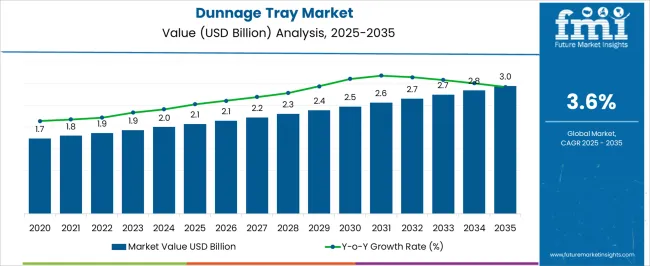

The Dunnage Tray Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

| Metric | Value |

|---|---|

| Dunnage Tray Market Estimated Value in (2025 E) | USD 2.1 billion |

| Dunnage Tray Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 3.6% |

The dunnage tray market is growing steadily, driven by rising demand from automotive, electronics, and industrial manufacturing sectors where safe handling and storage of components is critical. Lightweight, durable, and reusable trays are increasingly favored as manufacturers seek cost-effective and sustainable packaging solutions.

Current adoption is supported by improved logistics efficiency, as dunnage trays reduce damage rates and streamline assembly line processes. Growth is reinforced by the adoption of precision-molded trays tailored to specific components, ensuring compatibility with automated handling systems.

With rising emphasis on sustainability and recyclability, the shift from disposable packaging toward reusable dunnage solutions is accelerating. The outlook for the market remains positive, supported by manufacturing growth, supply chain optimization, and technological improvements in polymer design.

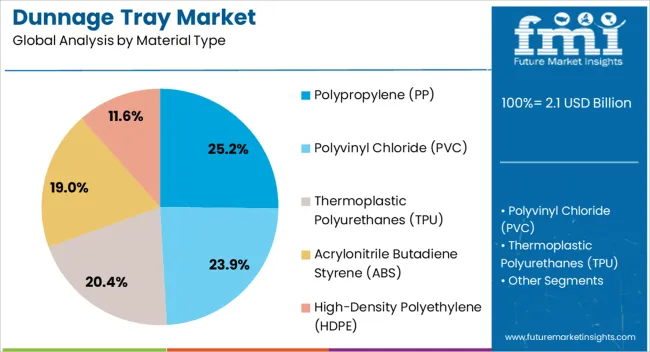

The polypropylene (PP) segment holds approximately 25.2% share of the material type category, supported by its favorable balance of strength, flexibility, and cost efficiency. PP’s resistance to chemicals and impact makes it an ideal material for reusable trays, ensuring durability in demanding industrial environments.

Its lightweight properties reduce handling costs and improve logistical efficiency across manufacturing and distribution systems. The segment also benefits from recyclability, aligning with sustainability targets in automotive and electronics industries.

With continuous advancements in polymer engineering and the availability of cost-effective raw materials, the PP segment is expected to sustain steady growth in the coming years.

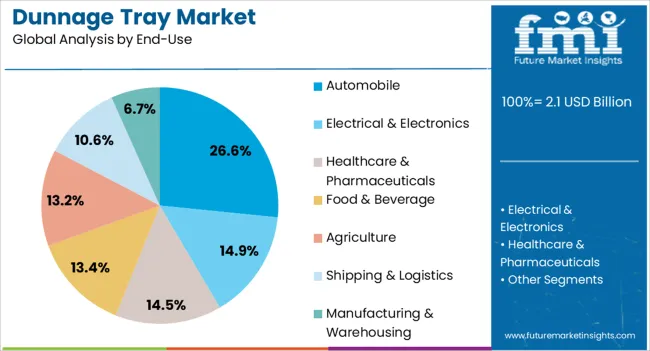

The automobile segment dominates the end-use category with approximately 26.6% share, reflecting the high volume of automotive component handling requirements. Dunnage trays are widely used in automotive manufacturing to transport and store parts such as gears, fasteners, and interior components, ensuring reduced risk of damage during assembly.

The segment benefits from the automotive industry’s reliance on reusable packaging to improve efficiency and sustainability in production lines. Customizable tray designs tailored to specific automotive parts have further enhanced adoption.

With ongoing expansion in global automobile production and supply chain optimization initiatives, the automobile segment is projected to maintain its leadership in the dunnage tray market.

Effective Material Handling Solutions are the Need of the Hour

The accelerating need for effective material handling solutions is presumed to trigger the demand for dunnage trays. Transportation in various industries such as automotive, electronics, and pharmaceuticals is primarily promoting these trays nowadays.

Properties such as providing damage-free shipping and handling materials to these industries with cost-saving initiatives have gained popularity over the years. Manufacturing industries are ready to gain significant industry share using these trays in their transport activities, owing to properties of dunnage trays such as cost-effectiveness and others.

Minimum Availability of Raw Materials is Stifling Industry Progress

With excellent opportunities stemming from the above drivers, some restraints loom large, potentially limiting the dunnage tray market growth. The highly competitive landscape is anticipated to hinder the industry's potential in the coming years.

Established players are expanding their product lines while offering affordable prices. Consequently, smaller players are facing a highly competitive environment for market entry.

The availability of raw materials is setting up barriers to the industry. Since the industry heavily depends on plastics, fluctuating oil prices can lead to a limited supply of plastic to the sector. Moreover, the use of plastic is limiting the industry growth due to rising sustainability initiatives in some regions nowadays.

Demand for Luxury Goods Creates Growth Opportunities for Producers

Increasing demand for luxury goods is anticipated to create lucrative growth opportunities for dunnage tray manufacturers. Luxury products require high-quality packaging solutions that can protect them during transportation and enhance their perceived value.

Hence, individual preferences are increasingly shifting toward these trays. Also, dunnage tray manufacturers can create premium trays made from materials such as leather, velvet, or silk, adding an extra touch of luxury to the packaging and making the products even more appealing to customers.

From 2020 to 2025, the dunnage tray market grew at a consistent pace. The global industry recorded a CAGR of 2.7% during the historical period. The industry growth of dunnage trays was impressive, reaching USD 2.1 billion in 2025 from USD 1.7 billion in 2020.

Factors involved in the progress of the industry during this period were increased safe logistics supply and the need for effective material handling solutions in the manufacturing industry. The offering of sustainable solutions was also a key factor, with several governments raising sustainability initiatives in their regions.

The same growth is expected to continue over the coming decade. However, with the good comes the bad. Several restraints are holding back the industry. Availability of raw materials and price fluctuations are set to feed the negativity surrounding the market.

The highly fragmented competitive landscape has hampered industry growth during this time. Also, established players are vying for a prominent industry share by launching new product lines in that period.

As the manufacturing sector faced tough times during the pandemic, dunnage trays also suffered. However, with the lifting of restrictions, these trays were back in the spotlight.

As the ban on single-use plastic becomes more common in industries, dunnage trays are set to occupy a prominent position. Due to the pandemic, the logistics industry also faced several challenges, resulting in lower profit margins and delays.

The explanation of leading segments in brief below. In terms of material type, the glass polypropylene (PP) segment is estimated to account for a share of 25.2% in 2025. By end-use, the automobile industry is anticipated to dominate by holding a share of 26.6% in 2025.

| Segment | Polypropylene (pp) |

|---|---|

| Value Share (2025) | 25.2% |

Polypropylene has firmly established its place as a key material component in the dunnage tray sector. Its exceptional benefits, such as versatility, lightweight nature, durability, and eco-friendliness, make it an attractive choice for businesses globally.

PP tray offers excellent durability along with recyclable benefits, which amplify the demand for PP trays and drive the growth rate. Also, their versatility allows for the manufacturing of compact designs, which accommodate the ideal number of parts per tray to reach shipping goals.

Furthermore, food industries are heavily using polypropylene trays for the packaging of fresh produce and daily items.

| Segment | Automobile |

|---|---|

| Value Share (2025) | 26.6% |

Dunnage trays are important components in the automotive sector, offering precision, safety, and efficiency in the transportation and storage of various car parts. These trays are custom-made to fit particular components, adapting to complex geometries and ensuring a secure fit, which also works with dedicated sensors.

With global trade and eCommerce, these trays ensure secure transportation, increasing demand and enhancing production, as anticipated by the dunnage tray market growth. Also, the demand for new car features and parts is also contributing to the segment's growth in the current period.

As automobile manufacturers are expanding their product lines, these trays are expected to gain promotion due to the increasing need for easy transportation of these materials.

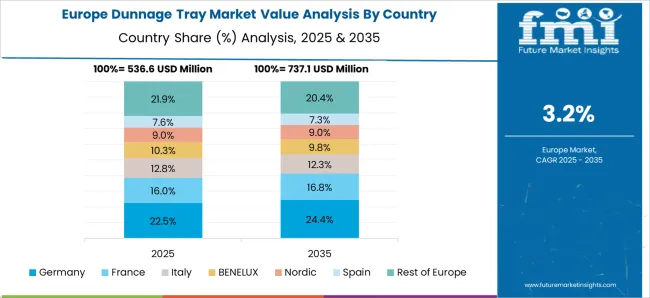

The dunnage tray industry is set to proliferate prosperously in the Asia Pacific, spearheaded by China. Furthermore, there is an upswing in demand for these products in South Korea and the United States, with the logistics sector playing a pivotal role in driving this growth.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.9% |

| Germany | 2.4% |

| United Kingdom | 2.7% |

| China | 5.2% |

| South Korea | 2.8% |

The dunnage tray industry in the United States is set to experience sluggish growth at a 2.9% CAGR. The United States is known as the most technologically advanced nation globally. Furthermore, the rising sales of eCommerce are leading the industry growth in the country. Both factors together have created a favorable environment for tray manufacturers.

Manufacturers in the United States continuously update their product lines and offer innovative solutions that cater to consumer demand. Dunnage Engineering, the leading manufacturer of dunnage trays in the United States, creates custom dunnage trays and totes made from injection-molded plastics.

These trays are specially designed for assembly, shipping, conveyor movement, and other purposes.

Germany's dunnage tray market is predicted to witness a slow-paced growth trajectory in the coming years, with a projected CAGR of 2.4% through 2035. The large inter-country logistics industry has propelled the demand in the country in recent years.

Several manufacturing industries are seeking out safe shipping and transportation facilities in the country. By providing these facilities to manufacturers at affordable pricing, dunnage trays are gaining popularity among industry manufacturers.

Moreover, sustainability initiatives by the government are further increasing the industry potential in Germany. Manufacturers are increasingly developing reusable dunnage trays for consumers.

A projected CAGR of 2.7% is expected to propel the United Kingdom's dunnage tray market to new heights, showcasing its potential for slow but steady success. Stricter regulations and standards for the transportation of goods have increasingly been implemented over the years.

Logistic suppliers are required to use packaging solutions that cater to these safety standards while ensuring the safety of their products during transportation. Thus, dunnage has emerged as a reliable and effective solution among manufacturers and logistic suppliers in the United Kingdom in recent years.

Dunnage tray market players are committed to constant innovation to develop new and improved dunnage packaging solutions. Manufacturers are continuously investing in research and development activities to create an innovative product line that caters to consumer demand.

Also, manufacturers are developing environmentally friendly and reusable materials to gain maximum industry share during the forecast period. Since each company has distinct packaging requirements, manufacturers aim to provide customized dunnage solutions to meet specific product and transportation needs.

Industry Updates

Depending on the material type, the segment is categorized into polypropylene (PP), polyvinyl chloride (PVC), thermoplastic polyurethanes (TPU), acrylonitrile butadiene styrene (ABS), and high density polyethylene (HDPE).

End use industries in the industry are electrical & electronics, healthcare & pharmaceuticals, automobile, food & beverages, agriculture, shipping & logistics, and manufacturing & warehousing.

Regional analysis of the industry is conducted in North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

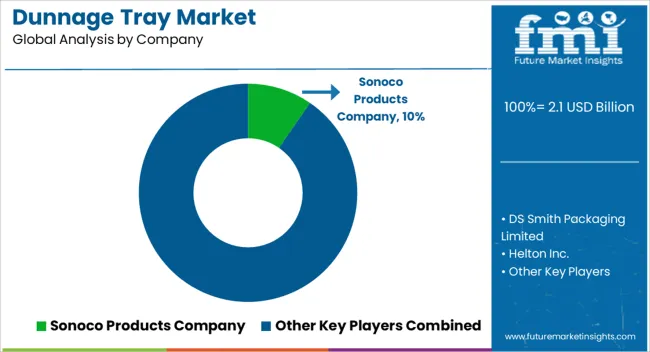

The global dunnage tray market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the dunnage tray market is projected to reach USD 3.0 billion by 2035.

The dunnage tray market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in dunnage tray market are polypropylene (pp), polyvinyl chloride (pvc), thermoplastic polyurethanes (tpu), acrylonitrile butadiene styrene (abs) and high-density polyethylene (hdpe).

In terms of end-use, automobile segment to command 26.6% share in the dunnage tray market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Understanding Market Share Trends in Dunnage Trays

Dunnage Packaging Market Analysis by Material, Product, and End Use Forecast Through 2025 to 2035

Dunnage Air Bags Market from 2025 to 2035

Dunnage Paper Bags Market

Tray Market Forecast and Outlook 2025 to 2035

Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tray Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Tray and Sleeve Packing Machines Market Size and Share Forecast Outlook 2025 to 2035

Tray Former Machines Market Size and Share Forecast Outlook 2025 to 2035

Tray Sealer Machines Market Size and Share Forecast Outlook 2025 to 2035

Industry Share & Competitive Positioning in Tray Sealer Machines

Market Share Distribution Among Tray Former Machines Manufacturers

Tray Liners Market

Tray Packing Machine Market

Tray Loader Market

ESD Trays Market Size and Share Forecast Outlook 2025 to 2035

Lab Trays Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA