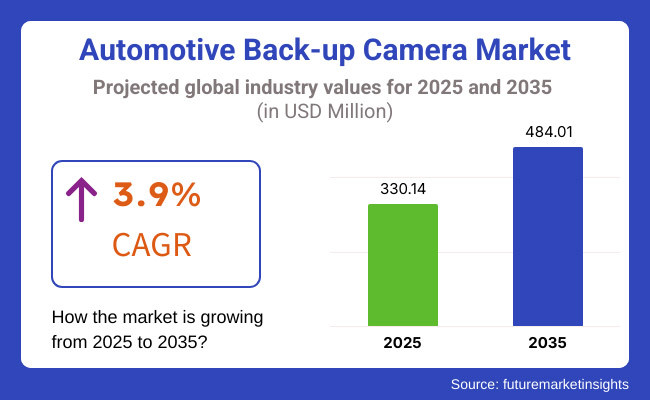

The global automotive back-up camera market is projected to increase from USD 330.14 million in 2025 to USD 484.01 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

This growth is being driven by the enforcement of automotive safety regulations, the expansion of advanced driver assistance systems (ADAS), and the incorporation of wide-angle, high-resolution imaging technologies across vehicle platforms.

Rear visibility standards are being mandated for all new passenger and commercial vehicles in several major automotive markets. In the United States, the National Highway Traffic Safety Administration (NHTSA) has required vehicles under 10,000 pounds to be equipped with rear-view technology since 2018, prompting global OEMs to adopt similar configurations.

Globally, the adoption of camera systems is being accelerated in response to the high incidence of low-speed collisions, particularly in logistics environments. According to Phillips Industries, approximately 75% of trailer-related accidents occur at low speeds, often within freight yards.

In response to these trends, the Rear-Vu camera system has been launched by Phillips Industries to improve safety during last-mile delivery and trailer maneuvering.

The company’s CEO, Rob Phillips, stated in Transport Topics (August 2024) that an industry-wide shift is being encouraged to bring trailer safety in line with passenger vehicle standards. The product has been designed specifically to support OEM integration and aftermarket retrofitting across fleet operations.

Enhanced adoption is also being driven by the integration of object detection, low-light imaging, and real-time video analytics. These features are being embedded into heavy-duty and utility vehicles, beyond their conventional use in high-end passenger cars. Insurance claims and personnel injury reports have been reduced where these systems have been installed, as noted in industry publications such as ProvisionUSA.

Future growth is expected to be sustained by the convergence of sensor fusion, autonomous braking modules, and vehicle-to-infrastructure (V2X) systems, where back-up cameras will continue to serve as core components of low-speed situational awareness and fleet safety strategies.

Surface-mounted units are expected to account for the largest share-approximately 46%-of the global automotive license plate mounting system market by 2025.

Over the forecast period from 2025 to 2035, the segment is projected to grow at a CAGR of 4.1%, slightly above the industry average of 3.9%. This configuration continues to be preferred by both OEMs and aftermarket providers due to its straightforward installation process and compatibility with a wide range of vehicle models.

Surface-mounted license plate holders are being adopted across passenger cars, light commercial vehicles, and two-wheelers for their cost-effectiveness and design flexibility. Their non-intrusive installation enables easier upgrades or replacements, making them especially attractive in regions with high vehicle customization rates. In addition, the segment benefits from increased sales of decorative and LED-backlit plates, which are often designed to be surface-mounted.

The growing focus on lightweight materials such as thermoplastics and aluminum composites is also enhancing product appeal in this category. Manufacturers are increasingly offering vehicle-specific mounts that minimize vibration and ensure regulatory compliance across global automotive markets.

Original Equipment Manufacturers (OEMs) are expected to lead the global market by contributing nearly 63% of total sales in 2025, with this segment forecast to expand at a CAGR of 4.0% through 2035. Regulatory mandates around plate visibility, mounting angles, and lighting integration have made factory-installed systems the standard across most new vehicle platforms.

OEMs are embedding license plate mounting systems as part of the vehicle design phase, ensuring seamless integration with bumper aesthetics, lighting components, and sensor systems. This is particularly important for advanced driver assistance systems (ADAS), where even minor obstructions or vibrations around the license plate can interfere with rear-view cameras or radar sensors.

Additionally, global harmonization of vehicle safety and compliance standards is prompting automakers to standardize mounting positions across export markets. Collaborations with Tier-1 suppliers are enabling the development of modular systems that accommodate multiple body types and regional license plate dimensions, streamlining production and reducing inventory complexity.

Challenge

High Costs and Regulatory Complexities

The Automotive Back-up Camera Market is affected by high production costs, stringent regulatory requirements, and integration complexities. The same vehicles must comply with safety regulations like the Federal Motor Vehicle Safety Standard (FMVSS) in the USA and other regions having similar standards, which raises compliance costs.

Also, the need to integrate back-up cameras with existing vehicle infotainment and driver assistance systems imposes additional complexity in terms of technology and calibration, which also adds to development costs. To remain affordably and competitively priced within their respective markets, companies are likely to have invested in cheap manufacturing and commodity style designs.

Market Saturation and Consumer Adoption Barriers

Moreover, owing to regulatory requirement, back-up cameras have found widespread acceptance resulting in market saturation in developed areas. Safety features are not a top priority for consumers in many emerging markets, which slows adoption rates in new premier digital markets and segments.

Moreover, the durability of camera components in extreme weather conditions & alleged malfunctions make many hesitant buyers. To combat these challenges, manufacturers need to build durable, weather-resistant camera systems and increase consumer education about the safety advantages of back-up cameras.

Opportunity

Rising Demand for Advanced Driver Assistance Systems (ADAS)

Autos becoming more and more advanced Driver Assistance Systems (ADAS) will lead to growth opportunities for the Automotive Back-up Camera Market. Automakers offer the back-up cameras in well-equipped ADAS packages that combine parking assistance, blind-spot recognition, and collision prevention.

As consumers increasingly crave protection and comfort, the need for high definition cameras with wide angle and night vision is growing. Forward-looking companies harnessing AI-driven image processing, sensor fusion technologies and real-time monitoring systems will be the top dogs in this burgeoning sector.

Technological Innovations and Smart Camera Systems

A dynamic of emerging technologies for back-up cameras including, but not limited to 360-degree vision and augmented reality overlays, as well as AI-driven obstacle detection is completely reshaping the landscape. Introducing smart camera systems powered with real-time analytics and enhanced image clarity that allow the driver to be more aware than ever before.

Demand is also being driven further due to the availability of along with seamless data-sharing cloud connected back-up camera solutions that provides integration with smart vehicle ecosystem. Market companies involved in small, high-density, and AI backup digital cameras will cash out of the rising pattern and fortify their market position.

The growth of back up cameras market in the United States automotive sector is attributed to the implementation of safety regulations in the country which now requires all the new vehicles to be equipped with rear-view cameras. Growing consumer demand for advanced driver-assistance systems (ADAS) and vehicle safety features is also stimulating market growth.

The growing adoption of electric and autonomous vehicles is also fuelling the demand for higher resolution, wide-angle back-up cameras. Furthermore, innovations in camera technology, such as night vision and augmented reality overlays are further fuelling the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

As more safety-conscious consumers opt for vehicles with built-in ADAS features, the market for back-up cameras for vehicles in the UK continues to expand. Adoption rates are driven by government regulations promoting vehicle safety and road accident prevention.

Additionally, the growing popularity of premium and electric vehicles is also propelling the demand for high-definition back-up cameras, which offer improved visibility as well as smart parking assist capabilities. Automakers are also introducing advanced camera sensors for better driver safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The back of car cameras market in the EU has a high demand in Germany, France, and Italy as its leading countries driving the market forward. Key Market Drivers: Stringent Vehicle Safety Regulations and Increased Consumer Awareness about Road Safety

Increasing adoption of 360-degree camera systems in luxury & midsegment vehicles is also fuelling growth of the market. Also, growing developments in AI-driven parking assistance system will find a substantial room for long-term growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

Japan is witnessing growth in automotive back-up camera market owing to its well-established automaker background and its swift penetration towards progressive vehicle safety technologies. The need for high-precision rear-view cameras is increasing as a result of the rise of autonomous and connected vehicles.

Major automakers are betting on AI-enabled camera systems and sensor fusion technology to improve vehicle safety. Furthermore, a rising consumer demand for premium safety features in compact and hybrid vehicles is further boosting the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

Demand for the automotive back-up camera in South Korea is set to expand as the country accelerates its foray into smart mobility and connected vehicle technologies. And leading automotive electronics manufacturers are driving innovations in high-resolution camera systems.

The growing number of electric and autonomous vehicles is also driving demand for high-performance back-up cameras with better night vision and the integration of automatic emergency braking. Furthermore, increasing government endorsement of vehicle safety standards is likely to fuel the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.1% |

Bosch Mobility Solutions (18-22%)

Bosch leads the automotive back-up camera market with its AI-powered imaging solutions, integrating night vision, object recognition, and real-time alerts for enhanced driver safety.

Magna International (15-19%)

Magna specializes in 360-degree surround-view camera systems, providing seamless integration with ADAS and parking assistance technologies.

Continental AG (12-16%)

Continental offers high-resolution, wide-angle back-up cameras with thermal imaging and real-time data processing to improve driver visibility in all conditions.

Panasonic Automotive (9-13%)

Panasonic focuses on digital rear-view mirror cameras and wireless connectivity solutions, delivering innovative imaging technologies for next-gen vehicles.

Valeo SA (7-11%)

Valeo ranks among the leader companies in the back-up camera field through its delivery of high-dynamic-range imaging capability and augmented reality instructions in addition to AI-based hazard detection systems.

Firms specializing in automotive technology supply solutions for back-up cameras by concentrating on high-resolution picture technology and ADAS controls and connected technology systems. Notable players include:

The overall market size for Automotive Back-up Camera Market was USD 330.14 Million in 2025.

The Automotive Back-up Camera Market expected to reach USD 484.01 Million in 2035.

The demand for the automotive back-up camera market will grow due to increasing vehicle safety regulations, rising consumer awareness about accident prevention, advancements in camera and sensor technologies, and the growing adoption of advanced driver assistance systems (ADAS) in modern vehicles.

The top 5 countries which drives the development of Automotive Back-up Camera Market are USA, UK, Europe Union, Japan and South Korea.

TFT-LCD Monitors and Surface Mounted Cameras lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Position, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Position, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Position, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Position, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Position, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Position, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Position, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Monitor, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Monitor, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Position, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Position, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Position, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Monitor, 2023 to 2033

Figure 27: Global Market Attractiveness by Position, 2023 to 2033

Figure 28: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Position, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Monitor, 2023 to 2033

Figure 57: North America Market Attractiveness by Position, 2023 to 2033

Figure 58: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Position, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Monitor, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Position, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Position, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Monitor, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Position, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Position, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Monitor, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Position, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Position, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Monitor, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Position, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Position, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Monitor, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Position, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Monitor, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Position, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Monitor, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Monitor, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Monitor, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Monitor, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Position, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Position, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Position, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Position, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Monitor, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Position, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA