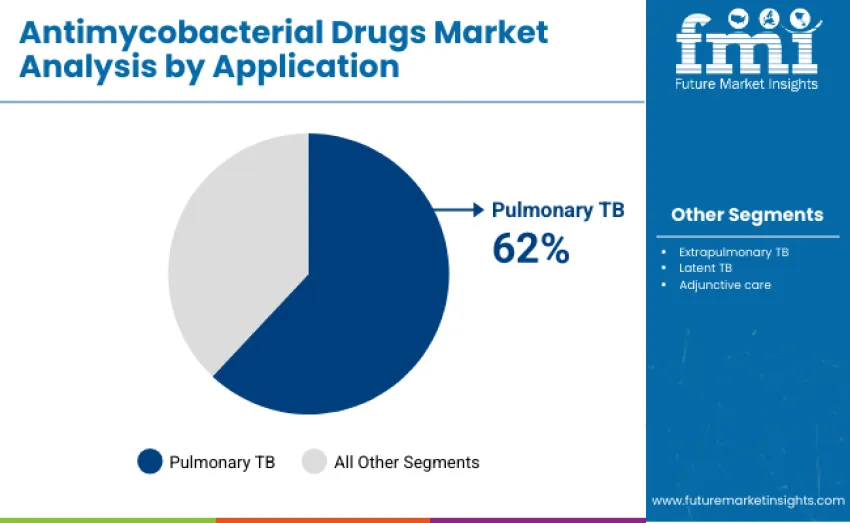

This market is segmented by product type, application, and region. By product type, categories include First-line TB drugs, Second-line/MDR-TB drugs, Latent TB treatment, Adjunctive therapies, and Others. Based on application, segments cover Pulmonary TB, Extrapulmonary TB, Latent TB, and Adjunctive care. Regional coverage spans Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

First-line TB drugs lead with about 40% share in 2025, driven by their essential role in treating drug-sensitive TB using core therapies like isoniazid, rifampicin, pyrazinamide, and ethambutol. Second-line/MDR-TB drugs hold 30%, addressing resistant cases. Latent TB treatments account for 12%, supporting prevention in high-risk groups. Adjunctive therapies contribute 10% by improving symptom control and adherence, while the remaining 8% covers emerging drug candidates and specialized formulations for pediatric and co-infected patients, reflecting growing diversification in TB treatment approaches.

Key advantages driving the first-line TB drugs segment include:

Pulmonary TB applications dominate with 62% market share in 2025, driven by the high prevalence of active TB cases requiring first- and second-line therapies. Extrapulmonary TB represents 18%, focusing on TB affecting organs other than the lungs, such as lymphatic and skeletal systems. Latent TB treatment accounts for 12%, emphasizing prevention in high-risk populations. Adjunctive care contributes 8%, supporting symptom management and treatment adherence. Pulmonary TB treatment remains central due to the global burden, while extrapulmonary care, latent TB prevention, and adjunctive therapies complement comprehensive TB management strategies.

Key market dynamics supporting application preferences include:

Market is driven by three key factors, the increasing prevalence of tuberculosis, including multidrug-resistant (MDR) and extensively drug-resistant (XDR) TB, creates sustained demand for effective therapies to improve treatment success and reduce mortality. Expansion of public health initiatives, government programs, and NGO-led campaigns increases access to advanced therapies, particularly in low- and middle-income countries. Advances in drug formulations, such as long-acting injectables, fixed-dose combinations, and oral therapies with improved adherence profiles, enable better treatment compliance and outcomes, especially in remote or resource-constrained regions.

What Are the Key Restraints Affecting Adoption in the TB Treatment Market?

Market restraints include high treatment costs and lengthy therapy durations, which can limit adoption in budget-constrained healthcare systems. Complex administration schedules and side effect management also pose challenges for both patients and healthcare providers, reducing overall compliance and potentially impacting treatment effectiveness. Limited drug availability in rural and underserved areas, combined with slow regulatory approvals in some regions, further restricts market penetration.

What Key Trends Are Shaping the Future of TB Treatment?

Key trends show accelerated adoption in Asia-Pacific and African markets, supported by government programs and international funding expanding TB diagnosis and treatment infrastructure. Advancements in drug development, including precision-targeted therapies and novel delivery systems integrated with rapid molecular diagnostics, are driving next-generation solutions. However, the market could face disruption if generic drug manufacturers offer lower-cost alternatives or if alternative strategies, like vaccines or host-directed therapies, gain widespread clinical adoption with superior efficacy and safety.

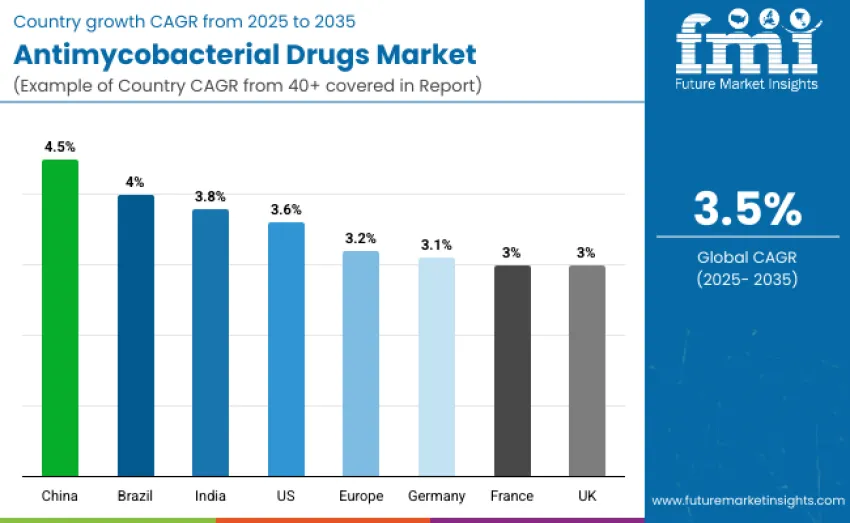

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 4.5% |

| Brazil | 4.0% |

| India | 3.8% |

| United States | 3.6% |

| Germany | 3.1% |

| Europe | 3.2% |

| France | 3.0% |

| United Kingdom | 3.0% |

China leads global growth with a 4.5% CAGR, supported by aggressive public health initiatives and expanded MDR/XDR TB programs. Brazil follows with 4.0% growth, driven by broader healthcare coverage and strong infectious disease partnerships. India records 3.8% CAGR as national TB control efforts and improved drug access strengthen adoption. The United States grows at 3.6% due to its mature pharmaceutical ecosystem and advanced TB research. Europe shows steady momentum at 3.2%, with Germany at 3.1%, while France and the United Kingdom each maintain 3.0% growth through structured national TB programs.

China shows strong growth potential with a 4.5% CAGR through 2035, driven by large-scale public health initiatives, expanded TB treatment programs, and policies improving access to advanced antimycobacterial therapies. Growth is concentrated in major hubs like Beijing, Shanghai, Shenzhen, and Guangzhou, where hospitals and clinics adopt next-generation regimens for MDR/XDR TB. Public hospitals, private providers, and national procurement systems enhance drug distribution across urban and semi-urban regions. Government support through subsidies, professional training, and investment in TB diagnostics and treatment infrastructure further strengthens nationwide adoption and program expansion.

India shows steady growth with a 3.8% CAGR through 2035, supported by expanding healthcare infrastructure, stronger MDR/XDR-TB management, and wider access to precision-targeted regimens. Healthcare providers implement standardized protocols and distribution systems aligned with global TB guidelines while addressing high domestic disease burden. National TB control programs, community outreach, and adherence initiatives sustain demand for advanced therapies. Major hubs such as Bangalore, Hyderabad, Mumbai, and Pune drive adoption across hospitals and public health centers. Government incentives supporting drug subsidies, adherence programs, and clinician training, alongside partnerships with domestic and global pharmaceutical manufacturers, further accelerate nationwide uptake.

Germany demonstrates advanced adoption of next-generation antimycobacterial therapies, supported by a highly developed healthcare system and strong clinical precision. Major hubs such as Berlin, Munich, Hamburg, and Frankfurt integrate advanced regimens within standardized TB treatment protocols, emphasizing drug quality, efficacy, and long-term reliability. Specialized TB centers deploy premium therapies alongside comprehensive staff training for MDR/XDR-TB management.

Clinical partnerships and technical education programs strengthen professional expertise. Collaboration between European distributors and pharmaceutical manufacturers ensures reliable supply and strict quality assurance. Alignment with national TB guidelines and hospital management systems enables standardized workflows, improved monitoring, and consistent treatment outcomes.

Brazil leads Latin American adoption of advanced antimycobacterial therapies, supported by expanding public health programs, improved TB treatment infrastructure, and wider access to MDR/XDR-TB medications. With a 4% CAGR through 2035, growth is driven by rising treatment demand across major cities such as São Paulo, Rio de Janeiro, Brasília, and Porto Alegre. Healthcare providers increasingly implement advanced regimens in hospitals, clinics, and community centers. Partnerships with international distributors improve pricing, affordability, and timely delivery, while collaborations between government agencies, NGOs, and pharmaceutical manufacturers support bulk procurement and technical training to strengthen nationwide TB management.

The United States shows mature adoption of antimycobacterial therapies, supported by strong healthcare infrastructure and widespread use across hospitals, clinics, and public health programs. Major hubs such as California, New York, Texas, and Washington integrate advanced MDR- and XDR-TB regimens into standardized care protocols. Growth remains steady with a 3.6% CAGR through 2035, driven by established TB control programs, high-quality clinical management, and skilled healthcare professionals. A robust pharmaceutical ecosystem ensures reliable drug supply, adherence monitoring, and alignment with national TB guidelines. Collaboration among government agencies, professional associations, and manufacturers supports continuous clinical feedback and next-generation therapy development.

The United Kingdom shows steady adoption of advanced antimycobacterial therapies, with major hubs such as London, Manchester, Bristol, and Edinburgh implementing next-generation MDR- and XDR-TB regimens across hospitals, public health clinics, and TB centers. Growth remains solid with a 3% CAGR through 2035, driven by expanding healthcare infrastructure, national TB control programs, and increasing focus on precision-targeted therapy. Standardized treatment protocols and comprehensive staff training strengthen clinical outcomes and support public health objectives. Educational partnerships between medical schools, public health institutions, and pharmaceutical companies enhance professional training and ensure broader access to advanced therapies across the UK’s healthcare network.

Europe demonstrates steady integration of advanced antimycobacterial therapies, supported by robust public health systems, harmonized TB management protocols, and investments in diagnostic modernization across EU member states. Growth remains consistent with a 3.2% CAGR through 2035, driven by coordinated government initiatives, cross-border research programs, and hospital networks standardizing MDR/XDR-TB treatment pathways.

Collaboration between pharmaceutical manufacturers, national health agencies, and academic institutions strengthens drug availability, clinical training, and adherence monitoring, ensuring uniform treatment quality across leading healthcare hubs. Continuous innovation reinforces diagnostics and treatment workflows reinforces Europe’s position as a structured, regulation-driven adopter of next-generation antimycobacterial solutions.

France maintains stable adoption of next generation antimycobacterial therapies, supported by a strong national healthcare system and well-regulated TB management frameworks. Growth is steady with a 3.0% CAGR through 2035, driven by the expansion of precision-targeted MDR/XDR-TB regimens across major centers in Paris, Lyon, and Marseille. Hospitals and pulmonary clinics follow standardized treatment pathways supported by government TB initiatives, improved diagnostic capability, and patient adherence programs. Collaboration between academic institutions, public health agencies, and pharmaceutical developers enhances clinical training and accelerates integration of advanced therapies, ensuring consistent, high-quality TB care nationwide.

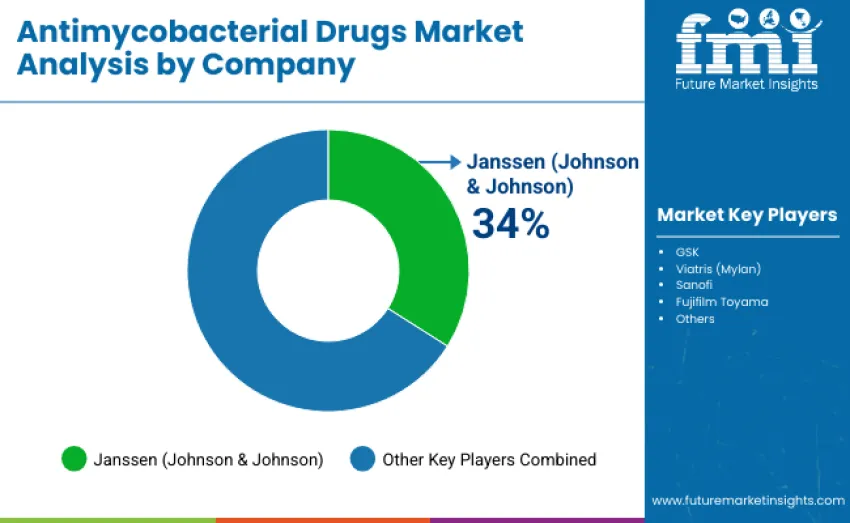

The antimycobacterial drugs market includes 12-15 players with moderate market concentration. The top three companies hold about 55-60% of global share, with Janssen (Johnson & Johnson) alone accounting for 34%, supported by strong brand credibility, extensive drug portfolios, and established global distribution networks. Competitive differentiation hinges on drug efficacy, safety, regulatory strength, and innovation in MDR/XDR-TB pipelines rather than pricing. Janssen leads with comprehensive first- and second-line therapies, longstanding global health partnerships, and deep expertise in TB management.

GSK and Viatris (Mylan) follow closely, maintaining strong positions through proven clinical outcomes, large-scale clinical trial programs, and trusted collaborations with national TB control initiatives. Both continue advancing R&D for drug-resistant TB and expanding access across high-burden regions.

Challengers like Sanofi and Fujifilm Toyama focus on niche formulations, innovative delivery systems, and targeted regional expansion, improving competitiveness in pediatric TB, MDR/XDR-specific therapies, and fixed-dose combinations. Meanwhile, emerging manufacturers from India and China intensify price-driven competition by supplying cost-effective generics and accelerating development cycles-particularly critical for Africa, Latin America, and Southeast Asia.

| Item | Value |

|---|---|

| Quantitative Units | USD 4,200 million |

| Product Type | First-line TB drugs, Second-line/MDR-TB drugs, Latent TB treatment, Adjunctive therapies, Others |

| Application | Pulmonary TB, Extrapulmonary TB, Latent TB, Adjunctive care |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Janssen (J&J), GSK, Viatris (Mylan), Sanofi, Fujifilm Toyama, Others |

| Additional Attributes | Dollar sales vary by product type and application, with adoption rising across North America, Europe, Asia Pacific, and Latin America. Competition centers on leading pharma companies, drug efficacy, WHO-aligned protocols, innovative formulations, improved delivery systems, and specialized therapies targeting drug-resistant TB and high-risk populations |

The global antimycobacterial drugs market is estimated to be valued at USD 4,200 million in 2025.

The antimycobacterial drugs market is projected to reach USD 5,924.5 million by 2035.

The antimycobacterial drugs market is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in the antimycobacterial drugs market are first-line TB drugs, second-line/MDR-TB drugs, latent TB treatment, adjunctive therapies, and others.

Pulmonary TB is expected to command the largest share at 62% in the antimycobacterial drugs market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drugs Glass Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Orphan Drugs Market Size and Share Forecast Outlook 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Retinal Drugs And Biologics Market

Antiviral Drugs Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxic Drugs Market Analysis – Growth, Trends & Forecast 2025-2035

3D Printed Drugs Market Outlook – Growth, Demand & Forecast 2025-2035

Depression Drugs Market

Parenteral Drugs Packaging Market

Brain Tumor Drugs Market Forecast & Analysis: 2025 to 2035

Infertility Drugs Market Analysis - Size, Share & Forecast 2025 to 2035

Expectorant Drugs Market Trend Analysis Based on Drug, Dosage Form, Product, Distribution Channel, and Region 2025 to 2035

Cannabinoid Drugs Market

Clot Busting Drugs Market Size and Share Forecast Outlook 2025 to 2035

Psychotropic Drugs Market Growth - Industry Trends & Outlook 2025 to 2035

Critical Care Drugs Market Analysis – Trends, Demand & Forecast 2024-2034

Anti-Malarial drugs Market

Antimetabolite Drugs Market Size and Share Forecast Outlook 2025 to 2035

Fish-Oil Based Drugs Market Analysis – Trends, Share & Growth Forecast 2024-2034

Plasma-Derived Drugs Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA