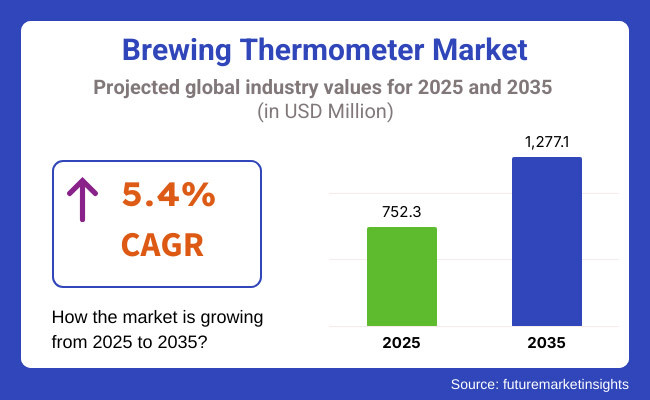

The brewing thermometer market is valued at USD 752.3 million in 2025 and is expected to reach USD 1,277.1 million by 2035, advancing at a 5.4 % CAGR throughout the forecast period.

Within the brewing thermometer market, the United States is the most lucrative country in 2025, accounting for about 34% of global sales thanks to its mature craft-beer ecosystem and stringent FDA/TTB calibration mandates. Asia-Pacific-led by China, Japan, and Australia-is poised to be the fastest-growing region from 2025 to 2035 as home-brewing culture and brewpub chains proliferate.

Labour shortages, precision-brewing demands, and tighter hygiene regulations are reshaping the brewing thermometer market. Operators increasingly insist on thermometers that pair with cloud dashboards, trigger automatic calibration reminders, and upload HACCP logs. Sustainability is another driver: manufacturers are rolling out low-power circuits, biodegradable casings, and rechargeable battery packs.

Price sensitivity among hobby brewers restrains premium adoption, but component cost declines are narrowing the analog-digital price gap. Key trends include IoT-ready probes, AI-based mash-profile recommendations, and multi-tool devices that measure both temperature and gravity.

Looking ahead, the brewing thermometer market will evolve toward predictive, self-optimising systems. AI controllers will analyse batch histories, automatically adjusting mash temperatures to boost extraction efficiency. UV-C self-sanitising probes and edge-analytics chips are likely to hit mainstream catalogues by 2030, cutting contamination risk and manual data entry.

Vendors offering open-API devices, Energy-Star-aligned power draws, and “hardware-as-a-service” rental plans are expected to capture outsized share as both nano-breweries and large facilities standardise on connected, data-rich brewing thermometers.

Digital models-equipped with Bluetooth/Wi-Fi, app dashboards, and ±0.1 °C accuracy-are hitting an adoption inflection point as craft brewers and hobbyists demand granular, remote-accessible data. Analog dial thermometers remain popular for their low cost and ruggedness, but their share is shrinking as digital price premiums compress. Manufacturers are now bundling smart probes with recipe-management software, accelerating replacement cycles in North America and Western Europe.

| Product Design | CAGR (2025 to 2035) |

|---|---|

| Digital Brewing Thermometers | 6.3 % |

The surge in at-home fermenters, spurred by lockdown hobby adoption and e-commerce kit availability, keeps home brewers the dominant application niche. They prefer compact, app-synced devices that store batch histories and push real-time alerts. Commercial craft breweries follow, prioritising AI-integrated probes that auto-log to quality-control systems.

| Application Segment | CAGR (2025 to 2035) |

|---|---|

| Home Brewing Enthusiasts | 5.9% |

| 2020 to 2024 (Market Evaluation) | 2025 to 2035 (Market Forecast) |

|---|---|

| The market experienced consistent growth fueled by the increase in home brewing culture and craft beer popularity. | The market will see faster adoption of smart and AI-enabled brewing thermometers. |

| Analog thermometers were the initial leaders, but digital thermometers became increasingly popular with their real-time monitoring feature. | Digital thermometers will further consolidate their leadership with improvements in cloud integration, wireless connectivity, and automated brewing systems. |

| The COVID-19 pandemic of 2020 to 2021 resulted in a home brewing boom, increasing demand for budget-friendly and easy-to-use brewing thermometers. | The market will move towards commercial brewing technology, with breweries embracing high-precision, AI-enabled thermometers to streamline production. |

| Major manufacturers concentrated on enhancing calibration precision and launching waterproof and rugged designs. | Manufacturers will focus on sustainability, creating environmentally friendly, battery-efficient, and solar-powered brewing thermometers. |

| North America and Europe dominated the market, with the USA contributing the highest share due to its robust craft beer culture. | Asia-Pacific will be the fastest-growing market, fueled by the growth of brewpubs and home brewing in China, Japan, and South Korea. |

| Historical brewing methods continued to guide product uptake, with most brewers using manual temperature control. | Automation and integration with IoT will become the norm, allowing for more accurate temperature control and minimizing human interference. |

| Industry partnerships resulted in the creation of multi-purpose brewing thermometers that included gravity measurement. | The market will witness strategic collaborations between brewing software companies and thermometer companies, facilitating smooth data monitoring and AI-based brewing suggestions. |

| The market CAGR continued to be moderate, with continuous investments in product development. | The market CAGR is expected to gain momentum, driven by technology-based product releases and the increasing demand for precision brewing. |

The USA dominates the market with more than 34% world share, powered by digital and intelligent temperature monitoring equipment. Brands such as ThermoWorks and Inkbird launched Wi-Fi and Bluetooth variants for real-time monitoring in 2024. High-precision instruments are in demand due to strict FDA and TTB regulations. Automation, AI-based brewing control, and cloud-based temperature-monitoring solutions will drive growth in the future.

The UK market is expanding, emphasizing regulatory compliance and innovation. ETI Ltd. has enhanced its digital temperature-monitoring devices to meet UKCA and EU standards. In 2024, automatic temperature logging and calibration gained traction. Post-Brexit trade policies increased demand for domestically produced devices. AI-integrated solutions, smart brewing analytics, and advanced temperature control technologies will drive future growth.

Germany's strict brewing regulations drive demand for calibrated temperature-monitoring devices. In 2024, Hanna Instruments introduced smart models with automation features, enhancing integration with brewing software. IoT-enabled devices gained popularity, minimizing temperature fluctuations. Future growth will focus on AI-powered temperature monitoring and cloud-based solutions as automation becomes a key industry trend.

Japan's market favors high-end digital temperature-monitoring devices with advanced calibration. Precision is critical, driving demand for lab-grade models. In 2024, brewers adopted automated logging and cloud storage solutions. Leading brands expanded AI-integrated devices for data-driven brewing. Future trends include predictive temperature control, automation, and enhanced sustainability in temperature monitoring technology.

China is a major manufacturer led by Inkbird. Demand for digital, cloud-connected temperature-monitoring devices is increasing. In 2024, new government regulations improved brewing equipment standards, boosting device quality and accuracy. High-tech models featuring Bluetooth, Wi-Fi, and AI monitoring gained popularity. Future growth will focus on smart sensors, automated controls, and AI-powered temperature management.

Government regulations significantly influence the market, focusing on food safety, quality control, and trade standards. Manufacturers must meet strict guidelines for calibration accuracy, material safety, and electronic certifications. Additionally, trade policies and tariffs impact global distribution and pricing, shaping market dynamics for brewing thermometers.

| Countries | Regulations Impacting the Market |

|---|---|

| United States | The FDA (Food and Drug Administration) and TTB (Alcohol and Tobacco Tax and Trade Bureau) regulate brewing equipment to ensure food safety. Digital thermometers must comply with FCC (Federal Communications Commission) standards for wireless transmission. |

| Canada | Health Canada mandates temperature-monitoring instruments used in food and beverage production to meet material safety standards. Measurement Canada enforces accuracy requirements for such devices. |

| United Kingdom | The Food Standards Agency (FSA) ensures that brewing equipment complies with food safety laws. Post-Brexit, UKCA (UK Conformity Assessed) marking is required for electronic temperature-monitoring instruments. |

| European Union | The CE (Conformité Européenne) Marking Directive requires all digital temperature-monitoring devices to meet EMC (Electromagnetic Compatibility) and RoHS (Restriction of Hazardous Substances) regulations. The EFSA (European Food Safety Authority) enforces hygiene and temperature measurement accuracy in brewing. |

| Australia | The Food Standards Australia New Zealand (FSANZ) mandates compliance with food safety laws. Wireless temperature-monitoring instruments must meet ACMA (Australian Communications and Media Authority) certification for electronic devices. |

| China | The State Administration for Market Regulation (SAMR) oversees product quality standards. Digital thermometers must comply with CCC (China Compulsory Certification) for electronics. |

| Japan | The Ministry of Health, Labour and Welfare (MHLW) regulates brewing equipment for food safety. Digital thermometers require TELEC (Telecom Engineering Center) certification for approval for wireless communication. |

| India | The Food Safety and Standards Authority of India (FSSAI) regulates temperature-monitoring instruments used in commercial brewing. The Bureau of Indian Standards (BIS) sets calibration and accuracy standards. |

Growth Opportunities

Expansion of Smart Brewing Technology

The demand for smart, AI-driven temperature-measuring devices is growing as brewers desire real-time monitoring, cloud connectivity, and automated brewing. Companies that invest in IoT-based devices will be at an advantage.

Growth in the Home Brewing Segment

The home brewing community continues to expand, especially in regions like North America and Europe, where craft beer culture is strong. To cater to home brewers, manufacturers can introduce affordable yet high-tech digital temperature-monitoring devices.

Emerging Markets in Asia-Pacific

There is a high demand for microbreweries and brewpubs, which in turn is driving demand for precision brewing equipment. Firms need to build their distribution networks and localize marketing efforts to capitalize on this growing market.

Strategic Recommendations

Focus on Digital Transformation

Business entities ought to focus on creating high-tech digital brewing thermometers with wireless capabilities, AI-driven analytics, and app compatibility to address contemporary brewing needs.

Enhance Product Affordability and Accessibility

While premium thermometers dominate the professional brewing sector, affordable digital models can help tap into the growing home brewing and small-scale brewery markets.

Expand Distribution via E-Commerce & Direct-to-Consumer Sales

Strengthening online sales channels, partnering with major e-commerce platforms, and offering direct-to-consumer options will increase market penetration, especially in emerging regions.

The market is actually part of the larger brewing equipment industry, which is itself a small subsector of the far larger food and beverage processing equipment market. Given the requirement for brewing equipment from the craft beer, home brewing, and commercial brewery sectors, the market is very closely intertwined. It is also highly dependent on the demand for the alcoholic beverage consumer market, technology advancements, and regulatory trends.

The market is majorly affected by global beer consumption trends, the disposable income available, and innovations in brewing technology. Strong growth in craft brewing, especially from North America and Europe, has led to increased demand for high-precision brewing thermometers as home brewers and commercial breweries both look for better temperature management. Greater online retail penetration has also seen greater access to more sophisticated brewing equipment across the world.

Economic factors such as inflation, raw material costs, and supply chain disruptions influence production and pricing. Automation and artificial intelligence-driven brewing technology will fuel future growth in the Asia-Pacific market. Sustainability developments, such as energy-efficient brewing tools, also play an active role in driving product development and growth.

The brewing thermometer market is competitive and fragmented, with established manufacturers and emerging players competing through technological innovation, strong distribution networks, and brand reputation across traditional and digital brewing equipment segments.

ThermoWorks Inc. (~18%)

ThermoWorks leads with high-accuracy digital thermometers, such as the well-known Thermapen series. Its emphasis on calibration precision and food safety compliance solidifies its hold in North America and Europe.

ETI Ltd. (Electronic Temperature Instruments) (~14%)

ETI is a premier European brand selling calibrated brewing thermometers. Its Bluetooth offerings and its compliance with EU food safety regulations fortify its strong market position.

Inkbird Tech. (~12%)

Inkbird dominates the home brewing segment with low-cost Wi-Fi and Bluetooth-compatible digital thermometers that appeal to tech-savvy brewers who desire intelligent brewing technology.

Hanna Instruments (~11%)

Hanna Instruments specializes in accurate lab-grade thermometers. Its strengths in pH meters and temperature compensation make it popular among commercial breweries.

Blichmann Engineering (~9%)

Blichmann is well known for high-end brewing gear, such as smart brewing controllers and integrated thermometers, that craft breweries use in large numbers to offer high-end brewing solutions.

Anvil Brewing Equipment (~8%)

Anvil provides long-lasting analog and digital thermometers priced in the middle range, serving serious home brewers who demand reliability and accuracy in their brewing equipment.

Others (~28%)

Local manufacturers and smaller players provide affordable analog thermometers and cutting-edge digital solutions. Startups targeting IoT-enabled brewing technology are growing in North America and Asia-Pacific.

Key Developments

By product design, the market is segmented into circular and rod shape.

Based on type, the market is segmented into analog and digital.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Increasing home brewing trends, craft beer expansion, and demand for precision.

Digital devices provide real-time monitoring, wireless connectivity, and greater accuracy, whereas analog models are less complex and cheaper.

Asia-Pacific and North America are witnessing rapid adoption due to the rising craft beer culture and technological advancements.

Automation allows for real-time monitoring of data, cloud integration, and accurate temperature control, which increases brewing efficiency.

Technologies such as IoT connectivity, AI-enabled analytics, and app-enabled monitoring are simplifying and making temperature-monitoring devices more effective.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 22: Europe Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 30: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Oceania Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 40: Oceania Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 41: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 42: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product design Type, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Product design Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 16: Global Market Attractiveness by Product design Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 34: North America Market Attractiveness by Product design Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Type, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product design Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product design Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Type, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Product design Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Product design Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ Million) by Type, 2023 to 2033

Figure 111: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Product design Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Product design Type, 2023 to 2033

Figure 128: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Product design Type, 2018 to 2033

Figure 135: MEA Market Volume (MT) Analysis by Product design Type, 2018 to 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Product design Type, 2023 to 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Product design Type, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 139: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product design Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Type, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Brewing Supplies Market Analysis by Product Type, Application, Category, and Region Forecast Through 2035

Brewing Chiller Market Trend Analysis Based on Type, Application, End-User, and Region 2025 to 2035

Understanding Market Share Trends in Brewing Additives

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Home Brewing Systems Market Size and Share Forecast Outlook 2025 to 2035

Beer Brewing Machine Market

Cider Brewing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Brewing System Market Size and Share Forecast Outlook 2025 to 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Home Beer Brewing Machine Market Analysis & Forecast 2025-2035

Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Dial Thermometers Market

Contact Thermometer Market

Baby Ear Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Wearable Thermometers Market

Dew Point Thermometer Market

Milk Froth Thermometer Market Size and Share Forecast Outlook 2025 to 2035

Ingestible Thermometers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA