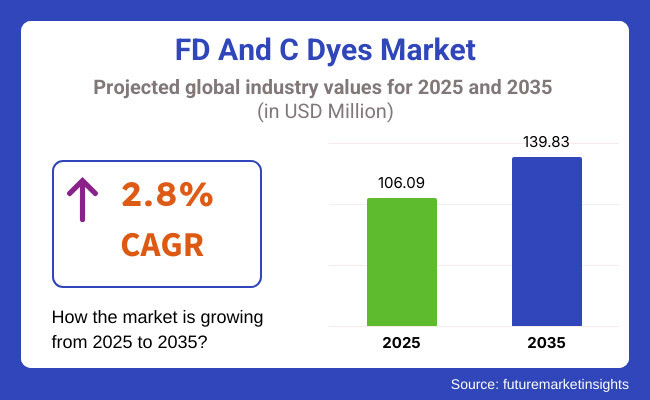

In 2025, the global FD and C dyes market size is assessed at USD 106.09 million and is forecasted to witness robust growth, reaching USD 139.83 million by 2035, reflecting a CAGR of 2.8%. The market's gradual yet consistent rise highlights the sustained demand for certified synthetic dyes across a range of food and beverage categories. Among various options, FD&C Blue No.1 continues to be favored for its intense shade and compatibility with acidic environments, particularly in drinks, confectionery, and pharmaceuticals.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 106.09 Million |

| Projected Market Size in 2035 | USD 139.83 Million |

| CAGR (2025 to 2035) | 2.8% |

Growth in the FD and C dyes market is being reinforced by the strong expansion of the processed food and beverage sectors, especially in North America and Asia-Pacific. Functional and ready-to-consume products have increasingly adopted synthetic dyes for visual appeal and brand differentiation. At the same time, regulatory scrutiny and evolving consumer preferences toward natural alternatives have restrained more aggressive expansion.

Despite this, FD and C dyes retain significant relevance due to their cost efficiency, stronger color payoff, and higher stability during processing and shelf life. The market is also witnessing trends toward clean-label compliance through improved traceability and manufacturing transparency. Manufacturers have been observed focusing on enhancing formulation standards and maintaining compliance with food-grade certifications under FDA and international frameworks.

Over the next decade, the FD and C dyes industry is expected to steadily advance, particularly in beverage and pharmaceutical applications, where synthetic dyes offer unmatched consistency. By 2035, increased R&D toward formulation blends and reduced dosage levels is likely to support market continuity.

Further, the growth of international export demand for processed and packaged foods, especially in regions with permissive regulatory environments, will sustain adoption. Market positioning will increasingly rely on compliance documentation, batch traceability, and supply chain validation as key differentiators, reinforcing the role of FD and C dyes in global food coloring systems.

Pharmaceutical and over-the-counter (OTC) drug applications are projected to account for 14.3% of the FD and C dyes market in 2025. Their role in solid dose and liquid formulations continues to be supported by stringent compliance with FDA’s 21 CFR Parts 70-82, which govern the use of certified color additives in drugs. FD&C dyes like Red No.40 and Yellow No.6 are preferred for their high batch-to-batch reproducibility and photostability, enabling consistent product appearance and accurate dosage identification in tablets, syrups, and gels.

Companies such as Colorcon and Sensient Pharmaceutical focus on excipient-grade dyes with robust documentation, including color certification and toxicological safety, to align with USA Pharmacopeia and European Pharmacopoeia monographs. Increasing drug formulation complexity and pediatric dosing innovations are reinforcing demand for water-soluble and stable dyes that meet regulatory audit expectations.

This segment, while smaller than beverages or food, is strategically critical due to higher compliance barriers and longer reformulation cycles. In emerging markets, relaxed color additive regulations are fostering parallel demand for FD and C dyes in generics and supplements, although regional pharmacovigilance systems may vary. As global pharmaceutical production diversifies, the use of synthetic dyes will remain pivotal where branding, identification, and compliance intersect.

Processed dairy applications are estimated to contribute around 9.6% of the global FD and C dyes market in 2025. Usage remains concentrated in flavored milks, dessert syrups, and yogurts, where consumer-facing products benefit from vibrant visual appeal. FD&C Blue No.1 and Yellow No.5 are commonly used in strawberry and tropical-themed SKUs, especially in markets with less restrictive colorant policies such as Southeast Asia and parts of Latin America.

The dairy segment benefits from the dyes’ heat and acid stability, key for pasteurization and prolonged cold chain storage. Producers like Kerry Group and International Flavors & Fragrances (IFF) continue offering synthetic dye systems tailored to high-protein dairy drinks and layered dairy desserts.

However, this segment faces competitive pressure from natural colorants such as beta-carotene and anthocyanins, which are increasingly used in clean-label reformulations in Europe and North America. Despite this, FD and C dyes retain traction in value-added and impulse-purchase categories where cost control and uniformity are prioritized.

Regulatory approval remains contingent on adherence to national food additive codes, such as Codex Alimentarius (CAC/GL 36-1989) and EU Regulation 1333/2008. Reformulation R&D is expected to balance between synthetic permanence and rising natural color appeal.

Stringent Regulatory Compliance and Safety Concerns

Stringent regulatory supervision from the FDA, EFSA, and other worldwide food safety bodies poses challenges to the FD&C Dyes Market. Regulatory requirements for permissible dye concentrations, labeling and safety assessment are contributing to operational challenges faced by manufacturers.

Moreover, there are increasing concerns about the potential health risks posed by synthetic dyes, resulting in heightened scrutiny, consumer skepticism, and in certain areas bans on specific synthetic colorings. To comply and maintain consumer trust, companies must invest in rigorous quality control, transparent labeling, and research into safer dye alternatives.

Shift Towards Natural Alternatives and Clean Labeling

Growing consumer demand for clean-label products and natural ingredients is hurting the growth of synthetic FD&C dyes. Food and beverage manufacturers are gravitating towards plant-based colorings sourced from beet juice, spirulina extract and turmeric, and viewed as healthier, with suppliers reporting high growth rates.

As a result, that are driving this trend, are decreasing the demand of artificial dyes, especially in the organic and health-conscious food segments. For manufacturers to increase the use of FD&C dyes, three areas must be addressed hybrid formulations, dye stability, and consumer education.

Expanding Applications in Pharmaceuticals and Personal Care

Apart from food and beverage applications, FD&C dyes are experiencing increased demand in the pharmaceutical and personal care sectors. These coloring agents help make things like tablet coatings, liquid medications, cosmetics and personal care products look pretty and pretty distinct. The need of high-quality dye and FDA approved dye is increasing at a rapid pace as drug formulation and cosmetic products are increasingly innovating.

Fifthly, Companies that invest in research and development to achieve better solubility as well as solubility stability, biocompatibility, label development will see growth as applications across these industries continue to expand.

Advancements in Stability and Customization of Synthetic Dyes

Improvements in dye formulation are providing new opportunities for manufacturers of FD&C dyes. Advances in heat stability, pH resistance, and lightfastness are allowing synthetic dyes to exceed the performance of their natural counterparts in certain applications.

Favorable purchasing trends which include the ability to develop custom color blends for unique applications in confectionery, beverages and pharmaceuticals are further supporting demand for customized solutions. Organizations that adopt AI-enabled formulation development, sustainable synthesis methods, and microencapsulation technologies will be at an advantage, in the evolving FD&C Dyes Market.

The FD&C Dyes Market is expected to grow at a steady CAGR of 5% from 2020 to 2024 as demand for colorant in processed foods, beverages and pharmaceuticals continue. On the other hand, existing regulatory concerns, rising consumer inclination towards natural colors, and other health issues caused the market to expand slowly in some countries.

Companies responded by improving safety certifications, reformulating dye compositions, and extending into non-food applications like personal care and cosmetics.

From 2025 to 2035, the synthetic dyes market is expected to experience limited growth. Biodegradable synthetic dyes, lab-grown pigments, and precision fermentation will reshape the industry. In addition, blockchain-powered supply chain transparency, digital provenance of dye origins, and AI-driven safety evaluations will ensure regulatory standards are met, reassuring consumers of product safety.

Owing to a competition-driven nature of the FD&C Dyes Market, the companies that will thrive in the next LD of the sector will be those that explore synthetic dye sustainability, customization, and digital transparency.

The FD and C dyes market is dominated in the United States, owing to the growing demand for certified food colorants coupled with increasing consumer preferences for visually appealing products along with strict regulations by FDA to assure dye safety. The increasing consumption of FD and C dyes in food and beverage, pharmaceuticals, and cosmetics is further boosting the market growth.

Also, the growing investments in natural and synthetic dye formulations, and innovations in high-stability and heat-resistant dyes are some of the factors that support the growth of the market. Furthermore, the adoption of clean-label ingredients, decreased artificial additives, and cutting-edge quality control procedures are boosting product attractiveness. (Organic-compliant and plant-based alternatives are also gaining traction with evolving consumer demands.)

With growing usage of FD and C dyes in confectionery, soft drinks, and nutraceuticals, the demand in the USA market is also increasing rapidly.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 2.9% |

FD and C dyes are widely used in food and beverages, personal care products, and pharmaceuticals, making the United Kingdom a significant market due to the factors such as a demand for vibrant food coloring solutions, growing applications in pharmaceuticals, and rising regulatory scrutiny on artificial additives. Growing focus regarding transparency in ingredient labeling is also aiding the growth of the market.

Increasing government regulations related to reducing the amount of synthetic dye usage and the development of stable, non-toxic food colorants further accelerates the market growth. Additionally, natural dye extraction, pH-sensitive formulations, and extended shelf life stability is starting to get more attention.

As well as investing in sustainable forms of dye and allergen-free alternatives to align with clean-label trends. In the United Kingdom, the growing demand for FD and C dyes in the Food and Beverages and Bakery products, Dairy and Processed Food products, and Dietary Supplements is further augmenting the market over the forecast period. Demand is also surging for bioengineered and nature-derived food colors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.7% |

Germany, France, and Italy hold the top positions in the European FD and C dyes market, owing to robust food safety regulations, shifting consumer demand for naturally sourced coloring agents, and growing utilization of sustainable dye production methods.

Growing conformity in the EU regarding food safety, along with efficient investments in bio-based and plant-extracted dyes, contributes to incremental growth of the market. The use of microencapsulation to improve dye stability and technological advancements in precision blending are heightening color consistency.

Market growth is further bolstered by increasing demand for allergen-free, non-GMO, and vegan-friendly dyes in confectionery, beverages, and processed foods. Similarly, the proliferation of research projects focused on dye safety, consumer-friendly food additives and environmentally-friendly production techniques is driving its greater uptake across the EU. The growing focus of EFSA (European Food Safety Authority) on food colorants is also accelerating investment in safe, transparent dye formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.8% |

The growth of Japan FD and C dyes market is attributed to the country’s focus on the food quality, increase in demand for aesthetically enhanced food products, and growing preference for functional and fortified foods. Increasing demand for heat-stable, pH-sensitive, and high-purity dyes in processed food is a key factor fuelling the market growth.

Innovation is spurred by the country’s focus on technological innovations in synthetic and natural dye formulation as well as the inclusion of non-toxic, biodegradable, and clean-label colorants Furthermore, stringent government policies on the use of artificial colorants and rising investments in algae-based and fruit-derived dyes are prompting companies to manufacture high-performance alternatives.

Moreover, these dyes were increasingly used in traditional sweets, convenience foods, and for pharmaceutical coating, which is also rapidly driving the market in the country’s food processing industry. The advancements in AI-powered colorant quality control and sustainable dye production in Japan are also setting the stage for the future of eco-conscious food coloring solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.9% |

Growing demand for aesthetically rich food and beverage products, rising adoption of enhanced dye stabilization methodologies and stringent government scrutiny on food additive safety are driving the growth of FD and C dyes market in South Korea.

Stringent regulations for synthetic dye safety and growing investments toward natural pigment extraction and sustainable dye production complement market growth. In addition, the focus of the country on increasing stability in food color segment using microencapsulation and emulsification and hybrid dye blending in addition are improving competitiveness in the regional market.

Market proliferation is also accelerated due to the increasing consumption of FD and C dyes in soft drinks, confectionery items, instant noodles, and functional foods. As consumer preferences evolve, companies are investing in smart labeling, dye traceability, and bio-based alternatives. The increasing popularity of premium food products and clean-label beverages in South Korea is also fuelling demand for high-quality non-toxic colorants.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 2.8% |

The global FD&C dyes market is undergoing significant growth, owing to regulations favoring the use of synthetic dyes and growing preferences for more stable, longer-lasting colors in food and beverage, pharmaceutical, and cosmetic products.

With consumers leaning toward products exhibiting such properties, companies are gravitating toward high-purity formulations, natural alternatives and enhanced stability to align with both consumers and industry standards. Emerging trends include clean-label dyes, plant-based colorants and augmented dye-processing technologies to improve solubility and uniformity.

The overall market size for FD and C dyes market was USD 106.09 million in 2025.

The FD and C dyes market expected to reach USD 139.83 million in 2035.

The demand for the FD and C dyes market will be driven by increasing use in the food and beverage industry, rising demand for vibrant and stable color additives in cosmetics and pharmaceuticals, growing regulatory approvals for safe consumption, and expanding applications in personal care and packaging industries.

The top 5 countries which drives the development of FD and C dyes market are USA, UK., Europe Union, Japan and South Korea.

Food & beverage and pharmaceuticals drive market growth to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FD and C Lakes Market Size, Growth, and Forecast for 2025 to 2035

Flight Data Recording (FDR) Market Size and Share Forecast Outlook 2025 to 2035

Netupitant-Palonosetron FDC Market

Computational Fluid Dynamics (CFD) Market – Trends & Forecast 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Handwheels Market Size and Share Forecast Outlook 2025 to 2035

Hands-Free Safety Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA