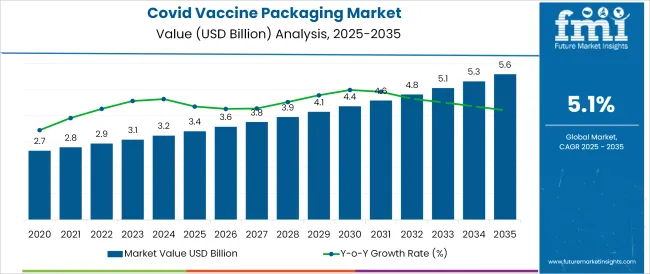

The Covid Vaccine Packaging Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

The Covid vaccine packaging market has evolved rapidly in response to unprecedented global demand for safe, efficient, and scalable vaccine distribution. The urgency to deliver billions of doses across diverse geographies has driven innovation and standardization in packaging solutions, emphasizing both protection and efficiency.

Regulatory scrutiny, cold chain requirements, and the need to maintain vaccine integrity throughout distribution have shaped the market dynamics. Industry focus on minimizing contamination risks, ensuring temperature stability, and optimizing logistics has created opportunities for advanced materials and designs.

Future growth is expected to be supported by investments in resilient supply chains, continued global immunization initiatives, and technological advancements aimed at enhancing the sustainability and cost-effectiveness of vaccine packaging. This trajectory is further underpinned by stronger collaborations between pharmaceutical manufacturers and packaging providers to meet evolving regulatory and operational challenges.

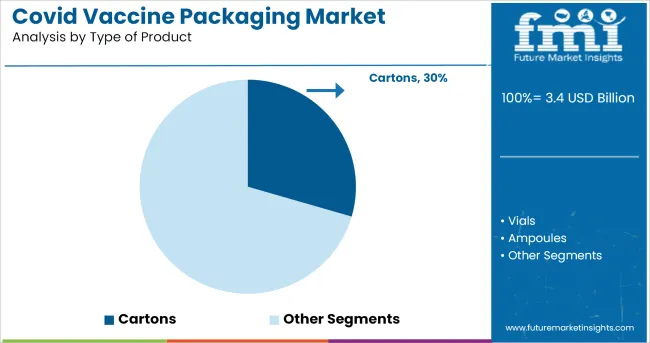

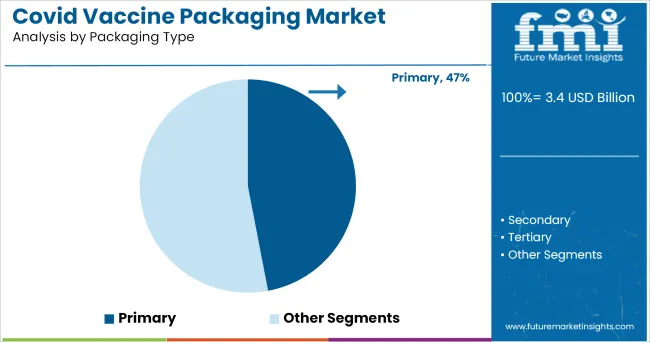

The market is segmented by Type of Product, Packaging Type, and Material and region. By Type of Product, the market is divided into Cartons, Vials, Ampoules, Syringes, Stoppers and Seals, Boxes, and Others. In terms of Packaging Type, the market is classified into Primary, Secondary, and Tertiary.

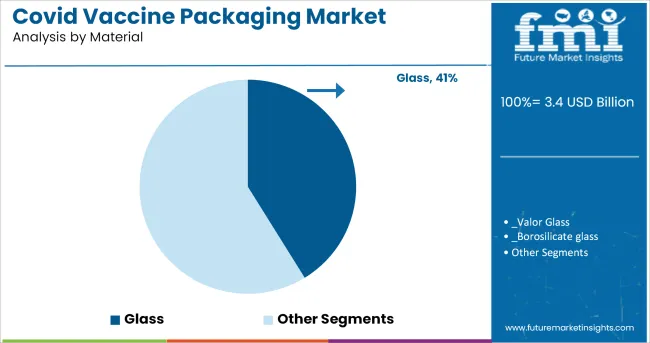

Based on Material, the market is segmented into Glass, Valor Glass, Borosilicate glass, Plastic, Paper, and Metal. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by type of product, cartons are projected to hold 29.5% of the total market revenue in 2025, establishing themselves as a leading product category. This position has been shaped by the versatility and protective capabilities of cartons, which have proven critical for secondary packaging in large-scale vaccine distribution.

The segment has benefited from the need to consolidate individual doses into manageable units for transport while providing space for regulatory labeling, traceability information, and usage instructions. Additionally, the lightweight and recyclable nature of cartons has aligned well with sustainability objectives and logistical efficiency, enhancing their appeal.

The ability to customize dimensions and configurations to accommodate varying vial and syringe formats has also reinforced the segment’s prominence, ensuring safe handling and distribution under stringent conditions.

In terms of packaging type, primary packaging is expected to account for 47.0% of the market revenue in 2025, emerging as the dominant segment. This leadership has been driven by the critical role of primary packaging in directly protecting the vaccine from external contaminants, ensuring sterility, and maintaining efficacy throughout storage and transport.

The segment has benefited from innovations that enable compatibility with ultra low temperature conditions and long term storage, addressing the unique requirements of Covid vaccines. The prominence of this segment has also been supported by the regulatory emphasis on maintaining product integrity and traceability at the dose level, which has necessitated stringent quality standards.

Advances in manufacturing precision and material performance have further reinforced the reliability and scalability of primary packaging, making it indispensable to the vaccine supply chain.

When segmented by material, glass is projected to capture 41.2% of the market revenue in 2025, confirming its leadership in the material category. This position has been shaped by the inherent properties of glass, including chemical inertness, impermeability, and excellent barrier performance, which are essential for preserving vaccine stability.

The segment has been further supported by its ability to withstand extreme cold chain conditions without compromising the integrity of the contents. Glass has also gained preference due to its long-standing acceptance by regulatory bodies and its proven track record in pharmaceutical packaging.

Manufacturing scalability, along with advancements in strengthening techniques and breakage resistance, has enhanced the suitability of glass for high volume production and distribution. The segment’s dominance reflects its continued relevance in addressing the demanding quality and safety standards of Covid vaccine delivery worldwide.

The COVID-19 vaccine packing market witnessed a drastic growth in the first quarter of 2024 and is expected to further expand at a high compound annual growth rate (CAGR) in the coming years. The outbreak of the COVID-19 pandemic across the globe has devastated the lives of many people. Since the outbreak, the demand for vaccines with high efficacy has been on the surge.

Many players in the biopharmaceutical and pharmaceutical industry like Pfizer Inc., Johnson & Johnson, Moderna Inc., and Serum Institute of India among many other are racing towards developing and delivering COVID-19 vaccines to the world population. This has incrementally heightened the demand for packaging of these covid vaccines.

The increasing demand for the covid vaccine packaging solutions in a short period has led to a trend among companies in offering pre sterilized primary and secondary packaging solutions.

The pre sterilized secondary packaging solutions like trays, nests and tubs are gaining popularity among the manufacturers. This is mainly because it conveniently eliminates the wash and sterilization process done by the pharmaceutical manufacturing companies and offers them ready to use alternatives for aseptic-fill operations.

There are many companies that are working on developing vaccines with high efficacy and different administration type like oral, intranasal, intramuscular and intradermal. According to the World Health Organization (WHO) data updated on July 6, 2024, there are over 105 vaccines in clinical development and 184 vaccines that are in the pre-clinical development stage.

With the increasing number of vaccines getting approval and development of different vaccine delivery systems the covid vaccine packaging market is anticipated to witness substantial growth during the foreseeable future.

There is alarmingly high demand for the covid vaccine packaging solutions globally. As this level of demand was not anticipated by the manufacturers in the industry the gap between the demand and supply of the packaging solutions is created.

The need for raw materials at a large scale and in a short period was difficult and this created a restraint in the covid vaccine packaging market growth. But with consistent efforts of the manufacturers as well as the government authorities to enhance the manufacturing capabilities, the effect of this restraint is dampening.

Key global players such as

In the Asian region, players like

Key players are competing against each other in the industry to acquire maximum market share for multiple segments. In the covid vaccine packaging market, manufacturers are adopting strategies like partnerships and capacity expansions to grow their product offerings and increase the consumer base.

The manufacturers are also focused on making agreements with governments of different countries and international organizations like UNICEF for the supply of covid vaccine packaging solutions.

For instance, in July 2024, Becton, Dickinson and Company signed an agreement with the USA government to provide over 190 million injection devices. Further, the company also received an additional order from the Canadian government for 75 million devices.

Furthermore, in December 2024, Scott AG in its Indian subsidiary Scott Kaisha invested over USD 17 Million for the expansion of its vial manufacturing capacity to reach over 300 million units.

The COVID-19 pandemic is still hitting major as well as minor economies of the world severely in the form of second and third waves. Although the effective treatment for the virus is yet to be found, vaccines with higher efficacy are being introduced in the market to tackle the mutated virus.

According to the Our World in Data organization facts updated on July 7, 2024, 24.6% of the total world population has received at least the first dose of vaccine. This creates a huge opportunity for the manufacturers to ramp up their manufacturing capabilities and gain higher market share by preparing themselves to fulfil the upcoming increase in demand.

India is the second most populated country in the world. India also has vaccine manufacturers like Serum Institute of India and Bharat Biotech which are among the top vaccine manufacturers globally. These two factors are major contributors that are anticipated to augment the demand for the covid vaccine packaging solutions in the Indian Market.

The global covid vaccine packaging market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the covid vaccine packaging market is projected to reach USD 5.6 billion by 2035.

The covid vaccine packaging market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in covid vaccine packaging market are cartons, vials, ampoules, syringes, stoppers and seals, boxes and others.

In terms of packaging type, primary segment to command 47.0% share in the covid vaccine packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

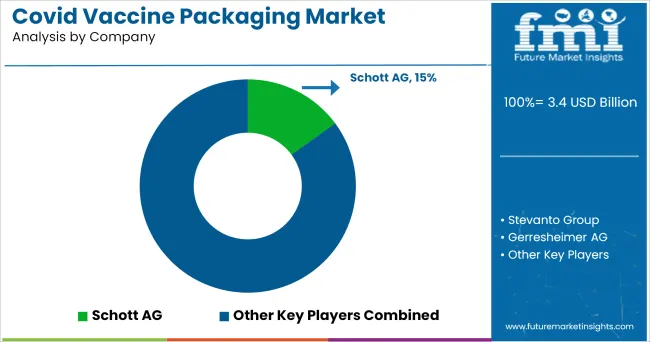

Market Share Distribution Among Covid Vaccine Packaging Manufacturers

COVID-19 Vaccine Packaging & Delivery Devices Market - Innovations & Trends 2025 to 2035

COVID-19 Saliva Sampling Test Potential Market Analysis - Trends & Future Outlook 2024 to 2034

Covid-19 Diagnostics Market – Demand, Growth & Forecast 2022-2032

Covid-19 Vaccine Development Tools Market - Growth & Forecast 2024 to 2034

Americas COVID-19 Testing Market - Trends & Forecast 2025 to 2035

Vaccine Preservatives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Stabilizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vaccine Vial Rubber Stopper Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Transport Carrier Market Size and Share Forecast Outlook 2025 to 2035

Vaccine Shippers Market Size and Share Forecast Outlook 2025 to 2035

Vaccines Market Insights - Trends, Growth & Forecast 2025 to 2035

Vaccine Ampoules Market

Vaccine Packaging Market Growth - Demand & Forecast 2024 to 2034

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Cat Vaccines Market Size and Share Forecast Outlook 2025 to 2035

Fish Vaccines Market

Live Vaccines Market

Swine Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Nasal vaccines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA