The counterfeit drug detection device market is experiencing robust expansion. Increasing global incidence of counterfeit pharmaceuticals, stringent regulatory frameworks, and rising emphasis on patient safety are major factors driving market growth. Current dynamics highlight the need for rapid, accurate, and portable detection systems that can ensure drug authenticity across complex supply chains.

Continuous advancements in spectroscopic, chromatographic, and imaging technologies are enhancing detection precision and operational reliability. Market participants are focusing on integrating AI-driven analytics and real-time data processing to improve field-level usability and compliance tracking.

The future outlook remains positive as government agencies and healthcare organizations intensify efforts to combat drug counterfeiting through advanced verification solutions Growth rationale is centered on the widespread adoption of compact and high-accuracy detection devices, increasing collaboration between manufacturers and pharmaceutical regulators, and the evolution of technology standards that promote transparency and traceability across global pharmaceutical distribution networks.

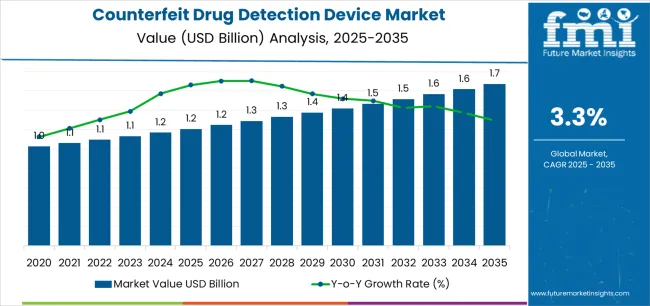

| Metric | Value |

|---|---|

| Counterfeit Drug Detection Device Market Estimated Value in (2025 E) | USD 1.2 billion |

| Counterfeit Drug Detection Device Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 3.3% |

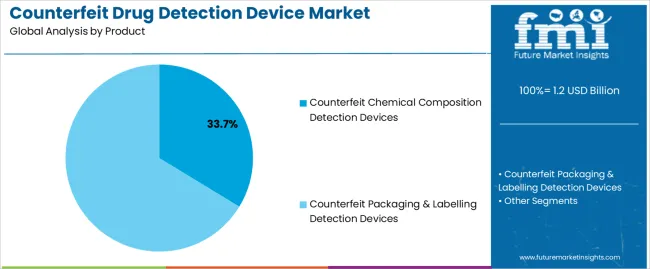

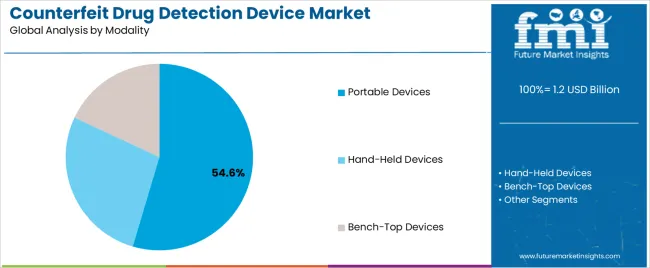

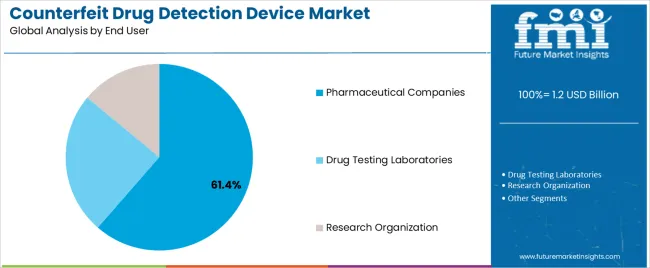

The market is segmented by Product, Modality, and End User and region. By Product, the market is divided into Counterfeit Chemical Composition Detection Devices and Counterfeit Packaging & Labelling Detection Devices. In terms of Modality, the market is classified into Portable Devices, Hand-Held Devices, and Bench-Top Devices. Based on End User, the market is segmented into Pharmaceutical Companies, Drug Testing Laboratories, and Research Organization. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The counterfeit chemical composition detection devices segment, accounting for 33.70% of the product category, has maintained its dominance due to its superior analytical capability in identifying counterfeit formulations through molecular and chemical profiling. The segment’s demand has been reinforced by its high detection accuracy and ability to differentiate authentic products from fraudulent ones.

Increased adoption across quality control laboratories and regulatory enforcement agencies has contributed to steady market penetration. Continuous improvements in sensor technology and miniaturization have enhanced device portability and precision.

Regulatory mandates requiring chemical verification of pharmaceuticals have further elevated segment relevance Ongoing R&D investment in spectroscopy-based identification and integration of cloud-enabled analysis platforms is expected to strengthen this segment’s position and support its sustained contribution to overall market growth.

The portable devices segment, holding 54.60% of the modality category, has emerged as the leading mode of deployment owing to its convenience, flexibility, and rapid detection capabilities. Field operability and real-time analysis have made portable systems essential for on-site drug verification across supply chains.

Lightweight design, ease of use, and compatibility with digital monitoring interfaces have enhanced adoption among regulatory bodies and law enforcement agencies. Increasing demand for mobility in pharmaceutical inspections and remote testing environments has further reinforced the segment’s growth.

Manufacturers are focusing on battery efficiency, wireless data transfer, and automated result generation to improve accuracy and user experience Continuous technological innovation and expanding use in resource-constrained regions are expected to maintain the segment’s leading share throughout the forecast period.

The pharmaceutical companies segment, representing 61.40% of the end user category, has sustained leadership due to its proactive role in safeguarding brand integrity and ensuring product authenticity across distribution channels. Adoption of counterfeit detection devices within pharmaceutical manufacturing and logistics operations has been driven by compliance obligations and the economic impact of counterfeit products.

Integration of advanced detection systems within production and packaging lines has enhanced security measures and traceability. Collaboration between manufacturers, regulatory bodies, and technology providers has accelerated the deployment of high-performance devices for routine quality verification.

The segment’s growth is further supported by corporate initiatives toward sustainable supply chain transparency and digital authentication frameworks Continued investment in device standardization and data integration platforms is expected to reinforce its dominant position and drive market expansion globally.

Counterfeit chemical composition detection devices are firm in their position at the top of the product segment. Pharmaceutical companies are the predominant users of counterfeit drug detection devices.

For 2025, counterfeit chemical composition detection devices are expected to account for 55.0% of the market share by product. Some of the key drivers for the increasing use of counterfeit chemical composition detection devices are:

| Attributes | Details |

|---|---|

| Top Product | Counterfeit Chemical Composition Detection Devices |

| Market Share (2025) | 55.0% |

Pharmaceutical industry use of counterfeit drug detection devices is anticipated to account for 37.8% of the market share in 2025. Some of the key drivers for the progress of counterfeit drug detection devices by pharmaceutical companies include:

| Attributes | Details |

|---|---|

| Top End User | Pharmaceutical Companies |

| Market Share (2025) | 37.8% |

Increasing governmental initiatives to curb counterfeit drugs are benefitting the market in the Asia Pacific. The rise in scams related to counterfeit drugs is also increasing the importance of the devices in the region.

Europe’s reputed security systems are integrating the device into their work, thus advancing the market’s prospects. The affluent pharmaceutical companies are also not hesitant to integrate the product into their work and thus the market is developing positively in the region.

| Countries | CAGR |

|---|---|

| India | 5.4% |

| Thailand | 5.0% |

| Malaysia | 3.8% |

| France | 3.8% |

| Spain | 4.0% |

The market is set to register a CAGR of 5.4% in India for the forecast period. The key drivers for growth are:

The CAGR for counterfeit drug detection device in Thailand is tipped to be 5.0% over the forecast period. Some of the key factors driving the growth are:

The CAGR for counterfeit drug detection device in Malaysia is tipped to be 3.8% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 3.8% in France for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 4.0% in Spain over the forecast period. Some of the key trends include:

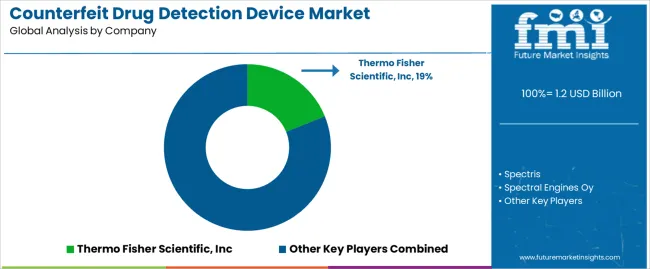

The counterfeit drug detection device market is fairly fragmented. While a few reputed companies have a significant share of the market demand, newer players and small-scale players also have the potential to thrive.

Technologically advancing the products, to keep the product line moving, is given priority by market players. Geographical expansion is also given significance by market players.

Recent Developments in the Counterfeit Drug Detection Device Market

The global counterfeit drug detection device market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the counterfeit drug detection device market is projected to reach USD 1.7 billion by 2035.

The counterfeit drug detection device market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in counterfeit drug detection device market are counterfeit chemical composition detection devices, _ultraviolet/vis devices, _infrared & near infrared spectroscopy device, _raman spectrometers, _xrd & xrf spectroscopy devices, counterfeit packaging & labelling detection devices, _rfid analyzer, _scanning & imaging systems and _others.

In terms of modality, portable devices segment to command 54.6% share in the counterfeit drug detection device market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Drug Device Combination Products Market Size and Share Forecast Outlook 2025 to 2035

Counterfeit Money Detection Market Size and Share Forecast Outlook 2025 to 2035

Seizure Detection Devices Market

Radiation Detection Device Market Size and Share Forecast Outlook 2025 to 2035

Arc Fault Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Road Side Drug Testing Devices Market

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Connected Drug Delivery Devices Market Size and Share Forecast Outlook 2025 to 2035

Implantable Drug Eluting Devices Market Size and Share Forecast Outlook 2025 to 2035

Pressure Ulcer Detection Devices Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Subcutaneous Drug Delivery Devices Providers

Endoscope Leak Detection Device Market

IV Fluid Transfer Drugs Devices Market Trends – Growth & Forecast 2025 to 2035

Heart Beat Irregularity Detection Device Market Trends - Growth & Forecast 2025 to 2035

Drug Taste Masking Technologies Market Forecast and Outlook 2025 to 2035

Drug-Gene Interaction Panels Market Size and Share Forecast Outlook 2025 to 2035

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Drug Tester Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Integrated Polymer Fibers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA