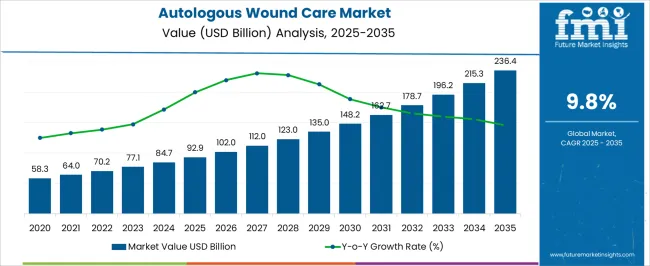

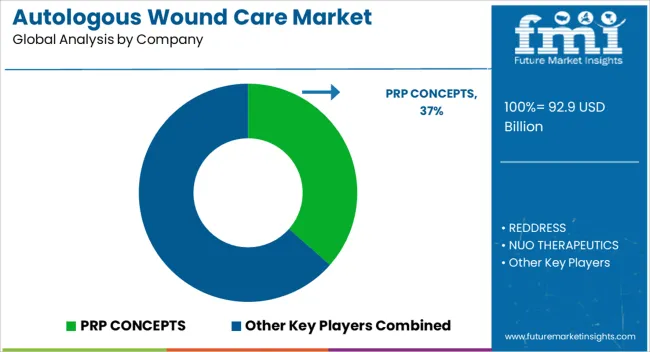

The Autologous Wound Care Market is estimated to be valued at USD 92.9 billion in 2025 and is projected to reach USD 236.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.8% over the forecast period.

| Metric | Value |

|---|---|

| Autologous Wound Care Market Estimated Value in (2025 E) | USD 92.9 billion |

| Autologous Wound Care Market Forecast Value in (2035 F) | USD 236.4 billion |

| Forecast CAGR (2025 to 2035) | 9.8% |

The Autologous Wound Care market is witnessing strong growth, driven by the increasing prevalence of acute and chronic wounds across healthcare settings and rising awareness of regenerative therapies. Growing adoption of autologous treatments, including platelet rich plasma and other patient-derived therapies, is being supported by their ability to promote faster healing, reduce infection risk, and minimize complications. Technological advancements in preparation techniques, delivery systems, and quality control have enhanced the efficacy and safety of autologous wound care products.

The market is further influenced by the rising number of surgical procedures, trauma cases, and diabetic wound incidents worldwide. Hospitals and specialized clinics are increasingly integrating autologous wound care solutions into standard treatment protocols due to clinical benefits and patient outcomes. Regulatory guidance and reimbursement support in key regions have strengthened adoption rates.

Continuous research in cellular therapies and personalized medicine is expected to expand the range of applications As healthcare providers focus on improving patient recovery and reducing hospital stays, the Autologous Wound Care market is anticipated to sustain robust growth over the coming decade.

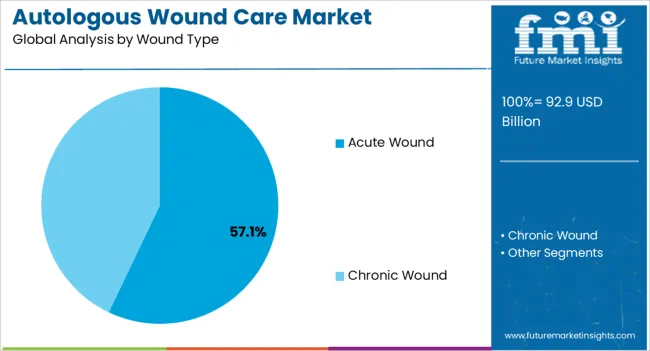

The acute wound type segment is expected to account for 57.1% of the market revenue in 2025, making it the leading wound category. Growth in this segment is being driven by the increasing incidence of trauma-related injuries, surgical wounds, and emergency cases requiring prompt and effective treatment. Autologous wound care solutions, particularly platelet rich plasma, offer accelerated healing, lower infection rates, and reduced scarring, making them highly suitable for acute wound management.

Hospitals and specialized care centers are increasingly integrating these therapies into standard protocols due to improved patient outcomes and reduced recovery times. Technological improvements in preparation methods and delivery systems have enhanced treatment consistency and efficacy.

The focus on personalized medicine, patient-specific treatment planning, and minimally invasive therapies has further fueled adoption As healthcare providers prioritize optimized wound care to reduce complications and hospital stays, acute wounds are expected to remain the largest application area, driving continued growth for autologous wound care solutions globally.

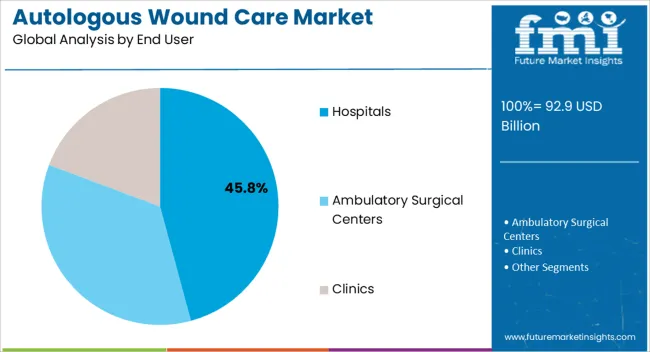

The hospitals end-user segment is projected to hold 45.8% of the market revenue in 2025, establishing it as the leading end-user category. Growth is being driven by the adoption of autologous wound care therapies for surgical, trauma, and acute wound management. Hospitals benefit from the ability to provide personalized treatment, improve patient outcomes, and reduce post-operative complications, thereby enhancing operational efficiency and patient satisfaction.

Integration with existing wound care protocols and compatibility with clinical workflows makes these therapies highly practical in hospital settings. Advances in treatment preparation, delivery devices, and staff training have improved adoption rates.

Increased investment in regenerative medicine programs and government incentives for innovative therapies have further encouraged hospitals to implement autologous wound care solutions As the emphasis on evidence-based and cost-efficient wound management grows, hospitals are expected to continue dominating the end-user segment, reinforcing the overall expansion of the market.

From 2020 to 2025, the global autologous wound care market experienced a CAGR of 8.5%, reaching a market size of USD 92.9 million in 2025.

Over the past two decades, numerous clinical trials have been conducted to evaluate the efficacy and safety of autologous wound care therapies.

These trials have been focused on various approaches, including stem cell-based therapies, tissue-engineered skin substitutes, and bioactive dressings. Some of these therapies have gained regulatory approvals and entered the market, providing options for autologous wound care.

Future Forecast for Autologous wound care Industry:

Looking ahead, the global autologous wound care industry is expected to rise at a CAGR of 10.3% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 236.4 million by 2035.

The autologous wound care industry is expected to continue its growth trajectory from 2025 to 2035, driven by increasing technological advancements and digital solutions for wound monitoring. The integration of digital health solutions in wound care is a growing trend. Mobile applications, wearable devices, and remote monitoring platforms allow for real-time monitoring of wounds, tracking healing progress, and facilitating communication between patients and healthcare providers.

Gene therapy approaches are being explored in autologous wound care to deliver therapeutic genes or modulate gene expression in the wound site. Researchers are investigating the use of gene therapy techniques to enhance wound healing processes, stimulate tissue regeneration, or modulate inflammatory responses. Gene therapy holds potential for personalized and targeted interventions in autologous wound care.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 236.4 million |

| CAGR % 2025 to End of Forecast (2035) | 5.8% |

The autologous wound care industry in the United States is expected to reach a market size of USD 236.4 million by 2035, expanding at a CAGR of 5.8%. Autologous wound care is part of the broader field of regenerative medicine, which focuses on harnessing the body's own healing capabilities.

In the United States, there is a growing interest in regenerative medicine therapies, including autologous approaches, for wound healing. This includes the use of autologous stem cells, growth factors, and other cellular components to promote tissue regeneration and wound repair.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 7.2 million |

| CAGR % 2025 to End of Forecast (2035) | 9.8% |

The autologous wound care industry in the United Kingdom is expected to reach a market share of USD 7.2 million, expanding at a CAGR of 9.8% during the forecast period.

The UK is investing in regenerative medicine initiatives, including autologous wound care, through research funding and collaborative projects. These initiatives aim to advance the understanding of wound healing mechanisms and develop innovative autologous therapies. Academic institutions, government bodies, and industry partners are actively engaged in these efforts.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 38.3 million |

| CAGR % 2025 to End of Forecast (2035) | 19.5% |

The autologous wound care industry in China is anticipated to reach a market size of USD 38.3 million, moving at a CAGR of 19.5% during the forecast period. Stem cell-based autologous wound care is gaining traction in China.

Researchers and clinicians are exploring the use of various types of stem cells, such as mesenchymal stem cells (MSCs) derived from the patient's own tissues, for promoting wound healing. Stem cell therapy aims to enhance tissue regeneration, modulate the inflammatory response, and accelerate wound closure.

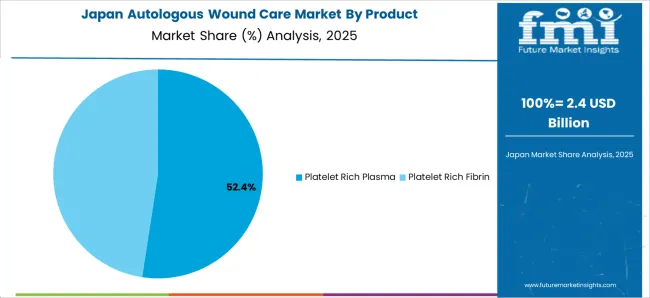

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 22.5 million |

| CAGR % 2025 to End of Forecast (2035) | 17.3% |

The autologous wound care industry in Japan is estimated to reach a market size of USD 22.5 million by 2035, thriving at a CAGR of 17.3%. Autologous growth factor therapies are gaining attention in Japan.

These therapies involve the extraction and concentration of growth factors from the patient's own tissues, such as platelet-rich plasma (PRP), to stimulate wound healing. Autologous growth factor therapies are being explored for the treatment of chronic wounds, diabetic ulcers, and other difficult-to-heal wounds.

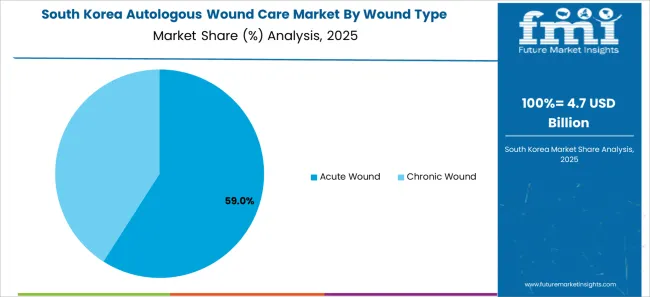

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 23.2 million |

| CAGR % 2025 to End of Forecast (2035) | 22.3% |

The autologous wound care industry in South Korea is expected to reach a market size of USD 23.2 million, expanding at a CAGR of 22.3% during the forecast period. South Korea is actively engaged in the development of tissue engineering and biotechnology approaches for autologous wound care.

Researchers and companies are working on the creation of biomaterial scaffolds and three-dimensional structures that can support cell growth and promote tissue regeneration at the wound site. These advancements aim to provide innovative solutions for healing chronic wounds and enhancing wound closure.

Platelet rich fibrin is expected to dominate the autologous wound care industry with a CAGR of 9.2% from 2025 to 2035. This segment captures a significant market share in 2025 due to its high efficiency, and expected appropriate results.

PRF is relatively simple to prepare. It involves the centrifugation of the patient's blood, which separates it into its various components, including PRF. The PRF can then be easily extracted and applied to the wound site. This ease of preparation makes PRF a convenient and accessible option for healthcare professionals.

Chronic wound type is expected to dominate the autologous wound care industry with a CAGR of 9.7% from 2025 to 2035. This segment captures a significant market share in 2025 due to rising prevalence of chronic diseases like diabetic foot ulcers, venous leg ulcers, and pressure ulcers, are prevalent medical conditions.

They affect a significant number of patients globally, leading to a substantial burden on healthcare systems. The high prevalence of chronic wounds creates a significant market demand for effective wound care solutions, including autologous therapies.

The hospital segment is expected to dominate the autologous wound care industry with a CAGR of 8.5% from 2025 to 2035. Hospitals are equipped with advanced infrastructure, technologies, and medical expertise, making them ideal settings for the adoption and implementation of autologous wound care. These facilities have the necessary resources and specialized personnel to perform autologous procedures, including the preparation and administration of therapies such as platelet-rich plasma (PRP) or stem cell treatments.

Autologous wound care sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

Product Development

Companies invest heavily in R&D to deliver therapies of wound care that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Strategic Alliances & Collaborations

Key industry leaders frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Companies might also gain access to new technology and markets through such agreements.

Expansion into Emerging Markets

Autologous wound care sector is expanding rapidly in emerging regions such as China and India. Key firms are enhancing their distribution networks and developing local manufacturing facilities to increase their presence in these areas.

Acquisitions and mergers

Mergers and acquisitions are frequently used by key players in the autologous wound care business to consolidate their market position, extend their product range, and gain access to new markets.

Key Developments in the Autologous wound care Market:

The global autologous wound care market is estimated to be valued at USD 92.9 billion in 2025.

The market size for the autologous wound care market is projected to reach USD 236.4 billion by 2035.

The autologous wound care market is expected to grow at a 9.8% CAGR between 2025 and 2035.

The key product types in autologous wound care market are platelet rich plasma and platelet rich fibrin.

In terms of wound type, acute wound segment to command 57.1% share in the autologous wound care market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Wound Evacuators Market Size and Share Forecast Outlook 2025 to 2035

Wound Stimulation Therapy Market Insights – Demand and Growth Forecast 2025 to 2035

Analysis and Growth Projections for Wound Healing Nutrition Market

Wound Irrigation Systems Market Growth - Trends & Forecast 2025 to 2035

Wound Debridement Products Market Analysis - Growth & Forecast 2025 to 2035

Global Wound Wash Market Analysis – Size, Share & Forecast 2024-2034

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Wound Measurement Devices Market

Wound Irrigation Devices Market

Wound Care Surfactant Market Insights – Demand and Growth Forecast 2025 to 2035

Wound Skin Care Market - Demand & Forecast 2025 to 2035

Wirewound Resistor Market Size and Share Forecast Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Spiral Wound Membrane Market

Animal Wound Care Market Size and Share Forecast Outlook 2025 to 2035

Topical Wound Agents Market Analysis - Trends, Growth & Forecast 2025 to 2035

Digital Wound Measurement Devices Market is segmented by Diabetic Ulcer, Chronic Wounds, Burns from 2025 to 2035

The Chronic Wound Care Market is segmented by product, wound type and distribution channel from 2025 to 2035

Advance Wound Care Market Analysis by Advance Wound Dressings, NPWT Devices and Others through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA