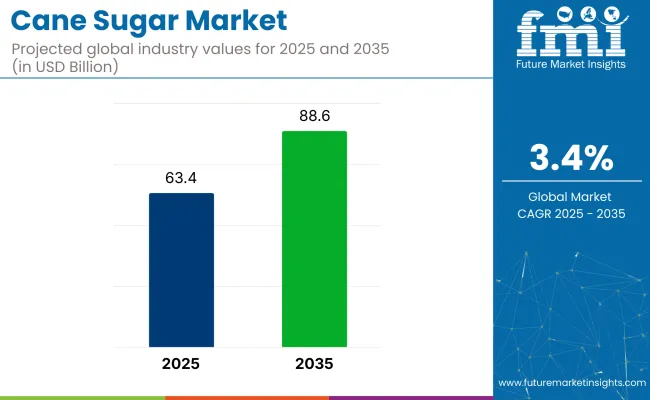

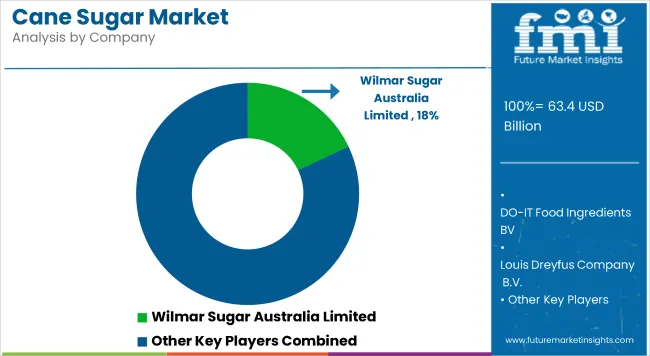

The global cane sugar market is worth USD 63.4 billion in 2025 and is expected to grow to USD 88.6 billion by 2035, reflecting a CAGR of 3.4%. The demand for cane sugar is primarily driven by the expanding bakery and confectionery sectors, especially in regions such as Asia and Africa.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 63.4 billion |

| Projected Size (2035F) | USD 88.6 billion |

| CAGR (2025 to 2035) | 3.4% |

Consumer trends favoring organic and brown sugar varieties, along with increasing health awareness, are likely to shape the market's trajectory. The popularity of desserts and sugary snacks continues to support growth, even as competition from sugar alternatives rises.

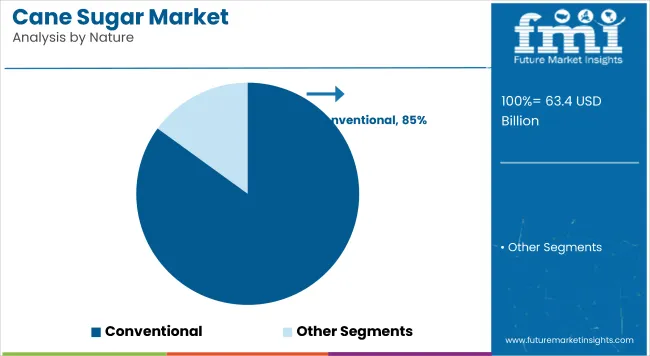

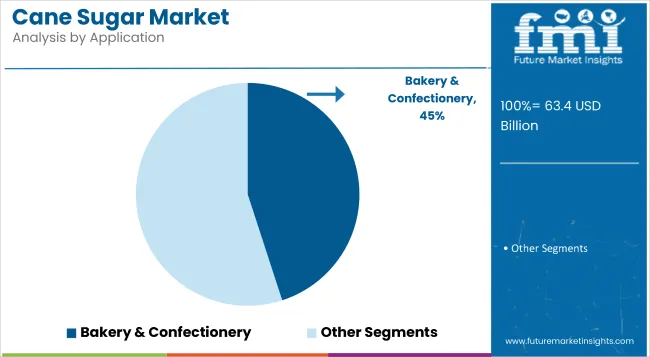

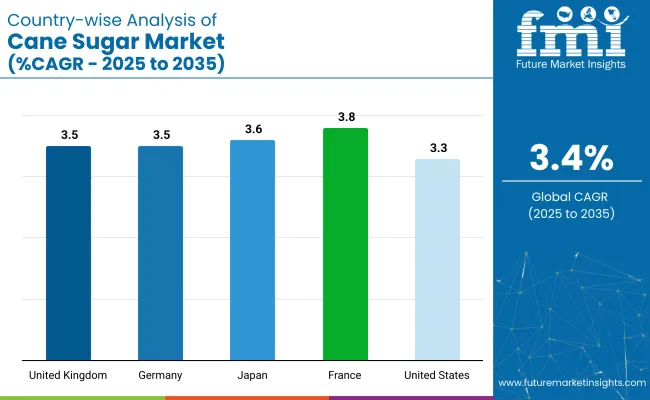

The USA will continue to lead with the largest market share, growing at a moderate CAGR of 3.3%. Meanwhile, France is anticipated to register the fastest growth at a CAGR of 3.8% closely followed by Japan with a CAGR of 3.6%. The conventional cane sugar dominates the nature segment with 85% of the market share. Meanwhile, the bakery & confectionery sector remains the largest application segment, driven by growing demand for sweets and baked goods, accounting for 45% of the market share in 2025.

The market holds a significant share within the broader sweeteners market, accounting for approximately 40-45% of the total market value. Within the sugar market, cane sugar dominates, accounting for approximately 60-65% of the overall sugar production, as it is the primary source of sugar globally.

In the food & beverage ingredients market, cane sugar makes up approximately 10-12%, given its widespread use in food processing and beverages. In the organic food & beverages market, the cane sugar share is relatively smaller, around 5-7%, primarily driven by organic cane sugar demand.

The global market is segmented into nature, form, application, and region. By nature, it is segmented into organic and conventional. By form, it is divided into crystallized sugar and liquid syrup. By application, it includes bakery & confectionery, dairy, beverages, other applications(such as snacks, ice cream, sauces, and processed foods).

By region, it covers North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa.

The conventional cane sugar segment holds a dominant position in the market, accounting for approximately 85% of the market share. This segment benefits from widespread use in both industrial and residential applications due to its lower cost and broader availability. Conventional sugar is used in a variety of applications, including processed foods, beverages, and sweeteners.

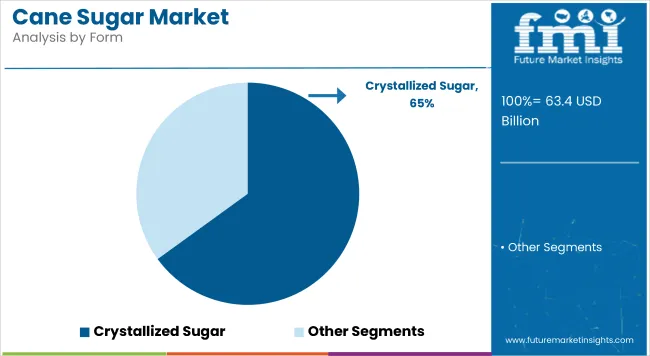

Crystallized sugar leads the market in terms of demand, holding 65% of the market share. It is widely used across various sectors, particularly in home cooking and food processing, owing to its ease of use, versatility, and long shelf life. As the primary form of sugar, crystallized sugar is preferred for baking and as a sweetener in beverages.

The bakery & confectionery sector is the largest application segment, capturing 45% of the market share. Sugar is a crucial ingredient in baked goods, candies, chocolates, and other sweets. The increasing demand for desserts and the global trend towards Western-style baked products drive the growth in this segment.

Recent Trends in the Cane Sugar Market

Challenges in the Cane Sugar Market

The market is projected to grow steadily across key countries, with Japan leading at a CAGR of 3.6% from 2025 to 2035, driven by demand in traditional sweets and modern desserts. The UK follows closely with a CAGR of 3.5% from 2025 to 2035, bolstered by bakery product and beverage consumption.

Both Germany and France are rising with respective CAGRs of 3.5% and 3.8%, supported by strong industrial demand but facing regulatory pressures on sugar content. The USA sees moderate growth at 3.3%, reflecting its high demand for confectionery and beverages despite growing health concerns.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA represents one of the largest markets for cane sugar due to its widespread consumption in the food and beverage sector, especially in confectioneries, soft drinks, and bakery products.

The USA cane sugar revenue is poised to grow at a CAGR of 3.3% from 2025 to 2035, although challenges are posed by the rising health-conscious trends leading to a shift toward sugar alternatives. Despite this, sugar demand remains robust due to the popularity of desserts and sweeteners in the USA diet, as well as the increasing preference for organic and sustainably sourced sugar.

The revenue from cane sugar in the UK is slated to see steady growth at a CAGR of 3.5% from 2025 to 2035, supported by its extensive use in bakery products and beverages. The market is heavily influenced by the rising demand for healthier and sustainable food products. Despite concerns about sugar consumption, UK consumers remain loyal to sweet treats, though sugar reduction initiatives are gaining traction. The government’s support for sustainable practices further boosts the market for organic sugar.

The cane sugar market in Germany is anticipated to witness rapid growth at a CAGR of 3.5%.With its robust food manufacturing sector, Germany holds a strong position in the European cane sugar market. The demand for cane sugar in bakery products, confectioneries, and beverages is substantial. However, rising health concerns and the regulatory push to reduce sugar content are influencing consumer behavior, leading to an increasing preference for alternative sweeteners.

France is an essential player in the European cane sugar market, with significant demand driven by its vibrant bakery, pastry, and confectionery industries. The cane sugar sales in France are poised to grow at a CAGR of 3.8% from 2025 to 2035.

French consumers exhibit a strong preference for high-quality sugar, particularly for gourmet products. At the same time, concerns over health and sustainability are driving a shift toward organic sugar and alternative sweeteners like stevia, impacting traditional sugar consumption.

The sales of cane sugar in Japan are witnessing steady growth, with a CAGR of 3.6% from 2025 to 2035, driven by demand for sweeteners in traditional sweets (wagashi) and modern desserts. Despite a mature market, sugar demand remains strong, especially for premium, high-quality cane sugar in gourmet products. However, growing health trends and the preference for lower-calorie alternatives are reshaping consumer behavior, leading to rising interest in organic and sustainably sourced sugar.

The market is moderately fragmented, with several global leaders controlling significant portions of the market share. Companies such as Global Organics Ltd., Louis Dreyfus Company B.V., and ASR Group International, Inc. compete by focusing on pricing strategies, innovation in sugar products, and strategic partnerships. These companies emphasize sustainability, with several taking initiatives to meet the growing demand for organic and specialty sugar.

Top companies in the cane sugar market are competing on several fronts, including pricing, product innovation, sustainability, and global expansion. Louis Dreyfus Company B.V. and ASR Group International, Inc. focus on expanding their geographic presence in key emerging markets, where sugar demand is growing, especially in Asia and Africa.

They are also increasing investments in organic sugar to cater to the rising health-conscious trend. Meanwhile, Wilmar Sugar Australia Limited has emphasized environmental sustainability through its initiatives on water conservation and reduced carbon footprint in production.

Recent Cane Sugar Market News

In July 2025, Bunge and Viterra unveiled a merger agreement to form a premier global Agribusiness solutions firm.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 63.4 billion |

| Projected Market Size (2035) | USD 88.6 billion |

| CAGR (2025 to 2035) | 3.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billions/Volume in kilotons |

| By Nature | Organic, Conventional |

| By Form | Crystallized Sugar, Liquid Syrups |

| By Application | Bakery & Confectionery, Dairy, Beverages, Other Applications |

| Regions Covered | North America, Latin America, Europe, Middle East and Africa, East Asia, South Asia, Oceania |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Global Organics, Ltd., DO-IT Food Ingredients BV, Louis Dreyfus Company B.V., Wilmar Sugar Australia Limited, ASR Group International, Inc., Tate & Lyle plc, Biosev S.A., Nanning Sugar Industry, Bunge Limited, Raizen |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

Based on nature, the industry is bifurcated into organic and conventional.

Based on the form, the Crystallized Sugar, Liquid Syrup.

Cane sugar is mostly used for applications like dairy, bakery, confectionery, beverage, canned and frozen foods, pharmaceuticals, and other food items.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The market size is valued at USD 63.4 billion in 2025.

The market is forecasted to reach USD 88.6 billion by 2035, reflecting a CAGR of 3.4%.

Conventional is expected to lead the market with an 85% share in 2025.

The bakery & confectionery segment is projected to hold a 45% share of the market in 2025.

France is anticipated to be the fastest-growing market with a CAGR of 3.8% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugarcane Packaging Market Analysis by Material and Application 2025 to 2035

Sugarcane Based PET Bottles Market

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

Organic Cane Sugar Market – Growth, Sustainability & Consumer Demand

Cane Chopper Market Size and Share Forecast Outlook 2025 to 2035

Cane Molasses Market Analysis by Type, Application, Form, End Use and Region Through 2035

Dodecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

Octadecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

Steviacane Market Analysis By Platform, By Application, By Type, and By Region - Forecast from 2025 to 2035

Sugared Egg Yolk Market Size and Share Forecast Outlook 2025 to 2035

Sugar Toppings Market Size, Growth, and Forecast for 2025 to 2035

Sugar Beet Pectin Market Growth - Functional Applications & Demand 2025 to 2035

Sugar Substitute Market Trends - Low-Calorie Sweeteners & Demand 2025 to 2035

Sugar-Free Sweets Market Growth - Trends & Consumer Preferences 2025 to 2035

Sugar-Free Gummy Market Insights - Consumer Trends & Growth 2025 to 2035

Sugar-based Excipients Market Analysis by Product, Type, Functionality, Formulation, and Region Through 2035

Sugar-Free Syrups Market Insights - Innovations & Consumer Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA