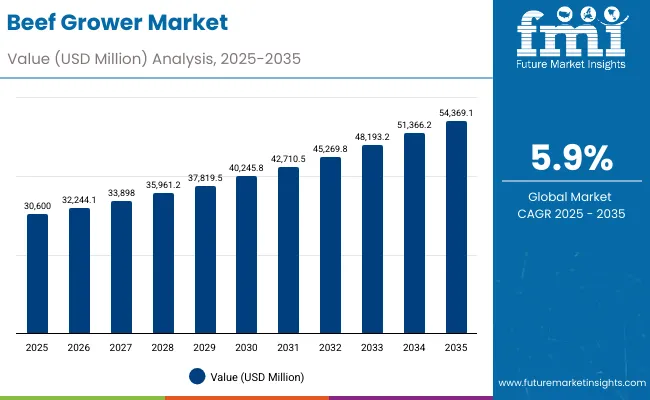

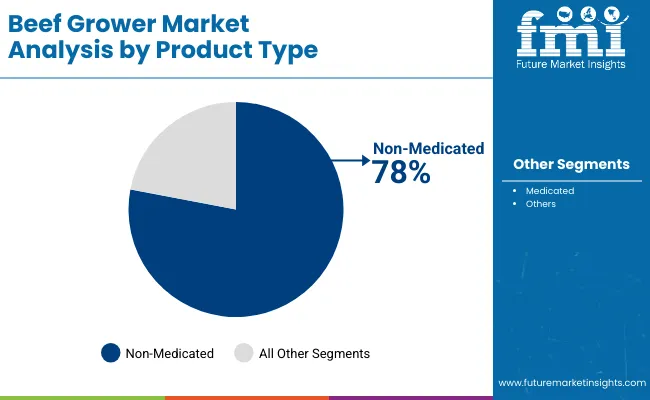

The beef grower market is valued at USD 30,600.0 million in 2025 and is projected to reach USD 54,369.1 million by 2035, advancing at a CAGR of 5.9%. Growth is driven by escalating protein demand, regulatory pressures for efficient livestock production, and the cattle industry's transformation toward precision feeding methodologies. Beef grower formulations offer optimized growth outcomes, efficient feed conversion, and enhanced cattle performance, making them essential for commercial cattle operations, precision livestock management, and institutional farming systems. Non-medicated formulations account for the largest share at 78% due to optimal performance-cost balance and widespread acceptance in standard cattle operations, while medicated variants support specialized health applications in complex livestock environments.

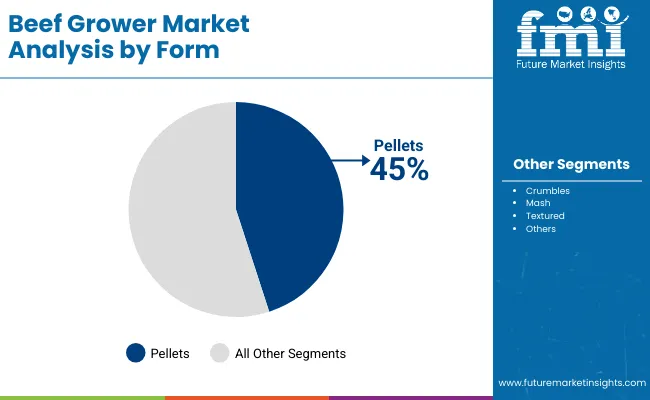

Pellets represent the dominant form at 45% of demand, followed by specialized feeding programs as producers expand nutritional optimization offerings. North America, particularly the USA, leads growth due to livestock infrastructure expansion and agricultural modernization, while Asia Pacific shows rapid expansion supported by cattle farming development in China and India. Competition in the beef grower market remains moderately consolidated, with key companies such as Cargill Inc., Archer Daniels Midland, and Land O'Lakes Inc. focusing on advanced nutrition technologies, performance optimization systems, and technical support capabilities to strengthen market positioning.

Beef Grower Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 30,600.0 million |

| Forecast Value in (2035F) | USD 54,369.1 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

Technological advancement in feed formulation technology, nutrition science, and production monitoring platforms has dramatically enhanced the capabilities and accessibility of beef grower systems. Modern formulations leverage advanced ingredient combinations, nutritional research, and performance analytics to provide optimized growth outcomes and efficient feed conversion, enabling immediate response to changing nutritional requirements and proactive herd management. The integration of veterinary guidance, performance monitoring, nutritional calculations, and feeding protocols enables these systems to optimize growth patterns based on actual cattle development needs rather than predetermined feeding schedules, resulting in significant performance improvements and enhanced beef quality outcomes.

The agricultural sector's increasing adoption of precision livestock management has created substantial demand for integrated nutrition management solutions that complement existing farm management systems. Beef grower formulations now interface seamlessly with livestock management software, enabling comprehensive data collection and analysis that supports broader agricultural decision-making processes. This integration capability has proven particularly valuable for large-scale commercial cattle operations where coordinated management of multiple cattle groups and feed types requires sophisticated nutrition and monitoring capabilities.

Economic considerations increasingly favor beef grower adoption as feed costs continue rising and labor shortages affect agricultural operations. Specialized nutrition systems reduce feed waste while improving cattle performance, creating compelling return-on-investment scenarios for beef producers. The ability to prevent nutritional deficiencies, optimize growth rates, and improve feed conversion efficiency based on cattle requirements generates measurable cost savings that often justify initial feed investments within relatively short payback periods.

Between 2025 and 2030, the beef grower market is projected to expand from USD 30,600.0 million to USD 40,245.8 million, resulting in a value increase of USD 9,645.8 million, which represents 40.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for efficient cattle nutrition systems, increasing applications in precision livestock management and cattle performance optimization, and growing penetration in emerging agricultural markets. Feed manufacturers are expanding their production capabilities to address the growing demand for customized beef grower formulations in various cattle segments and livestock management programs.

From 2030 to 2035, the market is forecast to grow from USD 40,245.8 million to USD 54,369.1 million, adding another USD 14,123.3 million, which constitutes 59.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced cattle nutrition infrastructure, the integration of cutting-edge feed technologies, and the development of customized beef grower systems for specific cattle applications. The growing adoption of precision livestock management and agricultural automation will drive demand for ultra-high efficiency beef grower formulations with enhanced nutritional specifications and consistent performance characteristics.

Between 2020 and 2025, the beef grower market experienced steady expansion, driven by increasing recognition of specialized cattle nutrition importance in livestock management operations and growing acceptance of performance-oriented feeding systems in complex agricultural markets. The market developed as farmers recognized the need for high-efficiency nutrition systems to address cattle requirements and improve overall operational productivity. Research and development activities have begun to emphasize the importance of advanced feed technologies in achieving better efficiency and performance in cattle production processes.

Market expansion is being supported by the increasing demand for efficient cattle nutrition infrastructure and the corresponding need for high-performance feed systems in livestock applications across global farming and cattle management operations. Modern cattle operators are increasingly focused on advanced nutrition technologies that can improve operational efficiency, reduce feed costs, and enhance cattle performance while meeting stringent quality requirements. The proven efficacy of beef grower formulations in various cattle applications makes them an essential component of comprehensive livestock management strategies and farm modernization programs.

The growing emphasis on precision livestock management and advanced cattle performance optimization is driving demand for ultra-efficient nutrition systems that meet stringent performance specifications and operational requirements for specialized applications. Agricultural operators' preference for reliable, high-performance feed systems that can ensure consistent cattle development is creating opportunities for innovative nutrition technologies and customized livestock solutions. The rising influence of cattle management protocols and agricultural efficiency standards is also contributing to increased adoption of premium-grade beef grower formulations across different cattle applications and feeding systems requiring advanced nutrition technology.

The beef grower market represents a specialized growth opportunity, expanding from USD 30,600.0 million in 2025 to USD 54,369.1 million by 2035 at a 5.9% CAGR. As farmers prioritize operational efficiency, cattle performance, and feed conversion in complex livestock processes, beef grower formulations have evolved from a basic agricultural input to an essential component enabling cattle management, performance optimization, and multi-stage livestock production across farming operations and specialized cattle applications.

The convergence of agricultural expansion, increasing automation adoption, specialized livestock infrastructure growth, and quality requirements creates momentum in demand. High-efficiency formulations offering superior nutritional performance, cost-effective non-medicated systems balancing performance with economics, and specialized medicated variants for health applications will capture market premiums, while geographic expansion into high-growth Asian agricultural markets and emerging market penetration will drive volume leadership. Agricultural emphasis on efficiency and performance provides structural support.

The market is segmented by product type, form, animal age group, ingredient type, sales channel, and region. By product type, the markets is divided into medicated and non-medicated feed formulations designed to enhance cattle health and growth performance. Based on form, the market is segmented into pellets, crumbles, mash, and textured variants, each suited for specific feeding systems and digestibility preferences. By animal age group, the market is categorized into calves (weaning stage), growers (post-weaning to finishing), and finishers, reflecting nutritional adjustments across growth cycles.

In terms of ingredient type, the market is segmented into grains such as corn, barley, and sorghum; oilseed meals including soybean and canola meal; additives such as vitamins, minerals, probiotics, and enzymes; and forage-based blends aimed at balanced nutrient intake. Based on sales channel, the market is divided into direct sales, feed stores and co-ops, online retail platforms, and distributors catering to regional and local supply networks. Regionally, the market spans North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The non-medicated segment is projected to account for 78.0% of the beef grower market in 2025, reaffirming its position as the category's dominant type. Agricultural operators increasingly recognize the optimal balance of performance and cost-effectiveness offered by non-medicated beef grower formulations for most livestock applications, particularly in cattle management and agricultural processes. This type addresses both performance requirements and long-term operational considerations while providing reliable nutrition across diverse cattle applications.

This type forms the foundation of most agricultural protocols for livestock applications, as it represents the most widely accepted and commercially viable level of cattle nutrition technology in the industry. Feed standards and extensive operational testing continue to strengthen confidence in non-medicated beef grower formulations among farming and agricultural providers. With increasing recognition of the performance-cost optimization requirements in cattle management, non-medicated systems align with both operational efficiency and nutrition goals, making them the central growth driver of comprehensive agricultural infrastructure strategies.

Pellets is projected to represent 45.0% of beef grower demand in 2025, underscoring its role as the primary form segment driving market adoption and growth. Farmers recognize that cattle feeding requirements, including complex livestock operations, specialized nutrition needs, and multi-stage cattle systems, often require advanced pellet formulations that standard feed technologies cannot adequately provide. Pellets offer enhanced handling efficiency and operational compliance in cattle feeding applications.

The segment is supported by the growing complexity of livestock operations, requiring sophisticated feed systems, and the increasing recognition that advanced nutrition technologies can improve cattle performance and operational outcomes. Additionally, farmers are increasingly adopting evidence-based feeding guidelines that recommend specific pellet formulations for optimal cattle efficiency. As understanding of livestock complexity advances and cattle requirements become more stringent, pellets will continue to play a crucial role in comprehensive nutrition strategies within the agricultural market.

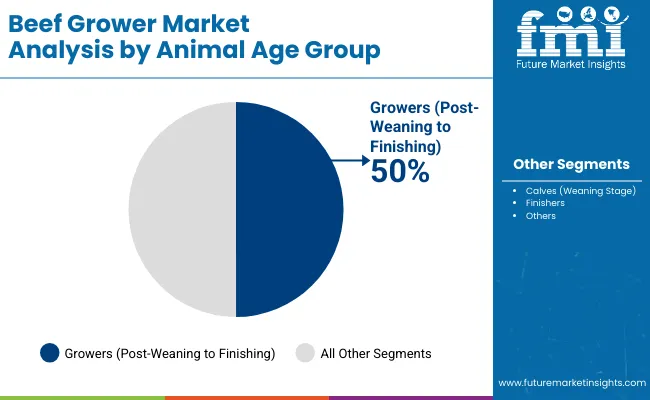

Growers are projected to represent 50.0% of beef grower demand in 2025, demonstrating their critical role as the primary age group segment driving market expansion and adoption. Agricultural operators recognize that grower cattle requirements, including complex development processes, specialized nutrition needs, and multi-level feeding systems, often require advanced beef grower formulations that standard nutrition technologies cannot adequately provide. Grower-focused beef grower formulations offer enhanced cattle performance and operational compliance in livestock applications.

The growers segment spans the critical post-weaning to finishing phase where cattle achieve maximum growth potential and feed conversion efficiency. This development stage requires carefully balanced nutrition protocols that support rapid muscle development, skeletal growth, and optimal weight gain while maintaining health standards. Farmers recognize that nutrition decisions during this phase directly impact final cattle quality, market weight achievement, and overall production economics. The growers segment benefits from increased feeding duration compared to other age groups, creating higher per-animal feed consumption volumes and sustained revenue opportunities for feed manufacturers.

The beef grower market is advancing steadily due to increasing recognition of specialized cattle nutrition importance and growing demand for high-efficiency feed systems across the agricultural and livestock management sectors. However, the market faces challenges, including complex feed formulation processes, potential for nutritional variations during storage and handling, and concerns about supply chain consistency for specialized livestock feed. Innovation in nutrition technologies and customized agricultural protocols continues to influence product development and market expansion patterns.

Expansion of Advanced Agricultural Facilities and Feed Technologies

The growing adoption of advanced agricultural facilities is enabling the development of more sophisticated beef grower production and performance control systems that can meet stringent operational requirements. Specialized agricultural facilities offer comprehensive livestock services, including advanced nutrition and monitoring processes that are particularly important for achieving high-efficiency requirements in cattle applications. Advanced agricultural infrastructure provides access to premium services that can optimize cattle performance and reduce feed costs while maintaining cost-effectiveness for large-scale livestock operations.

Integration of Precision Livestock Systems and Cattle Management Systems

Modern agricultural organizations are incorporating digital technologies such as real-time performance monitoring, automated feeding systems, and farm integration to enhance beef grower deployment and distribution processes. These technologies improve cattle performance, enable continuous operational monitoring, and provide better coordination between farmers and agricultural operators throughout the feeding cycle. Advanced digital platforms also enable customized performance specifications and early identification of potential nutritional deviations or supply disruptions, supporting reliable agricultural production.

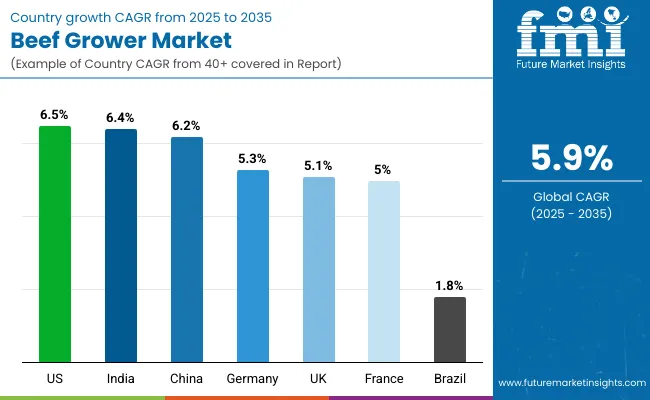

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.4% |

| China | 6.2% |

| USA | 6.5% |

| UK | 5.1% |

| Germany | 5.3% |

| France | 5.0% |

| Brazil | 1.8% |

The beef grower market is experiencing varied growth globally, with USA leading at a 6.5% CAGR through 2035, driven by the expansion of livestock infrastructure development, increasing cattle production capabilities, and growing domestic demand for high-efficiency cattle nutrition systems. India follows at 6.4%, supported by agricultural expansion, growing recognition of advanced livestock technology importance, and expanding cattle capacity.

China records 6.2% growth, with a focus on developing the agricultural infrastructure and precision livestock industries. Germany shows 5.3% growth, representing a mature market with expanding agricultural frameworks. UK demonstrates 5.1% growth with focus on advanced livestock adoption. France demonstrates 5.0% growth, emphasizing agricultural infrastructure expansion and systematic livestock approaches. Brazil demonstrates 1.8% growth, emphasizing cattle infrastructure expansion and systematic agricultural approaches.

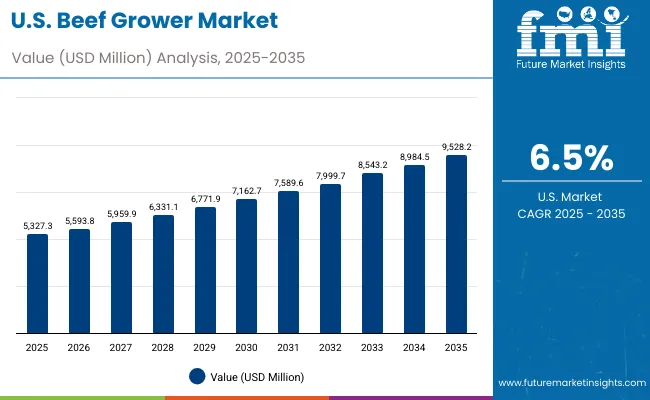

Revenue from beef grower in USA is projected to exhibit robust growth with a CAGR of 6.5% through 2035, driven by ongoing agricultural expansion and increasing recognition of high-efficiency cattle nutrition systems as essential livestock management components for complex farming processes. The country's expanding livestock infrastructure and growing availability of specialized nutrition capabilities are creating significant opportunities for beef grower adoption across both domestic and export-oriented agricultural facilities. Major international and domestic feed companies are establishing comprehensive nutrition and distribution networks to serve the growing population of farmers and agricultural facilities requiring high-performance cattle systems.

The American government's strategic emphasis on agricultural infrastructure modernization and livestock advancement is driving substantial investments in specialized nutrition capabilities. This policy support, combined with the country's large domestic agricultural market and expanding cattle requirements, creates a favorable environment for the beef grower market development. Government initiatives supporting agricultural development are driving demand for high-efficiency cattle systems throughout major agricultural centers, including Texas, Kansas, and Nebraska regions.

Revenue from beef grower in India is expanding at a CAGR of 6.4%, supported by increasing agricultural accessibility, growing livestock infrastructure awareness, and developing technology market presence across the country's major farming clusters. The country's large agricultural sector and increasing recognition of advanced cattle nutrition systems are driving demand for effective high-efficiency nutrition solutions in both livestock production and agricultural applications. International agricultural companies and domestic providers are establishing comprehensive distribution channels to serve the growing demand for quality cattle systems.

India's agricultural sector continues to benefit from favorable livestock policies, expanding agricultural capabilities, and cost-competitive cattle infrastructure development. The country's focus on becoming a global agricultural technology hub is driving investments in specialized livestock technology and cattle management infrastructure. Rising awareness about advanced nutrition options and improving agricultural capabilities are creating opportunities for specialized cattle systems across farming and agricultural settings in major hubs like Punjab, Haryana, and Uttar Pradesh.

China's advanced livestock technology market demonstrates sophisticated agricultural infrastructure deployment with documented beef grower effectiveness in farming departments and agricultural centers through integration with existing cattle systems and nutrition infrastructure. The country leverages agricultural expertise in livestock technology and cattle management systems integration to maintain a 6.2% CAGR through 2035. Agricultural centers, including major farming areas, showcase premium installations where beef grower formulations integrate with comprehensive cattle information systems and nutrition platforms.

Chinese farmers prioritize system reliability and cattle compliance in infrastructure development, creating demand for premium systems with advanced features, including performance validation and integration with Chinese agricultural standards. The market benefits from established livestock industry infrastructure and a willingness to invest in advanced cattle technologies that provide long-term operational benefits and compliance with nutrition regulations. Major farming regions demonstrate increasing adoption of specialized nutrition systems supporting both domestic consumption and export requirements.

UK's market expansion benefits from diverse agricultural demand, including livestock infrastructure modernization in major farming regions, nutrition development programs, and government agricultural programs that increasingly incorporate beef grower solutions for infrastructure enhancement applications. The country maintains a 5.1% CAGR through 2035, driven by rising agricultural awareness and increasing adoption of nutrition benefits, including superior cattle capabilities and reduced complexity. Market dynamics focus on cost-effective livestock solutions that balance advanced nutrition features with affordability considerations important to British agricultural operators.

Growing agricultural infrastructure creates demand for modern cattle systems in new farming facilities and agricultural equipment modernization projects. Regional livestock requirements are driving a diverse product portfolio from basic cattle systems to advanced nutrition platforms. Import dependency challenges are offset by potential local development partnerships with international nutrition manufacturers. Government agricultural initiatives are beginning to influence procurement standards and livestock infrastructure requirements across England, Scotland, Wales, and Northern Ireland farming regions.

Brazil demonstrates modest market development with a 1.8% CAGR through 2035, reflecting mature agricultural markets and established livestock infrastructure. The country's extensive cattle industry and established beef production systems create steady demand for cattle nutrition solutions, though growth rates remain moderate compared to emerging markets. Brazilian agricultural operators focus on cost-effective nutrition systems that provide reliable performance while maintaining competitive production costs in global beef markets.

The market is characterized by large-scale cattle operations requiring consistent feed quality and supply chain reliability. Feed manufacturers serving Brazilian markets emphasize bulk delivery capabilities, regional production facilities, and pricing stability to support extensive ranching operations. Government agricultural policies supporting livestock export competitiveness and production efficiency create opportunities for nutrition technologies that improve feed conversion rates. Major cattle-producing states like Mato Grosso, Goiás, and Minas Gerais drive demand for efficient feeding systems that support both domestic consumption and international export requirements.

Germany demonstrates steady market development with a 5.3% CAGR through 2035, distinguished by agricultural operators' preference for high-quality cattle systems that integrate seamlessly with existing farming equipment and provide reliable long-term operation in specialized livestock applications. The market prioritizes advanced features, including precision nutrition algorithms, performance validation, and integration with comprehensive cattle platforms that reflect German agricultural expectations for technological advancement and operational excellence.

Premium focus on precision systems with advanced nutrition algorithms and high-reliability capabilities for agricultural applications requiring exceptional performance standards drives market development. Integration requirements with existing agricultural information systems and cattle management platforms support comprehensive farm automation. The market emphasizes beef grower reliability and long-term performance in livestock applications with strict operational requirements. Strong preference for locally manufactured systems that comply with German engineering standards and agricultural regulations shapes competitive dynamics throughout Bavaria, Lower Saxony, and other major agricultural regions.

France demonstrates steady market development with a 5.0% CAGR through 2035, distinguished by livestock operators' preference for high-quality cattle systems that integrate seamlessly with existing agricultural equipment and provide reliable long-term operation in specialized farming applications. The market prioritizes advanced features, including precision nutrition algorithms, performance validation, and integration with comprehensive cattle platforms that reflect French agricultural expectations for technological advancement and operational excellence.

The French market benefits from established agricultural cooperatives and integrated supply chain systems that support efficient feed distribution and farmer education programs. Regional variations across major cattle-producing areas like Brittany, Normandy, and Burgundy create diverse market requirements ranging from intensive dairy operations to extensive beef production systems. Government agricultural policies supporting farm modernization and environmental compliance drive adoption of nutrition technologies that improve feed efficiency and reduce environmental impact. Emphasis on artisanal and premium beef production creates opportunities for specialized nutrition formulations supporting quality differentiation in domestic and export markets.

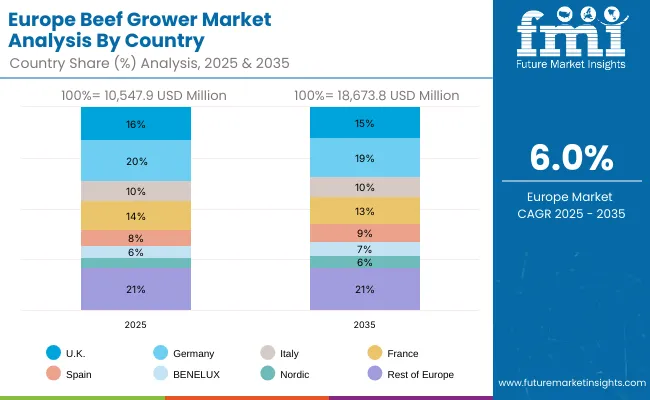

The beef grower market in Europe is projected to grow significantly, with individual country performance varying across the region. Germany is expected to maintain its leadership position with a market value of USD 2,094.3 million in 2025, supported by its advanced agricultural infrastructure, precision cattle management capabilities, and strong livestock presence throughout major agricultural regions.

UK follows with USD 1,673.3 million in 2025, driven by advanced nutrition protocols, livestock innovation integration, and expanding agricultural networks serving both domestic and international markets. France holds USD 1,464.1 million in 2025, supported by agricultural infrastructure expansion and growing adoption of high-efficiency cattle systems. Italy commands USD 1,045.8 million in 2025, while Spain accounts for USD 836.6 million in 2025. The Rest of Europe region, including Nordic countries, Eastern Europe, and smaller Western European markets, holds USD 2,199.1 million in 2025, representing diverse market opportunities with established agricultural and livestock infrastructure capabilities.

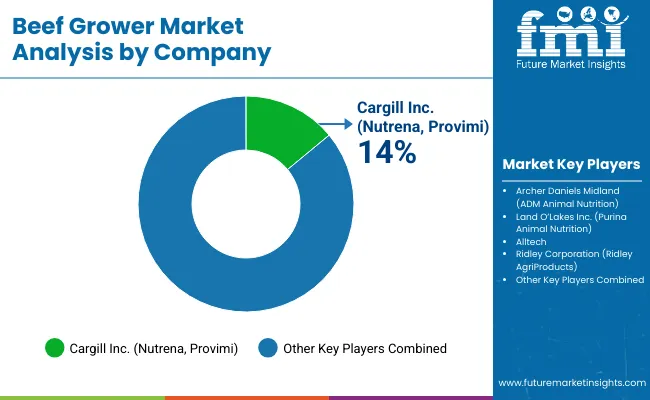

The beef grower market is characterized by competition among established feed companies, specialty nutrition companies, and agricultural technology suppliers focused on delivering high-efficiency, consistent, and reliable cattle nutrition systems. Companies are investing in nutrition technology advancement, performance enhancement, strategic partnerships, and customer technical support to deliver effective, efficient, and reliable livestock solutions that meet stringent farming and agricultural requirements. Cattle optimization, performance validation protocols, and supply chain strategies are central to strengthening product portfolios and market presence.

Cargill Inc. leads the market with a 14.0% market share, offering comprehensive high-efficiency beef grower formulations with a focus on performance consistency and nutrition reliability for agricultural applications. Archer Daniels Midland provides specialized nutrition systems with emphasis on farming applications and comprehensive technical support services. Land O'Lakes Inc. focuses on advanced livestock technologies and customized agricultural solutions for nutrition systems serving global markets. Alltech delivers established cattle systems with strong performance nutrition systems and customer service capabilities.

Ridley Corporation operates with a focus on bringing innovative livestock technologies to specialized agricultural applications and emerging markets. Companies provide comprehensive nutrition system portfolios, including advanced cattle services, across multiple agricultural applications and livestock management processes. Feed manufacturers specialize in customized nutrition solutions and performance management systems for agricultural systems with emphasis on cattle compliance. Agricultural suppliers provide reliable supply chain solutions and technical expertise to enhance market accessibility and customer access to essential livestock systems.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 30,600.0 Million |

| Product Type | Medicated, Non-Medicated |

| Form | Pellets, Crumbles, Mash, Textured |

| Animal Age Group | Calves (Weaning Stage), Growers (Post-Weaning to Finishing), Finishers |

| Ingredient Type | Grains (Corn, Barley, Sorghum), Oilseed Meals (Soybean Meal, Canola Meal), Additives (Vitamins, Minerals, Probiotics, Enzymes), Forage-Based Blends |

| Sales Channel | Direct Sales, Feed Stores & Co-ops, Online Retail, Distributors |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, USA, Germany, Japan, India, South Korea, France and 40+ countries |

| Key Companies Profiled | Cargill Inc., Archer Daniels Midland, Land O'Lakes Inc., Alltech, and Ridley Corporation |

| Additional Attributes | Dollar sales by product type and form, regional demand trends, competitive landscape, farming provider preferences for specific cattle systems, integration with specialty agricultural supply chains, innovations in nutrition technologies, performance monitoring, and cattle optimization |

The global beef grower market is estimated to be valued at USD 30,600.0 million in 2025.

The market size for the beef grower market is projected to reach USD 54,369.1 million by 2035

The beef grower market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in the beef grower market are medicated and non-medicated formulations.

In terms of product type, the non-medicated segment is expected to command 78.0% share in the beef grower market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beef Fat Market Size and Share Forecast Outlook 2025 to 2035

Beef Concentrate Market Size, Growth, and Forecast for 2025 to 2035

Beef Flavors Market Insights - Trends & Forecast 2025 to 2035

Beef Bouillon Market

Wagyu Beef Market Analysis by Type, End-use, Region and Others Through 2035

Global Organic Beef Meat Market Size, Growth, and Forecast for 2025 to 2035

Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Grass Fed Beef Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Breakdown of Processed Beef Market Share

Plant-Based Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Analysis of the USA Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Analysis of the Europe Processed Beef Market by Product Type, Processing Method, Distribution Channel, Packaging Type and Region through 2035

Asia Pacific Processed Beef Market Outlook - Size, Share & Industry Trends 2025 to 2035

Organic Starter-Grower Chicken Feed Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA