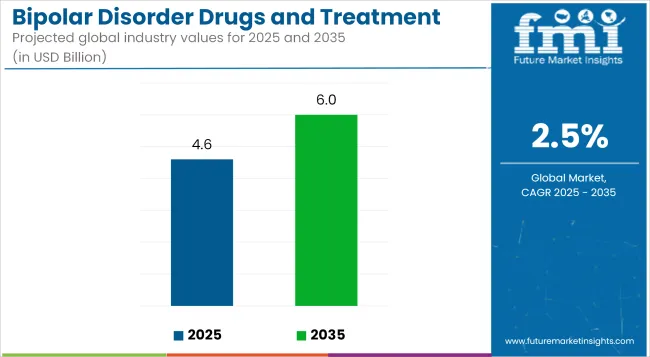

Growing prevalence of mental health disorders and awareness regarding psychiatry treatments are contributing to market growth between 2025 and 2035, supported by improvement in pharmacological and non-pharmacological treatments for bipolar disorder, the report noted. The market is expected to be worth USD 4.6 Billion in 2025 and USD 6.0 Billion in 2035, with a CAGR of 2.5% over the forecast period.

The significant increase of awareness towards mental health as an essential healthcare aspect is one of the major contributors in driving the market during the forecast period. Due to this reason, the government and private sectors are increasingly investing in psychiatric care. It would allow the rapid development of new drug formulations, such as long-acting injectable or more targeted mood stabilizers that would better align with a particular patient's needs, which is a growing trend in medicine, where adherence is often poor with current medications.

Nonetheless, market growth may be suppressed by high drug costs, side effects accompanied by long-term medicine consumption, and some regions' limited access to mental health services. To resolve such challenges, players in the sector are prioritizing and working on safer, more effective therapies and increasing tele psychiatry and digital mental health care solutions in partnerships and affordability.

Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.6 Billion |

| Industry Value (2035F) | USD 6.0 Billion |

| CAGR (2025 to 2035) | 2.5% |

North America dominates the bipolar disorder drugs and treatment market owing to the presence of advanced pharmaceuticals and mental healthcare in the USA The market is also expected to grow due to the high prevalence of bipolar disorder and the presence of major pharmaceutical players.

Government-led programs designed to enhance mental health care access and insurance coverage are also facilitating market growth. Tele psychiatry and mobile mental health applications offer patients more access to treatment and better adherence with their therapy regimens.

For Countries like German, French, and British-led mental health care policies as well as psychiatric drugs, Europe is meanwhile a major market for bipolar disorder treatment. The solution encompasses quality, evidence-based treatment options available under the strong regulatory framework guaranteed by European Medicines Agency (EMA) in the region.

Also, reimbursement policies and government-backed mental health awareness programs are helping patients access mood stabilizers, antipsychotic, and antidepressants. With the increasing emphasis on personalized medicine and pharmacogenomics, this area should continue to contribute to improving treatment strategies.

Asia-Pacific is projected to witness the highest growth in bipolar disorder drugs and treatment market owing to rising mental health risk perception in nations such as China, Japan, India, and South Korea. Urbanization and the accompanying lifestyle shifts in developing regions have resulted in a rising burden of mental health disorders, which has spurred the demand for better access to psychiatric medication and counselling services.

Government-led initiatives aimed at destigmatizing mental health issues and expanding healthcare infrastructure are playing an important role in driving market expansion. Nevertheless, regulatory differences, along with limited healthcare coverage of psychiatric disorders, introduce significant challenges that must be overcome for sustained growth.

Challenge

Side Effects and High Cost of Treatment

The critical challenge in the bipolar disorder drugs market is the adverse effects related to the prolonged application of mood stabilizers and antipsychotic drugs. Undesired effects like weight gain, metabolic disorders and neurological symptoms frequently result in poor medication adherence. Moreover, branded psychiatric drugs are expensive and are often not accessible in low-income areas.

Innovative medicines and generic variants with better safety profiles are needed and pharmaceutical firms wanted to meet these challenges.

Opportunity

Advancements in Digital Therapeutics and Personalized Medicine

Rising adoption of digital therapeutics in mental health treatment are creating lucrative opportunities for market growth. Mobile Applications, AI-powered Mental Health Assessments, and Virtual Therapy Platforms: Revolutionizing Patient Engagement and Adherence Its uridylation strengthen its target, the addictive collagenase breaking-apart Pathogen-associated molecular patterns; with elevated-low-function protein, which facilitates the unfolded protein response (UPR) and compensatory stress response two subjectively secreted systems which signal heavy-use exclusion to help the liver focus its time on endogenous supply creation.

The market is forecast to witness exciting new paths for growth over the next decade through ruthless research on gene-based therapies and the evolution of neurostimulation techniques such as transcranial magnetic stimulation (TMS).

Due to the rise in awareness, new diagnostic approaches, and newly available mood stabilizers and antipsychotic drugs, the Bipolar Disorder Drugs and Treatment Market is projected to grow between 2020 and 2024. Increased global focus on mental health resulted in a growing demand for other forms of personalized pharmacotherapy approaches, adjunctive therapies, and combination drug regimens.

Furthermore, the introduction of long-acting injectable (LAI) formulations of antipsychotic, atypical antipsychotics and targeted mood stabilizers played a crucial role in increasing treatment adherence and outcomes in patients. Costs, concerns about side effects and inadequate sustained management strategies, however, were difficult challenges. Another was a stigma surrounding mental health that discouraged people from seeking treatment.

AI-Driven Drug Development, Precision Psychiatry, and Digital Therapeutics. With these new trends in pharmacogenomics, gut-brain axis research, and AI-driven biomarker identification, treatment will only become more personalized.

The evolution of psychedelic-assisted therapy, neuromodulation techniques, and mood tracking through wearable technology will be additional transformative ways of treating patients. Moreover, block chain-based prescription tracking, digital mental health platforms, and AI-augmented early warning systems of mood episodes will advance proactive care frameworks.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with FDA, EMA, and psychiatric drug safety protocols for mood stabilizers and antipsychotics. |

| Drug Development & Treatment Options | Expansion of atypical antipsychotics, mood stabilizers, and antidepressant augmentation strategies. |

| Industry Adoption | Growth in long-acting injectable (LAIs) for bipolar disorder, combination therapies, and cognitive behavioural therapy (CBT) integration. |

| Personalized & AI-Driven Treatment | Limited personalization; reliance on trial-and-error medication approaches. |

| Market Competition | Dominated by pharmaceutical giants, psychiatry-focused biotech firms, and mental health service providers. |

| Market Growth Drivers | Growth fuelled by mental health awareness, tele psychiatry expansion, and rising diagnosis rates. |

| Sustainability and Accessibility | Early efforts in generic bipolar medications and telehealth accessibility. |

| Integration of AI & Digital Health | Emerging AI applications in diagnostic support and medication adherence tracking. |

| Advancements in Treatment Technologies | Introduction of non-invasive brain stimulation, wearable mental health trackers, and digital CBT platforms. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations on personalized psychiatry, psychedelic-assisted therapy approvals, and AI-driven treatment optimization. |

| Drug Development & Treatment Options | Introduction of AI-designed molecules, gut microbiome-based treatments, and precision medicine approaches. |

| Industry Adoption | Widespread use of neuromodulation, transcranial magnetic stimulation (TMS), and digital therapeutics for bipolar disorder management. |

| Personalized & AI-Driven Treatment | AI-driven mood prediction algorithms, biomarker-based drug matching, and personalized psychiatric interventions. |

| Market Competition | Increased competition from digital mental health start-ups, AI-powered drug discovery firms, and wearable health monitoring companies. |

| Market Growth Drivers | Expansion driven by neuroinformatics, digital health tracking, and data-driven psychiatric treatment models. |

| Sustainability and Accessibility | Large-scale adoption of block chain-enabled prescription monitoring, affordable AI-driven therapy platforms, and universal access to psychiatric care. |

| Integration of AI & Digital Health | AI-powered mood stabilization monitoring, VR-based therapy solutions, and smart drug delivery systems. |

| Advancements in Treatment Technologies | Evolution of personalized psychiatric implants, AI-driven therapy chatbots, and neurostimulation-integrated medication plans. |

The United States is the largest market for bipolar disorder drugs and therapeutics due to the high prevalence of cases followed by rising mental health awareness campaigns and growth in psychiatric drug formulations. Market growth is being driven by the presence of leading pharmaceutical companies and strong government support for mental health initiatives. Moreover, the growing acceptance of precision medicine and targeted therapies is fuelling progress in offerings novel mood stabilizers, antipsychotics, and adjunctive therapies.

Telemedicine and digital mental health platforms are also increasing access to bipolar disorder treatments particularly in historically underserved areas. The convergence of artificial intelligence with digital biomarkers in psychiatry is anticipated to improve the effectiveness and monitoring of treatment response.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

The UK bipolar disorder drugs and treatment markets are anticipated to maintain usage due to governmental initiatives strengthening mental health services and utilizing more NHS funded programs. Increasing awareness about bipolar disorders and stigmatization of mental health disorders are complementing the demand for effective pharmacological and therapeutic interventions.

Moreover, prolonged acting injectable antipsychotics and combine therapies are amplifying the patient compliance and outcomes. Digital mental health platforms including mobile apps for mood tracking and remote consultations are increasing patient access to care, too. Ongoing investment in psychiatric research and development is likely to fuel continued market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.3% |

The countries with the maximum share in the bipolar disorder drugs and treatment market currently in the European Union are Germany, France, and Italy which are spearheading the bipolar disorder drugs and treatment market in Europe owing to well-developed healthcare infrastructure, growing investments in mental health research, and better access of psychiatric drugs. The EU's focus on early intervention strategies within the region and its commitment to community-based mental health services are driving the demand for Product that can provide effective treatment options.

Advancements in biologics and mechanism-based novel psychiatric drugs are also changing treatment paradigms for bipolar disease. The rise of tele psychiatry services and AI-driven mental health diagnostics are helping bring care to more people. Growing regulatory backing for expediting drug approvals and patient-centric treatment networks is projected to fuel the market growth further.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 2.4% |

The Japan Bipolar Disorder Drugs and Treatment Market is anticipated to witness a robust growth owing to increasing awareness about mental health disorders, government efforts to promote psychiatric treatment in Japan and increasing pharmaceutical R&D. The country’s aging population and spiking rate of stress-related illnesses are driving demand for mood stabilizers and anti-psychotic medications.

Moreover, the global rise of outpatient mental health services and the growing practice of cognitive-behavioural therapy as an adjunct to treatment are ringing positive bells for patients. Japan’s pharmaceutical companies are investing heavily in developing next-generation psychotropic drugs that are cleaner and more effective. AI-augmented mental health diagnostics are also fostering prevention and intervention.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.2% |

In South Korea, the scale of bipolar disorder drugs and treatment market is dominated by the increasing government budget for mental health programs, rising patients with mood disorder, and enhancing focus on psychiatric research. The emphasis in the country on such digital mental health solutions as A.I. powered therapy platforms and virtual psychiatric consultations is helping facilitate care.

Moreover, growing insurance coverage for psychiatric medications and treatments are expected to boost market growth. The expectation that the innovation of pharmacogenomics and precision medicine will provide new approaches to customize treatment success in patients with bipolar disorder (BPD) is well established. Adoption of long-term treatment plans coupled with government initiatives for patient compliance is further driving market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.6% |

Due to their focus on long-term management of bipolar disorder, the Mood Stabilizers and Antipsychotic Drugs segments dominate the Bipolar Disorder Drugs and Treatment market. These are critical to managing mood swings and preventing relapse episodes and enhancing the quality of life for patients suffering from bipolar disorders. United States Now, as global mental health awareness continues to expand and socioeconomic factors promote psychiatric treatments, the demand for advanced pharmaceutical solutions rises worldwide.

Because the drugs that improve symptoms have also been shown to prevent severe mood changes, minimize mania and depression, and help keep patients well in the long term, mood stabilizers have become widely used because the efficacy of these medications has been proven. In contrast to short-term symptomatic treatment, mood stabilizers target the underlying neurological imbalances; hence, they are also preferred treatment modalities in both acute and maintenance settings.

The rising cases of bipolar disorders, moreover, its growing burden among adults and middle-aged population have sped up market adoption. It has been found that a majority of bipolar disorder patients, over 60%, are prescribed with the mood stabilizer drugs as their first-line treatment with proven effectiveness in the stabilization of extreme highs and lows of mood.

The range of high-performance mood stabilizing drugs, such as lithium-based drugs, extended-release valproates, and atypical antiepileptic agents, has bolstered the market demand, helping to ensure better symptom control and adherence to treatment.

Adoption has been further bolstered by the integration of immersive VR/AR technology along with ever-evolving AI-driven psychiatric monitoring platforms, which include predictive mood episode analysis, medication response tracking, and automated dose adjustment recommendations to ensure better patient outcomes and long-term disorder control.

Next-generation mood stabilizers with better pharmacokinetics and minimal side effects, as well as improved neuroprotective effects, have facilitated optimal growth in the market with better tolerability and personalization of treatment for patients.

AI enabled therapy chatbots, real-time mood logging applications and tele psychiatry, among others, have further driven the uptake of digital mental health solutions, thereby supporting market growth by increasing access to treatments for bipolar disorder.

Although it is associated with benefits such as lowering inflow of neurotransmitters which stabilizes mood, decreases relapses and improving patient pipeline adherence, the mood stabilizer segment is confronted with challenges including lithium toxicity concerns, long-term side effects issues, differences in patient-response.

Nonetheless, emerging inventions including artificial intelligence (AI)-driven medication response analytics, biomarker-based psychiatric treatment customization, and neuroplasticity-focused mood stabilizers are enhancing efficacy, safety, and patient engagement quality, thus facilitating uninterrupted mood stabilizing pharmaceutical market growth worldwide.

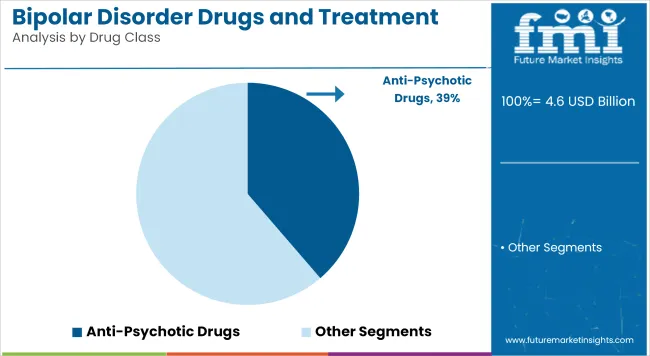

The total bipolar disorder meds market is monopolized by antipsychotic drugs, which are expected to dominate this market segment through 2030 due to the need for these drugs in alleviating severe manic episodes and reducing psychotic symptoms, shortening time to relief by preventing manic episodes from going too far. While traditional mood stabilizers take longer to work; antipsychotic medications act rapidly, rendering them as a cornerstone for acute intervention and crisis management in patients with bipolar disorder.

Demand for rescue psychiatric drugs, especially in emergency psychiatric settings and crisis intervention, has driven uptake. Research shows that more than 55% of bipolar patients with severe mania or mixed episodes take antipsychotics, given their ability to rapidly stabilize mood swings.

The popularity of atypical antipsychotic agents comprising second-generation dopamine-serotonin receptor modulators with lower propensity for extrapyramidal side effects has reinforced market demand as these newer agents are more advantageous in terms of patient compliance and treatment dropout rates.

The implementation of AI-optimized psychiatric diagnostic instruments, with instant symptom severity assessment, digital mood assessment, and machine-learning-based drug response forecasting, has contributed to even greater adoption, allowing for improved patient monitoring and therapeutic accuracy.

The continued development of first-in-class mechanism-of-action antipsychotic agents with glutamate modulating agents, partial dopamine agonists, and neuroinflammation targeting agents has been well-optimized and continues to offer strong market growth given improved efficacy and symptom coverage.

Implementation of patient-centric therapeutic approaches including personalized therapy planning, combined mood stabilizer-antipsychotic regimens, and adjunct psychosocial interventions have further stirred market growth for improved holistic management of bipolar disorder patients.

The antipsychotic drug segment has benefits in the treatment of acute mania, rapid stabilization of symptoms, and control of crises but faces challenges that include metabolic side effects, weight gain, and increased risk for lack of medication adherence.

But, new developments in AI-driven psychiatric risk evaluation, next-gen antipsychotic forms with little to no adverse effects and personalized pharmacogenomics-guided drug selection methods play a key role in enhancing treatment outcomes, safety and long-term adherence rates which is fertile ground for further growth of antipsychotic-related drugs with bipolar disorder worldwide.

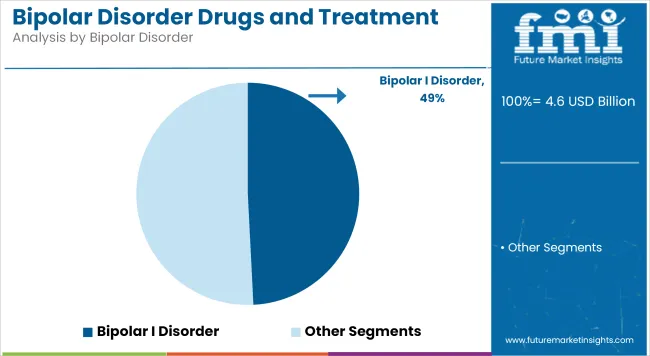

As more psychiatrist diversify their therapeutic approach with personalized treatment methodologies, the Bipolar I and Bipolar II disorders segments represent considerable shares in the Bipolar Disorder Drugs and Treatment market. How has recent findings on the bipolar disorder subtypes influenced treatment approaches customized medication courses, patient-specific psychiatric management.

Due to the severity of manic episodes, high rates of relapse, and increased risk of hospitalization, Bipolar I Disorder has seen strong market adoption. Bipolar I therefore often does not respond well to treatment compared to other forms of bipolar disorder, so well-defined drug-based treatment strategies are critically important.

And the growing need for intensive psychiatric supervision, especially in high-risk manic episodes, has driven adoption. The long-term efficacy of combined treatment with lithium and an antipsychotic agent has been assessed in many studies, and it has been shown that two thirds of patients with Bipolar I disorder may require a combination therapy to achieve a good control of mood episodes, which includes prevention of hospitalization.

Additionally, the growing demand for Bipolar I treatment regimen improvements, including AI-driven mood episode tracking, in-the-moment psychiatric risk assessment tools, and digital medication adherence support, have further bolstered this market, ensuring patient care and therapeutic continuity.

Incredible strides have been made in the management of Bipolar I, with clear benefits to the management of severe episodes, suicide risk, global symptoms burden, etc., yet this treatment segment remains characterized by complex polypharmacy, increased overall side effects burden and compliance challenges, especially in high-risk patients. Nevertheless, ground-breaking advancements like AI-powered treatment adherence prediction technology, smart psychiatric wearables for immediate mood tracking, and novel long-acting injectable bipolar medications are only enhancing safety, convenience, and treatment effectiveness, all while fostering ongoing growth for the management of Bipolar I disorder around the globe.

Bipolar II’s hypomanic episodes can often result in missed diagnoses or ineffective treatment, as opposed to the manic episodes common in Bipolar I. Increasing demand for early-stage intervention and personalized psychiatric care, especially among young adults and first-time bipolar disorder patients, has driven adoption. Research shows 60% of Bipolar II patients respond to combined treatment.

The Bipolar II treatment space benefits from benefits in early intervention, the management of patients with milder mood episodes, as well as reduced risk of hospitalization, yet there remains a considerable challenge within the space with underdiagnoses, a high relapse rate and some patient subgroups experiencing treatment resistance.

However, the continuous market expansion of Bipolar II disorder treatments worldwide is supported with recent innovations such as AI-based psychiatric screening, personalized pharmacotherapy selection systems, and digital behavioural therapy integration systems improving diagnostic accuracy, medication adherence, and patient outcomes.

Factors such as the rising prevalence of bipolar disorder in the world, increasing awareness about mental health, advancements in both pharmacological and non-pharmacological treatment options are driving the market for bipolar disorder drugs and treatment. As research expands in new therapeutics, and personalized treatment approaches, the market continues to grow steadily.

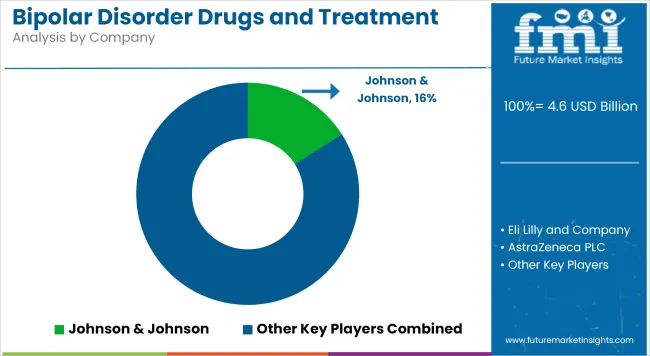

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Johnson & Johnson | 12-16% |

| Eli Lilly and Company | 10-14% |

| AstraZeneca PLC | 8-12% |

| GlaxoSmithKline plc | 6-10% |

| Otsuka Pharmaceutical Co., Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson | Develops mood stabilizers and atypical antipsychotics for bipolar disorder management. |

| Eli Lilly and Company | Specializes in second-generation antipsychotics and adjunctive therapies for bipolar treatment. |

| AstraZeneca PLC | Offers long-acting injectable formulations for improved bipolar disorder management. |

| GlaxoSmithKline plc | Focuses on lithium-based mood stabilizers and innovative psychiatric medications. |

| Otsuka Pharmaceutical Co., Ltd. | Develops novel antipsychotic and mood-regulating drugs in collaboration with leading research institutes. |

Key Company Insights

Johnson & Johnson (12-16%) Johnson & Johnson is a key player in bipolar disorder treatment, offering a range of atypical antipsychotics and combination therapies.

Eli Lilly and Company (10-14%) Eli Lilly focuses on advanced pharmacological treatments, including second-generation antipsychotics for bipolar disorder.

AstraZeneca PLC (8-12%) AstraZeneca enhances its presence in the market with long-acting injectable formulations for improved patient adherence.

GlaxoSmithKline plc (6-10%) GSK is a leader in lithium-based mood stabilizers and innovative psychiatric drugs for bipolar disorder management.

Otsuka Pharmaceutical Co., Ltd. (4-8%) Otsuka Pharmaceutical collaborates with major research institutions to develop novel mood-regulating therapies.

Other Key Players (45-55% Combined) Several pharmaceutical and biotech companies contribute to the growth of the bipolar disorder drugs and treatment market. These include:

The overall market size for the Bipolar Disorder Drugs and Treatment market was USD 5.3 Billion in 2025.

The Bipolar Disorder Drugs and Treatment market is expected to reach USD 6.8 Billion in 2035.

The demand for bipolar disorder drugs and treatments will be driven by the increasing prevalence of mental health disorders, rising awareness about bipolar disorder, advancements in pharmaceutical research, and the growing availability of personalized treatment options.

The top 5 countries driving the development of the Bipolar Disorder Drugs and Treatment market are the USA, Germany, China, Japan, and the UK.

The Mood Stabilizers segment is expected to command a significant share over the assessment period.

Table 01: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 02: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Bipolar Disorder

Table 03: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 04: Global Market Analysis 2017 to 2022 and Forecast 2023 to 2033, by Region

Table 05: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 06: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 07: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Bipolar Disorder

Table 08: North America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 09: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 10: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 11: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Bipolar Disorder

Table 12: Latin America Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 13: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 14: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 15: Europe Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Bipolar Disorder

Table 16: Europe Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 17: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 18: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 19: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Bipolar Disorder

Table 20: East Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 21: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 22: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 23: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Bipolar Disorder

Table 24: South Asia Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 25: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 26: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 27: Oceania Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Bipolar Disorder

Table 28: Oceania Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Table 29: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Country

Table 30: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Drug Class

Table 31: Middle East & Africa Market Analysis 2017 to 2022 and Forecast 2023 to 2033by Bipolar Disorder

Table 32: Middle East & Africa Market Value (US$ Million) Analysis 2017 to 2022 and Forecast 2023 to 2033, by Distribution Channel

Figure 01: Global Market Value (US$ Million) Analysis, 2017 to 2022

Figure 02: Global Market Forecast & Y-o-Y Growth, 2023 to 2033

Figure 03: Global Market Absolute $ Opportunity (US$ Million) Analysis, 2022 to 2033

Figure 04: Global Market Value Share (%) Analysis 2023 and 2033, by Drug Class

Figure 05: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Drug Class

Figure 06: Global Market Attractiveness Analysis 2023 to 2033, by Drug Class

Figure 07: Global Market Value Share (%) Analysis 2023 and 2033, by Bipolar Disorder

Figure 08: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Bipolar Disorder

Figure 09: Global Market Attractiveness Analysis 2023 to 2033, by Bipolar Disorder

Figure 10: Global Market Value Share (%) Analysis 2023 and 2033, by Distribution Channel

Figure 11: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Distribution Channel

Figure 12: Global Market Attractiveness Analysis 2023 to 2033, by Distribution Channel

Figure 13: Global Market Value Share (%) Analysis 2023 and 2033, by Region

Figure 14: Global Market Y-o-Y Growth (%) Analysis 2022-2033, by Region

Figure 15: Global Market Attractiveness Analysis 2023 to 2033, by Region

Figure 16: North America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 17: North America Market Value (US$ Million) Forecast, 2023-2033

Figure 18: North America Market Value Share, by Drug Class (2023 E)

Figure 19: North America Market Value Share, by Bipolar Disorder (2023 E)

Figure 20: North America Market Value Share, by Distribution Channel (2023 E)

Figure 21: North America Market Value Share, by Country (2023 E)

Figure 22: North America Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 23: North America Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 24: North America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 25: North America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 26: USA Market Value Proportion Analysis, 2022

Figure 27: Global Vs. USA Growth Comparison

Figure 28: USA Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 29: USA Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 30: USA Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 31: Canada Market Value Proportion Analysis, 2022

Figure 32: Global Vs. Canada. Growth Comparison

Figure 33: Canada Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 34: Canada Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 35: Canada Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 36: Latin America Market Value (US$ Million) Analysis, 2017 to 2022

Figure 37: Latin America Market Value (US$ Million) Forecast, 2023-2033

Figure 38: Latin America Market Value Share, by Drug Class (2023 E)

Figure 39: Latin America Market Value Share, by Bipolar Disorder (2023 E)

Figure 40: Latin America Market Value Share, by Distribution Channel (2023 E)

Figure 41: Latin America Market Value Share, by Country (2023 E)

Figure 42: Latin America Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 43: Latin America Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 44: Latin America Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness Analysis by Country, 2023 to 2033

Figure 46: Mexico Market Value Proportion Analysis, 2022

Figure 47: Global Vs Mexico Growth Comparison

Figure 48: Mexico Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 49: Mexico Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 50: Mexico Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 51: Brazil Market Value Proportion Analysis, 2022

Figure 52: Global Vs. Brazil. Growth Comparison

Figure 53: Brazil Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 54: Brazil Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 55: Brazil Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 56: Argentina Market Value Proportion Analysis, 2022

Figure 57: Global Vs Argentina Growth Comparison

Figure 58: Argentina Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 59: Argentina Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 60: Argentina Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 61: Europe Market Value (US$ Million) Analysis, 2017 to 2022

Figure 62: Europe Market Value (US$ Million) Forecast, 2023-2033

Figure 63: Europe Market Value Share, by Drug Class (2023 E)

Figure 64: Europe Market Value Share, by Bipolar Disorder (2023 E)

Figure 65: Europe Market Value Share, by Distribution Channel (2023 E)

Figure 66: Europe Market Value Share, by Country (2023 E)

Figure 67: Europe Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 68: Europe Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 69: Europe Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness Analysis by Country, 2023 to 2033

Figure 71: UK Market Value Proportion Analysis, 2022

Figure 72: Global Vs. UK Growth Comparison

Figure 73: UK Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 74: UK Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 75: UK Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 76: Germany Market Value Proportion Analysis, 2022

Figure 77: Global Vs. Germany Growth Comparison

Figure 78: Germany Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 79: Germany Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 80: Germany Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 81: Italy Market Value Proportion Analysis, 2022

Figure 82: Global Vs. Italy Growth Comparison

Figure 83: Italy Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 84: Italy Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 85: Italy Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 86: France Market Value Proportion Analysis, 2022

Figure 87: Global Vs France Growth Comparison

Figure 88: France Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 89: France Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 90: France Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 91: Spain Market Value Proportion Analysis, 2022

Figure 92: Global Vs Spain Growth Comparison

Figure 93: Spain Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 94: Spain Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 95: Spain Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 96: Russia Market Value Proportion Analysis, 2022

Figure 97: Global Vs Russia Growth Comparison

Figure 98: Russia Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 99: Russia Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 100: Russia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 101: BENELUX Market Value Proportion Analysis, 2022

Figure 102: Global Vs BENELUX Growth Comparison

Figure 103: BENELUX Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 104: BENELUX Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 105: BENELUX Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 106: East Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 107: East Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 108: East Asia Market Value Share, by Drug Class (2023 E)

Figure 109: East Asia Market Value Share, by Bipolar Disorder (2023 E)

Figure 110: East Asia Market Value Share, by Distribution Channel (2023 E)

Figure 111: East Asia Market Value Share, by Country (2023 E)

Figure 112: East Asia Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 113: East Asia Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 114: East Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 115: East Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 116: China Market Value Proportion Analysis, 2022

Figure 117: Global Vs. China Growth Comparison

Figure 118: China Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 119: China Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 120: China Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 121: Japan Market Value Proportion Analysis, 2022

Figure 122: Global Vs. Japan Growth Comparison

Figure 123: Japan Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 124: Japan Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 125: Japan Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 126: South Korea Market Value Proportion Analysis, 2022

Figure 127: Global Vs South Korea Growth Comparison

Figure 128: South Korea Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 129: South Korea Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 130: South Korea Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 131: South Asia Market Value (US$ Million) Analysis, 2017 to 2022

Figure 132: South Asia Market Value (US$ Million) Forecast, 2023-2033

Figure 133: South Asia Market Value Share, by Drug Class (2023 E)

Figure 134: South Asia Market Value Share, by Bipolar Disorder (2023 E)

Figure 135: South Asia Market Value Share, by Distribution Channel (2023 E)

Figure 136: South Asia Market Value Share, by Country (2023 E)

Figure 137: South Asia Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 138: South Asia Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 139: South Asia Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia Market Attractiveness Analysis by Country, 2023 to 2033

Figure 141: India Market Value Proportion Analysis, 2022

Figure 142: Global Vs. India Growth Comparison

Figure 143: India Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 144: India Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 145: India Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 146: Indonesia Market Value Proportion Analysis, 2022

Figure 147: Global Vs. Indonesia Growth Comparison

Figure 148: Indonesia Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 149: Indonesia Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 150: Indonesia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 151: Malaysia Market Value Proportion Analysis, 2022

Figure 152: Global Vs. Malaysia Growth Comparison

Figure 153: Malaysia Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 154: Malaysia Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 155: Malaysia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 156: Thailand Market Value Proportion Analysis, 2022

Figure 157: Global Vs. Thailand Growth Comparison

Figure 158: Thailand Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 159: Thailand Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 160: Thailand Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 161: Oceania Market Value (US$ Million) Analysis, 2017 to 2022

Figure 162: Oceania Market Value (US$ Million) Forecast, 2023-2033

Figure 163: Oceania Market Value Share, by Drug Class (2023 E)

Figure 164: Oceania Market Value Share, by Bipolar Disorder (2023 E)

Figure 165: Oceania Market Value Share, by Distribution Channel (2023 E)

Figure 166: Oceania Market Value Share, by Country (2023 E)

Figure 167: Oceania Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 168: Oceania Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 169: Oceania Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 170: Oceania Market Attractiveness Analysis by Country, 2023 to 2033

Figure 171: Australia Market Value Proportion Analysis, 2022

Figure 172: Global Vs. Australia Growth Comparison

Figure 173: Australia Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 174: Australia Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 175: Australia Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 176: New Zealand Market Value Proportion Analysis, 2022

Figure 177: Global Vs New Zealand Growth Comparison

Figure 178: New Zealand Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 179: New Zealand Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 180: New Zealand Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 181: Middle East & Africa Market Value (US$ Million) Analysis, 2017 to 2022

Figure 182: Middle East & Africa Market Value (US$ Million) Forecast, 2023-2033

Figure 183: Middle East & Africa Market Value Share, by Drug Class (2023 E)

Figure 184: Middle East & Africa Market Value Share, by Bipolar Disorder (2023 E)

Figure 185: Middle East & Africa Market Value Share, by Distribution Channel (2023 E)

Figure 186: Middle East & Africa Market Value Share, by Country (2023 E)

Figure 187: Middle East & Africa Market Attractiveness Analysis by Drug Class, 2023 to 2033

Figure 188: Middle East & Africa Market Attractiveness Analysis by Bipolar Disorder, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness Analysis by Distribution Channel, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness Analysis by Country, 2023 to 2033

Figure 191: GCC Countries Market Value Proportion Analysis, 2022

Figure 192: Global Vs GCC Countries Growth Comparison

Figure 193: GCC Countries Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 194: GCC Countries Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 195: GCC Countries Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 196: Türkiye Market Value Proportion Analysis, 2022

Figure 197: Global Vs. Türkiye Growth Comparison

Figure 198: Türkiye Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 199: Türkiye Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 200: Türkiye Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 201: South Africa Market Value Proportion Analysis, 2022

Figure 202: Global Vs. South Africa Growth Comparison

Figure 203: South Africa Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 204: South Africa Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 205: South Africa Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Figure 206: North Africa Market Value Proportion Analysis, 2022

Figure 207: Global Vs North Africa Growth Comparison

Figure 208: North Africa Market Share Analysis (%) by Drug Class, 2022 & 2033

Figure 209: North Africa Market Share Analysis (%) by Bipolar Disorder, 2022 & 2033

Figure 210: North Africa Market Share Analysis (%) by Distribution Channel, 2022 & 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Opioid Use Disorder Treatment Industry Analysis by Opioid Antagonists and Opioid Agonists and Partial Agonists through 2035

Market Positioning & Share in the Opioid Use Disorder Treatment Sector

Alcohol Use Disorder Treatment Market Growth - Demand & Innovations 2025 to 2035

Cannabis Use Disorder Treatment Market – Trends & Innovations 2025 to 2035

Glioblastoma Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Substance Use Disorder Treatment Market Size and Share Forecast Outlook 2025 to 2035

GLP-1 Diabetes Treatment Drugs Market Size and Share Forecast Outlook 2025 to 2035

Frontotemporal Disorders Treatment Market Size and Share Forecast Outlook 2025 to 2035

Anxiety Disorders And Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Opioid Use Disorder Treatment Providers in Europe

Major Depressive Disorder (MDD) Treatment Market Analysis – Growth & Forecast 2025 to 2035

Generalized Anxiety Disorder Treatment Market Insights by Drug Class, Therapies, Distribution Channel, and Region 2035

Lymphoproliferative Disorder Treatment Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

Lipoprotein Metabolism Disorders Treatment Market

Demand for Cannabis Use Disorder Treatment in Japan Size and Share Forecast Outlook 2025 to 2035

Post-Traumatic Stress Disorder (PTSD) Treatment Market Size and Share Forecast Outlook 2025 to 2035

Paediatric Neuropsychiatric Disorders Treatment Market

Human Growth Hormone (HGH) Treatment and Drugs Market Trends - Growth & Forecast 2025 to 2035

Australia & NZ Opioid Use Disorder Treatment Market Analysis – Size, Share & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA