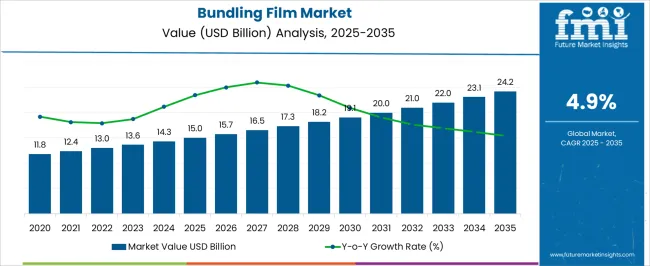

The Bundling Film Market is estimated to be valued at USD 15.0 billion in 2025 and is projected to reach USD 24.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

| Metric | Value |

|---|---|

| Bundling Film Market Estimated Value in (2025 E) | USD 15.0 billion |

| Bundling Film Market Forecast Value in (2035 F) | USD 24.2 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The bundling film market is experiencing steady expansion as industries prioritize lightweight, protective, and cost-effective packaging solutions. The market is benefiting from rising demand in food and beverage, consumer goods, logistics, and e-commerce sectors where bundling films offer optimized load containment, product visibility, and sustainability. Manufacturers are investing in recyclable and biodegradable film innovations to address environmental regulations and consumer pressure for eco-friendly packaging.

Simultaneously, automation trends in packaging operations are influencing the development of bundling films compatible with high-speed equipment and multi-format packaging lines. The ability of bundling films to reduce material consumption while maintaining package integrity has become a key value driver.

Furthermore, the growing need for secure unitization of irregular and multi-size items across supply chains is fueling demand for performance-grade films. As global retail and logistics sectors continue to scale, bundling films are expected to play a critical role in protective, efficient, and sustainable secondary packaging systems.

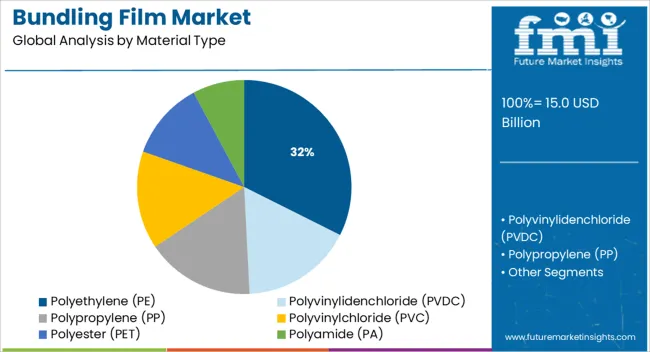

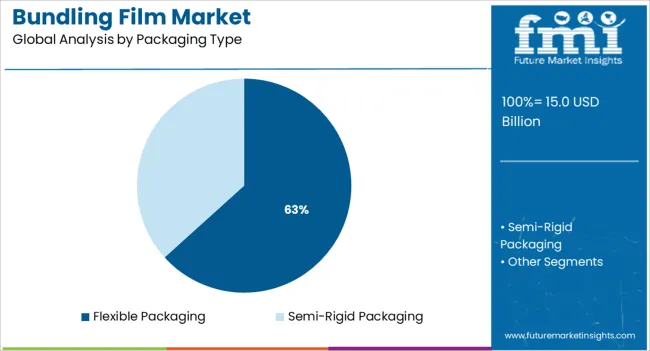

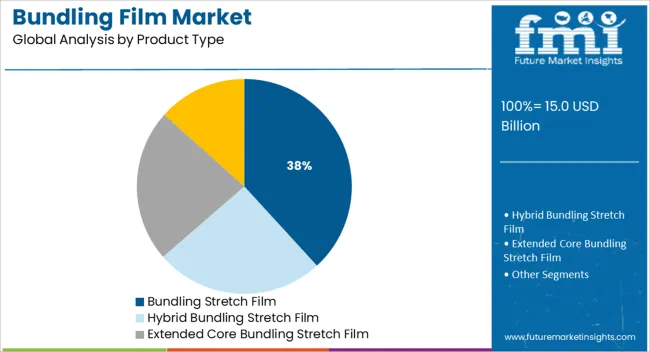

The market is segmented by Material Type, Packaging Type, Product Type, and End-Use and region. By Material Type, the market is divided into Polyethylene (PE), Polyvinylidenchloride (PVDC), Polypropylene (PP), Polyvinylchloride (PVC), Polyester (PET), and Polyamide (PA). In terms of Packaging Type, the market is classified into Flexible Packaging and Semi-Rigid Packaging. Based on Product Type, the market is segmented into Bundling Stretch Film, Hybrid Bundling Stretch Film, Extended Core Bundling Stretch Film, and Pre-Stretched Bundling Stretch Film. By End-Use, the market is divided into Food, Pharmaceuticals, Personal Care & Cosmetic Products, Industrial Goods, Commercial Goods, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polyethylene PE is projected to account for 32.4% of total revenue within the material type category in 2025, establishing it as the dominant material. Its continued leadership is supported by its favorable mechanical properties, cost efficiency, and widespread compatibility with automated bundling systems.

PE offers excellent stretchability, tear resistance, and clarity, making it suitable for various industrial and retail bundling applications. The material’s ability to perform consistently under high-speed operations while maintaining seal integrity has positioned it as a preferred choice for manufacturers.

Additionally, ongoing innovation in recyclable and downgauged PE films has enabled packaging producers to meet regulatory compliance without compromising performance. The extensive global supply chain for PE raw materials and its adaptability across industries further contribute to its dominant market share.

Flexible packaging is expected to capture 63.3% of the total bundling film market revenue in 2025, leading the packaging type segment. This leadership is driven by the increasing adoption of flexible formats across consumer goods, food, and industrial applications due to their lightweight nature and storage efficiency.

Flexible bundling films offer strong load stability and material savings compared to rigid packaging alternatives, contributing to lower shipping costs and reduced environmental impact. Their compatibility with high-speed wrapping and sealing machinery has made them the format of choice in automated environments.

Furthermore, flexible packaging enables easy branding, tamper evidence, and product visibility, which are critical in retail and transit scenarios. As companies seek to minimize carbon footprint and packaging waste, the demand for flexible solutions continues to grow, reinforcing this segment’s market share dominance.

Bundling stretch film is projected to account for 38.2% of market revenue in the product type category in 2025, making it the leading product type. This prominence is attributed to its superior load containment, flexibility, and ability to conform tightly around various product shapes and sizes.

The segment’s growth is being fueled by increasing demand from the logistics and retail sectors where secure unitization and tamper resistance are critical. Stretch films also reduce the need for additional secondary packaging materials, providing cost savings and material efficiency.

Manufacturers are introducing high-performance stretch films with improved elasticity, puncture resistance, and downgauged thickness to meet evolving customer demands. The use of stretch bundling in shrink-wrapping multipacks and protecting goods during transit has positioned this product type as an essential solution in both industrial and commercial applications.

Packaging has become a key constituent of modern life due to the ease of transportation, storage and inclination of the consumer towards a wide usage of bags. The rising demand of the packaging products is primarily due to its easy availability.

One such product which is growing at a healthy rate is bundling film market, most of the bundling film bags are lay flat or gusseted in nature and are available in different sizes and can also be customized to meet customer precise needs. Customization of bundling film packaging in terms of space, capacity can improve the market globally in the forecast period.

Growth in demand for bundling film market is expected to grow strongly for several reasons. One of the major factors contributing towards the growth of bundling film market is the dispensers which offer the ability to control the film tension during the application process, and also it offer a brake that allows users to modify film tension.

The lightweight stretch bundling film dispenser offers easy application for users which is another factor fueling the growth in the bundling film market. On the other hand, the restraining factors that are hindering the growth in the bundling film market is the higher initial cost of the plastic materials, dispensers and lack of awareness among consumer.

The increasing demand for bundling film products from different industries like food beverages, pharmaceuticals, chemical can also be a good opportunity for the bundling film market.

Geographically, the global bundling film market is segmented into North America, Latin America, Europe, Asia-Pacific (APAC) and the Middle East Africa (MEA). The global bundling film market is expected to witness a stable CAGR over the forecast period of 2020-2025. Moreover, North America is expected to be the largest bundling film market in terms of bundling film, due to the higher rate of exporting products and goods.

Apart from this, the wide growth of the plastic bags is expected to further boost the sales of the bundling film market in Asia Pacific by the end of the forecast period of 2020-2025.

Some of the major players identified across the globe in the bundling film market are Berry Plastics, Amcor Limited, Mondi Group, Professional Packaging Systems, Inc., Global-Pak, Plastipak Group, Halsted, Intertape Polymer Group, J HM Dickson, Jumbo Bag, Langston, LC Packaging, Jinxing Plastic Packaging Branch, Shanghai Lucky Hi-Tech Material International Trade Co., Ltd., Dongguan Yason Pack Co., Ltd., Tongcheng Soma Package Co., Ltd., Qingdao Bothwin International Trade Co., Ltd.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies.

The research report provides analysis and information according to market segments such as geography, material type, packaging type, by product type, end-use.

The global bundling film market is estimated to be valued at USD 15.0 billion in 2025.

The market size for the bundling film market is projected to reach USD 24.2 billion by 2035.

The bundling film market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in bundling film market are polyethylene (pe), polyvinylidenchloride (pvdc), polypropylene (pp), polyvinylchloride (pvc), polyester (pet) and polyamide (pa).

In terms of packaging type, flexible packaging segment to command 63.3% share in the bundling film market in 2025.

x

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share & Competitive Positioning in Shrink Bundling Film

Shrink Bundling Film Market by Material Type from 2024 to 2034

Bundling Machine Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Bundling Machine Manufacturers

Shrink Bundling Machine Market Trends & Forecast 2024-2034

Wrapping and Bundling Machines Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA