The global Eddy current testing market is anticipated to see immense growth over the forecast period 2025 to 2035, due to the application of non-destructive testing (NDT), growing adoption of modern inspection processes in manufacturing as well as aerospace, and advancements in sensor and probe technologies.

Eddy current testing (ECT) is an established non-destructive testing (NDT) method used for the detection of surface and subsurface defects in metallic and conductive materials while ensuring the safety and structural integrity of components and structures due to the high sensitivity of eddy current flows to material properties across many industries, especially aerospace, automotive, power generation and oil & gas.

Growth of the market is propelled by an enhanced focus on quality assurance, along with rising availability of automated and AI based ECT solutions. Moreover, the emergence of safety and compliance as a regulatory mandate, increased industrial automation, and rising investments in predictive maintenance solutions are projected to drive the industry forward.

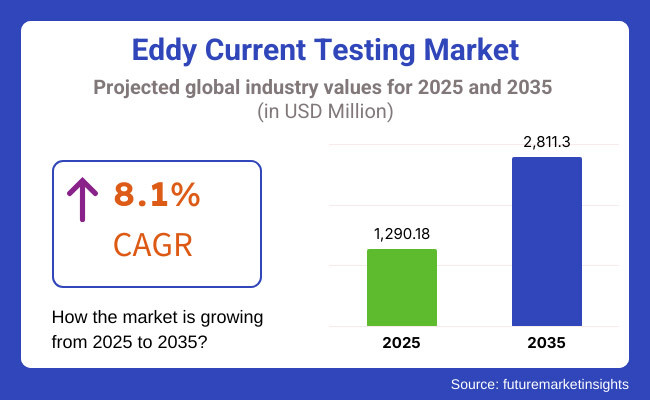

The Eddy current testing market, for a number of examples, was estimated to be about USD 1,290.18 million in 2025. The most current forecast 2023 to 2035 market estimate predicts the market size would surpass USD 2,811.30 million by 2035 and will grow at a CAGR of 8.1% during the forecast period.

Such growth can be attributed to the growing adoption of advanced NDT techniques, increasing demand for cost-efficient and high-precision testing solutions, and rising investments towards smart manufacturing. Also, the adoption of AI-driven defect recognition, next-gen portable testing tools, and cost-effective automation processes, which will further boost the market growth. Furthermore, the introduction of high-frequency ECT solutions multi-coil probe technology and the essential ability to offer digital inspection platforms are driving substantial efforts at market penetration and corporate adoption.

Despite the concerns, North America continues to be a dominant eddy current testing market, with a focus on strong industrial and aerospace sectors, significant adoption of advanced NDT techniques, and extensive investments in automation and AI-driven inspection technologies.

The driving market for this technology is for the development and commercialization of next generation ECT solutions, particularly high-frequency and multi-coil eddy current probes for improved defect detection in the USA and Canada. The growing need for quality assurance, regulatory compliance in aerospace and defense and the rising adoption of predictive maintenance solution is fueling the market growth. Product Innovation & Adoption evolution of Industry 4.0 & Smart Manufacturing

The increasing demand for safety-critical inspection and government policies promoting industrial automation are expected to support the growth of the electromagnetic NDT market in Europe. Germany, France, and the UK, among others, are working on high-precision, AI-powered eddy current testing systems for use in aerospace, energy, and automotive sectors.

Rising sustainability initiatives, increasing applications in renewable energy infrastructure inspections, and research on miniaturized ECT sensors are contributing to a momentous growth in market adoption. Moreover, increased applications in railway infrastructure testing, pipeline integrity assessment, and robotic-assisted ECT solutions are providing greater prospects for manufacturers and service providers.

Expanding industrialization, rising investment in power generation and transport, and increasing acceptance of NDT technologies in developing economies are key factors expected to drive growth of the Eddy current testing market in the Asia-Pacific region. China, India, and Japan, are pouring money into ECT research and development across the manufacturing, railways, and aerospace sectors.

The increasing demand for defect-free production is boosting regional market growth, as is the rapid expansion of infrastructure projects, a changing regulatory landscape, and government efforts to promote industrial safety. In addition, growing awareness regarding predictive maintenance along with development in automated eddy current test systems is expected to boost market penetration. Moreover, the aggressive entry of various domestic NDT equipment manufacturers, as well as collaborations with international technology firms is also driving regional market expansion.

Steady growth of the Eddy current testing market is forecasted in the coming decade due to ongoing innovations in sensor technologies, AI-based defect detection, and automation-assisted methods of NDT solutions. Companies aim for innovation in digital eddy current instruments, real-time data analysis, and compact, portable testing devices to enhance functionality, market appeal, and long-term usability.

Besides, growing consumer preference for smart industrial diagnostics, digital integration in non-destructive testing, and changing industry regulations are projected to shape the future of the industry. The deployment of intelligent inspection tools integrated with IoT and advanced AI image processing capabilities combined with next-gen multi-coil probe technology is driving global non-destructive testing solutions with optimized defect detection accuracy and efficiency.

Challenge

High Initial Investment and Equipment Costs

One of the restraints of the Eddy Current Testing (ECT) Market is the high cost of advanced testing equipment and infrastructure for the non-destructive testing (NDT) applications. Thus, eddy current testing is a costly process for small and mid-sized enterprises, as it needs specialized probes, sensors, and signal processing systems.

Moreover, the high costs are compounded by the integration of ECT with automated inspection systems and real time data analytics. Before that can happen, firms will need to invest in cost-competitive ECT solutions, commercialize modular equipment design, and offer leasing options to accelerate widespread market acceptance.

Limited Skilled Workforce and Training Requirements

The need for specialized knowledge in electromagnetic principles, flaw detection techniques, and data interpretation associated with Eddy current testing creates a skills gap in the industry. This has limited increased use of ECT particularly in industries like aerospace, automotive, and power generation due to a shortage of certified NDT (nondestructive testing) technicians trained in ECT.

Furthermore, continuous improvements in testing methods require constant training for the workforce. It is imperative for enterprises to cooperate with vocational training centers, design AI-empowered inspection paraphernalia, and provide licensure segments to up-skill the workforce and narrow the skills gap.

Opportunity

Growing Demand for Non-Destructive Testing in Critical Industries

Demand for eddy current testing is being driven by the low focus on safety, quality assurance and structural integrity in the oil & gas, automotive, aerospace, and manufacturing sectors. Governments and regulatory agencies are implementing strict safety regulations, mandating frequent inspections of pipelines, aircraft parts, and industrial machines.

Players that focus on investing in advanced ECT solutions with improved defect detection and automated reporting, in addition to real-time monitoring will gain from the growing demand for non-destructive testing solutions.

Technological Advancements in AI-Driven and Portable ECT Solutions

Advances in areas including AI-driven defect detection, the ability to process signals in real-time, and handheld eddy current testing equipment are changing the market. New compact, wireless ECT probes coupled with AI-powered analytics are making inspections faster and more accurate.

Furthermore, the rise of robotics and IoT connectivity are improving automatic large-scale inspections, minimizing manual work and increasing efficiency. To remain at the forefront of NDT, companies should target AI-centered testing solutions, cloud-based inspection data storage, and live defect prediction models to gain a competitive edge.

Eddy current testing market was growing from the year 2020 to 2024 on the basis of evolving regulatory compliance, enhancement of probe sensitivity, pushing the frontier of automated inspection solutions. The use of eddy current array (ECA) technology enabled better detection of cracks and similar defects, and AI-based software improved the accuracy in identifying those defects from the acquired data.

But hurdles like expensive hardware, lack of skilled labor, and the requirement to incorporate with digital twins slowed down market penetration. In response, companies were making investments in modular ECT solutions, expanding technician training programs and developing more affordable testing alternatives.

Market insights from 2025 to 2035 shows the potential for quantum sensing in NDT, AI-assisted real-time flaw detection, and automated robotic inspection signifying a new era of inspection possibilities. Intelligent ECT solutions will benefit from growing adoption of predictive maintenance strategies, smart manufacturing, and digital twin initiatives.

Other possibilities include blockchain used for inspection traceability and energy-efficient testing equipment for sustainable purposes which will revolutionize the market. The next wave of ECT market evolution will be based on players who put innovation at the forefront of their efforts in areas such as AI-based defect detection, real-time remote inspection, and sustainable testing approaches.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased safety compliance for aerospace, automotive, and energy sectors |

| Technological Advancements | Growth in eddy current array (ECA) and multi-frequency testing |

| Industry Adoption | Increased use in aerospace, power plants, and oil & gas pipelines |

| Supply Chain and Sourcing | Dependence on specialized probe manufacturers and costly hardware |

| Market Competition | Dominance of traditional NDT equipment providers |

| Market Growth Drivers | Demand for quality assurance, structural integrity, and defect detection |

| Sustainability and Energy Efficiency | Initial focus on reducing inspection downtime and improving efficiency |

| Integration of Smart Monitoring | Limited real-time flaw detection and manual reporting |

| Advancements in ECT Innovation | Development of enhanced eddy current probes and portable testers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking, real-time defect reporting, and blockchain-based inspection recordkeeping |

| Technological Advancements | Expansion of quantum sensing, nanotechnology-based ECT, and AI-powered defect classification |

| Industry Adoption | Widespread adoption in autonomous industrial inspections, predictive maintenance, and AI-driven robotic testing |

| Supply Chain and Sourcing | Shift toward modular, cost-effective sensor solutions and localized ECT component production |

| Market Competition | Rise of AI-driven testing startups, smart sensor developers, and automated NDT solution providers |

| Market Growth Drivers | Growth in autonomous quality control, predictive asset monitoring, and sustainability-focused NDT solutions |

| Sustainability and Energy Efficiency | Large-scale implementation of eco-friendly testing systems, AI-optimized inspection planning, and zero-waste testing methods |

| Integration of Smart Monitoring | AI-driven predictive defect analysis, cloud-based remote monitoring, and smart NDT system integration |

| Advancements in ECT Innovation | Introduction of autonomous drones for large-scale inspections, neural network-assisted flaw identification, and sustainable NDT practices |

Over the forecast period, the United States is expected to dominate the Eddy current testing market backed by the high demand for non-destructive testing (NDT) techniques in aerospace, automotive, and manufacturing industries and strict government regulations regarding the safety of the infrastructure. The increasing emphasis on identifying surface and subsurface defects is supporting the growth of the market.

Growing investments in advanced eddy current testing equipment, such as the use of portable and automated inspection systems also fuel market growth. Moreover, the refinement of AI-based flaw detection, digital twin, and real-time data analytics technologies is increasing the productivity of inspections.

The rising need for custom solutions to meet industrial demands is driving companies to develop multi-frequency and high-precision eddy current testing solutions. Rising adoption of NDT techniques in oil & gas pipelines, power plants, and defense applications is further contributing to the demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.3% |

UK Emerges as Key Market for Eddy Current Testing: Driven by Adoption of Advanced NDT Solutions in Aerospace Engineering, Increasing Regulatory Emphasis on Structural Integrity and Rising Investment in Automated Inspection Technologies The growth in market is also accredited to predictive maintenance and asset reliability.

Moreover government regulations promoting safety adherence and technological developments in phased-array eddy current and AI based defect identification facilitate the growth of market. Additionally, developments in remote and robotic eddy current testing systems are becoming widely accepted. To make access to data easier and improve analysis, the companies are investing in cloud-integrated inspection solutions as well.

The market adoption in the UK is further propelled by the rising transition toward Industry 4.0 and smart manufacturing initiatives. The growth of offshore wind farms and nuclear energy projects is also helping to fuel advances in demand for advanced NDT methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.9% |

The Western Europe Eddy current testing industry is showing the maximum development with Germany, France, and Italy contributing appreciably owing to the robust industrial automation, growing computerization structure modernization projects, and growing demand for precision inspection techniques in the transport and power markets.

With a European Union concentration on operational safety and investments in robotics-assisted eddy current testing and digital NDT solutions, the market is projected to grow rapidly. Other technologies currently gaining traction include AI-enhanced defect detection, automated reporting, and advanced electromagnetic sensors to improve inspection accuracy.

dditional, the demand for NDT applications in railway maintenance, renewable energy infrastructure, and high-performance material testing is also positively affecting market growth. This is supported by an expanded stringency of quality control standards across many industrial sectors, and new generation eddy current array probes. In addition, investments in smart NDT research and development are driving technological innovation.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 8.0% |

The Japanese Eddy current testing market is anticipated to expand with the emphasis placed on precision engineering, the availability of automated NDT systems, and the increase in demand for advanced manufacturing processes defect detection. Market growth is also propelled by an increasing demand for high-performance material testing in semiconductors and automotive industries.

Innovation is ignited through the country's focus on technology, such as AI-powered eddy current flaw detection, digital inspection platforms and automated testing robots. Additionally, stringent government regulations on industrial safety and infrastructure maintenance are propelling companies to develop high-sensitivity and ultra-fast scanning eddy current solutions.

Moreover, the augmented need for multilayer as well as high-resolution eddy current sensors in the aerospace, electronics and railway sectors is further propelling market growth across Japan's industrial domain. Also, automated NDT techniques are being molded by Japan&rsquos investment in smart factories and Industry 4.0 initiatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.2% |

Growing investments in industrial automation, increased utilization of advanced quality control methods, and supportive government initiatives promoting infrastructure safety and predictive maintenance are enabling South Korea emerge as a key market for eddy current testing. The market growth is also aided by rigorous government regulations on manufacturing safety and asset integrity, as well as the growing implementation of real-time defect detection and cloud-based NDT solutions.

The country is also improving competitiveness by concentrating on improving testing accuracy using AI-driven algorithms, wireless eddy current sensors, and machine-learning-based defect classification. Moreover, increasing demand for eddy current testing in shipbuilding, electronic manufacturing, and smart transportation systems, is expected to drive market as well.

NDT operation optimization and equipment: The companies are investing in miniaturization High Frequency Eddy Current Probes, automated inspection drones and remote monitoring from the end of a queue for NDT activities. The demand for advanced eddy current testing solutions is further boosted in South Korea with the rise of smart industrial facilities and AI-based quality assurance.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.1% |

The Eddy Current Array (ECA) technology has become popular because of its high sensitivity and capability of detecting surface and sub-surface defects and its effectiveness in complex geometries. Flying colors: aerospace, automotive and oil & gas are moving towards electric arc calography (ECA) for non-destructive testing (NDT) applications, corrosion mapping and weld inspection.

Because of this, enhanced scanning speeds, high-resolution imaging and detailed diagnostics from data are a few characteristics that make it popular amongst applications that require accurate real-time detection and analysis of defects.

Developments such as multi-coil probe designs for improved utilization and AI-based defect interpretation applied to ECA have also helped ensure ECA's position as a strong leader in the NDT field, with portable ECA options also now on the market.

Remote Field Testing (RFT) is significant to the inspection of ferromagnetic pipes, heat exchangers, and boiler tubes, which cannot be effectively measured using conventional eddy currents techniques, as they do not penetrate sufficiently thick sections. This is the most sought-after technique in the power generation and petrochemical sectors, where asset integrity and preventive maintenance are pivotal.

This becomes an important need as RFT is mainly used for assessing corrosion, wall thinning, and material degradation in areas that are not easily accessible and it has higher penetration power along with lower effect of increase in probe lifting. In addition, drones, automated scanning platforms, cloud-based analysis tools, and robotics have also increased the efficiency and scalability of remote field testing applications.

Eddy current testing market is mainly focused on inspection services for scientific applications as they offer, high precision defect detection, preventive maintenance, as well as quality control in several sectors. Third-party testing firms and internal NDT teams carry out regular inspections, materials testing, and structure assessments for organizations.

Businesses are leveraging AI in the manufacturing to address its specific challenges, resulting in the ever-increasing demand for automated and semi-automated inspection solutions, AI-driven defect recognition and remote monitoring systems, enabling them to improve safety, maximize operational process efficiency and meet tighter regulatory standards.

Furthermore, the growing adoption of predictive maintenance programs and digital twin technologies has also enhanced the significance of eddy current inspection services in contemporary industrial applications.

Eddy current testing devices must undergo calibration services to ensure they can be used in an efficient, accurate, marketability compliance manner. Many sectors: aerospace, production, power generation, etc. enter towards periodic calibration of equipment to bring in a level of thesis on defect detection, false alarm mitigation and instrument efficiency.

Increasing focus on ISO-certified calibration processes, automated calibration systems, and field verification services in various industries has led to developing high-precision calibration laboratories and mobile calibration units. Moreover, the evolution of digitalize calibration certificates, cloud-based tracking, and AI-powered calibration algorithms changed the way companies including NDT manage their equipment life cycles.

Eddy current testing solutions, for example, are being widely used, especially in the oil & gas industry where NDT methods are employed for pipeline integrity assessment, refinery equipment inspections, and offshore structure maintenance. As investments in pipeline expansion, deep-sea drilling, and LNG infrastructure grow, the demand for high-sensitivity defect detection, automated corrosion monitoring, and remote inspection capabilities has increased.

To improve safety, reduce downtime, and limit the chances of asset failures, companies are leveraging AI-enabled data analyses, robotic inspection tools, and real-time condition monitoring systems. Furthermore, rigorous government regulations regarding environmental safety and hazardous material management are fomenting the adoption of novel eddy current testing technologies.

The automotive sector is increasingly adopting eddy current technology for quality assurance, material verification and fatigue analysis of engine components, chassis structures, and processing conditions. Eddy current inspection is also used by automotive manufacturers and suppliers standards for weld integrity testing, crack detection, and heat treatment validation in a variety of high-performing lightweight materials and components in electric vehicle (EV) systems.

Eddy current testing inline, automated flaw detection, and AI-based defect classification are in high demand as emerging automated manufacturing, the fourth industrial revolution, and electric mobility speak the language of efficiency and mass production. The introduction of robotics and digital imaging technologies has also led to improved inspection of complicated structures of the car, motivating efficiency and manufacturing quality.

Growing demand for non-destructive testing (NDT) solutions in manufacture, aerospace, oil & gas, and power generation industries are driving the growth of eddy current testing (ECT) market. To improve the detection of flaws and the evaluation of materials, companies are working on new methods of the ECT, automated inspection systems, AI-based data analysis, etc. Some of the major developments are multi-frequency testing, portable ECT devices, and integrated digital reporting leading to better efficiency and accuracy.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Electric (GE) | 17-21% |

| Olympus Corporation | 13-17% |

| Zetec, Inc. | 10-14% |

| Eddyfi Technologies | 7-11% |

| MISTRAS Group, Inc. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| General Electric (GE) | Leading provider of advanced ECT solutions with AI-powered flaw detection and automated inspection systems. |

| Olympus Corporation | Specializes in portable eddy current testing devices and multi-frequency flaw detection technology. |

| Zetec, Inc. | Develops high-performance eddy current probes and software for industrial NDT applications. |

| Eddyfi Technologies | Offers innovative ECT solutions, including remote field testing and high-resolution flaw detection tools. |

| MISTRAS Group, Inc. | Focuses on integrated NDT services, including ECT for asset integrity and material evaluation. |

Key Company Insights

General Electric (GE) (17-21%)

GE is the leader in ECT, offering a powerful portfolio of advanced AI-based omni- directional environmental flaw detection and real-time data analysis capabilities. The company embeds automated ECT systems into industrial workflows to detect defects and inspect materials more efficiently. From production to service, GE is a worldwide leader in nondestructive testing technologies.

Olympus Corporation (13-17%)

Olympus provides portable and accurate eddy current testing devices that provide reliable flaw detection for industries that need it. In addition, being powered by using a multi-frequency technology, the company offers to increase in the detection accuracy and ease of use. Olympus' market leadership is reinforced by its strong distribution network and advanced probe designs.

Zetec, Inc. (10-14%)

Zetec designs high‐performance eddy current probes, software and inspection solutions for industrial applications. It specializes in high-resolution data capture and real-time defect analysis. With a strong emphasis on research and development, Zetec stays ahead of the curve, making it eagerly sought for industrial inspection.

Eddyfi Technologies (7-11%)

Eddyfi Technologies specializes in advanced eddy current testing methods such as remote field and advanced signal processing techniques. The company uses advanced imaging technology to provide higher accuracy for flaw detection as well as improved options for material characterization. The focus of Eddyfi on automating and driving NDT services through data increases its competitive landscape.

MISTRAS Group, Inc. (5-9%)

MISTRAS Group was the first to offer integrated NDT solutions that justified the industry's faith in its device Data-recorded testing procedures. Using digital reporting tools and AI-driven analytics, the company can optimize these inspection workflows. MISTRAS is a key industry player in all three asset integrity monitoring areas, driven by its strong service network and extensive experience in asset integrity management.

Other Key Players (35-45% Combined)

Several world class players and regional players are supporting development of Eddy current testing market that emphasize on advanced sensor technology, artificial intelligence based evaluation and automation. Key players include:

The overall market size for Eddy current testing market was USD 1,290.18 million in 2025.

The Eddy current testing market expected to reach USD 2,811.30 million in 2035.

The growing government regulations on plastic straws, rising consumer preference for environmentally friendly alternatives, increased awareness about environmental impact, growing adoption of these solutions in food services, and significant developments in biodegradable and compostable straw materials are fueling the demand for the eco-friendly straws market.

The top 5 countries which drives the development of Eddy current testing market are USA, UK, Europe Union, Japan and South Korea.

Eddy current array and remote field testing techniques drive market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 3: Global Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 4: Global Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Table 5: North America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 6: North America Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 7: North America Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 8: North America Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Table 9: Latin America Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 10: Latin America Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 11: Latin America Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 12: Latin America Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Table 13: Europe Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 14: Europe Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 15: Europe Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 16: Europe Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Table 17: Asia Pacific Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 18: Asia Pacific Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 19: Asia Pacific Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 20: Asia Pacific Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Table 21: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2017 to 2032

Table 22: Middle East and Africa Market Value (US$ billion) Forecast by Technique, 2017 to 2032

Table 23: Middle East and Africa Market Value (US$ billion) Forecast by Service, 2017 to 2032

Table 24: Middle East and Africa Market Value (US$ billion) Forecast by Industry Verticals, 2017 to 2032

Figure 1: Global Market Value (US$ billion) by Technique, 2022 to 2032

Figure 2: Global Market Value (US$ billion) by Service, 2022 to 2032

Figure 3: Global Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 4: Global Market Value (US$ billion) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ billion) Analysis by Region, 2017 to 2032

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 11: Global Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 12: Global Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 13: Global Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 14: Global Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 17: Global Market Attractiveness by Technique, 2022 to 2032

Figure 18: Global Market Attractiveness by Service, 2022 to 2032

Figure 19: Global Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 20: Global Market Attractiveness by Region, 2022 to 2032

Figure 21: North America Market Value (US$ billion) by Technique, 2022 to 2032

Figure 22: North America Market Value (US$ billion) by Service, 2022 to 2032

Figure 23: North America Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 24: North America Market Value (US$ billion) by Country, 2022 to 2032

Figure 25: North America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 28: North America Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 29: North America Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 30: North America Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 31: North America Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 32: North America Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 33: North America Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 34: North America Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 37: North America Market Attractiveness by Technique, 2022 to 2032

Figure 38: North America Market Attractiveness by Service, 2022 to 2032

Figure 39: North America Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 40: North America Market Attractiveness by Country, 2022 to 2032

Figure 41: Latin America Market Value (US$ billion) by Technique, 2022 to 2032

Figure 42: Latin America Market Value (US$ billion) by Service, 2022 to 2032

Figure 43: Latin America Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 44: Latin America Market Value (US$ billion) by Country, 2022 to 2032

Figure 45: Latin America Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 48: Latin America Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 51: Latin America Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 54: Latin America Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 57: Latin America Market Attractiveness by Technique, 2022 to 2032

Figure 58: Latin America Market Attractiveness by Service, 2022 to 2032

Figure 59: Latin America Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 60: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 61: Europe Market Value (US$ billion) by Technique, 2022 to 2032

Figure 62: Europe Market Value (US$ billion) by Service, 2022 to 2032

Figure 63: Europe Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 64: Europe Market Value (US$ billion) by Country, 2022 to 2032

Figure 65: Europe Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 68: Europe Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 69: Europe Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 71: Europe Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 72: Europe Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 74: Europe Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 75: Europe Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 77: Europe Market Attractiveness by Technique, 2022 to 2032

Figure 78: Europe Market Attractiveness by Service, 2022 to 2032

Figure 79: Europe Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 80: Europe Market Attractiveness by Country, 2022 to 2032

Figure 81: Asia Pacific Market Value (US$ billion) by Technique, 2022 to 2032

Figure 82: Asia Pacific Market Value (US$ billion) by Service, 2022 to 2032

Figure 83: Asia Pacific Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 84: Asia Pacific Market Value (US$ billion) by Country, 2022 to 2032

Figure 85: Asia Pacific Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 88: Asia Pacific Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 91: Asia Pacific Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 94: Asia Pacific Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 97: Asia Pacific Market Attractiveness by Technique, 2022 to 2032

Figure 98: Asia Pacific Market Attractiveness by Service, 2022 to 2032

Figure 99: Asia Pacific Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 100: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 101: Middle East and Africa Market Value (US$ billion) by Technique, 2022 to 2032

Figure 102: Middle East and Africa Market Value (US$ billion) by Service, 2022 to 2032

Figure 103: Middle East and Africa Market Value (US$ billion) by Industry Verticals, 2022 to 2032

Figure 104: Middle East and Africa Market Value (US$ billion) by Country, 2022 to 2032

Figure 105: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2017 to 2032

Figure 106: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 107: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 108: Middle East and Africa Market Value (US$ billion) Analysis by Technique, 2017 to 2032

Figure 109: Middle East and Africa Market Value Share (%) and BPS Analysis by Technique, 2022 to 2032

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technique, 2022 to 2032

Figure 111: Middle East and Africa Market Value (US$ billion) Analysis by Service, 2017 to 2032

Figure 112: Middle East and Africa Market Value Share (%) and BPS Analysis by Service, 2022 to 2032

Figure 113: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service, 2022 to 2032

Figure 114: Middle East and Africa Market Value (US$ billion) Analysis by Industry Verticals, 2017 to 2032

Figure 115: Middle East and Africa Market Value Share (%) and BPS Analysis by Industry Verticals, 2022 to 2032

Figure 116: Middle East and Africa Market Y-o-Y Growth (%) Projections by Industry Verticals, 2022 to 2032

Figure 117: Middle East and Africa Market Attractiveness by Technique, 2022 to 2032

Figure 118: Middle East and Africa Market Attractiveness by Service, 2022 to 2032

Figure 119: Middle East and Africa Market Attractiveness by Industry Verticals, 2022 to 2032

Figure 120: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Current Sensors Market Trends – Growth & Forecast 2025-2035

Current Carrying Wiring Devices Market - Forecast through 2034

Current Calibrator Market

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Current Ion Implanter Market Size and Share Forecast Outlook 2025 to 2035

Microcurrent Facial Market Analysis & Forecast by Application, End-use, and Region Through 2035

Fault Current Limiters Market Growth - Trends & Forecast 2025 to 2035

Optical Current Transformer Market Size, Growth, and Forecast 2025 to 2035

Constant Current Regulator Market Size and Share Forecast Outlook 2025 to 2035

Dry Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

3rd Rail Current Collector Market Size and Share Forecast Outlook 2025 to 2035

Residual Current Circuit Breaker Market Growth - Trends & Forecast 2025 to 2035

Wound Type Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Flexible AC Current Transmission System Market Size and Share Forecast Outlook 2025 to 2035

Hall-Effect Current Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

Magneto Optic Current Transformer Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current (HVDC) Capacitor Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Direct Current Power Supply Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA