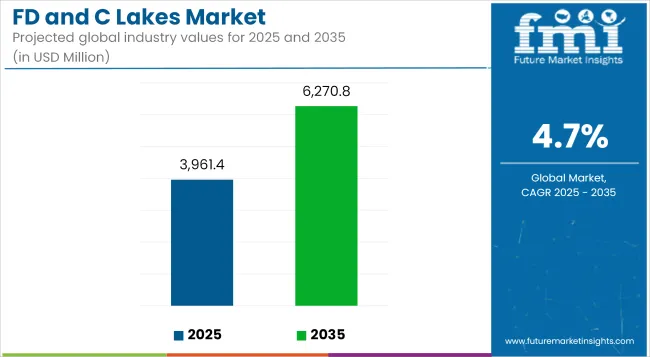

As of 2025, the global FD and C lakes industry is valued at approximately USD 3,961.44 million and is likely to register a CAGR of 4.7% to surpass USD 6,270.76 million by the end of 2035. This trajectory showcases a sustained demand for color-stable and oil-dispersible pigments across a diverse range of industries.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 3,961.44 Million |

| Projected Market Size in 2035 | USD 6,270.76 Million |

| CAGR (2025 to 2035) | 4.7% |

The market's reliance on aluminum lake pigments stems from their superior opacity, consistency, and compatibility with both oil- and water-based systems, which has driven adoption in processed food, personal care, and nutraceuticals.

The current momentum is supported by evolving regulatory clarity in colorant usage, growing investment in food decoration and cosmetic pigmentation, and a widening preference for consistent shades in formulation-heavy sectors. However, concerns regarding synthetic dye intake and consumer inclination toward natural colors are acting as a moderate restraint.

Despite this, FD and C lakes continue to dominate wherever water solubility or stability issues make traditional dyes unviable. Manufacturers are responding with reformulated lakes that meet global compliance while retaining performance integrity. The trend toward higher shelf stability and reduced reactivity is shaping next-generation lake pigments, particularly in OTC pharmaceuticals, snack coatings, and confectionery.

Over the next decade, the FD and C lakes market is expected to pivot toward clean-label-compatible solutions while retaining its industrial foothold through regulatory-grade variants. By 2025, Red 40 Lake and Yellow 6 Lake are forecast to retain stronghold positions in cosmetics and snack foods, respectively, due to their brightness and resistance to pH fluctuations.

By 2035, advanced formulation needs in chewable tablets, lipsticks, and convenience foods will demand high-load lake variants that ensure batch consistency under varied processing environments. Innovation in granulation and microencapsulation is expected to further push the usability of FD and C lakes across application domains requiring thermal resilience and strong tinting strength.

Specialty pharmaceutical applications account for nearly 18.4% of the FD and C lakes market in 2025, representing a strategically resilient growth pocket. These pigments are particularly favored in chewable tablets, film coatings, and topical creams, where oil dispersibility and color fastness under high-shear mixing are essential. Given the rigid compliance framework under the USA FDA’s 21 CFR Part 74 Subpart C, FD and C lakes remain among the few permissible synthetic colorants in OTC and Rx drug formulations in the United States.

Additionally, the European Medicines Agency (EMA) maintains strict but stable inclusion lists, which continue to support controlled usage across the EU. Companies like Colorcon and BASF are actively developing pre-formulated lake pigments for tablet coatings that address evolving clean-label and allergen-free requirements.

As pharmaceutical brand owners seek pigments that are both visually distinct and chemically inert, high-performance lakes such as FD&C Blue No. 2 and Yellow No. 6 are witnessing sustained demand. Furthermore, the rise in pediatric and geriatric drug formats is reinforcing market reliance on lake-based solutions that enable easy swallowing and identification. The segment’s growth is safeguarded by regulatory consistency and formulators’ low tolerance for batch inconsistency, ensuring steady offtake through 2035.

Industrial applications, including coatings, inks, and plastics, represent around 11.2% of the FD and C lakes market as of 2025. While not the largest in share, this segment plays a crucial role in sustaining demand beyond consumables, particularly in regulated-grade industrial coatings for toys, packaging interiors, and hygienic plasticware.

Given that these applications often mimic food-contact standards, certified lake pigments are preferred over conventional synthetic pigments. Regulatory frameworks such as EU Regulation (EC) No 1935/2004 on materials intended to come into contact with food have encouraged use of food-safe pigments in industrial coatings.

Companies such as Clariant and Sudarshan Chemical are supplying FD and C-compatible lakes that offer enhanced thermal resistance and minimal migration properties. Adoption in colored polymeric films for pharmaceutical blisters and personal care product packaging is also expanding, where stable and vivid colors must persist through extrusion or UV curing.

As environmental constraints tighten on volatile organic compound (VOC) emissions in paints and coatings, lake pigments, especially in powder or dispersion-ready form, are expected to witness improved preference. Their high pigment load capacity and low reactivity make them suitable for industrial R&D aimed at sustainability compliance without sacrificing visual appeal.

Regulatory Compliance and Health Concerns

The FD & C Lakes Market would be experiencing a challenging regulatory scenario as the domain is being stringently regulated by several bodies including the FDA and the EFSA among other global bodies of food safety. Regulations on allowable concentrations, transparency with labels, and safety evaluations foster greater operational complexity for manufacturers.

And consumer awareness about synthetic color additives and their possible health effects have driven stricter limits, and bans on some lakes. To avoid repercussions, they have to do clinical research, make various changes in quality assurance measures, and reformulate the dishes accordingly.

Competition from Natural Alternatives and Clean-Label Trends

As consumer preference trends toward clean-label products, there is a growing demand for natural colorants such as beet juice, spirulina extract, and turmeric. As a result of this shift, the FD & C Lakes Market has been influenced, prompting manufacturers to explore plant-based and/or non-synthetic sources to comply with changing consumer favors.

Natural colorants, on the other hand, have stability problems, so FD & C lakes are advantageous in specific applications. Companies will need to be innovative in developing more stable, hybrid solutions and sharing with consumers how FD & C lakes improve consistency and color vibrancy.

Expanding Applications in Pharmaceuticals and Cosmetics

Aside from applications in food and beverage, FD & C lakes are also expanding their footprint in pharmaceutical coatings, dietary supplements, and cosmetics. Their greater stability under dry conditions and in the presence of light and heat render them useful in pills, as tablet coatings, and in make-ups such as lipsticks and eyeshadows.

Growing demand in the pharmaceutical and personal care industries will drive companies specializing in high-purity FD & C lakes, enhanced solubility, and tailor-made formulations for these sectors.

Advances in Microencapsulation and Sustainable Manufacturing

Continued advancements in microencapsulation technology are also improving the performance functionalities of FD & C lakes (e.g., improved dispersion, solubility, and controlled release properties). Moreover, innovations in sustainable manufacturing, including bio-based pigment carriers and environmentally friendly production processes, are tackling environmental issues related to synthetic dyes.

The FD & C Lakes Market is evolving, and companies focused on AI-driven formulation development, biodegradable lake substrates, and carbon-neutral production will have the first-mover advantage.

The FD & C Lakes Market is expected to rise at a steady pace from 2020 to 2024 supported by steady demand from processed foods, pharmaceuticals and personal care products. Conversely, synthetic lake color manufacturers faced challenges due to heightened regulatory scrutiny, consumer interest in natural alternatives, and changing clean-label trends.

Companies responded by increasing regulatory compliance effort, improving formulation stability, and diversifying their application beyond the food and beverage industry.

2025 to 2035 market growth is anticipated to include AI-assisted color formulation, new bioengineered synthetic lakes and sustainable production methods. The industry's transformation will be powered by the emergence of biodegradable lake pigments, blockchain-enhanced supply chain traceability, and smart packaging to ascertain color stability.

Markets are expected to grow due to enhancements in edible coatings, better functional ingredient incorporation and AI-based safety evaluations. Interceptor Sustainable production, digital openness and multifunctional colors are the way forward and businesses that embrace this evolution will be at the forefront on the next phase of FD & C Lakes Market transformation.

North America will lead the FD and C lakes market as demand for high stability colorants accelerates across food, pharmaceutical and cosmetic end-use industries. Demand for bright, long-lasting pigments for use in processed foods and confectionery is driven by ongoing market expansion.

Increasing investments in correlation with advanced-manufacturing process implementations, Along with innovative aluminum-based and calcium-based lakes, are also sustaining the market growth. Moreover, use of non-toxic, water-insoluble pigments in pharmaceutical and personal care products is increasing product appeal.

FD and C lakes that are FDA-compliant and heat- and fade-resistant are also subspecialties of industry trends, and companies are looking focused on formulating those. Growing usage of lake pigments in coated tablets, decorative cosmetics, and food coatings is additionally supplementing demand across USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

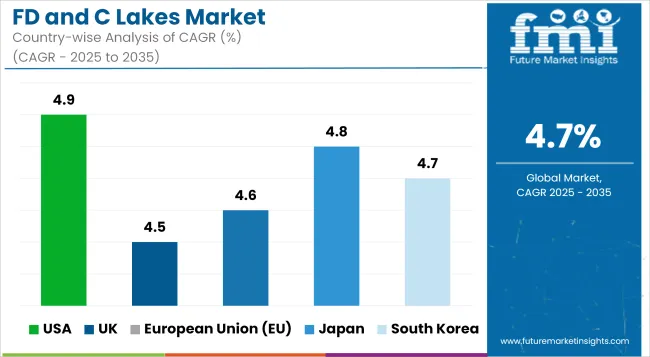

| USA | 4.9% |

The UK serves as a significantly impacting market for FD and C lakes, owing to the increasing demand for premium food colorants, properties that support various applications, such as cosmetics and pharmaceuticals in addition to food, and rising emphasis on ingredient transparency among suppliers and manufacturers in the region. Sustainable and allergen-free color additives are also increasingly being used, adding to market expansion.

The adoption of government policies for safe food colorants and improvements in formulated precision dye and particle stability further drive the market growth. In addition, advancements in hybrid dye-lake blends, high-purity synthetic lakes and organic pigment alternatives are on the rise. For example, companies are focusing on sustainable lake production methods and environmentally friendly packaging options.

In addition, growing adoption of FD and C lakes in decorative bakery products, lipsticks, and nutraceuticals is driving the market growth in UK. Also, the movement towards natural and synthetic blend color solutions is boosting demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.5% |

The top three countries from a European perspective for FD and C lakes consumption are Germany, France and Italy, which are all following stringent food and pharmaceutical regulations, an increasing demand for vivid and stable colorants, and growing demand for long-lasting pigments for use in personal care product applications.

Stringent adherence to food safety regulations by the European Union and growing investments in non-toxic, aluminum-free, and plant-derived lake pigments, are anticipated for rapid market growth. Moreover, the growing usage of microencapsulation for better pigment dispersion and the increased solubility of ingredients to improve product efficiency is also contributing to the growth of the market.

Growing demand for stable and high-intensity colorants in the coated pill, energy drink, and cosmetic formulation sectors also fuels market growth. Sustainable and clean-label pigment alternatives are increasingly available, and regulatory restrictions on synthetic colorants are also driving adoption across the EU. Ongoing research into bio-based and hybrid lake pigments is also increasing innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.6% |

Japan FD and C lakes market is growing on account of strong focus of the country on precision color technology, increasing demand for high-performance pigments coupled with rising utilization of lake dyes in functional foods and skincare products. The increasing demand for color solutions that do not migrate and fade are the major factors driving the growth of the market.

This, together with the focus on advanced pigment engineering and the incorporation of high-purity aluminum lakes, pH-stable formulations and novel dye-dispersion techniques, is driving innovation in the country. Additionally, stringent governmental regulations on synthetic colorant safety and growing investments towards clean-label allergen-free alternatives are stimulating companies to develop next-gen lake pigments.

Also accelerating market growth in Japan’s specialty chemicals market are the increasing demand for bright, long-lasting colorants in haircare products, supplements, and energy drinks. And the development of high-performance FD and C lakes in Japan is capitalizing on AI technologies for color matching and smart formulation of pigments.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

FD and C lakes are also gaining traction in South Korea, with the growing consumer preference for long-lasting and vibrant colorants in various applications such as cosmetics, confectionery, and pharmaceuticals. K-beauty and premium food color applications are on the rise and is adding to the growth of market.

Government restrictions on synthetic pigment safety and growing investment in the development of sustainable and bio-based lake pigments are factors widening market scope. The country also remains competitive by focusing on the development of pigment dispersion technologies with Nano-coating and hybrid pigment blends, as well as improved absorption properties.

Demand for FD and C lakes continue to grow in lip tints, eye makeup, protein powders and decorative icing, thereby driving adoption in the market. High-durability, UV-stable, and water-insoluble lake pigments to maximize color performance in a range of applications are being developed by companies investing in research and development. The increasing popularity of functional beauty products and natural hybrid colorants in South Korea is also contributing to the demand for advanced FD and C lake solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.7% |

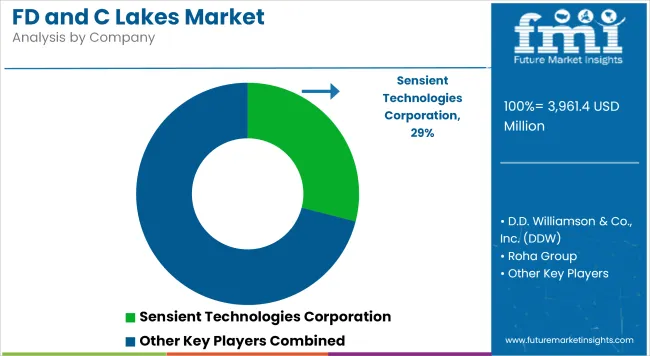

The FD & C lakes by usage in food, pharmaceuticals, cosmetics, and personal care products that require stable and insoluble colorants is driving the growth of the FD & C lakes market. Statistically, the companies are making strategies with a focus on natural alternatives, clean-label, and effective formulations while adhering to standard regulatory requirements.

Major trends in the market include transition to aluminum-free lakes, growing plant-based alternative, advances in dispersion technology for better application efficiency, etc.

The overall market size for FD and C lakes market was USD 3,961.44 million in 2025.

The FD and C lakes market expected to reach USD 6,270.76 million in 2035.

The demand for the FD and C lakes market will be driven by increasing use in cosmetics, pharmaceuticals, and food products, rising consumer preference for vibrant and stable color additives, growing regulatory approvals, expanding applications in personal care items, and advancements in color formulation technologies.

The top 5 countries which drives the development of FD and C lakes market are USA, UK, Europe Union, Japan and South Korea.

Powder and granule FD & C lakes dominate market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FD and C Dyes Market Size, Growth, and Forecast for 2025 to 2035

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Candle Air Fresheners Market Size and Share Forecast Outlook 2025 to 2035

Candle Box Market Size, Share & Forecast 2025 to 2035

Candle Jar Market Growth & Industry Forecast 2025 to 2035

Global Candy and Twisting Paper Market Analysis – Growth & Forecast 2024-2034

Candy Wrapping Machine Market

Candida Vaginitis Rapid Testing Market

Candelilla Wax Market

Command and Control System Market Size and Share Forecast Outlook 2025 to 2035

DC and PKI Market Size and Share Forecast Outlook 2025 to 2035

Cut And Stack Labels Market Size and Share Forecast Outlook 2025 to 2035

CNG and LPG Vehicles Market Trends - Growth & Forecast 2025 to 2035

Market Share Distribution Among Cut and Stack Labels Providers

Cat and Dog Food Topper Market Insights – Pet Nutrition & Industry Expansion 2024-2034

Case and Box Handling Robots Market Size and Share Forecast Outlook 2025 to 2035

Cell and Gene Therapy Clinical Trial Market Size and Share Forecast Outlook 2025 to 2035

Cell and Gene Therapy Manufacturing Market - Growth & Trends 2025 to 2035

Corn and Callus Remover Market Insights-Size, trends and Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA