The employee engagement market is expanding steadily as organizations prioritize workforce satisfaction, productivity, and retention through digital engagement platforms. Increasing competition for skilled talent and the shift toward hybrid working models have heightened the need for continuous communication and performance feedback systems.

The market is characterized by the integration of analytics-driven insights, gamification, and personalized recognition tools designed to enhance employee motivation and cultural alignment. Cloud-based platforms and mobile accessibility have broadened deployment flexibility across global enterprises.

Rising awareness of mental well-being, inclusion, and leadership transparency further fuels adoption. The outlook remains optimistic as organizations integrate engagement software into broader HR technology ecosystems, positioning it as a core element of talent management strategy.

| Metric | Value |

|---|---|

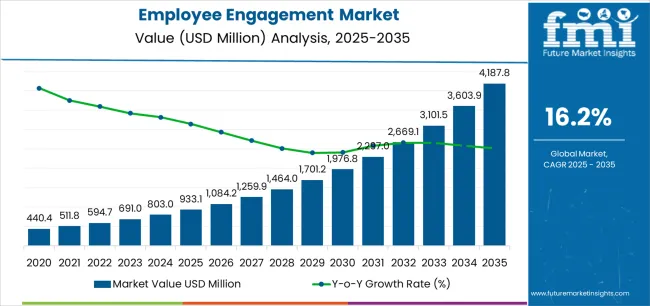

| Employee Engagement Market Estimated Value in (2025 E) | USD 933.1 million |

| Employee Engagement Market Forecast Value in (2035 F) | USD 4187.8 million |

| Forecast CAGR (2025 to 2035) | 16.2% |

The market is segmented by Solution, Deployment, Enterprise Size, and Industry and region. By Solution, the market is divided into Software and Services. In terms of Deployment, the market is classified into Cloud Based and On Premises. Based on Enterprise Size, the market is segmented into Large Enterprises and Small And Mid Sized Enterprises. By Industry, the market is divided into IT And Telecom, BFSI, Retail, Healthcare, Government, Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

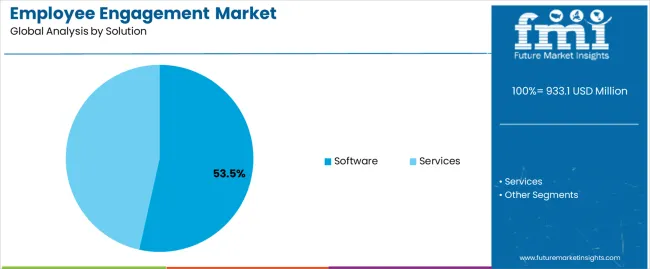

The software segment dominates the solution category with approximately 53.5% share, driven by its ability to streamline feedback management, performance analytics, and engagement tracking. Organizations are increasingly adopting dedicated engagement software to measure sentiment, enhance collaboration, and drive continuous improvement in employee experience.

The scalability and customization options of software-based platforms have made them suitable for diverse organizational structures. The integration of AI for predictive engagement modeling and sentiment analysis has further strengthened adoption.

With the rising emphasis on real-time employee interaction and retention, the software segment is expected to maintain its leadership within the market.

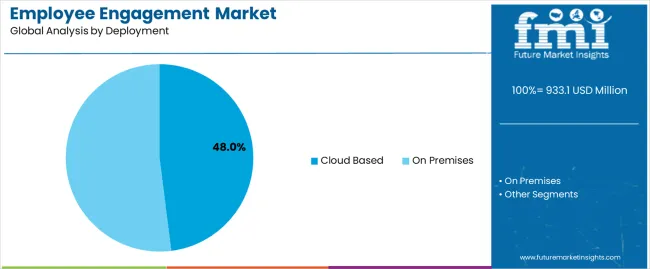

The cloud-based segment accounts for approximately 48.0% share of the deployment category, supported by the growing preference for scalable and cost-effective engagement solutions. Cloud deployment enables remote accessibility, simplified updates, and seamless integration with HR and collaboration tools.

The trend toward distributed teams has accelerated cloud adoption, as it allows organizations to maintain consistent communication and data management globally. The flexibility of subscription-based pricing models also appeals to both large and mid-sized enterprises.

As data security and compliance capabilities of cloud systems continue to improve, this segment is anticipated to expand further and reinforce its market dominance.

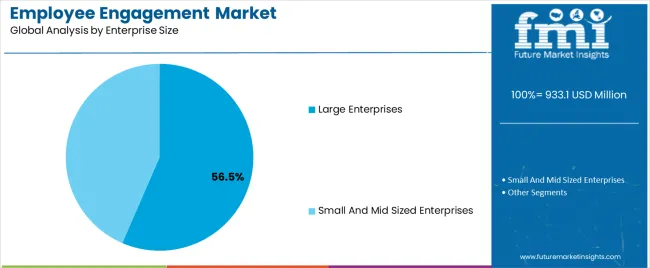

The large enterprises segment holds approximately 56.5% share in the enterprise size category, underscoring its leadership in adopting comprehensive engagement platforms. Larger organizations prioritize scalable, multi-functional solutions to enhance employee retention and align teams across geographies.

The complexity of workforce structures in these enterprises necessitates advanced analytics, reporting tools, and integration capabilities. Significant investment capacity enables large firms to deploy tailored engagement ecosystems that incorporate learning, recognition, and communication modules.

With continuous focus on culture transformation and productivity optimization, the large enterprises segment is projected to sustain its leading share throughout the forecast period.

Employees expect personalized experiences and tailored communication from their employers. Employee engagement platforms are offering features that allow organizations to customize content, recognition programs, and feedback mechanisms to better meet the diverse needs and preferences of their workforce.

The scope for employee engagement rose at a 15.4% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 16.2% over the forecast period 2025 to 2035.

There was a significant uptake of technology driven solutions for employee engagement, during the period. Companies increasingly invested in platforms and tools that facilitate communication, collaboration, feedback, and recognition among employees.

Organizations prioritized enhancing the overall employee experience by implementing initiatives focused on well being, work life balance, career development, and inclusivity. Employee engagement strategies became more holistic, encompassing all aspects of the employee journey.

The rise of remote and distributed workforces reshaped the landscape of employee engagement. Organizations adapted their approaches to accommodate remote employees, leveraging technology to maintain connectivity, foster team collaboration, and support virtual team building.

Organizations will increasingly adopt agile methodologies and practices to foster agility, resilience, and innovation. Employee engagement initiatives will align with agile principles, emphasizing flexibility, experimentation, and continuous improvement.

The use of data analytics and predictive modeling will become more sophisticated, enabling organizations to anticipate trends, forecast outcomes, and preemptively address engagement challenges. Employee engagement platforms will offer advanced analytics capabilities, providing actionable insights for decision makers.

Companies are increasingly recognizing the importance of employee well being and its impact on engagement. Organizations are investing in tools and strategies to support mental and physical health of their employees, with the rise of remote work and the blurring of boundaries between work and personal life.

Implementing new employee engagement strategies and technologies often requires organizational change. Resistance to change from employees, managers, or leadership can hinder adoption and effectiveness of engagement initiatives.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Australia and New Zealand, and Japan. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 13.1% |

| Germany | 15.7% |

| Japan | 17.4% |

| China | 16.7% |

| Australia and New Zealand | 19.7% |

The employee engagement market in the United States expected to expand at a CAGR of 13.1% through 2035. The shift towards remote work has highlighted the importance of effective employee engagement strategies for distributed teams. There is an increased demand for tools and platforms that facilitate communication, collaboration, and connection among remote employees, as more companies adopt remote and hybrid work models.

Organizations are increasingly recognizing the importance of prioritizing employee well being to enhance engagement and productivity. Employers are investing in employee assistance programs, mental health resources, wellness initiatives, and work life balance policies to support the holistic well being of their workforce.

The employee engagement market in Germany is anticipated to expand at a CAGR of 15.7% through 2035. Germany is undergoing a digital transformation across industries. There is a growing demand for employee engagement tools and platforms that facilitate communication, collaboration, and productivity in digital work environments, as companies digitize their operations and embrace technology driven solutions.

Germany has stringent labor laws and regulations that govern employee rights and workplace conditions. Employers are mandated to prioritize employee engagement, health, and safety in compliance with labor standards, creating a conducive environment for the adoption of employee engagement solutions and best practices.

Employee engagement trends in China are taking a turn for the better. A 16.7% CAGR is forecast for the country from 2025 to 2035. Employers are focused on talent retention strategies, with increased job mobility among Chinese workers. Employee engagement initiatives that prioritize career development, provide opportunities for advancement, and recognize employee contributions are critical for retaining key talent and reducing turnover.

Chinese workplaces are experiencing cultural shifts, particularly among younger generations entering the workforce. Millennials and Gen Z employees value factors such as meaningful work, work life balance, and opportunities for personal growth and development. Employers are adapting their employee engagement strategies to align with the preferences and expectations of these younger workers.

The employee engagement market in Japan is poised to expand at a CAGR of 17.4% through 2035. The country places a strong emphasis on work culture, including employee satisfaction, loyalty, and engagement. There is a growing demand for employee engagement solutions and practices that enhance workplace satisfaction and productivity, as companies recognize the importance of fostering positive work environments.

Japan faces demographic challenges, including an aging workforce and declining birth rates. Employers are focused on talent retention strategies to address skills shortages and maintain competitiveness. Employee engagement initiatives that foster career development, provide opportunities for skill enhancement, and recognize employee contributions are key for retaining top talent.

The employee engagement market in Korea is anticipated to expand at a CAGR of 19.7% through 2035. Both Australia and New Zealand are early adopters of technology and digital solutions. Companies in these countries are leveraging technology driven tools and platforms to enhance communication, collaboration, and employee engagement. Digital communication tools, collaboration software, and employee feedback platforms are in high demand as organizations embrace digital transformation.

Employers in Australia and New Zealand recognize the importance of creating positive employee experiences. From recruitment to offboarding, organizations are investing in employee engagement initiatives that prioritize meaningful work, career development, and opportunities for personal growth. Employee experience platforms and journey mapping tools are increasingly used to enhance the overall employee experience.

The below table highlights how integrated employee engagement software segment is projected to lead the market in terms of solution, and is expected to account for a share of 53.5% in 2025.

Based on deployment, the cloud based segment is expected to account for a share of 48.0% in 2025.

| Category | Market Share in 2025 |

|---|---|

| Integrated Employee Engagement Platform | 53.5% |

| Cloud Based | 48.0% |

Based on solution segment, under the software segment, the integrated employee engagement platform sub segment is expected to continue dominating the employee engagement market.

Integrated employee engagement platforms offer a comprehensive suite of features and functionalities designed to address various aspects of employee engagement, including communication, collaboration, recognition, feedback, and performance management.

Organizations are increasingly seeking unified solutions that consolidate disparate tools and streamline engagement initiatives across the entire employee lifecycle. The platforms seamlessly integrate with existing HR systems, communication tools, and productivity software, providing a cohesive user experience and eliminating the need for manual data entry and synchronization.

The integration enables real time access to employee data, streamlines administrative processes, and enhances data accuracy and consistency. The integrated platforms centralize employee data and engagement metrics in one accessible location, enabling organizations to gain holistic insights into workforce dynamics, sentiment trends, and engagement levels.

In terms of deployment, the cloud based segment is expected to continue dominating the employee engagement market, attributed to several key factors. Cloud based solutions offer scalability, allowing organizations to easily scale their employee engagement initiatives up or down based on changing needs and workforce dynamics. The flexibility enables organizations to adapt to growth, expansion, or seasonal fluctuations without significant infrastructure investments.

Cloud based deployment models typically operate on a subscription or pay as you go basis, eliminating the need for upfront hardware and infrastructure costs. Organizations can benefit from lower total cost of ownership and predictable operating expenses, making cloud based solutions an attractive option for businesses of all sizes.

The competitive landscape of the employee engagement market is characterized by a diverse array of vendors offering a wide range of solutions and services aimed at enhancing employee satisfaction, productivity, and organizational performance. The market is highly dynamic and competitive, driven by evolving workforce dynamics, technological advancements, and shifting organizational priorities.

Key Development

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 803.0 Million |

| Projected Market Valuation in 2035 | USD 3,603.9 Million |

| Value-based CAGR 2025 to 2035 | 16.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD Million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Solution, Deployment, Enterprise Size, Industry, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Cisco Systems; IBM Corporation; Microsoft Corporation; Google; Bitrix24; Atlassian Corporation Plc; Xoxoday; Connecteam; Officevibe (GSoft Group Inc.); ContactMonkey Inc.; Lattice; Peakon; BambooHR; Impraise; LumApps SAS |

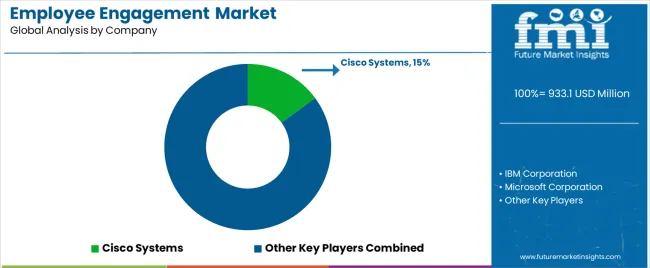

The global employee engagement market is estimated to be valued at USD 933.1 million in 2025.

The market size for the employee engagement market is projected to reach USD 4,187.8 million by 2035.

The employee engagement market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in employee engagement market are software, integrated employee engagement platform, standalone software, services, professional services and managed services.

In terms of deployment, cloud based segment to command 48.0% share in the employee engagement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Employee Benefits Strategy and Consulting Market Size and Share Forecast Outlook 2025 to 2035

Employee Advocacy Software Market Size and Share Forecast Outlook 2025 to 2035

Employee Recognition Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Ex-Employee Verification Market Size and Share Forecast Outlook 2025 to 2035

Fan Engagement Market Insights – Trends & Growth 2025 to 2035

Social Employee Recognition System Market Size, Growth, and Forecast for 2025 to 2035

Social Employee Recognition System Market in Korea – Industry Outlook & Forecast 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Customer Engagement Hub (CEH) Market Size and Share Forecast Outlook 2025 to 2035

Customer Engagement Solutions Market Analysis - Demand & Growth through 2034

Community Engagement Platform Market Analysis by Component, Deployment Mode, Industry and Region Through 2035

Social Media Engagement Applications Market Size and Share Forecast Outlook 2025 to 2035

Social Employee Recognition System Market in Japan - Growth & Forecast 2025 to 2035

North America Employee Recognition Software Market – Growth & Outlook 2025 to 2035

Western Europe Social Employee Recognition System Market - Trends & Forecast 2025 to 2035

Life Sciences Next-generation Customer Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Spending In Digital Customer Experience and Engagement Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA