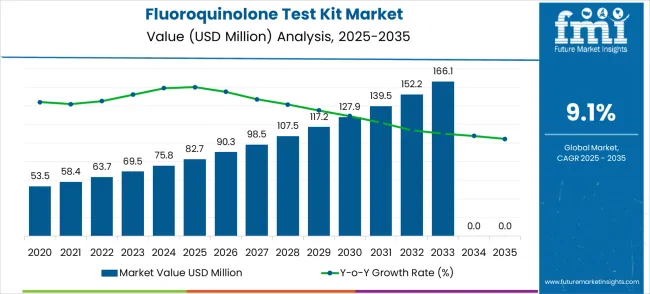

The fluoroquinolone test kit market is valued at USD 82.7 million in 2025 and is projected to reach USD 197.7 million by 2035, representing a CAGR of 9.1%. This reflects a robust growth trajectory driven by rising demand for rapid diagnostic tools, increasing prevalence of bacterial infections, and growing regulatory focus on antimicrobial resistance (AMR) testing. Over the decade, the market will gain USD 115.0 million in absolute terms, demonstrating strong potential in both developed and emerging markets.

Year-on-year growth analysis shows consistent expansion, with incremental increases in market value each year, reflecting steady adoption of fluoroquinolone testing across healthcare, pharmaceutical, and veterinary segments.

A deeper YoY analysis reveals a progressive acceleration in market expansion. Between 2025 and 2026, the market grows from USD 82.7 million to USD 90.3 million, a rise of 9.2%, closely matching the CAGR. Growth continues steadily through the forecast period, with values increasing to USD 98.5 million in 2027, USD 107.5 million in 2028, and USD 117.2 million in 2029. Later years show slightly larger absolute increments, with growth reaching USD 181.2 million in 2034 and USD 197.7 million in 2035. This gradual upward momentum signals healthy demand expansion with no evident sharp downturns, reflecting a balanced and predictable growth pattern for the market.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 82.7 million |

| Forecast Value in (2035F) | USD 197.7 million |

| Forecast CAGR (2025 to 2035) | 9.1% |

Volatility checks across the decade show minor fluctuations in annual growth rates, ranging from 8.9% to 9.4%, which is within a narrow band and points to a stable market environment. The highest growth years occur in the early phase (2026–2028), driven by technology adoption, enhanced diagnostic capabilities, and rising awareness of AMR issues. Mid-decade growth rates remain stable, reflecting consolidation and steady penetration into target markets, while later years display slightly stronger gains as new testing protocols, improved kit sensitivity, and broader regulatory mandates take effect globally.

The average YoY growth across the decade is approximately 9.1%, aligning with the forecast CAGR. This steady pace of expansion underscores a reliable upward trajectory for the market. The consistent year-on-year growth, coupled with minimal volatility, makes this market a compelling target for investment and innovation. The sustained rise is expected to be fueled by continuous advances in testing methodologies, increasing focus on antimicrobial stewardship, and expanding adoption of rapid diagnostic solutions in healthcare and pharmaceutical sectors.

Market expansion is being supported by the increasing stringency of food safety regulations and the corresponding demand for reliable antibiotic residue detection technologies. Modern food safety organizations are increasingly focused on testing systems that can provide rapid results, ensure regulatory compliance, and enable effective supply chain monitoring. The proven effectiveness of fluoroquinolone test kits in detecting antibiotic residues at regulated levels and their ability to support quality assurance programs makes them essential components of comprehensive food safety operations.

The growing focus on sustainable agriculture and environmental protection is driving demand for advanced testing systems that address regulatory requirements and consumer safety concerns. Agricultural industry preference for rapid testing solutions that combine high sensitivity with user-friendly operation is creating opportunities for innovative test kit development. The rising influence of traceability requirements and food quality standards is also contributing to increased adoption of proven fluoroquinolone test kits across different agricultural sectors and food processing environments.

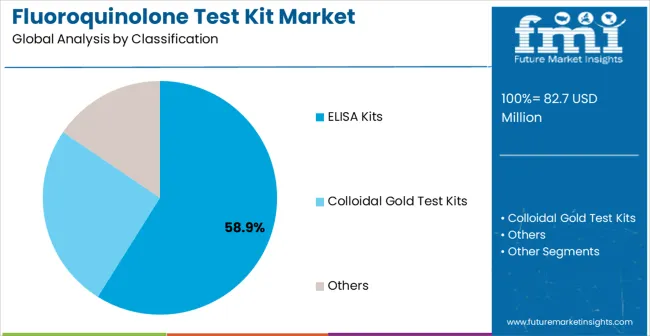

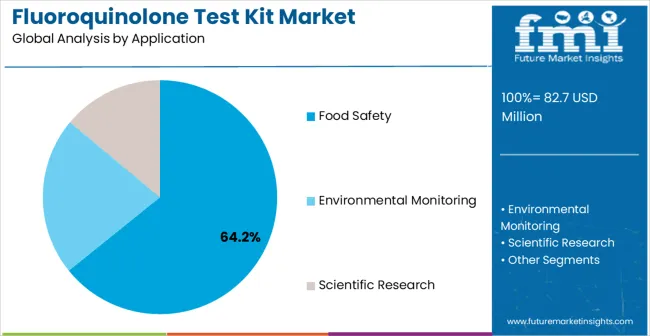

The market is segmented by classification, application, and region. By classification, the market is divided into ELISA kits, colloidal gold test kits, and others. Based on application, the market is categorized into food safety, environmental monitoring, and scientific research. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The ELISA kits segment is projected to account for 58.9% of the fluoroquinolone test kit market in 2025, reaffirming its position as the category's dominant classification. Laboratory professionals and quality control specialists increasingly recognize the superior analytical performance of ELISA-based systems for fluoroquinolone detection, particularly their ability to provide quantitative results and maintain excellent reproducibility across different testing environments. This testing technology addresses both sensitivity requirements and throughput needs, providing comprehensive analytical coverage for regulatory compliance applications.

This classification forms the foundation of most established testing protocols, as it represents the most widely validated and analytically proven approach in fluoroquinolone residue analysis. Technical certifications and extensive validation studies continue to strengthen confidence in ELISA kit formulations. With increasing recognition of the importance of quantitative analysis requiring standardized testing systems, ELISA kits align with both current regulatory requirements and laboratory quality assurance standards. Their broad applicability across multiple sample types ensures constant market dominance, making them the central growth driver of fluoroquinolone test kit demand.

Food safety applications are projected to represent 64.2% of fluoroquinolone test kit demand in 2025, underscoring their role as the primary application driving test kit adoption. Food safety professionals and regulatory authorities recognize that agricultural product monitoring requires specialized testing systems that can effectively detect fluoroquinolone residues and ensure consumer protection. Fluoroquinolone test kits offer optimal performance characteristics for meat, dairy, and aquaculture product testing across various food production and processing stages.

The segment is supported by the increasing stringency of food safety regulations requiring comprehensive antibiotic residue monitoring and the growing recognition that rapid testing provides superior operational efficiency for food production chains. Food safety organizations are increasingly adopting integrated monitoring approaches that leverage fluoroquinolone testing advantages for optimal supply chain quality assurance. As food safety standards continue to evolve toward more comprehensive residue monitoring and improved consumer protection, testing systems optimized for food safety applications will continue to play a crucial role in regulatory compliance strategies, reinforcing their essential position within the analytical testing market.

The fluoroquinolone test kit market is advancing steadily due to increasing focus on food safety regulations and growing adoption of rapid testing technologies for antibiotic residue detection. The market faces challenges including complex regulatory approval processes, high sensitivity requirements for trace-level detection, and concerns about cross-reactivity and matrix interference effects. Innovation in testing methodologies and quality control technologies continue to influence product development and market expansion patterns.

The growing adoption of automated laboratory systems is enabling more sophisticated testing workflows and high-throughput sample processing. Automated testing platforms require comprehensive test kit compatibility, including standardized protocols, reliable performance characteristics, and seamless integration capabilities, that advanced fluoroquinolone test kits can provide effectively. Laboratory automation creates demand for testing technologies that can support increased sample volumes while maintaining analytical accuracy and regulatory compliance.

Modern testing laboratories are incorporating digital technologies such as laboratory information management systems, electronic data capture, and cloud-based result reporting to enhance fluoroquinolone test kit utilization. These technologies improve testing efficiency, enable better traceability and documentation, and provide enhanced quality control monitoring and regulatory reporting capabilities. Advanced data management also enables optimized testing protocols and early identification of potential analytical issues or quality control failures.

| Country | CAGR (2025-2035) |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| Brazil | 9.6% |

| USA | 8.6% |

| UK | 7.7% |

| Japan | 6.8% |

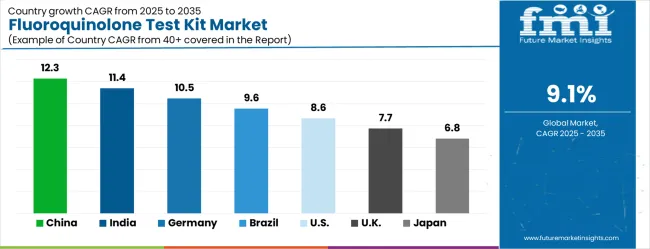

The market is experiencing varied growth globally, with China leading at a 12.3% CAGR through 2035, driven by expanding food safety regulations, increasing agricultural production monitoring, and growing investment in testing infrastructure. India follows at 11.4%, supported by agricultural sector modernization, increasing food export requirements, and expanding testing laboratory capabilities. Germany shows growth at 10.5%, focusing advanced analytical technologies and comprehensive food safety standards. Brazil records 9.6% growth, focusing on improved agricultural testing infrastructure and export quality assurance programs. The USA shows 8.6% growth, representing a mature market with established food safety regulations and ongoing testing technology advancement.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to expand at a CAGR of 12.3% between 2025 and 2035, driven by rising demand in pharmaceutical testing, food safety, and clinical diagnostics. Fluoroquinolone test kits are essential for detecting antibiotic residues in food products and ensuring compliance with strict safety regulations. Domestic manufacturers are investing in high-sensitivity test technologies, rapid detection systems, and large-scale production capabilities. Government regulations on antibiotic residue limits and enhanced food safety standards are fueling adoption. Demand is also supported by expanding pharmaceutical research facilities and increasing awareness of antibiotic resistance. Strategic collaborations between manufacturers and research institutions are enhancing product development. Rising exports of food and pharmaceutical products ensure steady demand for high-quality test kits in China.

India is expected to grow at a CAGR of 11.4% during 2025–2035, driven by rising awareness of antibiotic resistance, increasing quality control in pharmaceuticals, and expanding food safety regulations. Fluoroquinolone test kits are widely adopted in laboratories for rapid detection of antibiotic residues in animal products and pharmaceuticals. Local manufacturers are investing in cost-effective production, automation, and high-sensitivity test kits. Demand is supported by growth in pharmaceutical exports, strengthening food safety regulations, and expanding clinical diagnostic facilities. Government initiatives to improve healthcare standards and food safety protocols further support market growth. Adoption is rising in food processing plants and research laboratories for residue analysis.

Germany is projected to grow at a CAGR of 10.5% from 2025 to 2035, supported by strict regulatory frameworks, advanced laboratory infrastructure, and high adoption of rapid test solutions. Fluoroquinolone test kits are widely used for antibiotic residue analysis in pharmaceuticals, veterinary products, and food processing. German manufacturers focus on high-accuracy detection systems, automation, and compliance with EU regulations. Demand is driven by the pharmaceutical industry’s focus on quality assurance and the food industry’s strict safety standards. Growth is supported by laboratory upgrades, research collaborations, and strong regulatory enforcement. Germany’s leadership in food safety testing encourages steady adoption of advanced test kits.

Brazil is expected to grow at a CAGR of 9.6% between 2025 and 2035, supported by rising demand in food safety testing, clinical diagnostics, and pharmaceutical quality control. Fluoroquinolone test kits are essential for compliance with national food safety regulations and pharmaceutical quality standards. Local manufacturers focus on cost-effective solutions while importing high-precision kits for advanced applications. Growth is driven by rising meat and dairy exports, stricter residue control regulations, and expansion of diagnostic laboratories. Government campaigns for antibiotic residue monitoring enhance adoption in food processing plants. Partnerships between local laboratories and international kit providers improve testing capabilities and product availability.

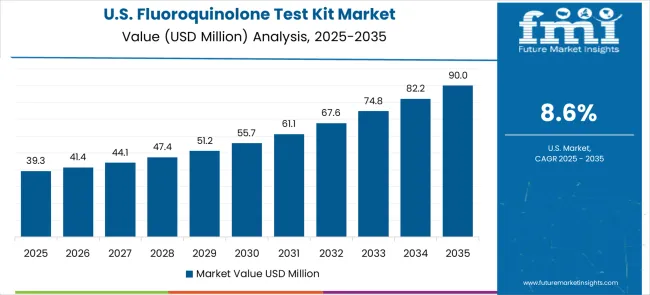

The United States is forecasted to grow at a CAGR of 8.6% during 2025–2035, supported by rising demand in clinical diagnostics, food safety testing, and pharmaceutical quality control. Fluoroquinolone test kits are valued for their speed, accuracy, and compliance with FDA standards. Manufacturers focus on innovation in rapid detection technology, automation, and high-sensitivity kits. Demand is driven by regulatory enforcement, expansion of food testing laboratories, and growing pharmaceutical manufacturing. Adoption is rising in diagnostic laboratories, pharmaceutical quality assurance facilities, and food processing plants. Strategic partnerships with technology providers enhance product quality and market reach.

The United Kingdom is expected to grow at a CAGR of 7.7% during 2025–2035, driven by increasing demand for food safety compliance, pharmaceutical quality control, and clinical diagnostics. Fluoroquinolone test kits are integrated into regulatory compliance programs and laboratory workflows to ensure rapid, reliable results. UK manufacturers focus on quality assurance, innovation, and adherence to regulatory standards. Growth is supported by expansion of clinical laboratories, increased food safety testing, and stronger government oversight of antibiotic residue levels. Adoption is growing in both public and private healthcare facilities. Partnerships with global suppliers ensure access to advanced testing technology, enhancing the UK’s capabilities in residue detection.

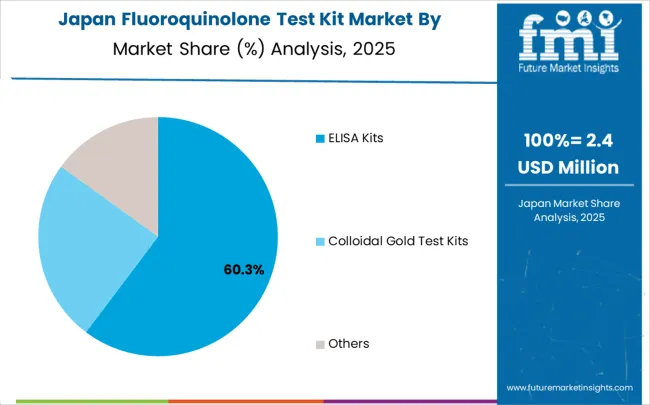

Japan is projected to grow at a CAGR of 6.8% during 2025–2035, supported by strong regulatory frameworks, advanced laboratory infrastructure, and growing awareness of antibiotic residue monitoring. Fluoroquinolone test kits are essential for compliance with strict food safety standards and pharmaceutical quality assurance. Japanese manufacturers focus on high-sensitivity kits, automation, and precision manufacturing. Growth is supported by rising demand in the food industry, pharmaceutical manufacturing, and clinical diagnostics. Adoption is driven by increasing exports of food products, stringent residue testing protocols, and government programs to ensure public health. Collaborations with international kit manufacturers strengthen innovation and efficiency in residue testing.

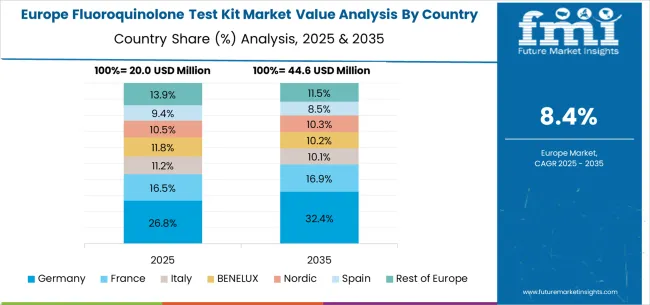

The fluoroquinolone test kit market in Europe is projected to expand steadily through 2035, supported by increasing adoption of comprehensive food safety monitoring, rising demand for rapid testing solutions, and ongoing innovation in analytical testing technologies. Germany will continue to lead the regional market, accounting for 25.9% in 2025 and rising to 26.7% by 2035, supported by strong analytical testing infrastructure, advanced food safety research capabilities, and robust regulatory compliance programs. The United Kingdom follows with 18.6% in 2025, increasing to 19.2% by 2035, driven by comprehensive food safety standards, testing excellence initiatives, and expanding analytical laboratory capabilities.

France holds 16.3% in 2025, edging up to 16.8% by 2035 as food safety organizations expand testing utilization and demand grows for advanced analytical technologies. Italy contributes 13.7% in 2025, remaining broadly stable at 14.1% by 2035, supported by growing food safety sector investment and increasing testing technology adoption. Spain represents 11.4% in 2025, inching upward to 11.8% by 2035, underpinned by strengthening agricultural testing infrastructure and food safety development initiatives.

BENELUX markets together account for 8.2% in 2025, moving to 8.5% by 2035, supported by advanced analytical requirements and food safety innovation initiatives. The Nordic countries represent 4.1% in 2025, marginally increasing to 4.3% by 2035, with demand fueled by comprehensive quality standards and early adoption of advanced testing technologies. The Rest of Western Europe moderates from 1.8% in 2025 to 0.6% by 2035, as larger core markets capture a greater share of testing technology investment, food safety programs, and fluoroquinolone test kit adoption.

The market is characterized by competition among established analytical testing companies, specialized diagnostic kit manufacturers, and comprehensive food safety solution providers. Companies are investing in test kit research and development, analytical validation, strategic partnerships, and technical support services to deliver accurate, reliable, and user-friendly fluoroquinolone detection solutions. Product innovation, regulatory compliance, and market access strategies are central to strengthening product portfolios and market presence.

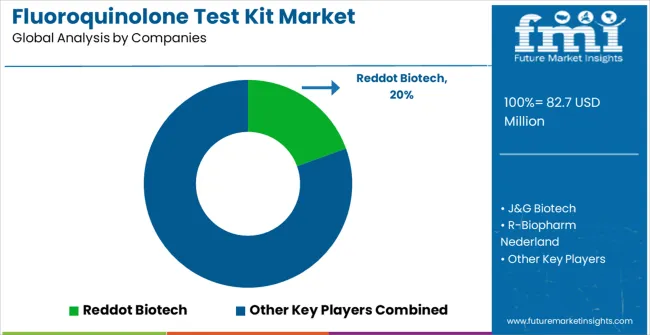

Reddot Biotech leads the market with comprehensive testing solutions focusing on analytical accuracy and regulatory compliance across diverse applications. J&G Biotech provides extensive diagnostic kit portfolios with focus on rapid testing and technical support. R-Biopharm Nederland focuses on specialized analytical systems and validated testing solutions for food safety applications. Abbexa delivers innovative testing technologies with strong performance characteristics and quality assurance.

MyBioSource operates with focus on diverse analytical solutions and custom testing development for specialized applications. Creative Diagnostics, Cusabio Technology, and United States Biological provide comprehensive testing portfolios with focus on analytical excellence and regulatory compliance. PerkinElmer, Shanghai Sangon Biotech, and Shandong Meizheng Bio-Technology deliver established analytical solutions with strong industry expertise. Beijing Biolab, Beijing Kwinbon Technology, and Shenzhen Bioeasy Biotechnology provide comprehensive testing portfolios including research support, technical consulting services, and custom analytical solutions to enhance market accessibility and customer satisfaction across diverse food safety and environmental monitoring applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 82.7 million |

| Classification | ELISA Kits, Colloidal Gold Test Kits, Others |

| Application | Food Safety, Environmental Monitoring, Scientific Research |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Reddot Biotech, J&G Biotech, R-Biopharm Nederland, Abbexa, MyBioSource, Creative Diagnostics, Cusabio Technology, United States Biological, PerkinElmer, Shanghai Sangon Biotech, Shandong Meizheng Bio-Technology, Beijing Biolab, Beijing Kwinbon Technology, Shenzhen Bioeasy Biotechnology |

| Additional Attributes | Dollar sales by test kit type and application, regional demand trends, competitive landscape, laboratory preferences for specific methodologies, integration with analytical systems, innovations in detection technologies, quality assurance strategies, and analytical performance optimization |

The global fluoroquinolone test kit market is estimated to be valued at USD 82.7 million in 2025.

The market size for the fluoroquinolone test kit market is projected to reach USD 197.7 million by 2035.

The fluoroquinolone test kit market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in fluoroquinolone test kit market are elisa kits, colloidal gold test kits and others.

In terms of application, food safety segment to command 64.2% share in the fluoroquinolone test kit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluoroquinolones ELISA Kit Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Equipment Market Size and Share Forecast Outlook 2025 to 2035

Testosterone Test Market Size and Share Forecast Outlook 2025 to 2035

Test rig Market Size and Share Forecast Outlook 2025 to 2035

Test and Measurement Sensors Market Size and Share Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Testosterone Booster Industry Analysis by Component, Source, Distribution Channels and Regions 2025 to 2035

Testosterone Injectable Market

Test Tube Market

Testliner Market

Testicular Cancer Treatment Market

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Intestinal Pseudo-Obstruction Treatment Market - Trends, Growth & Forecast 2025 to 2035

Intestinal Fistula Treatment Market Growth - Demand & Innovations 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

5G Tester Market Growth – Trends & Forecast 2019-2027

RF Tester Market Growth – Trends & Forecast 2019-2027

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA