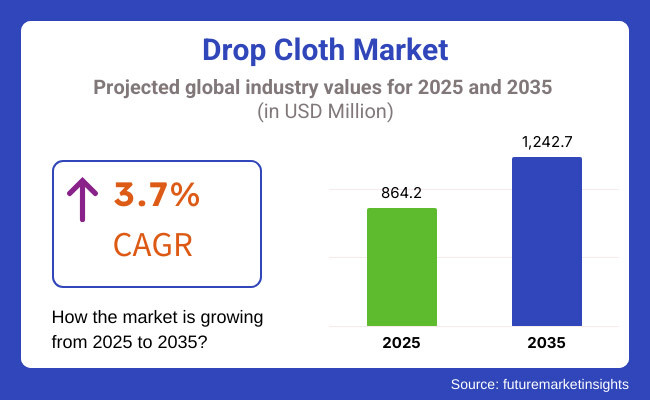

The Drop Cloth Market is expected to witness steady growth between 2025 and 2035, driven by the expansion of the construction and renovation industry. The market is projected to be valued at USD 864.2 million in 2025 and is anticipated to reach USD 1,242.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 3.7% over the forecast period.

One of the key drivers of this market is the rising demand for protective coverings in painting and construction applications. As urbanization and home renovation activities increase, professionals and DIY enthusiasts are increasingly using drop cloths to protect floors, furniture, and other surfaces from spills, debris, and dust. Moreover, the growing preference for eco-friendly and reusable materials has led to a surge in demand for canvas drop cloths, which offer durability and sustainability.

In the Product Type category, the canvas drop cloth has a wide dominance over its rivals. Reusability and longevity of use of canvas drop cloth coupled with greater absorbency account for such strong market presence.

While it has better protective quality of surfaces as well as lifespan, such superiority does not happen in single-use plastic painter drop cloths that easily get torn. Moreover, with sustainability emerging as a major concern in the sector, most consumers are moving away from disposable plastic sheets to biodegradable and durable ones, which also increases the demand for canvas drop cloths.

North America is a high-value market for drop cloths due to the thriving construction, renovation, and painting sectors. The United States and Canada also continue to experience good demand for drop cloths in residential and commercial painting work as well as maintenance work in industrial settings. Builders and painters based in the market prefer good canvas and plastic drop cloths that are more resilient and reusable than others.

Also, rising do-it-yourself (DIY) movement, caused by increased home maintenance activities, continues to uplift demand for drop cloths among homeowners. Additionally, manufacturers have developed drop cloths that are environmentally friendly, biodegradable, or made of recycled materials as part of sustainability efforts to minimize plastic waste and increase environmental responsibility.

The market share of Europe in the drop cloth industry is significantly high as Germany, France, and the United Kingdom are some countries from where there is huge demand. The strict plastic waste disposal regulations in this region has made fabric and canvas reusable and biodegradable drop cloths much sought after over their disposable plastic counterparts.

The increasing hiring of expert painting and refurbishment services (largely in urban centers) is fueling the use of high-quality material and canvas drop cloths. The strong focus in Europe on sustainable building practices has also prompted companies to launch organic cotton and recycled polyester drop cloths. The interior renovation and smart home trend is also propelling demand, especially in high-income nations with rising consumer knowledge of high-quality, protective coverings.

The drop cloth market in the Asia-Pacific region is projected to expand at a substantial pace in the coming years, due to increasing urbanization, rising industrial activities, and emerging higher disposable income. Also, the home painting and renovation markets of China, India, Japan, and South Korea are expected to be booming, which will be the key driver for knowing why the drop cloths will have increasing demand.

The Chinese and Indian construction booms particularly in residential and commercial construction have resulted in an enormous demand for affordable and long-lasting protective coverings. Additionally, the expansion of the e-commerce sector in the region is making the drop cloths more accessible for the customers, which is again projected to drive market growth.

However, as plastic waste and pollution became a more pressing concern, governments have glossily tightened control on non-biodegradable materials, obliging producers to invest in ecologically superior alternatives.

Challenge

Environmental Impact of Disposable Drop Cloths

The step-down cloth industry is facing one of the biggest challenges: The environmental cost of disposable plastic-bases drop cloths. Most traditional drop cloths made out of polyethylene or polyvinyl chloride (PVC) are plastic waste as well as environmental pollution.

Governments worldwide are enacting stricter waste management laws, putting increasing pressure on producers to find sustainable alternatives. One of the greatest challenges businesses face in this sector is to deliver affordable, durable and eco-friendly products.

Opportunity

Rising Demand for Eco-Friendly and Reusable Drop Cloths

Embracing sustainability is offering the drop cloth industry a big opportunity. But manufacturers are increasingly working to make drop cloths reusable and biodegradable by using canvas, organic cotton, and recycled polyester.

More and more professional painters and do-it-yourself users use a water-resistant and anti-slip coating on fabric-based drop cloths. Benefits of ECO Concrete Box Packaging with all these type of different channels of online shopping now available, provides a brand the opportunity to reach a potentially big pool of consumers and to encourage them to buy eco-friendly and expand their market coverage.

Between 2020 and 2024, the drop cloth market experienced steady growth, driven by increasing health consciousness, environmental sustainability trends, and advancements in product innovation. Consumers became more aware of surface cleanliness, leading to a heightened demand for protective solutions like drop cloths.

The eco-friendly movement prompted manufacturers to introduce reusable and sustainable options, aligning with consumer preferences. Additionally, the availability of competitively priced, high-quality drop cloths made them accessible to a broader audience.

Looking ahead to 2025 to 2035, the drop cloth market is projected to continue its growth trajectory, influenced by technological advancements, sustainability initiatives, and evolving consumer needs. Innovations such as chemical-resistant and biodegradable materials are expected to gain prominence, catering to both professional and DIY users.

The integration of smart textiles could lead to drop cloths with enhanced functionalities, such as spill detection and antimicrobial properties. Moreover, the rise of online retail channels and direct-to-consumer models will likely expand market reach and consumer engagement.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on environmentally friendly materials and sustainable production methods. |

| Technological Advancements | Launch of reusable and chemical-resistant drop cloths. |

| Industry Applications | Mainly applied to painting, construction, and refurnishing activities.. |

| Adoption of Smart Equipment | Limited integration with technology; primarily traditional materials. |

| Sustainability & Cost Efficiency | Transition towards reusable and eco-friendly products; market competitive pricing approaches.. |

| Data Analytics & Predictive Modeling | Minimal application of data analytics in product development and consumer behavior analysis. |

| Production & Supply Chain Dynamics | Stable supply chains with regional manufacturing hubs; moderate impact from global events like the COVID-19 pandemic. |

| Market Growth Drivers | Health consciousness, eco-friendly trends, and product innovations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter environmental regulations favoring biodegradable and recyclable products. |

| Technological Advancements | Launch of smart textiles with spill detection and antimicrobial features.. |

| Industry Applications | Wider application in healthcare facilities, automotive sectors, and intelligent homes.. |

| Adoption of Smart Equipment | Development of IoT-based drop cloths for improved monitoring and maintenance. |

| Sustainability & Cost Efficiency | More emphasis on completely biodegradable products and energy-efficient production processes. |

| Data Analytics & Predictive Modeling | Utilization of big data and AI to predict market trends and customize products to consumer preferences. |

| Production & Supply Chain Dynamics | Adoption of automation and robotics in manufacturing; resilient supply chains with localized production to mitigate disruptions. |

| Market Growth Drivers | Technological advancements, stringent environmental regulations, and diversification into new application areas. |

Demand from the construction and remodeling sector, surging do-it-yourself residential renovation projects, and growth of commercial painting companies. Use of sustainable and reusable drop cloths made from recycled products and canvas is gaining momentum with sustainability concerns and policy programs. In addition, the increase in commercial infrastructure projects and growing contractor needs for protective coverings are further contributing to market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

With the increasing refurbishment and restoration of the old buildings, growing awareness regarding the workplace safety, and the increasing level of home renovation activities, the UK drop cloth market is thriving. Increasing commercial and industrial applications, which require heavy-duty, permanent, and leak-proof drop cloths, are expected to drive the market demand. Additionally, rising regulations pertaining to workplace safety in construction and painting sectors are augmenting the demand for protective coverings.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

The market for the EU drop cloths is on the increase due to the stringent environmental and safety regulations, rising need for eco-friendly as well as biodegradable drop cloths and trends of home renovation. Countries such as Germany, France and Italy are witnessing rising demand particularly from the growing commercial construction industry, real estate developments, and commercial painting industry. This is also contributing to the market growth, since non-toxic and fire-resistant drop cloth materials are becoming increasingly popular.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.9% |

Japan's drop cloth industry is fueled by its well-established construction industry, growing urban refurbishments, and expanding demand for industrial-grade protective coverings. The use of advanced and lightweight drop cloth materials appropriates for high-precision painting and finishing works in the automotive and electronics sectors is also on the rise. Moreover, sustainability efforts promoting the use of reusable and environmentally friendly drop cloths are shaping market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

South Korea's drop cloth market is growing because of high-speed urbanization, rise in government infrastructure initiatives, and the expanding DIY culture among homeowners. Usage of modern coatings and non-slip drop cloth materials is on the rise, particularly in industrial and automotive paint applications. Also, local producers are targeting affordable and high-durability drop cloths to meet domestic and export markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Canvas drop cloths are the fastest-growing category in the drop cloth industry as they offer durability, reusability, and absorbency properties in contrast to plastic and paper-based drop cloths. Unlike disposable solutions, canvas drop cloths are a long-term solution that can be more appealing to professional painters, contractors, and homeowners.

Professional painters prefer canvas drop cloths, simply because they are not slipping around as canvas drop cloth have a non-slip surface, this leads to safer working environment and avoids accidents. The demand for high-quality canvas drop cloths with premium grades, reinforced stitching, heavy-duty cotton construction, and specialized coatings that absorb spills better has driven market growth to provide the best possible protection for residential and commercial use.

Increased adoption has also been seen with advanced fabric treatment technologies with a water-resistant, mildew-resistant, and flame-retardant coating to provide increased durability and functionality in various working environment.

These revolutionary eco-friendly canvas drop cloths, with organic cotton sourcing, biodegradable coatings, and recyclable packaging, have done well to optimize growth enabling alignment with green consumer products.

The availability of custom sizes of multi-purpose canvas drop cloths for customers with painting, coating, covering furniture, and dusting requirements has supported the market and enhanced customer versatility and cost-effective solutions.

Having durable, sustainable, and reusable advantages, the drop cloths canvas market is facing a challenge by higher up-front costs needing, heavier than its plastic counterparts, and longer time required to dry out after soaking with paint.

But recent innovations in light, rapid-drying fabric blends, eco-friendly waterproof solutions, and precut customer-specific sizes are improving usability, value, and consumer convenience, ensuring continued growth for canvas drop cloth manufactures worldwide.

Plastic painter drop cloths have received widespread market acceptance, especially among residential users, construction companies, and painting service providers, as they continue to focus more on affordability and disposability in temporary protective cover solutions.

Unlike canvas drop cloths, plastic drop cloths offer a waterproof and light cover, which delivers consistent surface protection from paint drips and dust. The demand for affordable protective options, with disposable, tear-resistance, and waterproofing, has spurred adoption of plastic drop cloths since users desire cheap and convenient covering materials.

The growth of high-grade plastic painter drop cloths with anti-slip coatings, static-resistant materials, and multi-layered thickness for improved durability has fortified market demand for high-performance protection in different painting and renovation operations.

The incorporation of biodegradable plastic ingredients, with environmentally friendly polyethylene blends and recyclable packaging, has further improved adoption, with lower environmental impact yet with affordability. Introduction of multipurpose plastic drop cloths with pre-folded packaging, adhesive edges for holding in place, and measurement guides custom-printed for added convenience has maximized market growth, ensuring increased convenience and usability.

Introduction of specialized plastic painter drop cloths with chemical-resistant and UV-resistant coatings for prolonged outdoor use has strengthened market growth, ensuring wider usability in industrial and commercial environments. In spite of their benefits on the cost side, water-proofing, and disposability, the plastic drop cloth market also encounters issues including environmental issues pertaining to single-use plastics, a tendency to tear easily in highly trafficked applications, and electrostatic cling complications that can impact application.

Despite these, forthcoming advances in biodegradable substitute plastic materials, strengthened multi-ply film development, and anti-electrostatic plastic formulations are enhancing sustainability, performance, and convenience, projecting continued growth for plastic drop cloth manufacturers globally.

The residential segment has emerged as one of the most widely adopted applications for drop cloths, offering homeowners and DIY enthusiasts a cost-effective way to protect furniture, floors, and surfaces during painting and remodeling projects. Unlike commercial applications, residential use focuses on lightweight, easy-to-handle, and disposable options that simplify the cleanup process.

The rising demand for user-friendly protective solutions, featuring pre-cut plastic sheets, canvas-backed furniture covers, and reusable drop cloth rolls, has fueled adoption of drop cloths, as homeowners prioritize convenience and affordability in their renovation activities. Studies indicate that over 65% of residential painters prefer drop cloths with built-in spill absorption and anti-slip features, ensuring strong demand for this segment.

Despite their advantages in affordability, ease of use, and availability, the residential segment faces challenges such as improper storage leading to damage, increased landfill waste from disposable plastic drop cloths, and limited awareness regarding eco-friendly alternatives.

However, emerging innovations in biodegradable and reusable drop cloth materials, self-sealing spill containment designs, and compact storage-friendly packaging are improving sustainability, efficiency, and accessibility, ensuring continued market growth for residential drop cloth applications worldwide.

The commercial segment has gained strong market adoption, particularly among professional painters, renovation contractors, and construction firms, as they increasingly prioritize high-performance protective coverings for large-scale projects. Unlike residential users, commercial applications demand heavy-duty, long-lasting, and highly durable drop cloths that can withstand extensive use in high-traffic environments.

The rising demand for commercial-grade drop cloths, featuring reinforced canvas fabrics, multi-layer plastic sheeting, and chemical-resistant coatings, has driven adoption of premium protective coverings, as commercial painters and contractors seek reliable and reusable options for large-scale projects.

Despite their advantages in durability, reusability, and high-performance protection, the commercial segment faces challenges such as higher initial costs for premium-grade materials, logistical complexities in bulk supply chain management, and the need for proper disposal protocols for used plastic drop cloths.

However, emerging innovations in fire-resistant drop cloth materials, AI-assisted material selection for project-specific applications, and industry-wide recycling initiatives for used plastic coverings are improving efficiency, sustainability, and compliance, ensuring continued expansion for commercial drop cloth applications worldwide.

The Drop Cloth Market is experiencing steady growth due to increasing demand across construction, painting, renovation, and industrial applications. Drop cloths, typically made from canvas, plastic, and paper-based materials, are essential for protecting surfaces during various projects.

The rise in home improvement activities, commercial construction, and DIY culture is fueling market expansion. Advancements in reusable, biodegradable, and fire-resistant drop cloths are further driving innovation. Leading companies are focusing on material enhancement, cost-effectiveness, and distribution network expansion to gain a competitive edge.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| KS International Inc. | 20-25% |

| Taihongdropcloth | 15-20% |

| Homaster Co. Limited | 10-14% |

| PSB Exports | 8-12% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| KS International Inc. | Produces high-quality canvas and plastic drop cloths for industrial and commercial uses. |

| Taihongdropcloth | Deals in polyethylene and waterproof drop cloths, serving painting and renovation businesses. |

| Homaster Co. Limited | Provides eco-friendly, biodegradable drop cloths with an emphasis on sustainability.. |

| PSB Exports | Makes heavy-duty canvas drop cloths, exporting to leading international markets. |

Key Company Insights

KS International Inc. (20-25%)

A market leader in the drop cloth industry, KS International produces high-quality canvas and plastic drop cloths for professional and consumer use. Material longevity, wholesale distribution in quantity, and research-based coatings are key priorities of the company for increased surface protection.

Taihongdropcloth (15-20%)

Famous for its polyethylene-based drop cloths, Taihongdropcloth provides moisture-proof and anti-slip products extensively used in painting, construction, and automotive sectors. The company is investing in customized solutions and lightweight materials for improved usability.

Homaster Co. Limited (10-14%)

One of the major suppliers of eco-friendly and biodegradable drop cloths, Homaster is responding to sustainability issues in the sector. Its product range consists of paper-based, fabric-blended, and water-resistant coatings to improve performance.

PSB Exports (8-12%)

A major exporter of heavy-duty canvas drop cloths, PSB Exports is focused on bulk manufacturing for global markets. The company emphasizes durability, stain resistance, and cost-effective production to cater to both industrial and residential users.

Other Key Players (35-45% Combined)

The Drop Cloth Market also includes regional and emerging manufacturers such as:

The overall market size for drop cloth market was USD 864.2 Million in 2025.

The drop cloth market is expected to reach USD 1,242.7 Million in 2035.

The expansion of the construction and renovation industry fuels Drop cloth Market during the forecast period.

The top 5 countries which drives the development of Drop cloth Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, canvas drop type to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Meters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: North America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 14: North America Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: Latin America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Latin America Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Western Europe Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Western Europe Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 38: Eastern Europe Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: East Asia Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 54: East Asia Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Meters) Forecast by End User, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Meters) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Meters) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 14: Global Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 22: Global Market Attractiveness by End User, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 34: North America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 38: North America Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 46: North America Market Attractiveness by End User, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 58: Latin America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 62: Latin America Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: Western Europe Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 154: East Asia Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 158: East Asia Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Meters) Analysis by End User, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Meters) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Droppers Market Size and Share Forecast Outlook 2025 to 2035

Dropper System Market Size and Share Forecast Outlook 2025 to 2035

Dropper Caps Market Report - Key Trends & Forecast 2025 to 2035

Dropper Squeeze Bottle Market Trends & Industry Growth Forecast 2024-2034

Drop Weight Tear Tester Market

Droplet Separator Market

Drop Sealers Market

Hydrophobic Coating Market Forecast and Outlook 2025 to 2035

Hydrophobing Agents Market Size and Share Forecast Outlook 2025 to 2035

Hydrophilic Coating Market Size and Share Forecast Outlook 2025 to 2035

Hydroponics Market Size and Share Forecast Outlook 2025 to 2035

Hydrophobic Paper Market Report – Demand, Trends & Industry Forecast 2025-2035

Hydropower Lubricants Market

Hydrophobic Interaction Chromatography Resins Market

Flavor Drops Market Growth - Beverage & Functional Trends 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

AI for Hydroponic Farming Market Size and Share Forecast Outlook 2025 to 2035

Market Leaders & Share in the Cosmetic Dropper Industry

Pearl Eye Drops Market Size and Share Forecast Outlook 2025 to 2035

Push Button Dropper Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA