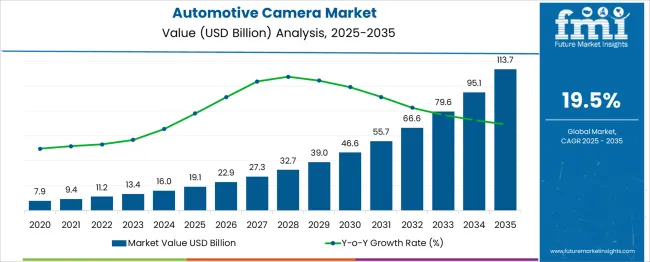

The Automotive Camera Market is estimated to be valued at USD 19.1 billion in 2025 and is projected to reach USD 113.7 billion by 2035, registering a compound annual growth rate (CAGR) of 19.5% over the forecast period. This growth trajectory can be segmented into three distinct phases reflecting evolving market dynamics and technological adoption. Between 2020 and 2025, the market grows from USD 7.9 billion to USD 16.0 billion, driven by increasing integration of cameras in passenger and commercial vehicles for safety and driver assistance applications. This foundational phase benefits from regulatory mandates on advanced driver assistance systems (ADAS), rising consumer awareness of vehicle safety features, and advancements in camera sensor technologies.

From 2026 to 2030, the market is expected to accelerate significantly, increasing from USD 19.1 billion to USD 39.0 billion, driven by the expanding adoption of surround-view cameras, night vision systems, and integration with vehicle connectivity solutions. The growing adoption of electric vehicles and the increasing demand for autonomous driving further propel the need for high-resolution and multifunctional camera systems.

From 2031 to 2035, the market surges from USD 46.6 billion to USD 113.7 billion, marking rapid mainstream integration driven by advancements in artificial intelligence, machine learning, and edge computing that enhance real-time image processing and predictive analytics. Increasing investments by OEMs and technology suppliers in improving vehicle safety, parking assistance, and autonomous capabilities underscore the sustained market expansion. The automotive camera market is thus transitioning from early adoption to widespread deployment, fueled by continuous innovation, regulatory support, and increasing demand for connected, intelligent mobility solutions globally.

| Metric | Value |

|---|---|

| Automotive Camera Market Estimated Value in (2025 E) | USD 19.1 billion |

| Automotive Camera Market Forecast Value in (2035 F) | USD 113.7 billion |

| Forecast CAGR (2025 to 2035) | 19.5% |

Integration of camera-based systems has become essential in meeting crash avoidance and driver monitoring standards, with manufacturers investing in vision-based sensor fusion to enhance road awareness and navigation. The deployment of mono and multi-camera setups has gained momentum due to their critical role in lane-keeping, object detection, traffic sign recognition, and parking assistance.

Enhanced imaging capabilities, driven by improvements in CMOS sensors, coupled with low-latency processing and edge inference capabilities, are fueling innovation in this space. As autonomous vehicle development progresses, the importance of cameras as primary vision inputs continues to rise.

OEM partnerships with semiconductor companies and AI vision specialists are laying the groundwork for software-defined vehicle architectures where cameras serve both safety and infotainment functions. With electrification, connectivity, and autonomy reshaping mobility ecosystems, automotive cameras are poised for widespread integration in both new-generation and retrofit vehicle platforms.

The automotive camera market is segmented by type, vehicle type,application, and geographic regions. By type, the automotive camera market is divided into Mono, Stereo, and Trifocal. In terms of vehicle type, the automotive camera market is classified into Passenger Cars, Utility Vehicles, and Commercial Vehicles. Based on application, the automotive camera market is segmented into ADAS, Lane departure systems, Emergency braking systems, Forward collision warning, Others, and Parking assist. Regionally, the automotive camera industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

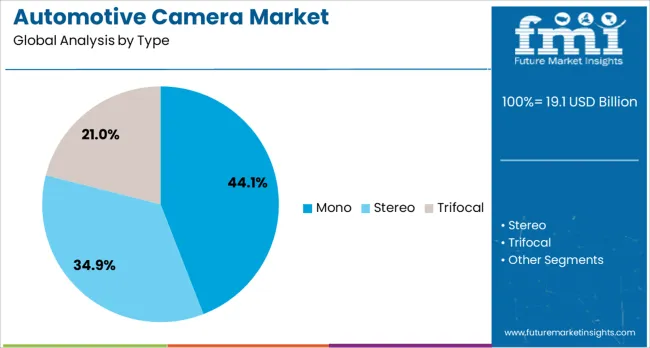

The mono camera segment is projected to account for 44.1% of the automotive camera market revenue share in 2025, making it the most dominant camera type in the sector. This growth is being driven by its cost-effectiveness, compact design, and wide applicability in key functions such as lane departure warning, forward collision alerts, and pedestrian detection.

Mono cameras are being extensively integrated in entry- and mid-level vehicle models to comply with regulatory safety norms without significantly impacting vehicle pricing. Their performance has been enhanced by the development of high-resolution sensors and improved low-light imaging, which have extended their utility in diverse driving conditions.

In addition, mono cameras offer lower power consumption and reduced system complexity, making them favorable for OEMs seeking efficient ADAS implementation. Their compatibility with edge-based AI processors and ability to integrate with software-defined platforms have further supported their deployment across global automotive production lines, especially in volume-driven passenger vehicle markets.

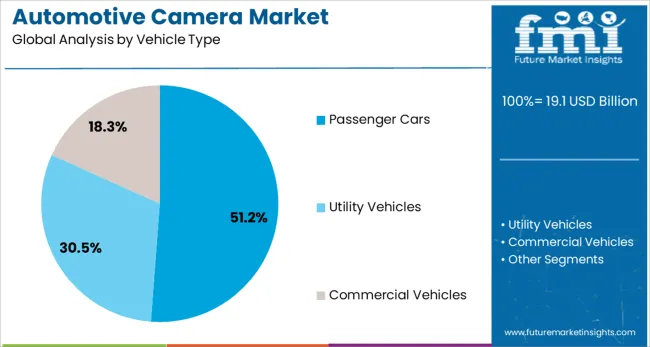

The passenger cars segment is expected to contribute 51.2% to the total automotive camera market revenue in 2025, solidifying its position as the leading vehicle type. This dominance is being fueled by growing consumer demand for enhanced safety features, increased penetration of ADAS, and the rising inclusion of camera systems even in lower-cost vehicle segments. Manufacturers are prioritizing visual intelligence systems to support safety ratings and regulatory compliance, particularly in regions where Euro NCAP, NHTSA, and similar authorities are setting benchmarks for camera-based functionalities.

The surge in electric and connected passenger vehicles has further accelerated integration of cameras for driver assistance, parking, and surround-view monitoring. Additionally, advancements in cabin monitoring technologies for fatigue detection and gesture recognition are increasing camera installations inside vehicles.

Passenger car platforms are increasingly adopting modular architectures, allowing manufacturers to scale camera deployments across trims with OTA (over-the-air) capabilities. As consumer expectations for tech-enabled safety grow, camera systems in this segment are expected to expand both in scope and sophistication.

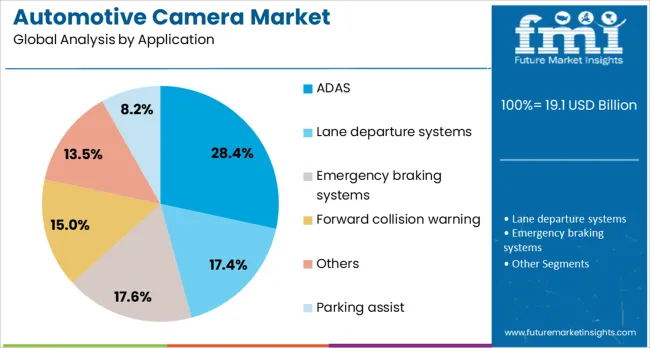

The ADAS application segment is anticipated to account for 28.4% of the automotive camera market revenue share in 2025, driven by heightened demand for vision-enabled safety and automation systems. Cameras are becoming critical enablers in ADAS functions such as adaptive cruise control, automatic emergency braking, blind spot monitoring, and lane centering. The adoption of ADAS has been reinforced by mandatory safety feature inclusion across key markets including the US, Europe, China, and Japan.

Camera systems configured for ADAS benefit from real-time object detection, depth estimation, and semantic segmentation, all of which are necessary for making high-speed driving decisions. Advances in software-defined camera firmware and edge AI have enabled continuous performance enhancements without hardware changes, making them integral to scalable ADAS platforms.

Automakers are leveraging camera-based ADAS not only for compliance but also to gain competitive differentiation. As semi-autonomous capabilities gain traction across mainstream vehicle segments, the demand for ADAS-optimized camera systems is expected to grow significantly in the years ahead.

The automotive camera market is shaped by regulatory mandates, ADAS integration, consumer-driven demand, and aftermarket adoption. These dynamics collectively drive its growth, making cameras a fundamental element of modern vehicle safety and convenience.

The automotive camera market is being propelled by stringent global safety regulations mandating advanced driver assistance systems in new vehicles. Government policies in regions such as North America, Europe, and Asia-Pacific require rearview cameras, lane departure warning, and other camera-enabled features as standard equipment. These mandates have significantly increased fitment rates, even in entry-level and mid-segment vehicles. Automakers are responding by integrating multi-camera setups to meet compliance while enhancing overall safety ratings. This regulatory push is further reinforced by programs like Euro NCAP and NHTSA, which reward higher safety scores for camera-equipped vehicles. As more countries adopt similar mandates, the baseline demand for automotive cameras will remain strong across all vehicle classes.

Automotive cameras are now integral to the performance of ADAS platforms, supporting features such as adaptive cruise control, autonomous emergency braking, and traffic sign recognition. Their ability to provide real-time visual data makes them essential for enabling accurate decision-making in driver assistance functions. Multi-camera configurations, including front, rear, side, and surround-view systems, allow comprehensive coverage of the vehicle’s environment. This integration has shifted cameras from optional luxury features to core safety components in mainstream vehicles. Automakers are also combining camera inputs with radar and LiDAR data for improved perception accuracy. As ADAS adoption grows, camera demand will expand proportionately, strengthening their role in active safety architectures.

Beyond safety compliance, consumer preferences are shaping the automotive camera market. Buyers increasingly value features such as 360-degree surround-view parking aids, blind-spot monitoring, and high-definition recording for security purposes. Cameras improve visibility in challenging driving conditions, such as night driving or adverse weather, making them attractive to safety-conscious drivers. The popularity of SUVs and crossovers has further increased demand for advanced camera systems due to their larger blind spots. In-cabin cameras for driver monitoring are also gaining attention, particularly in markets with drowsiness detection regulations. As these features become widely recognized as enhancing comfort and convenience, OEMs are leveraging them as selling points in competitive vehicle segments.

The aftermarket segment plays a crucial role in the automotive camera market, offering upgrade options for older vehicles without factory-installed systems. Consumers are retrofitting vehicles with rearview, dash, and surround-view camera kits to improve safety and driving convenience. Fleet operators are increasingly adopting camera-based monitoring systems for accident prevention and driver performance tracking. Technology upgrades, such as higher resolution, wider field-of-view lenses, and integration with mobile applications, have made aftermarket solutions more attractive. Insurance incentives for camera-equipped vehicles have also boosted adoption. This sector benefits from ease of installation, competitive pricing, and compatibility with a wide range of vehicle types, ensuring continued expansion in both developed and emerging markets.

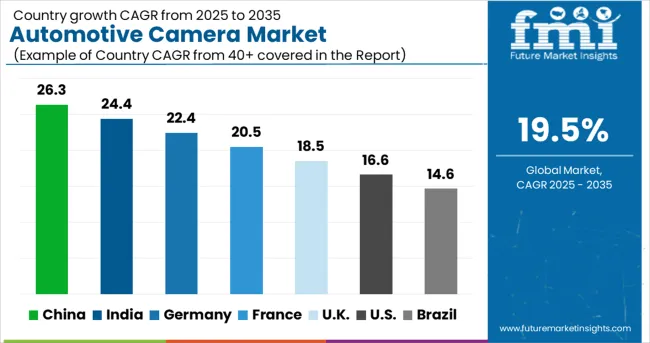

| Country | CAGR |

|---|---|

| China | 26.3% |

| India | 24.4% |

| Germany | 22.4% |

| France | 20.5% |

| U.K. | 18.5% |

| U.S. | 16.6% |

| Brazil | 14.6% |

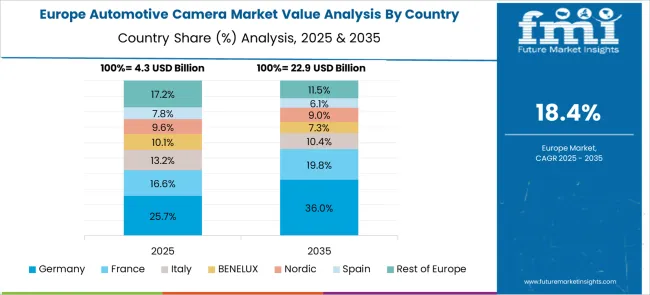

The automotive camera market is projected to grow globally at a CAGR of 19.5% between 2025 and 2035, fueled by regulatory safety mandates, rapid ADAS adoption, and increasing consumer demand for enhanced visibility systems. China leads with a CAGR of 26.3%, driven by high vehicle production volumes, government-enforced safety regulations, and large-scale integration of multi-camera ADAS suites. India follows at 24.4%, supported by growing automobile manufacturing, stricter crash safety norms, and rising fitment of driver monitoring and parking assist cameras. France achieves 20.5%, influenced by Euro NCAP compliance and expansion of camera-based pedestrian safety technologies. The United Kingdom records 18.5%, driven by increasing ADAS-equipped vehicle sales and aftermarket adoption. The United States posts 16.6%, shaped by steady integration of cameras into both mass-market and premium models along with growth in autonomous driving projects. This performance reflects the pivotal role of automotive cameras in next-generation safety and driver assistance solutions, with Asia-Pacific leading the adoption curve while Europe and North America sustain steady expansion.

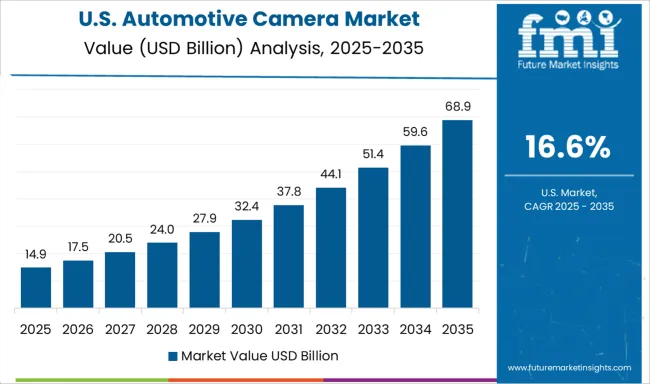

The United States is projected at 16.6% CAGR during 2025–2035, supported by steady ADAS penetration in mass and premium segments. Rearview and surround-view cameras have been adopted widely, while front vision, driver monitoring, and trailer assist cameras raise per-vehicle content. Replacement demand from high vehicle miles traveled keeps aftermarket volumes healthy. Insurance programs and safety ratings encourage camera fitment in SUVs, pickups, and crossovers. Fleet safety programs drive adoption of inward and outward cameras for compliance and incident investigation. Supply partnerships between Tier-1s and major OEMs improve time to market for higher resolution sensors, low-light lenses, and thermal options used in poor visibility.

The United Kingdom posts 18.5% CAGR for 2025–2035. Using proportional scaling to the 19.5% global benchmark, the 2020–2024 CAGR is estimated at 15.2%. Earlier growth stayed moderate due to slower model refresh cycles, limited driver monitoring adoption, and cost sensitivity in entry trims. The rise to 18.5% has been driven by higher SUV share, stronger Euro NCAP targets, and standardization of rear and front cameras across core nameplates. Greater use of surround-view suites in mid trims, plus rollout of fatigue and distraction monitoring, lifts unit content. Partnerships between OEMs and Tier-1s shorten validation windows and improve calibration quality, which supports faster fitment growth across fleets and retail channels.

China is assessed at 26.3% CAGR for 2025–2035, the highest among major markets. High production volumes and platform commonization enable rapid rollout of multi-camera suites that cover front, rear, side, and interior monitoring. Domestic suppliers scale optics, image sensors, and control units at competitive cost, which improves accessibility in compact and mid-size vehicles. Urban road conditions and parking density make surround-view and automated parking highly valued by buyers, boosting take rates. Regulatory focus on collision avoidance, lane discipline, and pedestrian detection strengthens OEM investment in vision stacks. Exports of China-built platforms with camera-rich trims lift shipments to Asia, Middle East, and Latin America, keeping factory utilization high.

India records 24.4% CAGR for 2025–2035, supported by rising safety awareness and stricter crash norms. Entry hatchbacks and compact SUVs now carry rear cameras as standard or popular options, while front cameras for lane support and traffic sign recognition gain traction in higher trims. Ride-hailing fleets prefer camera-equipped vehicles for compliance and incident review, which sustains demand in large cities. Localization of harnesses, brackets, and enclosures reduces cost and shortens lead times. Dealer-installed retrofit kits expand the addressable base among owners of older cars. As OEMs refresh platforms, multi-camera architectures are expected to migrate to mid trims, raising the camera count per vehicle and improving supplier volumes.

France is projected at 20.5% CAGR during 2025–2035. Euro NCAP priorities encourage forward vision upgrades, wider fields of view, and improved night performance. French plants serving European OEMs integrate camera modules with radar and control units, ensuring stable lead times for export programs. City driving patterns, tight parking spaces, and demand for automated parking aid adoption of 360-degree systems. Household preference for small crossovers raises fitment of blind-spot and rear cross-traffic camera features. Aftermarket channels remain active through certified installers handling retrofits and replacements after minor collisions. Policy interest in driver vigilance supports broader rollout of distraction and drowsiness monitoring in family cars and company fleets.

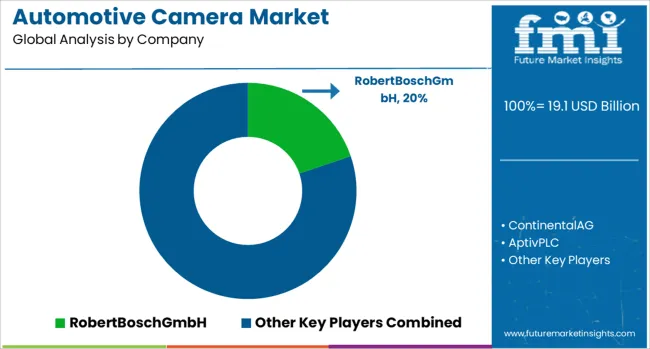

The automotive camera market demonstrates a moderately concentrated structure, with some dominant players such as Bosch, Continental, Magna, Denso, and Mobileye controlling a substantial portion of the global market. These companies hold significant leverage due to established OEM partnerships, global distribution networks, and proprietary technologies, including high-resolution imaging, AI-based processing algorithms, and integration with ADAS and autonomous driving systems. In parallel, a larger base of small and emerging players, such as ON Semiconductor, Ambarella, and Sony Semiconductor, contributes to a fragmented segment, offering niche solutions like low-light sensors, fisheye lenses, and specialized software analytics.

Barriers to entry remain high, driven by capital-intensive R&D, complex technology integration, software and AI development requirements, and strict automotive-grade certifications such as ISO 26262 and UNECE R157. These factors limit the ability of new entrants to scale quickly and compete with established players in high-volume OEM programs. The concentration and barriers create significant implications for mergers and acquisitions or joint ventures. Established players actively seek strategic alliances to enhance technology portfolios, expand regional reach, or gain faster integration into OEM supply chains. Small and emerging companies serve as attractive acquisition targets for their specialized technology, software expertise, or regional presence, providing dominant players with an accelerated route to innovation adoption and market expansion.

| Item | Value |

|---|---|

| Quantitative Units | USD 19.1 Billion |

| Type | Mono, Stereo, and Trifocal |

| Vehicle Type | Passenger Cars, Utility Vehicles, and Commercial Vehicles |

| Application | ADAS, Lane departure systems, Emergency braking systems, Forward collision warning, Others, and Parking assist |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | RobertBoschGmbH, ContinentalAG, AptivPLC, MagnaInternationalInc., Veoneer, DensoCorporation, Mobileye, and Valeo |

| Additional Attributes | Dollar sales, share, regional adoption trends, OEM vs aftermarket demand, regulatory impact, ADAS integration levels, competitor product roadmaps, pricing benchmarks, sensor fusion trends, technology upgrades, replacement cycle analysis. |

The global automotive camera market is estimated to be valued at USD 19.1 billion in 2025.

The market size for the automotive camera market is projected to reach USD 113.7 billion by 2035.

The automotive camera market is expected to grow at a 19.5% CAGR between 2025 and 2035.

The key product types in automotive camera market are mono, stereo and trifocal.

In terms of vehicle type, passenger cars segment to command 51.2% share in the automotive camera market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Back-up Camera Market Growth - Trends & Forecast 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA