The Griffin Beaker Market is an essential segment of the laboratory glassware industry, primarily serving scientific research, healthcare, education, and industrial applications. With increasing demand for precise and durable laboratory equipment, the market has been expanding steadily.

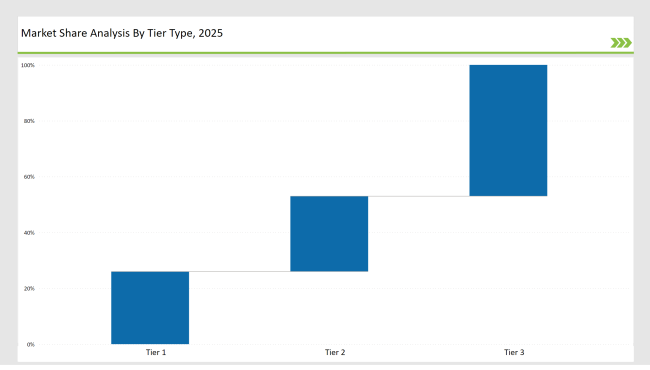

Tier 1 companies, such as DWK Life Sciences, Corning Inc., Kimble Chase, and Borosil, control 26% of the market. These industry leaders are experts in manufacturing high-quality borosilicate glass that lasts, withstands heat, and resists chemical attacks, ensuring durability for laboratories. Investments into sustainable manufacturing as well as precise calibration serve growing demand from the scientific research and pharmaceutical sectors, as well as educational institutions.

With a focus on advanced measurement accuracy and scalability, these companies integrate IoT-enabled labware, facilitating smart tracking and data analytics in modern laboratories. As research facilities and industrial applications grow, product customization and enhanced durability remain key competitive advantages for Tier 1 players.

The shift towards low-carbon and recyclable materials further strengthens their market position, aligning with evolving regulatory and environmental standards. The ability to balance cost efficiency with high-performance design ensures their dominance in the Griffin Beaker industry.

Tier 2 players, including Thermo Fisher Scientific, Pyrex, and Eisco Labs, hold 27% of the market. They cater to mid-sized laboratories and educational institutions, offering reliable yet affordable Griffin beakers.

Tier 3 players, comprising regional manufacturers and niche suppliers, control 47% of the market, focusing on custom solutions, cost-effective alternatives, and specialized laboratory applications.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (DWK Life Sciences, Corning Inc., Kimble Chase) | 12% |

| Rest of Top 5 (Borosil, Thermo Fisher Scientific) | 9% |

| Next 5 of Top 10 (Pyrex, Eisco Labs, United Scientific, Qorpak, SciLabware) | 5% |

Leading companies such as DWK Life Sciences, Corning Inc., Kimble Chase, Borosil, and Thermo Fisher Scientific have significantly shaped the Griffin Beaker industry through continuous advancements in heat-resistant materials, sustainability, and ergonomic designs.

These companies have developed high-end technology in borosilicate glass, which promises increased strength and resistance to thermal shock. Some of the pioneers in ultra-clear chemical-resistant glass are Corning Inc. and Kimble Chase, which develop it for precision laboratory applications. Borosil has developed inexpensive, high-accuracy beakers for educational purposes.

The move toward sustainable and environmentally friendly manufacturing has given rise to recyclable and low-carbon footprint glass beakers. Thermo Fisher Scientific has been a leader in smart lab technologies, which include the use of IoT-enabled tracking and RFID labeling.

Increasing demand in scientific research, pharmaceuticals, and industrial testing have driven these key players to innovate. Griffin Beakers continue to meet severe laboratory requirements while being aligned with global sustainability goals.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | DWK Life Sciences, Corning Inc., Kimble Chase, Borosil |

| Tier 2 | Thermo Fisher Scientific, Pyrex, Eisco Labs |

| Tier 3 | United Scientific, Qorpak, SciLabware |

| Manufacturer | Latest Developments |

|---|---|

| DWK Life Sciences | Expanded sustainable and ultra-durable Griffin beaker production (May 2024) |

| Corning Inc. | Launched ultra-clear chemical-resistant glass beakers (April 2024) |

| Kimble Chase | Developed high-temperature resistant Griffin beakers (March 2024) |

| Borosil | Introduced affordable, high-precision academic beakers (June 2024) |

| Thermo Fisher Scientific | Focused on custom-designed and IoT-enabled beakers (July 2024) |

DWK Life Sciences, Corning Inc., Kimble Chase, Borosil, and Thermo Fisher Scientific

The top five manufacturers account for 47% of the market, while the top ten players hold 26%.

Medium concentration, as top players hold 30-60% market share.

They contribute 12% of the market by catering to regional and specialized laboratory needs

Sustainability, precision manufacturing, and smart lab integration.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Griffin Beaker Market Size and Share Forecast Outlook 2025 to 2035

Stackable Beaker Market Size and Share Forecast Outlook 2025 to 2035

Sales Analysis of Tourism Industry in the Middle East Size and Share Forecast Outlook 2025 to 2035

Semen Analysis Systems Market Size and Share Forecast Outlook 2025 to 2035

Stone Analysis Software Market – Trends & Forecast 2025 to 2035

Water Analysis Instrumentation Market Analysis – Size, Share, and Forecast 2025 to 2035

Spend Analysis Software Market

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Failure Analysis Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Failure Analysis Equipment Market Insights – Forecast 2025 to 2035

Industry Analysis of Syringe and Needle in GCC Size and Share Forecast Outlook 2025 to 2035

Industry Analysis Non-commercial Acrylic Paint in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Medical Device Packaging in Southeast Asia Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Paper Bag in North America Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Lidding Film in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Last-mile Delivery Software in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Automotive Lightweight Body Panel in the United States Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Japan Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Korea Size and Share Forecast Outlook 2025 to 2035

Industry Analysis of Electronic Skin in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA