The global ballet pointe shoes market is valued at USD 128.7 million in 2025 and is projected to reach USD 321.8 million by 2035, registering a CAGR of 9.6%. Growth early in the forecast period is supported by increasing participation in ballet across all age groups, growing demand from professional dancers, and the ongoing expansion of ballet schools and performance companies. Pointe shoes are critical for professional ballet performances, leading to steady demand for specialized footwear designed for precision, comfort, and durability. Innovations in materials and construction techniques further contribute to expanding market reach, while custom fittings and personalization options gain popularity.

As the market progresses toward 2035, demand remains strong due to continued interest in ballet, especially in the context of performance arts and physical fitness. The later years of the forecast period experience stable growth, with an increasing focus on ergonomic design, sustainability in materials, and advanced manufacturing technologies. These factors sustain the market’s upward trend despite more predictable sales cycles. Overall, the ballet pointe shoes market sees consistent growth, driven by both professional and recreational dancers, with periodic surges aligned with seasonal demand in performance and training periods.

Between 2025 and 2030, the Ballet Pointe Shoes Market rises from USD 128.7 million to USD 203.5 million, generating USD 74.8 million in additional value. The first major breakpoint emerges around 2027–2028, when annual growth shifts from USD 8.5–9.4 million to USD 13.6–14.8 million. This inflection reflects accelerated enrollment in formal dance programs, expansion of youth ballet training, and rising global commercialization of dancewear brands. Increased demand for reinforced pointe shoes, personalized fittings, and performance-grade materials strengthens this mid-cycle shift, marking the point where the market transitions from steady expansion to faster adoption.

From 2030 to 2035, the market climbs from USD 203.5 million to USD 321.8 million, adding USD 118.3 million and establishing the second major breakpoint. The next inflection occurs around 2032–2033, when yearly growth surpasses USD 19 million and continues rising toward USD 28.2 million by 2035. This faster trajectory is driven by intensified demand for custom-engineered pointe shoes, advanced shock-absorption designs, and premium product lines adopted by elite academies and professional companies. Growth is further supported by expanding e-commerce penetration and international dance-tour circuits. Across the decade, the two breakpoints illustrate a transition from foundational growth to high-velocity market adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 128.7 million |

| Market Forecast Value (2035) | USD 321.8 million |

| Forecast CAGR (2025–2035) | 9.6% |

Demand for ballet pointe shoes is rising as dance schools, conservatories, and professional companies expand enrollment and performance schedules. Pointe shoes require precise craftsmanship, combining a hardened toe box, shank, and pliable satin upper to support dancers during en pointe work. Students advancing through graded training programs replace shoes frequently as fit, stiffness, and wear patterns change with technique development. Manufacturers refine last shapes, box profiles, and shank materials to accommodate varying foot structures and strength levels, allowing dancers to select models offering the right balance of support and flexibility. Growth in global ballet education—particularly in North America, Europe, and East Asia—continues to increase baseline demand for reliable, well-fitted pointe shoes across training pipelines.

Market expansion is also supported by performance-driven expectations within professional companies, where dancers rely on customized or semi-custom models to maintain consistency across rehearsals and touring schedules. Producers enhance durability through improved paste formulations, layered shank composites, and reinforced satin, helping shoes withstand repeated stress without compromising articulation. Retailers invest in specialized fitting services and foot-assessment tools to reduce injury risk and improve long-term comfort. Online distribution broadens access for independent dancers and regional studios unable to source multiple brands locally. Although high purchase frequency and fit variability present challenges for families and institutions, continued investment in materials research and precision manufacturing ensures stable adoption of pointe shoes across the global ballet community.

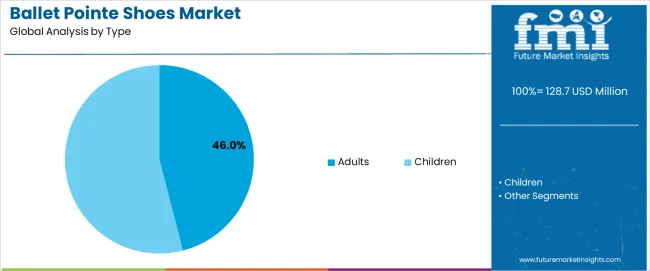

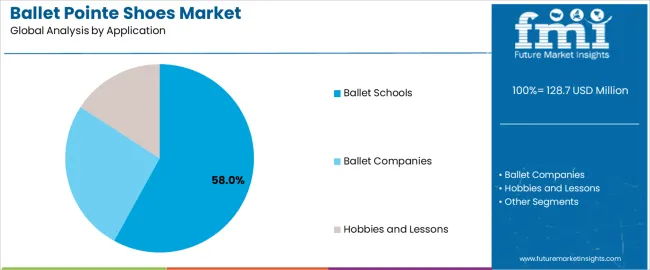

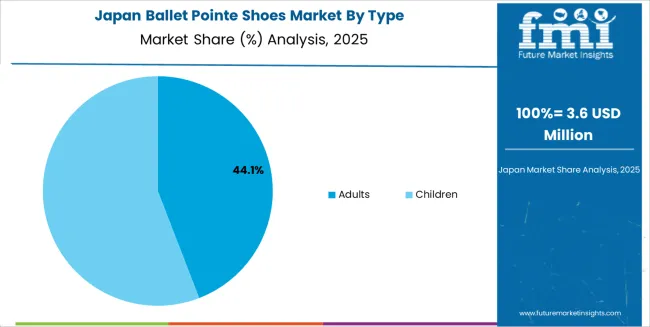

The ballet pointe shoes market is segmented by type, application, and region. By type, the market is divided into adults and children’s pointe shoes. Based on application, it is categorized into ballet schools, ballet companies, hobbies and lessons, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These divisions reflect differences in user age, skill level, and the specific needs of various ballet-related activities.

The adults segment accounts for approximately 46.0% of the global ballet pointe shoes market in 2025, making it the leading type category. This position is driven by the widespread demand for pointe shoes among professional and semi-professional dancers, as well as adult learners who pursue ballet as a hobby or for fitness. Adult ballet dancers require pointe shoes that offer a balance of durability, comfort, and performance, which contributes to sustained demand for specialized footwear tailored to their needs.

Manufacturers design pointe shoes for adults with reinforced shanks, varied width and length options, and customizable fit, addressing the anatomical differences that adults have compared to children. Adoption is strong in North America and Europe, where professional ballet companies and adult ballet schools continue to generate high demand for pointe shoes. The segment maintains its lead because adults, whether in training or performing, represent a large portion of the market, with long-term wear and performance expectations driving continuous need for quality pointe shoes.

The ballet schools segment represents about 58.0% of the total ballet pointe shoes market in 2025, making it the dominant application category. This position is linked to the significant role that ballet schools play in training the next generation of dancers, from beginners to advanced students. Ballet schools provide structured training programs that often require pointe shoe use at advanced stages of training, creating a steady demand for both children’s and adult-size pointe shoes tailored to varying levels of experience and foot development.

Ballet schools typically purchase pointe shoes in bulk for their students, ensuring consistent availability and fit. Adoption is especially strong in Europe, North America, and East Asia, where ballet schools are established institutions for training both recreational and professional dancers. The segment maintains its leading share because schools provide ongoing opportunities for pointe shoe sales through long-term student engagement, with regular replacements due to growth and wear. Ballet schools are central to the market, as they directly influence both the entry-level demand for shoes and the professional-grade needs for advanced students.

The ballet pointe shoes market is steady as classical ballet continues to command dedicated participation and performance venues worldwide. Pointe shoes support dancers during en pointe movement, and brands deliver specialised construct, shank strength and fit for various foot shapes and skill levels. Growth is driven by expanding dance schools in emerging regions, professional company investment and the popularity of dance as fitness activity. Adoption is limited by high manufacturing cost of custom fit shoes, frequent replacement cycles and the need for skilled fitting. Manufacturers are responding with advanced materials, improved constructions and sizing variants to address performance and comfort needs.

Demand rises as ballet gains traction beyond traditional Western hubs, with dance academies, fitness wellness programmes and recreational classes appearing in Asia Pacific, Latin America and the Middle East. As these participants progress to en pointe training, the need for high quality pointe shoes increases. Professional companies and touring groups continue to require specialised models with precise fit and durability. The ripple effect from performance exposure and dance media coverage encourages footwear adoption across age groups and skill levels, reinforcing market size and geographic spread.

Growth is constrained by the fact that pointe shoes require frequent replacement—sometimes every few performances for professionals—making cost a recurring burden. Custom fitting remains essential, especially in advanced levels, which limits mass market scale. Some markets lack access to specialist retailers or trained fitters, inhibiting adoption of premium models. Additionally, variability in material costs, small batch production and niche demand restrict price reductions. These issues particularly affect recreational dancers or emerging market purchasers who may opt for more affordable, less specialised footwear.

Key trends include use of lightweight composite materials, improved shank flexibility and modular fit systems that allow adjustable support across skill levels. Brands are experimenting with thermo mouldable components and semi custom designs that reduce fitting time. Some manufacturers are offering direct to consumer online fitting tools and localised distribution to reach new markets. Sustainability is increasingly a focus, with use of natural fibres and recyclable packaging. As ballet training evolves in emerging regions, supply chains are adapting to support smaller production runs and regional sizing variations.

| Country | CAGR (%) |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| Brazil | 10.1% |

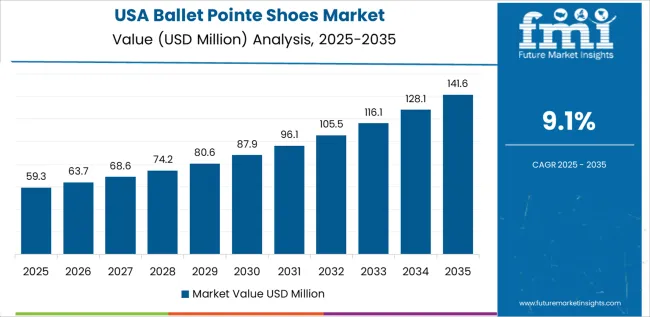

| USA | 9.1% |

| UK | 8.2% |

| Japan | 7.2% |

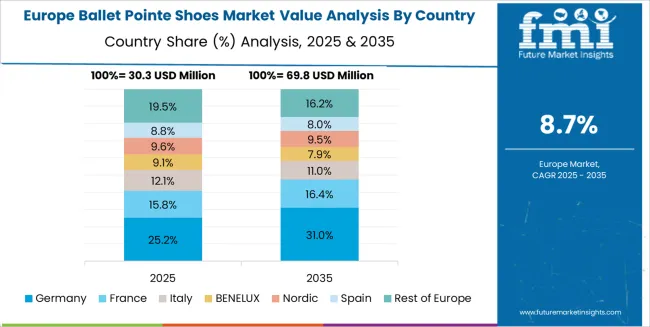

The Ballet Pointe Shoes Market is experiencing significant growth worldwide, with China leading at a 13.0% CAGR through 2035, driven by the growing popularity of ballet as a form of entertainment and fitness, along with increased participation in professional and recreational ballet. India follows at 12.0%, supported by rising interest in performing arts, expanding dance academies, and a growing middle-class demographic with increased disposable income. Germany records 11.0%, benefiting from a long-standing ballet tradition, demand for high-quality performance footwear, and strong support for the arts. Brazil grows at 10.1%, reflecting increasing demand from dancers and a rising number of ballet schools. The USA, at 9.1%, remains a mature market with a focus on innovation in shoe technology and materials, while the UK (8.2%) and Japan (7.2%) emphasize quality, comfort, and durability, along with cultural appreciation for ballet as both a traditional and modern art form.

China is projected to grow at a CAGR of 13% through 2035 in the ballet pointe shoes market. Expanding ballet schools, professional performances, and increasing interest in classical dance fuel demand for high-quality pointe shoes. Manufacturers focus on lightweight, durable materials for optimal support and comfort during performance. Retailers provide tailored fitting services and offer diverse styles designed for different foot shapes and sizes. The market also benefits from collaborations with renowned ballet companies to produce limited-edition releases. This growth is driven by a rising appreciation for ballet as an art form, along with increasing international exposure.

India is projected to grow at a CAGR of 12% through 2035 in the ballet pointe shoes market. Increased interest in ballet and classical dance, particularly among young students, drives demand for specialized footwear. Local manufacturers focus on crafting pointe shoes with sturdy yet flexible soles to prevent injury while allowing artistic expression. Retailers offer custom fitting services to ensure comfort and reduce strain during performances. Cultural integration of ballet with traditional Indian dance styles further accelerates adoption. This expanding market reflects the growing presence of dance academies and ballet performances across major cities.

Germany is projected to grow at a CAGR of 11% through 2035 in the ballet pointe shoes market. Established ballet institutions, professional dance companies, and high-level training programs increase the need for specialized pointe shoes. Manufacturers provide shoes made with premium materials, focusing on durability, flexibility, and comfort for prolonged usage. Professional dancers rely on pointe shoes that offer support during demanding choreography. Local retailers offer personalised fitting services and stock a wide range of designs to meet diverse professional and personal preferences. Market growth reflects the prominence of Germany’s classical dance scene and ballet heritage.

Brazil is projected to grow at a CAGR of 10.1% through 2035 in the ballet pointe shoes market. Increasing interest in ballet and contemporary dance in major urban centres drives the adoption of high-quality pointe shoes. Local manufacturers focus on crafting shoes with breathable fabrics and adjustable ribbons to improve comfort. Retailers cater to growing demand by offering a variety of styles designed for novice to professional dancers. The rise of regional dance competitions and performances in Brazil’s thriving cultural scene further boosts the popularity of pointe shoes. Market growth is fueled by increasing ballet education and training.

USA is projected to grow at a CAGR of 9.1% through 2035 in the ballet pointe shoes market. Ballet academies, professional dance companies, and theatrical productions continue to drive the demand for pointe shoes in the country. Manufacturers focus on using high-performance materials that balance strength and flexibility to support rigorous dance routines. Retailers offer a variety of shoe options with different stiffness levels, tailored to dancers’ preferences. Partnerships with leading dance academies allow brands to showcase their footwear at prominent events. The growing focus on dance health and safety ensures an emphasis on comfort and injury prevention.

UK is projected to grow at a CAGR of 8.2% through 2035 in the ballet pointe shoes market. Increasing interest in ballet, particularly among young dancers, strengthens demand for high-quality, durable pointe shoes. Local manufacturers focus on shoes designed for long-lasting performance, with a balance of flexibility and support. Retailers offer shoes in multiple widths, styles, and sizes to accommodate a broad range of dancers. Cultural support for classical arts and the prominence of ballet in national performances contribute to growing adoption, as the UK continues to be a hub for global dance talent and training.

Japan is projected to grow at a CAGR of 7.2% through 2035 in the ballet pointe shoes market. The growing popularity of ballet, especially among youth and professional dancers, increases the demand for high-quality, supportive pointe shoes. Manufacturers focus on creating shoes that provide a secure fit and ensure maximum comfort for extended training sessions. Retailers offer personalized fitting services to ensure optimal performance and comfort. Japan’s prominence in the global dance community and the rise of international ballet competitions further fuel the market’s growth, aligning with the growing interest in dance education.

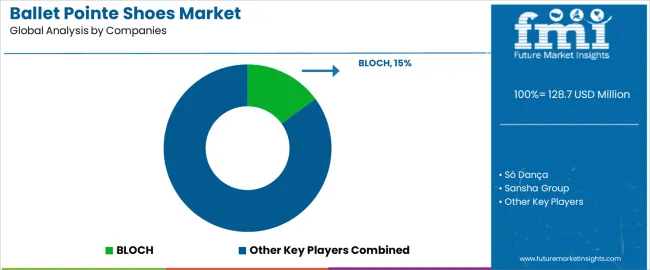

The global ballet pointe shoes market is moderately concentrated, shaped by a small group of established dancewear brands offering specialized footwear for professional and recreational dancers. BLOCH, Só Dança, and Sansha Group maintain dominant positions through a wide range of pointe shoes designed for various skill levels, offering performance and comfort through advanced materials and fit options. Onward Holding and Capezio Ballet Makers strengthen the upper-tier segment with products that combine tradition with innovation, incorporating flexible materials and customized fitting to enhance dancer performance and prevent injury. Wear Moi, Suffolk Dance, and Gaynor Minden provide options that emphasize durability, support, and innovative design for ballet dancers seeking high-quality, long-lasting pointe shoes.

Repetto, Grishko (Nikolay), and other regional brands contribute to the diversity of the market with specialized shoes designed for particular foot shapes, dance styles, or preferences. Repetto, known for its French heritage, offers a blend of traditional craftsmanship with contemporary design, while Grishko focuses on customizable features for professional dancers. Competition across this segment is influenced by factors such as fit, comfort, durability, and flexibility, while strategic differentiation depends on customizability, material innovation, and the ability to meet the exacting needs of ballet professionals. As demand for precision and comfort in pointe shoes grows, brands that can innovate in fitting technology and offer personalized solutions are positioned to maintain long-term competitiveness in the market.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Type | Adults, Children |

| Application | Ballet Schools, Ballet Companies, Hobbies and Lessons, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ additional countries |

| Key Companies Profiled | BLOCH, Só Dança, Sansha Group, Onward Holding, Capezio Ballet Makers, Wear Moi, Suffolk Dance, Gaynor Minden, Repetto, Grishko (Nikolay) |

| Additional Attributes | Dollar sales by type and application, regional adoption trends and CAGR by country, distribution split (retail vs e-commerce vs speciality fitters), sizing and custom-fit service penetration, seasonal demand cycles (performance vs training), product innovation (materials, shank tech), price tiers, replacement frequency, supply-chain and small-batch production effects. |

The global ballet pointe shoes market is estimated to be valued at USD 128.7 million in 2025.

The market size for the ballet pointe shoes market is projected to reach USD 321.9 million by 2035.

The ballet pointe shoes market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in ballet pointe shoes market are adults and children.

In terms of application, ballet schools segment to command 58.0% share in the ballet pointe shoes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Golf Shoes Market Size and Share Forecast Outlook 2025 to 2035

Baby Shoes Market Size and Share Forecast Outlook 2025 to 2035

Work Shoes Market Trends - Demand & Forecast 2025 to 2035

Water Shoes Market Trends – Demand & Forecast 2025 to 2035

Smart Shoes Market - Trends, Growth & Forecast 2025 to 2035

Trail Shoes Market

Tennis Shoes Market Insights - Demand & Growth 2025 to 2035

Casual Shoes Market Size and Share Forecast Outlook 2025 to 2035

Custom Shoes Market Report – Growth & Industry Trends 2024-2034

Skating Shoes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Running Shoes Market Growth - Trends & Demand Forecast 2025 to 2035

Slip-on Shoes Market Trends - Demand & Forecast 2025 to 2035

Diabetic Shoes Market Growth - Trends & Forecast 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Platform Shoes Market Trends - Demand & Forecast 2025 to 2035

Light Up Shoes Market Analysis – Growth & Forecast 2025 to 2035

Barefoot Shoes Market Growth – Size, Demand & Forecast 2024-2034

Volleyball Shoes Market Analysis - Growth & Forecast 2025 to 2035

Orthopedic Shoes Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA