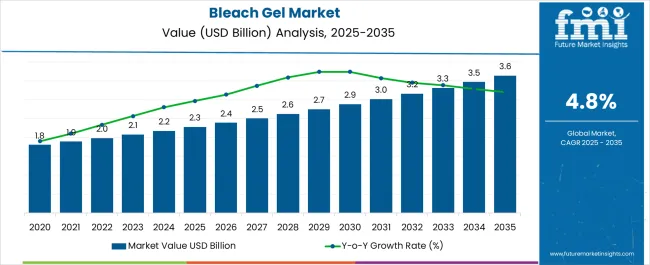

The Bleach Gel Market is estimated to be valued at USD 2.3 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Bleach Gel Market Estimated Value in (2025 E) | USD 2.3 billion |

| Bleach Gel Market Forecast Value in (2035 F) | USD 3.6 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The bleach gel market is experiencing stable growth, supported by rising demand for household cleaning and laundry care products. Current dynamics are being shaped by consumer preference for convenient, safe, and effective cleaning solutions. Growth has been reinforced by the increasing adoption of gel formulations, which offer ease of use, spill resistance, and enhanced stain removal properties compared to traditional liquid formats.

Expanding urban populations, heightened hygiene awareness, and rising disposable incomes are further supporting adoption across both developed and emerging regions. Manufacturers are investing in packaging innovation, formulation safety, and fragrance diversification to align with consumer expectations and regulatory requirements. Competitive intensity is being managed through branding strategies and product differentiation, while global distribution networks ensure broad market accessibility.

The future outlook highlights growth opportunities from premium product lines, eco-friendly packaging initiatives, and stronger retail penetration Collectively, these factors are expected to support consistent market expansion and sustained consumer acceptance across key regions.

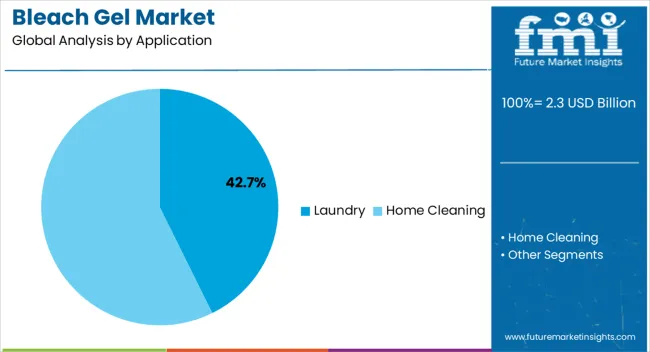

The laundry application segment, holding 42.70% of the application category, has been leading the market due to the widespread use of bleach gels in fabric care and stain removal. Market positioning has been reinforced by consumer reliance on convenient solutions that ensure effective cleaning without compromising fabric safety.

Growth has been supported by strong demand from both household and institutional users, where laundry hygiene remains a top priority. Adoption has also been strengthened by the ability of bleach gels to offer targeted application with reduced wastage compared to liquid alternatives.

Pricing competitiveness and availability across diverse retail formats have further sustained consumer preference Future performance is expected to be supported by increasing penetration of premium laundry care solutions, expansion in emerging economies, and continuous improvements in product formulations that address fabric safety and ease of use.

The regular fragrance segment, representing 51.30% of the fragrance category, has remained dominant due to consumer familiarity and wide acceptance across household applications. Its market share has been reinforced by affordability, consistent availability, and effectiveness in masking strong bleach odors.

Adoption has been supported by the broad appeal of regular scent profiles, which align with traditional cleaning habits across multiple consumer demographics. Reliability in performance and stability in formulation have further contributed to segment leadership.

Competitive strategies have focused on ensuring regular fragrances are consistently available across mass-market channels Growth potential is expected to remain strong as consumer trust in regular-scent bleach gels sustains repeat purchases, and manufacturers continue to balance fragrance consistency with performance optimization.

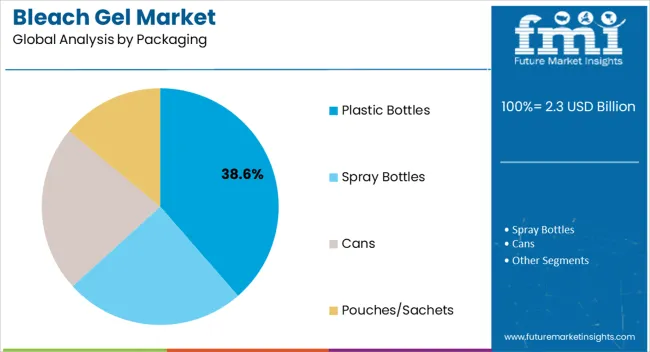

The plastic bottles segment, accounting for 38.60% of the packaging category, has been leading due to its cost-effectiveness, durability, and compatibility with bleach gel formulations. Market preference has been supported by widespread availability, ease of storage, and consumer convenience in handling and dispensing.

The segment has benefitted from established supply chains and scalability in mass production, making it the most widely adopted format in both retail and institutional channels. Safety features such as leak-proof caps and ergonomic designs have reinforced consumer trust and usability.

Market performance is expected to be further supported by advancements in lightweight bottle manufacturing and increasing adoption of recyclable plastics Sustainability trends are influencing producers to enhance eco-friendly packaging practices, ensuring that plastic bottles maintain relevance while evolving to meet environmental and regulatory requirements.

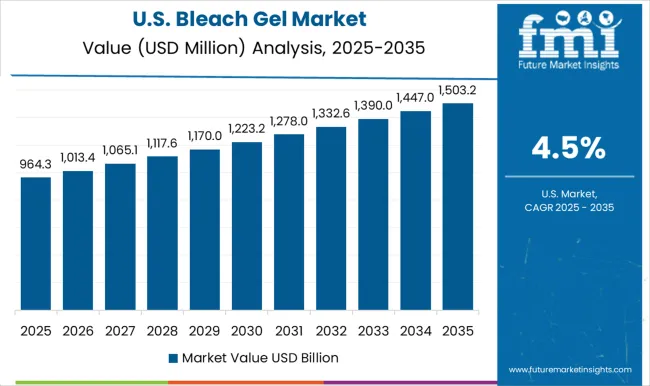

| Historical Value in 2025 | USD 1,965.30 million |

|---|

From 2020 to 2025, the bleach gel market witnessed substantial growth driven by heightened hygiene awareness amid global health concerns. Short term factors encompassed a surge in demand for effective disinfectants and cleaning agents, particularly during the COVID 19 pandemic.

Manufacturers responded by innovating bleach gels with stronger germ killing properties, promoting their effectiveness against viruses and bacteria. Consumer preferences shifted towards convenient, multipurpose bleach gels that offered cleaning and disinfection in one product.

| Market Estimated Size in 2025 | USD 2,065.50 million |

|---|

In the midterm, from 2025 to 2035, the market is poised to maintain steady growth, albeit at a slightly moderated pace. Ongoing concerns about hygiene and cleanliness, coupled with a continued emphasis on household disinfection, fuel the sustained demand for bleach gels.

Innovations focus on eco friendly formulations and packaging to align with growing sustainability trends. Manufacturers concentrate on enhancing stain removal capabilities while ensuring fabric and surface safety.

| Projected Market Value in 2035 | USD 3,364.50 million |

|---|

Long term projections from 2035 to 2035 reveal a mature market with consistent but slower growth. The market stabilizes as hygiene habits become ingrained, leading to a saturated demand for bleach gel products.

Industry players concentrate on further improving eco friendly solutions, introducing smarter packaging, and diversifying product variations to sustain market relevance. Strategic marketing campaigns highlighting convenience and advanced cleaning properties aim to maintain market share amidst evolving consumer preferences and emerging alternative cleaning solutions.

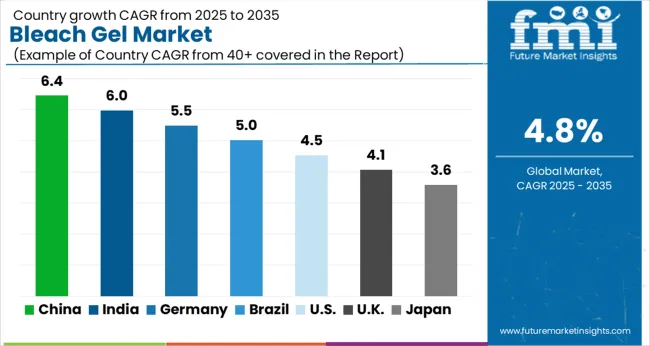

The bleach gel market in Canada is anticipated to maintain robust growth due to the following factors, registering a notable CAGR of 7.40% through 2035, driven by evolving consumer preferences and hygiene focused trends.

Canada is growing emphasis on hygiene standards, especially amid public health concerns like the COVID 19 pandemic, which fuels the demand for effective disinfectants, propelling the bleach gel market growth.

Increasing environmental consciousness among its consumers prompted a shift towards eco friendly cleaning solutions. Manufacturers innovate with biodegradable formulations, meeting the demand for sustainable bleach gel products.

Bleach gels offer multipurpose applications in its households, from surface disinfection to stain removal, aligning with consumers’ desire for convenient and effective cleaning solutions. This versatility contributes to sustained market growth and consumer preference for bleach gel products.

The bleach gel market in Australia is expected to rise at a CAGR of 6.60% through 2035 signifies an evolving landscape where customized formulations, innovative packaging, and health centric features play pivotal roles in consumer choice and market expansion.

Emerging trends in the Australia bleach gel market showcase a focus on tailor made formulations, catering to specific consumer needs, such as hypoallergenic variants and specialized scents for diverse preferences. The market witnesses a shift towards smart packaging solutions, incorporating user friendly designs and features like dosage control mechanisms or spill proof dispensers, enhancing convenience and safety.

Unexplored trends reveal a rising demand for bleach gels with added health oriented features, such as skin friendly compositions or added moisturizers, aligning with consumer preferences for products that prioritize safety and well being.

Rising environmental concerns propel a shift towards eco conscious bleach gel formulations, leveraging biodegradable ingredients and reduced chemical impact, appealing to eco aware consumers.

Adopting sustainable packaging materials, such as recyclable pouches and sachets, aligns with consumer demand for eco friendly solutions, enhancing product appeal, and minimizing environmental impact.

Integrating advanced technologies like stain specific formulas and smart dispensing systems cater to consumer preferences, elevating efficacy and user experience, driving market growth at a projected 5.30% CAGR through 2035.

Growing consumer interest in health oriented cleaning products pave the way for bleach gels infused with natural ingredients, promoting antibacterial properties while minimizing harsh chemical exposure.

Opportunities abound for brands offering customizable bleach gel solutions tailored to specific stain removal needs, enhancing consumer engagement and loyalty.

The burgeoning e commerce landscape presents an avenue for market growth, allowing brands to reach a wider audience and capitalize on the convenience driven purchasing behavior, contributing to the projected 5.10% CAGR through 2035.

Increasing consumer awareness and demand for eco friendly cleaning solutions drive the market towards biodegradable bleach gels and sustainable packaging, aligning with eco conscious preferences, and contributing to market expansion.

Brands leveraging personalized marketing approaches and emphasizing the efficacy of stain specific bleach gels to cater to diverse consumer needs, fostering product adoption and market growth.

Heightened concerns for cleanliness and hygiene post pandemic fuels the demand for powerful yet safe bleach gel formulations, positioning them as essential household products and propelling at a 5.00% CAGR through 2035.

| Category | Market Share in 2025 |

|---|---|

| Laundry | 62.10% |

| Pouches & Sachets | 19.90% |

Laundry is the premier choice in bleach gel applications due to its unmatched efficacy and user centric approach. With an unwavering commitment to quality and innovation, laundry has redefined stain removal, setting a new standard in the industry.

Its innovative formula ensures superior whitening power while safeguarding fabrics. Backed by extensive research and consumer insights, its seamless interface and customizable options resonate with diverse user needs, solidifying its dominance.

Anticipated to maintain a commanding 62.10% market share in 2025, its continuous advancements and customer centric focus exemplify its unparalleled position as the go to solution in the bleach gel domain.

Pouches & Sachets emerge as the pinnacle of packaging within the Bleach gel domain, heralded for their convenience and eco friendly design. Their compact, user friendly nature combines portability with optimal product preservation, ensuring hassle free usage and a reduced environmental footprint.

This innovative packaging solution reflects an evolving consumer preference for sustainability and practicality. Anticipated to command a substantial 19.90% market share in 2025, Pouches & Sachets offers a compelling blend of functionality and sustainability, aligning seamlessly with the desire of modern consumers for efficiency and environmental consciousness within the Bleach gel market segment.

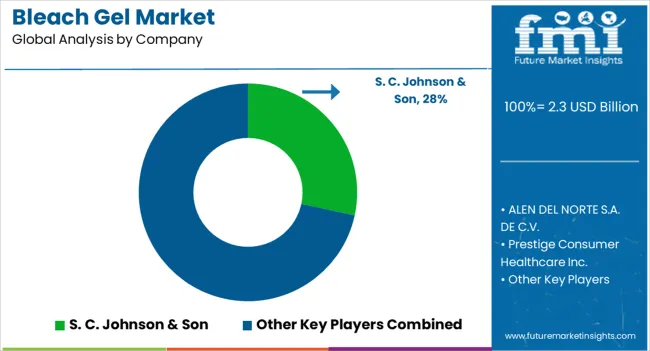

The bleach gel market exhibits a competitive landscape with key players like Clorox, Reckitt Benckiser, and Procter & Gamble leading the forefront. These companies boast a diversified product portfolio, offering bleach gels with advanced formulations, versatile applications, and strong brand recognition.

Regional players focus on niche segments, emphasizing eco friendly solutions and catering to specific consumer preferences. Intense competition fosters continuous innovation, driving R&D investments for safer, more effective, and environmentally conscious bleach gel products.

Strategic mergers, acquisitions, and collaborations enable market expansion, enhancing distribution networks and market penetration, while pricing strategies and marketing campaigns shape consumer perceptions in this dynamic and competitive industry.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 2.3 billion |

| Projected Market Valuation in 2035 | USD 3.6 billion |

| Value-based CAGR 2025 to 2035 | 4.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Application, Fragrance/Scent, Packaging, Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | ALEN DEL NORTE S.A. DE C.V.; S. C. Johnson & Son; Prestige Consumer Healthcare Inc.; Reckitt Benckiser Group plc.; Plus White |

The global bleach gel market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the bleach gel market is projected to reach USD 3.6 billion by 2035.

The bleach gel market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in bleach gel market are laundry and home cleaning.

In terms of fragrance/scent, regular segment to command 51.3% share in the bleach gel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bleaching Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Unbleached Softwood Kraft Pulp Market Size and Share Forecast Outlook 2025 to 2035

Unbleached Kraft Paperboard Market Analysis by Product type, Coating type, and End Use through 2025 to 2035

Unbleached Hardwood Kraft Pulp Market Demand & Growth 2024-2034

Unbleached Twill Tapes Market

Competitive Overview of Unbleached Softwood Kraft Pulp Companies

Leading Providers & Market Share in Food Bleaching Agent Industry

Solid Bleached Board Market

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Materials Market

Activated Bleaching Earth Market Growth - Trends & Forecast 2025 to 2035

Hypochlorite Bleaches Market Report - Growth, Demand & Forecast 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Gel Stent Market Size and Share Forecast Outlook 2025 to 2035

Gel-Type Strong Acid Cation Exchange Resin Market Size and Share Forecast Outlook 2025 to 2035

Gel Dryer Market Size and Share Forecast Outlook 2025 to 2035

Gel Warmers Market Size and Share Forecast Outlook 2025 to 2035

Gel Imaging Documentation Market Size and Share Forecast Outlook 2025 to 2035

Gel Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Gellan Gum Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA