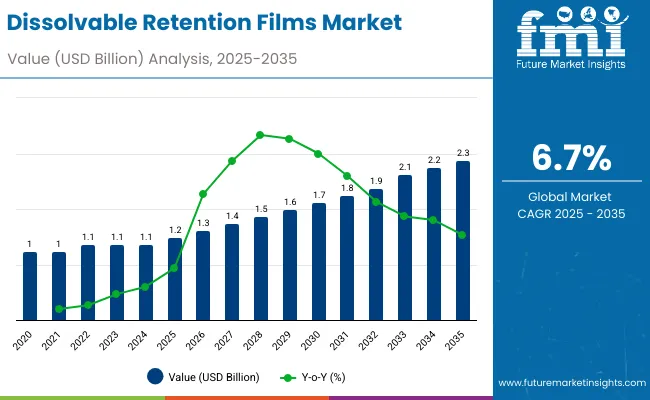

The dissolvable retention films market is projected to rise from USD 1.2 billion in 2025 to USD 2.3 billion by 2035 at a CAGR of 6.7%. Growth is influenced by stronger acceptance of single-use, unit-dose formats within home care, pharmaceutical, and agricultural activities. Polyvinyl alcohol and hydroxypropyl methylcellulose remain dominant due to high solubility, safe handling, and compatibility with modern packaging lines. Between 2025 and 2030, adoption is expected to increase as investment rises in biodegradable polymer grades and improved film-forming systems.

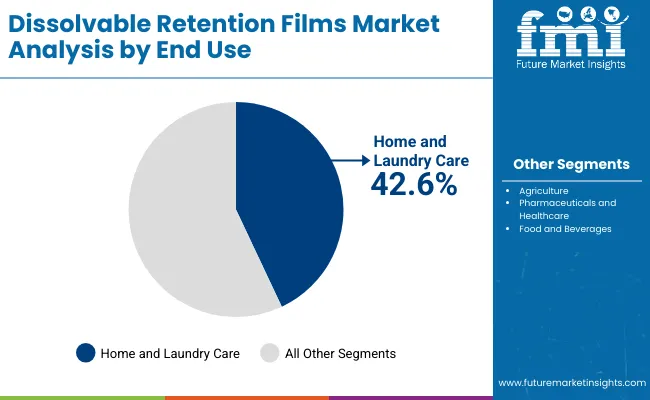

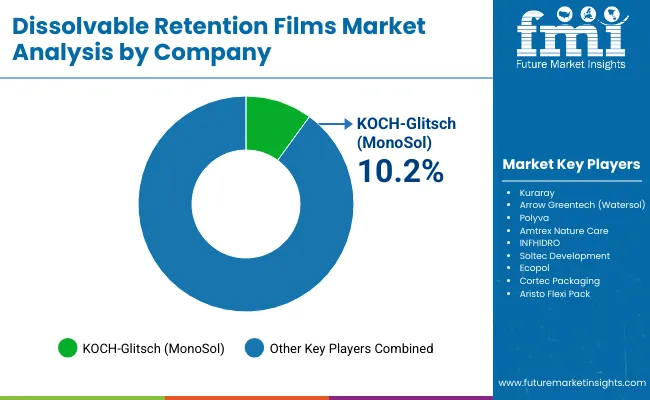

Asia Pacific is positioned to lead production due to access to resources and cost advantages, while North America and Europe focus on regulatory compliance, formulation consistency, and performance stability. The home and laundry care segment accounts for 42.6% of the market in 2025, supported by the widespread use of water-soluble capsules. Key players include KOCH Glitsch, Kuraray, Arrow Greentech, Polyva, Amtrex, INFHIDRO, Soltec Development, Ecopol, Cortec, and Aristo FlexPolymers.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 2.3 billion |

| CAGR (2025 to 2035) | 6.7% |

From 2020 to 2024, the dissolvable film industry evolved through advances in green chemistry and increased demand for safe single-use packaging. Manufacturers introduced biodegradable PVA and starch-based film alternatives with improved tensile strength and moisture control. By 2035, the market will reach USD 2.3 billion, driven by growth in detergents, crop protection agents, and pharmaceutical dose delivery. Asia-Pacific will lead in production efficiency, while Japan and South Korea emerge as early adopters of precision-coated water-soluble films.

The dissolvable retention films market is driven by global efforts to promote sustainability, reduce waste, and enhance user convenience. Dissolvable films minimize secondary packaging waste and support safe handling of concentrated formulations. Increasing product use in household care, agrochemicals, and pharmaceuticals further accelerates expansion.

The market is segmented by material, film type, application, end-use industry, and region. Materials include polyvinyl alcohol (PVA), hydroxypropyl methylcellulose (HPMC), starch-based polymers, and cellulose derivatives. Film types comprise water-soluble, protective coating, and barrier films. Key applications include detergent packaging, agrochemical doses, pharmaceutical unit doses, and food ingredients packaging. End-use industries encompass home and laundry care, agriculture, pharmaceuticals, and food & beverages.

Polyvinyl alcohol (PVA) is projected to capture 38.9% of the market in 2025, driven by its excellent solubility, strength, and environmental compatibility. Its ability to dissolve completely without leaving microplastic residues makes it ideal for single-use applications such as detergent pods and agrochemical pouches.

Manufacturers prefer PVA for its durability and flexibility during high-speed packaging operations. Ongoing advancements in water-soluble polymer blends further enhance film performance across varying temperatures and humidity levels. As sustainability regulations tighten, PVA remains the benchmark material for eco-friendly soluble packaging films.

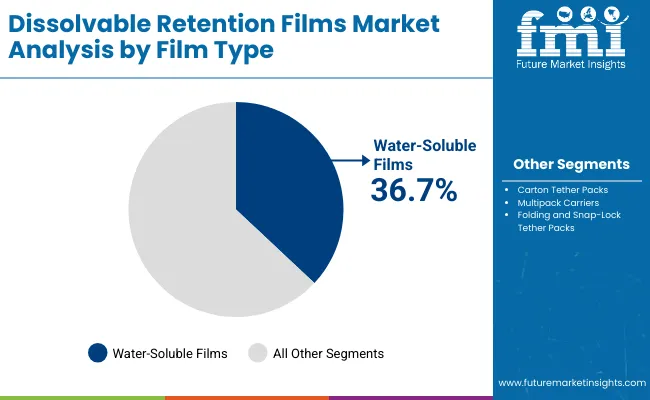

Water-soluble films are expected to hold 36.7% of the market in 2025, favored for single-dose applications where user safety and convenience are key. These films dissolve instantly in water, eliminating the need for additional packaging disposal and reducing chemical exposure risks.

Their adoption spans detergents, fertilizers, and cleaning concentrates, offering efficient delivery and minimal residue. Compatibility with automated forming and sealing systems enhances scalability. As sustainability and waste-reduction goals expand, water-soluble films continue to dominate across consumer and industrial packaging lines.

Detergent packaging is forecast to represent 35.8% of the market in 2025, driven by global adoption of pre-measured pod formats for household and industrial cleaning. Water-soluble films enable precise dosing, improve user experience, and minimize spillage or overuse.

Leading brands leverage this format to meet sustainability and efficiency standards. The segment benefits from advances in multi-layer film structures that balance solubility with mechanical strength. As eco-friendly cleaning products gain prominence, detergent packaging remains the most influential application segment.

The home and laundry care sector is expected to account for 42.6% of the market in 2025, reflecting growing consumer preference for dissolvable packaging solutions. Bio-based PVA films support next-generation laundry pods, dishwashing tablets, and concentrated cleaning liquids.

Innovation in biodegradable materials enhances performance while reducing plastic waste. Manufacturers are investing in automated pod-filling lines to meet mass-market demand. As eco-conscious consumers drive circular packaging adoption, the home and laundry care segment continues to dominate market expansion.

The market is driven by the expansion of sustainable home care packaging and heightened regulatory emphasis on eco-friendly, plastic-free solutions. Water-soluble films are increasingly adopted for unit-dose detergents, agrochemicals, and personal care products, minimizing plastic waste and improving user convenience. Rising consumer awareness and brand commitments to sustainability are further accelerating market adoption globally.

High material costs and limited heat resistance of certain biodegradable films are major challenges to market growth. Sensitivity to humidity and mechanical stress can reduce performance in harsh storage or transport conditions. Additionally, restricted compatibility with non-polar substances limits their use in some industrial formulations, constraining scalability across diverse packaging applications.

Ongoing biopolymer innovation for multi-layered water-soluble films is unlocking broader applications in pharmaceutical and food-grade packaging. Advanced formulations are enabling improved tensile strength, controlled solubility, and better protection for active ingredients. Collaborations between packaging firms and material scientists are fostering the development of compostable, high-barrier films, enhancing the market’s value proposition.

Emerging trends include smart dissolvable coatings that release active agents upon contact with water, enhancing product functionality. Micro-encapsulation technology is being integrated to enable precision delivery of detergents, nutrients, or pharmaceuticals. Barrier-layered PVA films are improving shelf stability and moisture control, supporting new use cases in healthcare and food industries. Together, these innovations are redefining water-soluble packaging as a sustainable and performance-driven solution.

The global dissolvable retention films market is expanding rapidly as sustainability, convenience, and hygiene converge across packaging applications. Asia-Pacific dominates production due to cost-effective raw materials, scaling biopolymer infrastructure, and growing agricultural and cleaning industries. North America and Europe are leading adopters in home care, healthcare, and pharmaceutical packaging, reinforced by eco-certification and waste-reduction policies. Advancements in water-soluble polymer technology and single-dose packaging continue to shape the next generation of sustainable films globally.

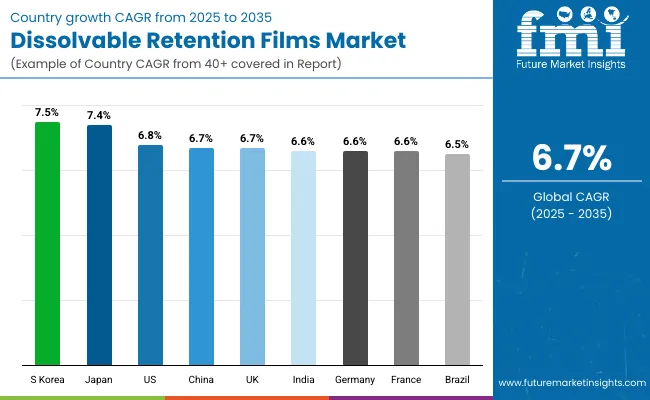

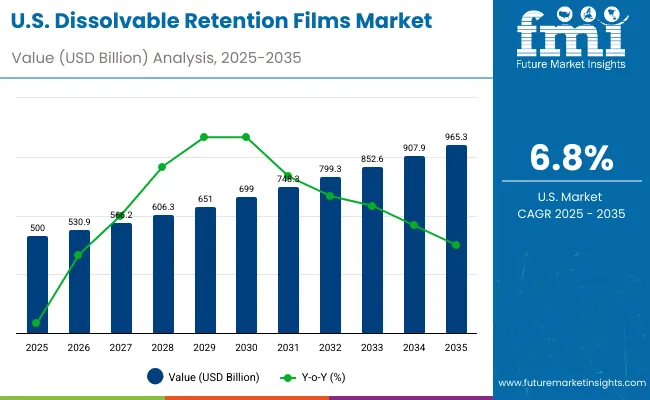

The USA will grow at 6.8% CAGR, fueled by rising adoption of dissolvable films in laundry pods and cleaning capsules. Water-soluble packaging suppliers are expanding capacity to meet FMCG and home-care demand. Collaborations between detergent manufacturers and polymer developers continue to enhance film strength and dissolution performance.

Germany will expand at 6.6% CAGR, supported by robust R&D in starch and cellulose-based polymers. The films are being increasingly adopted across agriculture, medical packaging, and pharmaceutical manufacturing. EU eco-design directives and circular material policies further accelerate the transition toward dissolvable packaging.

The U.K. will grow at 6.7% CAGR, driven by rapid eco-certification of home and personal care products. Unit-dose detergents are gaining popularity among sustainability-focused consumers. Private-label brands are increasingly investing in recyclable, dissolvable, and compostable packaging lines.

China will grow at 6.7% CAGR, propelled by large-scale production of PVA-based water-soluble films and government promotion of biodegradable materials. The agricultural and cleaning sectors are key adopters, while exports of dissolvable packaging continue to expand globally.

India will grow at 6.6% CAGR, with strong growth in urban adoption of laundry and dishwasher pods. Local starch-based film production is increasing as consumer brands transition toward eco-friendly packaging. Public and private R&D investments are improving material quality and affordability.

Japan will grow at 7.4% CAGR, leading in ultra-thin dissolvable film innovation for healthcare and cleaning applications. Precision dosing and dissolvable strip formats are being refined through nanotechnology. R&D in bioengineered polymers supports the country’s sustainability goals.

South Korea will lead with 7.5% CAGR, supported by technological leadership in biodegradable multilayer films. Smart dissolvable packaging for electronics and medical devices is emerging as a key innovation. High R&D intensity continues to position the country as a hub for advanced film development.

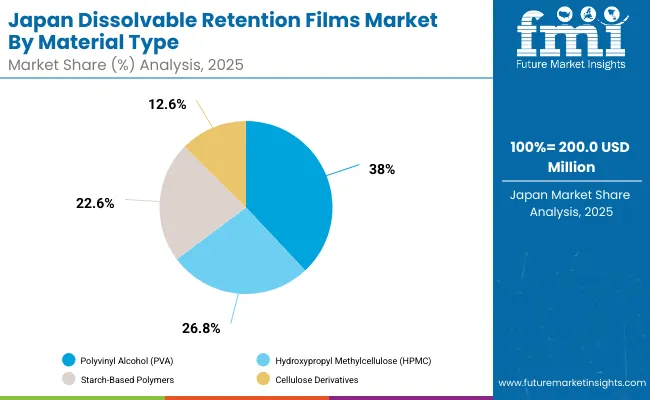

Japan’s dissolvable retention films market, valued at USD 200.0 million in 2025, is dominated by polyvinyl alcohol (PVA), holding a 39.2% share due to its water solubility and biodegradability. Hydroxypropyl methylcellulose (HPMC) films enhance film clarity and strength, while starch-based polymers and cellulose derivatives drive eco-friendly packaging and pharmaceutical applications.

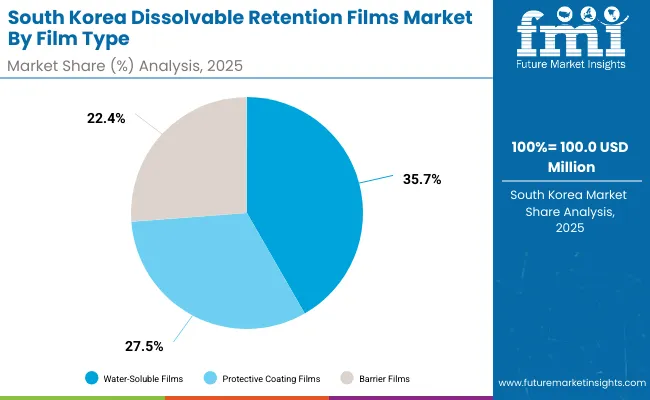

South Korea’s dissolvable retention films market, worth USD 100.0 million in 2025, is led by water-soluble films, capturing a 38.2% share supported by demand in detergent and agrochemical sectors. Protective coating films ensure controlled-release performance, while barrier films are used in personal care and medical packaging to enhance product safety and stability.

The market is moderately consolidated, with leading players including KOCH-Glitsch, Kuraray, Arrow Greentech, Polyva, Amtrex, INFHIDRO, Soltec Development, Ecopol, Cortec, and Aristo FlexPolymers. Key players focus on multi-layered film architecture, polymer innovation, and water-soluble coating efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion (2025) |

| By Material | PVA, HPMC, Starch-Based Polymers, Cellulose Derivatives |

| By Film Type | Water-Soluble, Protective Coating, Barrier |

| By Application | Detergent Packaging, Agrochemical Doses, Pharmaceutical, Food Ingredients |

| By End-Use Industry | Home & Laundry Care, Agriculture, Pharmaceuticals, Food & Beverages |

| Key Companies Profiled | KOCH- Glitsch, Kuraray, Arrow Greentech, Polyva, Amtrex, INFHIDRO, Soltec Development, Ecopol, Cortec, and Aristo FlexPolymers |

| Additional Attributes | Market driven by sustainable film adoption, eco- labeling, and bio-based innovation |

The market is valued at USD 1.2 billion in 2025, led by rising demand for sustainable water-soluble films.

It will reach USD 2.3 billion by 2035, supported by biodegradable material advancements and unit-dose packaging growth.

The market will grow at a CAGR of 6.7% over the forecast period.

Polyvinyl Alcohol (PVA) dominates with a 38.9% share, owing to high solubility and biodegradability.

Home and Laundry Care leads with 42.6% share, driven by single-dose detergent formats and eco-safe packaging.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Dissolvable Labels Market Analysis by Ink Type, Printing Technology, End Use, and Region Forecast Through 2035

User Retention Software Market

Urinary Retention Therapeutics Market Growth - Demand & Forecast 2025 to 2035

Suspension & Retention Packaging Market

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

LDPE Films Market

Card Films Market

Mulch Films Market Size and Share Forecast Outlook 2025 to 2035

Nylon Films for Liquid Packaging Market from 2024 to 2034

Vinyl Films Market

MDO-PE Films Market Analysis by Cast Films and Blown Films Through 2035

Edible Films and Coatings Market Growth - Trends & Forecast 2025 to 2035

Market Share Breakdown of Edible Films and Coatings

Retort Films Market

Tobacco Films Market Size and Share Forecast Outlook 2025 to 2035

Gelatin Films Market Size and Share Forecast Outlook 2025 to 2035

Lidding Films Market Size and Share Forecast Outlook 2025 to 2035

Optical Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA