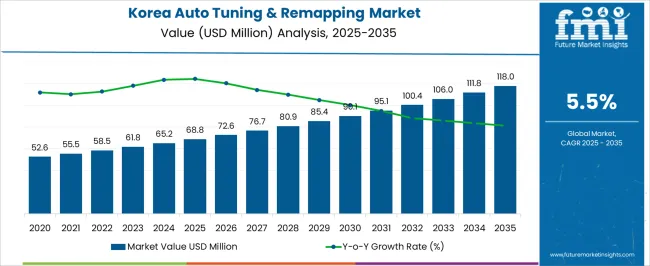

The Korea Automotive Performance Tuning and Engine Remapping Service Industry is estimated to be valued at USD 68.8 million in 2025 and is projected to reach USD 118.0 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Korea Automotive Performance Tuning and Engine Remapping Service Industry Estimated Value in (2025 E) | USD 68.8 million |

| Korea Automotive Performance Tuning and Engine Remapping Service Industry Forecast Value in (2035 F) | USD 118.0 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The Korea automotive performance tuning and engine remapping service industry is expanding steadily. Rising consumer preference for enhanced driving experience, growing awareness of engine efficiency, and increased availability of advanced tuning technologies are shaping demand. Current dynamics are defined by rising disposable incomes, evolving automotive lifestyles, and wider access to specialized service providers.

Fuel efficiency optimization and performance customization are being prioritized by both individual consumers and fleet owners. Regulatory frameworks related to emission standards are influencing tuning practices, with compliant solutions being adopted to ensure performance without compromising sustainability. The future outlook is driven by expanding adoption of electronic control unit remapping, integration of AI and data-driven diagnostics, and technological innovations that provide precise tuning options.

Growth rationale is centered on the dual drivers of improved performance and fuel economy, alongside consumer inclination toward personalized automotive solutions Strategic collaborations between service providers and aftermarket players are expected to strengthen market positioning and extend industry growth in Korea.

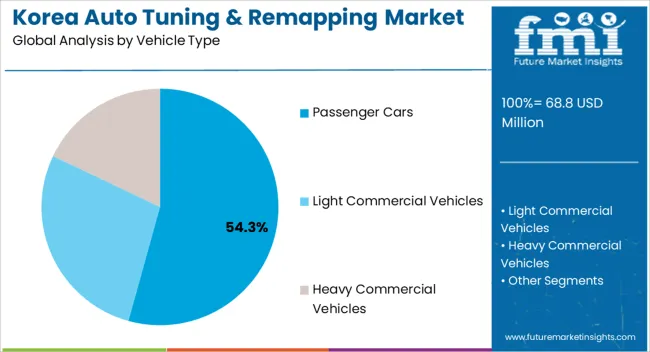

Passenger cars, holding 54.30% of the vehicle type category, represent the leading segment due to widespread ownership and strong consumer inclination toward performance enhancement in personal vehicles. Market share has been reinforced by demand for improved acceleration, torque, and overall driving dynamics, which are increasingly sought after by enthusiasts and everyday users.

Service adoption has been boosted by rising affordability of tuning packages, enhanced availability of skilled technicians, and integration of diagnostic software for precise remapping. Urbanization and higher car density in Korea have further driven service demand, particularly in metropolitan areas.

Continued focus on premium and mid-range passenger vehicles is expected to sustain adoption, while evolving consumer expectations for customization and advanced driving experiences will reinforce the segment’s market leadership.

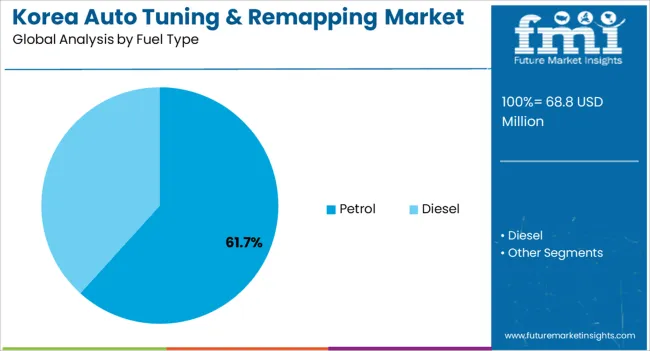

The petrol segment, accounting for 61.70% of the fuel type category, dominates due to the high penetration of petrol-powered vehicles in Korea’s automotive landscape. Demand has been influenced by ease of tuning petrol engines compared to diesel, as well as their responsiveness to remapping for performance improvements.

Adoption is further supported by a younger consumer demographic that prioritizes speed and agility, aligning with the tuning benefits petrol engines deliver. Availability of high-octane fuels and advanced aftermarket solutions has reinforced the segment’s growth.

Technological advancements in engine control units have enabled more precise remapping, optimizing both efficiency and performance This segment is expected to maintain leadership, with continued demand from both mainstream and premium petrol vehicle owners.

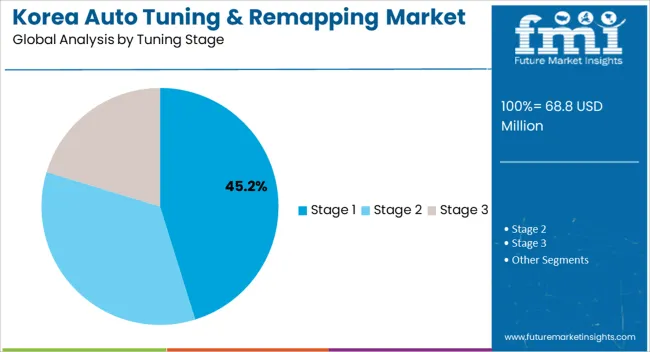

The Stage 1 tuning segment, representing 45.20% of the tuning stage category, has been leading due to its accessibility, affordability, and minimal modification requirements. It has gained strong traction among consumers seeking noticeable performance improvements without extensive hardware changes.

Service providers have emphasized Stage 1 packages as an entry point for customers, offering reliable enhancements in horsepower and torque within safe engine limits. Demand stability has been supported by shorter service times, lower costs, and compliance with regulatory guidelines.

Market growth is being reinforced by digital tuning tools that improve accuracy and consistency, ensuring wider acceptance among vehicle owners Continued consumer interest in incremental performance upgrades, combined with rising awareness of safe remapping practices, is expected to sustain the segment’s prominence within the Korean market.

Passenger cars reign supreme in Korea automotive performance tuning and engine remapping service due to numerous compelling factors. Their sheer industry dominance, at 73.7% in 2025, stems from a convergence of practicality, popularity, and customization potential.

| Vehicle | Passenger Cars |

|---|---|

| Industry Share | 73.7% |

These cars, widely owned across diverse demographics, offer a broad spectrum for modification and tuning. Their widespread usage in urban and suburban settings fuels the demand for enhanced performance, driving the industry growth. The Korea automotive landscape predominantly comprises passenger cars, fostering a robust ecosystem for specialized service, thus consolidating their dominant stance within its tuning and remapping sector.

Petrol asserts its supremacy in Korea automotive performance tuning and engine remapping service industry with a commanding 52.3% share in 2025 due to multifaceted advantages. Petrol engines, renowned for their adaptability and responsiveness to modifications, allure automotive enthusiasts seeking enhanced performance.

| Fuel | Petrol |

|---|---|

| Industry Share | 52.3% |

The availability of a wide array of tuning options and aftermarket parts tailored for petrol powered vehicles further solidifies its dominance. The prevalent infrastructure supporting petrol stations and a cultural preference for petrol fueled cars fortify its industry dominance, creating a conducive environment for specialized service, thus perpetuating its leading position within its tuning and remapping landscape.

In South Jeolla automotive performance tuning and engine remapping service, recent trends signify a shift towards eco tuning solutions, aligning with environmental concerns. Enthusiasts seek tuning service focusing on improved fuel efficiency and reduced emissions without compromising performance.

There is a notable surge in demand for advanced engine remapping techniques tailored for electric vehicles. Its growing EV industry has prompted specialized tuning service to enhance EV performance and range.

Tuning for luxury and imported vehicles gains momentum, catering to discerning clientele seeking personalized modifications and performance enhancements. An emerging trend also revolves around integrating aftermarket parts and accessories, allowing enthusiasts to customize their vehicles extensively. This amalgamation of eco consciousness, EV tuning, personalized luxury modifications, and aftermarket part integration shapes the evolving landscape of automotive performance tuning and engine remapping service in South Jeolla.

Numerous emerging opportunities beckon forward thinking businesses in the North Jeolla automotive performance tuning and engine remapping service industry. A prominent avenue lies in catering to the growing demand for electric vehicle tuning expertise. With the escalating adoption of EVs, there is a burgeoning need for specialized tuning service that optimize electric motor efficiency, battery management, and overall performance.

Capitalizing on eco tuning service represents another promising opportunity. An increasing emphasis on environmentally friendly solutions presents an industry opening for tuners who can offer modifications that enhance fuel efficiency and reduce emissions without compromising power.

Targeting fleet management companies and commercial vehicle operators is an unexplored frontier. Providing tuning and remapping service tailored to enhance the performance and efficiency of these fleets can be a lucrative avenue. These opportunities highlight the potential for innovative solutions in EV tuning, eco friendly modifications, and specialized service for commercial vehicle segments in the thriving automotive performance tuning and engine remapping service industry in North Jeolla.

The Korea automotive performance tuning and engine remapping service industry exemplifies a fusion of precision engineering and innovative technology. Boasting a dynamic landscape, it caters to diverse customer demands, from enhancing vehicle performance and aesthetics to addressing eco friendly solutions.

With a focus on meticulous modifications, advanced remapping techniques, and a burgeoning industry for electric vehicle tuning, its industry mirrors a commitment to delivering innovative solutions while navigating evolving regulations and customer preferences. Its continual evolution promises an exciting future, embracing advancements and meeting the evolving demands of automotive enthusiasts and commercial users.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 68.8 million |

| Projected Industry Size in 2035 | USD 118.0 million |

| Attributed CAGR between 2025 and 2035 | 5.5% CAGR |

| Historical Analysis of Demand for Automotive Performance Tuning and Engine Remapping Service in Korea Regions | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Report Coverage | Industry size, industry trends, analysis of key factors influencing Automotive Performance Tuning and Engine Remapping Service in Korea, insights on global players and their industry strategy in Korea, ecosystem analysis of local and regional Korea providers. |

| Key Regions within Korea Analyzed while Studying Opportunities for Automotive Performance Tuning and Engine Remapping Service in Korea | South Gyeongsang, North Jeolla, South Jeolla, Jeju |

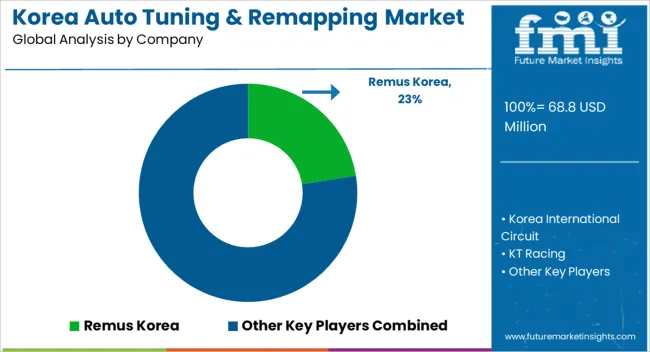

| Key Companies Profiled | Korea International Circuit; Remus Korea; KT Racing; Carshop Nunu; TS Autohaus |

The global Korea automotive performance tuning and engine remapping service industry is estimated to be valued at USD 68.8 million in 2025.

The market size for the Korea automotive performance tuning and engine remapping service industry is projected to reach USD 118.0 million by 2035.

The Korea automotive performance tuning and engine remapping service industry is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in Korea automotive performance tuning and engine remapping service industry are passenger cars, light commercial vehicles and heavy commercial vehicles.

In terms of fuel type, petrol segment to command 61.7% share in the Korea automotive performance tuning and engine remapping service industry in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Korea Smart Home Security Camera Market Size and Share Forecast Outlook 2025 to 2035

Korea Bicycle Component Aftermarket Analysis Size and Share Forecast Outlook 2025 to 2035

The Korea Non-Dairy Creamer Market in Korea is segmented by form, nature, flavor, type, base, end-use, packaging, distribution channel, and province through 2025 to 2035.

Korea Calcium Supplement Market is segmented by form,end-use, application and province through 2025 to 2035.

Korea Women’s Intimate Care Market Analysis - Size, Share & Trends 2025 to 2035

Korea Conference Room Solution Market Growth – Trends & Forecast 2025 to 2035

Korea Visitor Management System Market Growth – Trends & Forecast 2025 to 2035

Korea fiber optic gyroscope market Growth – Trends & Forecast 2025 to 2035

Korea Event Management Software Market Insights – Demand & Growth Forecast 2025 to 2035

Korea Submarine Cable Market Insights – Demand & Forecast 2025 to 2035

Last-mile Delivery Software Market in Korea – Trends & Forecast through 2035

Korea HVDC Transmission System Market Trends & Forecast 2025 to 2035

Korea Base Station Antenna Market Growth – Trends & Forecast 2025 to 2035

Smart Space Market Analysis in Korea-Demand & Growth 2025 to 2035

Korea I2C Bus Market Trends & Forecast 2025 to 2035

Korea On-shelf Availability Solution Market – Demand & Forecast 2025 to 2035

Korea Customized Premix Market Analysis – Size, Share & Trends 2025 to 2035

Korea Texturized Vegetable Protein Market Analysis – Size, Share & Trends 2025 to 2035

Korea Avocado Oil Market Analysis - Size, Share & Trends 2025 to 2035

Korea Wall Décor Market Analysis – Size, Share & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA