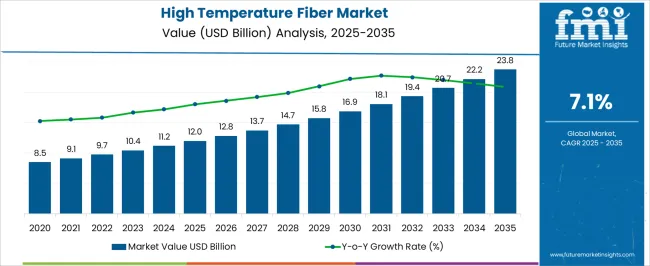

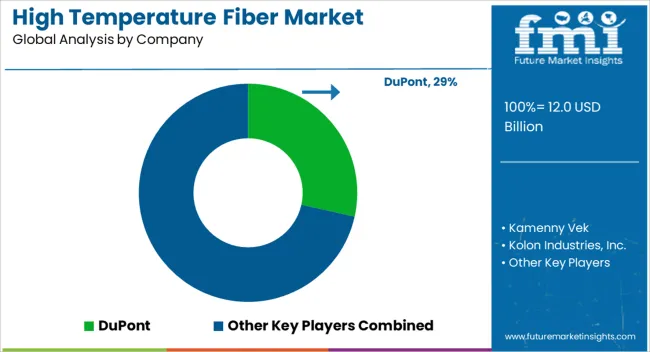

The High Temperature Fiber Market is estimated to be valued at USD 12.0 billion in 2025 and is projected to reach USD 23.8 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. A market share erosion or gain analysis reveals consistent growth with incremental advancements in the adoption of high-temperature fibers in various industries, such as aerospace, automotive, and construction. Between 2025 and 2030, the market grows from USD 12.0 billion to USD 16.9 billion, contributing USD 4.9 billion in growth, with a CAGR of 9.0%.

During this period, the market gains share due to the increasing demand for high-performance materials capable of withstanding extreme temperatures, primarily driven by advancements in aerospace and industrial manufacturing, where materials with higher thermal resistance are critical. The growing focus on energy efficiency and safety standards further accelerates this growth. From 2030 to 2035, the market continues to grow from USD 16.9 billion to USD 23.8 billion, contributing USD 6.9 billion in growth, with a slightly lower CAGR of 5.6%. This deceleration in growth rate suggests the market is nearing saturation in developed regions. However, the market continues to gain share globally, driven by increasing infrastructure investments, especially in emerging economies, and advancements in fiber technology, including enhanced heat-resistant properties and lightweight alternatives. The market shows consistent growth with strong demand in emerging sectors and industries.

Ceramic fiber manufacturing involves sol-gel processing, melt spinning, or chemical vapor deposition techniques that require precise control of chemical composition, fiber diameter, and surface characteristics affecting final product performance in aerospace, industrial insulation, and filtration applications. Alumina-silica fiber production demands high-purity raw materials and controlled crystallization procedures that prevent unwanted phase transformations during thermal cycling. Silicon carbide fiber development involves complex pyrolysis processes that convert polymer precursors into ceramic structures while maintaining fiber continuity and mechanical strength throughout temperature exposure cycles.

Carbon fiber applications for high-temperature use require specialized precursor materials and carbonization procedures that optimize thermal conductivity, oxidation resistance, and mechanical properties for aerospace engine components and industrial furnace applications. Pitch-based carbon fibers offer different thermal characteristics compared to PAN-based alternatives but require specialized processing equipment and quality control methods that ensure consistent performance across production batches. Surface treatment procedures affect fiber-matrix adhesion in composite applications where thermal expansion mismatches create interface stresses during temperature cycling.

Industrial filtration applications require fiber materials capable of withstanding corrosive gas environments, particulate loading, and thermal cycling while maintaining filtration efficiency and structural stability throughout extended service periods. Baghouse filter manufacturing involves weaving or needle-punching operations that create fabric structures from high-temperature fibers while accommodating cleaning procedures and mechanical stress from reverse-pulse operations. Chemical compatibility becomes critical when process gases contain acids, alkalis, or organic compounds that could degrade fiber materials over time.

| Metric | Value |

|---|---|

| High Temperature Fiber Market Estimated Value in (2025 E) | USD 12.0 billion |

| High Temperature Fiber Market Forecast Value in (2035 F) | USD 23.8 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

Industries such as automotive, aerospace, power generation, and metallurgy are increasingly integrating advanced fiber materials to ensure structural stability and operational efficiency under extreme heat conditions.

The demand is further supported by stringent safety standards and emission regulations driving the use of thermally stable materials in vehicle components, gaskets, and industrial insulation. Technological advancements in fiber engineering have enabled improved strength to weight ratios, greater thermal tolerance, and chemical resistance.

As industries prioritize high efficiency and durability, the market is expected to continue growing through investments in next generation composites and fiber reinforcement technologies.

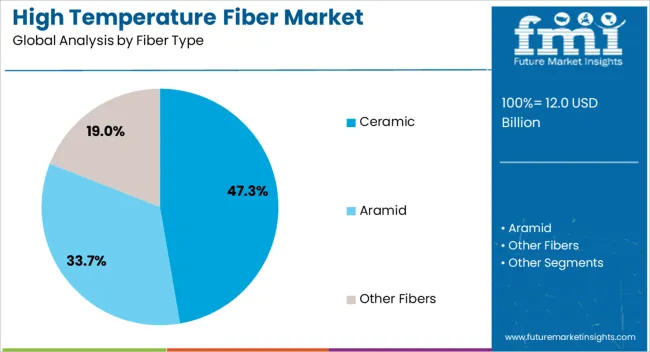

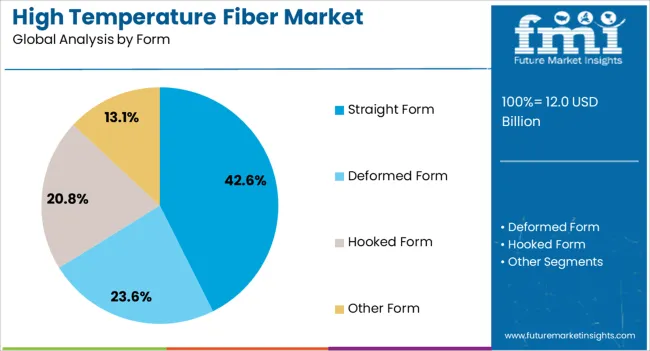

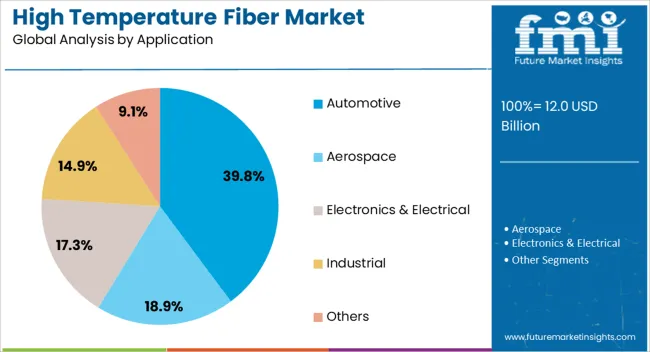

The high temperature fiber market is segmented by fiber type, form, application, and geographic regions. By fiber type, the high temperature fiber market is divided into Ceramic, Aramid, and Other Fibers. In terms of form, the high temperature fiber market is classified into Straight Form, Deformed Form, Hooked Form, and Other Form. Based on application, the high temperature fiber market is segmented into Automotive, Aerospace, Electronics & Electrical, Industrial, and Others.

Regionally, the high temperature fiber industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ceramic segment is projected to account for 47.30% of total market revenue by 2025 under the fiber type category, establishing it as the most dominant material. This growth is primarily attributed to its excellent resistance to extreme temperatures, low thermal conductivity, and lightweight composition.

Ceramic fibers are widely adopted in insulation linings, fireproofing materials, and thermal barriers due to their durability and versatility. Their non-corrosive and chemically stable nature makes them ideal for use in high-stress environments such as furnaces and exhaust systems.

Additionally, ceramic fibers support sustainable operations by enhancing energy efficiency and reducing heat loss. These functional advantages have solidified their leading role in the fiber type segment.

The straight form of high temperature fiber is expected to capture 42.60% of total market share by 2025, positioning it as the leading form type. This format is favored for its easy handling, structural rigidity, and compatibility with weaving and braiding processes used in the production of protective clothing, insulation wraps, and reinforcement materials.

Its form factor provides uniform thermal resistance and strength, making it particularly useful in applications requiring consistent fiber alignment. The widespread use of straight form fibers in industrial sealing, padding, and insulation products has further reinforced their position.

Its versatility in both manual and automated fabrication systems continues to support its dominance in the form segment.

The automotive segment is projected to hold 39.80% of the total market share by 2025 within the application category, establishing it as the leading industry vertical. This is driven by the automotive industry's increasing focus on heat management and emission reduction in internal combustion and hybrid engine platforms.

High temperature fibers are used in heat shields, exhaust wraps, and engine insulation to enhance vehicle performance and safety. The growing demand for lightweight and thermally efficient components is also accelerating the use of these fibers in vehicle structures and battery modules.

In addition, regulatory pressures on thermal efficiency and safety standards are reinforcing the integration of high performance materials across automotive manufacturing. These factors collectively support the leadership of automotive as the top application in the high temperature fiber market.

The high temperature fiber market is growing due to the increasing demand for materials that can withstand extreme conditions in industries like aerospace, automotive, and industrial manufacturing. These fibers, which include materials such as aramid, basalt, and ceramic, are crucial for applications requiring high heat resistance, such as insulation, protective clothing, and heat shields. As industries push towards higher efficiency and performance, the demand for fibers that can endure higher temperatures without compromising strength or flexibility is rising. Technological advancements and increased industrial applications are driving market growth.

The growth of the high-temperature fiber market is driven by the increasing need for materials that can perform in extreme environments. As industries like aerospace, automotive, and defense demand higher performance and reliability from their components, the requirement for heat-resistant fibers has grown. These fibers, often used for applications such as insulation, protective gear, and fire-resistant coatings, are essential in environments that expose materials to high temperatures. High-temperature fibers are particularly crucial in industries such as space exploration, where extreme heat resistance is needed for spacecraft and satellite components.Industries focused on improving energy efficiency in manufacturing processes require high-temperature fibers to insulate and protect equipment from heat damage, further driving demand.

A key challenge in the high-temperature fiber market is the high cost of production. Manufacturing these fibers requires specialized raw materials, such as aramid or ceramic, which are expensive to source and process. These fibers also require advanced manufacturing techniques to ensure that they meet the stringent quality and performance standards required in high-temperature applications. This can lead to higher product costs, which may limit adoption, especially for smaller businesses or industries with tight budgets. Furthermore, the availability of certain raw materials can be constrained, affecting supply chains and leading to potential delays or cost increases. Companies must manage these factors while maintaining product performance and reliability, which can be a significant challenge.

The high-temperature fiber market offers significant opportunities for growth, driven by technological advancements and the expansion of industrial applications. Innovations in fiber processing techniques and materials science are improving the performance, cost-effectiveness, and scalability of high-temperature fibers, making them more accessible to a wider range of industries. As sectors such as automotive and aerospace continue to evolve, the need for lightweight, heat-resistant materials is growing, providing opportunities for fiber manufacturers. The expansion of renewable energy sources, such as geothermal and concentrated solar power, also presents growth opportunities, as these industries require specialized high-temperature fibers for equipment protection and performance. The increasing adoption of high-temperature fibers in protective clothing and fire-resistant materials is another promising growth area.

A key trend in the high-temperature fiber market is the development of multi-functional and lightweight fibers. As industries strive for greater efficiency and performance, there is a growing demand for fibers that not only withstand high temperatures but also offer additional properties such as flexibility, durability, and resistance to corrosion or chemicals. The push towards lightweight materials in industries such as automotive and aerospace is also driving the development of high-temperature fibers that are both strong and lightweight. Furthermore, the integration of smart technologies into high-temperature fibers is gaining attention, with manufacturers exploring fibers that can monitor their condition in real time or offer self-healing capabilities. These innovations are shaping the future of high-temperature fibers, offering greater versatility and improved performance in challenging applications.

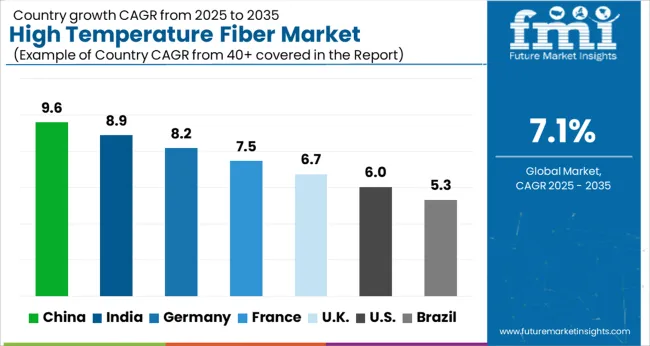

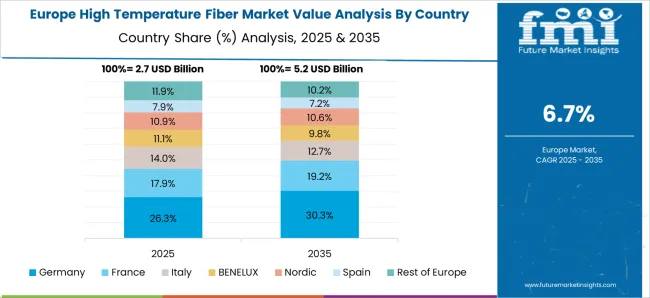

The global high temperature fiber market is projected to grow at a global CAGR of 7.1% from 2025 to 2035. China leads the market with a growth rate of 9.6%, followed by India at 8.9%. France records a growth rate of 7.5%, while the UK shows 6.7% and the USA follows at 6.0%. The market is primarily driven by increasing demand for high-performance fibers used in industries such as aerospace, automotive, and manufacturing. China and India are leading the growth, supported by rapid industrialization and expanding manufacturing sectors. Developed markets like France, the UK, and the USA are witnessing steady growth driven by high demand for advanced materials in high-temperature applications. The analysis spans over 40+ countries, with the leading markets shown below.

The high temperature fiber market in China is expanding at a 9.6% CAGR through 2035, fueled by the country’s booming industrial sector and increasing demand for materials that can withstand extreme temperatures. As industries such as aerospace, automotive, and manufacturing expand, the need for high-performance fibers is growing. China’s rapid industrialization and urbanization are further driving demand for high temperature fibers in production processes, particularly in high-temperature environments such as furnaces and reactors. The country’s focus on technological advancements and upgrading manufacturing standards is contributing to the increased use of high temperature fibers in various industrial applications.

Demand for high temperature fiber in India is expected to grow at an 8.9% CAGR through 2035, supported by the country’s growing industrial base and rising demand for advanced materials in sectors such as aerospace, automotive, and manufacturing. As India modernizes its infrastructure and industrial facilities, there is an increasing need for materials capable of withstanding extreme temperatures in various applications. India’s growing automotive sector, along with advancements in the manufacturing and aerospace industries, is driving the demand for high temperature fibers. The rise of smart manufacturing technologies and a focus on energy-efficient solutions are further fueling market growth.

France’s high temperature fiber market is projected to grow at a 7.5% CAGR, supported by increasing demand in aerospace, automotive, and industrial applications. The country’s industrial sectors, particularly aerospace and energy, require materials that can withstand high temperatures in extreme environments. France’s commitment to improving industrial efficiency and reducing carbon emissions is also boosting the demand for high temperature fibers. As industries continue to prioritize performance ,high temperature fibers are becoming essential in manufacturing processes. France’s technological expertise and innovation in high-performance materials continue to contribute to the growth of this market.

The high temperature fiber market in the UK is expected to grow at a 6.7% CAGR, driven by the growing demand for materials capable of withstanding high temperatures in aerospace, manufacturing, and automotive applications. As the UK focuses on enhancing its industrial base and developing energy-efficient technologies, the demand for high performance and heat-resistant fibers is on the rise. The aerospace sector, in particular, requires these fibers for engine components and high-heat environments. With an increased focus on manufacturing high-quality products, the UK market for high temperature fibers continues to grow steadily.

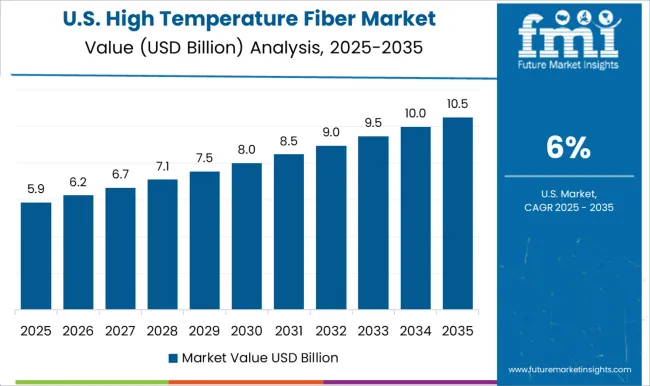

The USA high temperature fiber market is expected to grow at a 6.0% CAGR, driven by the rising demand for heat-resistant materials in industries such as aerospace, automotive, and energy. As the USA manufacturing sector grows, the need for high performance materials that can withstand extreme temperatures in production processes is increasing. The aerospace sector, which requires advanced fiber solutions for components exposed to high temperatures, is a major driver of the market. The USA focus on improving industrial efficiency and reducing operational costs is contributing to the growing adoption of high temperature fibers.

The High Temperature Fiber Market is evolving rapidly as industries pursue materials capable of withstanding extreme thermal, mechanical, and chemical stress. Growing applications in aerospace, defense, automotive, and industrial filtration are driving adoption, supported by stricter safety regulations and the global shift toward lightweight, heat-resistant composites. High temperature fibers are increasingly used in thermal insulation, protective apparel, and advanced composites for engines, turbines, and industrial furnaces, where both performance and longevity are critical.

DuPont remains a frontrunner with its Kevlar and Nomex product lines, offering exceptional thermal stability and mechanical strength for aerospace and protective gear applications. Teijin Limited, Toray Industries, Inc., and Toyobo Co., Ltd. are reinforcing their leadership in aramid and para-aramid fiber production, focusing on innovations that enhance heat resistance while maintaining low weight. Kolon Industries, Inc. and Yantai Tayho Advanced Materials Co., Ltd. continue expanding in Asia with cost-effective, high-performance fibers for defense and industrial markets.

Companies such as Morgan Advanced Materials, Owens Corning, and Kamenny Vek are advancing next-generation ceramic and basalt fiber technologies to serve insulation and composites markets. Meanwhile, Rex Sealing & Packing Industries Private Limited specializes in customized sealing and insulation solutions, addressing the needs of high-temperature processing sectors like petrochemicals and metallurgy.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.0 Billion |

| Fiber Type | Ceramic, Aramid, and Other Fibers |

| Form | Straight Form, Deformed Form, Hooked Form, and Other Form |

| Application | Automotive, Aerospace, Electronics & Electrical, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DuPont, Kamenny Vek, Kolon Industries, Inc., Morgan Advanced Materials, Owens Corning, Rex Sealing & Packing Industries Private Limited, Teijin Limited, Toray Industries, Inc., Toyobo Co., Ltd., and Yantai Tayho Advanced Materials Co., Ltd. |

| Additional Attributes | Dollar sales by product type (aramid fibers, glass fibers, ceramic fibers, carbon fibers) and end-use segments (aerospace, automotive, industrial, construction, protective clothing). Demand dynamics are influenced by the increasing need for heat-resistant materials in high-performance industries, the growing adoption of fireproof and heat-resistant technologies, and rising safety standards in industrial and construction sectors. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by the increasing demand for energy-efficient solutions, fire safety, and industrial insulation. |

The global high temperature fiber market is estimated to be valued at USD 12.0 billion in 2025.

The market size for the high temperature fiber market is projected to reach USD 23.8 billion by 2035.

The high temperature fiber market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in high temperature fiber market are ceramic, aramid and other fibers.

In terms of form, straight form segment to command 42.6% share in the high temperature fiber market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Temperature Fiberglass Filter Media Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Heat Pump Dryers Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Grease Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Overhead Conductor Market Size and Share Forecast Outlook 2025 to 2035

High Temperature Insulation Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Composite Resin Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Industrial Burner Market Growth - Trends & Forecast 2025 to 2035

High Temperature Alloys Market Growth - Trends & Forecast 2025 to 2035

High-Temperature Ceramics Market Growth - Trends & Forecast 2025 to 2035

High Temperature Adhesive Market Growth – Trends & Forecast 2024-2034

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High-Silica Fiber Market Analysis by Application, Use Case, and Region: Forecast for 2025 to 2035

High density Fiberboard (HDF) Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fiber Market Size and Share Forecast Outlook 2025 to 2035

High-Performance Fibers for Defense Market Report – Demand, Trends & Industry Forecast 2025 to 2035

Ultra-High Temperature (UHT) Processing Market Analysis by Mode, Form, Application and Region from 2025 to 2035

High Power Double-Clad Fiber Bragg Grating Market Size and Share Forecast Outlook 2025 to 2035

High Performance Carbon Fiber Precursor Market Size and Share Forecast Outlook 2025 to 2035

Industrial High-Temperature Graphitization Furnaces Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA