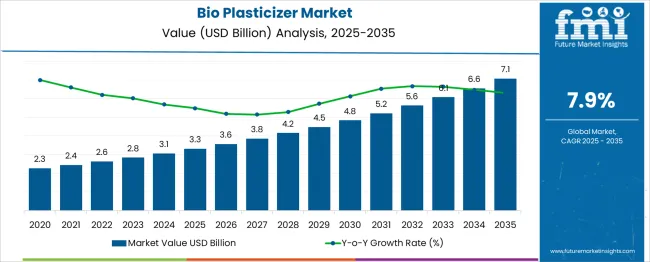

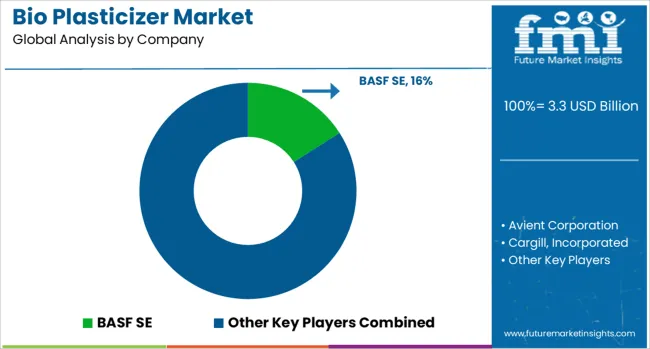

The Bio Plasticizer Market is estimated to be valued at USD 3.3 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.9% over the forecast period. Growing from USD 3.3 billion in 2025 to USD 7.1 billion by 2035, the market reflects expanding demand for non-toxic, eco-friendly plasticizers across packaging, medical, automotive, and consumer goods applications. The early adopter phase (2020–2025) was largely fueled by regulatory pressure to phase out phthalate-based plasticizers, particularly in North America and Europe. Environmental sustainability initiatives, coupled with growing health awareness, played a crucial role in triggering interest from forward-thinking manufacturers and end-users. From 2025 to 2030, the market is entering the early majority phase, characterized by increasing commercialization, broader formulation compatibility, and improved performance parity with conventional plasticizers. Key industries such as medical devices and food-grade packaging are driving volume adoption due to stricter regulatory compliance and consumer safety concerns. Between 2030 and 2035, mainstream adoption is expected to gain traction globally, with price competitiveness, improved production scalability, and supplier maturity enhancing overall uptake. This stage marks the acceleration toward market maturity, setting the stage for wider global acceptance, particularly in developing economies where regulations are beginning to align with global green chemistry standards.

| Metric | Value |

|---|---|

| Bio Plasticizer Market Estimated Value in (2025 E) | USD 3.3 billion |

| Bio Plasticizer Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The bio plasticizer market is experiencing strong momentum as industries shift away from petroleum-based additives toward environmentally friendly alternatives. Regulatory frameworks promoting non-toxic, phthalate-free plasticizers, especially in packaging and medical applications, are accelerating demand.

The market is further supported by rising public awareness of plastic safety, increased consumer preference for sustainable materials, and rapid R&D in bio-based plasticizer formulations. Plant-derived raw materials such as vegetable oils, citrates, and starches are being favored due to their low toxicity, biodegradability, and compatibility with existing polymer systems.

Additionally, as major economies implement circular economy policies, manufacturers are increasing investment in renewable feedstocks and green chemistry innovations. The future trajectory of this market is expected to benefit from broader adoption across flexible PVC, food contact materials, and children’s toys, driven by both legislation and consumer pressure.

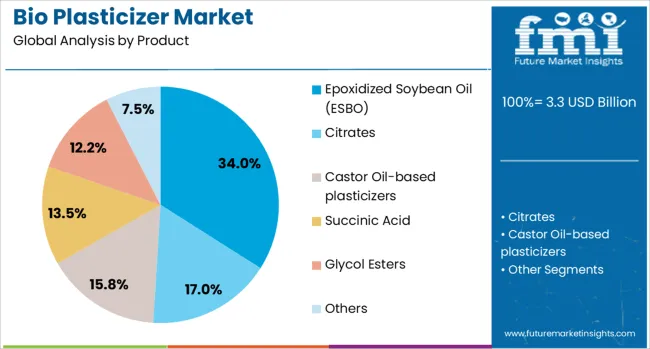

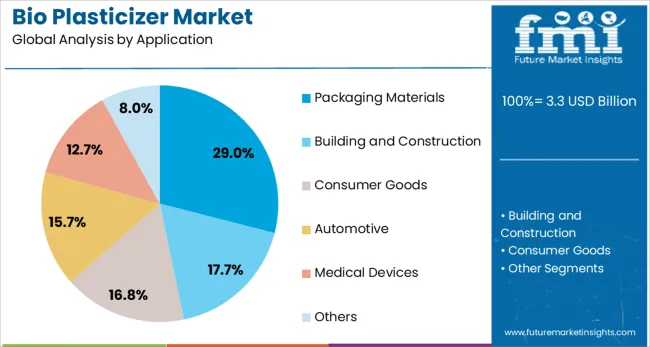

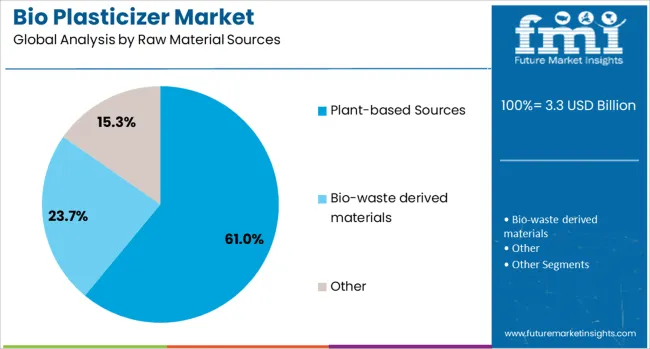

Product, application, raw material sources, and geographic regions segment the bio-plasticizer market. The product of the bio-plasticizer market is divided into Epoxidized Soybean Oil (ESBO), Citrates, Castor Oil-based plasticizers, Succinic Acid, Glycol Esters, and others. In terms of application, the bio plasticizer market is classified into Packaging Materials, Building and Construction, Consumer Goods, Automotive, Medical Devices, and others. Based on raw material sources, the bio-plasticizer market is segmented into Plant-based Sources, bio-waste-derived materials, and Other. Regionally, the bio plasticizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Epoxidized soybean oil (ESBO) is projected to lead the product category with a 34.00% market share in 2025. ESBO’s dominance stems from its excellent thermal stability, cost-effectiveness, and compatibility with PVC resins, making it a widely used secondary plasticizer.

It serves as both a stabilizer and plasticizer, particularly in applications where low migration and food safety are critical. Regulatory approval by agencies such as the FDA for food-contact uses has further cemented its role in packaging and medical products.

Derived from renewable soybean oil, ESBO aligns with global sustainability goals and offers a favorable environmental profile. Its ease of incorporation into existing manufacturing lines and its non-toxic nature make it a go-to solution for manufacturers transitioning away from phthalate-based plasticizers.

The packaging materials segment is expected to account for 29.00% of the total bio plasticizer market in 2025, making it the leading application area. This growth is driven by heightened environmental scrutiny and the need for food-safe, flexible packaging solutions that meet global compliance standards.

Bio plasticizers enhance the softness, flexibility, and printability of packaging films without introducing harmful residues. As major FMCG and food brands adopt greener packaging formats to meet corporate sustainability goals, the demand for bio-based additives has surged.

Moreover, consumer preference for recyclable and compostable packaging is pushing manufacturers to reformulate conventional plastic compounds. The sector’s expansion is further supported by legislation in the EU and North America restricting the use of phthalates and other toxic additives in food-contact applications.

Plant-based sources are anticipated to contribute 61.00% of the total market share in 2025, making them the dominant raw material segment. These include soy, castor, corn, and palm oils, which serve as abundant, renewable feedstocks for producing biodegradable plasticizers.

The widespread use of plant-derived materials is driven by growing demand for bio-content certification and carbon footprint reduction. These sources offer a sustainable alternative to fossil-derived materials and are gaining traction across both consumer goods and industrial sectors.

Plant-based plasticizers also exhibit favorable processing properties, including better plasticizing efficiency and thermal stability. The increasing focus on life-cycle assessments and end-of-life impact has led to a preference for materials that integrate seamlessly into composting and recycling systems, further strengthening the appeal of plant-based inputs.

The bio plasticizer market is expanding as manufacturers and regulatory bodies increasingly prioritize non-toxic and renewable alternatives to traditional phthalates. Products such as epoxidized soybean oil and citrates are widely adopted in industries like packaging, construction, automotive, and healthcare. Rising environmental awareness, regulatory restrictions, and increased demand for safer plasticizers support market growth. However, challenges such as high production costs, variability in raw materials, and limited performance in some applications continue to influence the rate of adoption across end-use sectors.

The growing restrictions on phthalate-based plasticizers have LED manufacturers to explore safer, bio-based alternatives that meet evolving regulatory standards. Bio plasticizers are gaining traction in sectors requiring high safety profiles, including food packaging, toys, and medical products. Epoxidized soybean oil and citrates are among the preferred options, offering improved safety and compatibility with flexible PVC. Packaging remains the largest application area due to its extensive use in consumer products. Additionally, rising demand in construction materials and automotive interiors is contributing to increased adoption. Governments in Europe and North America have implemented strict regulations that favor non-toxic additives, boosting industry investment in bio-based formulations. These trends are enabling long-term market traction, particularly in applications where consumer safety and environmental compliance are prioritized. As product performance improves and compatibility expands, bio plasticizers are expected to penetrate new markets where traditional plasticizers were once dominant, thereby creating room for broader application growth.

One of the primary barriers facing the bio plasticizer market is the higher cost of production compared to conventional alternatives. Since bio plasticizers rely on agricultural feedstocks such as soybean oil, castor oil, and other plant-based inputs, pricing is subject to fluctuations in crop yield and global commodity markets. This variability affects the stability of supply chains and often increases manufacturing expenses. Additionally, the cost of converting bio-based feedstocks into plasticizers through chemical processing adds another layer of expense. These factors make it difficult for small or cost-sensitive manufacturers to switch from petroleum-based options. In high-performance or industrial applications that require superior thermal and mechanical resistance, some bio-based products fall short of meeting technical requirements, leading to limitations in broader adoption. The market’s ability to compete on price while maintaining performance standards remains an ongoing challenge. Unless feedstock consistency improves and production costs decline, price sensitivity will continue to hinder large-scale substitution.

There is growing interest in the development of bio plasticizers tailored to new industrial uses such as construction adhesives, automotive interiors, and specialty coatings. These applications benefit from improved flexibility, thermal stability, and compatibility with newer types of polymers. Additionally, demand in Asia-Pacific is rising due to increased local production capacity and abundant availability of agricultural feedstocks. Countries like China and India are investing in bio-based manufacturing solutions that align with local environmental objectives. Meanwhile, North America and parts of Europe continue to lead in regulatory compliance and application diversity, especially in food-grade and medical packaging. As end-users seek alternatives that support environmental goals without compromising product integrity, bio plasticizers positioned for specialty functions are gaining attention. The development of region-specific product variants and increased research into high-efficiency conversion techniques are expected to further encourage market expansion. These combined efforts present a strong opportunity for manufacturers able to tailor offerings by geography and application.

The bio plasticizer market faces growth limitations due to complex certification processes required for food-contact and medical-grade applications. Regulatory compliance often involves time-consuming testing, safety validation, and region-specific approvals that delay product entry and increase development costs. Different countries have varying requirements, creating additional complications for globally operating suppliers. Inconsistent testing protocols and lack of unified certification standards restrict the scalability of bio plasticizer products across different markets. The industry is also fragmented, with many small and mid-sized players using distinct feedstocks and manufacturing methods, making it harder to establish economies of scale. This fragmentation results in inconsistent product quality, which can lead to reluctance from major manufacturers to adopt bio-based alternatives for high-volume use. While larger producers are working toward harmonized formulations, the absence of a global regulatory framework and the slow pace of certification approval remain key obstacles. These constraints limit wider adoption and increase reliance on traditional plasticizers in less regulated regions.

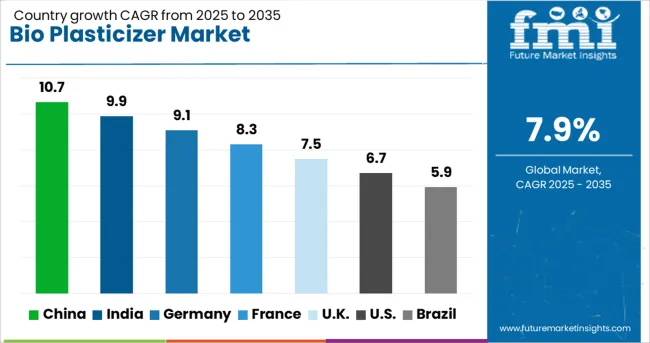

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

| USA | 6.7% |

| Brazil | 5.9% |

The global bio plasticizer market is growing at a CAGR of 7.9%, driven by increasing demand for non-toxic, renewable alternatives to conventional plasticizers in applications such as packaging, automotive, and medical devices. China leads with 10.7% growth, supported by strong chemical manufacturing capabilities and government initiatives to reduce environmental impact. India follows at 9.9%, fueled by the expansion of bioplastics in consumer goods and growing emphasis on green chemistry. Germany records 9.1% growth, reflecting innovation in bio-based materials and strict environmental regulations. The United Kingdom shows steady growth at 7.5%, focusing on sustainable packaging and product safety. The United States, at 6.7%, remains a mature but evolving market, shaped by regulatory compliance, demand for phthalate-free solutions, and advancements in bio-feedstocks. Market trends are influenced by raw material availability, biodegradability standards, and application-specific performance requirements. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the bio plasticizer market with a 10.7% CAGR, supported by strong policy enforcement on non-toxic materials and sustainable manufacturing. As environmental regulations tighten, industries are shifting from conventional phthalates to bio-based alternatives in sectors such as packaging, medical devices, and flooring. Domestic producers are scaling up manufacturing capacity using raw materials like soybean oil, castor oil, and other plant-based feedstocks. Research and development centers are focusing on improving thermal stability and mechanical properties of bio plasticizers for broader industrial use. Demand is also rising in automotive interiors, driven by green labeling and international quality standards. Government subsidies and green certification programs are motivating industries to adopt bio-based additives at a faster rate.

India is witnessing a 9.9% CAGR in the bio plasticizer market, fueled by expanding packaging, agriculture, and medical sectors. As consumer and industrial demand for non-toxic and eco-friendly materials grows, manufacturers are moving towards bio-derived alternatives such as epoxidized soybean oil and citrates. Public awareness about health and environmental risks of conventional plasticizers is rising. Domestic producers are forming joint ventures with international players to access advanced technology and sustainable raw materials. The flexible PVC segment, widely used in cables and hoses, is adopting bio plasticizers for enhanced safety and performance. Central and state-level regulations are aligning with global sustainability standards, encouraging usage in food-grade and children’s products.

Germany is seeing a 9.1% CAGR in the bio plasticizer market, supported by strict EU chemical safety laws and high consumer demand for sustainable materials. German companies are leaders in developing high-purity, bio-based alternatives suitable for sensitive applications like toys, food packaging, and medical tubing. Research-driven innovation is enabling better compatibility with various polymer systems. Demand from the automotive sector is increasing for bio plasticizers used in interior parts to meet eco-label requirements. Government incentives for circular economy initiatives and use of renewable feedstocks are fostering wider adoption. Local manufacturers are also focusing on closed-loop supply chains and life-cycle impact reduction.

The United Kingdom is experiencing a 7.5% CAGR in the bio plasticizer market, driven by demand for non-toxic additives across consumer goods, packaging, and healthcare applications. Post-Brexit regulatory adjustments are aligning closely with EU REACH standards, maintaining strong pressure on phthalate reduction. Manufacturers are investing in biodegradable and low-VOC formulations to meet end-user expectations. Sustainable packaging initiatives in retail and e-commerce are accelerating the switch to bio plasticized films. British universities and private R&D labs are advancing innovation in long-chain ester and vegetable oil-based plasticizers. Market growth is particularly strong in children’s products and home furnishings where low toxicity is a major requirement.

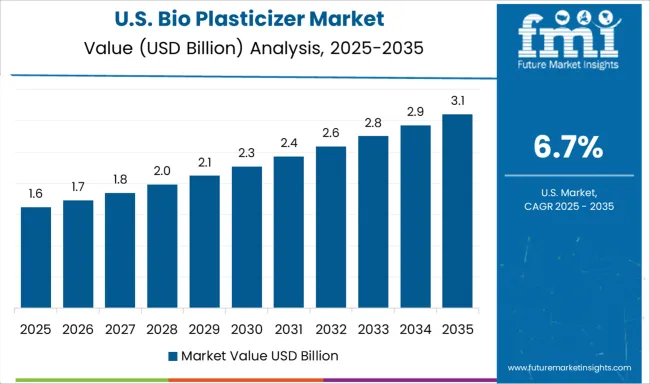

The United States is posting a 6.7% CAGR in the bio plasticizer market, driven by regulatory pressure, green consumer preferences, and industrial safety standards. Increasing scrutiny of phthalate use in medical and food-contact materials is promoting the adoption of bio-based alternatives. The healthcare sector is a key contributor, transitioning to non-toxic plasticizers in IV bags, tubing, and blood storage devices. Bioplastics and sustainable packaging applications are also major growth areas. American manufacturers are focusing on soy, castor, and citrus-derived inputs, backed by USDA certification programs. R&D activity is advancing multi-functional plasticizers that offer both flexibility and thermal resistance. E-commerce packaging and eco-conscious product labeling are further influencing market trends.

The Bio Plasticizer market is steadily gaining traction as industries increasingly explore alternatives to traditional phthalate-based plasticizers. Bio plasticizers, derived from renewable sources such as vegetable oils, starch, and other bio-based feedstocks, are primarily used to enhance the flexibility and durability of plastics in applications ranging from packaging and consumer goods to medical devices and construction materials. Their growing adoption is supported by evolving safety regulations and the rising demand for non-toxic, non-phthalate solutions across multiple sectors. Leading players in this market include BASF SE, Dow, Inc., Avient Corporation, and Evonik Industries AG, all of which have invested in expanding their bio-based additive portfolios.

These companies leverage advanced R&D capabilities and global distribution networks to cater to both high-volume industrial users and specialized end-use markets. Emery Oleochemicals and JUNGBUNZLAUER SUISSE AG are also well-recognized for their strong presence in the bio-based chemicals segment, offering bio plasticizers derived from citrates, adipates, and epoxides. Smaller or regionally focused companies such as Goldstab Organics Pvt. Ltd., GRUPO PRINCZ IPASA, and Cargill, Incorporated are also contributing to the market with customized and cost-effective solutions for specific polymer types like PVC or bioplastics. As awareness around chemical exposure and product safety grows in consumer and industrial markets, the demand for reliable, high-performance bio plasticizers is expected to intensify. Competition in the sector is increasingly centered around product compatibility, regulatory approvals, and cost-performance balance.

As reported on Jiaao Enprotech’s official website, at CHINAPLAS 2025 (April 23, 2025), the company unveiled its PST bio-based modified material, developed from renewable plant-based inputs using proprietary molecular design. It was highlighted for its suitability in high-performance applications like food packaging and medical supplies, and received strong interest from global clients.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Product | Epoxidized Soybean Oil (ESBO), Citrates, Castor Oil-based plasticizers, Succinic Acid, Glycol Esters, and Others |

| Application | Packaging Materials, Building and Construction, Consumer Goods, Automotive, Medical Devices, and Others |

| Raw Material Sources | Plant-based Sources, Bio-waste derived materials, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Avient Corporation, Cargill, Incorporated, DIC Corporation, Dow, Inc., Emery Oleochemicals, Evonik Industries AG, Goldstab Organics Pvt. Ltd., GRUPO PRINCZ IPASA, and JUNGBUNZLAUER SUISSE AG |

| Additional Attributes | Dollar sales vary by product type and end-use, with ESBO dominating, while citrates and succinic‑acid variants grow fastest. Asia‑Pacific leads volume, as North America values premium sustainable products. Pricing fluctuates with feedstock and regulatory costs. Growth accelerates via green formulations, packaging, automotive, and medical use, under phthalate bans and eco‑innovation trends. |

The global bio plasticizer market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the bio plasticizer market is projected to reach USD 7.1 billion by 2035.

The bio plasticizer market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in bio plasticizer market are epoxidized soybean oil (esbo), citrates, castor oil-based plasticizers, succinic acid, glycol esters and others.

In terms of application, packaging materials segment to command 29.0% share in the bio plasticizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-Plasticizers Market Growth - Trends & Forecast 2025 to 2035

UK Bio-Plasticizers Market Insights – Demand, Growth & Industry Trends 2025-2035

USA Bio-Plasticizers Market Report – Size, Share & Forecast 2025-2035

Japan Bio-Plasticizers Market Analysis – Size, Share & Forecast 2025-2035

ASEAN Bio-Plasticizers Market Analysis – Size, Share & Forecast 2025-2035

Germany Bio-Plasticizers Market Trends – Size, Share & Growth 2025-2035

Bio-Fiber Tether Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biobased Binder for Nonwoven Market Size and Share Forecast Outlook 2025 to 2035

Bio-Based Binder for Building Materials Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Microencapsulation Technology Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Film Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Disposable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Bio-based Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bio-wax Market Size and Share Forecast Outlook 2025 to 2035

Biomass Hot Air Generator Furnace Market Size and Share Forecast Outlook 2025 to 2035

Biological Indicator Vial Market Size and Share Forecast Outlook 2025 to 2035

Bioplastic and Biopolymer Market Forecast Outlook 2025 to 2035

Biodegradable Paper and Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Biocatalysis and Biocatalyst Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polyester Fiber Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA