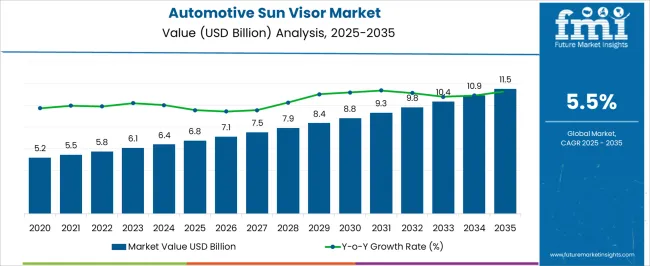

The automotive sun visor market is estimated to be valued at USD 6.8 billion in 2025 and is projected to reach USD 11.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

A comparison of the early and late growth curves highlights how expansion shifts from foundational adoption toward mature stabilization. From 2021 to 2025, the market advances from USD 5.2 billion to USD 6.8 billion. This early growth curve reflects consistent year-on-year increases averaging 5–6%, supported by rising vehicle production, greater consumer preference for comfort features, and wider integration of visors with mirrors, lighting, and storage add-ons. Momentum here is largely volume-driven, as both passenger and commercial vehicles register steady demand.

Between 2026 and 2030, the market climbs from USD 7.1 billion to USD 9.3 billion. Growth remains robust but slightly shifts toward value addition, with premium sun visors incorporating advanced materials, modular storage, and built-in electronic functionalities. The curve shows a more pronounced upward slope, indicating adoption of higher-value variants and broader penetration in mid-tier vehicle segments.From 2031 to 2035, the market expands from USD 9.8 billion to USD 11.5 billion. The late curve shows moderation, with annual growth tapering toward 4–5%, signaling maturity. Here, replacement demand, incremental product innovations, and expansion in emerging economies support value rather than sharp volume gains.

| Metric | Value |

|---|---|

| Automotive Sun Visor Market Estimated Value in (2025 E) | USD 6.8 billion |

| Automotive Sun Visor Market Forecast Value in (2035 F) | USD 11.5 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The automotive sun visor market holds a modest but steady presence across multiple parent domains, with percentage shares varying based on function and end-use adoption. Within the automotive interior components market, sun visors account for nearly 6 to 7%, positioned alongside headliners, dashboards, and trims that enhance cabin comfort and ergonomics. In the automotive safety components market, their share is estimated at 4 to 5%, since visors play a supporting role in reducing glare and improving driver visibility, complementing more dominant safety systems like airbags and seatbelts.

The passenger vehicle accessories market shows stronger integration, with sun visors holding about 7 to 8%, as they remain standard fitments in sedans, hatchbacks, and SUVs for both utility and aesthetic value. In the commercial vehicle components market, sun visors contribute nearly 3 to 4%, primarily in buses and heavy trucks where driver comfort and visibility during long hours of operation are important but not prioritized over functional components. Within the automotive OEM and aftermarket parts market, their contribution stands at 5 to 6%, covering both factory-installed visors and replacement or customized units sold through accessory channels.

The market is experiencing consistent growth as vehicle manufacturers increasingly prioritize driver comfort, visibility, and safety. Rising consumer expectations for premium interiors and enhanced driving experiences have influenced innovation in visor design and material selection. Stringent safety standards across global markets have compelled automakers to integrate sun visors that provide optimal glare reduction while complementing the vehicle’s aesthetic appeal.

The shift toward personalization and comfort in passenger and commercial vehicles has also strengthened the adoption of advanced visor materials and mechanisms. Growing demand from emerging economies, coupled with increasing vehicle production, is further driving the market’s expansion.

Technological enhancements, such as integrating storage features or electronic components within visors, are opening new opportunities for differentiation With automakers focusing on both functional and design improvements, the market is expected to witness sustained growth supported by advancements in materials, manufacturing processes, and consumer-centric innovation.

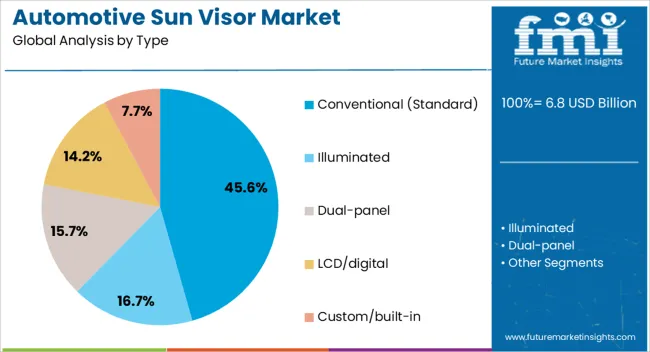

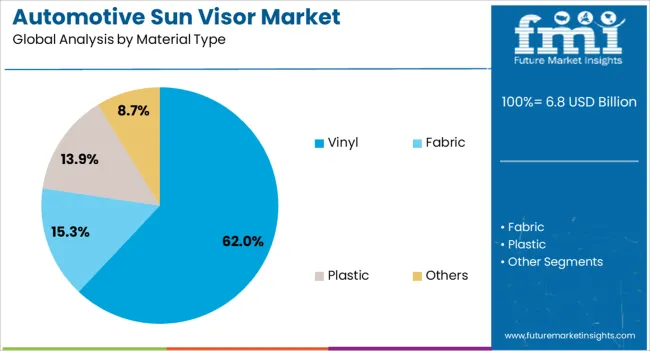

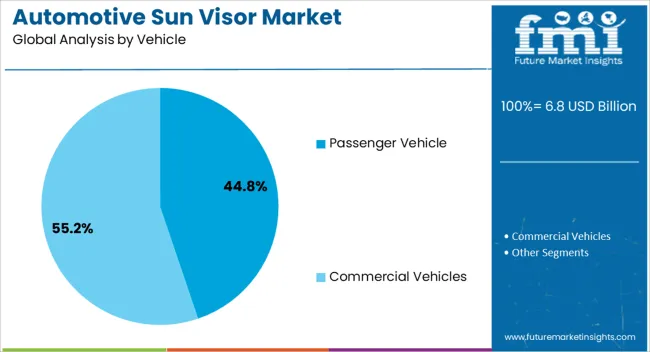

The automotive sun visor market is segmented by type, material type, vehicle, application, sales channel, and geographic regions. By type, automotive sun visor market is divided into conventional (Standard), illuminated, dual-panel, LCD/digital, and custom/built-in. In terms of material type, automotive sun visor market is classified into vinyl, fabric, plastic, and others. Based on vehicle, automotive sun visor market is segmented into passenger vehicle and commercial vehicles. By application, automotive sun visor market is segmented into sun glare protection, driver and passenger comfort enhancement, vanity mirror integration, rear and side window applications, and others. By sales channel, automotive sun visor market is segmented into OEM and Aftermarket. Regionally, the automotive sun visor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The conventional type segment is projected to hold 45.60% of the market revenue share in 2025, making it the leading type category. This dominance is supported by the widespread use of standard visors across mass-produced vehicles due to their cost efficiency, ease of manufacturing, and proven functionality in reducing glare. Conventional visors are valued for their reliability and straightforward design, which align well with the needs of high-volume production lines. Automakers have maintained strong adoption of this type due to minimal maintenance requirements and compatibility with diverse vehicle interiors. While advanced and multi-functional visors are emerging, the conventional type continues to benefit from its established presence in both entry-level and mid-range vehicle segments. The ability to meet safety regulations without significant design complexity has further reinforced its position As cost-sensitive markets expand and production volumes grow, conventional visors are expected to retain a significant portion of global demand.

The vinyl material type segment is expected to account for 62% of the market revenue share in 2025, establishing itself as the leading material choice. The preference for vinyl is driven by its durability, ease of cleaning, and cost-effectiveness in large-scale manufacturing. Vinyl offers a smooth finish and design flexibility, allowing manufacturers to produce visors that meet both functional and aesthetic requirements. Its resistance to wear, UV damage, and temperature variations has made it particularly suitable for automotive applications across diverse climates. The material’s ability to be produced in multiple colors and textures has further increased its acceptance among automakers aiming to enhance interior appeal. Additionally, vinyl’s favorable price-to-performance ratio supports high adoption in both budget and premium vehicle categories As the industry continues to prioritize materials that balance performance, durability, and cost, vinyl is expected to maintain its strong market position.

The passenger vehicle segment is anticipated to hold 44.80% of the market revenue share in 2025, making it the largest end-use category. Growth in this segment has been driven by the continuous increase in passenger vehicle production globally, supported by rising consumer demand and urban mobility trends. Passenger vehicles require sun visors not only for safety and glare reduction but also as a comfort-enhancing interior feature. Automakers have been investing in visor designs that align with the styling and functional needs of modern passenger cars, further boosting adoption. The segment’s prominence is reinforced by strong demand in both developed and emerging markets, where increasing disposable incomes and expanding middle-class populations are influencing vehicle purchases. With advancements in manufacturing and integration of features such as mirrors or lighting, passenger vehicle sun visors have evolved to meet diverse consumer expectations This combination of functionality, comfort, and safety has cemented the segment’s leadership position in the market.

The automotive sun visor category is supported by rising expectations for glare control, UV protection, and premium cabin feel across cars and commercial vehicles. Cost pressure, variant complexity, hinge durability, and packaging conflicts with airbags and cameras remain the main hurdles. Opportunity is opening in sliding and dual blade formats, damped pivots, LED vanity modules, modular frames, and heavy duty commercial designs. Material upgrades, low odor cover stocks, and reinforced pivots are improving longevity, while virtual visor concepts and localized manufacturing shape next steps. Vendors delivering consistent quality, fast prototypes, and documentation depth are set to gain.

Adoption is being driven by stronger expectations for glare control, UV shielding, and overall cabin comfort across passenger cars and commercial vehicles. Sun visors are specified to cut low angle sunlight, protect instrumentation readability, and reduce driver fatigue on long commutes. Larger glass areas, panoramic windscreens, and expanded roof glazing have increased the need for extended coverage, sliding rails, and secondary blades. Vanity mirrors with concealed lighting, ticket clips, and integrated holders are being requested by interior teams targeting higher perceived quality. Fleet operators value large, durable panels that withstand frequent adjustments in delivery and long haul duty. Compliance requirements for interior emissions, flammability, and head impact are being met through disciplined material selection and controlled assemblies. As infotainment screens, digital clusters, and camera housings proliferate around the header, visors are being engineered to clear sensors while preserving full articulation, ensuring dependable shading without interfering with critical systems.

Procurement remains cost sensitive because visors are treated as high volume, low margin interior parts with strict take rate assumptions. Material swings in foams, fabrics, and engineering plastics compress budgets, while freight variability complicates landed costs for global platforms. Quality risks persist around hinge torque drift, sagging over life, squeaks and rattles against the headliner, and mirror door breakage, leading to warranty exposure and costly field service kits. Packaging conflicts with airbags, grab handles, overhead consoles, and driver monitoring cameras increase tooling complexity and validation time. Variant sprawl for left hand and right hand drive, multiple trims, and colorways inflates inventory and slows change management. Advanced glazing with strong top band tint can reduce incremental shading needs in some models, tempering upgrade acceptance. Documentation for flammability, odor, and abrasion must be refreshed per revision, adding administrative load. These realities keep qualification thorough and supplier selection conservative.

Clear opportunity is being seen in premium feature sets that lift perceived value while controlling assembly time. Sliding telescopic visors, dual blade architectures, and damped pivots deliver broader coverage with smoother motion. Low profile LED vanity modules, hidden magnet latches, and edge lit mirrors raise cabin ambiance without glare. Modular carrier frames with swappable skins allow fast color changes and trim harmonization across nameplates, reducing tooling duplication. Commercial vehicles benefit from extra wide panels, exterior eyebrow add ons, and easy service hinges that survive intensive cycles. Aftermarket extenders and polarized clip ons open secondary channels for specialty use cases. Low odor, stain resistant cover stocks and scratch resistant mirror housings support longer life in hot environments. Suppliers that pair kitting, clear installation guides, and localized service with rapid prototyping and texture matching are being favored by studios seeking consistent grain, stitch quality, and tight header tolerances.

Material roadmaps emphasize lighter cores, improved impact modifiers, and heat stable elastomers that hold torque and compression set through extreme seasons. Fabric and film options with higher UV blocking and better soil release are being selected to maintain appearance over extended use. Hidden fasteners, anti rotation features, and reinforced pivots improve assembly repeatability on high speed lines. Digital configuration tools that output 3D data, part codes, and work instructions are being adopted by interior engineering and purchasing teams. Virtual visor concepts using selectively darkened panels have entered pilots, aiming to attenuate glare while keeping forward visibility high. Integration with header cameras and rain sensors is being accommodated through notches, cutouts, and controlled sweep arcs. Regionalization of production near final assembly reduces lead time and supports late stage color changes. The direction clearly favors tactile quality, cleaner motion, and designs that coexist neatly with expanding header electronics.

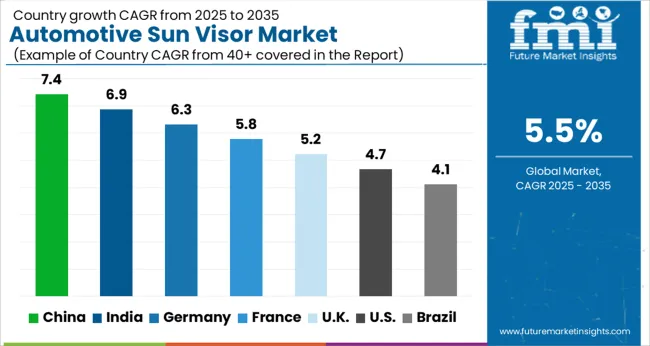

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The automotive sun visor market is projected to grow globally at a CAGR of 5.5% from 2025 to 2035. China leads with 7.4%, followed by India at 6.9% and Germany at 6.3%, while the UK grows at 5.2% and the USA posts 4.7%. China and India secure the strongest growth premiums of +1.9% and +1.4% above baseline, supported by rising car production, EV adoption, and expanding middle-class ownership. Germany sustains strong growth with premium automaker innovation, while the UK records steady aftermarket-driven demand. The USA, though slower, remains highly valuable with large-scale SUV, pickup, and luxury vehicle markets. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive sun visor market in China is forecast to expand at a CAGR of 7.4% between 2025 and 2035, making it the fastest-growing region. Rising vehicle production, particularly in passenger cars and electric vehicles, is fueling significant demand. Sun visors are being increasingly integrated with advanced features such as illuminated mirrors, touchscreen compatibility, and extendable panels. Domestic automakers are focusing on offering enhanced comfort and aesthetics to attract urban consumers. Global Tier-1 suppliers are also strengthening their footprint in China by collaborating with local manufacturers. The growing preference for premium vehicles and safety-focused accessories further supports adoption.

The automotive sun visor market in India is projected to grow at a CAGR of 6.9% from 2025 to 2035. Growth is supported by the country’s rising middle-class vehicle ownership and expansion in passenger car production. Sun visors are increasingly incorporated in mid-range and entry-level cars, often featuring mirrors, vanity lights, and anti-glare properties. Domestic suppliers dominate the market, while global companies are entering joint ventures to expand product offerings. Safety awareness and consumer preference for added cabin comfort are also driving adoption. Government initiatives to boost local manufacturing under “Make in India” policies are expected to reduce dependency on imports. T

The automotive sun visor market in Germany is expected to grow at a CAGR of 6.3% from 2025 to 2035. Strong premium automotive sector plays a major role, with brands like BMW, Mercedes, and Audi integrating high-quality visors with advanced features. Innovations such as sliding extensions, illuminated mirrors, and built-in infotainment integrations are gaining popularity. German automotive suppliers are leading in the development of lightweight materials and modular visor systems to improve comfort and fuel efficiency. Sun visors are also increasingly designed with eco-friendly materials in line with the country’s automotive innovation standards. With its strong export-oriented vehicle production, Germany remains a key European hub for high-quality sun visor adoption and development.

The automotive sun visor market in the United Kingdom is forecast to grow at a CAGR of 5.2% between 2025 and 2035. Growth is supported by the strong presence of passenger vehicle production and aftermarket sales. The UK automotive market emphasizes consumer comfort and safety, with rising adoption of sun visors equipped with mirrors, lights, and extension panels. Imports play a critical role, though local suppliers are active in producing specialized products for premium vehicles. With demand for hybrid and electric cars increasing, automakers are integrating smart and lightweight visors in line with evolving vehicle designs. Retail and aftermarket sales also add consistent demand, particularly in the replacement segment.

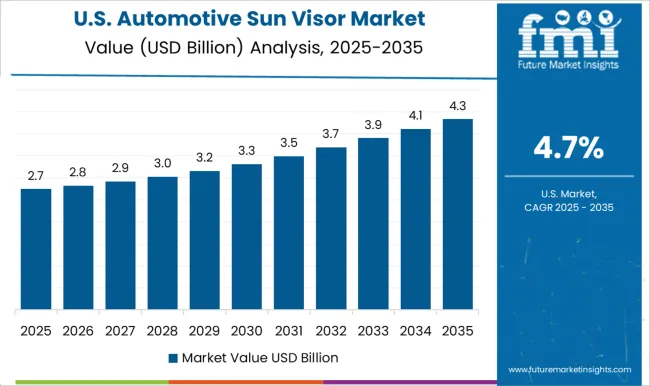

The automotive sun visor market in the United States is projected to grow at a CAGR of 4.7%, slower than Asia and Europe but significant in overall value. The USA demand is anchored by SUVs, pickup trucks, and luxury sedans, where sun visors are increasingly equipped with illuminated mirrors, sliding extensions, and premium finishes. Domestic suppliers focus on durable and safety-compliant visors, while imports provide cost-effective options for mid-range vehicles. The replacement market remains substantial, as consumers frequently upgrade visors for enhanced features and design. The rise of electric and autonomous vehicles is expected to bring integration of digital displays and smart visors into future models

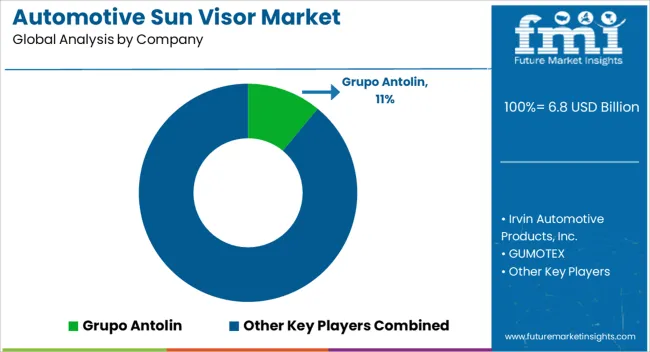

Competition in the automotive sun visor sector has been shaped by advances in material engineering, ergonomics, and integration with interior components such as lighting, mirrors, and safety systems. Grupo Antolin has positioned itself strongly by offering lightweight multifunctional sun visors that integrate mirrors, illumination, and sensor-ready modules tailored for passenger vehicles and premium segments. Irvin Automotive Products, Inc. has emphasized design versatility, producing visors with advanced pivot mechanisms, anti-glare coatings, and modular attachment systems compatible with multiple vehicle platforms. GUMOTEX has leveraged polymer technologies to deliver durable, lightweight visors suitable for both commercial and passenger vehicles, with a focus on corrosion resistance and long-term reliability. KASAI KOGYO CO., LTD. has concentrated on tactile and aesthetic quality, offering visors with premium fabric finishes, foam cores, and integrated lighting that elevate cabin experience.

Manufacturers such as Atlas / Atlas Holdings have maintained competitiveness through scalable production processes and robust supply chain integration, supporting high-volume automotive programs across North America and Europe. FOMPAK / Martur Fompak has focused on multifunctional visors for light commercial vehicles and passenger cars, integrating mirror assemblies with clip-on or retractable storage options. Hayashi Telempu Corporation has developed visors with embedded electronic modules, including illuminated mirrors and connectivity solutions for infotainment systems. Benecke-Kaliko AG has targeted luxury interiors with visors emphasizing advanced surface finishes, textile overlays, and soft-touch materials, catering to high-end vehicle requirements. Magna International Inc. has established a presence by delivering complete interior modules, integrating lighting, sensors, and enhanced safety features within sun visors to facilitate OEM adoption.

Market differentiation has been achieved through the combination of lighting and electronic integration, lightweight and premium materials, ergonomic pivot designs, and adherence to regulatory standards such as FMVSS 205 and ECE R21. The competitive landscape continues to be shaped by consumer demand for convenience, comfort, and safety, alongside the need for manufacturers to provide innovative, feature-rich solutions that align with evolving automotive interior trends.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.8 billion |

| Type | Conventional (Standard), Illuminated, Dual-panel, LCD/digital, and Custom/built-in |

| Material Type | Vinyl, Fabric, Plastic, and Others |

| Vehicle | Passenger Vehicle and Commercial Vehicles |

| Application | Sun glare protection, Driver and passenger comfort enhancement, Vanity mirror integration, Rear and side window applications, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Grupo Antolin, Irvin Automotive Products, Inc., GUMOTEX, KASAI KOGYO CO., LTD., FOMPAK / Martur Fompak, Hayashi Telempu Corporation, Magna International Inc. |

| Additional Attributes | Dollar sales by product type include standard visors, illuminated visors, and multifunctional visors with integrated electronics. Dollar sales by material type cover polymer, foam, fabric-coated, and leather-wrapped visors. Dollar sales by end use reflect passenger vehicles, commercial vehicles, and luxury vehicle segments. Demand dynamics are driven by rising consumer expectations for comfort and convenience, increasing adoption of illuminated and multifunctional visors, and regulatory safety requirements. Regional trends show Europe and North America as leading markets due to high automotive production and luxury vehicle penetration, while Asia Pacific is expanding rapidly with growing vehicle manufacturing and adoption of feature-rich interiors. |

The global automotive sun visor market is estimated to be valued at USD 6.8 billion in 2025.

The market size for the automotive sun visor market is projected to reach USD 11.5 billion by 2035.

The automotive sun visor market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in automotive sun visor market are conventional (standard), illuminated, dual-panel, lcd/digital and custom/built-in.

In terms of material type, vinyl segment to command 62.0% share in the automotive sun visor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA