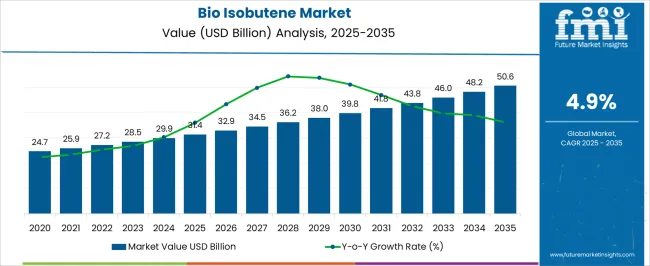

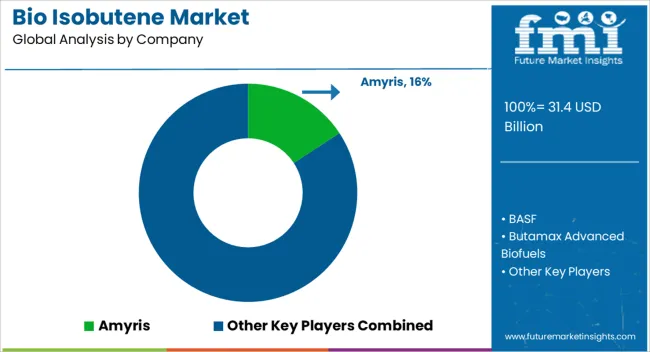

The bio isobutene market is expected to grow from USD 31.4 billion in 2025 to USD 50.6 billion by 2035, registering a 4.9% CAGR and generating an absolute dollar opportunity of USD 19.2 billion. Growth is driven by increasing demand for bio-based fuels, sustainable chemicals, and high-performance materials in automotive, packaging, and industrial applications. Advancements in fermentation technologies, catalytic processes, and feedstock utilization enhance production efficiency and product quality, supporting adoption across regions globally.

Rolling CAGR analysis provides insights into fluctuations in annual growth rates over the forecast period, reflecting both regional dynamics and technological adoption patterns. From 2025 to 2028, rolling CAGR remains slightly below the long-term average as early adoption in North America and Europe is steady, driven by incremental replacement of petroleum-derived isobutene and regulatory incentives for bio-based chemicals. Between 2029 and 2032, rolling CAGR rises above the average, fueled by expansion in Asia Pacific and Latin America, where industrial growth, biofuel mandates, and increasing manufacturing of bio-based polymers drive higher demand.

From 2033 to 2035, rolling CAGR moderates as mature markets reach higher penetration, with incremental revenue increasingly derived from process optimization, product upgrades, and feedstock diversification rather than new installations. Overall, the USD 19.2 billion opportunity reflects steady cumulative growth, with rolling CAGR trends revealing early-stage stability, mid-period acceleration, and late-stage moderation in the global bio isobutene market between 2025 and 2035.

| Metric | Value |

|---|---|

| Bio Isobutene Market Estimated Value in (2025 E) | USD 31.4 billion |

| Bio Isobutene Market Forecast Value in (2035 F) | USD 50.6 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The bio isobutene market is primarily driven by the synthetic fuel and biofuel sector, which accounts for around 42% of the market share, as bio-based isobutene is used to produce high-octane gasoline, renewable diesel, and aviation fuels. The chemical and petrochemical industry contributes about 28%, deploying bio isobutene as a feedstock for producing polymers, butyl rubber, and specialty chemicals. The cosmetics and personal care segment represents close to 15%, where it is used in formulations for emollients, fragrances, and stabilizers. The pharmaceutical sector accounts for roughly 10%, leveraging bio isobutene in intermediates for drug synthesis. The remaining 5% comes from packaging, coatings, and lubricant applications, where bio-based isobutene enhances sustainability and performance characteristics. The market is evolving with innovations in fermentation technology, catalyst efficiency, and green production processes. Advanced bioreactors and enzymatic conversion methods are improving yield, purity, and cost-effectiveness.

Integration with bio-refineries and renewable feedstocks is reducing dependency on fossil fuels. Companies are focusing on scalable, environmentally friendly production methods and improving process energy efficiency. Strategic collaborations between chemical manufacturers, biofuel producers, and research institutions are expanding deployment. Increasing demand for sustainable fuels, eco-conscious chemicals, and regulatory incentives for green alternatives continues to drive global bio-isobutene market growth.

The bio isobutene market is gaining momentum as industries transition toward low-carbon and renewable chemical alternatives in response to environmental regulations and sustainability goals. Bio-based isobutene, derived from renewable feedstocks, offers a cleaner substitute for its petrochemical counterpart and is increasingly being integrated into fuel additives, elastomers, and specialty chemicals.

Advancements in fermentation and catalytic conversion technologies have improved production efficiency, making bio isobutene more commercially viable. Market growth is further driven by the increasing demand for high-octane fuel components and bio-based polymers.

Strategic partnerships among biotechnology firms, chemical producers, and automotive stakeholders are accelerating the commercialization of bio isobutene applications. Looking forward, favorable regulatory frameworks and heightened awareness regarding lifecycle emissions are expected to strengthen market penetration, particularly in sectors seeking to reduce dependence on fossil-based resources

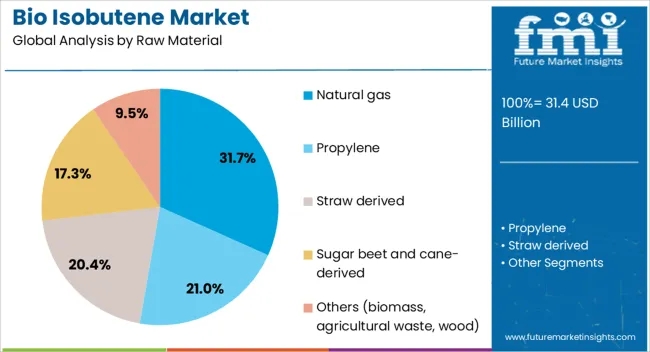

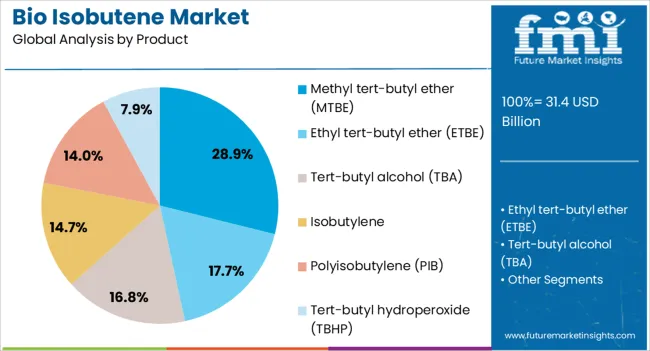

The bio isobutene market is segmented by raw material, product, application, and geographic regions. By raw material, the bio-isobutene market is divided into Natural gas, Propylene, straw-derived, Sugar beet and cane-derived, and Others (biomass, agricultural waste, wood). In terms of product, bio isobutene market is classified into Methyl tert-butyl ether (MTBE), Ethyl tert-butyl ether (ETBE), Tert-butyl alcohol (TBA), Isobutylene, Polyisobutylene (PIB), and Tert-butyl hydroperoxide (TBHP).

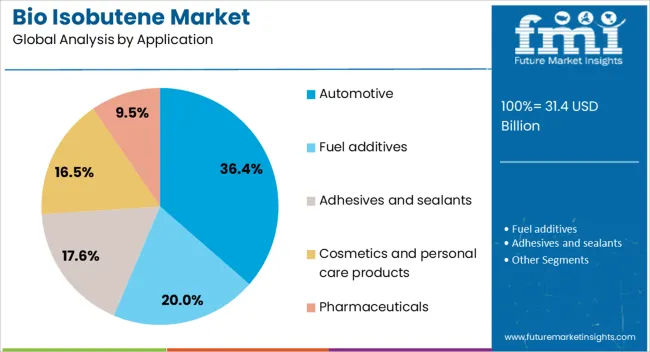

Based on application, bio isobutene market is segmented into Automotive, Fuel additives, Adhesives and sealants, Cosmetics and personal care products, and Pharmaceuticals. Regionally, the bio isobutene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural gas segment accounts for 32% of the raw material category in the bio isobutene market, reflecting its role as a widely available and energy-efficient input in conversion processes. Although traditionally associated with fossil fuel production, natural gas is being utilized in advanced bio-refining techniques that integrate renewable pathways, allowing for the partial substitution of petroleum-based feedstocks.

The segment benefits from an established infrastructure, stable supply chains, and lower emissions intensity compared to heavier hydrocarbons. Moreover, innovations in synthesis gas and biogas conversion technologies are enhancing the feasibility of using natural gas in renewable isobutene production.

As cost optimization and feedstock flexibility remain priorities for producers, the continued use of natural gas—particularly when blended with renewable methane—is expected to support scalable and economically viable bio isobutene output.

Methyl tert-butyl ether (MTBE) leads the product category with a 29% market share, owing to its critical role as a high-octane oxygenate in gasoline blending. Bio isobutene serves as a key precursor in the production of renewable MTBE, enabling fuel formulations that comply with stringent emission standards while maintaining engine performance.

The shift toward bio-based MTBE addresses environmental concerns associated with traditional petrochemical additives, particularly regarding groundwater contamination and lifecycle emissions. Adoption of renewable MTBE is gaining traction among refiners and fuel distributors aiming to meet regulatory targets for cleaner-burning fuels.

As global demand for environmentally compliant fuel components rises, the MTBE segment is poised to remain a significant outlet for bio isobutene utilization, supported by regulatory incentives and increasing public-sector mandates.

The automotive segment commands a dominant 36% share in the application category, driven by the use of bio isobutene derivatives in fuel additives, lubricants, and rubber components. The transition toward sustainable mobility and stricter emission standards is amplifying demand for renewable chemical intermediates that can replace petrochemical-based inputs without compromising performance.

Bio isobutene-derived MTBE and butyl rubber are being adopted for their cleaner combustion characteristics and enhanced material properties. Automakers and fuel companies are integrating bio-based solutions into supply chains to align with carbon reduction targets and circular economy goals.

The automotive industry's emphasis on lightweight, durable, and low-impact materials continues to position bio isobutene as a strategic input. As vehicle electrification and biofuel blending mandates expand globally, the segment is expected to sustain strong growth across both fuel and component applications.

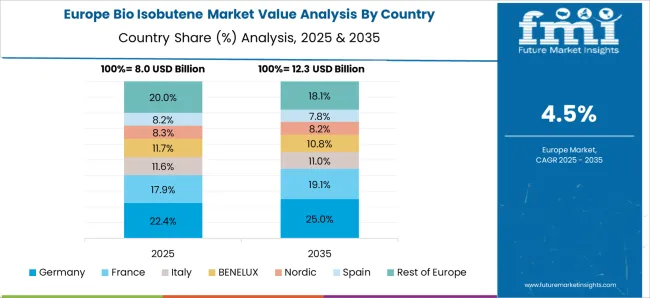

The bio isobutene market is expanding globally as industries shift toward renewable and bio-based feedstocks for fuels, lubricants, and chemical intermediates. Demand is rising for bio-isobutene derivatives in fuel additives, synthetic rubbers, and specialty chemicals. North America and Europe lead adoption due to established bio-refineries and sustainability policies, while Asia Pacific is witnessing rapid growth driven by industrialization, rising energy demand, and green chemical initiatives. Technological innovations in catalytic conversion, fermentation, and renewable feedstock processing are increasing yield and reducing production costs, creating measurable opportunities for market growth.

The primary driver for the bio isobutene market is increasing demand for renewable alternatives to fossil-based isobutene in fuels and chemical production. Bio isobutene is used in high-octane fuel additives, elastomers, synthetic rubbers, lubricants, and specialty chemicals. Rising adoption of sustainable automotive fuels in Europe and North America supports the production of bio-isobutene-derived ETBE and other ethers. Industrial sectors in Asia Pacific, such as packaging, coatings, and personal care, are increasingly using bio-based chemical intermediates to meet environmental regulations. Technological improvements in catalytic dehydration of bio-butanol and fermentation pathways have increased yields by 10–15%, improving cost competitiveness and supporting adoption across multiple chemical and industrial applications globally.

Opportunities in the bio isobutene market are driven by expansion of bio-refineries and growing renewable fuel mandates. Governments in the EU, US, and Asia Pacific are promoting blending mandates for bio-derived fuel additives, creating measurable demand for ETBE and related derivatives. Industrial investments in fermentation, dehydration, and catalytic upgrading technologies are increasing production capacity, enabling scale economies. Bio-based isobutene can also be converted into synthetic rubbers for tire manufacturing, adhesives, and elastomers, offering additional industrial growth avenues. Expansion of the chemical and fuel additive sectors in emerging economies, including India, China, and Brazil, presents opportunities for renewable bio-isobutene integration in local supply chains and industrial chemical production.

Key trends in the bio isobutene market include advances in catalytic conversion, process integration, and feedstock diversification. Fermentation-based bio-butanol and dehydration technologies are increasingly adopted to enhance yield and energy efficiency, achieving up to 90% conversion efficiency in pilot plants. Co-processing bio-isobutene with fossil feedstocks allows gradual adoption in existing chemical infrastructure. Investment in flexible feedstocks, including lignocellulosic biomass, sugarcane, and corn derivatives, diversifies supply and reduces production costs. Bio-based synthetic rubber, elastomer, and fuel additive applications are expanding rapidly in Asia Pacific, North America, and Europe. Industrial automation, IoT-enabled process monitoring, and energy recovery integration further enhance operational efficiency, reflecting a trend toward scalable, sustainable production models globally.

The bio isobutene market faces challenges from high production costs, feedstock supply variability, and technological complexity. Renewable feedstocks such as bio-butanol or biomass derivatives are 15–25% more expensive than fossil alternatives, impacting competitiveness in cost-sensitive fuel and chemical markets. Limited access to sustainable feedstock in certain regions constrains local production. Process scalability, catalytic stability, and downstream purification challenges increase capital expenditure and operational complexity. Regulatory variations in renewable fuel incentives across countries create adoption uncertainty. Manufacturers must focus on process optimization, catalytic improvements, and feedstock diversification to reduce costs, increase yield, and ensure consistent supply, supporting sustainable growth in industrial, fuel, and chemical applications.

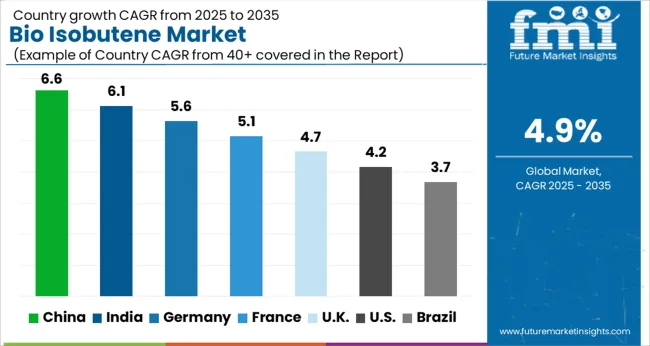

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The bio isobutene market is projected to grow at a global CAGR of 4.9% through 2035, supported by increasing applications in biofuels, specialty chemicals, and green chemistry initiatives. China leads at 6.6%, a 1.35× multiple over the global benchmark, driven by BRICS-focused industrial adoption, bio-based chemical production, and sustainability-oriented policies. India follows at 6.1%, a 1.25× multiple, reflecting growth in bio-based chemical manufacturing, fuel additives, and industrial applications. Germany records 5.6%, a 1.14× multiple, shaped by OECD-backed innovation, advanced chemical processing, and industrial integration. The United Kingdom posts 4.7%, 0.96× the global rate, with adoption concentrated in specialty chemical sectors and biofuel applications. The United States stands at 4.2%, 0.86× the benchmark, with steady uptake in renewable fuels, chemical manufacturing, and industrial processes. BRICS economies drive the bulk of market volume, OECD countries focus on technological advancement and high-value applications, while ASEAN nations contribute through growing bio-based chemical production and industrial adoption. This report includes insights on 40+ countries; the top markets are shown here for reference.

The bio isobutene market in China is projected to grow at a CAGR of 6.6%, driven by increasing demand from bio-based chemicals, fuel additives, and specialty polymer production. Leading companies such as Sinopec, China National Chemical, and local specialty chemical manufacturers are scaling production of bio isobutene through fermentation and catalytic processes. Adoption is concentrated in chemical manufacturing, automotive fuel additives, and industrial polymer applications. Technological trends include process optimization, improved fermentation efficiency, and cost reduction in bio-based feedstocks. Government initiatives supporting renewable chemicals, green fuels, and industrial decarbonization reinforce market growth. Rising awareness of sustainable chemical alternatives and increased investment in bio-refineries accelerates adoption in China.

The bio isobutene market in India is expected to expand at a CAGR of 6.1%, driven by growth in bio-based chemical production, automotive fuel additives, and polymer manufacturing. Key players such as Reliance Industries, Indian Oil, and local bio-refineries are scaling production with advanced fermentation and catalytic technologies. Adoption is concentrated in industrial chemical plants, fuel blending operations, and specialty polymer applications. Technological developments focus on improving yield, reducing costs, and optimizing renewable feedstock usage. Government initiatives promoting biofuels, green chemicals, and industrial decarbonization reinforce market growth. Rising demand for eco-friendly chemical alternatives and renewable energy integration supports adoption across India.

The bio isobutene market in Germany is projected to grow at a CAGR of 5.6%, supported by adoption in bio-based chemicals, specialty polymers, and fuel additives. Leading companies such as BASF, Evonik, and Clariant provide bio isobutene produced through fermentation and chemical catalysis. Adoption is concentrated in chemical plants, automotive fuel blending, and polymer manufacturing. Technological trends emphasize process efficiency, renewable feedstock utilization, and cost-effective scaling. Government incentives supporting renewable chemicals, environmental compliance, and sustainable industrial practices reinforce market growth. Increasing consumer demand for green chemicals and bio-based products accelerates adoption in Germany.

The bio isobutene market in the United Kingdom is projected to grow at a CAGR of 4.7%, driven by adoption in renewable chemicals, fuel additives, and specialty polymer production. Companies such as Croda, INEOS, and local chemical manufacturers supply bio isobutene produced via fermentation and catalytic conversion. Adoption is concentrated in chemical plants, industrial fuel blending, and polymer manufacturing. Technological trends include improving yield efficiency, cost reduction, and feedstock optimization. Government initiatives promoting bio-based chemicals, sustainable fuels, and green industrial practices reinforce market growth. Rising industrial interest in renewable and eco-friendly chemical alternatives accelerates adoption in the United Kingdom.

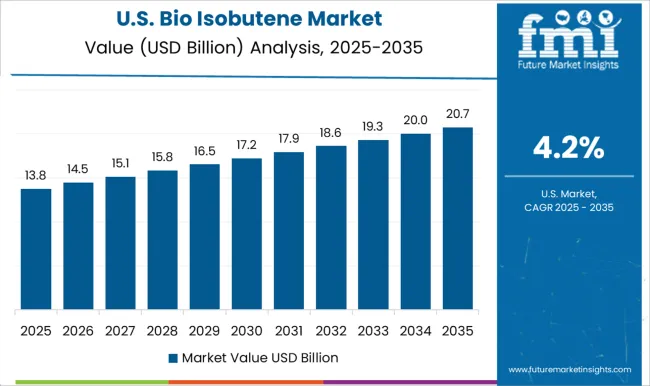

The bio isobutene market in the United States is expected to grow at a CAGR of 4.2%, supported by demand from specialty polymer production, bio-based chemicals, and renewable fuel additives. Leading manufacturers such as Amyris, LanzaTech, and commercial chemical producers are increasing capacity using advanced fermentation and catalytic technologies. Adoption is concentrated in industrial chemical plants, polymer manufacturing, and automotive fuel blending. Technological advancements emphasize process optimization, yield improvement, and cost efficiency. Government policies promoting biofuels, renewable chemicals, and industrial sustainability reinforce market adoption. Rising industrial focus on green chemistry supports steady market expansion in the United States.

Competition in the bio isobutene industry is being driven by the demand for renewable chemical intermediates, eco-efficient production, and versatile applications in fuels, lubricants, and polymers. Amyris and BASF are being advanced with high-purity bio-based isobutene produced through fermentation and catalytic processes, targeting sustainable chemical manufacturing and industrial uses. Butamax Advanced Biofuels and DuPont de Nemours are being positioned with integrated production systems that combine bio-feedstocks and innovative conversion technologies to optimize yield and process efficiency.

Eastman and ExxonMobil are being showcased with bio-derived isobutene solutions designed for high-performance elastomers, coatings, and synthetic rubbers, meeting both industrial and environmental standards. Fraunhofer and Global Bioenergies are being applied with research-driven approaches to enhance conversion rates, lower production costs, and expand commercial scalability. Ineos, Lanxess, and LyondellBasell are being highlighted with bio-isobutene tailored for chemical intermediates in plastics, adhesives, and specialty chemicals, while Sabic is being advanced with sustainable feedstock integration and high-purity formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 31.4 Billion |

| Raw Material | Natural gas, Propylene, Straw derived, Sugar beet and cane-derived, and Others (biomass, agricultural waste, wood) |

| Product | Methyl tert-butyl ether (MTBE), Ethyl tert-butyl ether (ETBE), Tert-butyl alcohol (TBA), Isobutylene, Polyisobutylene (PIB), and Tert-butyl hydroperoxide (TBHP) |

| Application | Automotive, Fuel additives, Adhesives and sealants, Cosmetics and personal care products, and Pharmaceuticals |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amyris, BASF, Butamax Advanced Biofuels, DuPont de Nemours, Eastman, ExxonMobil, Fraunhofer, Global Bioenergies, Ineos, Lanxess, LyondellBasell, and Sabic |

| Additional Attributes | Dollar sales by product type and end use, demand dynamics across fuels, chemicals, and personal care products, regional trends in bio-based chemical adoption, innovation in sustainable production and catalytic efficiency, environmental impact of petrochemical replacement, and emerging use cases in green fuels, lubricants, and specialty chemicals. |

The global bio isobutene market is estimated to be valued at USD 31.4 billion in 2025.

The market size for the bio isobutene market is projected to reach USD 50.6 billion by 2035.

The bio isobutene market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in bio isobutene market are natural gas, propylene, straw derived, sugar beet and cane-derived and others (biomass, agricultural waste, wood).

In terms of product, methyl tert-butyl ether (mtbe) segment to command 28.9% share in the bio isobutene market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA