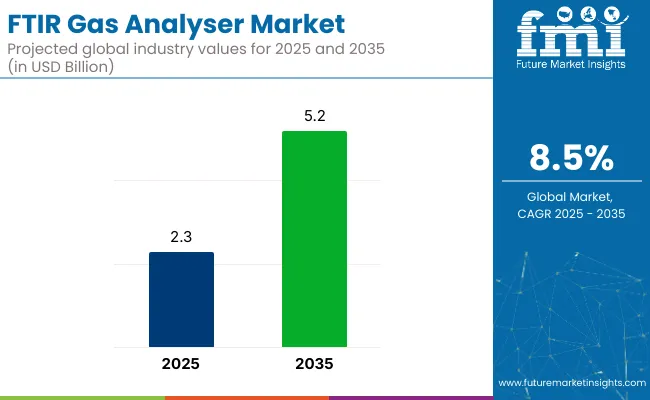

The global Fourier Transform Infrared (FTIR) gas analyser market is valued at USD 2.3 billion in 2025 and is projected to reach USD 5.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.5% during the forecast period. The adoption of FTIR gas analysers has been expanding steadily, supported by increasing requirements for multi-gas monitoring across environmental, industrial, and safety applications.

In 2024, Edinburgh Instruments introduced the IR5 FTIR spectrometer, marking its entry into the segment. This analyser supports configurations with dual detectors and photoluminescence modules, designed for high-resolution gas and molecular analysis. The product has been positioned to meet both academic and industrial research needs, offering temperature-controlled sampling options and multiple spectral range detectors.

Further developments have been seen in the portable analyser category. Gasmet launched the GT5000 Terra in 2025, engineered for field use under rugged conditions. The analyser supports up to 50 gases simultaneously, with measurements delivered within five seconds.

Gasmet’s official product release highlighted the system’s suitability for industrial hygiene inspections, greenhouse-gas assessments, and confined-space monitoring. The GT5000 Terra was noted for its low weight, integrated battery operation, and wireless data transmission, making it ideal for remote deployment scenarios.

ABB continues to enhance its FTIR portfolio with the MBGAS-3000 series. According to the company’s official specifications, the unit has been updated for better thermal and mechanical stability, and is tailored for original equipment manufacturer (OEM) applications in emissions monitoring. These systems are being utilized in stationary source compliance testing, continuous emissions monitoring, and industrial process control environments.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2.3 Billion |

| Market Value (2035F) | USD 5.2 Billion |

| CAGR (2025 to 2035) | 8.5% |

Growth in the FTIR gas analyser market is being driven by increased regulatory scrutiny across Europe and North America, where real-time monitoring of volatile organic compounds (VOCs), carbon monoxide (CO), and nitrogen oxides (NOx) is mandated. FTIR systems are valued for their ability to detect multiple gases simultaneously with high specificity, supporting compliance in sectors such as power generation, cement production, waste incineration, and chemical manufacturing.

Advancements in modularity and cloud connectivity are expected to continue reshaping user interfaces and data analytics. Industry participants are also offering service-linked product bundles, including rental, calibration, and on-site installation programs to support faster deployment.

Low concentration level FTIR gas analyzers (capable of ppb and ppm detection) are estimated to account for approximately 61% of the global market share in 2025 and are projected to grow at a CAGR of 8.7% through 2035. These systems are preferred for their ability to detect and quantify trace-level pollutants and volatile organic compounds (VOCs), which are critical for compliance in cleanroom environments, ambient air monitoring, and emission control.

Industries such as chemical processing, automotive emissions testing, and environmental research rely on low-level FTIR analyzers for their high spectral resolution and multi-gas analysis capability. Manufacturers continue to enhance sensitivity, data acquisition speed, and interference correction to meet global regulatory standards including EPA, EN, and ISO frameworks.

The chemical industry is projected to hold approximately 33% of the global FTIR gas analyzer market share in 2025 and is expected to grow at a CAGR of 8.6% through 2035. FTIR analyzers are widely deployed in chemical plants for continuous monitoring of stack gases, leak detection, and VOC quantification.

These systems provide simultaneous multi-component analysis, enabling better process control, environmental safety, and regulatory reporting. In 2025, operators in petrochemical, specialty chemicals, and polymer manufacturing are increasingly adopting FTIR-based solutions to meet stricter emission norms and maintain air quality within permissible limits.

The demand is particularly strong across Europe, North America, and parts of East Asia, where chemical clusters are expanding and environmental enforcement is intensifying. As facilities seek cost-effective, maintenance-friendly, and precise gas analysis tools, the chemical sector remains a primary growth driver for FTIR gas analyzer manufacturers.

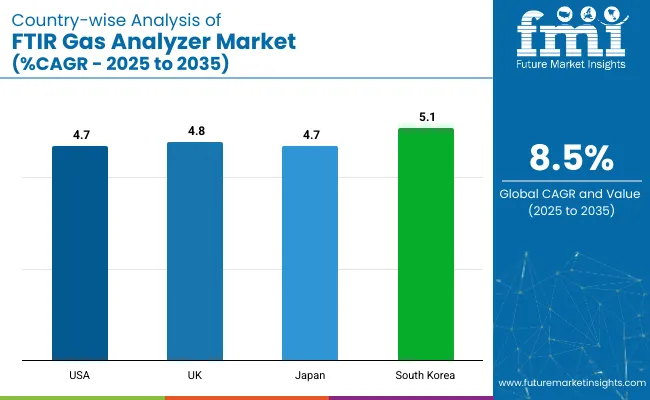

United States FTIR Gas Analyser industryis continuously growing due to high demand for precise gas measurements in different sectors and growing emphasis on environmental regulations. Industries are required to install high-end gas analyser equipment for compliance and monitoring due to stringent air quality standards. Furthermore, growing concerns over climate change and carbon footprint reduction has led business to adopt cleaner technologies, hence driving market growth.

FTIR gas analysers for concurrent detection and quantification of multiple gases are widely used in petrochemicals, power generation, pharmaceuticals etc. The need for optimizing processes and the need to maintain workplace safety will drive market adoption.

Companies are also looking to innovate what they are offering, investing in detection capabilities for multi-gas and improved data analytics to drive efficiency and improve compliance with regulations, she said. Additionally, recent developments in portable and AI-enabled FTIR analysers for field emissions analysis in real-time can help improve operational efficiencies across a range of industries. The increasing adoption of Industry 4.0 and smart factory initiatives is driving the deployment of IOT-enabled FTIR gas analysers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.7% |

The United Kingdom’s FTIR Gas Analyser market is experiencing steady growth, fueled by intensifying regulatory scrutiny on emissions and an accelerated national commitment to net-zero targets. In a landscape shaped by the UK’s Clean Air Strategy and carbon neutrality goals for 2050, industries are compelled to integrate advanced gas monitoring solutions for both compliance and operational transparency.

FTIR gas analysers, with their ability to perform simultaneous multi-gas detection with high precision, are gaining traction across key sectors such as chemical manufacturing, utilities, waste management, and pharmaceuticals. The UK’s large base of legacy industrial infrastructure also creates demand for retrofitting with smarter, low-maintenance, and highly accurate gas monitoring systems.

The shift towards decarbonization and circular economy models has driven companies to adopt FTIR analysers not just for regulatory compliance but also to achieve internal ESG (Environmental, Social, and Governance) performance benchmarks. Leading companies are investing in miniaturized, AI-augmented FTIR devices capable of providing real-time analytics, predictive maintenance insights, and remote monitoring, aligning with broader Industry 4.0 adoption across British manufacturing ecosystems.

Moreover, government-backed programs encouraging innovation in clean technologies and grants for industrial decarbonization are accelerating R&D in portable, IoT-integrated FTIR analysers. The growing need for flexible, in-field emissions testing - especially in waste-to-energy plants, offshore installations, and environmental research labs - is expected to drive further market expansion in the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

Japan’s FTIR Gas Analyser market is advancing rapidly, driven by the country’s twin imperatives of stringent environmental control and relentless technological innovation. The Ministry of the Environment’s tightening emission standards, especially for volatile organic compounds (VOCs) and hazardous air pollutants, has pushed industries to adopt high-precision FTIR-based gas analysis systems for real-time monitoring and compliance assurance.

FTIR gas analysers are witnessing heightened deployment across automotive, chemical, and semiconductor sectors. Automotive manufacturers leverage them extensively for exhaust gas analysis and R&D into next-generation, low-emission vehicles, while semiconductor fabrication plants require ultra-sensitive gas monitoring to ensure product quality and environmental safety. The Japanese government’s funding incentives for advanced sensing technologies are further catalyzing domestic R&D in miniaturized, AI-powered FTIR platforms.

The country’s national push towards Smart Cities, factory automation, and carbon neutrality by 2050 is fostering the adoption of IoT-enabled FTIR analysers. Companies such as Horiba, Shimadzu, and Hitachi High-Tech are at the forefront, embedding AI-driven analytics for predictive maintenance, multi-gas pattern recognition, and real-time process optimization, expanding FTIR applications beyond traditional compliance monitoring into proactive industrial efficiency gains.

With Japan’s industrial sector under pressure to achieve both economic and environmental optimization, FTIR technology is evolving from a regulatory necessity to a strategic tool for competitive advantage.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

South Korea’s FTIR Gas Analyser market is expanding swiftly, underpinned by aggressive industrialization, strengthened environmental regulations, and a national pivot toward smart, digitally connected industries. Regulatory pressure from the Ministry of Environment to curb industrial emissions - in alignment with global climate commitments - is compelling manufacturing hubs to upgrade to high-precision FTIR-based gas monitoring solutions.

The semiconductor and petrochemical sectors, cornerstones of South Korea’s economy, are among the largest adopters of FTIR technology. Here, analysers are not only used for emissions control but increasingly for process optimization, defect reduction, and safety assurance. Government-driven initiatives around smart healthcare infrastructure and enhanced indoor air quality standards are opening new growth avenues for FTIR deployments beyond traditional heavy industry.

Emerging technologies integrating FTIR systems with 5G connectivity, real-time AI analytics, and IoT platforms are reshaping South Korea’s gas monitoring landscape. Companies like LG Electronics, SKC, and Gasmet are investing heavily in portable, AI-augmented FTIR devices aimed at making gas analysis faster, smarter, and more scalable across industries.

These firms are also experimenting with machine learning-based spectral analysis to enhance detection sensitivity, efficiency, and predictive capabilities - essential features in South Korea’s vision for a fully integrated smart industrial economy.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

During the forecast year of 2025 to 2035, the Global FTIR Gas Analyser market would be twirling at a high growth rate of 8.5%.

The Worldwide FTIR Gas Analyser market was valued at USD 2.3 billion for the year 2025.

News: The Global FTIR Gas Analyser Industry is expected to reach USD 5.2 Billion by 2035 End.

North America is the fastest growing region in the In-line continuous emission monitoring system market, owing to stringent environmental regulations and rising need for monitoring industrial emissions.

BREMBO S.p.A., Surface Transforms PLC, MAT Foundry Group Ltd., TVR Automotive Limited, Alfa Romeo Automobiles S.p.A., Audi AG, Volkswagen of America, Carroll Shelby International, ALPINA Burkard Bovensiepen GmbH + Co. KG, BRABUS GmbH, ABT Sportsline GmbH, DeLorean Motor Company, and others are the key players operating in the Global FTIR Gas Analyser industry.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.