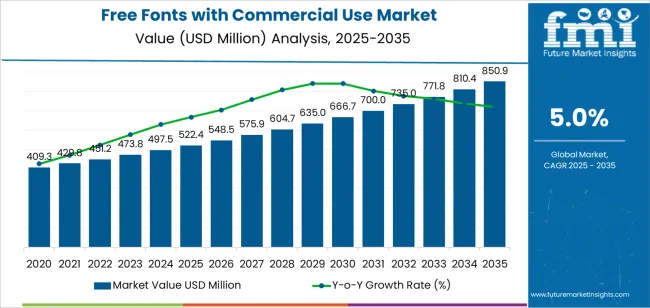

The free fonts with commercial use market is valued at USD 522.4 million in 2025 and is forecast to reach USD 850.9 million by 2035, growing at a CAGR of 5.0%. Market expansion is supported by rising global demand for legally compliant typography across digital content, branding, web development, and product design. Organizations increasingly rely on commercially licensed free fonts to reduce design costs, maintain copyright compliance, and support scalable deployment across print and digital platforms. The growth of online design tools, content creation software, and global e-commerce continues to reinforce demand for accessible, versatile typeface libraries.

Universal fonts represent the leading segment due to their broad applicability across multilingual content, responsive interfaces, and cross-platform environments. These font families offer consistent readability, extensive character sets, and compatibility with diverse operating systems and design workflows. Ongoing development of variable fonts, optimized webfonts, and lightweight file formats is improving performance, accessibility, and design flexibility for commercial applications.

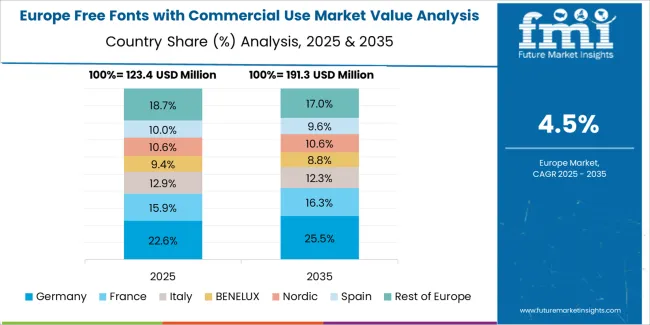

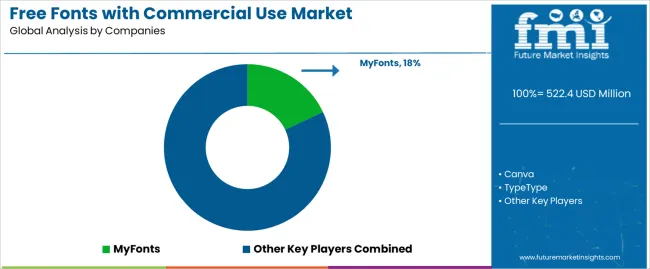

Asia Pacific leads market growth, driven by expanding digital content creation in China, India, and Southeast Asia. Europe and North America maintain strong adoption through established design ecosystems and increasing use of cloud-based creative platforms. Key companies include MyFonts, Canva, TypeType, Monotype Imaging, Monotype, Morisawa, and Adobe, focusing on licensing transparency, font optimization, and high-quality typeface distribution.

Growth momentum analysis shows a steady upward trajectory supported by expanding digital-content creation, wider adoption of open-license design assets, and increased use of lightweight font libraries across web, app, and brand-identity workflows. Between 2025 and 2029, momentum will remain firm as small businesses, independent creators, and digital-marketing teams increase reliance on commercial-use fonts to reduce licensing costs and speed design deployment. Growth during this period will also benefit from broader platform integration in website builders, design tools, and content-management systems.

From 2030 to 2035, momentum will moderate slightly as adoption becomes more uniform and the market shifts toward refinement of font repositories rather than rapid expansion. Demand will be sustained by regular updates to font families, multilingual support, and optimization for high-resolution and variable-font environments. Wider use of open-source design frameworks and standardization in commercial licensing practices will create predictable procurement cycles. The overall momentum pattern reflects a stable digital-asset ecosystem driven by continuous content production, usability requirements, and the growing preference for cost-efficient, license-clear typography across professional and commercial applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 522.4 million |

| Market Forecast Value (2035) | USD 850.9 million |

| Forecast CAGR (2025-2035) | 5.0% |

The free fonts with commercial-use market is expanding as digital designers, small businesses and large enterprises alike seek cost-effective typography solutions for branding, marketing collateral and user interfaces. Free-for-commercial-use fonts reduce licensing costs and simplify compliance for commercial projects, which encourages adoption across startup ventures and established firms. Enhanced online platforms and type foundries provide extensive libraries of fonts under open or permissive licenses that allow embedding, modification and redistribution, supporting scalability in digital publishing and e-commerce.

Growth is further supported by unrestricted global access, widespread design-tool integration and heightened demand for varied typefaces in multilingual and multi-platform environments. The market constraints include the necessity for careful evaluation of license terms, variances in font quality and glyph coverage, and designer concerns about uniqueness given the broad availability of free fonts. Some projects may still require premium or custom-designed typefaces to differentiate brand identity or meet advanced functional requirements.

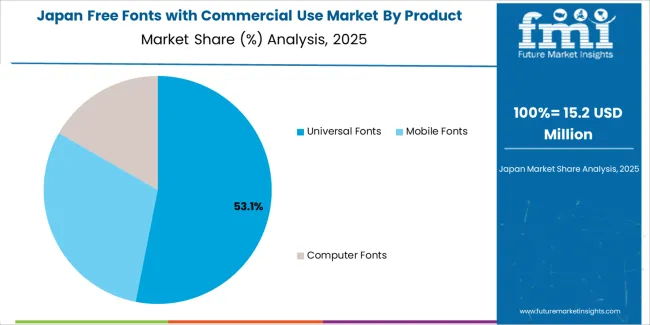

The free fonts with commercial use market is segmented by product type and application. By product type, the market includes mobile fonts, computer fonts, and universal fonts. Based on application, it is categorized into personal and enterprise use. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The universal fonts segment holds the leading position in the free fonts with commercial use market, representing an estimated 51.0% of total market share in 2025. Universal fonts are designed for compatibility across operating systems, devices, and software environments, making them practical for both digital and print applications. Their broad usability supports adoption among designers, developers, and organizations seeking consistent typography across multiple platforms without licensing restrictions.

The computer fonts segment follows with an estimated 32.0%, driven by use in desktop publishing, web design, graphic design suites, and corporate documentation. The mobile fonts category, accounting for about 17.0%, continues to expand with increased demand for mobile app development and responsive digital interfaces.

Key factors supporting the universal fonts segment include:

The enterprise segment accounts for approximately 54.0% of the free fonts with commercial use market in 2025. Enterprises adopt free commercially licensed fonts to reduce brand development costs, ensure broad usability across internal and external platforms, and streamline compliance with usage rights. These fonts are frequently used in marketing materials, websites, applications, and documentation.

The personal segment, representing an estimated 46.0%, includes individual creators, students, freelance designers, and content producers who use free commercial fonts for digital artwork, personal branding, and small-scale commercial projects.

Primary dynamics driving demand from the enterprise segment include:

Growing digital content creation, expansion of small business branding needs, and increased availability of open-license font repositories are driving market growth.

The Free Fonts with Commercial Use Market is expanding as creators, freelancers, and small enterprises seek cost-effective typography for branding, advertising, packaging, and web design. The rise of e-commerce stores, social media marketing, and digital publishing has increased the demand for fonts that can be used legally without licensing fees. Open-license font libraries, community-driven type design, and contributions from independent designers provide broader access to diverse typefaces suited for logos, UI design, and print materials. The growth of web-embedded fonts and cross-platform design tools also strengthens the adoption of freely licensed commercial-use fonts. As start-ups and microbusinesses pursue professional visual identities with limited budgets, the appeal of zero-cost, legally usable typefaces continue to rise.

Quality variability, limited legal clarity in some cases, and lack of premium typographic features are restraining adoption.

Free commercial-use fonts can vary widely in terms of kerning quality, glyph completeness, language support, and technical optimization. Some repositories provide incomplete license information, leading to uncertainty for businesses that require clear commercial rights. Designers working on large-scale or highly visible projects may avoid free options due to concerns about originality, long-term support, or font performance across operating systems and print workflows. Free fonts may also lack advanced OpenType features, specialist styles, or weights needed for complex branding systems, which limits their use in professional, high-detail typography work.

Growth in open-source typography communities, integration with design platforms, and increased demand for multilingual free fonts are shaping industry trends.

Open-source type communities are producing higher quality fonts with structured development, version control, and broader language coverage. Design platforms and website builders now offer integrated libraries of free commercial-use fonts, improving accessibility for non-technical users. Demand for multilingual support is rising as global digital communication expands, prompting font creators to develop extended character sets and improved readability across scripts. These developments support continued growth and diversification within the free commercial-use font ecosystem.

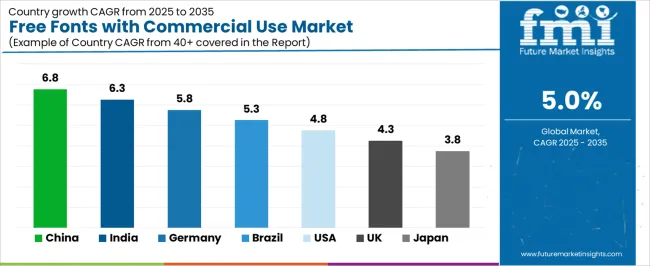

The global free fonts with commercial use market is expanding through 2035, supported by the growth of digital content production, wider adoption of open-license typefaces, and increased demand for legally compliant design assets across creative, corporate, and educational environments. China leads with a 6.8% CAGR, followed by India at 6.3%, reflecting strong digital-media activity and broader use of open-source typography. Germany grows at 5.8%, supported by regulated licensing frameworks and professional-design requirements. Brazil records 5.3%, driven by rising freelance and small-business design adoption. The United States grows at 4.8%, while the United Kingdom (4.3%) and Japan (3.8%) sustain stable demand through consistent digital-publishing and branding needs.

| Country | CAGR (%) |

|---|---|

| China | 6.8 |

| India | 6.3 |

| Germany | 5.8 |

| Brazil | 5.3 |

| USA | 4.8 |

| UK | 4.3 |

| Japan | 3.8 |

China’s market grows at 6.8% CAGR, supported by expanding digital content creation, increased corporate branding activity, and broad demand for typefaces that avoid licensing complications. Free commercial-use font libraries are widely adopted by small businesses, digital-marketing firms, e-commerce sellers, and app-development teams requiring legally compliant typography. Domestic platforms curate font packages optimized for Chinese character sets, focusing on clarity, stroke uniformity, and multiresolution compatibility. Growth in UI/UX design, mobile-app development, and streaming content increases usage of open-license fonts for scalable display across devices. Universities and design institutes promote open-type solutions for educational and professional applications.

Key Market Factors:

India’s market grows at 6.3% CAGR, supported by rising digital-marketing activity, increased use of open-source tools, and expanding freelance design communities. SMEs and content studios adopt free commercial-use fonts to reduce licensing expenditure while maintaining professional visual standards. Platforms offering multilingual typefaces, including Devanagari and regional scripts, gain significant traction as digital publishing grows. Fintech, e-commerce, and educational platforms increasingly incorporate open-license fonts in user interfaces and brand collateral. Broader access to cloud-based design tools strengthens consistent usage across metro and Tier-2 cities.

Market Development Factors:

Germany’s market grows at 5.8% CAGR, supported by strict licensing compliance, professional design requirements, and widespread use of open-license resources in corporate and public-sector environments. Companies prefer commercially permitted fonts that meet clarity, accessibility, and documentation standards required for regulated industries. German design agencies incorporate open-source typefaces in corporate identity systems, technical documentation, and digital communication. Universities and design schools promote open-type resources for academic and professional use. Increased demand for consistent, legally verified typefaces strengthens adoption across public institutions.

Key Market Characteristics:

Brazil’s market grows at 5.3% CAGR, driven by growth in small businesses, freelance creative services, and digital-marketing agencies seeking cost-efficient typeface options. Free commercial-use fonts support branding tasks for local businesses, online retailers, and community organizations. Creative professionals adopt open-license typefaces for social media graphics, web design, and print materials. Platforms offering Latin-script fonts optimized for mobile-friendly display gain popularity as digital communication expands. Increased participation in online education and content-production courses strengthens awareness of licensing-safe typography.

Market Development Factors:

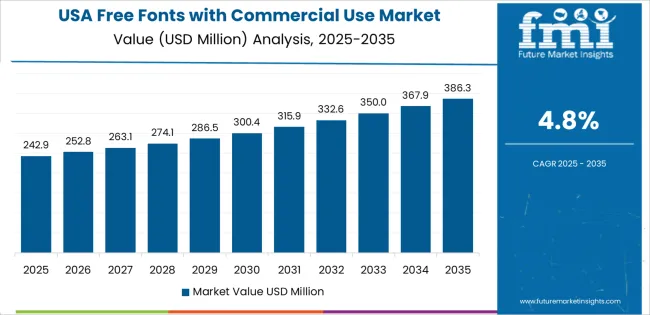

The United States grows at 4.8% CAGR, supported by widespread digital-publishing activity, increased use of open-source tools, and higher demand for legally compliant typography in design workflows. Creative agencies, technology firms, and education platforms incorporate free commercial-use fonts in UI assets, marketing materials, and internal documentation. Typeface repositories expand offerings optimized for screen readability, variable-font formats, and multi-weight families. Open-source design communities contribute to type development, increasing availability of high-quality fonts suitable for commercial environments. Growth in online branding and decentralized content creation supports continued adoption.

Key Market Factors:

The United Kingdom’s market grows at 4.3% CAGR, supported by strong digital-media activity, regulated licensing practices, and broader use of free commercial-use fonts in education, public services, and creative firms. SMEs and digital-design agencies rely on open-license typefaces for branding, newsletters, and UI components. Local repositories provide curated font sets emphasizing legibility, accessibility compliance, and consistent multi-device rendering. Growth in remote work and digital-content outsourcing increases demand for licensing-safe typography across distributed teams.

Market Development Factors:

Japan’s market grows at 3.8% CAGR, supported by expanding digital-publishing activity, demand for legible Japanese-character fonts, and steady adoption among design professionals. Companies and creators rely on free commercial-use typefaces with balanced stroke density and consistent rendering across high-resolution screens. Domestic foundries and open-source contributors release Japanese-optimized fonts suitable for websites, user interfaces, and printed materials. Growth in digital education, mobile-app development, and content-localization activities strengthens demand for high-quality open-license fonts.

Key Market Characteristics:

The free fonts with commercial use market is moderately fragmented, with about fifteen organizations providing open-license or freely usable typefaces for designers, software developers, and businesses. MyFonts leads the market with an estimated 18.0% global share, supported by its large catalogue, structured licensing information, and strong visibility among professional users seeking legally compliant commercial-use fonts. Its leadership is reinforced by consistent categorization, reliable search functions, and established relationships with independent type designers.

Canva, Adobe, Monotype, and TypeType follow as major competitors. These platforms offer curated free font selections alongside paid libraries, allowing users to combine commercially usable typefaces with broader design tools. Their competitive strengths include integrated design environments, broad multilingual support, and reliable licensing transparency. Morisawa, Fontworks, Hanyi, Foundertype, and DynaComware maintain strong positions in East Asian markets, offering Unicode-compliant free fonts suited to regional scripts with stable rendering performance.

Independent foundries such as Typodermic Fonts, Fontfabric, Makefont, and Justfont contribute significantly through open or freemium licensing models aimed at branding, web design, and software UI development. These contributors focus on stylistic diversity, display typefaces, and consistent file quality across formats.

Competition in this market centers on licensing clarity, font quality, language coverage, and platform accessibility. Growth is supported by wider adoption of no-cost commercial fonts in digital content creation, increased remote design activity, and demand for reliable, legally safe typefaces for global web and app development workflows.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Mobile Fonts, Computer Fonts, Universal Fonts |

| Application | Personal, Enterprise |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | MyFonts, Canva, TypeType, Monotype Imaging, Monotype, Morisawa, Adobe, Foundertype, Hanyi, Fontworks, DynaComware, SinoType, Typodermic Fonts, Makefont, Fontfabric, Justfont |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of commercial-use font marketplaces and type foundries; advancements in variable fonts, multilingual typeface development, and webfont licensing; integration with digital design platforms, mobile applications, enterprise branding, and creative software ecosystems. |

The global free fonts with commercial use market is estimated to be valued at USD 522.4 million in 2025.

The market size for the free fonts with commercial use market is projected to reach USD 850.9 million by 2035.

The free fonts with commercial use market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in free fonts with commercial use market are universal fonts, mobile fonts and computer fonts.

In terms of application, enterprise segment to command 54.0% share in the free fonts with commercial use market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Freeze Drying Market - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Drying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Freezer Paper Market Size and Share Forecast Outlook 2025 to 2035

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Free-from Titanium Dioxide Market Size, Growth, and Forecast for 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze-Dried Pet Food Market Anlysis by Pet Type, Nature, Source, Process Type, and Sales Channel Through 2035

Freeze Dried Melt Market Analysis by Product Form, Fruit Type, Sales Channel, Packaging, , and Region Through 2035

Free Standing Display Units Market by Material & End-Use Forecast 2025 to 2035

Freezer Bags Market Growth, Trends and Demand from 2025 to 2035

Freestanding Large Cooking Appliance Market Trends - Growth & Forecast 2025 to 2035

Competitive Overview of Freeze Dried Fruits Market Share

Market Share Distribution Among Free Standing Display Units Providers

Competitive Breakdown of Freezer Paper Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA