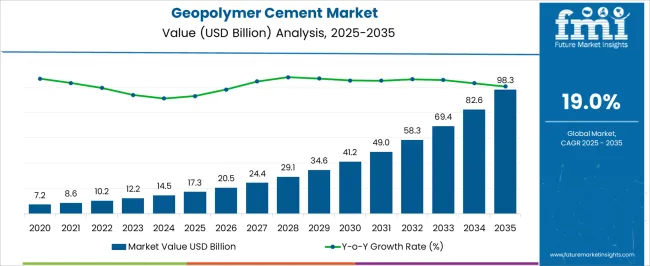

The global geopolymer cement market is projected to grow from USD 17.3 billion in 2025 to USD 98.3 billion by 2035, reflecting a robust compound annual growth rate (CAGR) of 19%. This growth trajectory underscores a significant shift from early adoption to widespread market acceptance. In the early phase (2020–2024), the market was characterized by limited adoption, primarily driven by niche applications and pilot projects. During this period, stakeholders focused on validating the material's performance and establishing its viability as an alternative to traditional cement. As the market transitioned into the scaling phase (2025–2030), increased production capabilities and broader industry acceptance facilitated more extensive use in commercial and residential projects. By the consolidation phase (2030–2035), geopolymer cement is expected to become a mainstream construction material, with established supply chains and standardized applications across various sectors.

This adoption lifecycle illustrates the maturation of the geopolymer cement market, highlighting the progression from experimental use to industry-wide integration. The early adoption phase was marked by research and development efforts, aiming to demonstrate the material's feasibility and advantages over conventional cement. The scaling phase saw the expansion of production facilities and the adoption of geopolymer cement in larger-scale projects, driven by its cost-effectiveness and performance characteristics. In the final consolidation phase, the market is anticipated to achieve stability, with established standards and widespread utilization, positioning geopolymer cement as a standard choice in the construction industry.

| Metric | Value |

|---|---|

| Geopolymer Cement Market Estimated Value in (2025 E) | USD 17.3 billion |

| Geopolymer Cement Market Forecast Value in (2035 F) | USD 98.3 billion |

| Forecast CAGR (2025 to 2035) | 19.0% |

The geopolymer cement market, growing from USD 17.3 billion in 2025 to USD 98.3 billion by 2035 at a CAGR of 19%, can be analyzed through key breakpoints that mark shifts in adoption and growth intensity. The first significant breakpoint occurs around 2025, when the market reaches USD 17.3 billion. Adoption moves from pilot projects to larger-scale commercial applications. Increased production capacity, coupled with early success stories, triggers a rapid expansion in demand.

Investors and manufacturers begin committing to long-term strategies, and supply chains start to stabilize, enabling more predictable pricing and availability. This breakpoint signifies the transition from niche experimentation to scaling adoption, setting the stage for accelerated market growth. The next major breakpoint emerges around 2030–2032, as the market approaches USD 58–69 billion. By this phase, geopolymer cement adoption is widespread across commercial and infrastructure projects, and the market dynamics shift from growth-driven expansion to competitive consolidation.

Margins stabilize as industry standards are established, and smaller players either scale operations or exit. This period also sees significant improvements in distribution efficiency and cost optimization, further solidifying market stability. The USD 98.3 billion mark in 2035 reflects the culmination of this consolidation, where geopolymer cement becomes a mainstream choice with mature supply chains, standardized applications, and entrenched industry acceptance.

The geopolymer cement market is experiencing significant momentum, supported by the global shift toward sustainable construction materials and the need to reduce carbon emissions in the building sector. Increasing concerns over the environmental impact of traditional Portland cement have accelerated the adoption of geopolymer cement, which offers a low carbon footprint, high durability, and resistance to chemical attacks.

Demand is being further stimulated by government regulations promoting green building practices and the circular economy, as geopolymer production often utilizes industrial by-products such as fly ash and slag. The market outlook is strengthened by ongoing research into improving material performance and scaling manufacturing processes for mass adoption.

Technological advancements in curing techniques and mix designs are expanding the range of applications in infrastructure, residential, and industrial construction. With cost efficiencies improving through optimized sourcing and processing, geopolymer cement is positioned to play an increasingly pivotal role in sustainable construction initiatives worldwide, ensuring long-term growth prospects.

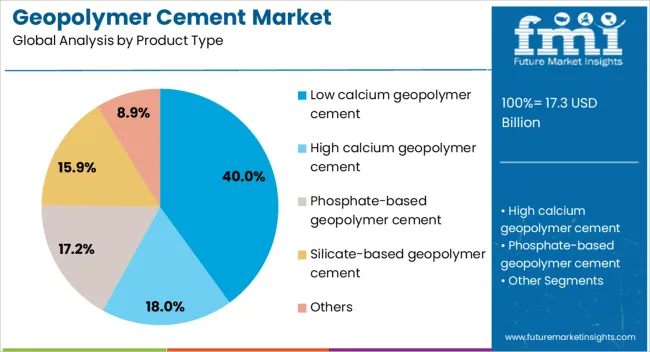

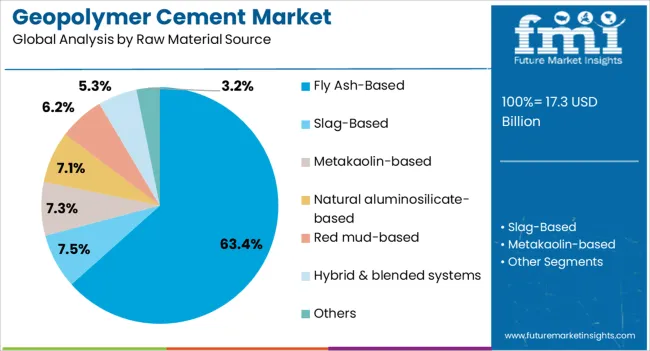

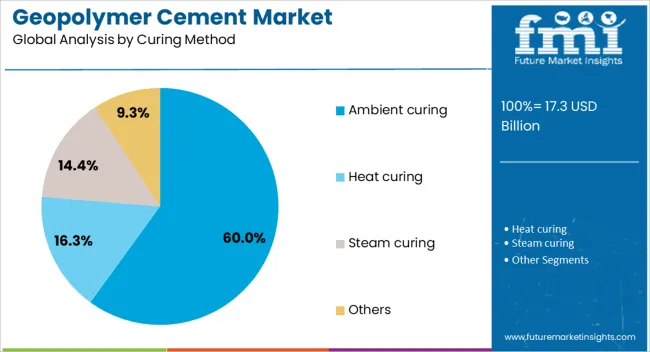

The geopolymer cement market is segmented by product type, raw material source, curing method, application, end use industry, performance attribute, and geographic regions. By product type, geopolymer cement market is divided into Low calcium geopolymer cement, High calcium geopolymer cement, Phosphate-based geopolymer cement, Silicate-based geopolymer cement, and Others. In terms of raw material source, geopolymer cement market is classified into Fly Ash-Based, Slag-Based, Metakaolin-based, Natural aluminosilicate-based, Red mud-based, Hybrid & blended systems, and Others. Based on curing method, geopolymer cement market is segmented into Ambient curing, Heat curing, Steam curing, and Others.

By application, geopolymer cement market is segmented into Concrete, Mortar & grouts, Precast elements, Pavements & overlays, Repair & rehabilitation, Waste encapsulation & immobilization, and Other applications. By end-use industry, the geopolymer cement market is segmented into Building & construction, Infrastructure, Oil & gas, Mining, Marine & underwater construction, Nuclear & waste management, and Others. By performance attribute, the geopolymer cement market is segmented into high-strength and Other performance attributes. Regionally, the geopolymer cement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low calcium geopolymer cement subsegment within the product type segment is expected to hold a 40% share of the Geopolymer Cement market revenue in 2025, making it the leading category. Its prominence has been reinforced by its superior chemical resistance, high compressive strength, and excellent thermal stability compared to higher calcium alternatives. The reduced calcium content results in a more stable aluminosilicate network, enhancing long-term durability and performance in aggressive environments.

This subsegment has been favored in large-scale infrastructure projects where longevity and low maintenance are critical. Furthermore, the lower heat of reaction during curing reduces the risk of thermal cracking, making it suitable for mass concrete applications.

The adaptability of low calcium geopolymer cement to various raw material sources and curing methods has also widened its adoption. As sustainability targets continue to shape procurement decisions in construction, the performance benefits and environmental advantages of this subsegment are expected to sustain its leadership position.

The fly ash-based subsegment within the raw material source segment is projected to account for 63.40% of the Geopolymer Cement market revenue in 2025, establishing itself as the leading source material. This dominance has been attributed to the abundant global availability of fly ash, a by-product of coal-fired power plants, and its favorable chemical composition for geopolymerization. Fly ash-based formulations deliver excellent workability, strength development, and resistance to chemical degradation, making them suitable for both structural and non-structural applications.

The use of fly ash also aligns with waste valorization practices, reducing landfill disposal and contributing to circular economy objectives. Cost-effectiveness and compatibility with existing production facilities have encouraged widespread adoption in commercial and infrastructure projects.

Additionally, regulatory incentives promoting the utilization of industrial by-products in construction materials have further accelerated demand. The technical benefits combined with sustainability credentials are expected to reinforce the fly ash-based subsegment’s dominance in the coming years.

The ambient curing subsegment within the curing method segment is anticipated to capture a 60% share of the Geopolymer Cement market revenue in 2025, positioning it as the leading curing approach. This preference has been supported by its operational simplicity, as ambient curing eliminates the need for specialized thermal curing equipment, reducing both energy consumption and production costs. The method has gained traction in regions with favorable climatic conditions that allow for consistent strength development at ambient temperatures.

It has been particularly beneficial for on-site applications where heat-curing infrastructure is impractical. Ambient curing also enhances project flexibility by enabling larger pours and faster construction cycles without compromising material performance.

Advances in mix design have further improved early strength gain and long-term durability under ambient curing conditions. As cost efficiency and sustainability remain key procurement drivers in construction projects, the adoption of ambient curing methods is expected to remain strong in the foreseeable future.

The geopolymer cement market is witnessing robust growth as the construction industry seeks sustainable alternatives to traditional Portland cement. With lower carbon emissions, high thermal resistance, and durability benefits, geopolymer cements are gaining traction in infrastructure, industrial, and commercial projects. Adoption is driven by environmental regulations, government incentives, and rising demand for eco-friendly building materials. Advances in raw material sourcing, mix design, and curing technologies further support market expansion. However, high production costs, limited awareness, and regulatory variations pose challenges that manufacturers and contractors must navigate.

One of the primary challenges facing the geopolymer cement market is the complexity of production processes and associated costs. Geopolymer cement requires precise control over raw materials such as fly ash, slag, or metakaolin, along with alkaline activators. Variations in raw material composition impact curing time, strength development, and final performance, making consistent quality delivery difficult. High initial investment in processing equipment, storage, and specialized curing facilities adds to operational expenses. Limited awareness among contractors and construction firms also hinders adoption, as traditional cement remains more familiar and widely available. Regulatory certification processes for new construction materials vary by region, creating additional barriers to market entry. To overcome these challenges, companies must invest in R&D, develop standardized formulations, and demonstrate long-term durability and sustainability benefits to offset cost concerns.

Eco-efficiency is the primary driver shaping the geopolymer cement market. Geopolymer formulations generate up to 80% less CO₂ than ordinary Portland cement, aligning with global carbon reduction goals. Industry trends include the integration of industrial by-products such as fly ash and blast furnace slag, promoting circular economy practices. Advances in nanotechnology and chemical additives are improving early strength development, workability, and resistance to chemicals and high temperatures. Digital modeling and mix optimization tools are also enhancing performance predictability and reducing material waste. Contractors and developers are increasingly leveraging geopolymer cement in infrastructure projects, precast elements, and high-temperature applications. As governments tighten carbon emissions regulations, demand for low-carbon, high-performance cement alternatives is expected to accelerate. Innovation in sustainable formulations and performance-enhancing additives is solidifying geopolymer cement as a mainstream solution in green construction.

The geopolymer cement market offers substantial opportunities in sustainable infrastructure and industrial construction. Rapid urbanization, growing demand for eco-friendly buildings, and government-backed green construction initiatives create a favorable environment. Industrial sectors requiring high chemical, heat, or fire resistance—including power plants, refineries, and chemical facilities—are increasingly adopting geopolymer cement for its durability and low maintenance. Precast concrete and modular construction solutions also provide avenues for large-scale deployment. Emerging markets, especially in Asia-Pacific and the Middle East, present untapped demand due to infrastructure development, sustainability regulations, and rising awareness of carbon footprint reduction. Partnerships with government agencies, research institutions, and construction firms can facilitate knowledge transfer, adoption, and certification compliance. With growing emphasis on low-carbon, resilient, and long-lasting construction materials, geopolymer cement adoption is expected to expand across commercial, industrial, and public infrastructure projects globally.

Market growth for geopolymer cement is restrained by regulatory ambiguity and raw material limitations. Certification standards for alternative cements differ widely by region, delaying adoption in projects that require compliance with local building codes. Limited standardized testing protocols and a lack of familiarity among engineers and contractors make integration into mainstream construction slower. Additionally, reliance on industrial by-products such as fly ash or slag creates supply dependency risks, as production varies with energy sector output and regional availability. Transportation costs for raw materials and inconsistent quality further impact scalability.

Cost competitiveness with traditional Portland cement remains a concern, particularly in developing regions with limited government incentives. Until regulatory frameworks stabilize and raw material sourcing becomes more predictable, market expansion will face obstacles despite growing demand for sustainable and high-performance construction solutions.

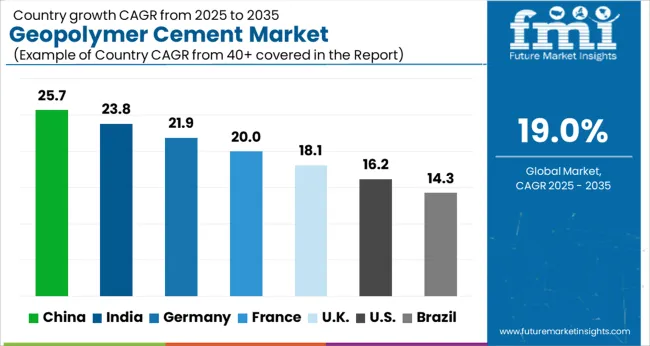

| Country | CAGR |

|---|---|

| China | 25.7% |

| India | 23.8% |

| Germany | 21.9% |

| France | 20.0% |

| UK | 18.1% |

| USA | 16.2% |

| Brazil | 14.3% |

The global geopolymer cement market is projected to grow at a CAGR of 19.0% through 2035, supported by increasing demand across construction, infrastructure, and industrial applications. Among BRICS nations, China has been recorded with 25.7% growth, driven by large-scale production and deployment in commercial and infrastructure projects, while India has been observed at 23.8%, supported by rising utilization in urban and industrial construction. In the OECD region, Germany has been measured at 21.9%, where production and adoption for industrial and sustainable construction applications have been steadily maintained. The United Kingdom has been noted at 18.1%, reflecting consistent use in infrastructure and commercial building projects, while the USA has been recorded at 16.2%, with production and utilization across industrial, commercial, and infrastructural sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The geopolymer cement market in China is expanding at a CAGR of 19.0%, reflecting rapid adoption of sustainable construction materials and government initiatives promoting low carbon technologies. Urban infrastructure projects, commercial construction, and green building certifications are driving demand for geopolymer alternatives to traditional Portland cement. Leading construction firms and cement manufacturers are investing in research and development to improve material performance, durability, and cost effectiveness. Adoption is further supported by industrial policies encouraging waste utilization, such as fly ash and slag, in geopolymer formulations. Awareness campaigns and pilot projects in major cities are helping stakeholders understand the environmental benefits of reduced CO2 emissions and energy efficiency. Additionally, collaborations between academia, research institutes, and construction companies are fostering innovation in geopolymer mix designs suitable for diverse applications including roads, bridges, and high rise buildings.

Geopolymer cement market in India is growing at a CAGR of 19.0%, driven by rapid urbanization, industrialization, and the push for green construction solutions. Public and private sector projects are increasingly incorporating low carbon and eco friendly materials, while government initiatives support energy efficient and emission reducing building techniques. Construction companies are adopting geopolymer cement in commercial buildings, roads, and industrial structures due to its superior chemical resistance and thermal performance. Availability of industrial byproducts like fly ash and slag is supporting cost effective production at scale. Research collaborations with universities and technical institutes are promoting innovation in geopolymer mix designs tailored for India’s climate and construction practices. Market penetration is also boosted by pilot projects, workshops, and awareness programs emphasizing long term sustainability and lower environmental impact compared to traditional Portland cement.

Geopolymer cement market is recording a CAGR of 21.9%, driven by stringent environmental regulations, green construction mandates, and sustainability oriented urban planning. Construction companies and material suppliers are investing in geopolymer technologies to reduce carbon footprints and comply with building codes. Pilot projects in commercial and infrastructure construction are demonstrating the superior performance, chemical resistance, and thermal stability of geopolymer cements. Industrial byproducts such as fly ash and slag are widely available, enabling cost effective production. Awareness campaigns and technical seminars are promoting knowledge sharing between engineers, architects, and construction firms. Research initiatives are focusing on optimizing geopolymer mix formulations and curing methods to improve strength, longevity, and adaptability for different structural applications. Government incentives and subsidies for low carbon construction are further stimulating market adoption.

The United Kingdom is witnessing a CAGR of 18.1% in the geopolymer cement market, supported by growing interest in sustainable construction and circular economy initiatives. Construction companies and infrastructure developers are exploring geopolymer solutions for commercial, residential, and public works projects to meet environmental targets. Government programs promoting energy efficiency and reduced CO2 emissions are accelerating adoption. Industrial byproducts such as fly ash and blast furnace slag are being utilized to produce geopolymer cement, offering cost and environmental benefits. Research collaborations between universities, industry bodies, and construction firms are advancing new formulations with improved strength, durability, and chemical resistance. Pilot projects and case studies are helping architects and engineers evaluate practical applications. Increasing awareness about environmental sustainability and lifecycle benefits is boosting market confidence and encouraging wider integration of geopolymer cement in mainstream construction.

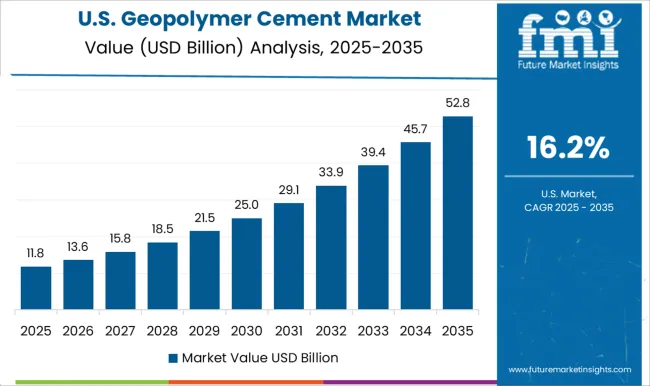

The United States geopolymer cement market is growing at a CAGR of 16.2%, driven by green building initiatives, infrastructure modernization, and corporate sustainability commitments. Construction companies and contractors are adopting geopolymer solutions in bridges, roads, industrial facilities, and commercial buildings due to their lower carbon footprint and resistance to chemical attack. Availability of fly ash, slag, and other industrial byproducts supports large scale production. Research institutions and universities are collaborating with the industry to optimize mix designs, curing methods, and performance metrics. Government incentives for low carbon and energy efficient construction are stimulating pilot projects and demonstration buildings. Awareness campaigns highlighting reduced lifecycle emissions and long term durability benefits are helping contractors and architects integrate geopolymer cement into standard construction practices, particularly in regions with high sustainability standards.

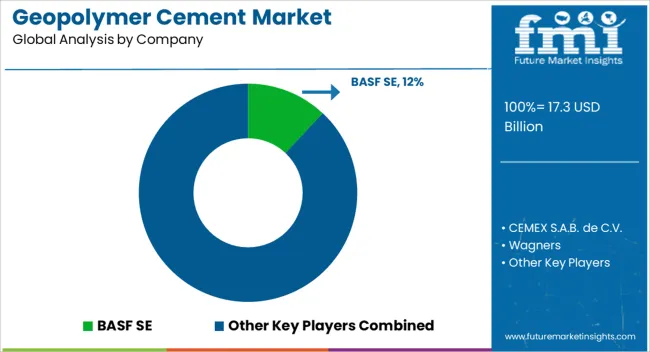

The geopolymer cement market is characterized by strong competition among global leaders and regional innovators. BASF SE leverages its extensive research capabilities and chemical expertise to develop high-performance geopolymer solutions for industrial and construction applications. CEMEX S.A.B. de C.V. integrates sustainable cement alternatives into its portfolio, emphasizing energy efficiency and carbon reduction, while maintaining a broad international presence. Wagner's focuses on specialized geopolymer binders for infrastructure projects, combining technical innovation with localized production strategies.

Zeobond Pty Ltd. positions itself with advanced, environmentally friendly formulations and tailored solutions for commercial construction, highlighting durability and fire resistance. Banah UK Ltd. and Alchemy Geopolymer Solutions, LLC emphasize product customization and flexible application methods, targeting niche markets that demand sustainable alternatives. Geopolymer Solutions LLC adopts a highly technical approach, offering consulting and engineered solutions to maximize performance in demanding environments. Market strategies revolve around innovation, sustainability, and targeted customer engagement. Companies invest in R&D to enhance material properties, reduce carbon footprint, and meet evolving regulatory standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 17.3 Billion |

| Product Type | Low calcium geopolymer cement, High calcium geopolymer cement, Phosphate-based geopolymer cement, Silicate-based geopolymer cement, and Others |

| Raw Material Source | Fly Ash-Based, Slag-Based, Metakaolin-based, Natural aluminosilicate-based, Red mud-based, Hybrid & blended systems, and Others |

| Curing Method | Ambient curing, Heat curing, Steam curing, and Others |

| Application | Concrete, Mortar & grouts, Precast elements, Pavements & overlays, Repair & rehabilitation, Waste encapsulation & immobilization, and Other applications |

| End Use Industry | Building & construction, Infrastructure, Oil & gas, Mining, Marine & underwater construction, Nuclear & waste management, and Others |

| Performance Attribute | High strength and Other performance attributes |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, CEMEX S.A.B. de C.V., Wagners, Zeobond Pty Ltd., Banah UK Ltd., Alchemy Geopolymer Solutions, LLC, and Geopolymer Solutions LLC |

| Additional Attributes | Dollar sales by type including fly ash-based, slag-based, and metakaolin-based cements, application across commercial construction, infrastructure projects, and residential buildings, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for sustainable construction materials, environmental regulations, and increasing adoption of low-carbon cement alternatives. |

The global geopolymer cement market is estimated to be valued at USD 17.3 billion in 2025.

The market size for the geopolymer cement market is projected to reach USD 98.3 billion by 2035.

The geopolymer cement market is expected to grow at a 19.0% CAGR between 2025 and 2035.

The key product types in geopolymer cement market are low calcium geopolymer cement, high calcium geopolymer cement, phosphate-based geopolymer cement, silicate-based geopolymer cement and others.

In terms of raw material source, fly ash-based segment to command 63.4% share in the geopolymer cement market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA