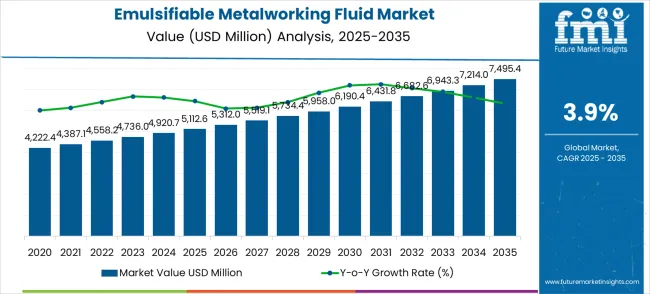

The emulsifiable metalworking fluid market is valued at USD 5,112.6 million in 2025 and is anticipated to reach USD 7,495.4 million by 2035, with a CAGR of 3.9%. From 2021 to 2025, the market is expected to expand from USD 4,222.4 million to USD 5,112.6 million, with intermediate values of USD 4,387.1 million, USD 4,558.2 million, USD 4,736.0 million, and USD 4,920.7 million. This initial growth phase is driven by the increasing use of emulsifiable fluids in metal cutting and grinding processes across various industries, such as automotive, aerospace, and manufacturing. These fluids are essential for reducing friction and heat, improving the surface finish, and extending the life of machinery, all of which contribute to their growing adoption.

Between 2026 and 2030, the market is expected to continue expanding from USD 5,112.6 million to USD 6,190.4 million, with intermediate values of USD 5,312.0 million, USD 5,519.1 million, USD 5,734.4 million, and USD 5,958.0 million. This phase indicates that the market is approaching its saturation point, as industries optimize fluid usage and focus on refining processes to achieve greater efficiency.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 5,112.6 million |

| Forecast Value in (2035F) | USD 7,495.4 million |

| Forecast CAGR (2025 to 2035) | 4% |

The metalworking fluids market contributes about 40-45%, driven by the increasing need for efficient lubricants and coolants in manufacturing processes. Emulsifiable metalworking fluids are essential in cutting, grinding, and machining operations, offering both cooling and lubrication to improve tool life and surface finish. The machinery and equipment market adds roughly 20-25%, as emulsifiable metalworking fluids are widely used in the production of various industrial machinery and equipment, where precision and performance depend on effective cooling and lubrication.

The automotive manufacturing market contributes around 15-18%, driven by the growing demand for metalworking fluids in the production of automotive components, where high-speed machining and precision are crucial for quality. The aerospace and defense market accounts for approximately 10-12%, as emulsifiable fluids are used for machining critical components such as engine parts, gears, and structural elements, where high performance and safety standards are required. The industrial parts and tooling market contributes about 8-10%, where these fluids are used in the manufacturing and maintenance of parts and tooling used in heavy-duty machinery, increasing the lifespan and operational efficiency of cutting tools.

Market expansion is being supported by the increasing sophistication of manufacturing operations and the corresponding need for high-performance metalworking fluids that can optimize machining efficiency while ensuring superior surface finish quality and extended tool life. Modern manufacturing processes require advanced fluid solutions that can provide excellent cooling properties, superior lubrication characteristics, and comprehensive corrosion protection while maintaining operational stability across diverse machining conditions. Emulsifiable metalworking fluids provide the necessary performance characteristics, operational flexibility, and cost-effectiveness to ensure optimal machining outcomes in demanding industrial applications.

The growing emphasis on green manufacturing practices and environmental compliance is driving demand for environmentally responsible metalworking fluid solutions that can reduce environmental impact while maintaining superior operational performance and comprehensive regulatory compliance. Manufacturing facilities are implementing comprehensive initiatives that focus on reducing waste generation, minimizing environmental footprint, and enhancing worker safety through advanced fluid selection and management practices. Regulatory requirements and industry standards are establishing stringent environmental and safety protocols that require specialized fluid technologies with validated environmental characteristics and comprehensive safety documentation.

The emulsifiable metalworking fluid market (USD 5,112.6M → 7,495.4M by 2035, CAGR ~4%) is driven by demand from machinery manufacturing, automotive, aerospace, and engineering industries, with China, India, and Germany as key growth regions. Together, targeted fluid innovation and application-specific solutions unlock USD 2.2–2.5 billion in incremental revenue opportunities by 2035 (aligned with the ~USD 2.38B market expansion).

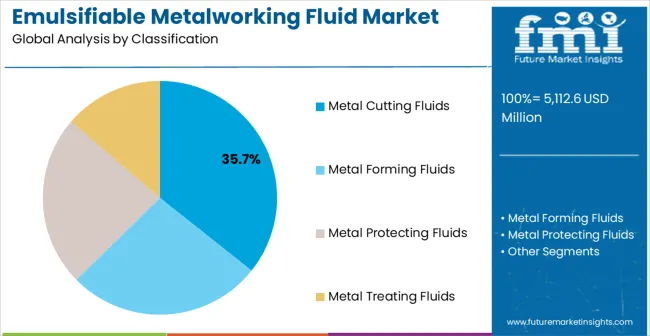

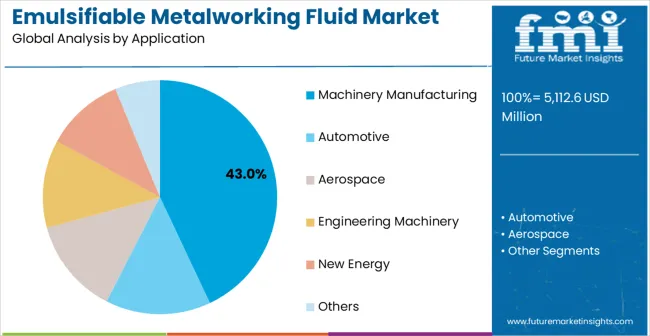

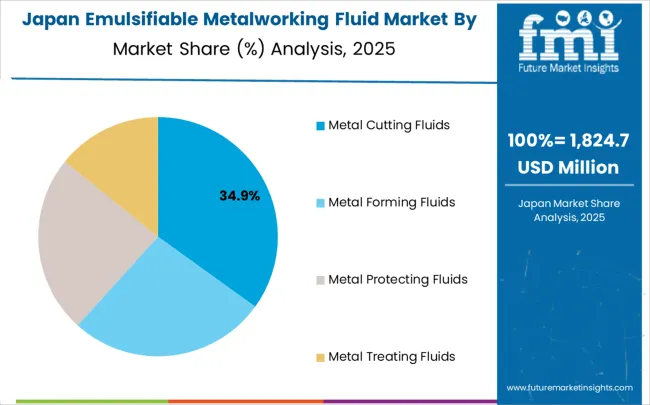

The market is segmented by fluid type, end-use industry, and region. By fluid type, the market is divided into metal cutting fluids, metal forming fluids, metal protecting fluids, and metal treating fluids. Based on end-use industry, the market is categorized into machinery manufacturing, automotive, aerospace, engineering machinery, new energy, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Metal cutting fluids are projected to account for 35.7% of the emulsifiable metalworking fluid market in 2025. This leading share is supported by the extensive use of cutting operations across diverse manufacturing industries and the critical importance of proper fluid selection in achieving optimal machining performance and tool longevity. Metal cutting fluid applications require superior cooling capabilities, excellent lubrication properties, and comprehensive chip evacuation support that enable high-speed machining operations while maintaining dimensional accuracy and surface finish quality. The segment benefits from continuous technological advancement in cutting tool materials, machining center capabilities, and precision manufacturing requirements that demand increasingly sophisticated fluid solutions.

Metal cutting fluid technology continues advancing through development of specialized formulations, enhanced additive packages, and improved environmental compatibility that support modern manufacturing requirements and regulatory compliance obligations. The segment growth reflects increasing adoption of high-performance cutting operations in expanding manufacturing facilities and growing precision machining applications that require superior fluid performance characteristics. Manufacturers are developing next-generation cutting fluid formulations with enhanced cooling efficiency, improved biological stability, and comprehensive environmental compatibility that address evolving manufacturing requirements while maintaining optimal machining performance and cost-effectiveness.

Machinery manufacturing applications are expected to represent 43% of emulsifiable metalworking fluid demand in 2025. This dominant share reflects the extensive use of metalworking fluids across diverse machinery production operations including component machining, assembly operations, and quality control processes that require consistent fluid performance and comprehensive operational support. Modern machinery manufacturing involves sophisticated machining operations, precision assembly processes, and comprehensive testing procedures that depend on high-quality metalworking fluids for optimal operational efficiency and product quality achievement. The segment benefits from ongoing industrial expansion, increasing automation adoption, and growing demand for precision machinery across construction, agricultural, and industrial equipment sectors.

Machinery manufacturing industry transformation toward higher precision requirements and advanced manufacturing technologies is driving significant emulsifiable metalworking fluid demand as manufacturers implement sophisticated machining operations and comprehensive quality assurance protocols. The segment expansion reflects increasing emphasis on operational efficiency, product quality optimization, and manufacturing cost management that depend on superior fluid performance and comprehensive operational support capabilities. Advanced machinery manufacturing applications are incorporating automated fluid management systems, real-time monitoring technologies, and comprehensive maintenance protocols that require sophisticated fluid solutions with enhanced performance characteristics and operational reliability features.

The emulsifiable metalworking fluid market is advancing steadily due to expanding manufacturing activities and growing emphasis on operational efficiency optimization. The market faces challenges including environmental regulations for fluid disposal, increasing raw material costs, and complex formulation requirements for specialized applications. Technological advancement efforts and green initiatives continue to influence product development and market expansion patterns.

The growing adoption of bio-based ingredients and eco-conscious formulation approaches in emulsifiable metalworking fluids is driving reduced environmental impact, enhanced biodegradability, and full compliance with environmental standards, all while maintaining superior operational performance. These eco-friendly fluid technologies integrate renewable content, lower toxicity levels, and offer improved disposal characteristics that support environmental responsibility and regulatory adherence. Such advancements empower manufacturers to meet their environmental goals and boost operational efficiency, while minimizing ecological footprints and enhancing workplace safety through advanced fluid selection and management practices.

Metalworking fluid manufacturers are developing comprehensive smart management systems and real-time monitoring technologies that enable automated fluid maintenance, predictive replacement scheduling, and comprehensive performance optimization throughout fluid service life. Advanced monitoring systems provide real-time concentration tracking, contamination detection, and comprehensive performance analysis that support efficient fluid utilization and operational cost management. These technological innovations support broader market adoption by providing enhanced operational benefits and comprehensive cost optimization that meet evolving manufacturing requirements for efficiency and eco-consciousness in metalworking operations.

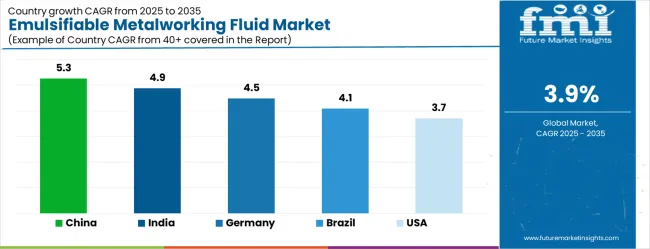

| Country | CAGR (2025-2035) |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| Brazil | 4.1% |

| United States | 3.7% |

| United Kingdom | 3.3% |

| Japan | 2.9% |

The emulsifiable metalworking fluid market demonstrates varied growth patterns across key countries, with China leading at a 5.3% CAGR through 2035, driven by massive manufacturing capacity expansion, growing automotive production, and increasing industrial modernization initiatives. India follows at 4.9%, supported by expanding manufacturing sector development, growing automotive industry, and increasing foreign investment in industrial operations. Germany records 4.5% growth, emphasizing precision manufacturing excellence, automotive industry leadership, and advanced machinery production capabilities. Brazil shows steady growth at 4.1%, expanding manufacturing infrastructure and automotive industry development. The United States maintains 3.7% growth, focusing on advanced manufacturing technologies and industrial modernization. The United Kingdom demonstrates 3.3% expansion, supported by manufacturing sector development and aerospace industry capabilities. Japan records 2.9% growth, leveraging technological excellence and precision manufacturing expertise.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

Revenue from emulsifiable metalworking fluids in China is projected to expand at the highest growth rate with a CAGR of 5.3%, driven by unprecedented manufacturing capacity development, government support for industrial modernization, and rapidly expanding automotive and machinery production capabilities. The country's comprehensive manufacturing development strategy includes massive investments in production facilities, advanced manufacturing technologies, and comprehensive supply chain infrastructure that require sophisticated metalworking fluid solutions. Major automotive manufacturers and machinery producers are establishing comprehensive production capabilities that support domestic demand growth and export market expansion. Government initiatives promoting manufacturing excellence are driving adoption of high-performance metalworking fluids across diverse industrial sectors. Industrial modernization programs are creating substantial demand for advanced fluid solutions that support precision manufacturing and operational efficiency optimization.

Revenue from emulsifiable metalworking fluids in India is projected to grow at a CAGR of 4.9%, supported by expanding manufacturing sector development, growing automotive industry capabilities, and increasing foreign direct investment in industrial operations and manufacturing infrastructure. The country's emphasis on manufacturing growth and industrial modernization is driving demand for metalworking fluid solutions that support precision manufacturing, operational efficiency, and comprehensive quality management across diverse industrial applications. Government programs promoting manufacturing development are creating favorable conditions for metalworking fluid adoption and technology advancement. Major international companies are establishing manufacturing facilities that require comprehensive metalworking fluid systems and technical support services. Educational institutions and training programs are developing workforce capabilities that support advanced manufacturing operations and fluid management requirements.

Demand for emulsifiable metalworking fluids in Germany is projected to expand at a CAGR of 4.5%, supported by the country's leadership in precision manufacturing, automotive industry excellence, and advanced machinery production capabilities across diverse industrial sectors. German manufacturers are implementing sophisticated metalworking fluid solutions that meet stringent quality standards while supporting complex manufacturing operations and comprehensive quality assurance protocols. The country's extensive automotive and machinery industries are driving significant metalworking fluid demand for precision machining operations and advanced manufacturing processes. Research institutions are collaborating with industry partners to develop next-generation fluid technologies that maintain German competitiveness in global manufacturing markets. Advanced manufacturing partnerships are facilitating technology development and knowledge sharing across fluid suppliers and manufacturing companies.

Revenue from emulsifiable metalworking fluids in Brazil is projected to expand at a CAGR of 4.1%, driven by expanding manufacturing infrastructure, growing automotive industry capabilities, and increasing emphasis on industrial modernization across diverse manufacturing sectors. Brazilian manufacturers are investing in metalworking fluid solutions to enhance production efficiency and support quality improvement initiatives while building domestic manufacturing competitiveness. Government programs supporting industrial development are facilitating access to advanced manufacturing technologies and comprehensive technical expertise. Regional manufacturing centers are developing specialized capabilities that support metalworking fluid applications across automotive, machinery, and industrial equipment production. International partnerships are providing technology transfer opportunities and technical assistance for advanced manufacturing implementations.

Demand for emulsifiable metalworking fluids in the United States is projected to grow at a CAGR of 3.7%, driven by advanced manufacturing technology adoption, industrial modernization initiatives, and comprehensive operational efficiency improvement programs across diverse manufacturing sectors. American manufacturers are implementing sophisticated metalworking fluid solutions to maintain global competitiveness while supporting advanced manufacturing operations and comprehensive quality management systems. The aerospace and automotive industries are driving significant metalworking fluid demand for precision manufacturing applications and advanced machining operations requiring superior performance characteristics. Government initiatives supporting domestic manufacturing competitiveness are creating opportunities for advanced fluid technology adoption and development programs. Regional manufacturing clusters are developing specialized expertise that supports diverse metalworking fluid applications and emerging manufacturing requirements.

Demand for emulsifiable metalworking fluids in the United Kingdom is projected to expand at a CAGR of 3.3%, supported by manufacturing sector modernization, aerospace industry development, and increasing emphasis on operational efficiency improvement across diverse industrial applications. British manufacturers are investing in metalworking fluid solutions to support precision manufacturing operations, quality enhancement, and comprehensive operational optimization while maintaining competitive manufacturing capabilities. The country's established aerospace and automotive industries are facilitating metalworking fluid adoption through comprehensive modernization programs and technology development initiatives. Government initiatives supporting manufacturing competitiveness are creating favorable conditions for advanced fluid technology adoption and comprehensive operational improvement. Advanced manufacturing partnerships are enabling knowledge sharing and technical collaboration that supports comprehensive metalworking fluid implementation across industrial applications.

Revenue from emulsifiable metalworking fluids in Japan is projected to expand at a CAGR of 2.9%, supported by technological excellence capabilities, precision manufacturing expertise, and emphasis on advanced manufacturing optimization across diverse industrial applications. Japanese manufacturers are implementing sophisticated metalworking fluid solutions that demonstrate superior performance characteristics while supporting various manufacturing applications requiring exceptional precision and operational reliability. The country's automotive and machinery industries are driving demand for high-performance metalworking fluids that support precision manufacturing processes and comprehensive quality control requirements. Collaborative research programs between industry and academic institutions are developing innovative fluid technologies that maintain Japan's competitive advantage in global manufacturing markets. Quality management systems and continuous improvement principles are driving adoption of metalworking fluid solutions that enhance operational excellence and manufacturing reliability. Advanced manufacturing methodologies are enabling development of next-generation fluid applications that provide enhanced performance characteristics and comprehensive operational optimization.

The emulsifiable metalworking fluid market in Europe is projected to expand from USD 1,383.2 million in 2025 to USD 2,027.0 million by 2035, registering a CAGR of 4% over the forecast period. Germany is expected to maintain its leadership with 32.1% market share in 2025, projected to grow to 32.6% by 2035, supported by its extensive manufacturing infrastructure and automotive industry capabilities. France follows with 19.7% market share in 2025, expected to reach 20.1% by 2035, driven by aerospace manufacturing activities and precision engineering operations.

The Rest of Europe region is projected to maintain stable share at 18.4% throughout the forecast period, attributed to expanding manufacturing activities in Eastern European countries and growing industrial development. United Kingdom contributes 15.6% in 2025, projected to reach 15.2% by 2035, supported by manufacturing sector modernization and aerospace industry development. Italy maintains 14.2% share in 2025, expected to grow to 15.1% by 2035, while other European countries demonstrate steady growth patterns reflecting regional industrial development and manufacturing sector advancement.

The emulsifiable metalworking fluid market is characterized by competition among established chemical companies, specialized lubricant manufacturers, and industrial fluid providers. Companies are investing in advanced formulation technologies, eco-friendly product development, comprehensive technical support services, and global distribution networks to deliver high-performance, environmentally responsible, and cost-effective metalworking fluid solutions. Strategic partnerships, technological innovation, and market expansion initiatives are central to strengthening product portfolios and customer relationships.

Quaker Houghton, USA-based, offers comprehensive emulsifiable metalworking fluid solutions with focus on automotive and industrial applications, advanced formulation technologies, and global technical support capabilities. FUCHS, Germany, provides specialized metalworking fluid portfolios emphasizing quality, performance optimization, and comprehensive customer service across diverse industrial sectors. ExxonMobil delivers advanced fluid technologies with focus on operational efficiency, environmental compliance, and comprehensive application support.

Castrol (BP) offers extensive metalworking fluid solutions with emphasis on sustainability, performance excellence, and comprehensive technical expertise. Henkel provides specialized industrial fluids with focus on precision applications and advanced formulation technologies. Other key players including Idemitsu Kosan, Blaser Swisslube, TotalEnergies, Cimcool Industrial Products, Petrofer, Master Fluid Solutions, LUKOIL, SINOPEC, ENEOS, Chemetall, and Ashburn Chemical Technologies contribute specialized expertise and diverse technical capabilities across global and regional markets.

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 5113 million |

| Fluid Type | Metal Cutting Fluids, Metal Forming Fluids, Metal Protecting Fluids, and Metal Treating Fluids |

| End-Use Industry | Machinery Manufacturing, Automotive, Aerospace, Engineering Machinery, New Energy, and Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Quaker Houghton, Fuchs, Exxon Mobil, BP Castrol, Henkel, Idemitsu Kosan, Blaser Swisslube, TotalEnergies, Cimcool Industrial Products, Petrofer, Master Fluid Solutions, LUKOIL, SINOPEC, ENEOS, Chemetall, Cosmo Oil Lubricants, Ashburn Chemical Technologies |

| Additional Attributes | Dollar sales by fluid type and end-use industry segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established chemical companies and specialized metalworking fluid manufacturers, buyer preferences for different fluid formulations and performance characteristics, integration with advanced manufacturing processes and automated production systems, innovations in bio-based formulations and fluid technologies, and adoption of smart fluid management systems and real-time monitoring capabilities for enhanced operational efficiency and environmental compliance. |

The global emulsifiable metalworking fluid market is estimated to be valued at USD 5,112.6 million in 2025.

The market size for the emulsifiable metalworking fluid market is projected to reach USD 7,495.4 million by 2035.

The emulsifiable metalworking fluid market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in emulsifiable metalworking fluid market are metal cutting fluids, metal forming fluids, metal protecting fluids and metal treating fluids.

In terms of application, machinery manufacturing segment to command 43.0% share in the emulsifiable metalworking fluid market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA