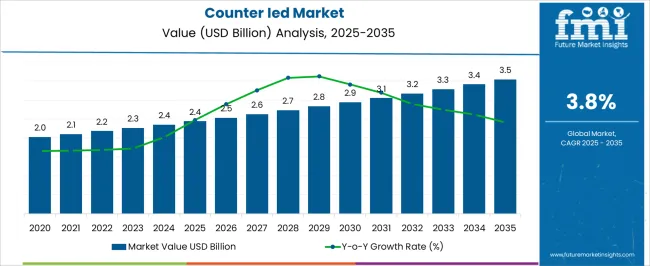

The counter Ied market is valued at USD 2.4 billion in 2025 and is projected to reach USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

A rolling CAGR analysis of this market highlights a pattern of steady, incremental growth rather than sharp accelerations, which is characteristic of a mature defense-oriented segment. In the early forecast years, the market progresses from USD 2.0 billion in 2024 to USD 2.4 billion in 2025, establishing a strong foundation with consistent year-on-year increments. Between 2026 and 2030, growth remains modest, rising gradually from USD 2.5 billion to USD 2.9 billion, reflecting sustained demand driven by military modernization, counterterrorism initiatives, and the need for advanced detection and neutralization technologies. The rolling CAGR during this period shows a slow but positive climb, suggesting stability with limited risk of market volatility.

Post-2030, the growth trajectory shows a slightly firmer pace, reaching USD 3.5 billion in 2035. This acceleration is largely attributed to continuous geopolitical tensions, technological innovation in electronic countermeasures, and increased adoption of unmanned systems for threat mitigation. Importantly, the decadal rolling CAGR illustrates that while the market does not experience dramatic surges, it maintains a dependable growth pathway that makes it attractive for long-term investments, particularly for firms focusing on niche applications such as electronic jammers, unmanned platforms, and advanced threat intelligence systems. This steady expansion signifies that the market is less susceptible to cyclical downturns, providing a reliable revenue stream for defense contractors and suppliers engaged in counter-IED solutions.

| Metric | Value |

|---|---|

| Counter Ied Market Estimated Value in (2025 E) | USD 2.4 billion |

| Counter Ied Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The counter Ied market holds a strategic position within the global defense and security sector, accounting for approximately 22–25% share of the overall explosive ordnance disposal and counterterrorism industry. Within the military defense operations segment, counter IED solutions contribute nearly 28–30%, driven by deployment of detection, neutralization, and blast mitigation technologies to safeguard troops and critical infrastructure in conflict zones. In domestic law enforcement and homeland security applications, the market represents around 18–20% share, reflecting increasing adoption of mobile robots, jammers, and X-ray screening systems to prevent civilian casualties and maintain public safety.

For intelligence and surveillance operations, counter IED systems account for roughly 12–14%, as advanced analytics and sensor integration improve threat identification and rapid response. The private security and critical facility protection sector contributes close to 10–12%, supported by rising demand from transport hubs, industrial sites, and high-value public venues. Growth is influenced by ongoing asymmetric warfare challenges, rising insurgency activities, and increased government expenditure on protective technologies. Manufacturers are focusing on portable and autonomous detection devices, sensor-fusion systems, and rapid-response robotic platforms to enhance operational effectiveness. With evolving threat landscapes, expanding defense budgets, and growing public safety priorities, counter IED solutions remain a critical component of global security infrastructure.

The counter IED market is experiencing sustained growth, driven by the increasing complexity of asymmetric threats and the need for advanced explosive detection and neutralization technologies. Rising geopolitical tensions, cross-border insurgencies, and the proliferation of improvised explosive devices have intensified the demand for modern countermeasures. The integration of AI-enabled detection systems, advanced sensor technologies, and real-time data analytics has enhanced the accuracy and efficiency of threat identification.

Governments and defense organizations are prioritizing investments in systems that can be rapidly deployed across varied terrains and operational environments. Collaborative defense programs between allied nations are fostering technological innovations and standardization in equipment design and operation.

Additionally, the emphasis on soldier safety and mission efficiency has led to the adoption of modular and scalable systems that can be upgraded through software enhancements As security challenges evolve, the Counter IED market is expected to expand further, with strong prospects for growth in both traditional and emerging defense markets.

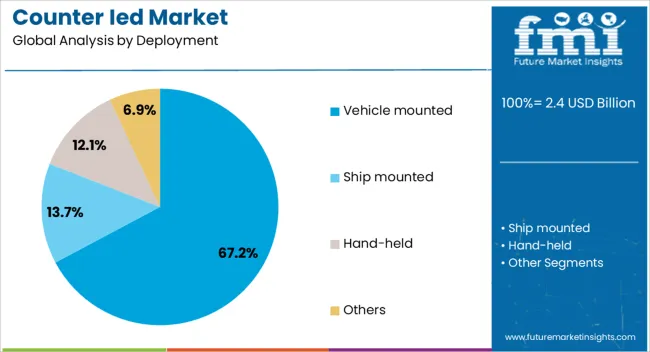

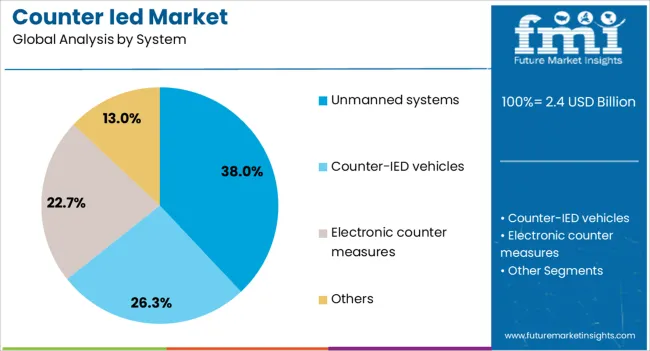

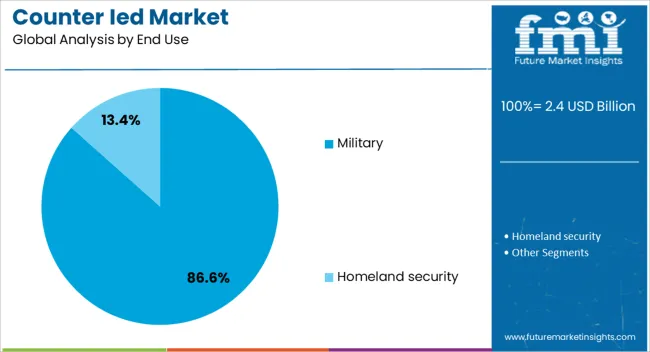

The counter ied market is segmented by deployment, system, end use, and geographic regions. By deployment, counter ied market is divided into vehicle mounted, ship mounted, hand-held, and others. In terms of system, counter ied market is classified into unmanned systems, counter-IED vehicles, electronic counter measures, and others. Based on end use, counter ied market is segmented into military and homeland security. Regionally, the counter ied industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The vehicle mounted deployment segment is projected to account for 67.21% of the counter IED market revenue share in 2025, making it the dominant deployment method. This growth has been attributed to the capability of vehicle mounted systems to provide mobility, protection, and integrated operational support in high-risk environments. These platforms are designed to operate in varied terrains while carrying advanced detection, jamming, and neutralization technologies.

The ability to integrate with other battlefield communication and surveillance systems has enhanced their operational value. Vehicle mounted solutions offer the advantage of extended range, high endurance, and the capacity to transport heavier payloads for comprehensive counter-IED operations.

Additionally, their armored design ensures crew safety while enabling continuous operation in hostile zones Military forces have preferred vehicle mounted platforms for both offensive and defensive missions, ensuring rapid deployment and sustained field presence, which has reinforced their leadership in this segment.

The unmanned systems segment is expected to hold 38% of the market revenue share in 2025, establishing itself as a critical technological component. This growth has been supported by the increasing use of remotely operated and autonomous platforms for hazardous missions where human exposure must be minimized. Unmanned systems can be deployed for detection, disruption, and safe disposal of explosive threats without placing personnel in direct danger.

Their integration with high-resolution imaging, robotics, and AI-based navigation allows for precise operations even in complex environments. These systems have gained traction due to their adaptability for ground, aerial, and underwater missions, making them highly versatile for defense applications.

Operational cost-efficiency, ease of transport, and quick deployment capabilities have further driven adoption As advancements in robotics, autonomy, and sensor fusion continue, unmanned systems are expected to expand their role in both tactical and strategic counter-IED operations.

The military end use segment is anticipated to command 86.57% of the market revenue share in 2025, solidifying its dominant position. The demand in this segment has been propelled by the continuous need to safeguard troops, secure military installations, and ensure the success of missions in conflict-prone areas. Military forces have invested significantly in advanced counter-IED technologies that integrate detection, disruption, and neutralization functions into cohesive systems.

The emphasis on interoperability across defense units and allied forces has driven the development of standardized equipment and shared operational protocols. Strategic modernization programs have prioritized counter-IED capabilities to address evolving threat patterns, especially in asymmetric warfare.

Training, simulation, and real-time data sharing have also become integral components of military counter-IED strategies, ensuring readiness and operational efficiency With ongoing conflicts and global security challenges, the military sector is expected to remain the primary driver of demand in this market.

Counter IED solutions are driven by military, law enforcement, private sector, and autonomous technology adoption. Rising threats and investment in detection, neutralization, and sensor-based platforms ensure consistent market expansion.

Growing military operations in conflict-prone regions are propelling the adoption of counter IED solutions. Defense forces are increasingly deploying detection, neutralization, and blast mitigation systems to safeguard personnel, equipment, and infrastructure. Threat intelligence integration with unmanned ground and aerial vehicles has improved operational efficiency, allowing real-time detection of explosives. Procurement strategies are focusing on portable, lightweight systems suitable for diverse terrains. Enhanced training and simulation exercises for personnel have increased reliance on counter IED technologies. Government budgets in NATO and non-NATO countries are allocating higher shares to protective equipment, while modernization of existing vehicles with integrated detection units supports the broader adoption of counter IED capabilities across active military theaters.

Police forces and homeland security agencies are accelerating the integration of counter IED technologies in urban and public spaces. Mobile robotic platforms, jammers, and remote-controlled inspection devices are being deployed to mitigate civilian casualties during high-risk events. Collaboration with private security firms and inter-agency intelligence sharing enhances preparedness and operational response. Training programs in bomb disposal and hazard recognition are leading to faster adoption of advanced tools. Rising public event security requirements, including stadiums, airports, and mass gatherings, are driving consistent demand for detection and neutralization devices. Adoption of sensor-based threat identification is increasing, enabling authorities to respond to threats proactively before they escalate.

Critical infrastructure operators and private security providers are increasingly investing in counter IED systems to protect high-value assets. Ports, energy plants, and transportation hubs are deploying sensor arrays, surveillance integration, and rapid-response teams to counter explosive threats. Insurance requirements and corporate risk management strategies are encouraging adoption, with ROI measured in reduced operational interruptions. Collaborative partnerships with defense manufacturers ensure tailored solutions suitable for private-sector applications. The market is witnessing innovation in portable detection kits, blast-resistant containers, and remote monitoring solutions, enabling proactive threat neutralization. Rising awareness of industrial vulnerabilities and liability pressures is encouraging a structured approach to deploying counter IED solutions across high-risk facilities globally.

Counter IED operations are increasingly leveraging autonomous robotics and integrated sensor networks. Ground robots, drones, and sensor-fusion systems allow safe reconnaissance, detection, and neutralization of explosive threats. Remote operation reduces personnel exposure and improves mission efficiency. Data analytics and AI-driven threat recognition are enabling predictive threat assessment and rapid decision-making. Modular designs and interchangeable payloads allow single platforms to perform multiple functions, reducing costs and improving versatility. Governments and private security agencies are scaling deployment to cover urban, industrial, and conflict environments. Field trials and adoption programs emphasize reliability, portability, and ease of integration with existing defense and security assets, driving sustained demand in the market.

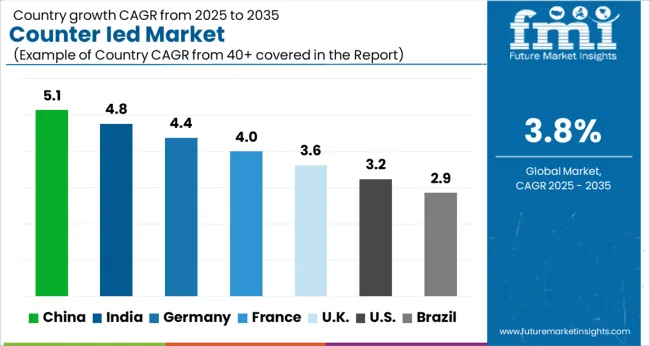

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

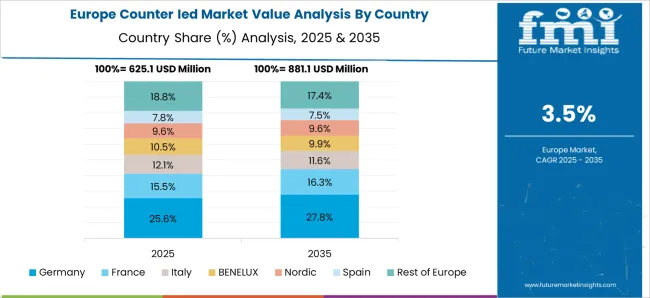

The counter Ied market is projected to grow globally at a CAGR of 3.8% from 2025 to 2035, fueled by rising defense budgets, increasing military operations, and expanding law enforcement initiatives. China leads with a CAGR of 5.1%, supported by modernization of armed forces, investments in detection and neutralization systems, and large-scale deployment in border and conflict-prone regions. India follows at 4.8%, driven by infrastructure security requirements, growing procurement of bomb disposal robots, and expansion of specialized counter IED units. France records a CAGR of 4.0%, with demand driven by urban security programs, military training, and public safety initiatives. The United Kingdom grows at 3.6%, influenced by homeland security upgrades, law enforcement adoption, and defense modernization programs. The United States posts 3.2%, shaped by ongoing military operations, high-value infrastructure protection, and deployment of advanced robotic and sensor-based solutions. The study encompasses over 40 regions, with these countries serving as key benchmarks for counter IED deployment strategies, defense procurement patterns, and technology adoption trends worldwide.

China is expected to grow at a CAGR of 5.1% during 2025–2035, surpassing the global benchmark of 3.8%, driven by modernization of military units, deployment of advanced bomb disposal systems, and increasing border security operations. During the 2020–2024 period, the growth rate was 4.4%, supported by procurement of robotic EOD systems, sensor-based detection solutions, and specialized counter Ied units. The increase in CAGR moving forward is driven by expanding domestic manufacturing of explosive detection equipment, integration of AI-enabled threat analytics, and government-backed initiatives to enhance homeland and border security. China’s strategic investments in military and law enforcement counter Ied technologies underpin this rise.

India is projected to achieve a CAGR of 4.8% between 2025 and 2035, exceeding the global average of 3.8%, supported by growing defense budgets, modernization of border security, and expansion of counterterrorism initiatives. During 2020–2024, India recorded a CAGR of 4.2%, driven by procurement of bomb disposal robots, specialized EOD training programs, and investment in urban and critical infrastructure protection. The rise in growth is attributed to increasing adoption of integrated detection systems, expansion of defense manufacturing capabilities, and strategic government initiatives to improve emergency response readiness. India’s focus on strengthening counter Ied preparedness underpins continued market expansion.

France is anticipated to grow at a CAGR of 4.0% from 2025 to 2035, above the global CAGR of 3.8%, driven by modernization of law enforcement, counterterrorism measures, and urban security investments. During 2020–2024, France recorded a CAGR of 3.5%, supported by demand for robotic disposal systems, sensor-based detection equipment, and military training programs in explosive ordnance disposal. The increase in CAGR moving forward is fueled by government initiatives to strengthen domestic counter Ied capabilities, integration of mobile and networked detection technologies, and deployment in high-risk regions. France’s adoption of advanced protocols for both military and civilian applications underpins this rise.

The UK is projected to grow at a CAGR of 3.6% during 2025–2035, slightly below China and India but above the global benchmark of 3.8%, influenced by investment in homeland security, law enforcement modernization, and international defense collaboration. During 2020–2024, the UK posted a CAGR of 3.2%, supported by procurement of robotic EOD platforms, urban security enhancement programs, and growing defense expenditures. The increase in CAGR is attributed to expanded deployment of integrated detection networks, adoption of unmanned ground and aerial EOD systems, and continuous training programs for specialized counter Ied units. Strategic defense alliances and procurement initiatives strengthen this market trajectory.

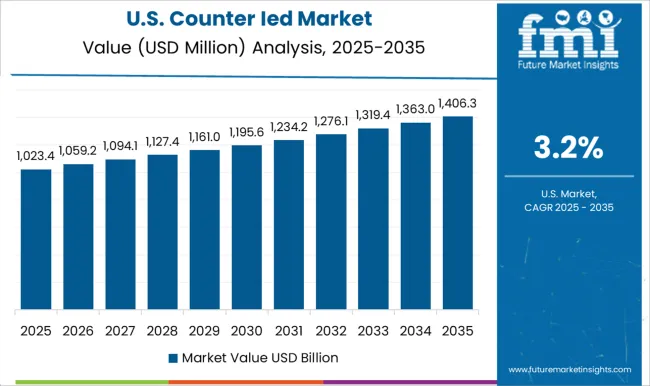

The USA is expected to grow at a CAGR of 3.2% between 2025 and 2035, slightly below the global CAGR of 3.8%, shaped by ongoing military operations, high-value infrastructure protection, and investments in advanced robotic and sensor-based detection systems. During 2020–2024, the USA recorded a CAGR of 2.8%, supported by modernization of explosive ordnance disposal programs, procurement of unmanned detection equipment, and counterterrorism initiatives. The increase in CAGR moving forward is influenced by adoption of networked detection technologies, expanded deployment in domestic and overseas operational theaters, and increased investment in autonomous EOD research. Focus on rapid response, safety, and threat mitigation underpins this growth.

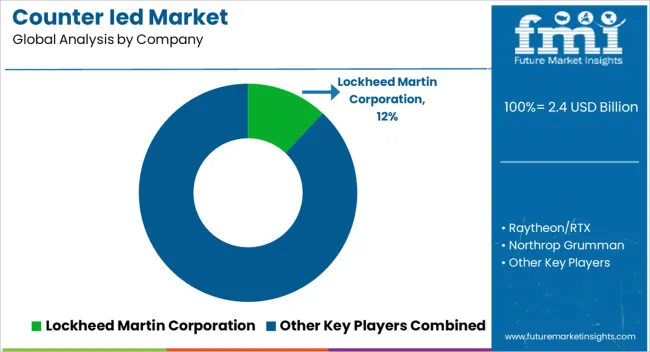

The counter Ied market is shaped by intense competition among leading global defense contractors, focusing on advanced detection, disposal, and neutralization systems. Lockheed Martin Corporation is a dominant player, leveraging its extensive capabilities in military robotics, sensor technologies, and integrated EOD solutions, maintaining a stronghold in both domestic and international markets. Raytheon/RTX excels in explosive detection technologies, threat analytics, and counterterrorism solutions, offering a wide portfolio for military and civilian applications. Northrop Grumman stands out for unmanned ground and aerial platforms, coupled with advanced robotic EOD systems for high-risk operations. General Dynamics is recognized for delivering specialized mobile disposal units and secure communication networks for operational coordination. Thales Group offers integrated counter Ied solutions, focusing on sensor fusion and rapid threat identification.

L3Harris Technologies is known for providing cutting-edge detection equipment and training solutions, while BAE Systems develops modular EOD systems and strategic partnerships with military clients. Elbit Systems specializes in robotic and remote-operated neutralization platforms for asymmetric warfare scenarios. These companies compete on system reliability, operational efficiency, and integration capabilities, with a focus on rapid deployment, autonomous functionality, and seamless coordination with defense and law enforcement agencies. Continuous R&D investment, strategic collaborations with government and security organizations, and enhancements in sensor and robotics technology remain central to maintaining leadership in the global counter Ied market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.4 billion |

| Deployment | Vehicle mounted, Ship mounted, Hand-held, and Others |

| System | Unmanned systems, Counter-IED vehicles, Electronic counter measures, and Others |

| End Use | Military and Homeland security |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lockheed Martin Corporation, Raytheon/RTX, Northrop Grumman, General Dynamics, Thales Group, L3Harris Technologies, BAE Systems, and Elbit Systems |

| Additional Attributes | Dollar sales, market share, CAGR trends, demand by military and civilian sectors, technology adoption, procurement budgets, regional threat analysis, competitive landscape, and future growth opportunities. |

The global counter ied market is estimated to be valued at USD 2.4 billion in 2025.

The market size for the counter ied market is projected to reach USD 3.5 billion by 2035.

The counter ied market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in counter ied market are vehicle mounted, ship mounted, hand-held and others.

In terms of system, unmanned systems segment to command 38.0% share in the counter ied market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Counter-IED Systems Market

Counterfeit Drug Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Counter Drone System Market Size and Share Forecast Outlook 2025 to 2035

Counterblow Hammers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Counterfeit Money Detection Market Size and Share Forecast Outlook 2025 to 2035

Countertop Convection Oven Market Size and Share Forecast Outlook 2025 to 2035

Countertop Blast Chiller Market Size and Share Forecast Outlook 2025 to 2035

Countertop Pressure Fryer Market Size and Share Forecast Outlook 2025 to 2035

Countertop Griddle Market Size and Share Forecast Outlook 2025 to 2035

United States Countertop Market Trends - Growth, Demand & Forecast 2025 to 2035

Countertop Market Size & Demand 2025 to 2035

Counter Bags Market by Material & Application from 2025 to 2035

Countertop Ice Dispensers Market - Space-Efficient Solutions & Industry Growth 2025 to 2035

Countertop Pizza Warmers & Merchandisers Market - Fresh & Ready Pizzas 2025 to 2035

Countertop Warmers & Display Cases Market – Food Presentation & Preservation 2025 to 2035

Competitive Overview of Counter Bags Market Share

Countertop Spray Market Trends – Growth & Forecast 2023-2033

Countertop Paper Napkin Dispenser Market

In-Counter Barcode Scanners Market Size and Share Forecast Outlook 2025 to 2035

Anti-counterfeit Pharmaceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA