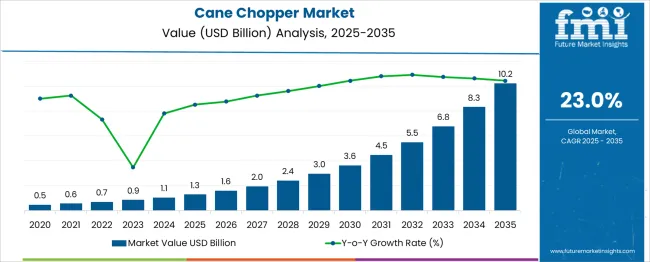

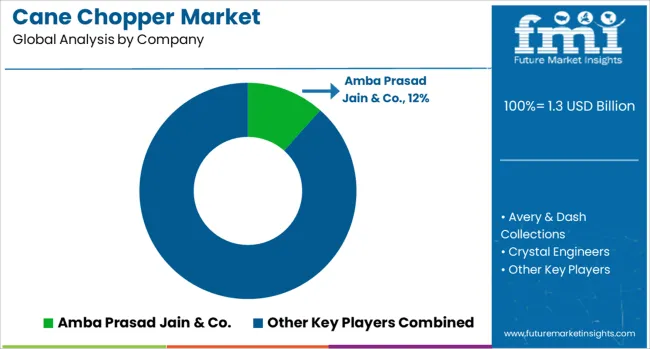

The Cane Chopper Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 10.2 billion by 2035, registering a compound annual growth rate (CAGR) of 23.0% over the forecast period.

| Metric | Value |

|---|---|

| Cane Chopper Market Estimated Value in (2025 E) | USD 1.3 billion |

| Cane Chopper Market Forecast Value in (2035 F) | USD 10.2 billion |

| Forecast CAGR (2025 to 2035) | 23.0% |

Market growth is further driven by the adoption of compact and portable models among small and mid-sized farms, where affordability and ease of operation are critical purchasing factors. Government initiatives to modernize agricultural infrastructure and improve farmer productivity have also created favorable conditions for increased adoption of cane choppers.

Rising labor costs and seasonal workforce shortages are expected to accelerate mechanization trends, thereby boosting demand across all capacity types. The market is likely to witness technological advancements focused on increasing cutting precision, reducing fuel consumption, and extending equipment lifespan.

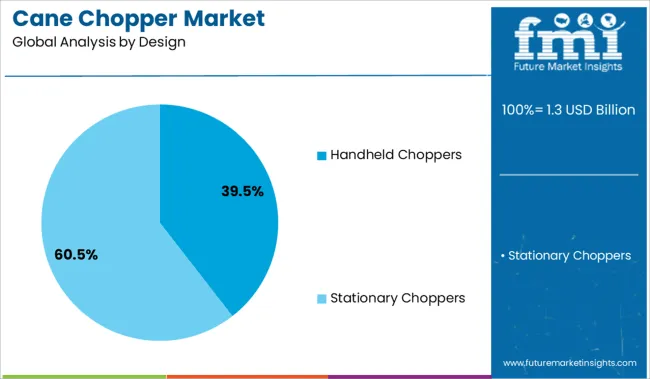

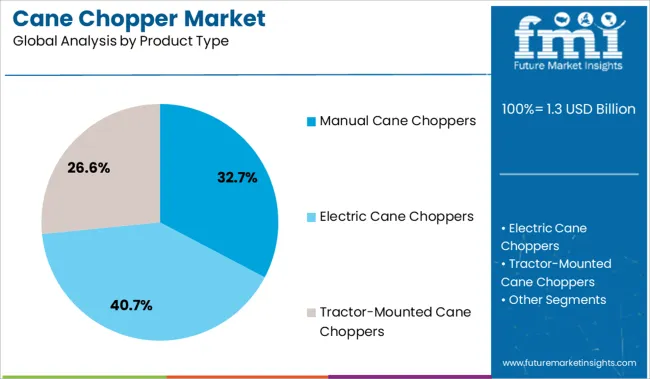

The cane chopper market is segmented by design, product type, capacity, end-user industry, and distribution channel and geographic regions. The cane chopper market is divided into Handheld Choppers and Stationary Choppers. The cane chopper market is classified into Manual Cane Choppers, Electric Cane Choppers, and Tractor-Mounted Cane Choppers.

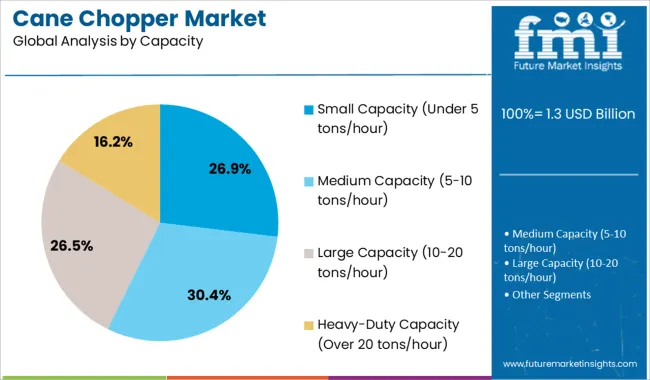

Based on the capacity of the cane chopper market, it is segmented into Small Capacity (Under 5 tons/hour), Medium Capacity (5-10 tons/hour), Large Capacity (10-20 tons/hour), and Heavy-Duty Capacity (Over 20 tons/hour). The end-user industry of the cane chopper market is segmented into Sugar Mills, Agricultural Cooperatives, Large Commercial Farms, Small to Medium Farming Enterprises, and Others (Bioenergy Production Units, etc.).

The distribution channel of the cane chopper market is segmented into Direct and Indirect. Regionally, the cane chopper industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The handheld choppers segment dominates the design category with a 39.5% market share, highlighting its strong preference among smallholder farmers and operations in areas with limited mechanization. These tools are favored for their portability, ease of use, and affordability, especially in remote or underdeveloped regions where access to power-driven equipment is limited.

Handheld choppers provide practical advantages in maintenance and are often constructed with durable materials that can withstand field conditions. Their design simplicity allows for quick deployment without specialized training, making them accessible to a wide user base.

Despite the emergence of powered alternatives, the segment continues to benefit from sustained demand in regions where manual labor remains prevalent. The market for handheld choppers is expected to remain stable, supported by consistent use in localized applications and continued investment in ergonomic and safety-oriented design improvements.

Manual cane choppers lead the product type category with a 32.7% share, reflecting their longstanding role in traditional agricultural practices. These units offer a cost-effective and durable solution for cutting cane into smaller, manageable sections for further processing or transport.

Favored for their low operational cost and minimal maintenance requirements, manual choppers are widely used in small-scale farming and community-level harvesting systems. Their reliance on human labor rather than fuel or electricity makes them particularly suitable for rural areas with limited infrastructure.

Continued improvements in blade quality, safety mechanisms, and ergonomic design have extended the usability and appeal of manual choppers. As governments and NGOs promote low-cost mechanization tools to improve agricultural productivity, the demand for manual cane choppers is expected to sustain moderate but consistent growth, particularly in developing regions.

The small capacity segment, defined as equipment processing under 5 tons per hour, accounts for 26.9% of the cane chopper market and is preferred for its suitability in small to medium-scale operations. This capacity range aligns with the needs of local cooperatives, decentralized processing units, and individual growers who operate within modest production volumes.

Small capacity choppers are often selected for their compact design, lower power requirements, and reduced upfront investment, which appeal to resource-constrained users. Their operational flexibility allows for deployment across varied terrains and field sizes, adding to their practicality in real-world farming scenarios.

As sustainability and operational efficiency become more important in the agricultural sector, small capacity models are being enhanced with user-friendly controls and improved safety features. The segment is poised for stable growth, supported by rising demand in regions where small-scale sugarcane cultivation continues to thrive.

Demand for cane choppers is rising as sugarcane farms scale up mechanization and pursue efficiency improvements. Sales of high-capacity rotary and shear choppers are increasing across major sugar-producing regions. Adoption is strongest in India, Brazil, and Thailand, where labor shortages and goals to maximize yield are encouraging investment in mechanized chopping systems.

Demand for rotary cane choppers with 50 horsepower or more rose by 28% in 2025, driven by expansion in large-scale mechanized sugarcane harvesting. Rotary units reduce residue particle size by 38%, improving field decomposition and boosting mill throughput. In regions such as Maharashtra and São Paulo, rotary choppers are integrated into end-to-end harvest systems, lowering manual labor costs by 34%. Machines equipped with feed-rate sensors and torque control reduced engine stall events by 22%. Modular attachments compatible with conventional tractors and trailers now account for over 45% of new equipment purchases, enabling faster harvest cycles with minimal transport delays.

Sales of shear and flail-type cane choppers increased 24% year over year in 2025, led by mid-sized growers in Southeast Asia and Africa. Shear choppers are suited for intercropping due to low soil disruption and adaptability to irregular cane spacing. Growers using shear-based workflows reported a 26% decrease in post-harvest losses from damaged stalks. Compact tractors fitted with flail choppers helped smallholders match the throughput of larger machines, cutting labor needs by 19%. Equipment with adjustable blade angles and depth regulation represented 31% of newly introduced models designed for slicing accuracy.

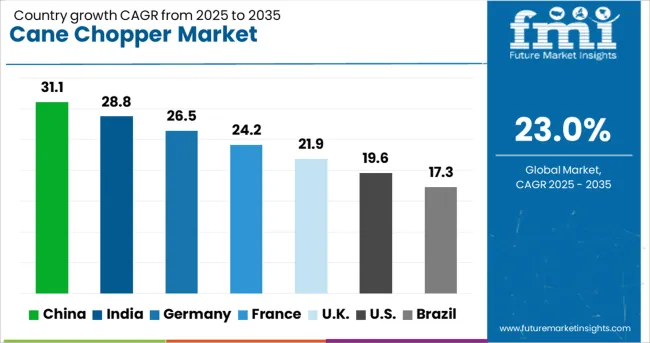

| Country | CAGR |

|---|---|

| China | 31.1% |

| India | 28.8% |

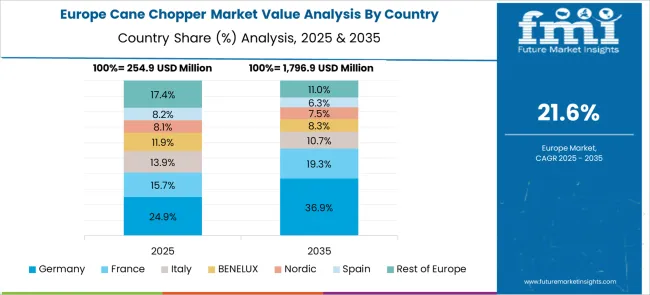

| Germany | 26.5% |

| France | 24.2% |

| UK | 21.9% |

| USA | 19.6% |

| Brazil | 17.3% |

The global market is set to expand at a CAGR of 23% between 2025 and 2035. China is expected to lead growth at 31.1% due to rapid farm mechanization and widespread adoption across Guangxi and Yunnan. India follows with 28.8% CAGR, supported by rising sugar demand and increased mechanized farming in Maharashtra and Uttar Pradesh. Germany, at 26.5%, is emerging as a technology exporter, particularly for precision harvesting systems. The United Kingdom, growing at 21.9%, is seeing traction through R&D-led pilot projects. The United States, projected at 19.6%, is focused on labor-saving solutions and integrated chopper systems for commercial sugarcane farming. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to grow at a 31.1% CAGR, the highest globally, driven by large-scale mechanization in sugarcane farming and government-backed agricultural modernization programs. Key provinces like Guangxi and Yunnan dominate adoption due to their significant contribution to national sugar output. Domestic manufacturers are focusing on producing compact, fuel-efficient choppers suited for small and mid-sized farms. Integration of smart technologies such as GPS-enabled guidance systems and automated feeding mechanisms is gaining traction for improved operational efficiency. Export of low-cost mechanized solutions to Southeast Asia further strengthens China’s role as a regional supplier in this segment.

India is forecast to grow at a 28.8% CAGR, supported by rising sugar demand and the transition from manual harvesting to mechanized systems in major sugarcane-producing states like Maharashtra, Uttar Pradesh, and Karnataka. Increasing labor shortages are accelerating the shift toward efficient harvesting equipment. Domestic manufacturers are introducing cost-sensitive models with energy-efficient designs, while global players are forming joint ventures to expand localized production. Government programs promoting farm mechanization under the Sub-Mission on Agricultural Mechanization (SMAM) are providing financial support to farmers. Custom hiring centers are enabling small-scale farmers to access advanced chopper machinery.

Germany is expected to grow at a 26.5% CAGR, primarily as a global technology supplier for precision cane chopping and harvesting systems. The country’s engineering expertise supports innovations in automated feeding, self-propelled mechanisms, and energy-optimized cutting blades. German OEMs are entering partnerships with manufacturers in Asia and Latin America to cater to cost-sensitive markets while maintaining technology leadership. The growing trend of integrating IoT-based diagnostics and predictive maintenance systems is positioning German equipment as the benchmark for reliability and productivity. Exports to Brazil, India, and Thailand are key revenue streams, supported by strong aftermarket service networks.

The United Kingdom is projected to grow at a 21.9% CAGR, driven by R&D investments in pilot projects for automated sugarcane harvesting systems. While domestic sugarcane production is limited, UK-based engineering firms are focusing on developing compact, modular chopper solutions for tropical export markets. Collaborations with research institutes emphasize the use of AI-based vision systems for optimized cutting and energy savings. Emerging interest in sustainability-focused designs and low-emission power units is fueling innovation in prototype development. Export-oriented strategies targeting Southeast Asia and Africa make the UK a niche player in technology-driven chopper solutions.

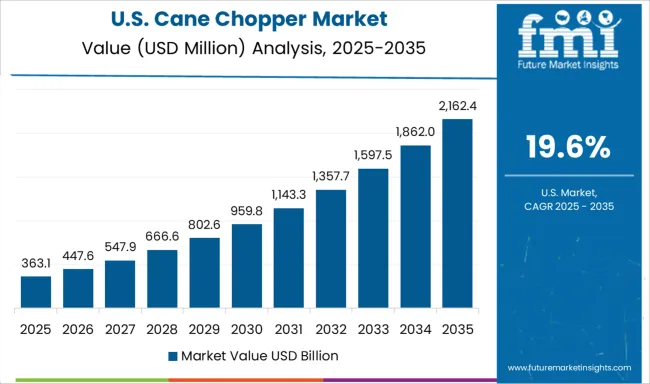

The United States is anticipated to grow at a 19.6% CAGR, supported by the push for labor-saving technologies in large-scale sugarcane plantations, particularly in Florida and Louisiana. Manufacturers are prioritizing chopper models with integrated collection systems to reduce post-harvest handling costs. Advancements in hybrid and electric power units for sustainable farming practices are gaining traction. OEMs focus on developing multi-crop adaptable choppers to enhance utilization rates for farmers. Strategic partnerships between agricultural equipment firms and software providers enable integration of telematics for real-time performance monitoring. Aftermarket services and financing programs are supporting widespread adoption across commercial farms.

Amba Prasad Jain & Co. is the market leader in 2025 with a significant share, supported by long-term contracts with sugar mills in India and Southeast Asia. Ulka Industries and Three Star Engineering Pvt. Ltd. are growing through exports of high-efficiency units embedded in turnkey mill systems. Crystal Engineers and Rachitech Pvt. Ltd. have established positions with durable blades and rotary systems suited for continuous high-load operations.

Tata Agrico and IMCO Alloys specialize in aftermarket components and high-alloy assemblies. EHS Manufacturing Pty Ltd and Pratco dominate in Australia and Latin America, where their rugged designs meet the needs of challenging field environments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Design | Handheld Choppers and Stationary Choppers |

| Product Type | Manual Cane Choppers, Electric Cane Choppers, and Tractor-Mounted Cane Choppers |

| Capacity | Small Capacity (Under 5 tons/hour), Medium Capacity (5-10 tons/hour), Large Capacity (10-20 tons/hour), and Heavy-Duty Capacity (Over 20 tons/hour) |

| End-User Industry | Sugar Mills, Agricultural Cooperatives, Large Commercial Farms, Small to Medium Farming Enterprises, and Others (Bioenergy Production Units, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amba Prasad Jain & Co., Avery & Dash Collections, Crystal Engineers, EHS Manufacturing Pty Ltd, IMCO Alloys & Co. KG, Leafcon, MacheteSpecialists, Pratco, Rachitech Pvt. Ltd., Ryan International Sugar Mill Parts, Saisidha Sugar Equipment & Engg. Co., Tata Agrico, Three Star Engineering Pvt. Ltd., Trimurti Project Engineers, and Ulka Industries Private Limited |

| Additional Attributes | Dollar sales by chopper type (electric, stationary, handheld) and end-use segment (sugar mills vs bioenergy units), demand dynamics across mechanized harvesting vs rental services, regional leadership in Asia‑Pacific and North America, innovation in IoT/GPS-enabled automation, and environmental impact via fuel efficiency and biomass utilization. |

The global cane chopper market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the cane chopper market is projected to reach USD 10.2 billion by 2035.

The cane chopper market is expected to grow at a 23.0% CAGR between 2025 and 2035.

The key product types in cane chopper market are handheld choppers and stationary choppers.

In terms of product type, manual cane choppers segment to command 32.7% share in the cane chopper market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cane Sugar Market Analysis - Size, Growth, and Forecast 2025 to 2035

Cane Molasses Market Analysis by Type, Application, Form, End Use and Region Through 2035

Chopper Pump Market Growth - Trends & Forecast 2024 to 2034

Dodecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Bottle Market Forecast and Outlook 2025 to 2035

Sugarcane-Derived Squalane Market Size and Share Forecast Outlook 2025 to 2035

Food Chopper Market Size and Share Forecast Outlook 2025 to 2035

Sugarcane Fiber Bowls Market – Growth & Demand 2025 to 2035

Sugarcane Packaging Market Analysis by Material and Application 2025 to 2035

Sugarcane Based PET Bottles Market

Octadecanedioic Acid Market Size and Share Forecast Outlook 2025 to 2035

Steviacane Market Analysis By Platform, By Application, By Type, and By Region - Forecast from 2025 to 2035

Rubber choppers Market

Refined Cane Sugar Market Analysis by Product Type and End Use Through 2035

Organic Cane Sugar Market – Growth, Sustainability & Consumer Demand

Portable Chopper Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vegetable Chopper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA