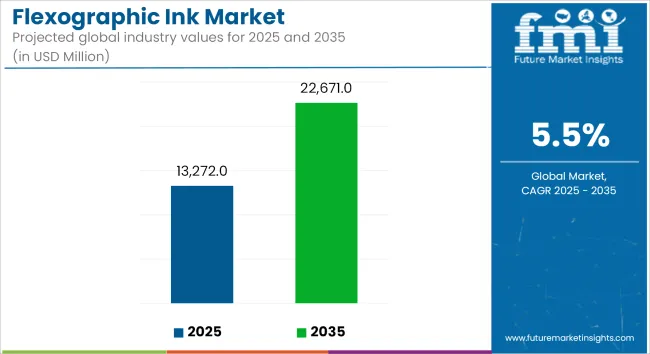

The global flexographic ink market is estimated to reach USD 13,272 million in 2025 and grow to USD 22,671 million by 2035, advancing at a CAGR of 5.5% during the forecast period. Market expansion is being driven by rising demand for flexible packaging across the food and beverage industry and increased preference for environmentally sustainable print solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 13,272 million |

| Industry Value (2035F) | USD 22,671 million |

| CAGR (2025 to 2035) | 5.5% |

Flexographic inks are being utilized in high-speed printing applications for packaging substrates such as paper, plastic films, metallic foils, and labels. With packaging design playing a critical role in brand differentiation and consumer appeal, the need for high-performance and visually consistent inks has been increasing. In particular, the food and beverage sector is promoting the use of safe, low-migration, and compliant ink technologies for flexible packaging formats such as pouches, wrappers, and cartons.

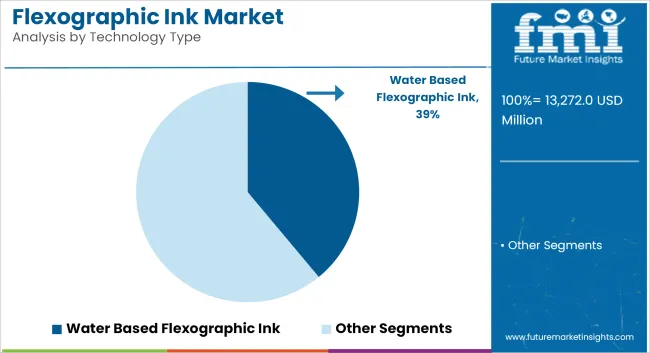

The shift toward water-based flexographic inks is accelerating, supported by regulatory pressure to reduce volatile organic compound (VOC) emissions and enhance sustainability. Water-based inks are being preferred for food-contact packaging applications due to their low toxicity, ease of cleanup, and minimal environmental impact. These inks are also being adopted to meet compliance with environmental directives such as the European REACH regulation and the USA Clean Air Act.

Solvent-based inks continue to be used in applications requiring fast drying and high abrasion resistance, particularly for outdoor or industrial labels. However, adoption is gradually declining due to stricter emissions standards, worker safety concerns, and waste disposal issues. As a result, water-based systems are capturing a larger share of the flexographic ink market.

In response to the demand for greener print technologies, ink manufacturers are investing in the development of bio-based ink formulations, low-energy curing solutions, and pigment dispersion technologies that enhance color performance while reducing environmental impact. The growing emphasis on compostable and recyclable packaging has further supported the adoption of water-based flexographic inks.

With continued growth in packaged food consumption, e-commerce, and private label goods, the flexographic ink market is expected to sustain steady momentum through 2035, supported by innovation in sustainable printing and compliance-driven product development.

Water-based flexographic inks are anticipated to command approximately 39% of global market share in 2025, advancing at a CAGR of 6.8% through 2035. This dominance stems from increasing environmental legislation restricting VOC emissions and growing demand for eco-labeled packaging. These inks are widely used for printing on corrugated board, tissue, and paper sacks in applications like foodservice packaging, grocery bags, and industrial shipping containers.

Western Europe and North America are seeing a marked transition from solvent-based to water-based ink formulations as national air quality norms tighten. Ink manufacturers are investing in polymer emulsions and stabilizers to enhance drying speed, rub resistance, and print definition on porous surfaces. In emerging economies, modernization of converting equipment and better availability of water-based formulations are further catalyzing adoption.

Consumer brands are also leaning toward water-based inks to meet their Scope 3 emission reduction targets, pushing converters to adopt more sustainable printing practices. The segment’s continued growth is underpinned by product innovation, regulatory harmonization (e.g., REACH, EPA, and FDA), and cost competitiveness in large-volume print runs.

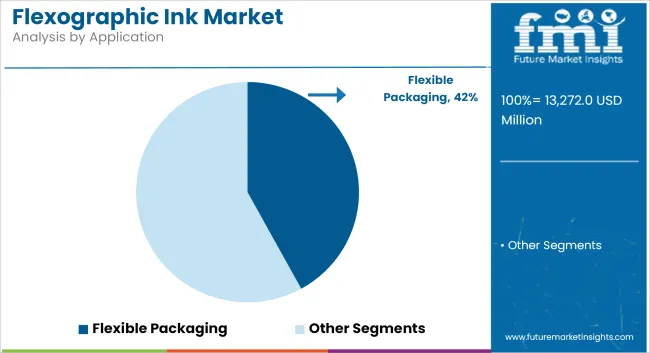

Flexible packaging stands as the largest and fastest-growing application segment in the global flexographic ink market, accounting for an estimated 42% of total ink consumption in 2025, with growth projected at a CAGR of 6.9% through 2035. The segment’s momentum is being driven by the widespread adoption of flexible packaging formats across food, beverage, personal care, pet food, and home care industries, where packaging must balance shelf appeal, durability, regulatory compliance, and environmental impact.

Flexographic inks are particularly well-suited for printing on plastic films (e.g., polyethylene, polypropylene, BOPP), aluminum foils, and biodegradable substrates used in flexible packaging due to their high print speed compatibility, fast drying characteristics, and formulation versatility. With converters shifting toward high-definition printing, brands are increasingly relying on advanced flexographic inks to achieve vivid color reproduction, smudge resistance, and brand consistency on flexible surfaces that require durability and aesthetic appeal.

The demand for low-VOC, non-toxic, and food-safe inks has accelerated the transition to water-based and UV-curable flexographic inks in this segment. In North America and the EU, brands and retailers are mandating the use of inks that are compliant with regulations like FDA 21 CFR, Swiss Ordinance, REACH, and EuPIA guidelines, prompting a surge in adoption of low-migration flexo ink systems for primary food packaging.

VOC Emissions and Environmental Controls

Environmental control is challenging the flexographic ink industry with VOC emission regulation. High-VOC, old-history inks and solvent chemistry are so out of style now, so demand is reducing. Clean technology investment on capital, at least more cost of manufacturing and technology-altering, is being demanded by firms.

Sustainable Ink Technologies Innovation

An increased focus on sustainability can result in innovation as well, particularly regarding ink technologies. Bio-based, water-based and UV-curable inks demonstrate promise in meeting environmental demands and the high level of need for sustainable packaging. And, with improvements to performance, adhesion and drying rates, the potential for their innovations have been realized: the creation of inks that, in an advisory role, would provide competitive value.

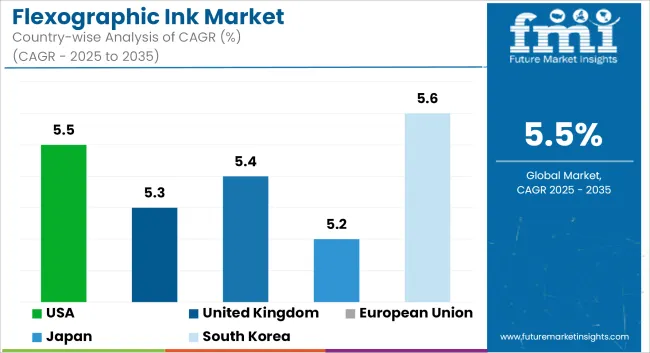

USA flexographic ink market is growing at a slower pace as flexible type Food and Beverage Packaging Solution is required to meet growing demand. This, combined with the growing demand for water-based low VOC emitting flexographic ink owing to increased environmental concerns and the transition to green friendly packaging solutions, have further built the momentum of demand. Also, the evolution of technology and the print quality, and the effectiveness of the flexographic printing has contributed to bring improvement in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

In the United Kingdom, the market for flexographic ink is expanding at a sluggish rate. Greater application of green inks, particularly water-based inks, is because of compliance with strict environmental laws and customers' need for sustainable packaging. Greater activity in the e-commerce market is also fuelling greater demand for quality packaging, thereby driving the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

European Union flexographic ink market is characterized by steady growth with the world's attention focused on circular economy and sustainability in the region. Germany, France, and Italy are at the forefront of implementing water-based and UV-curable flexographic inks. Reduction of carbon footprint and recyclability trends in packaging are pushing the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

Japanese flexographic ink market is growing at a slow rate owing to the innovative nature of print solutions and higher-quality packaging demand in Japan. Because of the environmental friendliness and fast-drying nature, uses of UV-curable flexographic inks are increasing. The naturally beautiful packaging demand of the cosmetics and personal care industry also drives the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

South Korean flexographic ink market is expanding on the strength of increasing packaging business and expansion in export of packaged goods. Consumer durables and consumer electronics industry demand for high-quality, durable packing has spurred expansion in advanced flexographic printing. Expansion in demand towards green packing solution also favours increasing market size.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The flexographic ink market is moderately consolidated, with leading players actively pursuing technology upgrades, acquisitions, and sustainability-driven innovations to gain market share. Competitive differentiation is being shaped by formulation expertise, compliance with environmental and food safety standards, and the ability to deliver customized inks for varied substrates and press configurations.

Global players such as Sun Chemical, Flint Group, and DIC Corporation are expanding their manufacturing and R&D capabilities across Asia-Pacific and Latin America to serve fast-growing packaging hubs. Strategic partnerships with packaging converters and OEMs (Original Equipment Manufacturers) are enabling ink producers to co-develop high-performance, low-emission ink solutions that align with evolving customer demands.

The flexographic ink market was valued at approximately USD 13,272 million in 2025.

The market is projected to reach around USD 22,671 million by 2035.

The increasing demand for packaging materials across various industries is a significant driver.

The leading countries in the flexographic ink market include the United States, China, Germany, Japan, and India.

The water-based inks segment is expected to grow in forecast period driven by their safety and environmental benefits.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexographic Printing Inks Market Size and Share Forecast Outlook 2025 to 2035

Flexographic Printing Plate Market Size and Share Forecast Outlook 2025 to 2035

Flexographic Printing Machine Market Analysis, Size, Share & Forecast 2024 to 2034

Flexographic Printing Market Growth – Trends & Forecast 2024-2034

Washable Flexographic Printing Plate Market Size and Share Forecast Outlook 2025 to 2035

Water-based Flexographic Printing Market Trends & Forecast 2024-2034

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Ink Abrasion Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Ink Tank Printer Market

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA