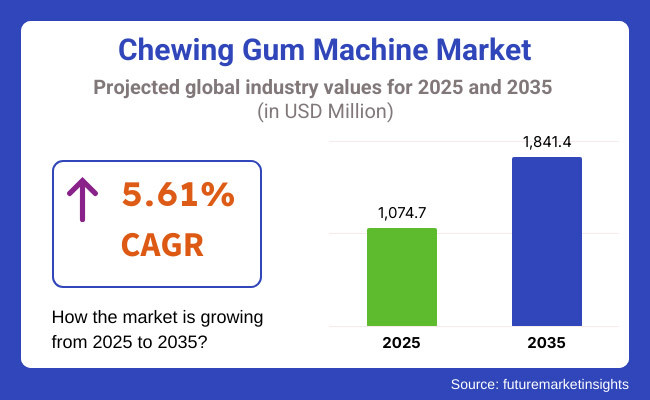

The chewing gum machine market is anticipated to be valued at USD 1,074.7 million in 2025. It is expected to grow at a CAGR of 5.61% during the forecast period and reach a value of USD 1,841.4 million in 2035.

Growth for the chewing gum machine market continued to stay steady in 2024, with retail networks expanding, urbanization increasing, and vending machine technologies on the rise as the main driving forces of the market.

2024 saw a considerable surge in the placement of vending machines in high-traffic areas such as shopping malls, office buildings, and public transport hubs to cater to the demand for snacking on the go. The digital payment integration trend was in full swing; vending machines employing contactless and mobile payment methods for greater user convenience became the trending topic of discussion.

Increased consumer demand for sugar-free chewing gums and functional chewing gums, including xylitol-based and vitamin-fortified chewing gums, resulted in the diversification of products from vending machines.

The market for chewing gum machines is witnessing initiatives for sustainable packaging material solutions due to climate consciousness on a global scale. Raw material price fluctuations, along with increased regulatory pressure on plastic waste, have emerged as major hurdles for players in the market, forcing them to explore innovation and streamline production methods.

Hence, in 2025 and beyond, with the adoption of AI-based vending systems for unique flavor offerings and higher penetration in emerging markets, the market could increase. Fast growth is forecast for the Asia-Pacific region, driven by rapid infrastructure development and rising disposable income. Other long-term development trends include smart vending solutions, biodegradable gum packaging options, and increased efficiency of the machine to meet changing consumer needs.

Future Market Insights undertook a recent survey that contained insights from chewing gum machine industry stakeholders, which include operators of vending machines, manufacturers of vending machines, and suppliers of the product. The study was to discover emerging trends, challenges, and growth opportunities defining the industry. The most significant trend affecting operators was the shift to digital payments. More than 70% of the operators of vending machines earmarked contactless and mobile payments as priority solutions for improving the user experience and sales efficiency.

The other major finding from the survey was a definitive shift toward sustainability, driven by environmental purchasing considerations. Over 65% of the manufacturers have shown interest in biodegradable or recyclable packaging to meet consumer preferences as well as government regulations.

High production costs are, however, a challenge. About 55% of retailers claimed eco-conscious consumers seek brands with sustainable practices, hence exploring partnerships with green chewing gum brand operators. Strategic placement in key user areas-such as malls, airports, and offices-remains a key driver for sales performance.

Another significant trend is functional chewing gums, including sugar-free forms, those infused with xylitol, and those enriched with vitamins. Close to 50% of suppliers said there was a constant increase in the demand for chewing gums from millennials and Gen Z.

About 40% of the industry observes flavor innovation differentiating, and exotic blends are becoming popular. Hybrid gum formulations combining oral care benefits and enhanced consumer experiences are gaining popularity. Vending machines are soon adopting personal preference-based offerings tailored to consumer preferences.

Forward-looking investment areas will include AI vending machines, inventory tracking, and data-driven marketing. Stakeholders agree that long-term competition will hinge on consumer development, sustainability, and digital transformation. Machine learning will improve real-time monitoring of sales along with dynamic pricing. Businesses are likely to dominate the evolving market as innovations in vending solutions keep increasing that enhance user convenience and automation.

| 2020 to 2024 (Historical Analysis) | 2025 to 2035 (Future Outlook) |

|---|---|

| The market expanded due to increasing urbanization, rising demand for on-the-go snacks, and improved vending technology. | AI-powered vending machines, smart inventory tracking, and personalized product recommendations will drive market penetration. |

| Contactless and mobile payments saw early adoption but were not yet widespread in all markets. | Cashless transactions, QR codes, and biometric payments will become the standard for vending machine purchases. |

| Companies started introducing biodegradable packaging due to growing environmental concerns and regulatory pressure. | Government mandates and consumer preferences will push all major players toward eco-friendly packaging and energy-efficient vending machines. |

| These regions led market growth due to established vending infrastructure and strong brand loyalty. | Rising disposable incomes and urbanization will significantly boost vending machine installations in APAC countries. |

| Sugar-free, organic, and functional gums (vitamin-infused, energy-boosting) gained popularity. | AI vending will enable personalized flavor recommendations while demand for health-focused gums will grow. |

| Wrigley, Mars, and Perfetti Van Melle held a dominant market share, while regional players expanded gradually. | Mergers, acquisitions, and collaborations with AI and fintech firms will shape competitive strategies. |

| The market grew at a moderate pace, with the gradual adoption of new technologies and product innovations. | A mix of technological advancements, smart vending, and sustainability initiatives will drive faster growth. |

Tabletop Machines dominate the market due to their compact size, affordability, and ease of placement in small retail stores, office spaces, and food service establishments. Tabletop chewing gum vending machines hold a dominant share of the market due to their compact design, affordability, and ease of placement in small retail spaces, office cafeterias, and food service establishments.

These machines accounted for approximately 65% of the total market share in 2024 due to their lower maintenance and installation costs. Their popularity continues to rise as businesses seek space-efficient vending solutions.

Foodservice Establishments are the largest end-user segment, as vending machines provide a self-service solution in quick-service restaurants, cafes, and entertainment venues. Foodservice outlets, including quick-service restaurants, cafes, and movie theaters, represent the largest end-use segment for chewing gum vending machines.

These venues prefer vending solutions that provide quick self-service options, reducing labor costs and increasing convenience for customers. The demand is expected to remain stable, driven by partnerships with food chains and restaurants.

Offline dominates with over 70% market share, driven by bulk purchases from retail chains, corporate offices, and food service businesses. The offline sales channel dominates the market, accounting for over 70% of total sales in 2024. Vending machine suppliers and distributors rely on bulk purchases from retail chains, corporate offices, and food service businesses. Offline sales are expected to maintain dominance due to the preference for direct purchases and servicing agreements with suppliers.

The USA remains a key market for chewing gum vending machines, driven by high consumer demand for convenience and snacking. The market is benefiting from the widespread adoption of digital payment and AI-driven vending solutions. Health-conscious trends are fueling demand for sugar-free and functional gums, prompting manufacturers to introduce innovative products and expand their vending networks.

The UK market is evolving with sustainability initiatives as regulations push manufacturers toward biodegradable gum and eco-friendly packaging. Smart vending machines with contactless payment integration are gaining popularity in urban centers. Growing health awareness has increased demand for xylitol-based and vitamin-infused gums, making functional chewing gum a strong driver of vending machine sales.

Strong regulatory policies on sugar consumption and packaging waste influence France's chewing gum vending machine market. The government's push for healthier alternatives is fostering growth in sugar-free and organic gum vending. High urban foot traffic in metro stations and shopping malls supports vending machine expansion, with digital payment options becoming the norm.

Germany leads in technological innovation, with AI-powered vending machines gaining traction in retail and transportation hubs. Sustainability remains a major focus, with government regulations encouraging the use of recyclable and biodegradable materials in vending products. Consumers’ preference for sugar-free and functional gums continues to rise, further shaping the product mix in vending machines.

Japan’s market is highly advanced, with vending machines being an integral part of urban infrastructure. Innovations such as facial recognition payment and personalized product recommendations are shaping the chewing gum vending sector. Functional chewing gums, including those with added vitamins and energy-boosting ingredients, are in high demand due to the country’s strong health-conscious culture.

China's chewing gum vending market is expanding rapidly due to increasing urbanization and the adoption of digital payment. The market is seeing a surge in smart vending machines equipped with QR codes and facial recognition payment systems. Growing consumer demand for healthier alternatives is driving the popularity of sugar-free and herbal-infused gums in vending machines.

Government policies are shaping the chewing gum vending machine industry, focusing on health, sustainability, and digital payments. Stricter sugar regulations promote sugar-free alternatives, while environmental laws mandate biodegradable packaging. Additionally, rising cashless transactions have led to data security laws requiring compliance to avoid fines and operational restrictions for vending machine operators.

| Countries | Regulatory Impact on Market |

|---|---|

| United States | FDA controls sugar levels; FTC regulates digital payment security for vending machines. |

| United Kingdom | Sugar tax on gums with high sugar content; sustainability regulations require recyclable packaging. |

| Germany | Tougher EU food safety regulations; vending machines have to accommodate cashless payments by 2027. |

| France | Plastic packaging ban for gum; incentives for biodegradable types. |

| China | QR code payment for vending is compulsory, and tougher import controls on artificial sweeteners. |

| India | FSSAI requires labeling for gums containing artificial additives; digital payment rules change. |

| Japan | Strong safety regulations for vending machines; advocacy for AI-driven smart vending technology. |

| Australia | Tighter consumer protection legislation for vending transactions; waste management regulations for the environment. |

| Brazil | Guidelines allow restrictions on sugar content in schools and public venues and expanded vending machines. |

| Canada | Federal guidelines encourage compliance with sugar-free chewing gum and bilingual labeling. |

Growth Opportunities

Expansion in Emerging Markets

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Targeting high-footfall locations such as shopping malls, metro stations, and universities can boost sales.

Digital Payment Integration

The increasing preference for cashless transactions is driving demand for vending machines with mobile payment, NFC, and QR code scanning capabilities. Companies investing in seamless payment solutions will gain a competitive edge.

AI & Smart Vending Technology

AI-driven vending machines with personalized recommendations, real-time inventory tracking, and dynamic pricing are becoming popular. Investing in data analytics can improve operational efficiency and customer experience.

Strategic Recommendations

Leverage AI & IoT

Implement smart vending solutions for predictive maintenance, optimized stocking, and consumer behavior insights.

Prioritize Digital Transformation

Ensure all vending machines support contactless and mobile payments to cater to tech-savvy consumers.

Target High-Growth Regions

Strengthen distribution networks in China, India, and Southeast Asia, where vending machine adoption is rising.

The global market is closely tied to consumer discretionary spending, as vending machines are a convenience-driven retail channel. Economic growth and increasing disposable income, especially in emerging markets, are driving massive adoption of automated vending solutions. Urbanization and infrastructure development also greatly affect the same, with higher-traffic locations such as malls, airports, and office buildings needing vending machines.

Another macroeconomic factor affecting the market is the cashless economy movement. Governments from across the world have also supported digital payment modes, thereby fast-tracking the commercial deployment of contactless and mobile payment-enabled vending machines. Meanwhile, inflation and changes in raw material prices are impacting machine manufacturing and operational costs.

Sustainability regulations also set the tone for industry dynamics. European and North American governments are impelling biodegradable packaging and energy-efficient vending solutions, which in turn will affect the investment decisions of leading players in the industry. AI, IoT, and smart vending technology would, in the long term, spur market demand as they enhance user experience and optimize inventory management.

The market is primarily driven by established vending machine manufacturers and chewing gum brands integrating intelligent vending solutions. It is expected that the chewing gum machine market will remain competitive because the major players are focusing on augmenting their market position with technological advancements, product differentiation, and strategic expansion in 2024.

These medium-sized players and regional manufacturers have also been gaining popularity because they focus on low-market segments, like sugar-free, functional, and organic gum vending. According to the report, revenues of companies that used AI vending machines integrated with digital payments increased by over 10% in 2024.

Asia-Pacific is emerging as a key growth region due to increasing urbanization and rising demand for vending machines. Local players are expected to benefit from the evolved consumer demand and cityization trends that boost Ethiopian consumers towards both a Western model and mentality.

Key Developments

The market is segmented by type into tabletop machines and floor-standing machines.

Based on end-use, the market is segmented into food service establishments, office buildings, and retail stores.

The market is segmented based on sales channels, including online and offline.

The market is segmented by region into North America, Latin America, Western Europe, South Asia & Pacific, East Asia, Middle East, and Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Mn) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Mn) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Mn) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Global Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End-use, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Mn) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 27: North America Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Mn) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 41: North America Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End-use, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Mn) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 51: Latin America Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Mn) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Mn) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 75: Europe Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Mn) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 89: Europe Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Mn) by Type, 2023 to 2033

Figure 98: East Asia Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 99: East Asia Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ Mn) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: East Asia Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 113: East Asia Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Mn) by Type, 2023 to 2033

Figure 122: South Asia Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 123: South Asia Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ Mn) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: South Asia Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 137: South Asia Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 142: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Mn) by Type, 2023 to 2033

Figure 146: Oceania Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 147: Oceania Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ Mn) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 157: Oceania Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 161: Oceania Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 166: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Mn) by Type, 2023 to 2033

Figure 170: MEA Market Value (US$ Mn) by End-use, 2023 to 2033

Figure 171: MEA Market Value (US$ Mn) by Sales Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Mn) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Mn) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Mn) Analysis by Type, 2018 to 2033

Figure 178: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 181: MEA Market Value (US$ Mn) Analysis by End-use, 2018 to 2033

Figure 182: MEA Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 185: MEA Market Value (US$ Mn) Analysis by Sales Channel, 2018 to 2033

Figure 186: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: MEA Market Attractiveness by Type, 2023 to 2033

Figure 190: MEA Market Attractiveness by End-use, 2023 to 2033

Figure 191: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

The increasing preference for on-the-go snacking, digital payment integration, and product variety are key factors boosting demand.

Companies are adopting biodegradable packaging and energy-efficient machines to comply with environmental regulations and meet consumer expectations.

Asia-Pacific is witnessing rapid expansion due to rising urbanization, higher disposable incomes, and advancements in automated retail solutions.

AI-driven recommendations, real-time inventory tracking, and contactless payment solutions are enhancing customer experience and operational efficiency.

Manufacturers are introducing sugar-free, xylitol-based, and vitamin-enriched gum options to cater to changing dietary trends and regulatory requirements.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA