The Fan Engagement Market is projected to experience remarkable growth between 2025 and 2035, driven by the increasing digitalization of entertainment platforms and the rising demand for interactive experiences between celebrities and their fans.

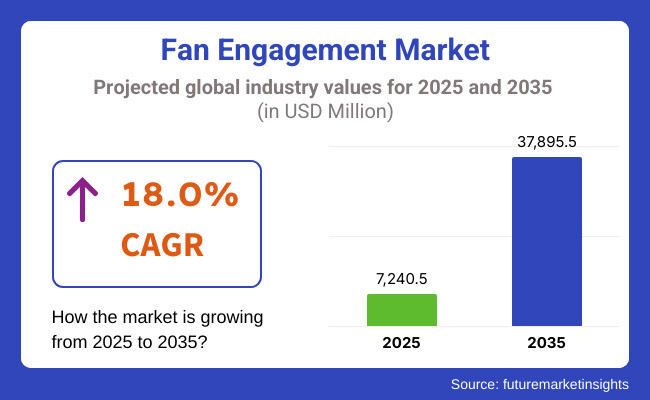

The market is expected to reach USD 7,240.5 million in 2025 and grow to USD 37,895.5 million by 2035, reflecting a compound annual growth rate (CAGR) of 18.0% over the forecast period.

A key factor contributing to this surge is the widespread adoption of social media and live streaming technologies, which allow artists, influencers, and entertainment figures to engage directly with their followers in real time. With the proliferation of AI-driven personalized interactions, the rise of NFTs (non-fungible tokens), and exclusive fan clubs, the industry is transforming traditional fan interactions into immersive and monetizable experiences.

Live calls score on top of the Engagement Type category because they are able to generate immediate, one-to-one, intimate exchanges between personalities and fans. Live video calls provide a genuine, face-to-face interaction, which is incredibly appealing to both personalities and fans.

This category is having robust monetization opportunities as platforms integrate more virtual meet-and-greets, one-on-one calls and fan Q&As. Moreover, the increasing use of AR/VR-based immersive experiences in live engagement with fans is also cementing leadership for this segment, delivering engagement levels beyond traditional channels such as social media.

Driven by a strong sports culture, entertainment sector development, and technological innovation in the region, North America is a high-value market in the fan engagement space. The United States and Canada boast the largest recorded sports leagues globally (NFL, NBA, MLB, and NHL), all of which invested heavily in digital fan engagements initiatives.

This change was aided by the rise of social media, fantasy sports, and even interactive fan experiences (AR/VR integrations, AI-powered content recommendations, and so on) that created a new way for fans to interact with their favorite athletes and teams.

An increase in direct-to-consumer (DTC) streaming stations has also emerged across the continent, enabling fans to easily access exclusive content and live games. In addition, brands and teams are utilizing data analytics to offer personalized fan experiences, increase merchandise sales, and improve sponsorship opportunities. Growing demand for immersive experiences is driving investments in smart stadiums, NFTs, and block chain-based fan tokens, while boosting audience engagement in North America.

Europe is the largest market share of that which is driven mainly by global football leagues like the English Premier League, La Liga, Bundesliga and Serie A where football club have been leading the charge with innovative fan engagement initiatives such as virtual meet and greets, interactive apps and exclusive content and experience digital fan memberships.

Social media platforms (Twitter, TikTok, Instagram, etc.) have a vital role to play in enabling live interaction, and fantasy sports platforms are witnessing millions of visitors still flocking to their sites. In this territory, there has also been the swift rise of blockchain-linked fan tokens that allow fans to help decide matters related to the club and access VIP events.

More and more European leagues and clubs are implementing sustainable solutions, including green stadium initiatives and online-only merchandise to reduce waste. Despite these developments, challenges exist in the regulatory landscape with respect to data, privacy, and monetization strategies that require companies to employ open and ethical ways to engage fans.

The fan engagement market will be fastest-growing in the Asia-Pacific region, as international sports, esports and digital entertainment platforms continue to gain steam. Esports is one of the drivers to reach out to younger viewers, and other countries leading the way, in new models of engagement are China, India, Japan and South Korea. Mobile-first content, which comprises a great deal of entertainment consumed by younger audiences pays very little for distribution, leaking ad revenues through streaming services and interactive gaming communities.

Cricket (a dominating sport in India and Australia) has seen heavy online fan engagement through fantasy cricket, exclusive players content, and AI-led analysis. In China, social commerce is transforming how fan base engage with stars, with players and influencers communicating directly with audiences at live-streaming events.

But the market is also confronting regulatory issues including government curation of social media sites and policies on how to monetize digital content as it also opens up rich revenues. Localized engagement strategies will be critical to either brands or squads who want to grow their fan base in Asia-Pacific.

Challenge: Digital Fatigue and Oversaturation

Fan engagement analysis: Major challenge is digital fatigue due to oversaturation of digital content and platforms Fans tend to get engagement burnout with so many streaming platforms, social media platforms, and fantasy sports platforms. It is both a challenge of too much content and too little.

The opportunity that sports teams, sports leagues, and entertainment brands have here is to fill that need with meaningful content that does not saturate the landscape. What is more, maintaining the peak of engagement and complying with privacy and data protection is increasingly becoming a challenge as regulations around the world tighten.

Opportunity: Emerging Technologies and Immersive Experiences

The quite big opportunities for the fan engagement space have come from technological advancements. The use of AR, VR, and the metaverse are also paving a new way for interactivity among fans, allowing users to attend games, concerts, and events virtually. Fan engagement with teams is also being revolutionized by block chain-based fan tokens and NFTs, which offer unique rewards and governance.

In the same vein, AI-driven content personalization is enabling brands to deliver hyper-targeted experiences that can lead to increased fan loyalty and unlock monetization opportunities. Watch out for these new AGI potential through them, corporations can disrupt the fan engagement business and create deeper and more unforgettable experiences for fans worldwide.

Between 2020 and 2024, the fan engagement market underwent a rapid transformation, driven by digital innovations, the rise of social media, and evolving consumption patterns. The COVID-19 pandemic accelerated the shift from in-person experiences to virtual and digital interactions, leading to increased reliance on live streaming, augmented reality (AR), and interactive content. Sports leagues, music artists, and entertainment brands leveraged digital platforms to maintain fan engagement, with personalized content, real-time interactions, and immersive virtual experiences gaining prominence.

Between 2025 and 2035, the fan engagement market will experience a transformative shift, driven by AI-powered personalization, decentralized content ecosystems, and hyper-immersive experiences. The widespread adoption of the metaverse, AI-driven content creation, and decentralized fan communities will redefine how fans interact with their favorite brands, teams, and artists.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter data privacy laws, digital rights management, and block chain-based asset regulations. |

| Technological Advancements | AI-powered chatbots, AR/VR experiences, and digital fan tokens. |

| Industry Applications | Sports, music, gaming, and social media-driven entertainment. |

| Adoption of Smart Equipment | VR/AR-based fan experiences, AI-powered content recommendations, and real-time analytics. |

| Sustainability & Cost Efficiency | Digital collectibles, carbon-neutral live streaming, and sustainable fan events. |

| Data Analytics & Predictive Modeling | AI-driven fan sentiment analysis, predictive engagement strategies, and real-time audience segmentation. |

| Production & Supply Chain Dynamics | Digital content saturation, platform fragmentation, and increased competition for fan attention. |

| Market Growth Drivers | Growth driven by digital transformation, AI-driven engagement tools, and interactive fan experiences. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | AI-powered fan data regulations, Web3-driven digital rights policies, and decentralized content ownership laws. |

| Technological Advancements | AI-driven virtual influencers, deep fake-generated interactions, and neural-linked fan engagement platforms. |

| Industry Applications | AI-powered smart stadiums, brain-computer interfaces in fan engagement, and hyper-personalized metaverse interactions. |

| Adoption of Smart Equipment | Emotion-driven AI engagement, holographic fan interactions, and biometric authentication for event access. |

| Sustainability & Cost Efficiency | AI-driven sustainable content creation, blockchain-based transparent event ticketing, and zero-carbon digital engagement. |

| Data Analytics & Predictive Modeling | Quantum-enhanced predictive modeling, AI-powered emotional recognition, and decentralized data ownership models. |

| Production & Supply Chain Dynamics | AI-optimized fan content ecosystems, decentralized streaming platforms, and blockchain-enabled fan economies. |

| Market Growth Drivers | AI-powered hyper-personalized engagement, decentralized fan communities, and immersive metaverse-driven experiences. |

As more and more sports, entertainment, and esports sectors are focusing mainly on digitalization and adopting AI-based fan interaction solutions, the American fan interaction market is witnessing a growing boom. Innovative engagement tools from augmented reality (AR) and virtual reality (VR) live event experiences have helped enhance fan engagement, too.

Additionally, sports teams, music artists, and content creators are utilizing NFTs, blockchain collectibles, and fan-personalized content strategies to engage with fans.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.5% |

The UK fan market is booming because of the widespread presence of football clubs, music festivals, and esports events that are using digital platforms for engaging with fans. The need for interactive streaming, gamification of fan experiences, and subscription-based content models is fueling the growth of the market.

In addition, the use of social media, fantasy sports, and mobile apps is enabling fans to connect more intensively with their favorite teams and celebrities.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.8% |

The EU fan engagement industry is growing as sports franchises, gaming organizations, and entertainment brands are willing to invest big in fan loyalty initiatives, digital ticketing technology, and real-time engagement analysis. Germany, France, and Spain are witnessing the rapid adoption of AI-based chatbots, VR-enabled live events, and block chain-driven fan reward systems.

The increasing popularity of esports leagues and interactive digital concerts is also fueling engagement across platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.2% |

Japan's fan market is transforming because of the growing power of anime, J-pop, and gaming fandoms. Mobile apps, membership schemes, and virtual meet-and-greets are becoming mainstream among entertainment businesses. In addition, 5G technology, AR events, and AI-powered fan personalization tools are increasing digital fan interaction, especially in music and sport.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.9% |

South Korea's fan engagement market is booming with the hegemony of K-pop, esports, and participative digital content. Entertainment behemoths in South Korea are spearheading trends in metaverse-based fan interactions, AI-facilitated chat services, and private online merchandise sales. Furthermore, the speedy growth of live-streaming platforms, digital fan clubs, and social media-enabled fan engagement is accelerating the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.5% |

Social media personalities have become one of the fastest-rising categories in the fan engagement market, using platforms like Instagram, TikTok, YouTube, and Twitter to create vibrant, interactive communities. In contrast to conventional fan engagement practices, online interactions provide real-time connection, enabling greater intimacy between influencers and their followers. Increasing demand for direct and interactive interaction, including Q&A sessions, backstage material, and special fan clubs, has led to market growth.

The growth of pay-to-play fan groups, including influencer-based mentorship platforms, interactive games, and custom content, has contributed further to market demand, delivering more immersive and monetized experiences. The convergence of AI-enabled fan engagement software, including chatbot-responded communications, predictive content curation, and sentiment monitoring, has enhanced fan interactions, enhancing social media personas' capabilities for increasing engagement and audience loyalty.

Blockchain-backed digital collectibles, including rare NFTs, customized memorabilia, and authenticated fan access tokens, have maximized market expansion, guaranteeing higher fan investment in engagement-based digital assets. The integration of metaverse-driven engagement programs, including virtual influencer-fan meet-and-greets, augmented reality (AR) content creation, and AI-developed customized interactions, has solidified market growth, guaranteeing a vibrant and interactive fan experience.

Although with benefits of increased accessibility, real-time engagement, and revenue possibilities, social media personalities are plagued by issues like algorithmic-based content visibility restrictions, fatigue among fans from saturated participation requests, and government issues over data protection and digital earnings. Yet new breakthroughs in AI-based fan analysis, decentralized content sharing, and interactive holographic interactions are enhancing targeting, security, and ongoing growth for social media personality-based fan connection models globally.

Live video calls have witnessed robust market adoption, especially from influencers, artists, and entertainment professionals who want to have direct and exclusive interactions with their fans. In contrast to passive social media interactions, live video calls provide immediate, face-to-face communication, allowing fans to have greater emotional connections and memorable, unique experiences.

The rising need for personalized fan engagement experiences, including one-on-one calls, customized shootouts, and group interactions, has encouraged market adoption, as fans want more personal connections with creators. The growth of live video monetization formats, with pay-per-session calls, VIP group experiences, and premium fan interactions, has supported market demand, providing lucrative participation opportunities for celebrities and influencers.

The inclusion of AI-powered engagement tools, with automated scheduling, real-time tracking of fan sentiment, and AI-suggested interactions, has further fueled adoption, providing hassle-free and optimized fan experiences. The creation of brand-sponsored live fan engagements, including influencer partnerships, promotional tie-ins, and fan rewards programs, has maximized market growth, ensuring more commercial engagement opportunities.

The use of virtual reality (VR) and AR-based live engagements, including holographic fan meetups, virtual meet-and-greet sessions, and gamified digital interactions, has strengthened market growth, ensuring immersive and technologically enhanced engagement solutions.

In spite of exclusivity strengths, immediacy of interactions, and flexibility in monetization, the live video calls segment is plagued by issues including scheduling conflicts for influencers, limitations in the digital infrastructure, and fan accessibility issues related to cost barriers and geographic restrictions. However, new inventions in AI-driven engagement scheduling, block chain-secured digital identity authentication, and scalable cloud-based live streaming solutions are enhancing efficiency, promoting greater accessibility, and guaranteeing ongoing expansion for live video call-based fan engagement services across the globe.

The entertainment industry has turned to interactive forms of engagement with fans such as virtual concerts, compound gaming collaborations in online multiplayer worlds, and unique behind-the-scenes content showcasing fan + creator interactions. Unlike passive forms of media consumption, interactive entertainment engages fans to participate in interactive and immersive activities with their favorite artists, celebrities, and creators. The growth in the popularity of immersive entertainment elements, such as real-time concerts, exclusive movie screenings, and interactive gaming tournaments, has driven adoption as fans seek active and behind-the-scenes experiences.

Despite access facilitation advantages, delivery options for immersive content and revenue potential, the entertainment segment grapples with competitors on the platform, threats of digital piracy and the ability to monetize engagement without alienating audiences. However, innovative progress with in the domain of block chain-based content protection, AI-powered interactive storytelling and immersive VR-powered fan entertainment is helping to augment content protection, creativity on a global scale while further ensuring ensuing market growth for entertainment-driven fan engagement solutions.

The personalized messages market has seen significant market adoption, especially among content creators, celebrities, and influencers who want one-on-one and meaningful interactions with their fan community. In contrast to mass communication channels, personalized messages enable extremely tailored and emotionally resonant interactions. The increasing popularity of direct-to-fan communication, including video shootouts, personalized greetings, and special celebratory messages, has fueled adoption, as fans crave more intimate and personalized engagement experiences.

In spite of customization, emotional appeal, and monetization potential benefits, the segment of personalized messages is challenged by scalability issues, time limits for influencers, and fan access prices. That said, new age breakthroughs in AI-driven message customization, automated digital greeting platforms, and NFT-backed personalized video content are enhancing scalability, streamlining fan engagement, and ensuring long-term growth for personalized message-based fan engagement services across the globe.

The Fan Engagement Market is experiencing significant growth, driven by the digital transformation of sports, entertainment, and media industries. The increasing adoption of AI-driven analytics, social media interaction, and immersive fan experiences is reshaping engagement strategies.

Additionally, the rise of virtual and augmented reality (VR/AR), block chain-based fan tokens, and interactive streaming platforms is further fueling market expansion. Leading companies are leveraging AI, cloud computing, and data analytics to offer personalized and real-time fan experiences across various platforms.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IBM Corporation | 18-22% |

| SAP SE | 15-19% |

| Oracle Corporation | 12-16% |

| Cisco Systems, Inc. | 8-12% |

| Wipro Limited | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| IBM Corporation | Provides AI-driven fan engagement solutions, leveraging Watson AI for predictive analytics, chatbots, and digital fan experiences. |

| SAP SE | Develops data-driven fan engagement platforms, integrating real-time analytics, mobile apps, and loyalty programs. |

| Oracle Corporation | Offers cloud-based fan experience solutions, optimizing ticketing, customer relationship management (CRM), and personalized marketing. |

| Cisco Systems, Inc. | Focuses on smart stadium technology, enhancing connectivity, security, and digital fan interactions. |

| Wipro Limited | Provides AI-powered sports analytics and fan engagement solutions, improving sponsorship activations and fan insights. |

Key Company Insights

IBM Corporation (18-22%)

A world leader in AI-based fan engagement, IBM combines Watson AI, predictive analytics, and cloud technology to design customized fan experiences. IBM is working closely with sports leagues and media firms to drive digital interaction through chatbots, data analytics, and engaging content.

SAP SE (15-19%)

SAP is expert in real-time fan engagement solutions, providing predictive analytics, CRM capabilities, and loyalty programs. SAP collaborates with sports franchises and entertainment companies to maximize fan interactions, ticketing systems, and data-driven sponsorship activations.

Oracle Corporation (12-16%)

As a leading cloud-based fan engagement solution provider, Oracle is emphasizing CRM, ticketing optimization, and digital marketing solutions. It is investing in artificial intelligence (AI)-powered audience segmentation and real-time customer engagement analytics for increasing fan loyalty and brand monetization.

Cisco Systems, Inc. (8-12%)

Cisco leads in smart stadium technology, deploying 5G-enabled connectivity, security solutions, and in-venue digital experiences. The company is transforming live event engagement through IoT-powered stadiums, interactive digital screens, and connected fan zones.

Wipro Limited (6-10%)

A key player in AI-powered sports analytics and digital engagement solutions, Wipro helps sports franchises, streaming platforms, and event organizers enhance fan sentiment analysis, content personalization, and sponsorship activation strategies.

Other Key Players (30-40% Combined)

The Fan Engagement Market is also influenced by several regional and emerging technology providers, including:

The overall market size for fan engagement market was USD 7,240.5 Million in 2025.

The fan engagement market is expected to reach USD 37,895.5 Million in 2035.

The increasing digitalization of entertainment platforms and the rising demand for interactive experiences between celebrities and their fans fuels Fan Engagement Market during the forecast period.

The top 5 countries which drives the development of Fan Engagement Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of application, social media personalities to command significant share over the forecast period.

Table 01: Global Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 02: Global Market Shipments (‘000 Units) Analysis, by Application, 2018H-2033F

Table 03: Global Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 04: Global Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Region

Table 05: Global Market Shipments (‘000 Units) Analysis, by Region, 2018H-2033F

Table 06: North America Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 07: North America Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 08: North America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 09: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 10: Latin America Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 11: Latin America Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 12: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 13: East Asia Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 14: East Asia Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 15: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 16: South Asia & Pacific Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 17: South Asia & Pacific Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 18: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 19: Western Europe Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 20: Western Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 21: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 22: Eastern Europe Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 23: Eastern Europe Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Table 24: Central Asia Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 25: Central Asia Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 26: Russia & Belarus Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 27: Russia & Belarus Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 28: Balkan & Baltics Countries Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 29: Balkan & Baltics Countries Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 30: Middle East & Africa Market Value (US$ Million) Forecast (2023 to 2033) by Application

Table 31: Middle East & Africa Market Value (US$ Million) Forecast (2023 to 2033) by Engagement Type

Table 32: Middle East & Africa Market Value (US$ Million) Analysis and Forecast (2018 to 2033) by Country

Figure 01: Global Market Value (US$ Million), 2018 to 2022

Figure 02: Global Market Value (US$ Million), 2023 to 2033

Figure 03: Global Market Size (US$ Million) and Y-o-Y Growth Rate from 2023 to 2033

Figure 04: Global Market Size and Y-o-Y Growth Rate from 2023 to 2033

Figure 05: Global Market Shipments (Million Units) and Y-o-Y Growth Rate from 2022-2033

Figure 06: Global Market: Market Share Analysis, by Application – 2023 & 2033

Figure 07: Global Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 08: Global Market: Market Attractiveness, by Application

Figure 09: Global Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 10: Global Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 11: Global Market: Market Attractiveness, by Engagement Type

Figure 12: Global Market: Market Share Analysis, by Region – 2023 & 2033

Figure 13: Global Market: Y-o-Y Growth Comparison, by Region, 2023 to 2033

Figure 14: Global Market: Market Attractiveness, by Region

Figure 15: North America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 16: Latin America Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 17: East Asia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 18: South Asia & Pacific Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 19: Western Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 20: Eastern Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 21: Central Asia Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 22: Russia & Belarus Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 23: Balkan & Baltics Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 24: Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 25: North America Market Value (US$ Million), 2018 to 2022

Figure 26: North America Market Value (US$ Million), 2023 to 2033

Figure 27: North America Market: Market Share Analysis, by Application – 2023 & 2033

Figure 28: North America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 29: North America Market: Market Attractiveness, by Application

Figure 30: North America Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 31: North America Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 32: North America Market: Market Attractiveness, by Engagement Type

Figure 33: North America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 34: North America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 35: North America Market: Market Attractiveness, by Country

Figure 36: U.S. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 37: Canada Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 38: Latin America Market Value (US$ Million), 2018 to 2022

Figure 39: Latin America Market Value (US$ Million), 2023 to 2033

Figure 40: Latin America Market: Market Share Analysis, by Application – 2023 & 2033

Figure 41: Latin America Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 42: Latin America Market: Market Attractiveness, by Application

Figure 43: Latin America Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 44: Latin America Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 45: Latin America Market: Market Attractiveness, by Engagement Type

Figure 46: Latin America Market: Market Share Analysis, by Country – 2023 & 2033

Figure 47: Latin America Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 48: Latin America Market: Market Attractiveness, by Country

Figure 49: Brazil Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 50: Mexico Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 51: Rest of LATAM Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 52: East Asia Market Value (US$ Million), 2018 to 2022

Figure 53: East Asia Market Value (US$ Million), 2023 to 2033

Figure 54: East Asia Market: Market Share Analysis, by Application – 2023 & 2033

Figure 55: East Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 56: East Asia Market: Market Attractiveness, by Application

Figure 57: East Asia Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 58: East Asia Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 59: East Asia Market: Market Attractiveness, by Engagement Type

Figure 60: East Asia Market: Market Share Analysis, by Country – 2023 & 2033

Figure 61: East Asia Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 62: East Asia Market: Market Attractiveness, by Country

Figure 63: China Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 64: Japan Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 65: South Korea Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 66: South Asia & Pacific Market Value (US$ Million), 2018 to 2022

Figure 67: South Asia & Pacific Market Value (US$ Million), 2023 to 2033

Figure 68: South Asia & Pacific Market: Market Share Analysis, by Application – 2023 & 2033

Figure 69: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 70: South Asia & Pacific Market: Market Attractiveness, by Application

Figure 71: South Asia & Pacific Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 72: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 73: South Asia & Pacific Market: Market Attractiveness, by Engagement Type

Figure 74: South Asia & Pacific Market: Market Share Analysis, by Country – 2023 & 2033

Figure 75: South Asia & Pacific Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 76: South Asia & Pacific Market: Market Attractiveness, by Country

Figure 77: India Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 78: ASEAN Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 79: Oceania Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 80: Rest of SAP Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 81: Western Europe Market Value (US$ Million), 2018 to 2022

Figure 82: Western Europe Market Value (US$ Million), 2023 to 2033

Figure 83: Western Europe Market: Market Share Analysis, by Application – 2023 & 2033

Figure 84: Western Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 85: Western Europe Market: Market Attractiveness, by Application

Figure 86: Western Europe Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 87: Western Europe Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 88: Western Europe Market: Market Attractiveness, by Engagement Type

Figure 89: Western Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 90: Western Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 91: Western Europe Market: Market Attractiveness, by Country

Figure 92: Germany Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 93: Italy Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 94: France Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 95: U.K. Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 96: Spain Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 97: BENELUX Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 98: Nordics Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 99: Rest of Western Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 100: Eastern Europe Market Value (US$ Million), 2018 to 2022

Figure 101: Eastern Europe Market Value (US$ Million), 2023 to 2033

Figure 102: Eastern Europe Market: Market Share Analysis, by Application – 2023 & 2033

Figure 103: Eastern Europe Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 104: Eastern Europe Market: Market Attractiveness, by Application

Figure 105: Eastern Europe Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 106: Eastern Europe Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 107: Eastern Europe Market: Market Attractiveness, by Engagement Type

Figure 108: Eastern Europe Market: Market Share Analysis, by Country – 2023 & 2033

Figure 109: Eastern Europe Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 110: Eastern Europe Market: Market Attractiveness, by Country

Figure 111: Poland Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 112: Hungary Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 113: Romania Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 114: Czech Republic Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 115: Rest of Eastern Europe Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 116: Central Asia Market Value (US$ Million), 2018 to 2022

Figure 117: Central Asia Market Value (US$ Million), 2023 to 2033

Figure 118: Central Asia Market: Market Share Analysis, by Application – 2023 & 2033

Figure 119: Central Asia Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 120: Central Asia Market: Market Attractiveness, by Application

Figure 121: Central Asia Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 122: Central Asia Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 123: Central Asia Market: Market Attractiveness, by Engagement Type

Figure 124: Russia & Belarus Market Value (US$ Million), 2018 to 2022

Figure 125: Russia & Belarus Market Value (US$ Million), 2023 to 2033

Figure 126: Russia & Belarus Market: Market Share Analysis, by Application – 2023 & 2033

Figure 127: Russia & Belarus Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 128: Russia & Belarus Market: Market Attractiveness, by Application

Figure 129: Russia & Belarus Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 130: Russia & Belarus Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 131: Russia & Belarus Market: Market Attractiveness, by Engagement Type

Figure 132: Balkan & Baltics Countries Market Value (US$ Million), 2018 to 2022

Figure 133: Balkan & Baltics Countries Market Value (US$ Million), 2023 to 2033

Figure 134: Balkan & Baltics Countries Market: Market Share Analysis, by Application – 2023 & 2033

Figure 135: Balkan & Baltics Countries Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 136: Balkan & Baltics Countries Market: Market Attractiveness, by Application

Figure 137: Balkan & Baltics Countries Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 138: Balkan & Baltics Countries Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 139: Balkan & Baltics Countries Market: Market Attractiveness, by Engagement Type

Figure 140: Middle East & Africa Market Value (US$ Million), 2018 to 2022

Figure 141: Middle East & Africa Market Value (US$ Million), 2023 to 2033

Figure 142: Middle East & Africa Market: Market Share Analysis, by Application – 2023 & 2033

Figure 143: Middle East & Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 144: Middle East & Africa Market: Market Attractiveness, by Application

Figure 145: Middle East & Africa Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 146: Middle East & Africa Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 147: Middle East & Africa Market: Market Attractiveness, by Engagement Type

Figure 148: Middle East & Africa Market: Market Share Analysis, by Country – 2023 & 2033

Figure 149: Middle East & Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 150: Middle East & Africa Market: Market Attractiveness, by Country

Figure 151: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Northern Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 154: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 155: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 141: Middle East & Africa Market Value (US$ Million), 2023 to 2033

Figure 142: Middle East & Africa Market: Market Share Analysis, by Application – 2023 & 2033

Figure 143: Middle East & Africa Market: Y-o-Y Growth Comparison, by Application, 2023 to 2033

Figure 144: Middle East & Africa Market: Market Attractiveness, by Application

Figure 145: Middle East & Africa Market: Market Share Analysis, by Engagement Type – 2023 & 2033

Figure 146: Middle East & Africa Market: Y-o-Y Growth Comparison, by Engagement Type, 2023 to 2033

Figure 147: Middle East & Africa Market: Market Attractiveness, by Engagement Type

Figure 148: Middle East & Africa Market: Market Share Analysis, by Country – 2023 & 2033

Figure 149: Middle East & Africa Market: Y-o-Y Growth Comparison, by Country, 2023 to 2033

Figure 150: Middle East & Africa Market: Market Attractiveness, by Country

Figure 151: GCC Countries Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 152: Turkey Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 153: Northern Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 154: South Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Figure 155: Rest of Middle East & Africa Market Absolute $ Opportunity (US$ Million), 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fan-Out Wafer Level Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fanfold Market Growth – Industry Trends & Forecast 2024 to 2034

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

Marfan Syndrome Management Market Size and Share Forecast Outlook 2025 to 2035

HVAC Fan & Evaporator Coil Market Size and Share Forecast Outlook 2025 to 2035

Turbofan Engines Market Growth - Trends & Forecast 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Duct Fans Market Growth – Trends & Forecast 2025 to 2035

Bionic Fan Market Size and Share Forecast Outlook 2025 to 2035

Ceiling Fan Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA