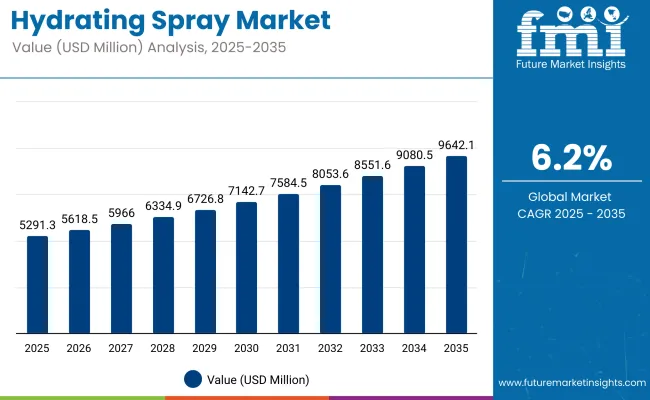

The Global Hydrating Spray Market is expected to record a valuation of USD 5,291.3 million in 2025 and USD 9,642.1 million in 2035, with an increase of USD 4,350.8 million, which equals a growth of 82.3% over the decade. The overall expansion represents a CAGR of 6.2% and a 1.8X increase in market size.

Global Hydrating Spray Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 5,291.3 million |

| Market Forecast Value in (2035F) | USD 9,642.1 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

During the first five-year period from 2025 to 2030, the market increases from USD 5,291.3 million to USD 7,142.8 million, adding USD 1,851.5 million, which accounts for 42.5% of the total decade growth. This phase records steady adoption of facial mists, makeup setting sprays, and soothing skincare products, driven by layering routines and demand for lightweight, multifunctional hydration. Facial Hydrating Sprays dominate this period as they cater to over 60% of skincare needs across both personal and professional use.

The second half from 2030 to 2035 contributes USD 2,499.3 million, equal to 57.5% of total growth, as the market jumps from USD 7,142.8 million to USD 9,642.1 million. This acceleration is powered by widespread deployment of SPF-infused hydrating mists, dermatologist-approved calming sprays, and the rise of digital-first D2C skincare platforms. Online distribution channels, including e-commerce and subscription-based models, capture a larger share above 50% by the end of the decade. Functional formulations enriched with vitamins, antioxidants, and mineral actives grow in share, expanding beyond basic water-based options to targeted, skin-type-specific solutions.

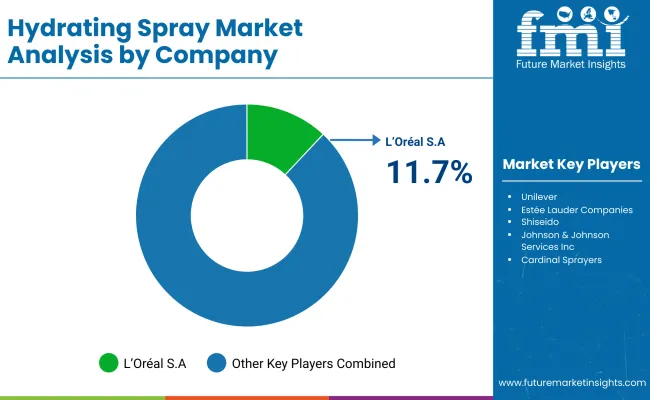

From 2020 to 2024, the Global Hydrating Spray Market grew from approximately USD 3,900 million to USD 5,291.3 million, driven by the rise of skincare layering trends, the clean beauty movement, and increased demand for on-the-go hydration. During this period, the competitive landscape was led by global cosmetics giants controlling nearly 90% of the premium segment revenues. Companies such as L’Oréal S.A. (11.7%), Estée Lauder, and Shiseido focused heavily on facial mists and mineral-rich water sprays integrated with dermatologist-recommended routines.

Competitive differentiation centered on ingredient purity, skin sensitivity claims, and multi-use positioning (hydration + makeup setting + UV protection). Subscription models and refillable packaging had limited adoption during this period, contributing less than 10% to the global market.

Demand for hydrating sprays is projected to reach USD 5,291.3 million in 2025, with the revenue mix shifting rapidly toward personalized solutions. Water-based forms remain essential, but humectant-enriched, vitamin-infused, and SPF-integrated sprays gain stronger traction. Traditional global leaders face growing competition from digitally native brands offering AI-powered skincare diagnostics, ingredient transparency, and cloud-based skincare coaching.

L’Oréal and Estée Lauder are pivoting to hybrid models with sensorial forms, remote skincare trials, and ingredient-specific refills. Emerging players specializing in botanical formulations, eco-certified packaging, and mobile-integrated skincare routines are gaining share. The future of competitive advantage is shifting from brand name and distribution power to ecosystem depth, personalization, and sustainable innovation.

Advancements in cosmetic formulation science have significantly enhanced the performance and multifunctionality of hydrating sprays. These products now offer more than just surface moisturethey deliver anti-pollution benefits, UV protection, and soothing effects, making them essential to modern skincare routines. Facial Hydrating Sprays, in particular, are witnessing high adoption due to their compatibility with makeup, skin layering regimens, and portability. The growing consumer preference for clean-label, water-based, and lightweight skincare has accelerated demand.

Water-based formulations are dominating due to their non-greasy texture and high tolerance across skin types, while ingredient-conscious buyers are increasingly drawn to mists enriched with hyaluronic acid, botanical extracts, and vitamins. Online platformsespecially D2C and subscription-based skincare servicesare expanding the consumer base. Their focus on personalization, transparency, and recurring delivery models is reshaping how consumers engage with facial and body care categories. Refillable spray packaging and mini forms are also contributing to higher frequency of purchase and sustainable consumption.

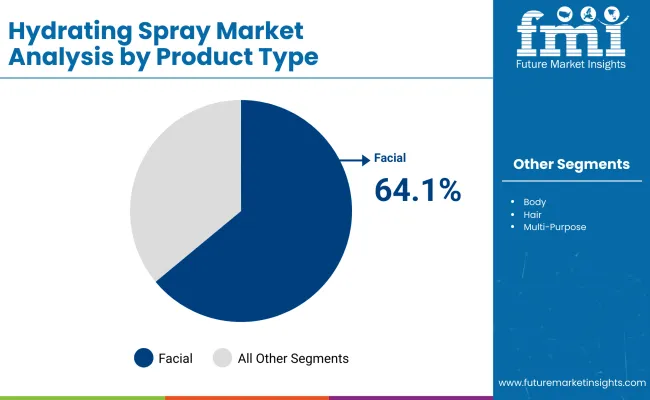

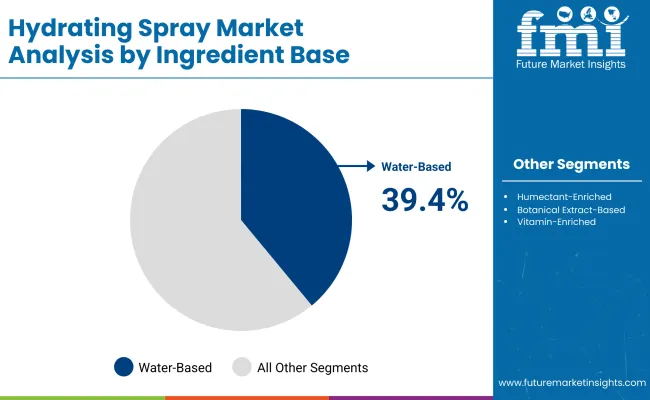

The market is segmented by product type, ingredient base, packaging size, distribution channel, and region. By Product Type, Facial Hydrating Sprays lead the market with a 64.1% share in 2025. Other categories such as Body, Hair, and Multi-Purpose Hydrating Sprays serve specific routines but account for a smaller portion of sales. By Ingredient Base, Water-Based formulations dominate with a 39.4% share in 2025, driven by demand for thermal water, spring water, and mineral-rich bases. Other active-led categories include humectant-enriched (e.g., hyaluronic acid), botanical extract-based, and vitamin-infused mists.

By Packaging Size, 100-200 ml forms account for the largest share at 48.3%, balancing portability and value-for-money. Travel-size minis and salon-sized refills are growing in niche applications. By Distribution Channel, online platformsespecially e-commerce marketplaces and brand-owned D2C websitesare expanding rapidly. While offline stores such as pharmacies and beauty retailers remain important in emerging markets, subscription-based skincare delivery is unlocking higher LTV (lifetime value) in developed economies.

By Region, North America remains the largest market, led by the USA, which held a 28.1% share in 2025. Asia-Pacific is the fastest-growing region, with China and India contributing strongly due to urbanization, skincare awareness, and digital retail expansion. Europe continues to lead in clean beauty innovation and refillable packaging adoption.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Facial Hydrating Sprays | 64.1% |

| Others | 35.9% |

The Facial Hydrating Sprays segment is projected to contribute 64.1% of the global Hydrating Spray Market revenue in 2025, maintaining its lead as the dominant product type. This leadership is attributed to the category’s multifunctionality, lightweight application, and compatibility with daily skincare routines including toning, setting, and SPF layering. The surge in demand is further bolstered by increased awareness of hydration layering, especially in urban and working populations.

The segment also benefits from its broad appeal across gender, age, and skin types, often supported by dermatological recommendations. With online tutorials and beauty influencers promoting facial mists as “everyday essentials,” this segment is expected to retain its dominant position throughout the decade, both in value and volume.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Water-Based | 39.4% |

| Others | 60.6% |

Water-Based formulations are projected to account for 39.4% of the global market revenue in 2025, leading the ingredient base segment. The dominance of water-based sprays is driven by high consumer trust in thermal spring water, purified water, and mineral-rich water as gentle yet effective hydration sources.

These formulations are especially popular among consumers with sensitive skin, supporting their reputation as safe, non-irritating, and highly versatile products. The segment continues to evolve with added humectants, antioxidants, and electrolytes, but remains grounded in water as the core delivery medium. As clean-label and fragrance-free demands rise, water-based hydrating sprays are positioned to remain the go-to form for everyday skin refreshment and hydration.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| 100-200 ml | 48.3% |

| Others | 51.7% |

The 100-200 ml packaging segment is projected to contribute 48.3% of the Hydrating Spray Market revenue in 2025, emerging as the most preferred form across both retail and online channels. This size balances portability with cost-effectiveness, making it ideal for regular daily users who value convenience without frequent restocking.

Brands are favoring this form for mainstream and premium facial mist lines, with most dermatologist-approved and travel-friendly sprays launched in this volume range. Additionally, 100-200 ml forms comply with international carry-on regulations, contributing to their high popularity among frequent travelers and beauty consumers who favor mid-sized, high-performance mists.

Drivers

Dermocosmetic Positioning of Facial Sprays in Europe and North America

The widespread positioning of hydrating sprays as dermocosmetic productsparticularly in France, Germany, and the USA has elevated their status beyond cosmetic refreshers. Brands like La Roche-Posay, Avène, and Vichy have successfully anchored thermal water sprays as prescription-recommended hydration therapies for post-procedure care, eczema relief, and barrier repair. This medical-skincare crossover creates trust, secures pharmacy channel placement, and enables premium pricingespecially for facial hydrating sprays.

D2C-Driven Ingredient Transparency in APAC Markets

In Asia-Pacific (especially China and South Korea), digitally native brands are leveraging ingredient-level transparency and skin-type-specific messaging to differentiate SKUs. Water-based sprays with single or dual actives (e.g., 95% rosewater + niacinamide) are gaining traction due to platforms like Little Red Book and Tmall Global allowing side-by-side comparisons. The driver here is not only formulation efficacy but also digital-first ingredient education that aligns with growing consumer skincare IQ.

Restraints

Low Repurchase Rate for Non-Facial Forms (Body & Hair Sprays)

While facial sprays see routine-based adoption, body and hair hydrating sprays suffer from low repeat usage. Consumers often perceive body mists as seasonal or luxury add-ons, and hair sprays as occasional de-frizzers or refreshers rather than daily-use staples. This limits volume growth and results in higher shelf turnover rates in retail, discouraging aggressive SKU expansion by brands in these sub-segments.

Regulatory Ambiguity Around Functional Claims (SPF, Anti-Pollution)

In many markets, especially Southeast Asia and the Middle East, hydrating sprays that make claims like SPF protection or anti-pollution defense fall into a regulatory gray zone. Depending on the country, these sprays may require drug or OTC classification instead of cosmetic approval, increasing cost and compliance burdens. Smaller players find it difficult to scale SKUs with hybrid claims, which restrains innovation in multifunctional forms.

Key Trends

Rise of Refillable Hydrating Sprays & Eco-Conscious Atomizers

In markets like France, Japan, and the Nordics, refillable facial sprays using high-quality glass bottles and aluminum pump systems are emerging as a trend among mid-to-premium brands. The demand is driven by Gen Z and Millennial buyers prioritizing low-waste consumption and clean beauty alignment. These refills are often sold in pouch or capsule forms, with some brands offering lifetime bottles as part of loyalty or subscription programs.

Adoption of Skincare Misting in Male Grooming and Gym Kits

A growing microtrend in the USA, UK, and UAE is the inclusion of hydrating facial mists in men’s grooming and fitness routines. Male-focused brands now include anti-fatigue or mattifying mists as part of post-shave or post-workout kits. These products are positioned as sweat-neutralizers, barrier refreshers, or pore refinersa strategic shift that opens up new application occasions and merchandising angles for hydration products beyond traditional female segments.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.8% |

| India | 13.6% |

| Germany | 6.2% |

| USA | 4.5% |

| UK | 7.1% |

| Japan | 9.2% |

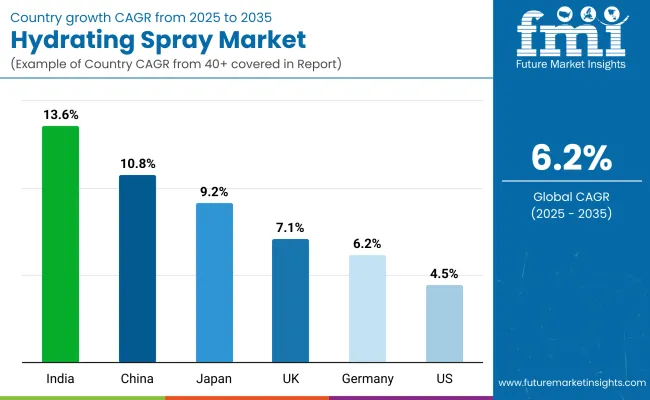

The global Hydrating Spray Market exhibits distinct regional disparities in growth trajectory, shaped by consumer skincare habits, urbanization rates, and the maturity of digital retail ecosystems. Asia-Pacific emerges as the fastest-growing region, anchored by India at 13.6% CAGR and China at 10.8% CAGR. India’s accelerated growth is fueled by rising adoption of facial hydration products in tier-1 and tier-2 cities, driven by younger, digitally engaged consumers and expanding online D2C platforms.

Premium skincare routines once limited to metros are now penetrating mid-income urban households through affordable, refillable mist forms. In China, hydrating sprays are benefiting from ingredient-conscious buyers seeking minimal formulations with hyaluronic acid and floral waters. The region’s momentum is also supported by influencer-driven product education on platforms like Little Red Book and TmallGlobal. Europe maintains a robust growth outlook, led by Germany at 6.2% CAGR and the UK at 7.1% CAGR.

Growth here is anchored in the dermocosmetic positioning of facial sprays as pharmacy-grade hydration solutions, especially in markets like France and Germany. Stringent regulatory requirements around product safety, clean labeling, and sustainability are encouraging innovation in preservative-free, fragrance-free sprays, further expanding category relevance across skin-sensitive consumer groups. North America exhibits moderate but steady expansion, with the USA growing at 4.5% CAGR.

As one of the most established markets globally, the USA shows high product penetration in facial sprays but limited growth in newer forms such as body and hair hydrating sprays. Growth is increasingly driven by refillable packaging forms, clean-ingredient claims, and the inclusion of hydrating mists in men’s grooming and gym-care routines. While product saturation is visible in major metro markets, expansion is occurring in wellness spas, clinical dermatology centers, and subscription-based skincare kits.

Japan, with a 9.2% CAGR, presents a mature yet premium-oriented opportunity. Consumers in Japan favor ultra-light, non-fragranced sprays positioned as part of “skin minimalism” regimens. High trust in water-based and thermal formulations, combined with advanced spray technology and packaging design, maintains Japan’s reputation for high-quality hydration forms with a focus on sensorial experience.

| Year | USA Hydrating Spray Market (USD Million) |

|---|---|

| 2025 | 1169.38 |

| 2026 | 1236.55 |

| 2027 | 1307.57 |

| 2028 | 1382.68 |

| 2029 | 1462.10 |

| 2030 | 1546.08 |

| 2031 | 1634.88 |

| 2032 | 1728.79 |

| 2033 | 1828.09 |

| 2034 | 1933.09 |

| 2035 | 2044.13 |

The Hydrating Spray Market in the United States is projected to grow at a CAGR of 4.5% from 2025 to 2035, led by mature consumer demand for high-end skincare and wellness-centric facial sprays. The USA holds a 22.1% global market share in 2025, expected to see a slight decline to 21.2% by 2035, as Asia-Pacific markets accelerate.

The USA Hydrating Spray segment is valued at USD 1,169.38 million in 2025, rising to USD 2,044.13 million by 2035. Facial Hydrating Sprays remain dominant in the USA, reflecting their widespread usage in skincare layering routines, wellness kits, and travel-friendly hydration. Demand is also expanding in niche segments such as men’s grooming, post-workout misting, and on-the-go travel kits.

The Hydrating Spray Market in the UK is expected to grow at a CAGR of 7.1% through 2035. A strong culture of pharmacy-backed skincare and the increasing popularity of SPF-infused hydrating sprays are driving sales. Eco-conscious shoppers are showing higher affinity for plastic-free, glass-packaged, and sustainably sourced mists.

India is forecast to grow at a CAGR of 13.6%, the highest among major countries in the hydrating spray market. Market share is projected to increase from 5.2% in 2025 to 6.1% in 2035. Rising penetration into tier-2 and tier-3 cities, beauty influencer-led skincare education, and price-accessible SKUs are making hydration mists part of daily skin routines.

| Market Share | 2025 |

|---|---|

| China | 12.1% |

| India | 5.2% |

| Germany | 14.1% |

| USA | 22.1% |

| UK | 8.1% |

| Japan | 6.9% |

| Market Share | 2035 |

|---|---|

| China | 13.4% |

| India | 6.1% |

| Germany | 12.8% |

| USA | 21.2% |

| UK | 7.6% |

| Japan | 8.4% |

China is set to grow at a CAGR of 10.8%, with hydrating sprays accounting for 12.1% of the global market in 2025, expected to rise to 13.4% by 2035. Chinese demand is driven by ingredient-conscious buyers seeking minimal, functional formulations like hyaluronic acid, floral waters, and thermal spring extracts. Digital beauty ecosystems like Xiaohongshu and Tmall Global amplify adoption through influencer-led education.

| Product Segment | Market Value Share, 2025 |

|---|---|

| Facial Hydrating Sprays | 61.3% |

| Others | 38.7% |

The USA Hydrating Spray Market is valued at USD 1,169.38 million in 2025, with Facial Hydrating Sprays leading at 61.3% (USD 716.83 million), followed by other product types at 38.7% (USD 452.55 million). The dominance of facial sprays is driven by their integration into skincare layering routines, wellness kits, and professional spa treatments. Mature consumer demand for dermatologist-recommended, multipurpose hydration formats such as sprays that combine hydration, soothing, and makeup setting keeps this segment ahead.

Portability, refillable packaging, and compatibility with on-the-go lifestyles enhance adoption, while e-commerce platforms and subscription-based beauty boxes ensure recurring sales. Functional innovations like SPF-infused and vitamin-rich mists are strengthening premium positioning. Other hydrating formats see niche growth in men’s grooming, fitness, and travel-oriented products.

| Ingredient Base Segment | Market Value Share, 2025 |

|---|---|

| Humectant-Enriched | 54.7% |

| Others | 45.3% |

The China Hydrating Spray Market is valued at USD 640.25 million in 2025, with Humectant-Enriched formulations leading at 54.7% (USD 350.22 million), followed by other ingredient bases at 45.3% (USD 290.03 million). Humectant-rich sprays, often formulated with hyaluronic acid, glycerin, and aloe vera, are highly favored for year-round hydration across varied climates. China’s skincare-savvy youth, influenced by platforms like Xiaohongshu and Tmall Global, actively seek transparent ingredient lists and clinical-grade hydration solutions.

Seasonal formulations designed for humid summers and dry winters further drive category innovation. Premium domestic brands position hydrating sprays as essential toner-step replacements, while international brands target the market with thermal and botanical water mists.

The Global Hydrating Spray Market remains moderately fragmented, with a mix of multinational skincare giants, regional beauty leaders, and specialist wellness brands actively competing in innovation, reach, and product positioning. L’Oréal S.A., the market leader with an 11.7% share in 2025, continues to dominate due to its broad skincare portfolio, strong global distribution, and early investment in dermatologist-backed hydration ranges.

Its brands such as La Roche-Posay, Vichy, and L’Oréal Paris anchor facial hydrating spray adoption across both mass and dermocosmetic segments. The company is investing in water science, micro-mist spray technology, and on-the-go travel packaging to extend category leadership.

Other prominent players in the fragmented 88.3% share are regional manufacturers and niche clean beauty brands focused on ingredient purity, minimalist formulations, and eco-conscious packaging. These include brands with core offerings in humectant-enriched or SPF-infused sprays, often tailored to local climate conditions and skin types.

Competitive differentiation is increasingly being shaped not just by formula innovation, but by the ecosystem surrounding the productincluding skin diagnostic app integration, reusable/refillable spray solutions, and AR-based skin hydration tracking tools offered by leading and emerging players alike. As consumer preferences shift toward multi-functionality, ingredient clarity, and sustainability, the market is moving beyond basic hydration toward wellness-enhancing, mood-oriented, and dermocosmetic-formulated sprays, challenging traditional giants to stay agile amid rising indie and D2C competition.

Key Developments in Global Hydrating Spray Market

| Item | Value |

|---|---|

| Quantitative Units | USD 5,291.3 million |

| Product Type | Facial Hydrating Sprays, Body Hydrating Sprays, Hair Hydrating Sprays, Multi-Purpose Hydrating Sprays |

| Ingredient Base | Water-Based, Humectant-Enriched, Botanical Extract-Based, Vitamin-Enriched / Antioxidant Sprays, SPF or Functional Additive-Based, Natural / Organic Formulations |

| Packaging Size | Below 100 ml, 100-200 ml, 201-300 ml, Above 300 ml |

| Sales Channel | Offline Channels: Supermarkets / Hypermarkets, Beauty & Cosmetics Specialty Stores, Pharmacies / Drugstores, Department Stores, Salons & Spas Online Channels: E-commerce Marketplaces, Brand-Owned D2C Websites, Subscription-Based Online Models |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever, L’Oréal, Estée Lauder Companies, Shiseido, Johnson & Johnson Services, Inc., Cardinal Sprayers, Oriflame Cosmetics AG, Kao Corporation, Procter & Gamble, Revlon, Eau Thermale Avène, Mario Badescu Skin Care Inc., The Nature’s Co., Heritage Store, La Roche Posay |

| Additional Attributes | Dollar sales by product type, ingredient base, packaging size, and channel; gender-specific consumption; natural and clean-label preferences; consumer shift toward SPF-infused and antioxidant-based mists; rise in male grooming product inclusion; portability and on-the-go usage trends; subscription-based D2C growth; strong demand in Asia’s humid/tropical climates; innovation in botanical and vitamin-based formulations |

The global Hydrating Spray Market is estimated to be valued at USD 5,291.3 million in 2025.

The market size for the global Hydrating Spray Market is projected to reach USD 9,642.1 million by 2035.

The global Hydrating Spray Market is expected to grow at a CAGR of 6.2% between 2025 and 2035.

The key product types in the Hydrating Spray Market are Facial Hydrating Sprays, Body Hydrating Sprays, Hair Hydrating Sprays, and Multi-Purpose Hydrating Sprays.

In terms of product type, Facial Hydrating Sprays will command the largest share in 2025, contributing 64.1% of global sales.

In 2025, Others (including botanical extract-based, vitamin-enriched, SPF-based) collectively account for 60.6% of the market, while Water-Based formulations hold a 39.4% share.

100-200 ml bottles dominate the market in 2025, with a 48.3% share of global sales.

Both offline channels (such as supermarkets, salons, and pharmacies) and online platforms (including e-commerce marketplaces and brand-owned websites) are key contributors, with rising traction for subscription-based D2C models.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrating Emollient Creams Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Polyurethane Foam Market Size and Share Forecast Outlook 2025 to 2035

Spray Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Spray Painting Machine Market Size and Share Forecast Outlook 2025 to 2035

Spray Caps Market Size and Share Forecast Outlook 2025 to 2035

Spray Booth Ventilation System Market Size and Share Forecast Outlook 2025 to 2035

Spray Covers Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Spray Foam Insulation Market 2025 to 2035

Spray Cheese Market Analysis by Flavours, Distribution Channel and Region through 2035

Spray Dryer Market Growth – Trends & Forecast 2025-2035

Spray Nozzle Market Growth – Trends & Forecast 2024-2034

Sprayer Cap Market Growth & Trends Forecast 2024-2034

Spray Washer Market

Spray Drying Equipment Market

Dehydrating Breather Market Size and Share Forecast Outlook 2025 to 2035

Mini Spray Bottles Market Size and Share Forecast Outlook 2025 to 2035

Mist Sprayer Pumps Market by Pump Type & Application Forecast 2025 to 2035

Competitive Breakdown of Mist Sprayer Pumps Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA