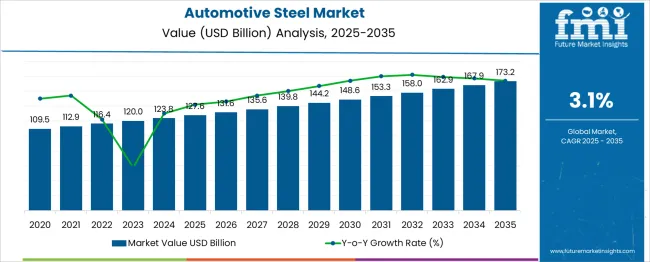

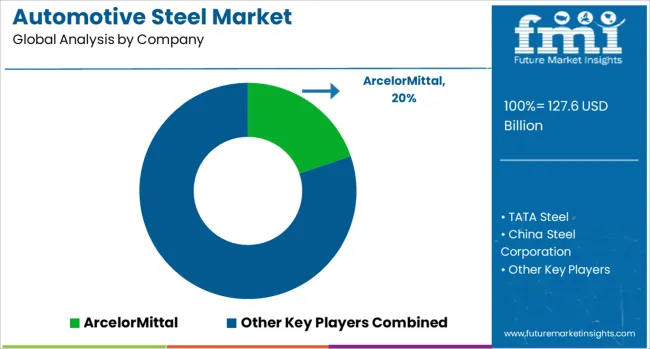

The automotive steel market is projected to expand from USD 127.6 billion in 2025 to USD 173.2 billion by 2035, adding ~USD 45.6 billion in absolute opportunity. From 2025 to 2030, the market rises to ~USD 148.6 billion (≈ USD 21.0 billion gain, ~46% of total growth). From 2030 to 2035, it increases to ~USD 173.2 billion (≈ USD 24.6 billion gain, ~54% of total), supported by EV platform content, AHSS penetration, and coating/forming innovations. This phase is supported by automotive manufacturers’ efforts to improve vehicle safety, fuel efficiency, and emission compliance through lightweight yet durable steel solutions. Innovations in advanced high-strength steel (AHSS) and ultra-high-strength steel (UHSS) further bolster adoption across structural and safety components. Additionally, stringent government regulations on vehicle emissions and safety continue to drive steel usage for weight reduction and structural integrity. The automotive steel market is positioned for consistent growth through 2035, fueled by evolving automotive design trends, regulatory requirements, and sustainability efforts in the industry.

| Metric | Value |

|---|---|

| Automotive Steel Market Estimated Value in (2025 E) | USD 127.6 billion |

| Automotive Steel Market Forecast Value in (2035 F) | USD 173.2 billion |

| Forecast CAGR (2025 to 2035) | 3.1% |

The automotive steel market is undergoing a significant transformation driven by the convergence of regulatory pressures, fuel efficiency targets, and material innovation strategies. As automotive OEMs pursue enhanced structural integrity and crash performance, steel continues to be favored for its recyclability, cost-effectiveness, and mechanical strength. In particular, the integration of advanced high-strength steels (AHSS) and hot-stamped components is gaining prominence across vehicle platforms, addressing weight reduction goals without compromising safety.

The market is further supported by investments in electric vehicle (EV) production and chassis reinforcements, which require precise steel formulations and consistent mechanical properties. Global trends toward sustainable manufacturing have also increased the focus on circular economy models within the steel value chain.

As automakers explore a balance between lightweight composites and traditional metals, steel’s adaptability to various forming processes remains a critical advantage. In the years ahead, regional expansions of steel plants and partnerships between automakers and steel manufacturers are expected to catalyze growth, particularly across Asia and Europe.

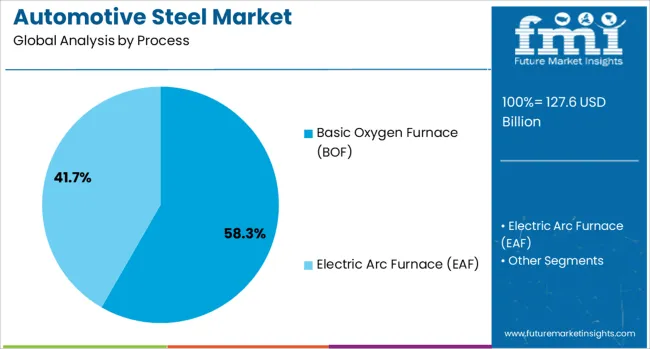

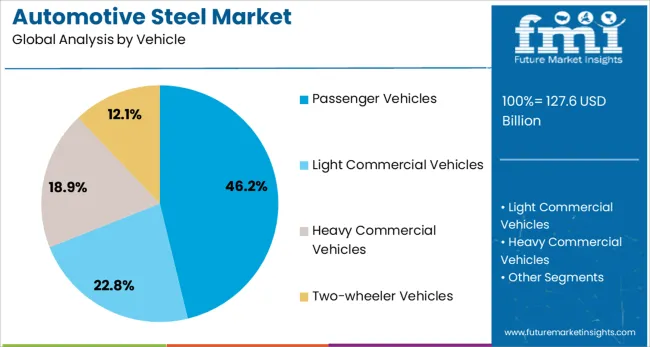

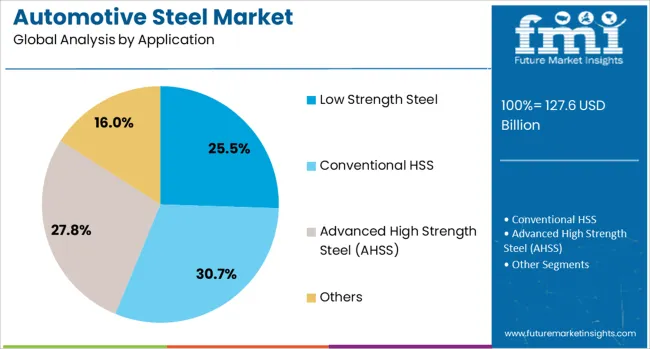

The automotive steel market is segmented by process, vehicle, application, and geographic regions. By process, the market is divided into Basic Oxygen Furnace (BOF) and Electric Arc Furnace (EAF). In terms of vehicle, the market is classified into Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles Two-wheeler Vehicles. Based on application, the market is segmented into Low Strength Steel, Conventional HSS, Advanced High Strength Steel (AHSS), and Others. Regionally, the automotive steel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The basic oxygen furnace process is projected to account for 58.3% of the total revenue share in the automotive steel market in 2025, maintaining its dominance due to its high throughput capacity and suitability for mass automotive steel production. This process is preferred for its efficiency in producing large volumes of primary steel with controlled chemical composition, essential for manufacturing consistent flat and long steel products used in vehicle structures.

The capability of the basic oxygen furnace to incorporate iron ore and recycled scrap allows for flexibility in raw material input while meeting strict metallurgical standards. Continuous investments in furnace modernization and energy recovery technologies have further optimized production cycles, reducing carbon intensity per ton of steel.

As automakers demand high-volume supply of hot rolled coils, galvanized sheets, and structural steel components, the basic oxygen furnace route remains a key enabler. Its integration with downstream rolling mills and automotive-grade coating lines has reinforced its role in fulfilling the quality and quantity requirements of global vehicle manufacturers.

Passenger vehicles are expected to represent 46.2% of the automotive steel market revenue in 2025, driven by rising vehicle production across Asia, Europe, and North America. The segment’s dominance is influenced by the growing demand for fuel-efficient and safer vehicles, requiring optimized use of steel in body-in-white, doors, chassis, and crumple zones.

Manufacturers are increasingly relying on a blend of high-strength and ultra-high-strength steels to meet crash test compliance, structural rigidity, and light weighting targets simultaneously. The advancement of electric and hybrid passenger vehicles has also contributed to segment growth, as these models require specialized structural frames and battery enclosures designed with thermally stable and corrosion-resistant steel grades.

Moreover, continuous technological innovation in steel processing has allowed for formability, weldability, and strength characteristics tailored for complex automotive components. The expansion of global middle-class populations and supportive government policies on vehicle ownership are expected to sustain the volume and material demands in the passenger vehicle segment.

Low strength steel is anticipated to hold 25.5% of the total automotive steel market revenue in 2025, supported by its widespread usage in non-critical automotive components. The segment’s continued relevance stems from its favorable forming characteristics and cost efficiency, making it ideal for producing parts such as interior brackets, panels, and seat frames where high tensile strength is not essential.

Automotive OEMs continue to incorporate low strength steel in specific design areas to optimize cost-performance ratios, especially in entry-level and economy vehicle models. The high ductility of these steels allows for complex shaping and stamping operations, contributing to assembly speed and manufacturing scalability.

Additionally, the ability of low strength steel to be galvanized or coated enhances its durability and corrosion resistance, aligning with vehicle longevity goals. As automotive manufacturers strive for material optimization by deploying multi-grade steel strategies across car architectures, the strategic use of low strength steel continues to play a foundational role in balancing performance with affordability.

Automotive steel demand is fueled by expanding vehicle production, high-strength steel adoption, EV platform integration, and safety regulations. These factors ensure continued relevance and dominance in automotive manufacturing.

Expanding global vehicle manufacturing volumes are a primary driver for automotive steel demand. Every new vehicle requires substantial steel content for body structures, chassis, and safety components, ensuring consistent consumption. Growth in emerging automotive hubs is reinforcing this trend, with OEMs expanding assembly lines to meet domestic and export requirements. Increased adoption of high-strength and advanced high-strength steel grades is improving performance while optimizing vehicle weight. Automotive steel suppliers are investing in advanced forming and joining techniques to meet evolving design needs. This production-driven demand ensures steady procurement cycles for both primary and secondary steel producers, strengthening long-term market stability across passenger, commercial, and specialty vehicle categories.

High-strength and advanced high-strength steel (AHSS) have become central to modern vehicle design due to their ability to offer greater strength at reduced thickness. This shift enables weight optimization without compromising crash safety performance. Automakers are replacing conventional mild steel in key structural areas, such as pillars, frames, and reinforcement zones, with AHSS for improved durability and protection. The transition is also helping manufacturers meet fuel efficiency targets by reducing overall vehicle mass. Steelmakers are enhancing alloy composition, hot stamping processes, and forming precision to cater to evolving OEM requirements. This product mix shift is increasing average revenue per vehicle for suppliers.

The rising production of electric and hybrid vehicles is creating new applications for automotive steel. Battery enclosures, motor housings, and high-load structural members often require specialized grades for strength, corrosion resistance, and crash safety compliance. High-strength steel offers a cost-effective alternative to aluminum in these areas while maintaining robust performance. Manufacturers are adapting production lines to supply components tailored for EV and hybrid architectures, particularly in floorpan and underbody designs. Partnerships between automakers and steel producers are ensuring early integration of steel solutions into platform development. This segment is emerging as a high-value growth avenue for the automotive steel industry.

Strict global crash safety regulations are directly influencing automotive steel consumption. To meet compliance, automakers rely on reinforced structures using advanced steel grades in areas such as side-impact beams, roof rails, and crumple zones. Governments in key markets have tightened impact and rollover standards, increasing the proportion of high-performance steel in new models. This regulatory influence is especially significant in premium vehicles, where structural rigidity is a major selling point. Steel suppliers are responding with innovations in hot-formed parts, precision welding, and corrosion protection to meet these requirements. As safety compliance becomes more stringent, steel content per vehicle is expected to remain stable or increase.

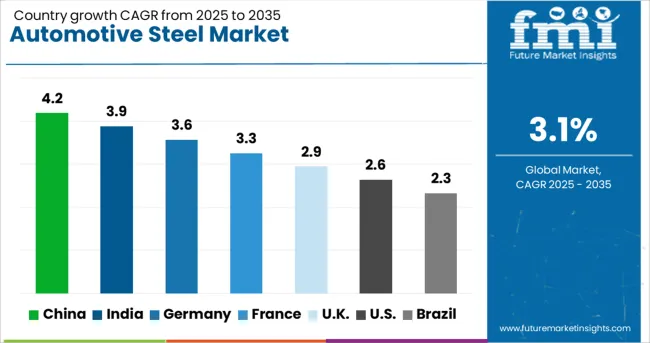

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

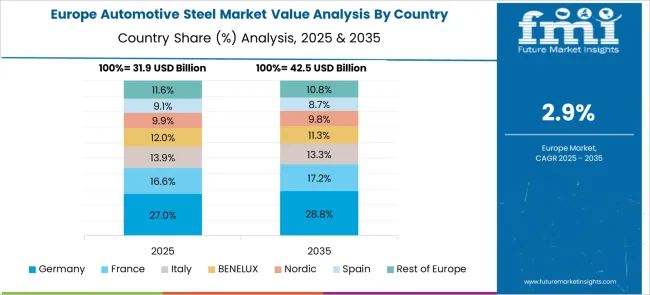

The automotive steel market is projected to expand globally at a CAGR of 3.1% between 2025 and 2035, supported by consistent vehicle production volumes, increasing adoption of high-strength steel grades, and rising demand from electric and hybrid vehicle platforms. China leads with a CAGR of 4.2%, driven by large-scale domestic automotive manufacturing, infrastructure for EV production, and OEM investment in advanced steel applications. India follows at 3.9%, benefiting from expanding passenger and commercial vehicle assembly, stronger safety regulations, and localization of steel supply chains. Germany posts 3.6%, supported by premium vehicle production, integration of ultra-high-strength steel in lightweight designs, and export-focused manufacturing. The United Kingdom grows at 2.9%, reflecting steady demand from commercial fleets, niche sports car manufacturing, and aftermarket upgrades, while the United States posts 2.6%, driven by replacement demand, SUV and pickup production, and renewed investment in domestic automotive steel capacity. The analysis covers more than 40 countries, with these six serving as reference points for capacity expansion, advanced steel development, and strategic investment planning in the global automotive steel industry.

China is projected to post a CAGR of 4.2% during 2025–2035, up from roughly 3.2% recorded during 2020–2024, indicating faster consumption tied to vehicle output recovery and model refresh cycles. The earlier phase was shaped by uneven production schedules and commodity price volatility that constrained purchases by mills and OEMs. The next period is set to gain from wider use of high-strength grades in body-in-white, stronger supplier localization near assembly hubs, and increased EV platform launches that favor engineered steels for underbody and enclosure parts. Export programs for finished vehicles are expected to stabilize mill capacity use and tighten contract pricing.

India is expected to register a 3.9% CAGR during 2025–2035, higher than the near 3.0% achieved in 2020–2024 as assembly capacity additions and stricter safety targets increase steel intensity per vehicle. Earlier growth was shaped by intermittent supply gaps and preference for conventional grades that limited value growth per ton. The outlook improves with higher penetration of advanced high-strength steels in pillars, rails, and floor assemblies and with new rolling lines commissioned by domestic mills. Stronger small SUV and LCV production is likely to support steady coil offtake, while vendor parks near OEM clusters enhance just-in-time deliveries and lower logistics costs for stampers.

Germany is forecast at 3.6% CAGR for 2025–2035, above the estimated 2.6% registered in 2020–2024 as premium platforms intensify use of ultra-high-strength steels. Earlier, output softness and model mix favored aluminum in select trims, limiting steel revenue per vehicle. The coming period benefits from mixed-material strategies where press-hardened components secure crash targets at competitive cost, raising steel’s share in critical load paths. Export resilience in premium SUVs and performance models should support steady coil demand, while agreements between mills and tier-ones encourage stable pricing and assured slit-coil availability for complex stampings. Tooling refresh cycles will also spur higher-value steel usage.

The United Kingdom is projected to grow at 2.9% CAGR during 2025–2035, compared with about 1.9% during 2020–2024. The earlier CAGR was held back by pandemic-era volume shocks, model discontinuations, and sourcing disruptions that delayed coil purchases and tempered mix toward lower-value grades. The rise to 2.9% is expected as new EV-leaning platforms add underbody and enclosure steel content, plant utilization improves with confirmed model allocations, and mill-service center partnerships secure stable slit-coil supply. Fleet renewal in vans and pickups should lift high-strength demand in frames and load floors, while stricter safety targets sustain press-hardened parts in side structures.

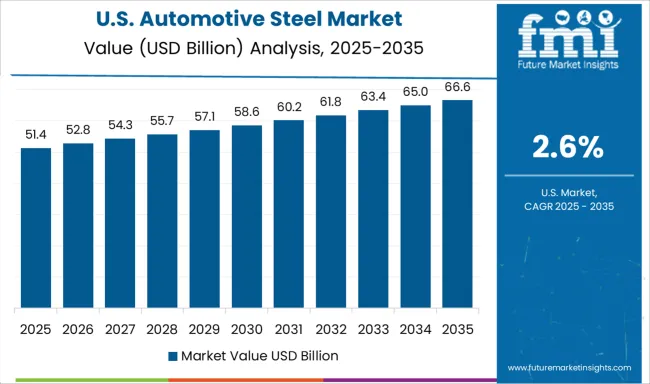

The United States is anticipated to post a 2.6% CAGR during 2025–2035, above the estimated 1.9% recorded in 2020–2024 as inventories and production schedules normalize. Earlier growth was tempered by supplier bottlenecks and a model mix that favored carryover platforms with modest steel upgrades. The forecast period benefits from renewed pickup and SUV programs that increase high-strength steel intensity in frames, rocker panels, and cab structures. New EAF capacity coming online is expected to stabilize coil availability, while tighter safety targets encourage adoption of press-hardened components. Aftermarket body repair volumes also support steady sheet demand in collision parts channels.

The automotive steel market is defined by a competitive mix of global steel giants, diversified industrial groups, and specialized producers supplying high-strength, advanced high-strength, and ultra-high-strength steels for automotive applications. ArcelorMittal leads with extensive automotive steel portfolios, including light weighting solutions and tailored blanks for OEM platforms. TATA Steel and JSW Group maintain strong positions in Asia with localized supply networks and advanced coating technologies. China Steel Corporation and HBIS Group cater to large-scale domestic vehicle production, while Hyundai Steel integrates steelmaking with in-house automotive manufacturing. United States Steel Corporation and NUCOR Corporation focus on advanced grades and expanded EAF capacity to serve North American automakers.

POSCO and Nippon Steel Corporation are recognized for innovation in ultra-high-strength steel for safety-critical components. JFE Steel Corporation and Kobe Steel provide specialty grades for premium and performance vehicles. Jindal Steel & Power focus on cost-efficient mass-market supply. Outokumpu OYJ, known for stainless steel expertise, supports niche applications like exhaust systems. Strategic priorities across the sector include expanding AHSS production, developing corrosion-resistant coatings, enhancing formability, and aligning supply chains with EV manufacturing requirements to strengthen partnerships with global OEMs and tier-one suppliers.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Process | Basic Oxygen Furnace (BOF) and Electric Arc Furnace (EAF) |

| Vehicle | Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles, and Two-wheeler Vehicles |

| Application | Low Strength Steel, Conventional HSS, Advanced High Strength Steel (AHSS), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ArcelorMittal, TATA Steel, China Steel Corporation, Hyundai Steel, United States Steel Corporation, JSW Steel Limited, POSCO, Nippon Steel & Sumitomo Metal Corporation, JFE Steel Corporation, NUCOR Corporation, Jindal Steel & Power, HBIS Group, Outokumpu Oyj, and Kobe Steel |

| Additional Attributes | Dollar sales, share, demand trends by vehicle segment, high-strength steel adoption rates, OEM procurement strategies, raw material cost impacts, regional capacity expansions, and competitive positioning. |

The global automotive steel market is estimated to be valued at USD 127.6 billion in 2025.

The market size for the automotive steel market is projected to reach USD 173.2 billion by 2035.

The automotive steel market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in automotive steel market are basic oxygen furnace (bof) and electric arc furnace (eaf).

In terms of vehicle, passenger vehicles segment to command 46.2% share in the automotive steel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Stainless Steel Market Size and Share Forecast Outlook 2025 to 2035

Automotive Structural Steel Market Growth - Trends & Forecast 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA