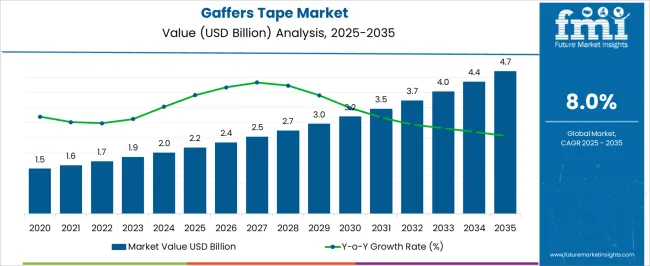

The Gaffers Tape Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 4.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Gaffers Tape Market Estimated Value in (2025 E) | USD 2.2 billion |

| Gaffers Tape Market Forecast Value in (2035 F) | USD 4.7 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The gaffers tape market is showing a consistent upward trend driven by growing adoption across commercial, industrial, and consumer-grade applications that require residue-free adhesive solutions. Market dynamics are being shaped by the expanding use of durable, matte-finish tapes in professional audio-visual setups, stage rigging, electrical insulation, and high-temperature packaging environments. Recent developments in adhesive technology and backing material formulations are allowing manufacturers to produce tapes with enhanced tensile strength, weather resistance, and surface compatibility.

Regulatory shifts encouraging the reduction of plastic waste are also influencing innovation toward recyclable and sustainable alternatives in tape manufacturing. A rise in demand for moisture-resistant and non-reflective adhesive solutions in the entertainment and media industry has led to increasing deployment in filming locations, studios, and event venues.

With the growing sophistication of e-commerce and logistics networks, gaffers tape is increasingly used in secure packaging applications that require easy removability and non-damaging adhesion The market outlook remains positive as end-use industries continue to prioritize performance and efficiency in temporary fastening and bundling solutions.

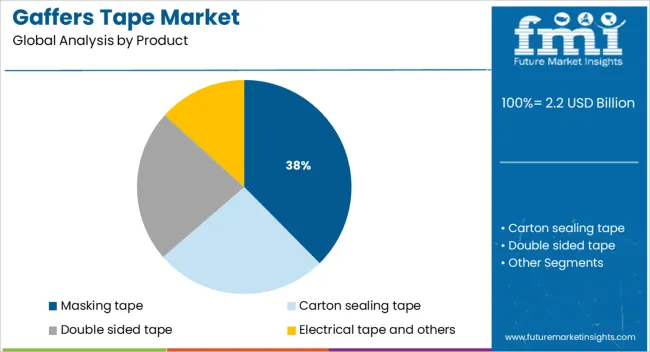

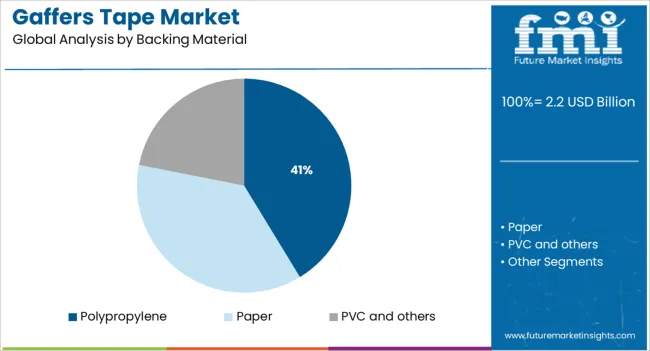

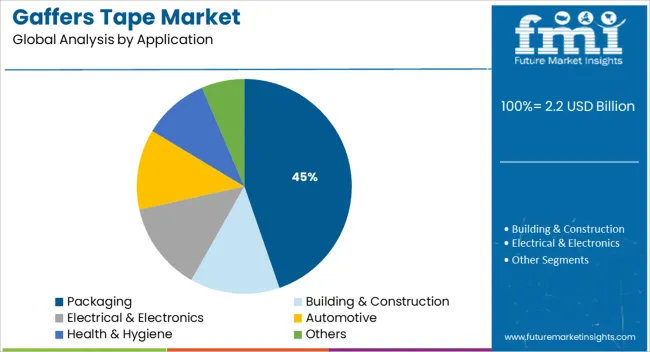

The market is segmented by Product, Backing Material, and Application and region. By Product, the market is divided into Masking tape, Carton sealing tape, Double sided tape, and Electrical tape and others. In terms of Backing Material, the market is classified into Polypropylene, Paper, and PVC and others. Based on Application, the market is segmented into Packaging, Building & Construction, Electrical & Electronics, Automotive, Health & Hygiene, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The masking tape segment is projected to account for 37.6% of the gaffers tape market revenue share in 2025, making it the leading product category. This dominance is being driven by the growing preference for versatile, residue-free tapes in surface protection, painting, and bundling tasks across construction, automotive, and general maintenance sectors. The ability of masking tape to adhere securely yet remove cleanly without damaging surfaces has made it highly suitable for both industrial and household uses.

Increasing demand for high-precision masking in temperature-sensitive environments, especially in painting and powder-coating operations, has reinforced the product’s value proposition. Furthermore, enhanced compatibility with diverse substrates such as metal, glass, wood, and plastic is supporting its application across a wide spectrum of industries.

The ongoing expansion of do-it-yourself (DIY) trends, coupled with rising awareness around surface safety and efficiency, has further propelled the widespread adoption of masking tapes As end users continue to seek high-performance adhesive solutions with clean removal characteristics, the segment is expected to retain its market-leading status.

The polypropylene backing material segment is expected to hold 41.3% of the gaffers tape market revenue share in 2025, reflecting its strong position in terms of material preference. The segment’s growth is being supported by the intrinsic strength, flexibility, and cost-efficiency that polypropylene provides compared to alternative materials. Its resistance to tearing, abrasion, and chemicals under various environmental conditions makes it ideal for industrial, commercial, and packaging-related tape applications.

Manufacturers are increasingly utilizing polypropylene to produce lightweight and durable gaffers tapes that meet high adhesion standards while minimizing production costs. Enhanced compatibility with both synthetic and natural adhesive coatings has also enabled the material to meet the performance needs of diverse sectors, including logistics, entertainment, and construction.

Additionally, advancements in recyclable and sustainable polypropylene grades are aligned with industry-wide initiatives focused on reducing environmental impact The ability to balance performance, affordability, and adaptability has positioned polypropylene as a preferred choice in the evolving landscape of backing materials for gaffers tape.

The packaging application segment is anticipated to capture 44.7% of the gaffers tape market revenue share in 2025, securing its place as the most significant area of application. The rise of e-commerce, along with increasing global shipping volumes, has accelerated the demand for secure, tamper-evident packaging solutions that do not compromise surface integrity. Gaffers tape is being increasingly adopted for packaging due to its ability to provide strong adhesion with easy removability, particularly in high-value goods, electronics, and sensitive materials.

The matte finish and non-reflective properties of gaffers tape have further enhanced its suitability for discreet packaging solutions across both retail and industrial sectors. As businesses seek environmentally responsible alternatives to traditional packaging materials, the reusability and lower residue characteristics of gaffers tape are becoming highly valued.

Moreover, the integration of printable surfaces on gaffers tape for branding and logistics tracking is gaining traction The continued expansion of supply chain infrastructure and fulfillment operations is expected to reinforce the dominance of the packaging segment within the overall market.

Global packaging industry has witnessed a number of technological advancement from last couple of decades. As packaging is unexecuted without the use of tape, the increasing demand for packaging from industrial sector in turn is creating huge opportunity for industrial tape market.

The introduction of gaffers tape over duct tape has provided the manufacturer a wide range of packaging advancement. Gaffer tape which is also known as camera tape or spike tape is regarded as heavy cotton cloth pressure sensitive tape that delivers high adhesive properties.

Through gaffers tape, now the manufacturers can use the tape on any kind of packaging material without the need for a solvent (such as water) or heat for activation. Gaffer tape is widely used in theatre, photography, film television production and industrial staging works.

One of the significant factors contributing towards the growth of the gaffers Tape market share is the rampant growth of industrial tape industry. Moreover, the growing consumption of Gaffers Tape from automotive and construction segment is expected to rise the demand of gaffers Tape over the forecast period.

Furthermore, Gaffers Tape is suitable for all types of packaging material owing to its properties such as better adhesive holding power, improved moisture resistance, better conformability and instant adhesion. Characteristics such as compatibility with various sterilization forms and non-toxic nature displayed by Gaffers Tape is further estimated to enhance the demand of Gaffers Tape market over the forecast period.

Ease of entrance in the market has resulted in increasing competition in the global tape market. This has encouraged the vendors to introduce new and advance form of gaffers Tape, for instance double sided gaffers tape with high performance.

Today most of the gaffers tape companies are focusing on highly efficient eco-friendly recovery technology for adhesive coating and is expected to be the next growth opportunity for pressure sensitive manufacturers over the forecast period.

However, the gaffers tape market is highly fragmented market due to presence of numerous regional and local players. These manufacturers offers innovative packaging solution related to tape at a lower price than multinational players, resulting in intense price wars. It is expected that large multinational players will acquire the small regional and local players over the forecast period.

Geographically, the global gaffers tape market is segmented into North America, Latin America, Europe, Asia-Pacific (APAC) and the Middle East Africa (MEA). The global gaffers tape market is expected to witness a significant CAGR over the forecast period of 2020-2035.

Moreover, APAC dominates the global gaffers tape market and the trend is expected follow the same over the forecast period due to growing construction industry in the wake of population growth, government plan for infrastructure development and urbanization. Apart from this, the ample availability of raw material such as PVC, polypropylene etc.

in China is projected to fuel the demand for gaffers tape market in APAC region. North America is expected to follow APAC in gaffers tape market over the forecast period.

Some of the major players identified across the globe in the Gaffers Tape market are Henkel AG Co., KGaA, 3M Company, The Dow Chemical Company, Avery Dennison, Ashland Inc. and H.B Fuller.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geography, product type, material type and end-use.

The report is a compilation of first-hand information, qualitative, and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global gaffers tape market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the gaffers tape market is projected to reach USD 4.7 billion by 2035.

The gaffers tape market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in gaffers tape market are masking tape, carton sealing tape, double sided tape and electrical tape and others.

In terms of backing material, polypropylene segment to command 41.3% share in the gaffers tape market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Breakdown of Gaffers Tape Providers

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

Leading Providers & Market Share in PVC Tapes Industry

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Duct Tape Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA