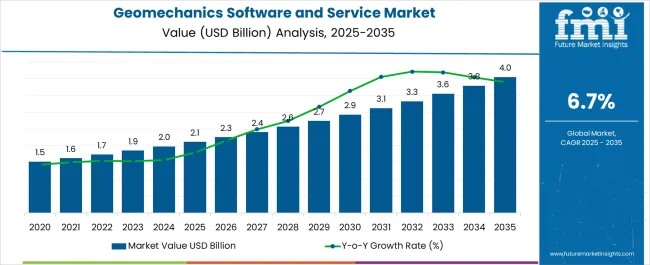

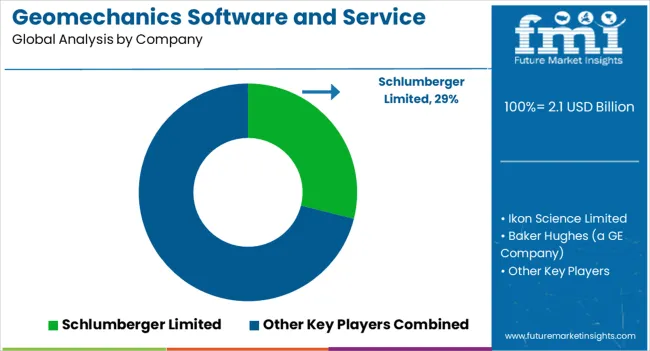

The Geomechanics Software and Service Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 4.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Geomechanics Software and Service Market Estimated Value in (2025 E) | USD 2.1 billion |

| Geomechanics Software and Service Market Forecast Value in (2035 F) | USD 4.0 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The geomechanics software and service market is advancing rapidly due to the increasing complexity of subsurface exploration and the need for precise analysis of rock and soil behavior. Rising demand for enhanced drilling efficiency, safe reservoir management, and reduced operational risks has led industries to adopt advanced geomechanics tools.

Integration of artificial intelligence, data analytics, and 3D modeling has enabled more accurate predictions and optimization of drilling operations. The push for sustainable resource extraction and regulatory compliance has further supported adoption across energy and mining sectors.

The outlook remains promising as companies continue to prioritize real time decision making, operational safety, and cost efficiency, positioning geomechanics solutions as a vital enabler in high risk industrial operations.

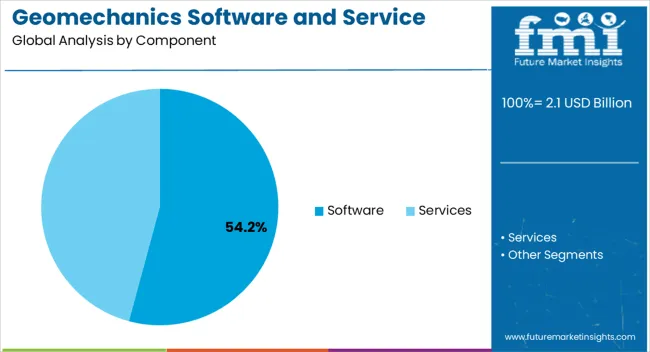

The software segment is projected to hold 54.20% of total revenue by 2025 within the component category, making it the leading segment. Growth is being driven by the ability of software to provide simulation, modeling, and predictive insights that optimize drilling and exploration activities.

Enhanced visualization, automated workflows, and compatibility with other subsurface analysis tools have strengthened its adoption.

As industries seek to mitigate risks and improve efficiency, reliance on advanced software platforms continues to expand, solidifying its dominance in the component segment.

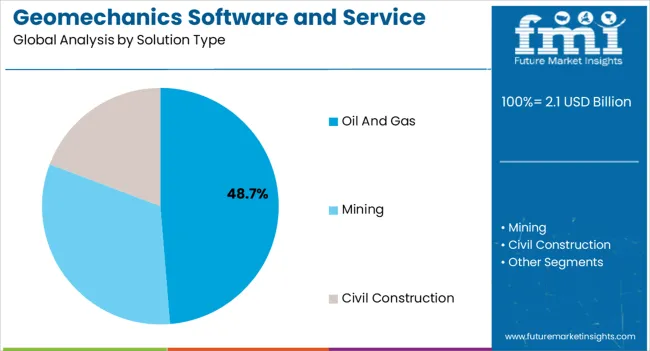

The oil and gas segment is expected to account for 48.70% of total market revenue by 2025, establishing it as the leading end use industry. This prominence is supported by the high need for geomechanics solutions in reservoir management, wellbore stability, and hydraulic fracturing operations.

Rising global energy demand and the push to maximize production from complex reservoirs have further increased adoption. Compliance with strict safety and environmental regulations has also driven reliance on geomechanics analysis in oil and gas projects.

These factors collectively reinforce the leadership of this segment.

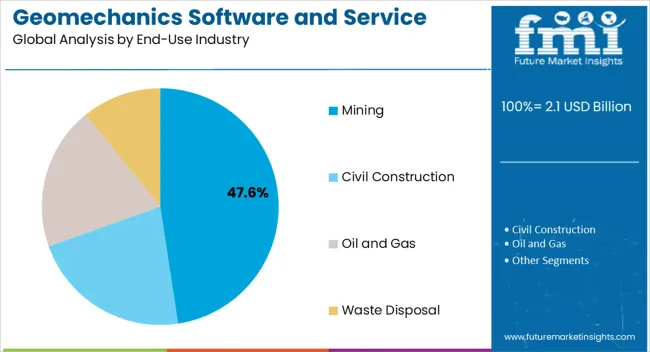

The mining segment is projected to contribute 47.60% of total market revenue by 2025, positioning it as a key end use category. Its growth is attributed to the rising demand for advanced geomechanics in open pit design, underground excavation, and slope stability analysis.

Increasing safety requirements, coupled with the need to optimize resource extraction, are accelerating the adoption of geomechanics software and services in mining operations. The integration of advanced modeling capabilities with field data has enhanced operational planning and risk mitigation.

As global mining projects expand, this segment is expected to maintain strong adoption levels.

It has become increasingly significant to conduct geomechanical investigations to increase awareness of green initiatives. This has led to the increased use of geomechanics software and services in the market. As the oil & gas industry has become increasingly digitalized, the market demand for software and services related to geomechanics has increased.

An increase in technological innovation in the oil and gas industries is leading to a better understanding of their reservoir resources, improvements in safety and health, and enhancements in operational efficiency.

The global demand for seismic and geophysical imaging continues to grow within the oil and gas industry, infrastructure development, and civil construction markets, which is driving the market toward further growth in geomechanics software and service in the market.

Oil and gas companies are turning to geomechanics images to maximize exploration activities. With the growth in construction projects and investments in infrastructure, this industry is experiencing a good deal of growth in the mining and oil and gas sectors. Additionally, the increasing need for companies to reduce the costs of operations is also encouraging companies to adopt geomechanics software and services in the market.

Oil & gas companies are searching for methods to reduce the costs of operations and increase efficiency since oil prices are uncertain and competition is increasing. Consequently, organizations are increasingly seeking geomechanics software and services for optimizing operational performance using advanced tools and services.

Technological innovations such as IoT have made geomechanical data generation easy in recent years and thus geomechanics software adoption is expected to rise in the future.

It is anticipated that the increasing cost of resolution, accuracy, precision, range, and repeatability to put downward pressure on the market for geotechnical services and inhibit growth. In addition, the cost of systems and services associated with geotechnical software and hardware is predominantly influenced by the complexity of structures. Thus, the high costs of geotechnical services are a limiting factor in the growth of the market.

The decline in investments made in IT projects in the oil and gas and mining industries is limiting the growth of the geomechanics software and services market although commodity prices are fluctuating. Even with this, the lack of competent professionals in the oil and gas industry is acting as one of the key impediments to the growth of the industry.

It has become increasingly vital to conduct geomechanical investigations to increase the awareness of green initiatives and this has led to the increased use of geomechanics software and services in the market. As the oil & gas industry has become increasingly digitalized, the market demand for software and services related to geomechanics has increased.

An increase in technological innovation in the oil and gas industries is leading to a better understanding of their reservoir resources, improvements in safety and health, and enhancements in operational efficiency.

Oil and gas companies are turning to geomechanics images to maximize exploration activities. With the growth in construction projects and investments in infrastructure, this industry is experiencing a good deal of growth in the mining and oil and gas sectors. Additionally, the increasing need for companies to reduce the costs of operations is also encouraging companies to adopt geomechanics software and services in the market.

Oil & gas companies are searching for methods to reduce the costs of operations and increase efficiency since oil prices are uncertain and competition is increasing. Consequently, organizations are increasingly seeking geomechanics software and services for optimizing operational performance using advanced tools and services. Technological innovations such as IoT have made geomechanical data generation easy in recent years and thus geomechanics software adoption is expected to rise in the future.

As of 2025, Japan’s geomechanics software and service market accounted for 5.8% of the revenue share, driven by government initiatives to support safety concerns in the construction industry. There is an increasing pool of technologically advanced companies, as well as an increase in the demand for ultrasonic surveys from clients in this region that have propelled the growth of the geomechanics software and services market.

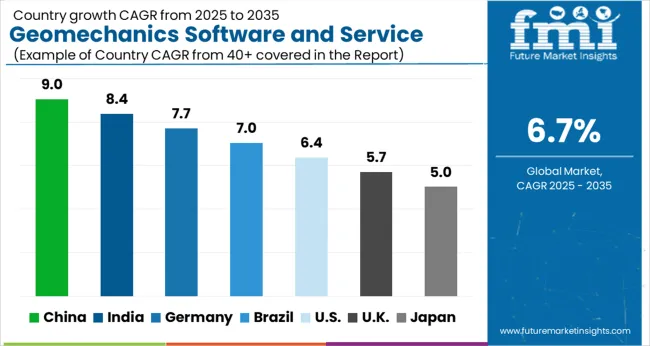

In Asia Pacific, new investment in the oil and gas and mining industries is likely to be a driving factor in generating strong growth prospects during the forecast period. As a result of government regulations in this country that favor renewable power generation resources, China and India are expected to be significant markets for geomechanics software and services in the market.

In the last two years, China has contributed 7.8% of revenue growth across the region, mainly due to the factors such as:

The market for geomechanics software and services is in demand due to an increasing number of mining projects and oil and gas plants being set up in India. As a part of a global forecast, the market for geomechanics software and services in India is anticipated to expand at a CAGR of 6.9% from 2025 to 2035.

In North America, increasing oil & gas activities are positively influencing the growth of the market. According to estimates, the United States market value has commanded a 25.4% share in 2025. Over the forecast period, this region is predicted to expand at a compound annual rate of 7.9%.

Shale gas exploration is continuing to grow in the market, which is resulting in the growth of the region's market. Moreover, the presence of the key market players in the region is also fostering the growth of this market.

During the forecast period, the geomechanics software and service market in the United Kingdom is anticipated to expand at a compound annual growth rate of 5.7%. The United Kingdom has large reserves of mineral resources than any other region in the world, which means there is an increased need for geomechanical software as well as services.

Services account for 7.9% of the market growth over the forecast period. Among the key factors contributing to the growth of the market can be attributed to the fact that support and maintenance for software solutions have been widely adopted by the oil and gas industry on a large scale.

The growing demand for real-time analytics in the oil & gas industry has also contributed to the acceleration of the adoption of software consulting services in the market. In addition, third-party service providers are also creating a market for services within the oil and gas market.

Growing market demand for consultation services from companies with expertise in different industries such as mining, oil, gas, etc. is further propelling the development of geomechanics software and services in the market. The rise in demand for 3D/4D modeling services and triaxial core analysis for geomechanics demand for these services has raised in the market.

The demand for geomechanics services has grown in the market as a result of the rise in construction projects and engineering solutions to the issues of tunnel design and soil/rock structure interaction. Hence, all these factors are propelling the growth of services in the geomechanics industry.

Geomechanics software has seen a strengthening market since the oil & gas sectors have been experiencing great safety concerns and increased risk factors in recent years. This has influenced the market growth for geomechanics software packages. A few factors have sparked the development and growth of geomechanics software and services, which include:

The geomechanics model can be applied to different parts of the exploration and production industry, from the exploration phase to abandonment, and from microscale to model reservoirs, fields, and basins. In addition, regulators, NGOs, and others are increasingly urging governments to restrict exploration and development activities in many parts of the world about perceived adverse environmental impacts. Therefore, the demand for geomechanics software and services is rising in the market.

Increasing efficiency and minimizing costs in petroleum exploration and production have further increased the demand for geomechanics software and services. According to estimates, the oil and gas market captured a 43.6% share globally in 2025.

The competitive landscape in the Geomechanics Software and Service markets is dynamic and evolving, with several key players competing for market share. These players offer a range of software solutions and services aimed at assisting industries in analyzing and managing the mechanical behavior of geological materials. Some of the prominent companies operating in this market include:

Schlumberger Limited: Their offerings help in understanding the behavior of subsurface formations, optimizing drilling operations, and assessing reservoir performance.

IHS Markit Ltd: IHS Markit offers geomechanics software and consulting services to the energy industry.

Baker Hughes Company: Baker Hughes provides geomechanics software and services that enable companies to evaluate rock properties, predict formation behavior, and optimize wellbore stability.

Itasca Consulting Group, Inc: Itasca Consulting Group specializes in geomechanics software and consulting services for various industries, including mining, civil engineering, and energy.

Rocscience Inc: Rocscience offers geomechanics software for geotechnical engineers and researchers.

Bentley Systems, Incorporated: Bentley Systems provides software solutions for infrastructure design, including geomechanics applications.

GeoStru S.R.L: GeoStru specializes in geotechnical software solutions, including geomechanics software for analyzing soil and rock behavior.

Plaxis B.V: Plaxis develops geomechanics software, primarily focused on finite element analysis for geotechnical applications.

Recent Developments:

The global geomechanics software and service market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the geomechanics software and service market is projected to reach USD 4.0 billion by 2035.

The geomechanics software and service market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in geomechanics software and service market are software, _standalone, _integrated, services, _consulting, _integration and implementation and _support and maintainance.

In terms of solution type, oil and gas segment to command 48.7% share in the geomechanics software and service market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Customer Service Software Market Size and Share Forecast Outlook 2025 to 2035

Poland IT Software and Service Market Report – Forecast 2013-2020

Russian IT Software & Services Market Report – Growth & Forecast 2014-2020

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Professional Services Automation Software Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network Market Size and Share Forecast Outlook 2025 to 2035

Service Lifecycle Management Application Market Size and Share Forecast Outlook 2025 to 2035

Service Delivery Automation Market Size and Share Forecast Outlook 2025 to 2035

ServiceNow Tech Service Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Networking (SDN) And Network Function Virtualization (NFV) Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Perimeter (SDP) Market Size and Share Forecast Outlook 2025 to 2035

Service Orchestration Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Wide Area Network SD-WAN Market Size and Share Forecast Outlook 2025 to 2035

Software Defined Radio (SDR) Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Service Robotics Market Size and Share Forecast Outlook 2025 to 2035

Service Trucks Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Networking SDN Market Size and Share Forecast Outlook 2025 to 2035

Software-Defined Anything (SDx) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA