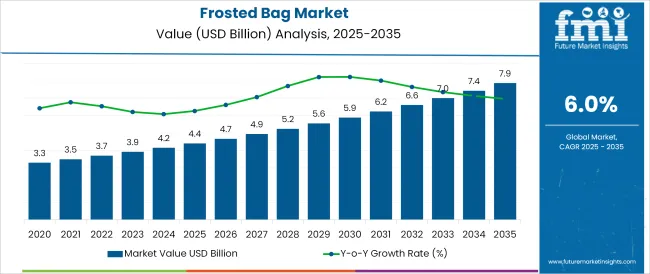

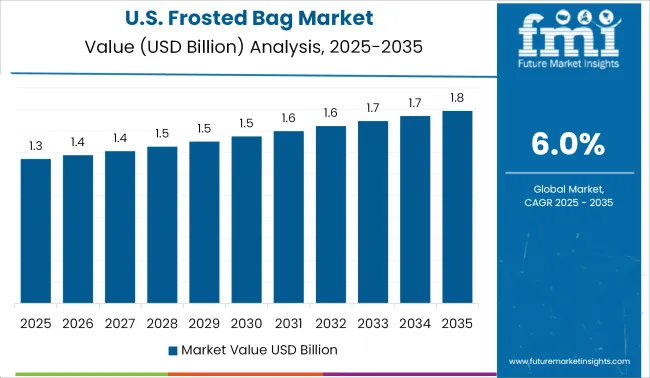

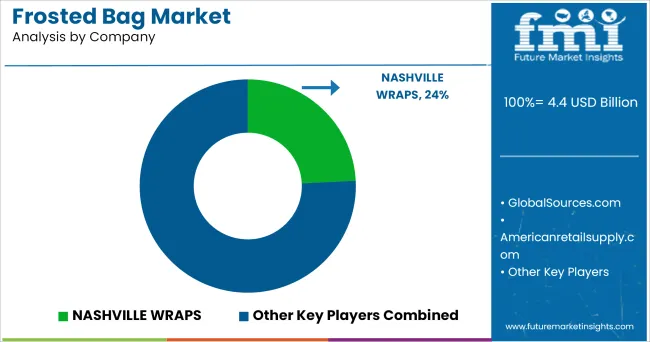

The Frosted Bag Market is estimated to be valued at USD 4.4 billion in 2025 and is projected to reach USD 7.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

The frosted bag market is demonstrating steady growth as businesses and consumers increasingly prioritize durability, aesthetics, and sustainability in packaging solutions. Demand is being fueled by rising consumption of packaged goods, premiumization trends in retail, and the growing emphasis on reusable and environmentally conscious alternatives to conventional plastic bags.

Frosted bags are being favored for their balance of visual appeal and functionality, catering to both brand differentiation needs and operational efficiency. Future growth is expected to be underpinned by innovations in recyclable materials, regulatory encouragement of sustainable practices, and expanding adoption in foodservice and retail sectors.

Enhanced consumer engagement through premium packaging and alignment with corporate sustainability commitments are paving the way for broader market penetration and evolving use cases.

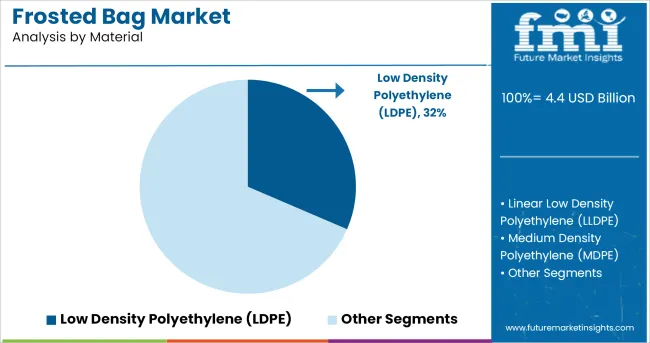

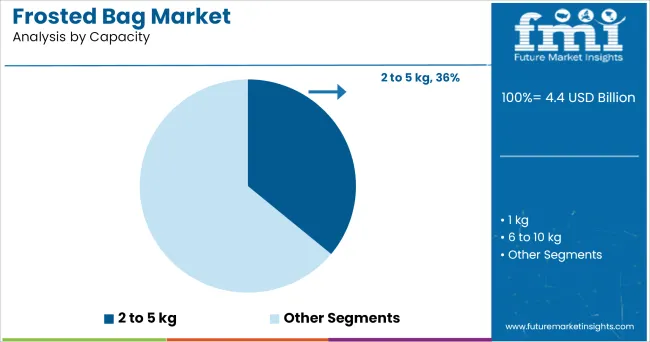

The market is segmented by Material, Capacity, and Application and region. By Material, the market is divided into Low Density Polyethylene (LDPE), Linear Low Density Polyethylene (LLDPE), Medium Density Polyethylene (MDPE), Polypropylene (PP), and High Density Polyethylene (HDPE). In terms of Capacity, the market is classified into 2 to 5 kg, 1 kg, 6 to 10 kg, and 10 kg and Above.

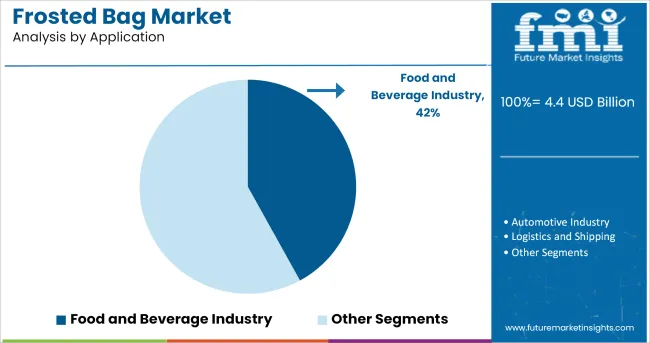

Based on Application, the market is segmented into Food and Beverage Industry, Automotive Industry, Logistics and Shipping, Pharmaceutical, Consumer Goods, Textile, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, low density polyethylene (LDPE) is projected to hold 31.5% of the total market revenue in 2025, making it the leading material type. This leadership has been attributed to LDPE’s inherent flexibility, strength, and ability to produce a frosted finish that is both durable and visually appealing.

Its lightweight nature and cost effectiveness have enabled wide adoption across industries where presentation and protection are equally important. The material’s ability to withstand moisture and mechanical stress while maintaining clarity and texture has reinforced its preference among manufacturers and retailers.

Additionally, advancements in producing recyclable and thinner gauge LDPE have further enhanced its viability, making it an optimal choice for businesses seeking reliable, attractive, and sustainable packaging solutions.

Segmented by capacity, the 2 to 5 kg category is expected to account for 36.0% of the frosted bag market revenue in 2025, securing its position as the dominant segment. This leadership has been driven by its suitability for a wide range of applications that require both convenience and sturdiness.

The 2 to 5 kg capacity has proven optimal for balancing load-bearing requirements with ease of handling, making it popular in retail, foodservice, and takeaway scenarios. Its versatility in accommodating various product sizes and weights while maintaining structural integrity has been instrumental in its adoption.

Furthermore, businesses have favored this capacity range to meet consumer demand for reusable, practical, and aesthetically pleasing bags that are neither too bulky nor too limited, strengthening its continued prominence in the market.

When segmented by application, the food and beverage industry is forecast to capture 42.0% of the market revenue in 2025, establishing itself as the leading end use sector. This dominance has been reinforced by the sector’s need for packaging solutions that offer hygiene, durability, and an elevated customer experience.

Frosted bags have been increasingly adopted in this industry to package and present takeaway meals, baked goods, specialty beverages, and grocery items in a manner that aligns with brand aesthetics and consumer expectations. The ability to protect contents from contamination while projecting a premium image has strengthened their position.

Additionally, heightened consumer sensitivity to presentation in the foodservice context, along with regulatory focus on sustainable and reusable packaging, has prompted widespread deployment of frosted bags. The segment’s central role in driving demand stems from its volume, frequency of use, and willingness to invest in packaging that enhances both functionality and brand perception.

Due to increased demand from end-user industries such as food and grains, retail and pharmaceuticals, the frosted bag market is expected to grow significantly in the future. During the forecast period, emerging markets may support multi-level market growth. The United States, India, China, Germany, the United Kingdom and Brazil are the world's largest food producers.

Due to the demand for packaged food, the consumption of paper and plastic bags has estimated to rise sharply. The recycling of plastic packaging is a main assignment confronted with the aid of using the packaging enterprise throughout the world. The method of recycling multi-layer plastic packaging is complicated because it includes extra steps in comparison to the mono-layer bendy plastic packaging.

Several huge groups also are seeking to lessen their environmental footprint. Frosted bag packaging is a good choice because the customer can reuse it many times after receiving it. This makes it ideal for retailers who want to maintain brand consistency.

Other than offering packaging that’s strong and easy-to-carry, retailers also get to provide their clients with a reusable bag. Automotive OEMs’ growing attention on light weighting has precipitated new possibilities for plastics for the closing decades. The definition of reusable bags is still under debate, which makes it difficult for manufacturers to plan for future capacity requirements.

The dominant market position of this segment can be explained by the increased demand for such products in various application areas in the food and grain, pharmaceutical and retail industries. The increased demand for plastic bags is due to increased demand. Used for lightweight, economical and practical packaging solutions.

In addition to the significant improvement in production, the North American market has also experienced an economic recovery. Since most end-user applications are related to the economic health of the economy, the market is expected to grow at a moderate rate.

Due to the increasing labour demand for semi-finished products, which drives the demand for food bags, the European region has a dominant position in several countries such as Germany and the United Kingdom. In Europe, the vegetable sector dominates because vegetables are exposed to the highest levels in the food.

According to the different end consumers, the market is divided into restaurants, hotels, tea and cafes, candy and snack bars, cafes, houses, etc. In Europe, the main demand for the catering sector comes from labour, who consumes ready-made groceries in the comfort of their homes, which further increases the demand for frosted bags.

Some of the leading manufacturers and suppliers of Frosted bag include

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global frosted bag market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the frosted bag market is projected to reach USD 7.9 billion by 2035.

The frosted bag market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in frosted bag market are low density polyethylene (ldpe), linear low density polyethylene (lldpe), medium density polyethylene (mdpe), polypropylene (pp) and high density polyethylene (hdpe).

In terms of capacity, 2 to 5 kg segment to command 36.0% share in the frosted bag market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Frosted Bottle Market Trends – Size, Share & Growth 2025-2035

Bagasse Tableware Products Market Size and Share Forecast Outlook 2025 to 2035

Bag Closure Clips Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-box Packaging Market Size and Share Forecast Outlook 2025 to 2035

Bag Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Bag On Valve Product Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bag Sealer Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Bagging Machine Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Bottle Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Disposable Cutlery Market Size and Share Forecast Outlook 2025 to 2035

Bagasse Bowls Market Size and Share Forecast Outlook 2025 to 2035

Bag-in-Box Filler Market Insights - Growth & Forecast 2025 to 2035

Bag Market Insights - Growth & Demand 2025 to 2035

Bag Clips Market Insights – Demand, Trends & Forecast 2025 to 2035

Baggage Scanner Market Growth, Trends & Forecast 2025 to 2035

Bag Re-sealer Market Growth – Size, Trends & Forecast 2025 to 2035

Competitive Landscape of Bag-in-Tube Market Share

Market Share Breakdown of Bag-In-Box Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA