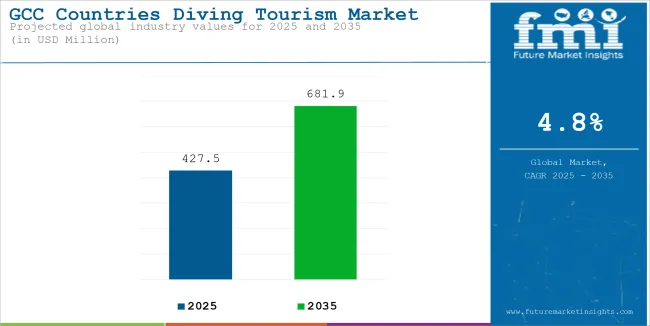

The GCC diving tourism market will witness a steep growth curve over the next ten years. With a market size of USD 427.5 million in 2025 estimated, the market is likely to expand to USD 681.9 million by 2035, with a CAGR of 4.8% from 2025 to 2035. Increased interest in marine exploration, easier access to world-class dive sites, and added demand for environmentally friendly and sustainable tourism experiences are the main drivers for this rise.

The GCC region, especially the UAE, Oman, and Bahrain, is becoming a prime destination for divers worldwide, offering both exotic underwater ecosystems and the latest in diving technology.

| Attribute | Value |

|---|---|

| Estimated Industry Size (2025E) | USD 427.5 Million |

| Projected Value (2035F) | USD 681.9 Million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The market is also expanding rapidly due to increased international exposure, luxury travel trends, and the popularity of dive resorts and liveaboard experiences. GCC countries are promoting a sustainable approach to marine tourism, focusing on environmental protection, coral reef conservation, and underwater archaeological explorations. This innovation and sustainability are leading to an increasing number of divers visiting the region annually.

As attention is drawn through new diving technologies, sustainable tourism practices, and unique underwater attractions, the diving tourism market for the GCC region will increase to 1.6X value over the next 10 years.

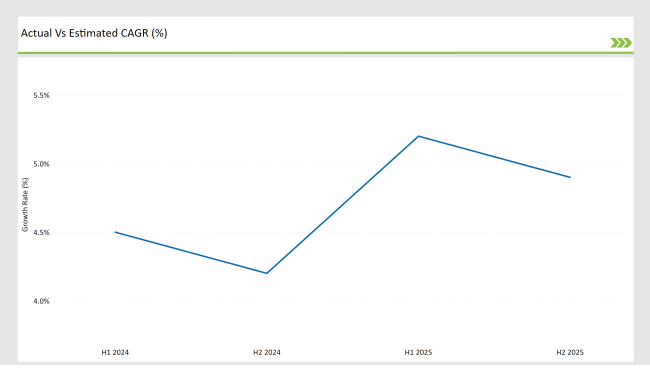

The GCC diving tourism market began on an encouraging note in 2024, with bookings increasing by 4.5% compared to the previous year. This upward trend is expected to continue throughout 2025, with an overall CAGR of 4.8%.

Some of the key growth drivers are the demand for luxury dive resorts, eco-friendly diving tours, and the technology that has made diving accessible to all levels of skill. This indicates an easily visible shift within the market itself towards a further rise in the demand for liveaboard diving and expansion on guided tours directed at marine conservation

Wreck diving has received much attention in the GCC market and is specially popular around the UAE and Bahrain because of many historical shipwrecks and underwater ruins available for exploration. Vast ancient trade routes close to the UAE and, not to mention an enriching maritime history of Bahrain, make it an inviting haven for those who want to dig out sunken ships, military vessels, or ancient structures. This segment of diving tourism is likely to expand as more shipwreck sites will be found and opened for the public to visit.

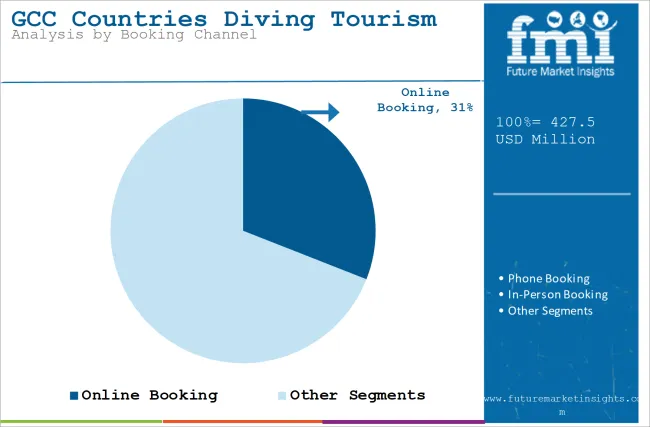

Like global trends, online booking platforms are the preferred source for divers in the GCC region. The ease of availability of diving packages, checking available dive sites, and price comparison through mobile applications and websites is driving the adoption of online booking channels.

Tourists can book their experiences prior to the tour, check its availability, and even have a customized dive itinerary. As dive operators in the area focus more on enriching their offerings digitally, an overwhelming onslaught online is projected.

| Date | Development & Details |

|---|---|

| Dec 2025 | Launch of Marine Conservation Diving Packages by Dive Arabia: Dive Arabia, a key diving operator in the UAE, has launched its first eco-friendly diving packages in the Gulf of Oman. These packages are aimed at protecting coral reefs and marine life, allowing environmentally conscious tourists to explore pristine underwater ecosystems while promoting sustainable tourism. |

| Jul 2024 | Expansion of Diving Resorts in Oman: An established resort chain opened new eco-friendly diving resorts along Oman’s coast. The resorts offer divers access to Oman’s rich marine life, including vibrant coral reefs and diverse fish species. These resorts are committed to reducing their environmental impact by implementing green building practices and offering educational programs on marine preservation. |

| Oct 2024 | Launch of VR Diving Experiences by Al-Dive Technologies: Al-Dive Technologies, in collaboration with leading GCC dive operators, launched an innovative virtual reality diving experience. This allows potential divers to explore famous GCC dive sites in VR before committing to a real-life diving adventure. This initiative is designed to increase accessibility and attract new customers. |

| Jan 2024 | Partnership Between UAE Marine Parks and Dive Operators: An agreement between the UAE Ministry of Climate Change and Environment and several dive operators has been announced. The campaign aims to promote sustainable diving experiences in protected marine areas that host coral reefs, marine life, and efforts to preserve those underwater environments. |

| Mar 2024 | Introduction of Family-Oriented Diving Packages by Dive Arabia: Dive Arabia has launched family-friendly diving packages targeting the parents, with children above 8 years old, and these packages take in shallow-water dives, introductory snorkeling, and conservation-focused activities. The tours allow families seeking a safe and educational approach to exposure to marine life. |

Technological innovations in diving equipment have really raised the threshold of the diving experience in the GCC. Advanced dive computers, underwater cameras, and advancements in diving masks, rebreathers, and much more mean that divers may enjoy a safer, more intimate experience.

Dive operators in the region have been incorporating the latest and most innovative equipment possible to enhance underwater view, comfort, and safety. The introduction of virtual reality (VR) and augmented reality (AR) technologies also allows people to experience the diving sites virtually before a real dive.

Liveaboard diving is expected to be on the increase within the GCC region, as divers seek longer multi-day trips into remote areas that are pristine and still unexplored. In the UAE, Bahrain, and Oman, liveaboard operators are offering exclusive access to un-explored sites, including coral reefs off the Musandam Peninsula in Oman and waters surrounding artificial islands in the UAE.

These liveaboard trips give divers unparalleled access to unspoiled underwater ecosystems while enhancing the overall appeal of diving tourism.

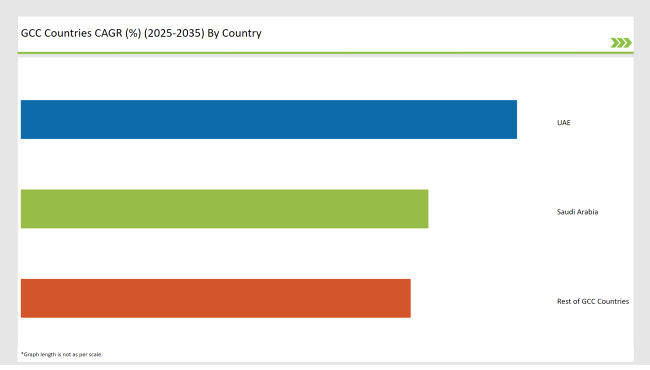

The Saudi Arabian diving tourism market is experiencing high growth due to the country's ambitious Vision 2030, which focuses on increasing tourism and diversifying the economy. Saudi Arabia boasts over 2,000 kilometers of coastline along the Red Sea and the Arabian Gulf, providing some of the world's most pristine and uncharted dive sites, including vibrant coral reefs, shipwrecks, and unique underwater ecosystems.

Farasan Islands, Red Sea coast near Jeddah, and the untouched marine life of the Arabian Gulf are the most popular dive destinations, attracting both international divers and local enthusiasts. Heavy investments in tourism infrastructure and other initiatives by the Saudi government seem to be turning the country into a thriving hub for diving tourism, especially through eco-tourism and marine conservation efforts. Saudi Arabia is also focusing on luxury and adventure tourism, positioning the country as an emerging premium diving destination for a global market seeking new, unexplored underwater adventures.

The UAE is developing as one of the luxury diving tourism markets in the GCC. Market share in the UAE is still driven by world-class dive resorts, luxurious liveaboard cruises, and premium diving experiences. Divers find coral reefs, shipwrecks, and marine life in the warm waters of the Arabian Gulf to explore.

Dubai and Abu Dhabi are also rapidly and dramatically increasing high-end diving experiences for affluent tourists, such as private guided dives and underwater photo shoots.

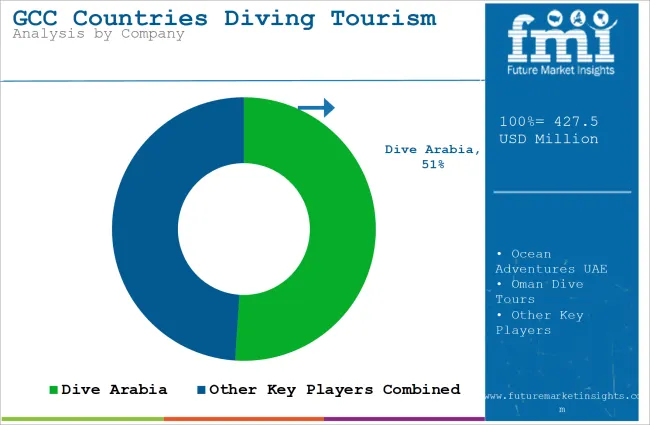

The GCC diving tourism market is moderately concentrated, with key players such as Dive Arabia, Ocean Adventures UAE, and Oman Dive Tours.

The key operators are diversifying their services to cater to the various consumer segments by offering eco-conscious diving experiences, family-friendly packages, and exclusive liveaboard diving tours. Smaller operators are targeting niche markets such as wreck diving, underwater photography tours, or specialized marine research expeditions.

The GCC diving tourism market is expected to grow at a CAGR of 4.8% from 2025 to 2035.

The market is projected to reach an estimated value of USD 681.9 million by 2035.

The main drivers are the increasing demand for sustainable and luxury diving experiences, growing interest in underwater exploration, and the adoption of advanced diving technologies.

Key players in the GCC diving tourism industry include Dive Arabia, Ocean Adventures UAE, and Oman Dive Tours, known for their various diving packages focused on sustainability and luxury.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Functional Food & Beverage Market Size and Share Forecast Outlook 2025 to 2035

GCC Natural Gas Market Size and Share Forecast Outlook 2025 to 2035

GCC Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

GCC Mini Cranes Market Size and Share Forecast Outlook 2025 to 2035

GCC Functional Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GCC Medical Gloves Market Trends - Growth, Demand & Forecast 2025 to 2035

GCC Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

GCC Automotive Turbocharger Market Trends – Growth, Demand & Forecast 2025–2035

GCC Yeast Market Trends – Growth, Demand & Forecast 2025–2035

GCC Green and Bio-based Polyol Market Trends – Growth, Demand & Forecast 2025–2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

GCC Barite Market Trends – Growth, Demand & Forecast 2025–2035

GCC 1,4-Diisopropylbenzene Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Yacht Charter Service Market Analysis – Trends & Forecast 2025 to 2035

GCC Flare Gas Recovery System Market Report – Trends, Demand & Industry Forecast 2025–2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

GCC Electric Golf Cart Market Outlook – Demand, Growth & Forecast 2025-2035

GCC Active Spoiler Market Trends – Growth, Demand & Outlook 2025-2035

GCC Hydrochloric Acid Market Growth – Trends & Forecast 2025-2035

GCC Calcium Oxide Market Growth – Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA