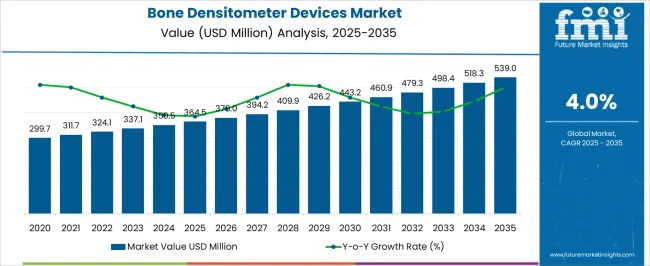

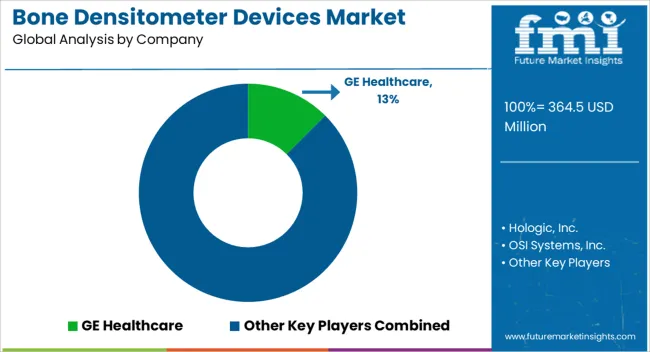

The Bone Densitometer Devices Market is estimated to be valued at USD 364.5 million in 2025 and is projected to reach USD 539.0 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Bone Densitometer Devices Market Estimated Value in (2025 E) | USD 364.5 million |

| Bone Densitometer Devices Market Forecast Value in (2035 F) | USD 539.0 million |

| Forecast CAGR (2025 to 2035) | 4.0% |

The bone densitometer devices market is gaining momentum, largely driven by the rising prevalence of osteoporosis and increasing awareness of bone health across aging populations. Healthcare publications and industry updates have highlighted the growing adoption of diagnostic imaging tools for early detection of bone density loss, particularly among postmenopausal women and elderly men.

The expansion of preventive healthcare programs and reimbursement support for bone density screening in several countries has enhanced accessibility to these devices. Technological advancements, including improved imaging precision, compact device designs, and digital integration with patient management systems, have further elevated adoption rates.

Investment disclosures from medical device companies have emphasized research into more portable and cost-effective solutions to address screening needs in outpatient and community healthcare settings. The market outlook remains positive, as hospitals, clinics, and diagnostic centers continue to prioritize osteoporosis detection and fracture risk assessment. Segmental growth is being steered by peripheral bone densitometers, DXA technology, and hospitals, each shaping adoption trends based on usability, clinical accuracy, and patient throughput.

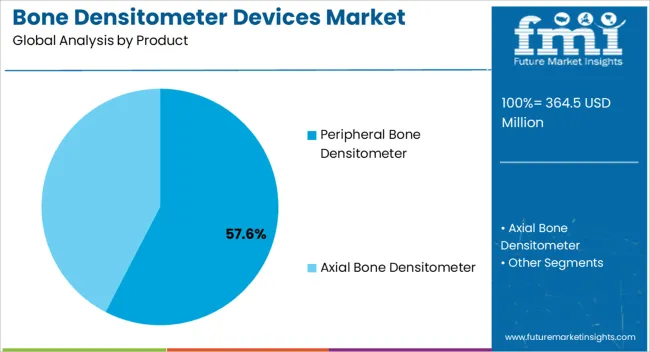

The Peripheral Bone Densitometer segment is projected to capture 57.60% of the bone densitometer devices market revenue in 2025, establishing itself as the leading product type. Growth of this segment has been underpinned by the affordability, portability, and ease of use of peripheral devices compared to central systems.

Healthcare providers have increasingly utilized peripheral densitometers for community-based screening programs, allowing broader access to osteoporosis diagnostics. Clinical adoption has been reinforced by shorter testing times and lower maintenance requirements, making these devices suitable for primary care settings.

Additionally, the ability of peripheral devices to serve as cost-efficient preliminary diagnostic tools has supported their role in identifying at-risk populations for referral to advanced imaging. With rising demand for preventive screening and decentralized healthcare services, the Peripheral Bone Densitometer segment is expected to maintain its market leadership.

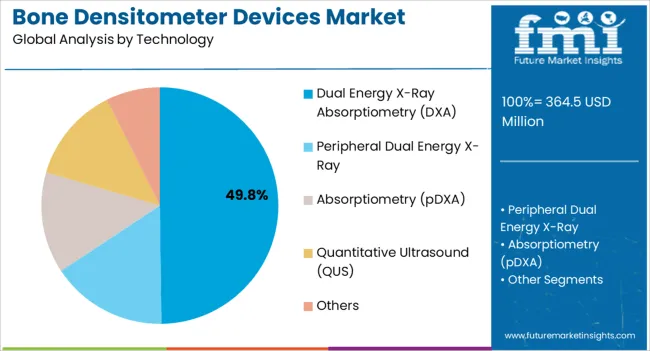

The Dual Energy X-Ray Absorptiometry (DXA) segment is projected to account for 49.80% of the bone densitometer devices market revenue in 2025, reflecting its position as the gold-standard technology for bone density measurement. DXA has been recognized for its high precision, reproducibility, and ability to provide detailed diagnostic information, which has driven its extensive use in both clinical and research settings.

Hospitals and diagnostic centers have prioritized DXA systems due to their capability to assess multiple skeletal sites, providing a more comprehensive evaluation of bone health and fracture risk. Technological enhancements, such as faster scan times, reduced radiation exposure, and integration with electronic health records, have further supported DXA’s widespread adoption.

Industry publications have also underscored the role of DXA in clinical trials and drug development, strengthening its relevance in the broader healthcare ecosystem. With ongoing emphasis on clinical accuracy and early osteoporosis detection, the DXA segment is expected to retain its prominence.

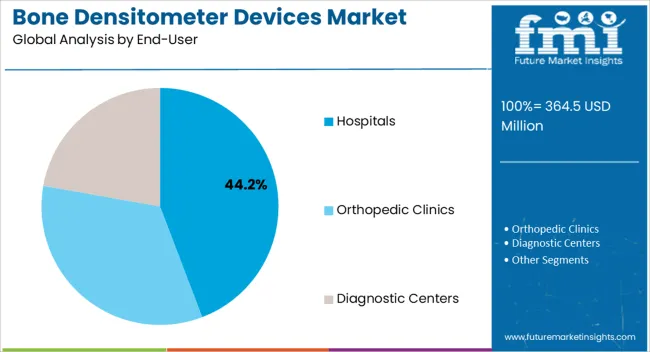

The Hospitals segment is projected to hold 44.20% of the bone densitometer devices market revenue in 2025, positioning itself as the dominant end-user category. Growth in this segment has been driven by hospitals’ capacity to invest in advanced diagnostic imaging systems and their central role in providing comprehensive osteoporosis care.

Hospitals have increasingly integrated bone densitometry into preventive health check-ups, orthopedic assessments, and fracture risk evaluations, ensuring steady utilization of these devices. Furthermore, patient preference for hospital-based diagnostics, due to access to multidisciplinary care and advanced imaging infrastructure, has reinforced this segment’s growth.

Annual reports and press releases from healthcare providers have highlighted expanding diagnostic departments and increased focus on women’s health programs, further boosting hospital-based adoption. With a steady flow of patients requiring routine bone health monitoring and the availability of skilled radiologists, hospitals are expected to remain the largest end-user segment in the market.

As per Future Market Insights (FMI), the sales of the bone densitometer devices market rose at a CAGR of 3.3% between 2020 and 2025. In 2025, the global bone densitometer devices market is expected to account for nearly 1% of the overall global orthopedic devices market accounting for around USD 42.2 billion.

The prevalence of knee osteoarthritis is one of the key factors fueling the growth in the bone densitometer devices market. As per the Lancet journal, the global incidence of knee osteoarthritis was 203 per 10,000 persons per year in the age criteria of 20 and above.

Moreover, there are approximately annual 350.5 million individuals with incident knee osteoarthritis (OA) worldwide in 2024. As the number of cases of knee OA increases, the demand for bone assessment devices is expected to surge.

According to The Lancet journal, the global incidence of knee osteoarthritis in people aged 20 and up was 203 per 10,000 per year. Furthermore, in 2024, there were roughly 350.5 million people globally with incident knee osteoarthritis. Hence, the rising prevalence of osteoarthritis will propel the growth in the bone densitometer devices market in the upcoming decade.

Further, a rise in favorable reimbursement policies by Medicare is expected to enhance the demand for bone densitometer devices, especially across the United States and India. Medicare provides coverage for the diagnosis of osteoporosis by bone densitometer, which is approved by the United States Food and Drug Administration (FDA). Medicare provides private health insurance plans for the treatment of osteoporosis, which is responsible for the growth of the bone densitometer devices market.

Besides this, key players are focusing on developing innovative product offerings such as low-dosage, patented narrow-fan beam technology. Hence, the growing need for excellent precision and accuracy, high-definition image quality, and faster scan for multiple clinical applications will boost the growth in the forthcoming decade. On the back of this, FMI estimated the global bone densitometer devices market to rise at a CAGR of 4.2% over the forecast period (2025 to 2035).

| Category | Product |

|---|---|

| Leading Segment | Axial |

| Market Share | 69.2 |

| Category | End User |

|---|---|

| Leading Segment | Hospitals |

| Market Share | 64.6% |

The tabular information shown reveals the complex structure of a market segmented into different groups, each of which has certain subcategories and their corresponding proportional representation. The 'Axial' subcategory has a notable presence in the 'Product' section, holding a dominant share of 69.2% by 2035. This statistic emphasises how common 'Axial' is among the products under examination.

Similar to this, the subcategory 'Hospitals' appears as the main player in the 'End User' segmentation, accounting for a sizeable amount of roughly 64.6% by 2035. This number emphasises the important significance hospitals play among end users. Together, these numbers shed light on how subcategories are distributed within their segments, offering insightful information on the complex makeup of the larger market landscape.

Rising Initiatives to Raise Osteoporosis Awareness in Developing Economies to Boost Sales

The awareness regarding osteoporosis is less among people in both developed and developing countries. Hence, several NGOs are working to increase awareness about osteoporosis and the diagnosis of osteoporosis by bone densitometer devices. Public Health Foundation Enterprises (PHFE) is working to build awareness about osteoporosis in the USA, whereas Osteoporosis Foundation India (OFI) is also working in India for the same cause.

This attempt of NGOs about creating awareness regarding osteoporosis is expected to increase the demand for bone densitometer devices in the market. Over the last few decades, the development of bone densitometer devices with advanced features has increased. The bone densitometer devices can evaluate a strong relationship between bone density at virtually any skeletal site and the subsequent risk for fractures of the spine, hip, and forearm.

These advanced features of bone densitometer devices can raise the demand for the devices in the market. Thus, an increased offering by the leading players in the market for bone densitometer devices will create lucrative opportunities and propel the growth of this market.

Bone densitometer devices are costly, owing to which they are less affordable in low-economic countries. In low-economic countries, the preference for refurbished bone densitometer devices in hospitals and clinics is rising. This is expected to limit the growth in the market.

The cost of refurbished bone densitometer devices is 40% to 50% less than the new devices. This might decrease the revenue generated from these devices and hamper the growth of the bone densitometer devices market.

Dual-energy X-ray absorptiometry (DXA) is the most widely used technology in bone densitometer devices. However, this technology has some limitations such as it cannot distinguish between cortical and trabecular bones.

Furthermore, it cannot evaluate microstructural characteristics such as size, shape, and orientation of bone. This limitation of DXA technology of bone densitometer devices can restrain the growth of the bone densitometer devices market. These factors are expected to hamper revenue growth of the bone densitometer devices market over the forecast period.

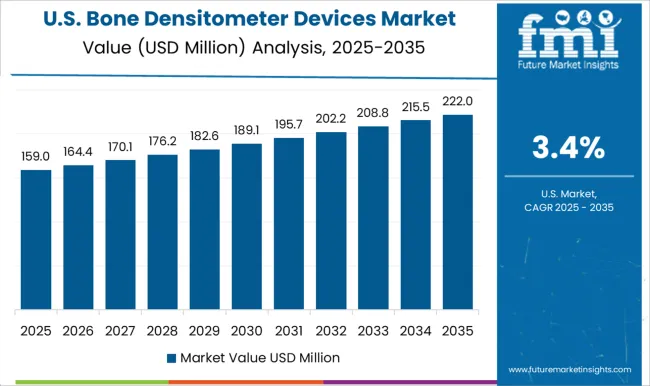

Over 7 out of 10 Bone Densitometer Devices Sales Come from the United States Market

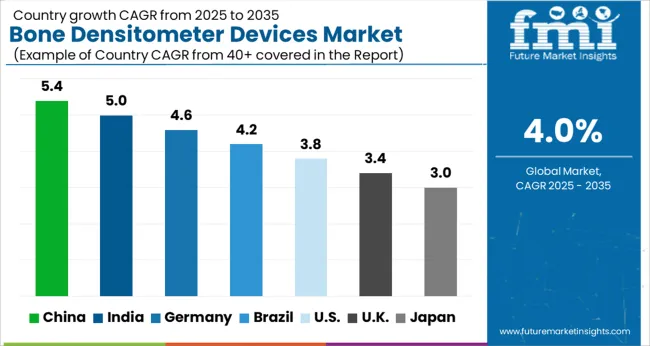

As per the study, the United States is expected to be the largest and most profitable market, holding a market share of around 73.2% in 2025. The United States bone densitometer devices market is expected to register a CAGR of 4.9% during the forecast period owing to a large patient population.

As per the CDC, 2024, osteoarthritis affects more than 364.5 million persons in the United States. According to Osteoarthritis Action Alliance, 2025, women account for 62% of patients with osteoarthritis. In terms of revenue contribution, the United States bone densitometer devices market share is anticipated to remain dominant during the forecast period due to the presence of vast growth opportunities for bone densitometer device manufacturers.

Favorable Initiatives to Raise Awareness of Bone Diseases to Spur Growth

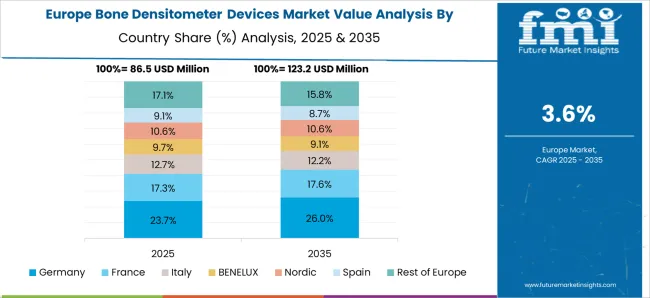

FMI estimates, Germany dominated the Europe bone densitometer devices market and accounted for around 22.9% in 2025. This is owing to the immediate availability of DXA scans and favorable reimbursement policies in the country making it a lucrative market for bone densitometer devices. Moreover, various awareness campaigns by NGOs on osteoporosis in this region are expected to drive the bone densitometer devices market in the upcoming years.

China is projected to be the most attractive market in the East Asia bone densitometer devices market and held a market share of around 32.4% in 2025. Growth is predicted to rise on the back of increased device usage among patients over 50 and among female patients nationwide. Demand in China's bone densitometer devices market is estimated to expand at a CAGR of 5.2% over the forecast period (2025 to 2035).

The axial bone densitometer device segment accounted for the dominant share of 69.0% in 2025. The segment is predicted to expand at a CAGR of 4.2% as the axial bone densitometer system is more accurate than the peripheral bone densitometer. Additionally, dual-energy X-ray absorptiometry (DXA) and quantitative computed tomography (QCT) are used in axial bone densitometers and are widely used for the diagnosis of the spinal or proximal femur.

Dual Energy X-Ray Absorptiometry Holds Over 3/5th of Global Revenue

Dual-energy X-ray absorptiometry (DXA) accounted for the leading share of around 64.2% in 2025. This is due to its advanced features such as improved resolution, image quality, and faster scanning. It is used only in the axial bone densitometer to measure the bone density of the spine and hip and is also used for the diagnosis of osteoporosis.

Further, in terms of end users, the hospital segment accounted for a 64.6% value share in 2025. Growth in the segment is due to a growing preference for hospital-based treatment for disease monitoring of cystic fibrosis, chronic renal disease, and osteoporosis, the majority of bone density scans are performed in hospitals.

Key players in the market are focused on enhancing product features to strengthen their position in the bone densitometer devices market, and also to expand their footprint in emerging markets. The key strategy adopted by manufacturers to lead in the market is the acquisition & distribution agreement of other companies to expand their business.

For instance

Recent Developments Observed by FMI

| Attribute | Details |

|---|---|

| Estimated Market Value 2025 | USD 364.5 million |

| Projected Market Size 2035 | USD 539.0 million |

| CAGR 2025 to 2035 | 4.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2011 to 2025 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Germany, United Kingdom, France, Italy, Spain, Russia, BENELUX, China, Japan, South Korea, India, Thailand, Indonesia, Malaysia, Australia, New Zealand, Turkey, South Africa, and GCC Countries |

| Key Segments Covered | Product, Technology, End User, and Region |

| Key Companies Profiled | GE Healthcare; Hologic, Inc.; OSI Systems, Inc.; Diagnostic Medical Systems Group; Swissray Global Healthcare Holding, Ltd.; BeamMed, Ltd.; Echolight S.P.A; Scanflex Healthcare AB; Medonica Co., Ltd.; Eurotec Systems S.r.l; AMPall Co., Ltd.; L’acn L’accessorio Nucleare S.R.L; Shenzhen XRAY Electric Co., Ltd.; YOZMA BMTech Co., Ltd.; Nanoomtech Co., Ltd.; Osteosys Corporation; FURUNO Electric Co., Ltd.; XinGaoYi Co., Ltd.; Anjue Medical Equipment; Trivitron Healthcare |

| Report Coverage | Market Forecast, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

The global bone densitometer devices market is estimated to be valued at USD 364.5 million in 2025.

The market size for the bone densitometer devices market is projected to reach USD 539.0 million by 2035.

The bone densitometer devices market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in bone densitometer devices market are peripheral bone densitometer and axial bone densitometer.

In terms of technology, dual energy x-ray absorptiometry (dxa) segment to command 49.8% share in the bone densitometer devices market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bone Morphogenetic Protein Market Size and Share Forecast Outlook 2025 to 2035

Bone Metabolism Test Market Size and Share Forecast Outlook 2025 to 2035

Bone Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Bone and Teeth Supplements Market Size and Share Forecast Outlook 2025 to 2035

Bone Growth Stimulators Market is segmented by product type, application and end user from 2025 to 2035

Bone Graft Fixation System Market – Growth & Demand 2025 to 2035

Bone and Joint Health Supplement Market Analysis by Product Type, Form and Sale Channels Through 2035

Bone Regeneration Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Fixation Plates Market Trends - Growth, Demand & Forecast 2025 to 2035

Bone Marrow Transplant Market is segmented by transplant type, disease indication, and end user from 2025 to 2035

Bone Grafts and Substitutes Market Overview - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Screw System Market Growth – Demand, Trends & Industry Forecast 2024-2034

Bone Distractors Market

Bone Cement Mixers Market

Bone Conduction Hearing Devices Market

Bone Densitometers Analysis by Product Type, by Technology and by End User through 2035

Oral Bone Implant Material Market Size and Share Forecast Outlook 2025 to 2035

Fish Bone Minerals Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Bioactive Bone Grafts Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA